Professional Documents

Culture Documents

Concepcion Vidal de Roces and Her Husband

Uploaded by

Chii0 ratings0% found this document useful (0 votes)

17 views3 pagestax

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documenttax

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

17 views3 pagesConcepcion Vidal de Roces and Her Husband

Uploaded by

Chiitax

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 3

CONCEPCION VIDAL DE ROCES and her husband,

MARCOS ROCES, and ELVIRA VIDAL DE RICHARDS, plaintiff-appellants,

vs.

JUAN POSADAS, JR., Collector of Internal Revenue, defendant-appellee.

Feria and La O for appellants.

Attorney-General Jaranilla for appellee.

IMPERIAL, J.:

The plaintiffs herein brought this action to recover from the defendant, Collector of Internal Revenue, certain sums of

money paid by them under protest as inheritance tax. They appealed from the judgment rendered by the Court of First

Instance of Manila dismissing the action, without costs.

On March 10 and 12, 1925, Esperanza Tuazon, by means of public documents, donated certain parcels of land situated in

Manila to the plaintiffs herein, who, with their respective husbands, accepted them in the same public documents, which

were duly recorded in the registry of deeds. By virtue of said donations, the plaintiffs took possession of the said lands,

received the fruits thereof and obtained the corresponding transfer certificates of title.

On January 5, 1926, the donor died in the City of Manila without leaving any forced heir and her will which was admitted

to probate, she bequeathed to each of the donees the sum of P5,000. After the estate had been distributed among the

instituted legatees and before delivery of their respective shares, the appellee herein, as Collector of Internal Revenue,

ruled that the appellants, as donees and legatees, should pay as inheritance tax the sums of P16,673 and P13,951.45,

respectively. Of these sums P15,191.48 was levied as tax on the donation to Concepcion Vidal de Roces and P1,481.52 on

her legacy, and, likewise, P12,388.95 was imposed upon the donation made to Elvira Vidal de Richards and P1,462.50 on

her legacy. At first the appellants refused to pay the aforementioned taxes but, at the insistence of the appellee and in

order not to delay the adjudication of the legacies, they agreed at last, to pay them under protest.

The appellee filed a demurrer to the complaint on the ground that the facts alleged therein were not sufficient to

constitute a cause of action. After the legal questions raised therein had been discussed, the court sustained the demurrer

and ordered the amendment of the complaint which the appellants failed to do, whereupon the trial court dismissed the

action on the ground that the afore- mentioned appellants did not really have a right of action.

In their brief, the appellants assign only one alleged error, to wit: that the demurrer interposed by the appellee was

sustained without sufficient ground.

The judgment appealed from was based on the provisions of section 1540 Administrative Code which reads as follows:

SEC. 1540. Additions of gifts and advances. After the aforementioned deductions have been made, there shall

be added to the resulting amount the value of all gifts or advances made by the predecessor to any those who,

after his death, shall prove to be his heirs, devisees, legatees, or donees mortis causa.

The appellants contend that the above-mentioned legal provision does not include donations inter vivos and if it does, it is

unconstitutional, null and void for the following reasons: first, because it violates section 3 of the Jones Law which

provides that no law should embrace more than one subject, and that subject should be expressed in the title thereof;

second that the Legislature has no authority to impose inheritance tax on donations inter vivos; and third, because a legal

provision of this character contravenes the fundamental rule of uniformity of taxation. The appellee, in turn, contends

that the words "all gifts" refer clearly to donations inter vivos and, in support of his theory, cites the doctrine laid in the

case of Tuason and Tuason vs. Posadas (54 Phil., 289). After a careful study of the law and the authorities applicable

thereto, we are the opinion that neither theory reflects the true spirit of the aforementioned provision. The gifts referred

to in section 1540 of the Revised Administration Code are, obviously, those donations inter vivos that take effect

immediately or during the lifetime of the donor but are made in consideration or in contemplation of death. Gifts inter

vivos, the transmission of which is not made in contemplation of the donor's death should not be understood as included

within the said legal provision for the reason that it would amount to imposing a direct tax on property and not on the

transmission thereof, which act does not come within the scope of the provisions contained in Article XI of Chapter 40 of

the Administrative Code which deals expressly with the tax on inheritances, legacies and other acquisitions mortis causa.

Our interpretation of the law is not in conflict with the rule laid down in the case of Tuason and Tuason vs. Posadas, supra.

We said therein, as we say now, that the expression "all gifts" refers to gifts inter vivos inasmuch as the law considers

them as advances on inheritance, in the sense that they are gifts inter vivos made in contemplation or in consideration of

death. In that case, it was not held that that kind of gifts consisted in those made completely independent of death or

without regard to it.

Said legal provision is not null and void on the alleged ground that the subject matter thereof is not embraced in the title

of the section under which it is enumerated. On the contrary, its provisions are perfectly summarized in the heading, "Tax

on Inheritance, etc." which is the title of Article XI. Furthermore, the constitutional provision cited should not be strictly

construed as to make it necessary that the title contain a full index to all the contents of the law. It is sufficient if the

language used therein is expressed in such a way that in case of doubt it would afford a means of determining the

legislators intention. (Lewis' Sutherland Statutory Construction, Vol. II, p. 651.) Lastly, the circumstance that the

Administrative Code was prepared and compiled strictly in accordance with the provisions of the Jones Law on that

matter should not be overlooked and that, in a compilation of laws such as the Administrative Code, it is but natural and

proper that provisions referring to diverse matters should be found. (Ayson and Ignacio vs. Provincial Board of Rizal and

Municipal Council of Navotas, 39 Phil., 931.)

The appellants question the power of the Legislature to impose taxes on the transmission of real estate that takes effect

immediately and during the lifetime of the donor, and allege as their reason that such tax partakes of the nature of the

land tax which the law has already created in another part of the Administrative Code. Without making express

pronouncement on this question, for it is unnecessary, we wish to state that such is not the case in these instance. The tax

collected by the appellee on the properties donated in 1925 really constitutes an inheritance tax imposed on the

transmission of said properties in contemplation or in consideration of the donor's death and under the circumstance that

the donees were later instituted as the former's legatees. For this reason, the law considers such transmissions in the

form of gifts inter vivos, as advances on inheritance and nothing therein violates any constitutional provision, inasmuch as

said legislation is within the power of the Legislature.

Property Subject to Inheritance Tax. The inheritance tax ordinarily applies to all property within the power of

the state to reach passing by will or the laws regulating intestate succession or by gift inter vivos in the manner

designated by statute, whether such property be real or personal, tangible or intangible, corporeal or

incorporeal. (26 R.C.L., p. 208, par. 177.)

In the case of Tuason and Tuason vs. Posadas, supra, it was also held that section 1540 of the Administrative Code did not

violate the constitutional provision regarding uniformity of taxation. It cannot be null and void on this ground because it

equally subjects to the same tax all of those donees who later become heirs, legatees or donees mortis causa by the will of

the donor. There would be a repugnant and arbitrary exception if the provisions of the law were not applicable to all

donees of the same kind. In the case cited above, it was said: "At any rate the argument adduced against its

constitutionality, which is the lack of Uniformity, does not seem to be well founded. It was said that under such an

interpretation, while a donee inter vivos who, after the predecessor's death proved to be an heir, a legatee, or a

donee mortis causa, would have to pay the tax, another donee inter vivos who did not prove to he an heir, a legatee, or a

donee mortis causa of the predecessor, would be exempt from such a tax. But as these are two different cases, the

principle of uniformity is inapplicable to them."

The last question of a procedural nature arising from the case at bar, which should be passed upon, is whether the case, as

it now stands, can be decided on the merits or should be remanded to the court a quo for further proceedings. According

to our view of the case, it follows that, if the gifts received by the appellants would have the right to recover the sums of

money claimed by them. Hence the necessity of ascertaining whether the complaint contains an allegation to that effect.

We have examined said complaint and found nothing of that nature. On the contrary, it be may be inferred from the

allegations contained in paragraphs 2 and 7 thereof that said donations inter vivos were made in consideration of the

donor's death. We refer to the allegations that such transmissions were effected in the month of March, 1925, that the

donor died in January, 1926, and that the donees were instituted legatees in the donor's will which was admitted to

probate. It is from these allegations, especially the last, that we infer a presumption juris tantum that said donations were

made mortis causa and, as such, are subject to the payment of inheritance tax.

Wherefore, the demurrer interposed by the appellee was well-founded because it appears that the complaint did not

allege fact sufficient to constitute a cause of action. When the appellants refused to amend the same, spite of the court's

order to that effect, they voluntarily waived the opportunity offered them and they are not now entitled to have the case

remanded for further proceedings, which would serve no purpose altogether in view of the insufficiency of the complaint.

Wherefore, the judgment appealed from is hereby affirmed, with costs of this instance against the appellants. So ordered.

Avancea, C.J., Villamor, Ostrand, Abad Santos, Hull, Vickers and Buttes, JJ., concur.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Petroleum Regulation No. 9 Covers Financial, Administrative ControlsDocument22 pagesPetroleum Regulation No. 9 Covers Financial, Administrative ControlsbennyusNo ratings yet

- BIR Ruling 097-11Document4 pagesBIR Ruling 097-11Jobi BryantNo ratings yet

- Foundations - Tax Exempt Foundations Their Impact On Our Economy US Gov 1962 140pgs PDFDocument140 pagesFoundations - Tax Exempt Foundations Their Impact On Our Economy US Gov 1962 140pgs PDFjulianbreNo ratings yet

- Revenue Receipts and Capital ReceiptsDocument17 pagesRevenue Receipts and Capital Receiptsvivek mishra100% (2)

- Answer Key HandoutsDocument5 pagesAnswer Key HandoutsRichard de Leon100% (1)

- Insurance Reviewer PDFDocument26 pagesInsurance Reviewer PDFChiiNo ratings yet

- NCC CaseDocument4 pagesNCC CaseChiiNo ratings yet

- Transportation Digest - Transportation of Goods A.M.+D.G. Transportation - Atty. AbañoDocument13 pagesTransportation Digest - Transportation of Goods A.M.+D.G. Transportation - Atty. AbañoJoan MacedaNo ratings yet

- For Succession3Document2 pagesFor Succession3ChiiNo ratings yet

- Workshop Activities For Kids v2Document3 pagesWorkshop Activities For Kids v2ChiiNo ratings yet

- Succession 7Document7 pagesSuccession 7ChiiNo ratings yet

- New Zealand Ins. Co. v. Adriana Choa Toy 97 Phil 646 51 OG 5179Document1 pageNew Zealand Ins. Co. v. Adriana Choa Toy 97 Phil 646 51 OG 5179ChiiNo ratings yet

- Tamayo v. Aquino 105 Phil 949Document1 pageTamayo v. Aquino 105 Phil 949ChiiNo ratings yet

- For Legal FormsDocument17 pagesFor Legal FormsChiiNo ratings yet

- MP3 SDocument16 pagesMP3 SChiiNo ratings yet

- In The Matter of The Petition For Habeas Corpus of Minor Shang Ko Vingson YuDocument1 pageIn The Matter of The Petition For Habeas Corpus of Minor Shang Ko Vingson YuChiiNo ratings yet

- American Ins. Co. of Newark v. Manila Port Service 72 SRCA 18Document2 pagesAmerican Ins. Co. of Newark v. Manila Port Service 72 SRCA 18ChiiNo ratings yet

- For Succession3Document2 pagesFor Succession3ChiiNo ratings yet

- For SuccessionDocument3 pagesFor SuccessionChiiNo ratings yet

- Transactions of Offshore Banking Units: ExceptionDocument1 pageTransactions of Offshore Banking Units: ExceptionChiiNo ratings yet

- For LaborDocument3 pagesFor LaborChiiNo ratings yet

- 2014-03-04 Election Law Discussion GuideDocument1 page2014-03-04 Election Law Discussion GuideChiiNo ratings yet

- Second DivisionDocument3 pagesSecond DivisionChiiNo ratings yet

- 2014-02-21 Public Officer Discussion GuideDocument3 pages2014-02-21 Public Officer Discussion GuideChiiNo ratings yet

- Criminal Law 1Document150 pagesCriminal Law 1ChiiNo ratings yet

- Sps. Fernando Torres v. Medina (Rule 16)Document1 pageSps. Fernando Torres v. Medina (Rule 16)ChiiNo ratings yet

- Complex, Continuing, Continued CrimesDocument2 pagesComplex, Continuing, Continued CrimesChiiNo ratings yet

- Tax CasesDocument1 pageTax CasesChiiNo ratings yet

- Philamlife V. Cta DoctrineDocument1 pagePhilamlife V. Cta DoctrineChiiNo ratings yet

- BIR RULING NO. 157-81 (Connected To Marubeni Case) Doctrine: PDocument1 pageBIR RULING NO. 157-81 (Connected To Marubeni Case) Doctrine: PChiiNo ratings yet

- Taxation of Employer-Purchased AnnuitiesDocument1 pageTaxation of Employer-Purchased AnnuitiesChiiNo ratings yet

- Roger Weliner v. CirDocument1 pageRoger Weliner v. CirChiiNo ratings yet

- Sps. Fernando Torres v. Medina (Rule 16)Document1 pageSps. Fernando Torres v. Medina (Rule 16)ChiiNo ratings yet

- Arnel Sagana v. Richard Francisco (Rule 14)Document1 pageArnel Sagana v. Richard Francisco (Rule 14)ChiiNo ratings yet

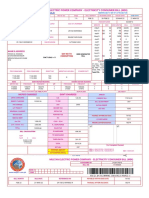

- LESCO - Web BillDocument1 pageLESCO - Web BillMalik IrfanNo ratings yet

- Form 709 United States Gift Tax ReturnDocument5 pagesForm 709 United States Gift Tax ReturnBogdan PraščevićNo ratings yet

- Amazon Order Details for Sunglasses and Bike AccessoriesDocument1 pageAmazon Order Details for Sunglasses and Bike AccessoriesJuanse CeballosNo ratings yet

- Dark Side of Valuation NotesDocument11 pagesDark Side of Valuation Notesad9292No ratings yet

- Britannia Annual Report 2015-16Document188 pagesBritannia Annual Report 2015-16Prabha KaranNo ratings yet

- Financial Analysis Dr. Reddy'sDocument9 pagesFinancial Analysis Dr. Reddy'sSoumya ChakrabortyNo ratings yet

- Caspian Oil and Gas Potential and Export ChallengesDocument285 pagesCaspian Oil and Gas Potential and Export ChallengespauldmeNo ratings yet

- Abdul Latif and Rafiq Cleaning Services L.L.CDocument2 pagesAbdul Latif and Rafiq Cleaning Services L.L.CMuhammad Shahzad ChandiaNo ratings yet

- Managing Change at ICICI Bank Through Mergers and DownsizingDocument19 pagesManaging Change at ICICI Bank Through Mergers and DownsizingArun ChristopherNo ratings yet

- Spouses Pacquiao vs. CtaDocument3 pagesSpouses Pacquiao vs. CtaEM DOMINGO100% (2)

- Fiscal Fact: Updated State and Local Option Sales TaxDocument5 pagesFiscal Fact: Updated State and Local Option Sales TaxNathan MartinNo ratings yet

- Assignment 01 Capital BudgetingDocument1 pageAssignment 01 Capital BudgetingChrisNo ratings yet

- Contract Drafting - Assignment 2Document2 pagesContract Drafting - Assignment 2verna_goh_shileiNo ratings yet

- MarketingDocument16 pagesMarketingGabriel-Adrian AcasandreiNo ratings yet

- Ingot Market - 6WResearch - VipulDocument41 pagesIngot Market - 6WResearch - Vipulvipul tutejaNo ratings yet

- SC rules junk dealer as common carrierDocument11 pagesSC rules junk dealer as common carrierWerner SchlagerNo ratings yet

- 7 The Crown As Corporation by Frederick MaitlandDocument14 pages7 The Crown As Corporation by Frederick Maitlandarchivaris.archief6573No ratings yet

- 2013 LAVCA ScorecardDocument43 pages2013 LAVCA ScorecardJonnattan MuñozNo ratings yet

- More Sex Is Safer SexDocument3 pagesMore Sex Is Safer SexShwetabh Mani TripathiNo ratings yet

- Multan Electric Power Company - Electricity Consumer Bill (Mdi)Document1 pageMultan Electric Power Company - Electricity Consumer Bill (Mdi)Zohaib AhmadNo ratings yet

- MGT201 BRAC Bank ReportDocument30 pagesMGT201 BRAC Bank Report2221979No ratings yet

- The Contemporary World (Gned 07)Document15 pagesThe Contemporary World (Gned 07)Arriana JutajeroNo ratings yet

- Ford Motor Company Pestel & Environment AnalysisDocument3 pagesFord Motor Company Pestel & Environment AnalysisCHARALABOS LABROUNo ratings yet

- PTI Proposed Amended Constitution 2014Document62 pagesPTI Proposed Amended Constitution 2014PTI OfficialNo ratings yet

- Hilton 2222Document70 pagesHilton 2222Dianne Garcia RicamaraNo ratings yet