Professional Documents

Culture Documents

Assignment 01 Capital Budgeting

Uploaded by

ChrisCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Assignment 01 Capital Budgeting

Uploaded by

ChrisCopyright:

Available Formats

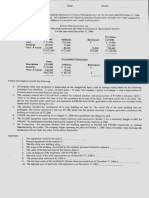

CASE 1:

1. ABC Company’s average production of valve stems over the past three years has been 80,000 units each year. Expectations

are that this volume will remain constant over the next four years. Cost records indicate that unit product costs for the valve

stem over the last several years have been as follows:

Direct materials P 3.60

Direct labor 3.90

Variable manufacturing overhead 1.50

Fixed manufacturing overhead* 9.00

Unit product cost P18.00

*Depreciation of tools (that must now be replaced) accounts for one-third of the fixed overhead. The balance is for other

fixed overhead costs of the factor that require cash expenditures. If the specialized tools are purchased, they will cost

P2,500,000 and will have a disposal value of P100,000 at the end of their four-year useful life.

ABC Company has a 30% tax rate, and management requires a 12% after-tax return on investment. Straight-line

depreciation would be used for financial reporting purposes, but for the tax purposes, the following variable depreciation

each year will be used.

Year 1 P 832,500

Year 2 1,112,500

Year 3 370,000

Year 4 185,000

The sales representative for the manufacturer of the specialized tools has stated, “The new tools will allow direct labor and

variable overhead to be reduced by P1.60 per unit.” Data from another company using identical tools and experiencing

similar operating conditions, except that annual production generally averages 100,000 units, confirms the direct labor and

variable overhead cost savings. However, the other company indicates that it experienced an increase in raw material cost

due to the higher quality of material that had to be used with the new tools. The other company indicates that its unit product

costs have been as follows:

Direct materials P 4.50

Direct labor 3.00

Variable manufacturing overhead 0.80

Fixed manufacturing overhead 10.80

Unit product cost P19.10

Referring to the figures above, the production manager stated, “These numbers look great until you consider the difference in

volume. Even with the reduction in labor and variable overhead cost, I’ll bet our total unit cost figure would increase to over

P20 with the new tools.”

Although the old tools being used by ABC Company are now fully depreciated, they have a salvage value of P45,000. These

tools will be sold if the new tools are purchased; however if the new tools are not purchased, then the old tools will be

retained as standby equipment. ABC Company’s accounting department has confirmed that total fixed manufacturing

overhead costs, other than depreciation, will not change regardless of the decision made concerning the valve stems.

However, the accounting department has estimated that working capital needs will increase by P60,000 if the new tools are

purchased due to the higher quality of material required in the manufacture of the valve stems.

Required:

P 2,515,000

a. The net investment in new tools amounted to? ____________

Solution:

Purchase price of new tools P 2,500,000

Add: Increase in working capital 60,000

Total 2,560,000

Deduct: Salvage Value of the old tools 45,000

Net investment P 2,515,000

P 33,830

b. The net advantage of the use of declining method of depreciation instead of straight-line method is? ____________

Solution:

PV of tax benefits, declining method P 603,333

PV of tax benefits, straight-line method (2,500,000/4*0.3*3.03735) 569,503

Net advantage P 33,830

c. Should ABC Company purchase the new tools? Justify your answer and include not just quantitative aspect of the

project but also the qualitative aspects as well (20 points, minimum of 30 words for the justification paragraph.)

You might also like

- Cost & Managerial Accounting II EssentialsFrom EverandCost & Managerial Accounting II EssentialsRating: 4 out of 5 stars4/5 (1)

- Management Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageFrom EverandManagement Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageRating: 5 out of 5 stars5/5 (1)

- Group IiiDocument21 pagesGroup IiiMark ChouNo ratings yet

- Crc-Ace Review School, Inc.: Management Accounting Services (1-40)Document8 pagesCrc-Ace Review School, Inc.: Management Accounting Services (1-40)LuisitoNo ratings yet

- Cost and Management Accounting AssignmentDocument8 pagesCost and Management Accounting AssignmentDinkar SuranglikarNo ratings yet

- Group IiiDocument20 pagesGroup IiiMark ChouNo ratings yet

- ReSA B44 MS First PB Exam Questions Answers - SolutionsDocument13 pagesReSA B44 MS First PB Exam Questions Answers - SolutionsWesNo ratings yet

- Chapter 2 Standard Costs and Operating Performance Measures Problem DiscussionDocument12 pagesChapter 2 Standard Costs and Operating Performance Measures Problem DiscussionSteffany RoqueNo ratings yet

- T R S A: HE Eview Chool of CcountancyDocument12 pagesT R S A: HE Eview Chool of CcountancyNamnam KimNo ratings yet

- Entrepreneurship 12 - Costs of Materials, Labor and OverheadDocument6 pagesEntrepreneurship 12 - Costs of Materials, Labor and OverheadJolly Roy Bersaluna80% (10)

- Fin5 Comprehensive ExamDocument9 pagesFin5 Comprehensive ExamEmma Mariz GarciaNo ratings yet

- Management Advisory Services - FinalDocument8 pagesManagement Advisory Services - FinalFrancis MateosNo ratings yet

- Cost Behavior 2nd Exam BSADocument4 pagesCost Behavior 2nd Exam BSARica Jayne Gerona CuizonNo ratings yet

- RMYC Cup 2 - RevDocument9 pagesRMYC Cup 2 - RevJasper Andrew AdjaraniNo ratings yet

- Midterm Question Strategic Management Accounting (11th Batch)Document5 pagesMidterm Question Strategic Management Accounting (11th Batch)Samir Raihan ChowdhuryNo ratings yet

- MASDocument7 pagesMASHelen IlaganNo ratings yet

- ACT23 - 12 - Standard Costs and Variance AnalysisDocument4 pagesACT23 - 12 - Standard Costs and Variance AnalysisLim JugyeongNo ratings yet

- Activity Based Costing ER - NewDocument14 pagesActivity Based Costing ER - NewFadillah LubisNo ratings yet

- MAS_3104_Standard_Costing_and_Variance_Analysis___MCQDocument6 pagesMAS_3104_Standard_Costing_and_Variance_Analysis___MCQmonicafrancisgarcesNo ratings yet

- Nacua CAC Unit2 ActivityDocument13 pagesNacua CAC Unit2 ActivityJasper John NacuaNo ratings yet

- Master in Managerial Advisory Services: Easy QuestionsDocument13 pagesMaster in Managerial Advisory Services: Easy QuestionsKervin Rey JacksonNo ratings yet

- Assignment 4 CCMA-3Document10 pagesAssignment 4 CCMA-3JaspreetNo ratings yet

- Asian Academy For Excellence Foundation, Inc.: Practical Accounting 2-Cost CPA Review O2017Document6 pagesAsian Academy For Excellence Foundation, Inc.: Practical Accounting 2-Cost CPA Review O2017didi chenNo ratings yet

- Issues in Management Accounting Bac 4407Document6 pagesIssues in Management Accounting Bac 4407Rugeyye RashidNo ratings yet

- P1 - Management Accounting - Performance EvaluationDocument24 pagesP1 - Management Accounting - Performance EvaluationSritijhaaNo ratings yet

- MX - Cost Accounting PDFDocument5 pagesMX - Cost Accounting PDFZamantha TiangcoNo ratings yet

- Korarai 18181881Document4 pagesKorarai 18181881KyraraNo ratings yet

- First Long Quiz COSMANDocument5 pagesFirst Long Quiz COSMANKawaii SevennNo ratings yet

- Exercises On Introduction To Cost AccountingDocument4 pagesExercises On Introduction To Cost AccountingAsi Cas Jav100% (1)

- Team PRTC May 2023 1st PBDocument46 pagesTeam PRTC May 2023 1st PBEpfie SanchesNo ratings yet

- Acca107 Midterms Oct 06 2021 Answer KeyDocument12 pagesAcca107 Midterms Oct 06 2021 Answer KeyMary Kate OrobiaNo ratings yet

- Quezon City University Final Examination 1 Semester (AY-2021-2022) Cost Accounting & Control (SBAC 2D)Document5 pagesQuezon City University Final Examination 1 Semester (AY-2021-2022) Cost Accounting & Control (SBAC 2D)Maria Erica TorresNo ratings yet

- Semi-Finals (Intro To Cost Accounting, Cost of Goods Sold, High-Low Method and Regression Analysis, Standard Costing)Document6 pagesSemi-Finals (Intro To Cost Accounting, Cost of Goods Sold, High-Low Method and Regression Analysis, Standard Costing)Alyssa Nichole CastilloNo ratings yet

- Unit Costing and Job CostingDocument3 pagesUnit Costing and Job Costinglevix hyuniNo ratings yet

- Mas Final Preboard Batch 90 PDFDocument22 pagesMas Final Preboard Batch 90 PDFBinibining KoreaNo ratings yet

- MS Preweek Lecture - 6.23Document8 pagesMS Preweek Lecture - 6.23Miguel ManagoNo ratings yet

- SP21 CH5 Practice QuizDocument4 pagesSP21 CH5 Practice QuizJudith GarciaNo ratings yet

- D) Ending Work in Process Is Less Than The Amount of The Beginning Work in Process InventoryDocument9 pagesD) Ending Work in Process Is Less Than The Amount of The Beginning Work in Process InventoryPhương Thảo HoàngNo ratings yet

- ACCCOB3 CVP Analysis Case Problems Instructions:: Ryan - Roque@dlsu - Edu.phDocument2 pagesACCCOB3 CVP Analysis Case Problems Instructions:: Ryan - Roque@dlsu - Edu.phdanii yaahNo ratings yet

- Mas Quizzer - Anaylysis 2021 Part 1Document6 pagesMas Quizzer - Anaylysis 2021 Part 1Ma Teresa B. CerezoNo ratings yet

- MAS Final RequirementDocument19 pagesMAS Final RequirementDonna Zandueta-TumalaNo ratings yet

- MS-1stPB 10.22Document12 pagesMS-1stPB 10.22Harold Dan Acebedo0% (1)

- MAS B41 First Pre-Board Exams (Questions, Answers - Solutions)Document15 pagesMAS B41 First Pre-Board Exams (Questions, Answers - Solutions)Nanananana100% (3)

- 27th Batch First PB MasDocument11 pages27th Batch First PB MasRommel Royce100% (1)

- Group IiiDocument19 pagesGroup IiiMark ChouNo ratings yet

- Cost accounting concepts and classificationsDocument3 pagesCost accounting concepts and classificationsJaycel Yam-Yam VerancesNo ratings yet

- AFAR - 11.1-Cost Accounting (Job Order and Process Costing)Document3 pagesAFAR - 11.1-Cost Accounting (Job Order and Process Costing)Daniela AubreyNo ratings yet

- Cost QP CIA IIDocument4 pagesCost QP CIA IIPrasanna PNo ratings yet

- Relevant Costing ExercisesDocument4 pagesRelevant Costing ExercisesSnowy WhiteNo ratings yet

- Assigment Sample ProblemsDocument5 pagesAssigment Sample ProblemsRamainne RonquilloNo ratings yet

- Marketing Bachelor of Business (Hons) ACC103 Management Accounting 1 AssignmentDocument8 pagesMarketing Bachelor of Business (Hons) ACC103 Management Accounting 1 AssignmentReina TrầnNo ratings yet

- MAS BSA - Activity Based CostingDocument4 pagesMAS BSA - Activity Based CostingJanellaReanoReyesNo ratings yet

- MS B45 First PB With AnswersDocument13 pagesMS B45 First PB With AnswersSophia RabacalNo ratings yet

- T R S A: HE Eview Chool of CcountancyDocument13 pagesT R S A: HE Eview Chool of CcountancyRica Mae TestaNo ratings yet

- MASDocument10 pagesMASMelvin TalaveraNo ratings yet

- Entrepreneurship-1112_Q2_SLM_WK4Document8 pagesEntrepreneurship-1112_Q2_SLM_WK4mariceldaan2No ratings yet

- CPV Highlow ABC Costing Key To CorrectionDocument3 pagesCPV Highlow ABC Costing Key To CorrectionlairadianaramosNo ratings yet

- First Pre-board Examination ReviewDocument17 pagesFirst Pre-board Examination ReviewSelyn Padua100% (2)

- Cost Accounting Quiz SolutionsDocument3 pagesCost Accounting Quiz SolutionsCrizhae OconNo ratings yet

- Answers Homework # 16 Cost MGMT 5Document7 pagesAnswers Homework # 16 Cost MGMT 5Raman ANo ratings yet

- Ashwat Question BankDocument4 pagesAshwat Question Banksaurabh iyer100% (1)

- Quiz-Shareholder EquityDocument2 pagesQuiz-Shareholder EquityChrisNo ratings yet

- Business Ethics and Social ResponsibilityDocument32 pagesBusiness Ethics and Social ResponsibilityChrisNo ratings yet

- A.Business Partners: 2 Screenshots: Execute The Following in Your Own DatabaseDocument2 pagesA.Business Partners: 2 Screenshots: Execute The Following in Your Own DatabaseChrisNo ratings yet

- Collection and Interpretation of DataDocument3 pagesCollection and Interpretation of DataChrisNo ratings yet

- Quiz 2 SapDocument1 pageQuiz 2 SapChrisNo ratings yet

- Seatwork #3.1-PFRS For SMEsDocument1 pageSeatwork #3.1-PFRS For SMEsChrisNo ratings yet

- Handbook1 eDocument27 pagesHandbook1 eAnkush SharmaNo ratings yet

- Quiz #3.1-Cash, Payables and Liquidity Management-SolutionsDocument1 pageQuiz #3.1-Cash, Payables and Liquidity Management-SolutionsChrisNo ratings yet

- List of Business PartnersDocument1 pageList of Business PartnersChrisNo ratings yet

- Working Capital QuizDocument12 pagesWorking Capital QuizChrisNo ratings yet

- ACCOUNTING DIRECTIVES - 004 - CIS&CAF Form - 1579655159-NewDocument1 pageACCOUNTING DIRECTIVES - 004 - CIS&CAF Form - 1579655159-NewChrisNo ratings yet

- Co NT Rol S: en Ts Erv IceDocument35 pagesCo NT Rol S: en Ts Erv IceZesorith Thunder100% (1)

- Nonprofit Financial Statements QuizDocument3 pagesNonprofit Financial Statements QuizJoanna Rose Deciar100% (1)

- How To Customize Lists in SAP Business OneDocument19 pagesHow To Customize Lists in SAP Business OneChrisNo ratings yet

- Collection and Interpretation of DataDocument1 pageCollection and Interpretation of DataChrisNo ratings yet

- Advanced Accounting Baker Test Bank - Chap012Document67 pagesAdvanced Accounting Baker Test Bank - Chap012donkazotey50% (2)

- 14 x11 Financial Management B-1Document9 pages14 x11 Financial Management B-1amirNo ratings yet

- UB - Analytics and Programming in Finance Lesson 1 - RevDocument32 pagesUB - Analytics and Programming in Finance Lesson 1 - RevChrisNo ratings yet

- Quiz #3.2-Time Value of Money-SolutionsDocument2 pagesQuiz #3.2-Time Value of Money-SolutionsChrisNo ratings yet

- Audit Problem UzDocument7 pagesAudit Problem UzRaies JumawanNo ratings yet

- Covert Symptoms, Which Need A More Detailed Study and A Logical Extension of The CPA'sDocument10 pagesCovert Symptoms, Which Need A More Detailed Study and A Logical Extension of The CPA'sAngeline Joyce RamirezNo ratings yet

- Overview of Working Capital Management and Cash ManagementDocument48 pagesOverview of Working Capital Management and Cash ManagementChrisNo ratings yet

- 320 - Fraud ArticleDocument28 pages320 - Fraud ArticleChrisNo ratings yet

- Harvard MBA Resume SummaryDocument1 pageHarvard MBA Resume Summaryowais khanNo ratings yet

- Government Accounting Journal Entries-QuizDocument1 pageGovernment Accounting Journal Entries-QuizChrisNo ratings yet

- Problem No. 1Document20 pagesProblem No. 1ChrisNo ratings yet

- Acctg. 323 Midterm ExamDocument2 pagesAcctg. 323 Midterm ExamChrisNo ratings yet

- RFBTDocument9 pagesRFBTJulius Lester AbieraNo ratings yet

- Advance Accounting2 FinalsDocument6 pagesAdvance Accounting2 FinalsClarice Kristine SalesNo ratings yet

- Joint VentureDocument2 pagesJoint VentureAries Gonzales CaraganNo ratings yet

- Furkhan Pasha - ResumeDocument3 pagesFurkhan Pasha - ResumeFurquan QuadriNo ratings yet

- Module 6 - Project Closure and TerminationDocument29 pagesModule 6 - Project Closure and TerminationAnthonyNo ratings yet

- Original Aucm Accounting For Decision Making 4E Wiley E Text For Deakin Full ChapterDocument41 pagesOriginal Aucm Accounting For Decision Making 4E Wiley E Text For Deakin Full Chapterbetty.neverson777100% (26)

- Jasper Gifford Economics DraftDocument10 pagesJasper Gifford Economics DraftHiNo ratings yet

- Case-Relic-Spotter PDFDocument10 pagesCase-Relic-Spotter PDFdbh jNo ratings yet

- Shobha DevelopersDocument212 pagesShobha DevelopersJames TownsendNo ratings yet

- IDENTIFIKASI PAD KABUPATEN KEPU LA UAN SANGIHEDocument8 pagesIDENTIFIKASI PAD KABUPATEN KEPU LA UAN SANGIHESentahanakeng Malahasa perkasaNo ratings yet

- Rolta Wins 13 Million Dollar Contract For Engineering Systems (Company Update)Document1 pageRolta Wins 13 Million Dollar Contract For Engineering Systems (Company Update)Shyam SunderNo ratings yet

- 02 Activity 2Document1 page02 Activity 2Nica GalandeNo ratings yet

- Chapter 1 - The Nature of Management Control SystemsDocument21 pagesChapter 1 - The Nature of Management Control SystemsyanuarwirandonoNo ratings yet

- Founder Share Purchase and Vesting Agreement SummaryDocument15 pagesFounder Share Purchase and Vesting Agreement SummaryIafrawNo ratings yet

- Affidavit - SampleDocument3 pagesAffidavit - Sampleqandaadvisory2No ratings yet

- Food Delivery Agreement SummaryDocument2 pagesFood Delivery Agreement SummaryChas Vnertia77% (35)

- Tugas 7: Akuntansi Sewa Guna UsahaDocument1 pageTugas 7: Akuntansi Sewa Guna UsahaZazan Zanuwar0% (1)

- Stone Supplier at PSN Project PT. Elektrindo Solusi EnergiDocument26 pagesStone Supplier at PSN Project PT. Elektrindo Solusi EnergiElektrindo Solusi EnergiNo ratings yet

- ENGG650 Assignment 1Document1 pageENGG650 Assignment 1Jihan BerroNo ratings yet

- Audit 2023Document18 pagesAudit 2023queenmutheu01No ratings yet

- Zero Base BudgetingDocument15 pagesZero Base BudgetingSumitasNo ratings yet

- Revenue Regulations on Compromise SettlementDocument6 pagesRevenue Regulations on Compromise SettlementMilane Anne CunananNo ratings yet

- Accrual Accounting vs Cash AccountingDocument20 pagesAccrual Accounting vs Cash AccountingHaroon AhmadNo ratings yet

- Presentation - Reconciling Supply and DemandDocument21 pagesPresentation - Reconciling Supply and DemandArthur BouchardetNo ratings yet

- Joint Venture Between Tata and ZaraDocument4 pagesJoint Venture Between Tata and ZaraShrishti Agarwal100% (1)

- Intro To Tax ManagementDocument55 pagesIntro To Tax ManagementJam HailNo ratings yet

- Certificate in Islamic Finance SyllabusDocument4 pagesCertificate in Islamic Finance SyllabusJMF2020No ratings yet

- Factors Affecting Employee Relations in Banking: A SCB Case StudyDocument51 pagesFactors Affecting Employee Relations in Banking: A SCB Case StudyMBAMBO JAMESNo ratings yet

- GST Question Bank Nov 22Document750 pagesGST Question Bank Nov 22mercydavizNo ratings yet

- Nature, Scope and Practice of Managerial EconomicsDocument10 pagesNature, Scope and Practice of Managerial Economics버니 모지코No ratings yet

- TUGAS 1 (Shoshana Grossbard) Jacob Mincer A Pioneer of Mo (BookFi - Org) UTS S3-Halaman-111-128Document18 pagesTUGAS 1 (Shoshana Grossbard) Jacob Mincer A Pioneer of Mo (BookFi - Org) UTS S3-Halaman-111-128Fakhrul RoziNo ratings yet

- Capstone Research Paper - Ferrari 2015 Initial Public OfferingDocument9 pagesCapstone Research Paper - Ferrari 2015 Initial Public OfferingJames A. Whitten0% (1)