Professional Documents

Culture Documents

Revenue Regulations on Compromise Settlement

Uploaded by

Milane Anne CunananOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Revenue Regulations on Compromise Settlement

Uploaded by

Milane Anne CunananCopyright:

Available Formats

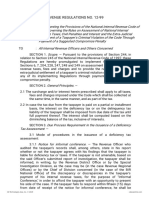

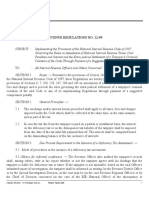

December 16, 2002

REVENUE REGULATIONS NO. 30-02

SUBJECT : Revenue Regulations Implementing Sections 7(c), 204(A) and 290

of the National Internal Revenue Code of 1997 on Compromise

Settlement of Internal Revenue Tax Liabilities Superseding Revenue

Regulations Nos. 6-2000 and 7-2001

TO : All Internal Revenue Officers and Others Concerned

SECTION 1. Scope and Objectives. — Pursuant to Section 244 of the National

Internal Revenue Code of 1997 (Code), these Regulations are hereby promulgated for

the purpose of implementing Sections 7(c), 204(A) and 290 of the same Code,

superseding Revenue Regulations (RR) Nos. 6-2000 and 7-2001 and giving an authority

to the Commissioner of Internal Revenue to compromise the payment of internal

revenue tax liabilities of certain taxpayers with outstanding receivable accounts and

disputed assessments with the Bureau of Internal Revenue and the Courts.

SECTION 2. Cases which may be Compromised. — The following cases may,

upon taxpayer's compliance with the basis set forth under Section 3 of these

Regulations, be the subject matter of compromise settlement, viz.:

1. Delinquent accounts;

2. Cases under administrative protest after issuance of the Final

Assessment Notice to the taxpayer which are still pending in the

Regional O ces, Revenue District O ces, Legal Service, Large

Taxpayer Service (LTS), Collection Service, Enforcement Service and

other offices in the National Office;

3. Civil tax cases being disputed before the courts;

4. Collection cases filed in courts;

5. Criminal violations, other than those already led in court or those

involving criminal tax fraud.

EXCEPTIONS:

1. Withholding tax cases, unless the applicant-taxpayer invokes provisions

of law that cast doubt on the taxpayer's obligation to withhold;

2. Criminal tax fraud cases con rmed as such by the Commissioner of

Internal Revenue or his duly authorized representative;

3. Criminal violations already filed in court;

4. Delinquent accounts with duly approved schedule of installment

payments;

5. Cases where nal reports of reinvestigation or reconsideration have been

issued resulting to reduction in the original assessment and the

taxpayer is agreeable to such decision by signing the required

CD Technologies Asia, Inc. © 2018 cdasiaonline.com

agreement form for the purpose. On the other hand, other protested

cases shall be handled by the Regional Evaluation Board (REB) or the

National Evaluation Board (NEB) on a case to case basis;

6. Cases which become nal and executory after nal judgment of a court,

where compromise is requested on the ground of doubtful validity of

the assessment; and

7. Estate tax cases where compromise is requested on the ground of

financial incapacity of the taxpayer.

SE CTI O N 3. Basis For Acceptance of Compromise Settlement. — The

Commissioner may compromise the payment of any internal revenue tax on the

following grounds:

1. Doubtful validity of the assessment. — The offer to compromise a delinquent

account or disputed assessment under these Regulations on the ground of reasonable

doubt as to the validity of the assessment may be accepted when it is shown that: TDCaSE

(a) The delinquent account or disputed assessment is one resulting from a

jeopardy assessment (For this purpose, "jeopardy assessment" shall

refer to a tax assessment which was assessed without the bene t of

complete or partial audit by an authorized revenue o cer, who has

reason to believe that the assessment and collection of a de ciency

tax will be jeopardized by delay because of the taxpayer's failure to

comply with the audit and investigation requirements to present his

books of accounts and/or pertinent records, or to substantiate all or

any of the deductions, exemptions, or credits claimed in his return); or

(b) The assessment seems to be arbitrary in nature, appearing to be based

on presumptions and there is reason to believe that it is looking in

legal and/or factual basis; or

(c) The taxpayer failed to le an administrative protest on account of the

alleged failure to receive notice of assessment and there is reason to

believe that the assessment is lacking in legal and/or factual basis; or

(d) The taxpayer failed to le a request for reinvestigation/reconsideration

within 30 days from receipt of nal assessment notice and there is

reason to believe that the assessment is lacking in legal and/or

factual basis; or

(e) The taxpayer failed to elevate to the Court of Tax Appeals (CTA) an

adverse decision of the Commissioner, or his authorized

representative, in some cases, within 30 days from receipt thereof

and there is reason to believe that the assessment is lacking in legal

and/or factual basis; or

(f) The assessments were issued on or after January 1, 1998, where the

demand notice allegedly failed to comply with the formalities

prescribed under Sec. 228 of the National Internal Revenue Code of

1997; or

(g) Assessments made based on the "Best Evidence Obtainable Rule" and

there is reason to believe that the same can be disputed by su cient

CD Technologies Asia, Inc. © 2018 cdasiaonline.com

and competent evidence; or

(h) The assessment was issued within the prescriptive period for

assessment as extended by the taxpayer's execution of Waiver of the

Statute of Limitations the validity or authenticity of which is being

questioned or at issue and there is strong reason to believe and

evidence to prove that it is not authentic.

2. Financial Incapacity. — The offer to compromise based on nancial incapacity

may be accepted upon showing that:

(a) The corporation ceased operation or is already dissolved. Provided, that

tax liabilities corresponding to the Subscription Receivable or Assets

distributed/distributable to the stockholders representing return of

capital at the time of cessation of operation or dissolution of

business shall not be considered for compromise; or

(b) The taxpayer, as re ected in its latest Balance Sheet supposed to be

led with the Bureau of Internal Revenue , is suffering from surplus or

earnings de cit resulting to impairment in the original capital by at

least 50%, provided that amounts payable or due to stockholders

other than business-related transactions which are properly includible

in the regular "accounts payable" are by ction of law considered as

part of capital and not liability, and provided further that the taxpayer

has no sufficient liquid asset to satisfy the tax liability; or

(c) The taxpayer is suffering from a networth de cit ( total liabilities exceed

total assets) computed by deducting total liabilities (net of deferred

credits and amounts payable to stockholders/owners re ected as

liabilities, except business-related transactions) from total assets

(net of prepaid expenses, deferred charges, pre-operating expenses,

as well as appraisal increases in xed assets), taken from the latest

audited financial statements, provided that in the case of an individual

taxpayer, he has no other leviable properties under the law other than

his family home; or

(d) The taxpayer is a compensation income earner with no other source of

income and the family's gross monthly compensation income does

not exceed the levels of compensation income provided for under

Sec. 4.1.1 of these Regulations, and it appears that the taxpayer

possesses no other leviable or distrainable assets, other than his

family home; or

(e) The taxpayer has been declared by any competent

tribunal/authority/body/government agency as bankrupt or insolvent.

The Commissioner shall not consider any offer for compromise settlement on

the ground of nancial incapacity of a taxpayer with Tax Credit Certi cate (TCC), issued

under the National Internal Revenue Code of 1997 or Executive Order No. 226, on hand

or in transit, or with pending claim for tax refund or tax credit with. the Bureau of

Internal Revenue, Department of Finance One-Stop-Shop Tax Credit and Duty Drawback

Center (Tax Revenue Group or Investment Incentive Group) and/or the courts, or with

existing nalized agreement or prospect of future agreement with any party that

CD Technologies Asia, Inc. © 2018 cdasiaonline.com

resulted or could result to an increase in the equity of the taxpayer at the time of the

offer for compromise or at a de nite future time. Moreover, no offer of compromise

shall be entertained unless and until the taxpayer waives in writing his privilege of the

secrecy of bank deposits under Republic Act No. 1405 or under other general or special

laws, and such waiver shall constitute as the authority of the Commissioner to inquire

into the bank deposits of the taxpayer.

Presence of circumstances that would place the taxpayer-applicant's inability to

pay in serious doubt can be a ground to deny the application for compromise based on

financial incapacity of the taxpayer to pay the tax.

SECTION 4. Prescribed Minimum Percentages of Compromise Settlement. —

The compromise settlement of the internal revenue tax liabilities of taxpayers, reckoned

on a per tax type assessment basis, shall be subject to the following minimum rates

based on the basic assessed tax:

1. For cases of "financial incapacity" —

1.1. If taxpayer is an individual whose only source of income is from

employment and whose monthly salary, if single, is P10,500 or less, or

if married, whose salary together with his spouse is P21,000 per

month, or less, and it appears that the taxpayer possesses no other

leviable/distrainable assets, other than his family home — 10%

1.2. If taxpayer is an individual without any source of income — 10%

1.3. Where the taxpayer is under any of the following conditions:

1.3.1. Zero networth computed in accordance with Sec. 3.2(c) hereof

— 10%

1.3.2. Negative networth computed in accordance with Sec. 3.2(c)

hereof — 10%

1.3.3. Dissolved corporations —20%

1.3.4. Already non-operating companies for a period of:

(a) three (3) years or more as of the date of application for

compromise settlement — 10%,

(b) Less than 3 years — 20%

1.3.5. Surplus or earnings de cit resulting to impairment in the

original capital by at least 50% — 40%

1.3.6 Declared insolvent or bankrupt, — 20%

unless taxpayer falls squarely under any situation as discussed

above, thus resulting to the application of the appropriate rate.

2 For cases of "doubtful validity" — A minimum compromise rate equivalent

to forty percent (40%) of the basic assessed tax.

The taxpayer may, nevertheless, request for a compromise rate lower than

forty percent (40%): Provided, however, that he shall be required to

submit his request in writing stating therein the reasons, legal and/or

factual, why he should be entitled to such lower rate: Provided, further,

CD Technologies Asia, Inc. © 2018 cdasiaonline.com

that for applications of compromise settlement based on doubtful

validity of the assessment involving an offer lower than the minimum

forty percent (40%) compromise rate, the same shall be subject to the

prior approval by the NEB.

The herein prescribed minimum percentages shall likewise apply in compromise

settlement of assessments consisting solely of increments, i.e., surcharge, interest,

etc., based on the total amount assessed.

SECTION 5. Documentary Requirements. —

1. If the application for compromise is premised under Sec. 4.1.1 hereof, the

taxpayer-applicant shall submit with his application (a) a certi cation from his

employer on his prevailing monthly salary, including allowances; and (b) a sworn

statement that he has no other source of income other than from employment.

2. If the application is premised under Sec. 4.1.2 hereof, the taxpayer-applicant

shall submit with his application a sworn statement that he derives no income from any

source whatever. HDTSCc

3. If the application is premised under Sec. 4.1.3 hereof, a copy of the applicant's

latest audited nancial statements or audited Account Information Form led with the

BIR shall be submitted with the application. Nonetheless, for situation under Sec.

4.1.3.3 hereof, the "Notice of Dissolution" submitted to SEC or other similar or

equivalent document should likewise be submitted. For situation under Sec. 4.1.3.6, a

copy of the order declaring bankruptcy or insolvency shall be submitted.

In all cases of offer based on nancial incapacity, Waiver of the Secrecy of Bank

Deposit under R.A. 1405 and Sworn Statement saying that he has no Tax Credit

Certi cate (TCC) on hand or in transit or claim for tax refund or TCC under the National

Internal Revenue Code of 1997 and Executive Order No. 226 pending in any o ce shall

be submitted.

Moreover, additional requirements prescribed under the existing Revenue

Memorandum Order (RMO) shall still be complied with unless amended and/or

expanded by an amendatory RMO.

SE CTI O N 6. Approval of Offer of Compromise. — Except for offers of

compromise where the approval is delegated to the REB pursuant to the succeeding

paragraph, all compromise settlements within the jurisdiction of the National O ce

(NO) shall be approved by a majority of all the members of the NEB composed of the

Commissioner and the four (4) Deputy Commissioners. All decisions of the NEB,

granting the request of the taxpayer or favorable to the taxpayer, shall have the

consequence of the Commissioner.

Offers of compromise of assessments issued by the Regional O ces involving

basic de ciency taxes of Five Hundred Thousand Pesos (P500,000) or less and for

minor criminal violations discovered by the Regional and District O ces, shall be

subject to the approval by the Regional Evaluation Board (REB), comprised of the

following Officers of the Region:

Regional Director — Chairman

Members:

• Assistant Regional Director

• Chief, Legal Division

CD Technologies Asia, Inc. © 2018 cdasiaonline.com

• Chief, Assessment Division

• Chief, Collection Division

• Revenue District Officer having jurisdiction over the taxpayer-applicant

Provided, however, that if the offer of compromise is less than the prescribed

rates set forth in Sec. 4 hereof, the same shall always be subject to the approval of the

NEB.

The compromise offer may be paid before or after the approval of the offer of

compromise by the Board (NEB or REB), at the option of the taxpayer. In case of

disapproval of compromise offer previously paid, the same shall be dealt with in

accordance with the prevailing procedures embodied in the Revenue Memorandum

Order issued for this purpose, including amendments thereto.

SECTION 7. Report of the Commissioner on the Exercise of His Authority to

Compromise to the Congressional Oversight Committee. — The Commissioner shall

submit to the Congressional Oversight Committee through the Chairmen of the

Committee on Ways and Means of both the Senate and House of Representatives,

every six (6) months of each calendar year, a report on the exercise of his powers to

compromise the tax liabilities of taxpayers. In this regard, the REB should submit to the

Commissioner all the necessary reports and data in due time for the latter to be able to

submit the required reports to the Congressional Oversight Committee.

SE CTI O N 8. Repealing Clause. — These Regulations supersede Revenue

Regulations No. 6-2000, and Revenue Regulations No. 7-2001. All other issuances

inconsistent with the provisions of these Regulations are hereby amended, modi ed or

repealed accordingly.

SECTION 9. Effectivity. — The provisions of these Regulations shall take effect

after fteen (15) days following publication in any newspaper of general circulation

except for cases the compromise of which have been con rmed by the Secretary of

Finance in which case these Regulations shall take effect immediately upon publication.

(SGD.) JOSE ISIDRO N. CAMACHO

Secretary of Finance

Recommending Approval:

(SGD.) GUILLERMO L. PARAYNO, JR.

Commissioner of Internal Revenue

Published in Manila Bulletin on Dec. 27, 2002.

CD Technologies Asia, Inc. © 2018 cdasiaonline.com

You might also like

- Revenue Regulations on Tax Compromise SettlementDocument11 pagesRevenue Regulations on Tax Compromise SettlementBobby Olavides SebastianNo ratings yet

- Taxation Review Income Taxation For Individual TaxpayersDocument8 pagesTaxation Review Income Taxation For Individual TaxpayersAsh AdoNo ratings yet

- TAX-1701 (Authority of The Commissioner of Internal Revenue)Document3 pagesTAX-1701 (Authority of The Commissioner of Internal Revenue)saligumba mikeNo ratings yet

- 2 Authority of The Commissioner of Internal Revenue 1Document13 pages2 Authority of The Commissioner of Internal Revenue 1Catherine AlzagaNo ratings yet

- 2 Authority of The Commissioner of Internal RevenueDocument12 pages2 Authority of The Commissioner of Internal RevenueAngel MarieNo ratings yet

- Tax Remedies and Assessment ProceduresDocument27 pagesTax Remedies and Assessment ProceduresNodlesde Awanab ZurcNo ratings yet

- Strategic Tax MNGT 2Document3 pagesStrategic Tax MNGT 2accpco.100No ratings yet

- REMEDIESDocument9 pagesREMEDIESkathlenejane.garciaNo ratings yet

- Tax-Remedies - Authority-of-CIR 2022Document4 pagesTax-Remedies - Authority-of-CIR 20229nh9xfrkqyNo ratings yet

- Taxation Law Reviewer Key ConceptsDocument13 pagesTaxation Law Reviewer Key ConceptsJericho PedragosaNo ratings yet

- Tax 2 Finals ReviewerDocument19 pagesTax 2 Finals Reviewerapi-3837022100% (2)

- Title VIII Tax Remedies NotesDocument7 pagesTitle VIII Tax Remedies NotesAnthony Yap100% (1)

- Rmo 22 01Document20 pagesRmo 22 01Maria Leonora Bornales100% (1)

- Uniform LayoutDocument7 pagesUniform LayoutJade CoritanaNo ratings yet

- CODAL - TAXATION - TITLE VIII RemediesDocument10 pagesCODAL - TAXATION - TITLE VIII RemediesTea AnnNo ratings yet

- Tax 1701 Cir PDFDocument22 pagesTax 1701 Cir PDFHeva AbsalonNo ratings yet

- Title Viii - RemediesDocument7 pagesTitle Viii - RemedieshrvyvyyyNo ratings yet

- Tax RemediesDocument10 pagesTax RemediesBryan CatungalNo ratings yet

- Revenue Regulations on Tax AssessmentDocument16 pagesRevenue Regulations on Tax AssessmentI.G. Mingo MulaNo ratings yet

- Income Taxation (Old Standard) RemediesDocument2 pagesIncome Taxation (Old Standard) RemediesKenneth CalzadoNo ratings yet

- RR 12-99Document16 pagesRR 12-99doraemoanNo ratings yet

- Revenue Memorandum Order No. 033-18Document9 pagesRevenue Memorandum Order No. 033-18TreshaNo ratings yet

- Review Materials: Prepared By: Junior Philippine Institute of Accountants UC-Banilad Chapter F.Y. 2019-2020Document25 pagesReview Materials: Prepared By: Junior Philippine Institute of Accountants UC-Banilad Chapter F.Y. 2019-2020AB CloydNo ratings yet

- Commissioner of Internal Revenue vs. Univation Motor Philippines, Inc. (Formerly Nissan Motor Philippines, Inc.), 901 SCRA 512, April 10, 2019Document18 pagesCommissioner of Internal Revenue vs. Univation Motor Philippines, Inc. (Formerly Nissan Motor Philippines, Inc.), 901 SCRA 512, April 10, 2019j0d3No ratings yet

- Taxation Law Reviewpower of Cir ReportDocument31 pagesTaxation Law Reviewpower of Cir ReportFiliusdeiNo ratings yet

- Concept of Assessment Requisites For A Valid Assessment: 10 Years After DiscoveryDocument5 pagesConcept of Assessment Requisites For A Valid Assessment: 10 Years After DiscoveryJD BarcellanoNo ratings yet

- Suspension of Running of Statute of Limitations. Sec. 223, NIRCDocument2 pagesSuspension of Running of Statute of Limitations. Sec. 223, NIRCshiejingNo ratings yet

- Tax - 4 - Module - 3 With AnswerDocument14 pagesTax - 4 - Module - 3 With AnswerDanielNo ratings yet

- BIR's powers and dutiesDocument19 pagesBIR's powers and dutiesjeff herradaNo ratings yet

- RR 12-99 Rules On Assessments PDFDocument19 pagesRR 12-99 Rules On Assessments PDFJeremeh PenarejoNo ratings yet

- RR No. 30-02Document1 pageRR No. 30-02Joanna MandapNo ratings yet

- A. Assessment B. Collection: Remedies of The GovernmentDocument10 pagesA. Assessment B. Collection: Remedies of The GovernmentGianna CantoriaNo ratings yet

- Tax Review Remedies of The GovernmentDocument120 pagesTax Review Remedies of The GovernmentJaline Aquino MozoNo ratings yet

- Tax Remedies of Government and Tax PayersDocument3 pagesTax Remedies of Government and Tax PayersHanah Grace DelfinNo ratings yet

- Tax Remedies and CompromiseDocument5 pagesTax Remedies and Compromiselegine ramaylaNo ratings yet

- Module 6 Tax Remedies ReviewerDocument11 pagesModule 6 Tax Remedies ReviewerburgerpattygirlNo ratings yet

- Tax2 Finals REMDocument16 pagesTax2 Finals REMAlexandra Castro-SamsonNo ratings yet

- Notes in Taxation IIDocument6 pagesNotes in Taxation IIJoe BuenoNo ratings yet

- Remedies Under NIRCDocument14 pagesRemedies Under NIRCcmv mendoza100% (3)

- Finals Personal Study Guide Tax2Document116 pagesFinals Personal Study Guide Tax2TeacherEliNo ratings yet

- TRAIN Law ProvisionsDocument5 pagesTRAIN Law ProvisionsCarmela WenceslaoNo ratings yet

- Remedies of The TaxpayerDocument4 pagesRemedies of The TaxpayerAngelyn Sanjorjo50% (2)

- RemediesDocument45 pagesRemediesCzarina100% (1)

- Bir RR 12-99Document21 pagesBir RR 12-99Isaac Joshua AganonNo ratings yet

- Title ViiiDocument8 pagesTitle ViiiErica Mae GuzmanNo ratings yet

- Rev. Regs. 12-99Document21 pagesRev. Regs. 12-99Phoebe SpaurekNo ratings yet

- Notes in Tax RemediesDocument104 pagesNotes in Tax RemediesJeremae Ann CeriacoNo ratings yet

- Tax REv NotesDocument23 pagesTax REv NotesCti Ahyeza DMNo ratings yet

- Ac 5288Document31 pagesAc 5288Choco KookieNo ratings yet

- Tax-Remedies (Govt-Remedies-Highlights)Document38 pagesTax-Remedies (Govt-Remedies-Highlights)Yves Nicollete LabadanNo ratings yet

- Taxpayer'S Obligations and Privileges: I. General Audit Procedures and DocumentationDocument4 pagesTaxpayer'S Obligations and Privileges: I. General Audit Procedures and DocumentationKristen StewartNo ratings yet

- Pale Cases 02232019Document3 pagesPale Cases 02232019DenardConwiBesaNo ratings yet

- Tax Collection Systems: Withholding Taxes Collected Under This SystemDocument9 pagesTax Collection Systems: Withholding Taxes Collected Under This Systememielyn lafortezaNo ratings yet

- RR 13-01Document5 pagesRR 13-01Peggy SalazarNo ratings yet

- Bar Review Companion: Taxation: Anvil Law Books Series, #4From EverandBar Review Companion: Taxation: Anvil Law Books Series, #4No ratings yet

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeFrom Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeRating: 1 out of 5 stars1/5 (1)

- 1040 Exam Prep Module XI: Circular 230 and AMTFrom Everand1040 Exam Prep Module XI: Circular 230 and AMTRating: 1 out of 5 stars1/5 (1)

- 1040 Exam Prep: Module II - Basic Tax ConceptsFrom Everand1040 Exam Prep: Module II - Basic Tax ConceptsRating: 1.5 out of 5 stars1.5/5 (2)

- RR No. 13-2018 CorrectedDocument20 pagesRR No. 13-2018 CorrectedRap BaguioNo ratings yet

- 53765-2003-Rule On Custody of Minors and Writ of HabeasDocument6 pages53765-2003-Rule On Custody of Minors and Writ of HabeasJennylyn Biltz AlbanoNo ratings yet

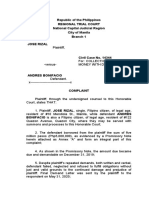

- Republic of The Philippines Regional Trial Court National Capital Judicial Region City of Manila Branch 1 Jose RizalDocument4 pagesRepublic of The Philippines Regional Trial Court National Capital Judicial Region City of Manila Branch 1 Jose RizalMilane Anne CunananNo ratings yet

- 3SCorpo CUNANAN Task1 RCCDocument22 pages3SCorpo CUNANAN Task1 RCCMilane Anne CunananNo ratings yet

- 213485-2018-Republic v. SerenoDocument261 pages213485-2018-Republic v. SerenoKristina B DiamanteNo ratings yet

- ARDC vs Ago Dispute Over Corporate Property ImprovementsDocument19 pagesARDC vs Ago Dispute Over Corporate Property ImprovementsMilane Anne CunananNo ratings yet

- Petitioner vs. vs. Respondent: Third DivisionDocument8 pagesPetitioner vs. vs. Respondent: Third DivisionMilane Anne CunananNo ratings yet

- Stonehill vs. Diokno - Right To Rss Is: (Ppop)Document11 pagesStonehill vs. Diokno - Right To Rss Is: (Ppop)Milane Anne CunananNo ratings yet

- Edu vs. GomezDocument3 pagesEdu vs. GomezShiela PilarNo ratings yet

- 203942-2016-Taina Manigque-Stone v. Cattleya Land Inc.Document13 pages203942-2016-Taina Manigque-Stone v. Cattleya Land Inc.ACNo ratings yet

- Court upholds validity of mortgage on disputed propertyDocument3 pagesCourt upholds validity of mortgage on disputed propertyShiela PilarNo ratings yet

- Petitioners vs. vs. Respondents: Second DivisionDocument14 pagesPetitioners vs. vs. Respondents: Second DivisionMilane Anne CunananNo ratings yet

- A Hidden and Unknown Deposit of Money Is Considered A HiddenDocument2 pagesA Hidden and Unknown Deposit of Money Is Considered A HiddenMilane Anne CunananNo ratings yet

- TAX 1 DIGESTS - LimitationsDocument12 pagesTAX 1 DIGESTS - LimitationsMilane Anne Cunanan100% (1)

- Petitioner vs. vs. Respondents Araneta, Mendoza & Papa Martin B. LaureaDocument6 pagesPetitioner vs. vs. Respondents Araneta, Mendoza & Papa Martin B. LaureaMilane Anne CunananNo ratings yet

- Case Doctrines SummaryDocument3 pagesCase Doctrines SummaryMilane Anne CunananNo ratings yet

- 132215-1989-Moles v. Intermediate Appellate CourtDocument9 pages132215-1989-Moles v. Intermediate Appellate CourtJ castNo ratings yet

- Plaintiffs-Appellants Vs Vs Defendants-Appellees Almacen & Almacen Diosdado GaringalaoDocument4 pagesPlaintiffs-Appellants Vs Vs Defendants-Appellees Almacen & Almacen Diosdado GaringalaoMilane Anne CunananNo ratings yet

- Rev. 2.11. 135056-1985-Escaler - v. - Court - of - Appeals PDFDocument6 pagesRev. 2.11. 135056-1985-Escaler - v. - Court - of - Appeals PDFMilane Anne CunananNo ratings yet

- Plaintiffs-Appellees vs. vs. Defendant-Appellant Villareal, Almacen, Navarra & Associates Sycip, Salazar, Luna, Manalo & FelicianoDocument6 pagesPlaintiffs-Appellees vs. vs. Defendant-Appellant Villareal, Almacen, Navarra & Associates Sycip, Salazar, Luna, Manalo & FelicianoMilane Anne CunananNo ratings yet

- Borbon v. Servicewide PDFDocument7 pagesBorbon v. Servicewide PDFAnonymous mxCPJJPVEfNo ratings yet

- Petitioner vs. vs. Respondents Pantaleon Z. Salcedo Leandro B. FernandezDocument7 pagesPetitioner vs. vs. Respondents Pantaleon Z. Salcedo Leandro B. FernandezJanna SalvacionNo ratings yet

- 6 Fedman - Development - Corp. - v. - Agcaoili20180911-5466-Yu715wDocument8 pages6 Fedman - Development - Corp. - v. - Agcaoili20180911-5466-Yu715wMark De JesusNo ratings yet

- Court upholds land sale despite unpaid balanceDocument9 pagesCourt upholds land sale despite unpaid balanceAisa CastilloNo ratings yet

- 1.-153136-1939-Levy Hermanos Inc. v. GervacioDocument3 pages1.-153136-1939-Levy Hermanos Inc. v. GervacioJanna SalvacionNo ratings yet

- Bachrach Motor Co. Inc. v. MillanDocument4 pagesBachrach Motor Co. Inc. v. MillanVia Rhidda ImperialNo ratings yet

- 117633-2000-Laforteza v. Machuca PDFDocument12 pages117633-2000-Laforteza v. Machuca PDFNichole Patricia PedriñaNo ratings yet

- 203942-2016-Taina Manigque-Stone v. Cattleya Land Inc.Document13 pages203942-2016-Taina Manigque-Stone v. Cattleya Land Inc.ACNo ratings yet

- r.1. 121287-2004-Arra - Realty - Corp. - v. - Guarantee - Development20180412-1159-Onax2u PDFDocument20 pagesr.1. 121287-2004-Arra - Realty - Corp. - v. - Guarantee - Development20180412-1159-Onax2u PDFMilane Anne CunananNo ratings yet

- Hbupm1741l Q1 2023-24Document2 pagesHbupm1741l Q1 2023-24ProlayNo ratings yet

- Tax Rates Card 2023 GC - 220819 - 230837Document5 pagesTax Rates Card 2023 GC - 220819 - 230837smnomanNo ratings yet

- Borrower ChecklistDocument2 pagesBorrower ChecklistquibroNo ratings yet

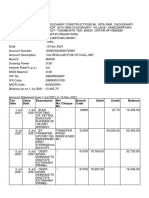

- Contractor's Ledger 1Document4 pagesContractor's Ledger 1Fareha RiazNo ratings yet

- 183553-2012-Diageo Philippines, Inc. v. Commissioner of Internal RevenueDocument7 pages183553-2012-Diageo Philippines, Inc. v. Commissioner of Internal RevenueButch MaatNo ratings yet

- Swiftcom Screen Report Deut BniDocument1 pageSwiftcom Screen Report Deut BniBagus AndriansyahNo ratings yet

- 3 6bitcoinDocument1 page3 6bitcoinjohn.whiteNo ratings yet

- Istilah Pajak Dalam Bahasa InggrisDocument2 pagesIstilah Pajak Dalam Bahasa Inggrisroida hasugianNo ratings yet

- TRAIN Law (PWC Philippines) PDFDocument16 pagesTRAIN Law (PWC Philippines) PDFYzar VelascoNo ratings yet

- Classification of Taxes: A. Domestic CorporationDocument5 pagesClassification of Taxes: A. Domestic CorporationWenjunNo ratings yet

- HSBC Amanah Malaysia Berhad ("HSBC Amanah") Universal Terms & ConditionsDocument41 pagesHSBC Amanah Malaysia Berhad ("HSBC Amanah") Universal Terms & ConditionsfaridajirNo ratings yet

- Standard Format SBLC Incoming (Final) - CorrectionDocument1 pageStandard Format SBLC Incoming (Final) - Correctionfugga50% (2)

- 5338 - September 2021 - P33MK3ZQEFJQM1AFODHYA3BR5477351240762656333113912Document1 page5338 - September 2021 - P33MK3ZQEFJQM1AFODHYA3BR5477351240762656333113912Shreyash SahayNo ratings yet

- Source Docuemnts For UploadingDocument26 pagesSource Docuemnts For UploadingCarlene Mae Ugay100% (1)

- TXN Date Value Date Description Ref No./Cheque No. Branch Code Debit Credit BalanceDocument12 pagesTXN Date Value Date Description Ref No./Cheque No. Branch Code Debit Credit Balancevijay choudharyNo ratings yet

- Tax InvoiceDocument2 pagesTax InvoiceNoman AnsariNo ratings yet

- Tax Audit Requirements for Intraday Equity and F&O Trading IncomeDocument5 pagesTax Audit Requirements for Intraday Equity and F&O Trading IncomebalakrishnaNo ratings yet

- Dav Public School,: Bseb Colony, PatnaDocument5 pagesDav Public School,: Bseb Colony, PatnaSaumya SaumyaNo ratings yet

- Rhombus Energy, Inc. vs. Commissioner of Internal Revenue DigestDocument2 pagesRhombus Energy, Inc. vs. Commissioner of Internal Revenue DigestEmir MendozaNo ratings yet

- Individual Taxpayer 1atax2Document21 pagesIndividual Taxpayer 1atax2Joneric RamosNo ratings yet

- Contract Guernsey Tax Summary To PDFDocument1 pageContract Guernsey Tax Summary To PDFMancus MariusNo ratings yet

- GST Amendments For June 22 Students by CA Vivek GabaDocument6 pagesGST Amendments For June 22 Students by CA Vivek GabayashNo ratings yet

- Prepaid CreditDocument8 pagesPrepaid CreditJavier RojasNo ratings yet

- Compute Income TaxDocument24 pagesCompute Income TaxMelody Fabreag76% (25)

- Account Statement-Unlocked PDFDocument12 pagesAccount Statement-Unlocked PDFvamsiNo ratings yet

- Wmcustomer 17586699 E73 CustomerInvoice PDFDocument1 pageWmcustomer 17586699 E73 CustomerInvoice PDFmdazajalamNo ratings yet

- Managing Transaction Taxesfor BrazilDocument31 pagesManaging Transaction Taxesfor BrazilLuiz A M V BarraNo ratings yet

- Report IBPMECMCXXXX760BBP - SB 0169-1Document5 pagesReport IBPMECMCXXXX760BBP - SB 0169-1MuhammadAsimNo ratings yet

- 25 Dollar 1Up Account Signup and Payment StepsDocument12 pages25 Dollar 1Up Account Signup and Payment StepsDeepak YadavNo ratings yet

- SBI Simply Click Jan22-1Document1 pageSBI Simply Click Jan22-1Broke BondNo ratings yet