Professional Documents

Culture Documents

Singapore Property Weekly Issue 162

Uploaded by

Propwise.sg0 ratings0% found this document useful (0 votes)

1K views13 pagesIn this issue:

- Is Paying Just 5 Times Your Annual Income for a Property Realistic?

- Singapore Property News This Week

- Resale Property Transactions (June 11 – June 17)

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentIn this issue:

- Is Paying Just 5 Times Your Annual Income for a Property Realistic?

- Singapore Property News This Week

- Resale Property Transactions (June 11 – June 17)

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

1K views13 pagesSingapore Property Weekly Issue 162

Uploaded by

Propwise.sgIn this issue:

- Is Paying Just 5 Times Your Annual Income for a Property Realistic?

- Singapore Property News This Week

- Resale Property Transactions (June 11 – June 17)

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 13

Issue 162

Copyright 2011-2014 www.Propwise.sg. All Rights Reserved.

Contribute

Do you have articles and insights and articles that youd like to share

with thousands of readers interested in the Singapore property

market? Send them to us at info@propwise.sg, and if theyre good

enough, well publish them here, on our blog and even on Yahoo!

News.

Advertise

Want to get your brand, product, service or property listing out to

thousands of Singapore property investors at a very reasonable

cost? Head over to www.propwise.sg/advertise/ to find out more.

CONTENTS

p2 Is Paying Just 5 Times Your Annual

Income for a Property Realistic?

p7 Singapore Property News This Week

p12 Resale Property Transactions

(June 11 - June 17 )

Welcome to the 162

th

edition of the

Singapore Property Weekly.

Hope you like it!

Mr. Propwise

FROM THE

EDITOR

SINGAPORE PROPERTY WEEKLY Issue 162

Page | 2

Back to Contents

By Mr. Propwise

In a recent blog post, guest contributor

Property Soul shared her rules on buying a

property you can afford, what she called the

3-3-5 rule. In a nutshell, the 3-3-5 rule

states that:

1. You should have at least 30% of the

propertys price in initial capital to cover

the downpayment and other costs.

2. Your monthly mortgage payment should

not exceed one-third of your monthly

salary.

3. The purchase price of the property should

not exceed five times your annual income

Is Paying Just 5 Times Your Annual Income for a Property Realistic?

SINGAPORE PROPERTY WEEKLY Issue 162

Page | 3

Back to Contents

Propwise.sg reader JC wrote in to comment

that Rule #3 was unrealistic and overly

conservative. Heres what he had to say:

The five times of income to property price

ratio is quite ridiculous. I feel that this ratio is

only applicable during the "mata wear khaki

shorts" days. How can one ever find such a

low ratio of five times in today's context? No

way, even if the property market is to crash,

or rather correct. Nevertheless, I would

definitely wish such a ratio would still hold

today, and I would bet all my money into

property.

Example: a couple earns $15,000 per month,

which annually would be $180,000. At five

times, they can only afford a property that is

$900,000, which can only buy a 2-bedder

condo at an RCR or OCR location in

Singapore. If the couple has kids, then I think

its pretty difficult to live in a smallish 2-bedder

of approximately 75 to 85 square meters with

a maid!

Rather, many couples CAN afford properties

at $1.2 to $1.5 million and above when their

income is approximately $10,000 per month,

which is a 10x rather than 5x ratio. With

savings of $400,000 to $500,000

(approximately 30% of $1.5mil), they can

easily afford the mortgage at $3,000 per

month (2% interest rate over 28 years). A

savings of $400,000 is not difficult to achieve

for a couple (both university grads) who have

worked for 10 years possibly with a little help

from their parents, say $50,000 to $80,000.

In a nutshell, the 3-3-5 rule is skewed towards

an unrealistic scenario which is unlikely to

happen in Singapore (for Rule #3).

SINGAPORE PROPERTY WEEKLY Issue 162

Page | 4

Back to Contents

We need to be realistic about the current

pricing, current market, and hopefully,

capitalize or gain from it through long term

investment or enjoyment of the property. If we

stick to this rule, we will NEVER buy a

property (condo, that is) in Singapore, unless

we earn $25,000 per month income combined

for a couple. (i.e. $12,500 each!)

I routed this question to Property Soul, who

had the following response:

This is what I called the boiling frog

phenomenon. When people are in a high-

price environment for too long, they will

gradually think that it is normal and

acceptable to pay high prices. Similarly, when

people are in a prolonged boom of the

property market, they will forget what a

value-for-money home is, or why it is

necessary to calculate the ROI of an

investment property.

When the market prices are climbing rapidly,

salespeople will tell their clients that it is

impossible to go back to the low prices in the

past. But history has proven that they are

wrong every single time.

It is when market prices have corrected

sharply that people begin to realize that

buyers have been overpaying for their

properties during the last peak of the property

market. These buyers pay the price of

holding their overpriced properties for the

long-term to break-even, while missing the

opportunities to buy when prices become

reasonable.

Developers can sell at future prices and

sellers can market at unreasonably high

prices. But as buyers, it doesnt mean that we

have to take whatever they offer in the

market. We all can exercise our individual

judgment to see whether the current

SINGAPORE PROPERTY WEEKLY Issue 162

Page | 5

Back to Contents

properties are overpriced before we buy

anything.

Of course, being kaypoh, I have some

thoughts as well on this discussion:

I view the 3-3-5 rule as a conservative

affordability test. When you are making

the biggest purchase in your life (of a

property), you typically want to err on the

side of being conservative. If your

purchase meets Property Souls 3-3-5

rule test, then you know that financially

you are not stretching yourself and can

sleep peacefully in your home. However,

that doesnt mean that you MUST follow

the rule. For example, if you find a home

that you like and meets your

requirements, and it is six times your

income, I dont think theres anything

wrong with buying it as long as you have

prepared for unexpected contingencies

(e.g. have a cushion of savings).

Sure a couple earning $10,000 a month

can potentially buy a $1.5 million condo,

but it is very aggressive. An 80%

mortgage loan (i.e. $1.2 million) at a 2%

rate over 30 years will result in a monthly

mortgage payment of $4,435, or 44% of

their income. They might be able to tide

over if they do not spend too much in

other areas. But we should NOT assume

a 2% rate of interest using a more

conservative 4% mortgage rate (a long

term average), their monthly mortgage

will balloon to $5,729 per month, which

could put significant stress on their

finances, especially if one party loses his

or her job. So yes, if you are aggressive

you can buy an expensive condo (as JC

has pointed out), but you may not survive

the tough times.

SINGAPORE PROPERTY WEEKLY Issue 162

Page | 6

Back to Contents

Yes, a couple with kids and a maid will

feel very cramped in a 900 square foot

condo apartment, but it is a choice. They

could have chosen to buy a resale HDB

flat, or can choose to suffer in a

cramped apartment for a few years until

they can comfortably afford to upgrade.

In general we have very short memories.

It wasnt too long ago (certainly not during

the mata wear khaki short days) when

properties were more affordable. In fact, it

was in 2006 when I bought my first

private property and I paid less than 5x

combined income for it.

I dont think that property prices will

necessarily go back to the previous lows

as Property Soul has mentioned. In fact,

looking at the URA Property Price Index

over a long period of time we see that the

general trend is an upward one, with

higher lows and higher highs. Property

prices go up over long periods of time due

to inflation and rising incomes. But the

market has cycles as well thats what I

look at to time my entry and exit into the

market.

Hope you found this discussion interesting! If

you have any opinions or stories youd like to

share, do email me at info@propwise.sg.

SINGAPORE PROPERTY WEEKLY Issue 162

Singapore Property This Week

Page | 7

Back to Contents

Residential

2in 5 Sentosa condos resold at a loss

According to market watchers, cooling down

measures such as loan restrictions may have

driven buyers away from the luxury homes

market. Data from URA Realis that was

gathered by STProperty.sg showed that 31

condominium units at Sentosa have been

resold since May 2013, however, about two in

five units were resold at a loss. According to

HSR Research, between January and May

this year, the average resale price fell 25 per

cent to $1,800 per square foot as compared

to $2,400 per square foot over the same

period last year. Nonetheless, since only five

transactions were made this year, price

movements are expected to be more volatile.

Among others, four units at The Berth, three

units at The Oceanfront, two at the Coast and

one at Azure were resold at a loss. Nicholas

Mak from SLP International believes that

given the weak leasing market, owners may

choose to sell their property at a loss as they

are unable to rent their units out. Other

analysts believe that owners who have

bought their Sentosa units at marked up

prices earlier may be at the losing end now.

(Source: Business Times)

SINGAPORE PROPERTY WEEKLY Issue 162

Page | 8

Back to Contents

TDSR may push mortgagee sales to a new

high in Q2

The number of properties that are auctioned

by mortgagees in Q2 this year is the highest

since Q3 2009. According to Colliers

International, the number of properties that

have been put up for auction this quarter

almost doubled from 22 units in Q1 to 42 units

in Q2 this year. This is likely to be due to the

implementation of the total debt servicing ratio

(TDSR) framework. Auctioneers explain that

the TDSR framework has made it difficult for

financially tight borrowers to secure buyers for

their properties. As such, more of such homes

have been put up for auction by financial

institutions. As the supply of non-landed

private homes increases, mortgagors face an

even greater challenge in selling off their

property. This means that mortgagee sales

may increase even further. Besides that,

market analysts believe that the weak leasing

market may also contribute to the raise in

mortgagee sales, as owners may not be able

to find tenants.

(Source: Business Times)

30 out of 80 units released at Trilive condo

in Kondo have been sold

Roxy-Pacific Holdings Trilive condo project at

Kovan area was launched last Friday.

However, sales have been slow at its launch

said Teo Hong Lim, Roxy-Pacifics executive

chairman. The 222-unit freehold project which

is located 650 meters away from Kovan MRT,

has released 80 of its units at a discounted

price of $1,550 per square foot for early birds.

Yet only 30 units have been sold so far.

According to Teo, private home sales have

been slow thus product differentiation may be

the key to closing a deal.

SINGAPORE PROPERTY WEEKLY Issue 162

Page | 9

Back to Contents

Unit sizes at the Trilive condo project begin

from 463 square feet for a one-bedroom unit

to 1,195 square feet for a four-bedroom unit.

Of the 222 units, around 80 per cent of the

units are dual key units. Prices start from

$730,000 for a single bedroom unit to

$870,000 for a two-bedroom unit. A two-

bedroom dual key unit will start from

$960,000, a three-bedroom dual key unit is

priced around $1.3 million, and a four-

bedroom unit will cost around $1.65 million.

(Source: Business Times)

Three new residential sites on GLS

confirmed list

Three 99-year leasehold residential sites are

up for tender under the confirmed list of H1

2014 Government Land Sales programme. Of

the three sites, two reside in Sengkang while

the other is an executive condominium (EC)

plot that is located at Choa Chu Kang. The

Sengkang land parcels are both at Fernvale

Roadthe smaller land plot is around 16,604

square meters while the larger plot is around

17,414 square meters. The tenders for both

plots will close on August 7 and the two sites

are expected to yield a total of 1,100 units

when fully developed. Market analysts believe

that each of the Sengkang site will draw bids

from $420 to $480 per square foot per plot

ratio. On the other hand, the EC plot at Choa

Chu Kang which is expected to yield around

535 homes is expected to draw bids between

$310 and $350 per square foot per plot ratio

before its tender closes on September 4.

(Source: Business Times)

SINGAPORE PROPERTY WEEKLY Issue 162

Page | 10

Back to Contents

Commercial

More land plots at Gambas and Tuas for

sale

The fourth land parcel at Gambas Crescent

has been launched for sale, along with two

new sites at Tuas South. The Gambas

Crescent site which is 15,665 square meters

large and has a maximum gross plot ratio of

2.5, is zoned for light industrial use for

Business-1 development. The site has a 30-

year lease and is expected to draw bids

between $90 and $120 per square foot per

plot ratio (psf ppr). Nicholas Mak from SLP

International believes that Far East

Organisation, which owns three other sites in

the area, may aggressively bid for the fourth

Gambas Crescent site in order to secure a

stronger presence within the area. However,

Ong Kah Seng, RST Research director

believes that there is no major need for the

property giant to own the fourth parcel as

they already have a strong territorial

presence. On the other hand, the land parcel

at Tuas South Avenue 7, which also has a 30-

year lease, is 25,700 square meters. It has a

maximum gross plot ratio of 2.0 and is zoned

for heavier industrial use for Business-2

development. Analysts believe that site will

draw bids from $75 to $85 psf ppr. Lastly, the

site at Tuas South Avenue 14 has been

launched under the reserve list. It has a

maximum gross plot ratio of 2.0 too, and is

33,300 square meters large.

(Source: Business Times)

Property investment sales slow to a crawl

Investment sales in Singapore property has

slowed to $3.5-$3.6 billion this quarter.

SINGAPORE PROPERTY WEEKLY Issue 162

Page | 11

Back to Contents

Such sales cover big-ticket transactions that

are beyond $10 million. In H1 of 2013, the

total amount of investment sales was around

$12 billion. However, the year-to-date tally

this year is only around $8 billion. Both CBRE

and Savills predict that there will be a fall in

investment sales from last years $30 billion.

CBRE expects that there will be $12-$15

billion worth of transactions this year while

Savills predicts that there will be $16-$18

billion worth of transactions. This pullback in

investments is expected to be due to the

governments cooling measures. According to

Desmond Sim from CBRE, the

implementation of the total debt servicing

ratio framework has affected buyers and

sellers interest. Not only so reduced land

supply in the Government Land Sales

programme may also result in a decrease in

investment sales. Furthermore, according to

CBRE, there is increased interest in overseas

property. Nonetheless, according to Savills

Singapore, investment sales in the office

sector have been optimistic as there are

about $680 million of office transactions

recorded this quarter.

(Source: Business Times)

SINGAPORE PROPERTY WEEKLY Issue 162

Page | 12

Back to Contents

Non-Landed Residential Resale Property Transactions for the Week of Jun 11 Jun 17

Postal

District

Project Name

Area

(sqft)

Transacted

Price ($)

Price

($ psf)

Tenure

1 THE SAIL @ MARINA BAY 614 1,380,000 2,249 99

2 ICON 915 1,530,000 1,672 99

3 THE ANCHORAGE 1,798 2,370,000 1,318 FH

4 THE BERTH BY THE COVE 1,668 2,700,000 1,618 99

4 REFLECTIONS AT KEPPEL BAY 915 1,480,000 1,618 99

4 TERESA VILLE 3,972 4,725,000 1,190 FH

5 BOTANNIA 1,249 1,618,888 1,297 956

8 CITY SQUARE RESIDENCES 570 935,000 1,639 FH

8 CITYLIGHTS 689 1,070,000 1,553 99

8 HERTFORD COLLECTION 1,345 2,050,000 1,524 FH

9 HILLTOPS 2,874 11,285,640 3,927 FH

9 THE ORCHARD RESIDENCES 2,852 10,552,400 3,699 99

9 HELIOS RESIDENCES 1,916 5,100,000 2,662 FH

9 CAIRNHILL CREST 818 1,588,000 1,941 FH

10 DUCHESS RESIDENCES 1,485 2,720,000 1,831 999

10 BELLERIVE 958 1,615,000 1,686 FH

10 THE MARBELLA 1,399 2,338,000 1,671 FH

10 SPANISH VILLAGE 1,173 1,780,000 1,517 FH

11 MULBERRY TREE 441 820,000 1,858 FH

11 MANDALE HEIGHTS 764 980,000 1,282 FH

14 LE CRESCENDO 915 1,085,000 1,186 FH

14 D'HERITAGE CASTLE 1,173 1,035,000 882 FH

14 TORIEVIEW MANSIONS 1,335 1,000,000 749 FH

15 THE AZZURO 646 870,000 1,347 FH

15 WATER PLACE 1,227 1,600,800 1,305 99

15 SANCTUARY GREEN 1,399 1,630,000 1,165 99

Postal

District

Project Name

Area

(sqft)

Transacted

Price ($)

Price

($ psf)

Tenure

15 OCEAN PARK 2,110 2,320,000 1,100 FH

15 LAGUNA PARK 1,615 1,340,000 830 99

16 BAYSHORE PARK 1,292 1,360,000 1,053 99

16 PARBURY HILL CONDOMINIUM 2,185 2,300,000 1,053 FH

16 WATERFRONT WAVES 1,668 1,600,000 959 99

17 ESTELLA GARDENS 657 680,000 1,036 FH

18 RIS GRANDEUR 1,066 1,060,000 995 FH

18 LIVIA 1,539 1,430,000 929 99

18 TROPICAL SPRING 1,528 1,400,000 916 99

18 TROPICAL SPRING 1,378 1,240,000 900 99

18 CHANGI RISE CONDOMINIUM 1,023 890,000 870 99

19 THE QUARTZ 1,367 1,270,000 929 99

21 THE CASCADIA 1,141 1,700,000 1,490 FH

21 HIGHGATE 1,109 1,185,000 1,069 FH

22 PARC VISTA 1,249 1,088,000 871 99

22 LAKEHOLMZ 1,249 1,055,000 845 99

23 CASHEW HEIGHTS CONDOMINIUM 1,227 1,220,000 994 999

23 HILLVIEW REGENCY 969 940,000 970 99

23 THE MADEIRA 1,356 1,200,000 885 99

23 PARKVIEW APARTMENTS 980 845,000 863 99

23 MI CASA 1,119 940,000 840 99

23 NORTHVALE 1,518 1,268,000 835 99

23 REGENT HEIGHTS 1,163 920,000 791 99

NOTE: This data only covers non-landed residential resale property

transactions with caveats lodged with the Singapore Land Authority.

Typically, caveats are lodged at least 2-3 weeks after a purchaser

signs an OTP, hence the lagged nature of the data.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Electrolux Case StudyDocument4 pagesElectrolux Case StudyEmily GevaertsNo ratings yet

- Sun Pharma Report.Document26 pagesSun Pharma Report.knowledge_power67% (15)

- Viking Form 2 ADVDocument36 pagesViking Form 2 ADVSOeNo ratings yet

- Terminology in Product Cost Controlling (SAP Library - Cost Object Controlling (CO-PC-OBJ) ) PDFDocument2 pagesTerminology in Product Cost Controlling (SAP Library - Cost Object Controlling (CO-PC-OBJ) ) PDFkkka TtNo ratings yet

- Anti Money Laundering PolicyDocument8 pagesAnti Money Laundering PolicysonilaNo ratings yet

- Singapore Property Weekly Issue 383Document13 pagesSingapore Property Weekly Issue 383Propwise.sgNo ratings yet

- Singapore Property Weekly Issue 385Document11 pagesSingapore Property Weekly Issue 385Propwise.sgNo ratings yet

- Singapore Property Weekly Issue 386Document12 pagesSingapore Property Weekly Issue 386Propwise.sgNo ratings yet

- Singapore Property Weekly Issue 384Document10 pagesSingapore Property Weekly Issue 384Propwise.sgNo ratings yet

- Singapore Property Weekly Issue 381Document13 pagesSingapore Property Weekly Issue 381Propwise.sgNo ratings yet

- Singapore Property Weekly Issue 380Document13 pagesSingapore Property Weekly Issue 380Propwise.sgNo ratings yet

- Singapore Property Weekly Issue 382Document13 pagesSingapore Property Weekly Issue 382Propwise.sgNo ratings yet

- Singapore Property Weekly Issue 373Document13 pagesSingapore Property Weekly Issue 373Propwise.sgNo ratings yet

- Singapore Property Weekly Issue 366Document12 pagesSingapore Property Weekly Issue 366Propwise.sgNo ratings yet

- Singapore Property Weekly Issue 378Document10 pagesSingapore Property Weekly Issue 378Propwise.sgNo ratings yet

- Singapore Property Weekly Issue 376Document13 pagesSingapore Property Weekly Issue 376Propwise.sgNo ratings yet

- Singapore Property Weekly Issue 377Document7 pagesSingapore Property Weekly Issue 377Propwise.sg100% (1)

- Singapore Property Weekly Issue 379Document13 pagesSingapore Property Weekly Issue 379Propwise.sgNo ratings yet

- Singapore Property Weekly Issue 374Document12 pagesSingapore Property Weekly Issue 374Propwise.sgNo ratings yet

- Singapore Property Weekly Issue 375Document8 pagesSingapore Property Weekly Issue 375Propwise.sgNo ratings yet

- Singapore Property Weekly Issue 371Document11 pagesSingapore Property Weekly Issue 371Propwise.sgNo ratings yet

- Singapore Property Weekly Issue 372Document12 pagesSingapore Property Weekly Issue 372Propwise.sgNo ratings yet

- SingaporeDocument10 pagesSingaporePropwise.sgNo ratings yet

- Singapore Property Weekly Issue 370Document10 pagesSingapore Property Weekly Issue 370Propwise.sgNo ratings yet

- Singapore Property Weekly Issue 364Document13 pagesSingapore Property Weekly Issue 364Propwise.sgNo ratings yet

- Singapore Property Weekly Issue 367Document13 pagesSingapore Property Weekly Issue 367Propwise.sgNo ratings yet

- Singapore Property Weekly Issue 369Document12 pagesSingapore Property Weekly Issue 369Propwise.sgNo ratings yet

- Singapore Property Weekly Issue 365Document13 pagesSingapore Property Weekly Issue 365Propwise.sgNo ratings yet

- Singapore Property Weekly Issue 359Document15 pagesSingapore Property Weekly Issue 359Propwise.sgNo ratings yet

- Singapore Property Weekly Issue 358Document15 pagesSingapore Property Weekly Issue 358Propwise.sgNo ratings yet

- Singapore Property Weekly Issue 362Document7 pagesSingapore Property Weekly Issue 362Propwise.sgNo ratings yet

- Singapore Property Weekly Issue 363Document13 pagesSingapore Property Weekly Issue 363Propwise.sgNo ratings yet

- Singapore Property Weekly Issue 361Document11 pagesSingapore Property Weekly Issue 361Propwise.sgNo ratings yet

- Singapore Property Weekly Issue 360Document10 pagesSingapore Property Weekly Issue 360Propwise.sgNo ratings yet

- Singapore Property Weekly Issue 357Document13 pagesSingapore Property Weekly Issue 357Propwise.sgNo ratings yet

- HDFC Repaired 22222Document124 pagesHDFC Repaired 22222rahulsogani123No ratings yet

- Monetary Policy Statement October 2020Document2 pagesMonetary Policy Statement October 2020African Centre for Media ExcellenceNo ratings yet

- Response Letter - LOA - VAT 2021 - RAWDocument2 pagesResponse Letter - LOA - VAT 2021 - RAWGeralyn BulanNo ratings yet

- Ch03 Corrected.S17Document11 pagesCh03 Corrected.S17ariesNo ratings yet

- Valuation of GoodwillDocument15 pagesValuation of Goodwillbtsa1262013No ratings yet

- A Commission To Both Lender and Borrower, Is A Bank. It Is Conceded That A Total of 59,463 SavingsDocument45 pagesA Commission To Both Lender and Borrower, Is A Bank. It Is Conceded That A Total of 59,463 SavingsJustice PajarilloNo ratings yet

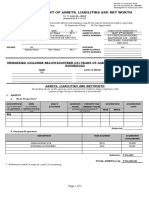

- Sworn Statement of Assets, Liabilities and Net WorthDocument2 pagesSworn Statement of Assets, Liabilities and Net WorthKal El DadiNo ratings yet

- CORRECTION OF ERRORS Theories PDFDocument7 pagesCORRECTION OF ERRORS Theories PDFJoy Miraflor AlinoodNo ratings yet

- DP HCM (MATHS) Printable PDFDocument81 pagesDP HCM (MATHS) Printable PDFAarzoo RatheeNo ratings yet

- Module 4 PDFDocument19 pagesModule 4 PDFRAJASAHEB DUTTANo ratings yet

- Chaprer III PFS PreparationDocument63 pagesChaprer III PFS PreparationFrancis Dave Peralta BitongNo ratings yet

- Wyckoff Methode With Supply and - Alex RayanDocument49 pagesWyckoff Methode With Supply and - Alex RayanmansoodNo ratings yet

- Additional Income and Adjustments To IncomeDocument1 pageAdditional Income and Adjustments To IncomeSz. RolandNo ratings yet

- A. QB Lesson 6Document28 pagesA. QB Lesson 6Shena Mari Trixia Gepana100% (1)

- General Exception. A Bond That Otherwise Satisfies The Hedge Fund Bond TestDocument1 pageGeneral Exception. A Bond That Otherwise Satisfies The Hedge Fund Bond TestVIVEK SHARMANo ratings yet

- Mike BarnsDocument28 pagesMike BarnsSiraj KuvakkattayilNo ratings yet

- IHC Appeal 2014Document2 pagesIHC Appeal 2014isnahousingNo ratings yet

- Monetary PolicyDocument23 pagesMonetary PolicyManjunath ShettigarNo ratings yet

- Letter-SB-Request For Special Session-11 October 2023Document5 pagesLetter-SB-Request For Special Session-11 October 2023cj.pulga.palNo ratings yet

- 210703165404suraksha Smart City Phase 1 - BookletDocument9 pages210703165404suraksha Smart City Phase 1 - BookletRoshan chauhanNo ratings yet

- IBM Final PDFDocument4 pagesIBM Final PDFpohweijunNo ratings yet

- TA DA RulesDocument54 pagesTA DA RulesSheikh InayatNo ratings yet

- Intacc Midterm Sw&QuizzesDocument68 pagesIntacc Midterm Sw&QuizzesIris FenelleNo ratings yet

- Lesson 7.8: Simple InterestDocument18 pagesLesson 7.8: Simple InterestAnalie CabanlitNo ratings yet

- CRD of Michael Yehuda RiceDocument23 pagesCRD of Michael Yehuda RicebuyersstrikewpNo ratings yet