100% found this document useful (5 votes)

5K views49 pagesWyckoff Methode With Supply and - Alex Rayan

This document provides an overview and introduction to the Wyckoff method of technical analysis. It discusses key concepts in the Wyckoff method including:

- The Wyckoff price cycle which analyzes natural market forces through price action, volume, and time.

- Wyckoff accumulation and distribution schematics which illustrate typical patterns seen in accumulating and distributing markets.

- Wyckoff phases which outline the progression of a market from prior downtrend to new uptrend.

- Key terms used in Wyckoff analysis like preliminary support, selling climax, automatic rally, and signs of strength.

The document serves as an introductory guide for readers looking to learn the basic concepts and terminology

Uploaded by

mansoodCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

100% found this document useful (5 votes)

5K views49 pagesWyckoff Methode With Supply and - Alex Rayan

This document provides an overview and introduction to the Wyckoff method of technical analysis. It discusses key concepts in the Wyckoff method including:

- The Wyckoff price cycle which analyzes natural market forces through price action, volume, and time.

- Wyckoff accumulation and distribution schematics which illustrate typical patterns seen in accumulating and distributing markets.

- Wyckoff phases which outline the progression of a market from prior downtrend to new uptrend.

- Key terms used in Wyckoff analysis like preliminary support, selling climax, automatic rally, and signs of strength.

The document serves as an introductory guide for readers looking to learn the basic concepts and terminology

Uploaded by

mansoodCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

- Introduction: Provides a general overview of trading securities risks and the necessity of understanding strategies to minimize those risks.

- What is The Wyckoff Method?: Explains the fundamentals and history of the Wyckoff trading method.

- Wyckoff Rules: Outlines the stages of supply and demand and their implications for financial markets.

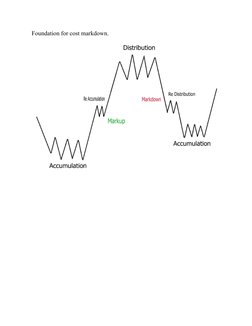

- Wyckoff Price Cycle: Describes the cyclical nature of price movements as interpreted by Wyckoff.

- Wyckoff Schematics: Introduces visual schematics used in Wyckoff analysis to predict movement directions.

- Wyckoff Phases: Details various phases of the Wyckoff method, explaining market trends and patterns in trading.

- Wyckoff Distribution: Analyzes the distribution phase, highlighting key stages like supply and demand.

- Wyckoff Channels: Explains the concept of up and down channels in trading using Wyckoff's method.

- Wyckoff Volume Types Bars in My Strategy: Discusses the different volume types that signal various trading opportunities.

- Supply and Demand: Explores how supply and demand principles apply to forex trading.

- Drawing Supply and Demand Areas: Provides techniques for identifying and drawing supply and demand zones in trading charts using candles.

- Conditions for Supply and Demand Areas: Defines the criteria for establishing supply and demand zones in analysis.

- How To Trade Supply And Demand With Price Action: Guides on trading supply and demand zones effectively using price action strategies.

- How To Trade Wyckoff With Supply And Demand with Price Action Candles: Integrates Wyckoff's method with price action trading using visual aids and examples.