Professional Documents

Culture Documents

Utah Proposed Property Tax Increases For 2014

Uploaded by

The Salt Lake TribuneOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Utah Proposed Property Tax Increases For 2014

Uploaded by

The Salt Lake TribuneCopyright:

Available Formats

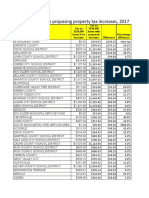

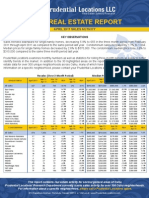

Proposed

Property Tax Increases, 2014

Local government

Tax

without

increase*

ROCKVILLE TOWN

$168.74

CASTLE VALLEY TOWN

LOGAN CITY SCHOOL DISTRICT

KAYSVILLE

TOOELE COUNTY MUNICIPAL TYPE SERVICE FUND

CLINTON

OGDEN CITY SCHOOL DISTRICT

Tax with proposed

increase*

Tax hike*

Percent

increase

$389.52

$220.77

130.8%

$133.50

$267.48

$133.98

100.4%

$901.66

$1,010.92

$109.26

12.1%

$108.20

$215.92

$107.73

99.6%

$0.00

$101.10

$101.10

New

$212.50

$295.27

$82.78

39.0%

$1,018.37

$1,091.92

$73.55

7.2%

ELK RIDGE CITY

$279.07

$343.99

$64.92

23.3%

MORGAN COUNTY SCHOOL DISTRICT

$844.90

$898.23

$53.33

6.3%

SALT LAKE CITY SCHOOL DISTRICT

$698.74

$745.33

$46.59

6.7%

HEBER CITY

$133.62

$176.90

$43.28

32.4%

$1,091.80

$1,134.37

$42.57

3.9%

PARK CITY SCHOOL DISTRICT

$505.76

$545.49

$39.73

7.9%

NORTH SANPETE SCHOOL DISTRICT

$896.57

$929.45

$32.87

3.7%

JUAB COUNTY SCHOOL DISTRICT

$943.99

$972.84

$28.85

3.1%

GRANITE SCHOOL DISTRICT

$786.24

$807.77

$21.52

2.7%

WEBER FIRE DISTRICT

$164.13

$185.53

$21.40

13.0%

$28.38

$49.55

$21.17

74.6%

TOOELE COUNTY SCHOOL DISTRICT

WASATCH COUNTY FIRE PROTECTION SPECIAL SERVICE

DISTRICT

UPPER SEVIER RIVER WATER CONSERVANCY DISTRICT

$4.02

$23.65

$19.63

488.2%

COTTONWOOD HEIGHTS PARKS AND RECREATION AREA

$129.01

$148.17

$19.16

14.8%

ALTA TOWN

$123.22

$141.90

$18.68

15.2%

WASHINGTON COUNTY SCHOOL DISTRICT

$836.38

$853.88

$17.50

2.1%

CARBON COUNTY SCHOOL DISTRICT

$838.16

$854.71

$16.56

2.0%

CACHE

$265.59

$281.91

$16.32

6.1%

WEST POINT

$117.78

$131.38

$13.60

11.5%

$73.67

$87.03

$13.36

18.1%

GRAND COUNTY SCHOOL DISTRICT

$732.32

$745.33

$13.01

1.8%

KANAB CITY

$170.52

$182.46

$11.94

7.0%

MIDVALE CITY

SANPETE WATER CONSERVANCY DISTRICT

$35.95

$47.30

$11.35

31.6%

EMERY COUNTY SCHOOL DISTRICT

$656.52

$667.17

$10.64

1.6%

MURRAY CITY SCHOOL DISTRICT

$801.50

$809.54

$8.04

1.0%

WASATCH

$284.04

$291.01

$6.98

2.5%

DAGGETT COUNTY SCHOOL DISTRICT

$509.89

$516.75

$6.86

1.3%

SALT LAKE CITY

$666.46

$671.07

$4.61

0.7%

LOGAN CITY

$252.58

$256.72

$4.14

1.6%

$11.35

$14.66

$3.31

29.2%

LEWISTON CITY

$268.07

$270.56

$2.48

0.9%

WEST VALLEY CITY

$515.69

$518.05

$2.37

0.5%

SALT LAKE VALLEY LAW ENFORCEMENT SERVICE AREA

$252.46

$253.65

$1.18

0.5%

SALT LAKE COUNTY UNIFIED FIRE SERVICE AREA

$246.91

$247.97

$1.06

0.4%

DAVIS COUNTY MOSQUITO ABATEMENT DISTRICT

*Tax on a $215,000 home, the median value for a home in Utah

Source: Salt Lake Tribune analysis of Utah Tax Commission data

You might also like

- Richter Et Al 2024 CRB Water BudgetDocument12 pagesRichter Et Al 2024 CRB Water BudgetThe Salt Lake Tribune100% (4)

- 2020 Property Collection For Cook CountyDocument5 pages2020 Property Collection For Cook CountyWGN Web DeskNo ratings yet

- Cupp-Patterson School Funding Formula Estimated AidDocument17 pagesCupp-Patterson School Funding Formula Estimated AidAndy ChowNo ratings yet

- See Squamish Housing Stats For JulyDocument9 pagesSee Squamish Housing Stats For JulyJennifer ThuncherNo ratings yet

- NetChoice V Reyes Official ComplaintDocument58 pagesNetChoice V Reyes Official ComplaintThe Salt Lake TribuneNo ratings yet

- SEC Cease-And-Desist OrderDocument9 pagesSEC Cease-And-Desist OrderThe Salt Lake Tribune100% (1)

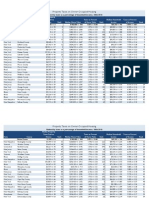

- Local Governments Proposing Property Tax Increases in 2017Document2 pagesLocal Governments Proposing Property Tax Increases in 2017The Salt Lake TribuneNo ratings yet

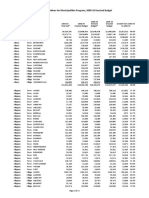

- Property Tax Hikes - 2016Document2 pagesProperty Tax Hikes - 2016The Salt Lake TribuneNo ratings yet

- Proptax 06 10 IncomeDocument102 pagesProptax 06 10 IncomeTax FoundationNo ratings yet

- City ZIP Code Average Listing Average Selling Average Sold Top 10 Price Price To List RatioDocument2 pagesCity ZIP Code Average Listing Average Selling Average Sold Top 10 Price Price To List RatioBrett WidnessNo ratings yet

- Budgeted Change in Per - Pupil Spending by Region 2010 - 11 School YearDocument15 pagesBudgeted Change in Per - Pupil Spending by Region 2010 - 11 School YearNick ReismanNo ratings yet

- City ZIP Code Average Listing Average Selling Average Sold Top 10 Price Price To List RatioDocument2 pagesCity ZIP Code Average Listing Average Selling Average Sold Top 10 Price Price To List RatioBrett WidnessNo ratings yet

- 2009 NetTaxBefFrz CertifiedDocument2 pages2009 NetTaxBefFrz CertifiedwhundleyNo ratings yet

- HB153 - 2011 School District RankingDocument37 pagesHB153 - 2011 School District RankingGreg MildNo ratings yet

- M&O Levy Proposal October 10, 2011Document1 pageM&O Levy Proposal October 10, 2011Debra KolrudNo ratings yet

- Expense Plan: Totals $ 2,250 $ 27,000 $ 26,350 2.5%Document2 pagesExpense Plan: Totals $ 2,250 $ 27,000 $ 26,350 2.5%JatinTaldarNo ratings yet

- Attach - 2024 Year Over Year Breakdowns and GraphsDocument15 pagesAttach - 2024 Year Over Year Breakdowns and GraphsTom SummerNo ratings yet

- Beth Tax RatesDocument1 pageBeth Tax RatesJulie_SeelyNo ratings yet

- Salario Minimo Auxilio PDFDocument1 pageSalario Minimo Auxilio PDFDayanna BelloNo ratings yet

- Salario Minimo Auxilio PDFDocument1 pageSalario Minimo Auxilio PDFpaulaNo ratings yet

- Proptax10 Home ValueDocument28 pagesProptax10 Home ValueTax FoundationNo ratings yet

- Oct 21 StatsDocument1 pageOct 21 StatsMatt PollockNo ratings yet

- City CleanersDocument2 pagesCity Cleanersapi-295200238No ratings yet

- Apegs Salary Survey Summary Results 2021Document4 pagesApegs Salary Survey Summary Results 2021Brian TaiNo ratings yet

- AmstedamfollyDocument1 pageAmstedamfollyflippinamsterdamNo ratings yet

- 2013 Snohomish County School District Levy TaxDocument2 pages2013 Snohomish County School District Levy TaxDebra KolrudNo ratings yet

- 2008 Domestic Water SurveyDocument1 page2008 Domestic Water SurveyCaroline Nordahl BrosioNo ratings yet

- LD1495 Incidence REPORTDocument3 pagesLD1495 Incidence REPORTMelinda JoyceNo ratings yet

- Property Taxes On Owner-Occupied HousingDocument66 pagesProperty Taxes On Owner-Occupied HousingTax FoundationNo ratings yet

- Trabajo 2Document2 pagesTrabajo 22021 Eco AHUATZIN ALCANTARA MIRANDANo ratings yet

- Lake County Single Family Sales Summary 2006-2013Document91 pagesLake County Single Family Sales Summary 2006-2013The News-HeraldNo ratings yet

- K 12 EducationDocument15 pagesK 12 EducationWTOL DIGITAL100% (1)

- Single Family HomesDocument1 pageSingle Family Homesapi-26358990No ratings yet

- Ford Realty Boston Luxury Condos 2017 ReportDocument6 pagesFord Realty Boston Luxury Condos 2017 ReportFord RealtyNo ratings yet

- Montreal Municipal Taxes 2010Document1 pageMontreal Municipal Taxes 2010Montreal GazetteNo ratings yet

- City of Richmond Employees Making $200K+ Per YearDocument8 pagesCity of Richmond Employees Making $200K+ Per YearBill Gram-ReeferNo ratings yet

- Federalcompliancecosts 20061026Document1 pageFederalcompliancecosts 20061026Andrew NeuberNo ratings yet

- Island Homes Sold - 2016Document2 pagesIsland Homes Sold - 2016cutty54No ratings yet

- 2019 Property Tax Increases in UtahDocument3 pages2019 Property Tax Increases in UtahThe Salt Lake TribuneNo ratings yet

- Electricity What Your City PaysDocument1 pageElectricity What Your City Paysbilal761No ratings yet

- Dórea - Gerenciamento de Risco IqDocument172 pagesDórea - Gerenciamento de Risco IqFernanda CorreiaNo ratings yet

- Greater Vancouver Dec 2010Document7 pagesGreater Vancouver Dec 2010urbaniak_bcNo ratings yet

- May 2012Document5 pagesMay 2012Jared ReimerNo ratings yet

- 2020 Property Collection For Cook CountyDocument5 pages2020 Property Collection For Cook CountyWGN Web DeskNo ratings yet

- AIM 09 - 10 Remaining PaymentsDocument72 pagesAIM 09 - 10 Remaining PaymentsrkarlinNo ratings yet

- News Water Rwsarates2010Document1 pageNews Water Rwsarates2010readthehookNo ratings yet

- Truth in Taxation Park Rapids Schools 2023-24Document23 pagesTruth in Taxation Park Rapids Schools 2023-24inforumdocsNo ratings yet

- April 2011 OREODocument1 pageApril 2011 OREOJoe SegalNo ratings yet

- Total Per Pupil Spending Growth 1988-89 To 2006-07Document2 pagesTotal Per Pupil Spending Growth 1988-89 To 2006-07Education Policy CenterNo ratings yet

- MaineHousingReport December2010Document2 pagesMaineHousingReport December2010Pattie ReavesNo ratings yet

- Chart Top Towns 2019Document11 pagesChart Top Towns 2019Tony PetrosinoNo ratings yet

- SM014 Elemental Costing DatabaseDocument41 pagesSM014 Elemental Costing DatabasewanfaroukNo ratings yet

- TM Budget Presentation 2015Document34 pagesTM Budget Presentation 2015jxmackNo ratings yet

- 2021 Illustrative Property Assessment Examples - PFC2020-1014Document3 pages2021 Illustrative Property Assessment Examples - PFC2020-1014Darren KrauseNo ratings yet

- 2015 Budget TrackerDocument72 pages2015 Budget TrackerericNo ratings yet

- News Release: Home Sales Activity Strong Through Olympic PeriodDocument7 pagesNews Release: Home Sales Activity Strong Through Olympic PeriodBenAmzalegNo ratings yet

- Proptax 06 10 TaxpaidDocument102 pagesProptax 06 10 TaxpaidTax FoundationNo ratings yet

- Unsaved Preview Document (Dragged)Document1 pageUnsaved Preview Document (Dragged)Titan ValuationNo ratings yet

- Property Taxes On Owner-Occupied HousingDocument28 pagesProperty Taxes On Owner-Occupied HousingTax FoundationNo ratings yet

- U.S. Army Corps of Engineers LetterDocument3 pagesU.S. Army Corps of Engineers LetterThe Salt Lake TribuneNo ratings yet

- Upper Basin Alternative, March 2024Document5 pagesUpper Basin Alternative, March 2024The Salt Lake TribuneNo ratings yet

- Salt Lake City Council Text MessagesDocument25 pagesSalt Lake City Council Text MessagesThe Salt Lake TribuneNo ratings yet

- Park City ComplaintDocument18 pagesPark City ComplaintThe Salt Lake TribuneNo ratings yet

- Settlement Agreement Deseret Power Water RightsDocument9 pagesSettlement Agreement Deseret Power Water RightsThe Salt Lake TribuneNo ratings yet

- Superintendent ContractsDocument21 pagesSuperintendent ContractsThe Salt Lake TribuneNo ratings yet

- Gov. Cox Declares Day of Prayer and ThanksgivingDocument1 pageGov. Cox Declares Day of Prayer and ThanksgivingThe Salt Lake TribuneNo ratings yet

- Unlawful Detainer ComplaintDocument81 pagesUnlawful Detainer ComplaintThe Salt Lake Tribune100% (1)

- US Magnesium Canal Continuation SPK-2008-01773 Comments 9SEPT2022Document5 pagesUS Magnesium Canal Continuation SPK-2008-01773 Comments 9SEPT2022The Salt Lake TribuneNo ratings yet

- The Church of Jesus Christ of Latter-Day Saints Petition For Rehearing in James Huntsman's Fraud CaseDocument66 pagesThe Church of Jesus Christ of Latter-Day Saints Petition For Rehearing in James Huntsman's Fraud CaseThe Salt Lake TribuneNo ratings yet

- Spectrum Academy Reform AgreementDocument10 pagesSpectrum Academy Reform AgreementThe Salt Lake TribuneNo ratings yet

- Teena Horlacher LienDocument3 pagesTeena Horlacher LienThe Salt Lake TribuneNo ratings yet

- Opinion Issued 8-Aug-23 by 9th Circuit Court of Appeals in James Huntsman v. LDS ChurchDocument41 pagesOpinion Issued 8-Aug-23 by 9th Circuit Court of Appeals in James Huntsman v. LDS ChurchThe Salt Lake Tribune100% (2)

- 2023.03.28 Emery County GOP Censure ProposalDocument1 page2023.03.28 Emery County GOP Censure ProposalThe Salt Lake TribuneNo ratings yet

- Employment Contract - Liz Grant July 2023 To June 2025 SignedDocument7 pagesEmployment Contract - Liz Grant July 2023 To June 2025 SignedThe Salt Lake TribuneNo ratings yet

- Goodly-Jazz ContractDocument7 pagesGoodly-Jazz ContractThe Salt Lake TribuneNo ratings yet

- David Nielsen - Memo To US Senate Finance Committee, 01-31-23Document90 pagesDavid Nielsen - Memo To US Senate Finance Committee, 01-31-23The Salt Lake Tribune100% (1)

- HB 499 Utah County COG LetterDocument1 pageHB 499 Utah County COG LetterThe Salt Lake TribuneNo ratings yet

- Wasatch IT-Jazz ContractDocument11 pagesWasatch IT-Jazz ContractThe Salt Lake TribuneNo ratings yet

- Utah Senators Encourage Gov. DeSantis To Run For U.S. PresidentDocument3 pagesUtah Senators Encourage Gov. DeSantis To Run For U.S. PresidentThe Salt Lake TribuneNo ratings yet

- US Magnesium Canal Continuation SPK-2008-01773 Comments 9SEPT2022Document5 pagesUS Magnesium Canal Continuation SPK-2008-01773 Comments 9SEPT2022The Salt Lake TribuneNo ratings yet

- PLPCO Letter Supporting US MagDocument3 pagesPLPCO Letter Supporting US MagThe Salt Lake TribuneNo ratings yet

- US Magnesium Canal Continuation SPK-2008-01773 Comments 9SEPT2022Document5 pagesUS Magnesium Canal Continuation SPK-2008-01773 Comments 9SEPT2022The Salt Lake TribuneNo ratings yet

- Proc 2022-01 FinalDocument2 pagesProc 2022-01 FinalThe Salt Lake TribuneNo ratings yet

- Ruling On Motion To Dismiss Utah Gerrymandering LawsuitDocument61 pagesRuling On Motion To Dismiss Utah Gerrymandering LawsuitThe Salt Lake TribuneNo ratings yet

- Final Signed Republican Governance Group Leadership LetterDocument3 pagesFinal Signed Republican Governance Group Leadership LetterThe Salt Lake TribuneNo ratings yet

- Redistricting LawsuitDocument2 pagesRedistricting LawsuitThe Salt Lake TribuneNo ratings yet