Professional Documents

Culture Documents

DPWH Department Order 012 S2011

Uploaded by

theengineer30 ratings0% found this document useful (0 votes)

5 views6 pagesDepartment Order

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentDepartment Order

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

5 views6 pagesDPWH Department Order 012 S2011

Uploaded by

theengineer3Department Order

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 6

Republic of the Philippines

DEPARTMENT OF PUBLIC WORKS AND HIGHWAYS

OFFICE OF THE SECRETARY

Manila M AR 1lt 2 0 1 1

'!'?/~tJI'WI;

O}. /Y- ~I/

DEPARTMENT ORDER

1 2

SUBJ ECT: PREPARATION OF APPROVED

BUDGET FOR THE CONTRACT

NO.

Series of 201 (D~.If/'11

The following policies, rules and procedures relative to the preparation of the

"Approved Budget for the Contract" (ABC) are hereby issued for the guidance of all

concerned.

The ABC shall be prepared on the basis of the design for the project which

has been duly approved by authorized officials in accordance with existing

regulations.

All items of work to be used in preparing the ABC shall conform to the

Standard Specifications for Highways and Bridges, revised 2004, Standard

Specifications for Public Works, 1995, and approved Special Specifications for the

project.

The ABC shall be composed of the Direct Cost and the Indirect Cost.

A. The Direct Cost shall consist of the following:

A.1 Cost of materials to be used in doing the work item called for, which

shall include, inter alia, the following:

A.1.1 Cost at source, including processing, crushing, stockpiling,

loading, royalties, local taxes, construction and/or

maintenance of haul roads, etc.

A.1.2 Expenses for hauling to project site.

A.1.3 Handling expenses.

A.1.4 Storage expenses.

A.1.5 Allowance for waste and/or losses, not to exceed 5% of

materials requirement.

A.2 Cost of Labor:

A.2.1 Salaries and wages, as authorized by the Department of

Labor and Employment.

A.2.2 Fringe benefits, such as vacation and sick leaves, benefits

under the Workmen's Compensation Act, GSIS and/or SSS

contributions, allowances, 13

th

month pay, bonuses, etc.

D.O. No. 12 S. 2011 P.2/5

A.3 Equipment Expenses

A.3.1 Rental of equipment which shall be based on the prevailing

"Associated Construction Equipment Lessors, Inc." (ACEL)

rental rates approved for use by the DPWH (Presently it is the

2009 ACEL Rates). Rental rates of equipment not indicated in

the ACEL booklet shall be taken from the rental rates

prepared by the Bureau of Equipment. For simplicity in

computation, the operated rental rates are preferred over the

bare rental rates as the former includes operator's wages,

fringe benefits, fuel, oil, lubricants and equipment

maintenance. The make, model and capacity of the

equipment should be indicated in the detailed unit cost

analysis.

A.3.2 Mobilization and demobilization, shall be treated as a

separate pay item. It shall be computed based on the

equipment requirements of the project stipulated in the

proposal and contract booklet. In no case shall mobilization

and demobilization exceed 1% of the Estimated Direct Cost

(EDC) of the civil works items.

B. The Indirect Cost shall consist of the following:

B.1 Overhead Expenses - ranges from 5 - 7% of the EDC, which includes

the following:

B.1.1 Engineering and Administrative Supervision.

B.1.2 Transportation allowances.

B.1.3 Office Expenses, e.g., for office equipment and supplies,

power and water consumption, communication and

maintenance.

B.1.4 Premium on Contractor's All Risk Insurance (CARl).

B.1.5 Financing Cost.

(a) Premium on Bid Security

(b) Premium on Performance Security

(c) Premium on Surety for Advance Payment

(d) Premium on Warranty Bond (one year)

B.2 Contingencies - ranges from 0.5 - 2% of the EDC. These include

expenses for meetings, coordination with other stakeholders,

billboards, stages during ground breaking & inauguration ceremonies

and other unforeseen events.

D.O. No. 12 S. 2011 P.3/5

B.3 Miscellaneous Expenses - ranges from 0.5 - 1% of the EDC. These

include laboratory tests for quality control and plan preparation.

B.4 Contractor's Profit Margin - shall be 8% of EDC.

B.5 VAT Component - shall be 12% of the sum of the EDC, OCM and

Profit.

NOTE: For the percentage to be used for Nos. 8.1, 8.2

and 8.3, see OCM (Overhead, Contingencies and

Miscellaneous) column in the tabulation below .

---- .. -_._----

INDIRECT COST

% FOR TOTAL

ESTIMATED

OCM AND PROFIT INDIRECT COST

% FOR

DIRECT COST (EDC)

OCM AND PROFIT

OCM PROFIT

(% OF EDC) (% OF EDC)

Up to P5Miliion 10 8 18

Above P5M up to P50M 9 8 17

Above P50M up to P150M 7 8 15

Above P150M 6 8 14

._-

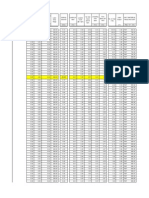

C. The prescribed format for the calculation of the ABC is shown in

Attachment "A".

D. Instructions for filling-up the format:

0.1 Columns (1) to (4) are self-explanatory.

0.2 Column (5) is the EDC of the work item as calculated and reflected in

the cost analysis prepared by the Estimator.

0.3 Columns (6) and (7) are the mark-ups in percent for OCM and profit.

0.4 Column (8) is the total mark-up, which is the sum of the percentages

under columns (6) and (7).

0.5 Column (9) is the Peso value of the total mark-up. It is determined by

multiplying the total mark-up on percent in column (8) with the EDC

(column 5).

D.O. No. 12 S. 2011 PA/5

0.6 Column (10) is the VAT component which is 12% of the sum of

columns (5) and (9).

0.7 Column (11) is the total estimated Indirect Cost which is the sum of

columns (9) and (10).

0.8 Column (12) is the total estimated Total Cost or the sum of columns

(5) and (11).

0.9 Column (13) is the unit cost for each item of works, determined by

dividing the estimated Total Cost in column (12) by its total quantity in

column (3).

0.10 Columns (1) thru (5) shall be filled up by the Implementing Office

concerned, i.e. the Head of the Project Management Office /

Implementing Unit in the case of the Central Office, the Chief of the

Construction/Maintenance Division in the case of the Regional

Offices, or the Chief of the Construction/Maintenance Section in the

case of the District Offices. These officials shall be responsible for

the integrity and reasonableness of their estimates vis-a-vis current

market prices of materials, equipment and labor, cost-effectiveness of

construction methods and equipment, minimum production rates for

equipment and labor set by the Department, numbers and types of

equipment, materials, labor used and other factors.

0.11 Columns (6) thru (14) shall be filled by the Bureau of Construction

(BOC) in the case of Central Office, the Assistant Regional Director in

the case of Regional Office for projects within their delegated

authority and the Assistant District Engineer in the case of District

Office for projects within their delegated authority. They shall similarly

be responsible for the reasonableness and integrity of the

calculations. They may revise the submitted estimates if, in their

evaluation, the estimates need to be adjusted in accordance with the

provisions of this Department Order.

The officials who will finally approve the ABC (i.e., District Engineer/Regional

Director/Undersecretary/Secretary) may also cause revisions on these estimates as

part of the judicious exercise of their authority.

Since the ABC is to be compared with the Contractor's bid and is the ceiling

for acceptable bid prices in accordance with the provision of R.A. 9184, the ABC

should be based on the approved Bidding Documents for the contract which contain

the same work items and quantities as those to be used by the contractors in

preparing their bid.

DPWH estimators shall continuously update their information/statistics on

market prices of all construction inputs and use only unit prices that are realistic

based on valid up-to-date information, in contrast to guesswork and haphazard

pricing. All assumptions in generating the estimate should be shown in the cost

analysis.

D.O. No. 12 S. 2011 P.5/5

In all cases, estimates for special items of work (SPL) should be accompanied

with plans and specifications, methods of construction, measurements and payments

duly approved by the head of the Implementing Office.

All Department Orders, circulars, memoranda and other issuances, or

portions thereof that are inconsistent with this Department Order are hereby revoked

or amended accordingly.

This Department Order shall take effect immediately.

GELIO L. SINGSON

Secretary

Ilnllllll! I~ 11I11

WIN110~

Attachment to D.O. No. 1 2 S. 2 0 1 1

ATTACHMENT 'A"

APPROVED BUDGET FOR THE CONTRACT

Project Name and Location

Stations

Length Contract Duration:

MARK-UPS

TOTAL MARK-UP

ITEM

DESCRIPTION QUANTITY UNIT

ESTIMATED DIRECT IN PERCENT

VAT

TOTAL

TOTAL COST

UNIT

NO COST

OCM PROFIT % VALUE

INDIRECT COST COST

(1) (2) (3) (4) (5) (6) (7) (8)

(9) (10) (11) (12) (13)

(5)X(8) 12%[(5)+(9)] (9)+(10) (5)+(11) (12}/(3)

TOTAL

PREPARED/SUBMITIED BY: RECOMMENDING APPROVAL: APPROVED:

DATE PREPARED

You might also like

- AndhraPradesh Revisied Standard Data BookDocument317 pagesAndhraPradesh Revisied Standard Data Bookjoechand84% (93)

- Rev C Diagnostic Repair Manual AC Evolution 1.0 2.0 50 60 HZDocument254 pagesRev C Diagnostic Repair Manual AC Evolution 1.0 2.0 50 60 HZVariACK100% (1)

- Foundations of Airport Economics and FinanceFrom EverandFoundations of Airport Economics and FinanceRating: 5 out of 5 stars5/5 (1)

- 17-QA-QC ManualDocument34 pages17-QA-QC ManualAbdul Gaffar100% (3)

- DO - 029 - S2011 Revised Guidelines On Preparation of ABCDocument6 pagesDO - 029 - S2011 Revised Guidelines On Preparation of ABCroldskiNo ratings yet

- DPWH Department Order 72 Series of 2012 (ABC)Document6 pagesDPWH Department Order 72 Series of 2012 (ABC)Jayson Lupiba100% (3)

- Office of The Secretary: 'P WRRDocument6 pagesOffice of The Secretary: 'P WRRJessica HerreraNo ratings yet

- ABC DO - 197 - s2016Document5 pagesABC DO - 197 - s2016Carol Santos63% (8)

- DPWH - Preparation of Approved Budget For The ContractDocument6 pagesDPWH - Preparation of Approved Budget For The ContractELMERNo ratings yet

- Do 22 DPWHDocument6 pagesDo 22 DPWHEngineering OfficeNo ratings yet

- Republic of The PhilippinesDocument5 pagesRepublic of The Philippinesjie yinNo ratings yet

- Boq PreambleDocument16 pagesBoq PreambleIzo Serem100% (2)

- Boq P1a Water Utilities Pack 1 Original1234Document37 pagesBoq P1a Water Utilities Pack 1 Original1234Seifeldin Ali Marzouk0% (1)

- BSR 2020 EN New - UnlockedDocument189 pagesBSR 2020 EN New - Unlockedkavinda89No ratings yet

- PP - Civil Engineering (For CESMM3) - Section11 - Uploaded 20-05-2021Document19 pagesPP - Civil Engineering (For CESMM3) - Section11 - Uploaded 20-05-2021Amila KarunarathneNo ratings yet

- Schedule of Rates 2012-13 WRD KarnatakaDocument173 pagesSchedule of Rates 2012-13 WRD KarnatakaRiazahemad B Jagadal100% (1)

- Do 071 S2012Document15 pagesDo 071 S2012AlvinCrisDonacaoDemesa100% (1)

- C-2016.06.16-Project Contingencies, Quality Control, W.C. Agency ChargesDocument6 pagesC-2016.06.16-Project Contingencies, Quality Control, W.C. Agency ChargesromorthraipurNo ratings yet

- Ce Laws, Contracts and SpecificationsDocument20 pagesCe Laws, Contracts and SpecificationsMIKE ARTHUR DAVIDNo ratings yet

- DPWH - Plans - Program of Work and Approved Budget For The ContractDocument2 pagesDPWH - Plans - Program of Work and Approved Budget For The ContractChris Gonzales100% (8)

- Guide For Architect EngineersDocument104 pagesGuide For Architect EngineersMohammed ZubairNo ratings yet

- Chapter HeloDocument23 pagesChapter Heloanuj bhagwanNo ratings yet

- AO1M1Document13 pagesAO1M1jashkishore0% (1)

- R6 - Part 2 Requirements - BOQ (Preamble) - Ver1Document8 pagesR6 - Part 2 Requirements - BOQ (Preamble) - Ver1Anonymous FpRJ8oDdNo ratings yet

- Hcuy Ce10 (QS) Lp4 MergedDocument11 pagesHcuy Ce10 (QS) Lp4 Mergedrosary originalNo ratings yet

- Guidance C.2 Pricing DataDocument11 pagesGuidance C.2 Pricing DataKyle MoolmanNo ratings yet

- MC#64 S 2016 NIA Revised Guidelines in Preparation of ABC-EPCDocument47 pagesMC#64 S 2016 NIA Revised Guidelines in Preparation of ABC-EPCAnjienette100% (1)

- 01 NEC ECC PN V2 20210811 Final r1Document120 pages01 NEC ECC PN V2 20210811 Final r1Junli LiuNo ratings yet

- 01 Nec Ecc PN V1.0 201610Document120 pages01 Nec Ecc PN V1.0 201610Bruce Wong100% (2)

- Er - 1110 3 1300Document24 pagesEr - 1110 3 1300Ahmad Ramin AbasyNo ratings yet

- Building SorDocument224 pagesBuilding SorAshutosh AgrawalNo ratings yet

- Day 1 Session 3 Preparation of EstimatesDocument27 pagesDay 1 Session 3 Preparation of EstimatesCHERUKURI YUVA RAJU 20981A0107No ratings yet

- Series of 2023: Prices of Construction Materials and Equipment Rental Rates For VariousDocument2 pagesSeries of 2023: Prices of Construction Materials and Equipment Rental Rates For VariousanbertjonathanNo ratings yet

- Vol2 PDFDocument82 pagesVol2 PDFVimal SinghNo ratings yet

- 01 Nec Ecc PN V1.1 201703Document122 pages01 Nec Ecc PN V1.1 201703sonnykinNo ratings yet

- Department Order 71 2012Document30 pagesDepartment Order 71 2012Lileth Lacorte VirayNo ratings yet

- Unit Rates Build UpDocument6 pagesUnit Rates Build UpBernard KagumeNo ratings yet

- Analysis of Rates For Building Construction WorksDocument5 pagesAnalysis of Rates For Building Construction WorksRajarathinam ThangaveluNo ratings yet

- 15 - Nishikant Dhawale - EAI-17-104Document12 pages15 - Nishikant Dhawale - EAI-17-104NISHIKANT DHAWALENo ratings yet

- MAP - Boso-Boso - 3jun2020Document5 pagesMAP - Boso-Boso - 3jun2020Francis Nano FerrerNo ratings yet

- 01 NEC ECC PN V2 20210811 Track Changes Final r1Document126 pages01 NEC ECC PN V2 20210811 Track Changes Final r1Fadi BoustanyNo ratings yet

- Bill of Quantities Rev.2 (IMEK-CP-151217)Document2 pagesBill of Quantities Rev.2 (IMEK-CP-151217)ZevanyaRolandTualakaNo ratings yet

- Fiscal Management ER 415-1-16Document66 pagesFiscal Management ER 415-1-16joe_pulaskiNo ratings yet

- Ref Acceleration CostDocument37 pagesRef Acceleration CostNovelyn DomingoNo ratings yet

- Endorsing Authority MPWDocument33 pagesEndorsing Authority MPWAldrin Ray MendezNo ratings yet

- !! 03 Spek 1A Pekerjaan Penunjang EngDocument12 pages!! 03 Spek 1A Pekerjaan Penunjang EngJawaraWasisNo ratings yet

- Analysis of RatesDocument5 pagesAnalysis of Ratesakstrmec23No ratings yet

- Commercial Bank of Ethiopian Estimation Manual For Mechanical EquipmentDocument47 pagesCommercial Bank of Ethiopian Estimation Manual For Mechanical EquipmentTekeba BirhaneNo ratings yet

- One Click LCC - TutorialDocument4 pagesOne Click LCC - Tutorialbernardette soustNo ratings yet

- NEC Collaboration CLLB Ti: Practice NotesDocument122 pagesNEC Collaboration CLLB Ti: Practice NotesCT0011No ratings yet

- West Bengal Schedule Rates of Building Works 2015Document399 pagesWest Bengal Schedule Rates of Building Works 2015Arunashish Mazumdar75% (8)

- Manual For Civil Engineering Works (Part - I)Document3 pagesManual For Civil Engineering Works (Part - I)Prerna BhattNo ratings yet

- Preamble For SBOQDocument5 pagesPreamble For SBOQsanthosh kumar t mNo ratings yet

- BOQ GuidelineDocument16 pagesBOQ GuidelineGerry TriazNo ratings yet

- Schedule of Rates - 2012-13Document173 pagesSchedule of Rates - 2012-13Kannan HariNo ratings yet

- Career Change From Real Estate to Oil and Gas ProjectsFrom EverandCareer Change From Real Estate to Oil and Gas ProjectsRating: 5 out of 5 stars5/5 (1)

- Irregularities, Frauds and the Necessity of Technical Auditing in Construction IndustryFrom EverandIrregularities, Frauds and the Necessity of Technical Auditing in Construction IndustryNo ratings yet

- The Contractor Payment Application Audit: Guidance for Auditing AIA Documents G702 & G703From EverandThe Contractor Payment Application Audit: Guidance for Auditing AIA Documents G702 & G703No ratings yet

- Good Documentation Practices (GDP) in Pharmaceutical IndustryFrom EverandGood Documentation Practices (GDP) in Pharmaceutical IndustryNo ratings yet

- Engineering Service Revenues World Summary: Market Values & Financials by CountryFrom EverandEngineering Service Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Nursing Audit: Workplace and Environmental Safety Area Date of Audit Name/Signature of AuditorDocument1 pageNursing Audit: Workplace and Environmental Safety Area Date of Audit Name/Signature of AuditorJose LeuterioNo ratings yet

- Unit Material Hauling CostDocument2 pagesUnit Material Hauling CostJose LeuterioNo ratings yet

- Unit Material Hauling CostDocument2 pagesUnit Material Hauling CostJose LeuterioNo ratings yet

- CE Bearing JGDocument6 pagesCE Bearing JGJose LeuterioNo ratings yet

- Pds FormDocument10 pagesPds FormJose LeuterioNo ratings yet

- End Area FormDocument1 pageEnd Area FormJose LeuterioNo ratings yet

- Genie PDFDocument264 pagesGenie PDFjohanaNo ratings yet

- Peritoneal Dialysis Unit Renal Department SGH PD WPI 097 Workplace InstructionDocument10 pagesPeritoneal Dialysis Unit Renal Department SGH PD WPI 097 Workplace InstructionAjeng SuparwiNo ratings yet

- Victron Orion-Tr - Smart - DC-DC - Charger-Manual Non IsolatedDocument19 pagesVictron Orion-Tr - Smart - DC-DC - Charger-Manual Non IsolatedThomist AquinasNo ratings yet

- Rec Site Visit Report 1Document6 pagesRec Site Visit Report 1api-474887597No ratings yet

- D 7752Document6 pagesD 7752Asep TheaNo ratings yet

- Cruz v. CA - G.R. No. 122445 - November 18, 1997 - DIGESTDocument2 pagesCruz v. CA - G.R. No. 122445 - November 18, 1997 - DIGESTAaron Ariston80% (5)

- PsychodramaDocument5 pagesPsychodramaAkhila R KrishnaNo ratings yet

- Implementation Plan SLRPDocument6 pagesImplementation Plan SLRPAngelina SantosNo ratings yet

- Jepretan Layar 2022-11-30 Pada 11.29.09Document1 pageJepretan Layar 2022-11-30 Pada 11.29.09Muhamad yasinNo ratings yet

- 3 Day WorkoutDocument3 pages3 Day Workoutsonu091276No ratings yet

- Pre Commissioning Check List of GeneratorDocument26 pagesPre Commissioning Check List of GeneratorSUROHMAN ROHMANNo ratings yet

- Imperial SpeechDocument2 pagesImperial SpeechROJE DANNELL GALVANNo ratings yet

- Data NX 45-5-1800-4Document1 pageData NX 45-5-1800-4BHILLA TORRESNo ratings yet

- FPGA-based System For Heart Rate Monitoring PDFDocument12 pagesFPGA-based System For Heart Rate Monitoring PDFkishorechiyaNo ratings yet

- Cytomegalovirus Infection and Disease in The New Era of Immunosuppression Following Solid Organ TransplantationDocument9 pagesCytomegalovirus Infection and Disease in The New Era of Immunosuppression Following Solid Organ TransplantationReza Firmansyah IINo ratings yet

- Epididymo OrchitisDocument18 pagesEpididymo OrchitisRifqi AlridjalNo ratings yet

- Tutorial Slides - Internal Forced Convection & Natural ConvectionDocument31 pagesTutorial Slides - Internal Forced Convection & Natural ConvectionVivaan Sharma75% (4)

- Homoeopathic Treatment of Complicated Sebaceous Cyst - A Case StudyDocument5 pagesHomoeopathic Treatment of Complicated Sebaceous Cyst - A Case StudyDr deepakNo ratings yet

- Wel-Come: Heat Treatment Process (TTT, CCT & CCR)Document14 pagesWel-Come: Heat Treatment Process (TTT, CCT & CCR)atulkumargaur26No ratings yet

- 95491fisa Tehnica Acumulator Growatt Lithiu 6.5 KWH Acumulatori Sistem Fotovoltaic Alaska Energies Romania CompressedDocument4 pages95491fisa Tehnica Acumulator Growatt Lithiu 6.5 KWH Acumulatori Sistem Fotovoltaic Alaska Energies Romania CompressedmiaasieuNo ratings yet

- 21-Ent, 45 Notes To PGDocument12 pages21-Ent, 45 Notes To PGAshish SinghNo ratings yet

- Yumiko@Document2 pagesYumiko@api-25886263No ratings yet

- Thai Cuisine: Reporters: Bantayan, Kenneth Samejon, Clarish Lovely Relevo, Mary GraceDocument47 pagesThai Cuisine: Reporters: Bantayan, Kenneth Samejon, Clarish Lovely Relevo, Mary Gracemiralona relevoNo ratings yet

- Arcelor Mittal Operations: Operational Area Is Sub-Divided Into 4 PartsDocument5 pagesArcelor Mittal Operations: Operational Area Is Sub-Divided Into 4 Partsarpit agrawalNo ratings yet

- TruEarth Case SolutionDocument6 pagesTruEarth Case SolutionUtkristSrivastavaNo ratings yet

- Mechanical Pumps: N. HilleretDocument12 pagesMechanical Pumps: N. HilleretAmrik SinghNo ratings yet

- Bradycardia AlgorithmDocument1 pageBradycardia AlgorithmGideon BahuleNo ratings yet