Professional Documents

Culture Documents

Singapore Property Weekly Issue 175

Uploaded by

Propwise.sg0 ratings0% found this document useful (0 votes)

1K views22 pagesIn this issue:

- Jurong Lake District – the Next Hotspot for Property Hunting?

- The Jurong Lake District – A Jewel or the Next Punggol 21?

- Singapore Property News This Week

- Resale Property Transactions (September 10 – September 16)

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentIn this issue:

- Jurong Lake District – the Next Hotspot for Property Hunting?

- The Jurong Lake District – A Jewel or the Next Punggol 21?

- Singapore Property News This Week

- Resale Property Transactions (September 10 – September 16)

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

1K views22 pagesSingapore Property Weekly Issue 175

Uploaded by

Propwise.sgIn this issue:

- Jurong Lake District – the Next Hotspot for Property Hunting?

- The Jurong Lake District – A Jewel or the Next Punggol 21?

- Singapore Property News This Week

- Resale Property Transactions (September 10 – September 16)

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 22

Issue 175

Copyright 2011-2014 www.Propwise.sg. All Rights Reserved.

Contribute

Do you have articles and insights and articles that youd like to share

with thousands of readers interested in the Singapore property

market? Send them to us at info@propwise.sg, and if theyre good

enough, well publish them here, on our blog and even on Yahoo!

News.

Advertise

Want to get your brand, product, service or property listing out to

thousands of Singapore property investors at a very reasonable

cost? Head over to www.propwise.sg/advertise/ to find out more.

CONTENTS

p2 Jurong Lake District the Next Hotspot

for Property Hunting?

p7 The Jurong Lake District A Jewel or

the Next Punggol 21?

p13 Singapore Property News This Week

p20 Resale Property Transactions

(September 10 September 16 )

Welcome to the 175

th

edition of the

Singapore Property Weekly.

Hope you like it!

Mr. Propwise

FROM THE

EDITOR

SINGAPORE PROPERTY WEEKLY Issue 175

Page | 2

Back to Contents

By Property Soul (Guest Contributor) I have to admit that Prime Minister Lee

HsienLoongsrecent 10th National Day Rally

speech failed to get my attention the whole

time. But the moment when I heard our PM

sayI thought tonight I should show ... Jurong

Lake at sunset, my heart immediately

skipped a beat.

He devoted a big part of his speech to paint a

heavenly picture of the Jurong Lake District,

followed by all the possibilities for future

development of the area, before he ended his

speech with a sentimental note on believing

in Singapore.

Wow, as property-obsessed Singaporeans,

how could our imaginations not run wild with

Jurong Lake District the Next Hotspot for Property Hunting?

SINGAPORE PROPERTY WEEKLY Issue 175

Page | 3

Back to Contents

the potential upside of properties in the west?

The future roadmap of Jurong Lake

District

The 'Jurong Lake Story' was first introduced

as part of the draft Master Plan 2008. It is the

'remaking our heartland' plan to shift business

activities from the CBD to the west by building

a commercial and residential hub in Jurong

for both business and leisure.

Five years on, the Jurong Gateway area was

almost there with office buildings, a training

centre, three shopping malls in three years,

as well as a hospital and a condominium on

the way.

The Jurong Lake Gardens area will also

undergo a facelift for the housing estates and

waterfront living. There will be a new cycling

network, cycling trails in Taman Jurong along

the town to town boulevard, Bukit Batok to

Jurong Gateway, as well as the community

boulevard to bring residents to the lakes. The

heartland corridor will link up estates and the

green spine will connect Teban and Pandan

Gardens.

When completed, the Jurong Lake Gardens

will be a family-friendly residential district

close to nature, watersports and outdoor

activities.

SINGAPORE PROPERTY WEEKLY Issue 175

Page | 4

Back to Contents

Should buyers take the plunge in the

west?

A strategic coverage of Jurong Lake District

at the National Day Rally can stimulate

interest from developers to bid for new sites

released in that area. But I am not from a

developer or a property agency who cant

wait to sell you the J Gateway, Lakeville,

Jurong West Condo or Vision Exchange.

I still recall vividly the day (29 June 2013)

when 1,400 blank cheques were submitted to

MCL Land to ballot for the 738-unit J

Gateway. Successful buyers paid $1,400 to

$1,800 psf for their units, only to find out later

in the evening that the government just

announced the TDSR framework with effect

from the very same day.

What signal do you think the government was

sending to the market?

What hardcore property investors and

landlords want

As a hardcore property investor, I only want

to buy value-for-money and good quality

properties minus all the market hype. The

moment I buy I have to be sure that I can

make a profit, and not have to hope that

prices will go up.

As a sophisticated landlord, I only want to buy

properties that attract expatriates with good

budgets, preferably on company leases. I

dont want to deal with difficult tenants, late or

no payment, etc.

I am not sure what you are looking for as a

buyer or a landlord, but ask yourself four

questions before you take the plunge:

1. Are you buying the hotspot area at the

peak or bottom of the market?

SINGAPORE PROPERTY WEEKLY Issue 175

Page | 5

Back to Contents

2. How long are you prepared for the hotspot

area to realize its full potential?

3. Do your dream tenants like to stay in

exclusive or heartland districts?

4. Will your tenants like to have the terminal

of Singapore-Kuala Lumpur High Speed Rail

at their doorstep?

Jurong Lake District the next East Coast

or Punggol?

Where do you stay? It is a casual question

commonly asked by Singaporeans. But you

can be sized up by your answer. Because in

Singapore, many judge your financial status

from the area where you live.

1. East Coast

East Coast in the Katong area has been

inhabited by the wealthy elite from the late

nineteenth century. It was where the

privileged class of Caucasians or prominent

local families built their seaside villas and

mansions. With the prestigious status and

rich heritage of the location, it is no doubt that

East Coast continues to be the preferred

choice for many expatriates and middle class

families.

2. Punggol

Punggol was traditionally a rural area with

animal and vegetable farms. With

urbanization and government planning, it has

been completely transformed into a new town

under the Punggol 21 initiative. Punggol has

changed from dotted farmhouses to crowded

HDB blocks and condominium projects

popular with young families.

3. Jurong

Jurong was planned to be an industrial area

for big factories from heavy industries.

SINGAPORE PROPERTY WEEKLY Issue 175

Page | 6

Back to Contents

Jurong Island was constructed for oil,

petrochemical and chemical plants. HDB flats

were built to house workers and their families

working in nearby factories. The working

class is thus the foundation of the Jurong

community, especially in the Jurong West

area. That is why Jurong often gives the

impression of having factory pollution and

traffic congestion.

The three shopping malls at Jurong Gateway

are frequented by heartlanders in flip flops

and short pants. The upscale Robinsons and

Isetan have their regional branches there.

They dont attract many customers like their

main stores in Orchard. For some reason I

still prefer to patronize the latter.

There is going to be a new hotel. It is absurd

that you dont see tourists in the Jurong Lake

area, the Chinese Garden and the Japanese

Garden. We make every effort to visit an

outlet mall in a foreign country. Yet tourists

here only flock to the two integrated resorts

but not IMM with 55 outlets and which is just

30 minutes drive from town.

Is Jurong Lake District a property gem?

Well, it is too early to tell.

Will the transformation of Jurong make it the

next East Coast?

Wait, we are not there yet. We have a long

way to go.

By guest contributor Property Soul, a

successful property investor, blogger, and

author of the No B.S. Guide to Property

Investment.

SINGAPORE PROPERTY WEEKLY Issue 175

Page | 7

Back to Contents

By Paul Ho (guest contributor)

The Punggol 21 Masterplan was rolled out

twenty years ago amidst much fanfare and

high expectations. Twenty years on, the

Punggol 21 Masterplan remains largely

unfulfilled. The Jurong Lake District idea was

mooted around 2008 as part of the

Masterplan, but did not garner much

confidence due to the failure of Punggol 21

(those people staying in Punggol East can

testify to the lack of amenities).

Apart from that, people who have witnessed

the natural beauty of the British Lake District

will find our Jurong Lake District a far cry from

it.

The Jurong Lake District A Jewel or the Next Punggol 21?

SINGAPORE PROPERTY WEEKLY Issue 175

Page | 8

Back to Contents

I thus initially dismissed the Jurong Lake

District Masterplan. However, fast-forward to

2014, and various developments have

mushroomed around the Jurong Gateway.

Making up for a lack of natural beauty

Whatever Singapore lacks in natural beauty, it

has a way of making up for with beautifully-

landscaped gardens and a wide range of

amenities. The Urban Redevelopment

Authority (URA) has delivered excellent town

planning that is purposeful and elegant.

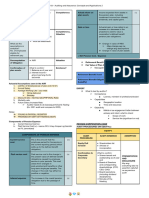

(Source: Jurong Lake District brochure, URA)

SINGAPORE PROPERTY WEEKLY Issue 175

Page | 9

Back to Contents

Developments around Jurong East MRT have

started to take shape, anchored by the

Jurong East MRT interchange, established

businesses around the International Business

Park, major shopping malls, a hospital,

education hub, high-rise offices and

residential units.

The Jurong Lake district is not exactly a

green field site as there are many

developments already in place. As such, the

effort required to realize this Masterplan may

be smaller than that for Punggol 21 thus it is

less likely to fail.

Upcoming developments in the Jurong

Lake District

According to the Masterplan, these are the

developments planned for the Jurong area:

1. New Infrastructure such as a new bus

interchange, road network and upgrading of

Jurong East MRT Station

2. 1.9 ha White site next to Jurong East MRT

Station available for application in the

Government Land Sales Reserve List

3. Big Box Warehouse Retail Outlet (34,000

sqm of new retail space)

4. Jurong Entertainment Centre

redevelopment (28,000 sqm of retail space

and an Olympic-size ice skating rink)

5. New Jurong General Hospital and

Community Hospital (the integrated hospital

will serve residents staying in the west region)

Most of these developments are centered

around Jurong Gateway, the crown jewel of

the Jurong Lake District. With a catchment

consumer base of Jurong East HDB dwellers,

the Lakeside village (a designated F&B hub)

is likely to be developed fast and find

SINGAPORE PROPERTY WEEKLY Issue 175

Page | 10

Back to Contents

success. The Lakeside village is connected

via bridges to the Japanese Garden and

Chinese Garden, bringing lakeside enjoyment

to residents staying nearby.

Developments along Yuan Ching Road have

yet to materialize. We estimate that the

Jurong Lake District could become a reality in

5 to 7 years. Once this area develops to

include waterfront hotels, it could revitalize

the Jurong area.

Hotspots in the Jurong Lake District

Ironically, the crown jewel of the Jurong Lake

District the Jurong Gateway is not

anywhere along the lake. The Jurong

Gateway is anchored by Jurong East MRT

station, and is a major MRT hub in the vicinity

of a newly-built hospital, new residential units,

and the International Business Park which

houses many multi-national companies.

Properties located near the Jurong Gateway

will thus be sought after.

Jurong Gateway condominiums have

transacted above $1700 psf for smaller sized

units. Some businesses may relocate to so as

to better manage their operations in Tuas or

in Johor/Iskandar. The Jurong Gateway is

likely to develop into the Orchard Road of

the West.

By contrast, developments along Yuan Ching

Road are largely incomplete. The area will be

revitalized when the lakefront hotels as well

as edutainment clusters are completed. The

prime locations in Yuan Ching Road will be

around Lakeside MRT station, which are

already being priced in the $1,300 to $1,500

psf range based on Lakefront Residences

figures.

SINGAPORE PROPERTY WEEKLY Issue 175

Page | 11

Back to Contents

Other areas of Yuan Ching Road will be more

residential and therefore quieter. These

residences will be further from the MRT and

will likely be priced lower than those nearer to

Lakeside MRT.

Some HDB flats around Ho Ching road were

built in 1972 and are 42 years old. They are

ripe for selective en-bloc redevelopment

(whether residents like it or not). As land

becomes premium along Yuan Ching, Ho

Ching, Tah Ching and Kang Ching roads,

these HDB units may consequently become

targets for redevelopment.

More residential development to come

around the lake

We expect that premium residential housing

in the Jurong vicinity will be around Jurong

East MRT (Jurong Gateway) or Yuan Ching

road. Just like Bedok Reservoir, more

condominium clusters may form around the

lake. If selective en-bloc development takes

place, it is likely that premium housing will be

introduced in its place to capture maximum

land revenue for the government. As the

Jurong Gateway economic cluster and Tuas

relocation of factories take shape, more

people may opt to stay in and around Yuan

Ching Road, given the limited supply of

condominiums around Jurong Gateway.

Yuan Ching Road residences are connected

by bridges to the Japanese and Chinese

Gardens. If cycling is allowed in the gardens,

one can cycle to work in the Jurong Gateway

from Yuan Ching Road in 15 minutes. Given

the beautiful lake with bridges to walk

through, the distance from Jurong East MRT

to Yuan Ching could easily become an

enjoyable 15 to 30 minutes walk home,

thereby raising the value of housing along

SINGAPORE PROPERTY WEEKLY Issue 175

Page | 12

Back to Contents

Yuan Ching Road. Thus we expect the

housing around Yuan Ching Road to narrow

the gap with those in the Jurong Gateway.

Some potential downsides

Most properties (if not all) in the area are 99

years leasehold. All things being equal, we do

not like leasehold properties. Not having a

choice for 999 and Freehold titles is a major

downside especially in newly-developed

estates.

Also, pricing will be capped and compared

against more established areas or regional

centers such as Orchard Road.

Furthermore, Jurong is an industrial hub with

factories in Tuas and a catchment workforce

of 100,000 people. Being more industrial in

nature and surrounded by historically-cheaper

HDB housing, Jurong is perceived to be more

working-class and blue-collar. It will take time

to change this perception. Capital upside may

be limited for buyers if developers get greedy

and price new developments too high.

Conclusion

The Jurong Lake District is an up and coming

district which looks very likely to be realized in

5 to 7 years in its entirety. It will also be the

most well-connected recreational, business,

edutainment, education and medical centre in

the West zone.

By Paul Ho, holder of an MBA from a

reputable university and editor of

www.iCompareLoan.com, Singapores first

Cloud-based Home Loan reporting platform

used by Property agents, financial advisors

as well as Mortgage brokers.

SINGAPORE PROPERTY WEEKLY Issue 175

Singapore Property This Week

Page | 13

Back to Contents

Residential

4,630 BTO flats launched in September

4,630 built-to-order flats will be launched in

September, said the Housing & Development

Board (HDB). These flats will be launched in

non-mature estates such as Bukit Batok,

Hougang and Jurong West. Projects will also

be released in mature estates like Kallang

and Whampoa. Flat applications will begin

from September 24 to September 30.

According to HDB, existing flat owners can

choose to pay half the downpayment of a new

flat, if they move into a two-room or three-

room flat, in a non-mature estate. Flat owners

who are on the HDB loan will only be required

to pay 5 per cent downpayment instead of the

current 10 per cent. Also, flat owners who are

taking up a loan with financial institutions will

only be required to pay 10 per cent

downpayment, instead of the current 20 per

cent. The remaining amount will be paid with

the balance purchase price, when the keys

for the new HDB flat are ready for collection.

National Development Minister Khaw Boon

Wan said that this scheme will benefit cash-

tight flat owners who want to rightsize their

apartments. In particular, retirees-to-be will

stand to benefit the most from the flexibility of

the new scheme, said Ong Kah Seng from

RST Research.

(Source: Business Times)

SINGAPORE PROPERTY WEEKLY Issue 175

Page | 14

Back to Contents

No further discounts for re-launched units

at Waterfront@Faber

According to World Class Land, there will be

no further price discounts at the re-launch of

Waterfront@Faber. While sales of the

waterfront condominium had slowed down

since May, its developer will not cut prices

significantly for units that have already been

released. Instead, at its re-launch, prime-

facing units will be released. The indicative

mid-level prices for launched units are from

$910,000 for a dual-key two-bedroom unit;

$1.28 million for a three-bedroom unit that

faces the pool; $1.308 million for a three-

bedroom unit facing the river and $1.53

million for a four-bedroom unit facing the river.

Unit sizes range from 753 square feet for a

two-bedder to 1,281 square feet for a four-

bedroom unit. Since August, all two-bedroom

units have been sold. Furthermore, 77 units

out of the 210 units at the condominium have

been sold at a median price of $1,247 per

square foot.

(Source: Business Times)

Good response at freehold condo sale at

East Coast

More than half of the launched units have

been sold at Seventy St Patricks, a freehold

condominium in East Coast. Each unit at the

186-unit condominium was sold at an

average price of $1,630 per square foot. Out

of the 36 launched penthouses, 16 have

already been sold at its private launch. The

penthouses, which are about 1,647 square

feet large, are going for about $2.4 million

each, while a two-bedroom unit, which is

about 700 square feet large, is selling for $1.2

million. The condominium is estimated to be

completed in 2017.

SINGAPORE PROPERTY WEEKLY Issue 175

Page | 15

Back to Contents

It will comprise of nine blocks of five-storey

buildings, and will have facilities such as a

50-meter pool.

(Source: Business Times)

Commercial

Colliers: retail rents at Orchard to remain

flat

A report released by Colliers International

said that the average monthly gross rents for

prime ground floor retail space at Orchard

Road will fall by a maximum of one per cent

for the rest of 2014. Chia Siew Chuin from

Colliers International said that since March,

the influx of tourists and retail sales has

slowed. This is likely to impact the rental

prices of the malls at Orchard Road.

According to the Colliers report, the average

monthly gross rents of prime retail space in

Orchard have fallen by 0.5 per cent to $36.25

per square foot from the previous quarter.

Nonetheless, rent in the regional centres is

expected to grow by one to two per cent in

2014 as businesses in these areas are less

dependent on tourist money. In Q3 2014, the

average imputed capital value for prime

strata-titled retail space in Orchard is at

$6,942 per square foot. On the other hand,

the imputed capital value for regional centres

is at $4,491 per square feet in Q3 this year.

According to Calvin Yeo from Colliers

International, this may result in smaller

brands exiting the market. As such, Yeo

predicts that shopping malls in Orchard Road

will be predominately occupied by larger

brands if this trend continues.

(Source: Business Times)

SINGAPORE PROPERTY WEEKLY Issue 175

Page | 16

Back to Contents

Grade A office rents will be the highest

since 2008

Cushman & Wakefield predicts that Grade A

office rents will be the highest since 2008, by

the end of this year. According to market

experts, Grade A office rents have been the

highest in three years. This quarter, the

overall rents for Grade A offices are at $10.20

per square foot per month. This is 2 per cent

higher than the previous quarter and 9.9 per

cent higher than in 2013. Cushman &

Wakefield predicts that there will be strong

leasing activities in Q4 this year as

CapitaGreen and South Beach are expected

to be completed by then. Not only so,

vacancy rates at the Marina Bay Financial

Centre have also decreased from 6.6 per cent

to 6.1 per cent. Vacancy rates in the suburbs

have also fallen from 2.5 per cent to 1.8 per

cent, said market experts. As Grade A office

rents at prime locations surge, more tenants

may look to the suburbs for rental space. As

such office vacancies in those regions are

expected to fall even further.

(Source: Business Times)

Singapore is 6

th

most expensive city to

rent offices

In June 2014, Singapore has been ranked the

sixth most expensive city to rent offices and

homes, according to a report by Savills that

measured the costs of renting living and

working spaces. London came up top in the

rankings, followed by Hong Kong, which

topped last years ranking. Savills explained

that Hong Kongs competitiveness was

boosted by a weakened currency and falling

residential rents. Total real estate costs went

down by 5.6 per cent in the first half of 2014

in Hong Kong.

SINGAPORE PROPERTY WEEKLY Issue 175

Page | 17

Back to Contents

On the other hand, London real estate grew

at an annualised rate of 10.6 per cent, due to

the appreciation of the pound in relation to the

dollar. Savills added that despite slower

economic growth, Singapores office market

has been robust. Thus, rents have increased

by 7.3 per cent in H1 this year in Singapore.

The report predicts that a shortage of land

supply in Singapore may force employees to

relocate lower value industries to Malaysia.

Employers may find it more difficult to attract

and retain talent from abroad due to the high

cost of real estate in Singapore.

(Source: Business Times)

Citimac complex on en bloc sale

Citimac Industrial Complex is on en bloc sale

for a minimum price of $550 million or $1,350

per square foot of potential gross floor area.

The freehold site is located near Tai Seng

MRT Station. It has a 3.5 maximum gross plot

ratio; of this, at least 2.5 plot ratio of the land

has been zoned for Business 1 use and the

remaining gross floor area is zoned for white

use. Its tender will close on October 30. Tan

Hong Boon from JLL believes that such

freehold industrial sites are rare. While the

complex is located at a prime area, market

experts do not expect it to draw many bids

due to its high minimum bidding price.

Nonetheless, market experts believe that

potential overseas buyers may bid more

aggressively in the sale of the complex.

(Source: Business Times)

Cooling measures push bid prices for

Tuas site down

An industrial site at Tuas Bay Close was sold

for $25.5 million or $51.28 per square foot per

plot ratio in a recent tender.

SINGAPORE PROPERTY WEEKLY Issue 175

Page | 18

Back to Contents

This land price is the lowest for an industrial

plot, since October 2010, said Nicholas Mak

from SLP International. In August, another

site at Tuas South was sold for $56.01 per

square foot per plot ratio. This was

significantly higher than the recent selling

price of the Tuas Bay Close site, even though

both sites had the same size and tenure. The

lukewarm sales could be due to the

implementation of the cooling measures. Not

only so, Mak believes that the expected

increase in B2-zoned sites near Tuas Bay

Close in the future may have also pushed bid

prices down. The Tuas Bay Close site has a

maximum gross plot ratio of 1.7. It is 2.7ha

large and can be strata-divided for sale.

(Source: Business Times)

Property investments increases in Q3

fromQ2

Savills Singapore reported that property

investment sales increased by 13.6 per cent

from $4.7 billion in Q2 2014, to $5.4 billion in

Q3 2014. Nonetheless, investment sales in

Q3 this year is still 61.2 per cent lower than in

2013. Since investment sales can be used to

estimate developer and property investors

interest in the market, the total debt servicing

ratio framework, which was announced in

2013 could have impacted market sentiments

this year. Nonetheless, Savills is optimistic

about the office market. From Q2 2014,

property investments in the office market

have surged to $1.25 billion in Q3. Jeremey

Lake from CBRE said that as the rental

market strengthens and as supply of office

space remains tight, prices of office buildings

will continue to increase.

SINGAPORE PROPERTY WEEKLY Issue 175

Page | 19

Back to Contents

Yet, Savills reported that the overall

investment saes for commercial properties

have fallen by 14.6 per cent to $1.97 billion.

This is likely because there were no

commercial land sites released under the

Government Land Sales Programme. While

market experts believe that there will be

sustained interest in Singapores market, the

competition from overseas property markets

will continue to challenge Singapores market.

(Source: Business Times)

More properties auctioned in 2014

According to data from Colliers International,

the number of properties put up for auction by

mortgagees have increased to 112 in the first

nine months of 2014, from 20 in the same

period last year. Not only so, JLL said that 80

per cent of the 44 properties have been

successfully auctioned off since 2013. Yet,

according to Colliers International, the

number of properties that were sold by

owners fell from 348 to 274. Grace Ng from

Colliers International believes that stricter

loan curbs have made it difficult for cash-tight

owners to finance their homes. As such, more

houses have been put up for auction by

mortgagees. High-end residential homes in

prime districts like Marina Bay and Sentosa

Cove are increasingly auctioned off as

demand for them falls. This is likely to be due

to the implementation of the total debt

servicing ratio framework and the additional

buyers stamp duty. This year, a total of 9

auctioned properties have changed hands for

a total of $30.5 million. Ng predicts that the

total value of the transactions made at

auctions, will be around $80 million by the

end of 2014.

(Source: Business Times)

SINGAPORE PROPERTY WEEKLY Issue 175

Page | 20

Back to Contents

Non-Landed Residential Resale Property Transactions for the Week of Sep 10 Sep 16

Postal

District

Project Name

Area

(sqft)

Transacted

Price ($)

Price

($ psf)

Tenure

4 REFLECTIONS AT KEPPEL BAY 1,539 3,300,000 2,144 99

5 PARC IMPERIAL 398 695,000 1,745 FH

5 ONE-NORTH RESIDENCES 1,421 1,940,888 1,366 99

5 THE PARC CONDOMINIUM 1,518 1,940,000 1,278 FH

5 WEST BAY CONDOMINIUM 893 830,000 929 99

8 CITYLIGHTS 592 940,000 1,588 99

9 VISIONCREST 700 1,460,000 2,087 FH

9 MARTIN PLACE RESIDENCES 646 1,330,000 2,059 FH

9 MARTIN PLACE RESIDENCES 1,722 3,500,000 2,032 FH

9 CAIRNHILL CREST 1,733 3,428,000 1,978 FH

9 THE EDGE ON CAIRNHILL 3,175 5,100,000 1,606 FH

10 THE GRANGE 2,282 4,880,000 2,139 FH

10 DRAYCOTT EIGHT 2,863 5,800,000 2,026 99

10 ONE TREE HILL RESIDENCE 2,454 4,000,000 1,630 FH

10 CASABELLA 1,884 2,976,720 1,580 FH

10 PINEWOOD GARDENS 1,658 2,525,000 1,523 FH

10 THE TESSARINA 1,367 2,080,000 1,522 FH

10 LEEDON 2 840 1,200,000 1,429 FH

10 VALLEY PARK 1,550 2,150,000 1,387 999

11 SOLEIL @ SINARAN 581 1,315,000 2,262 99

11 PARK INFINIA AT WEE NAM 560 1,060,000 1,894 FH

11 PAVILION 11 958 1,550,000 1,618 FH

11 AMARYLLIS VILLE 1,259 1,865,000 1,481 99

11 HILLCREST ARCADIA 958 870,000 908 99

Postal

District

Project Name

Area

(sqft)

Transacted

Price ($)

Price

($ psf)

Tenure

12 THE TIER 538 780,000 1,449 FH

12 OLEANDER TOWERS 1,141 1,180,000 1,034 99

14 BLISS VILLE 1,195 1,350,000 1,130 FH

14 ASTORIA PARK 1,173 1,250,000 1,065 99

14 CENTRAL GROVE 1,206 1,250,000 1,037 99

14 STARVILLE 1,238 1,230,000 994 FH

14 THE SUNNY SPRING 1,066 928,000 871 FH

14 BALMY COURT 1,119 925,000 826 FH

14 SUNFLOWER REGENCY 1,184 870,000 735 FH

15 PEACH GARDEN 5,231 7,350,000 1,405 FH

15 FORTUNE JADE 1,098 1,240,000 1,129 FH

15 BUTTERWORTH VIEW 1,227 1,280,000 1,043 FH

15 LEGENDA AT JOO CHIAT 1,033 1,010,000 977 99

16 PARBURY HILL CONDOMINIUM 1,453 1,628,000 1,120 FH

16 CASA MERAH 1,227 1,280,000 1,043 99

16 CASAFINA 1,378 1,230,000 893 99

16 FAIRMOUNT CONDOMINIUM 1,238 1,065,000 860 99

16 AQUARIUS BY THE PARK 1,227 1,055,000 860 99

17 AVILA GARDENS 893 775,000 867 FH

18 EASTPOINT GREEN 958 900,000 939 99

18 SAVANNAH CONDOPARK 1,453 1,350,000 929 99

18 EASTPOINT GREEN 1,884 1,730,000 918 99

18 RIS GRANDEUR 1,356 1,210,000 892 FH

18 MELVILLE PARK 958 735,000 767 99

SINGAPORE PROPERTY WEEKLY Issue 175

Page | 21

Back to Contents

NOTE: This data only covers non-landed residential resale property

transactions with caveats lodged with the Singapore Land Authority.

Typically, caveats are lodged at least 2-3 weeks after a purchaser

signs an OTP, hence the lagged nature of the data.

Postal

District

Project Name

Area

(sqft)

Transacted

Price ($)

Price

($ psf)

Tenure

19 KOVAN GRANDEUR 388 620,000 1,600 99

19 THE QUARTZ 1,195 1,195,000 1,000 99

21 HUME PARK I 1,356 1,300,000 959 FH

22 LAKEHOLMZ 1,238 1,100,000 889 99

23 HILLVISTA 1,130 1,456,570 1,289 FH

23 DAIRY FARM ESTATE 2,131 2,130,000 999 FH

23 GUILIN VIEW 861 840,000 975 99

23 THE MADEIRA 1,356 1,180,000 870 99

23 THE WARREN 1,238 1,042,000 842 99

23 GUILIN VIEW 1,259 1,030,000 818 99

23 PARKVIEW APARTMENTS 980 780,000 796 99

23 NORTHVALE 1,270 990,000 779 99

27 THE SENSORIA 1,475 1,280,000 868 FH

28 SELETAR SPRINGS CONDOMINIUM 2,077 1,350,000 650 99

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Financial Accounting, 7e by Pfeiffer, Hanlon, Magee 2023, Test BankDocument32 pagesFinancial Accounting, 7e by Pfeiffer, Hanlon, Magee 2023, Test BankTest bank World0% (1)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- 3 Keys To Achieve Consistent Profit From Stock Market by Adam KhooDocument60 pages3 Keys To Achieve Consistent Profit From Stock Market by Adam KhooSau Fei100% (6)

- DAS Trader Pro Video Series: Hot Key ScriptsDocument12 pagesDAS Trader Pro Video Series: Hot Key ScriptsvasseNo ratings yet

- Accion Venture Lab - ESOP Best Practices PDFDocument44 pagesAccion Venture Lab - ESOP Best Practices PDFjeph79No ratings yet

- Essentials To ICTDocument19 pagesEssentials To ICTTS100% (9)

- Algo Dma PreviewDocument105 pagesAlgo Dma PreviewAlchemy1100% (2)

- Singapore Property Weekly Issue 381Document13 pagesSingapore Property Weekly Issue 381Propwise.sgNo ratings yet

- Singapore Property Weekly Issue 386Document12 pagesSingapore Property Weekly Issue 386Propwise.sgNo ratings yet

- Singapore Property Weekly Issue 383Document13 pagesSingapore Property Weekly Issue 383Propwise.sgNo ratings yet

- Singapore Property Weekly Issue 384Document10 pagesSingapore Property Weekly Issue 384Propwise.sgNo ratings yet

- Singapore Property Weekly Issue 382Document13 pagesSingapore Property Weekly Issue 382Propwise.sgNo ratings yet

- Singapore Property Weekly Issue 385Document11 pagesSingapore Property Weekly Issue 385Propwise.sgNo ratings yet

- Singapore Property Weekly Issue 374Document12 pagesSingapore Property Weekly Issue 374Propwise.sgNo ratings yet

- Singapore Property Weekly Issue 378Document10 pagesSingapore Property Weekly Issue 378Propwise.sgNo ratings yet

- Singapore Property Weekly Issue 380Document13 pagesSingapore Property Weekly Issue 380Propwise.sgNo ratings yet

- Singapore Property Weekly Issue 376Document13 pagesSingapore Property Weekly Issue 376Propwise.sgNo ratings yet

- Singapore Property Weekly Issue 377Document7 pagesSingapore Property Weekly Issue 377Propwise.sg100% (1)

- Singapore Property Weekly Issue 362Document7 pagesSingapore Property Weekly Issue 362Propwise.sgNo ratings yet

- Singapore Property Weekly Issue 379Document13 pagesSingapore Property Weekly Issue 379Propwise.sgNo ratings yet

- Singapore Property Weekly Issue 375Document8 pagesSingapore Property Weekly Issue 375Propwise.sgNo ratings yet

- Singapore Property Weekly Issue 366Document12 pagesSingapore Property Weekly Issue 366Propwise.sgNo ratings yet

- Singapore Property Weekly Issue 372Document12 pagesSingapore Property Weekly Issue 372Propwise.sgNo ratings yet

- Singapore Property Weekly Issue 373Document13 pagesSingapore Property Weekly Issue 373Propwise.sgNo ratings yet

- SingaporeDocument10 pagesSingaporePropwise.sgNo ratings yet

- Singapore Property Weekly Issue 369Document12 pagesSingapore Property Weekly Issue 369Propwise.sgNo ratings yet

- Singapore Property Weekly Issue 370Document10 pagesSingapore Property Weekly Issue 370Propwise.sgNo ratings yet

- Singapore Property Weekly Issue 365Document13 pagesSingapore Property Weekly Issue 365Propwise.sgNo ratings yet

- Singapore Property Weekly Issue 364Document13 pagesSingapore Property Weekly Issue 364Propwise.sgNo ratings yet

- Singapore Property Weekly Issue 363Document13 pagesSingapore Property Weekly Issue 363Propwise.sgNo ratings yet

- Singapore Property Weekly Issue 371Document11 pagesSingapore Property Weekly Issue 371Propwise.sgNo ratings yet

- Singapore Property Weekly Issue 367Document13 pagesSingapore Property Weekly Issue 367Propwise.sgNo ratings yet

- Singapore Property Weekly Issue 360Document10 pagesSingapore Property Weekly Issue 360Propwise.sgNo ratings yet

- Singapore Property Weekly Issue 361Document11 pagesSingapore Property Weekly Issue 361Propwise.sgNo ratings yet

- Singapore Property Weekly Issue 357Document13 pagesSingapore Property Weekly Issue 357Propwise.sgNo ratings yet

- Singapore Property Weekly Issue 359Document15 pagesSingapore Property Weekly Issue 359Propwise.sgNo ratings yet

- Singapore Property Weekly Issue 358Document15 pagesSingapore Property Weekly Issue 358Propwise.sgNo ratings yet

- Syllabus FINA 6092 - Advanced Financial ManagementDocument5 pagesSyllabus FINA 6092 - Advanced Financial ManagementisabellelyyNo ratings yet

- AggrivateDocument14 pagesAggrivatemvtharish138No ratings yet

- PALOMARIA-MODULE 4 - Consumer MathDocument16 pagesPALOMARIA-MODULE 4 - Consumer MathALMIRA LOUISE PALOMARIANo ratings yet

- Reflection Paper 2 - Financial Management PlanDocument3 pagesReflection Paper 2 - Financial Management PlanANGEL JIYAZMIN DELA CRUZNo ratings yet

- Images Ebook Sample - Assessment.questions Ceilli Ceilli - English Ceilli - Set2Document26 pagesImages Ebook Sample - Assessment.questions Ceilli Ceilli - English Ceilli - Set2phyliciayapNo ratings yet

- Ubs GlobalDocument24 pagesUbs GlobalJoOANANo ratings yet

- Capital MarketDocument10 pagesCapital Marketसम्राट सुबेदीNo ratings yet

- Aec64 Audit 2 Notes-22-24Document3 pagesAec64 Audit 2 Notes-22-24Althea RubinNo ratings yet

- Week 4 - ch16Document52 pagesWeek 4 - ch16bafsvideo4No ratings yet

- FAtDocument6 pagesFAtCassandra AnneNo ratings yet

- 7.1.1 Record Keeping: It Is Necessary To Have Good Records For Effective Control and For Tax PurposesDocument9 pages7.1.1 Record Keeping: It Is Necessary To Have Good Records For Effective Control and For Tax PurposesTarekegnNo ratings yet

- 54 Ipo ChecklistDocument8 pages54 Ipo ChecklistsurajgulguliaNo ratings yet

- RMDocument23 pagesRMVarun MoodbidriNo ratings yet

- Statement of The ProblemDocument24 pagesStatement of The ProblemLia AmmuNo ratings yet

- Group 2 - FS Analysis, Planning, Forecasting 20240217 - UpdatedDocument30 pagesGroup 2 - FS Analysis, Planning, Forecasting 20240217 - Updateddias khairunnisaNo ratings yet

- HedgingDocument7 pagesHedgingSachIn JainNo ratings yet

- NCCMP ProjectDocument76 pagesNCCMP Projectaman_luthra1611No ratings yet

- 2point2 Capital - Investor Update Q1 FY22Document6 pages2point2 Capital - Investor Update Q1 FY22Anil GowdaNo ratings yet

- Single EntryDocument5 pagesSingle EntryAMIN BUHARI ABDUL KHADERNo ratings yet

- Bsit 7th Semester Course Outline.Document7 pagesBsit 7th Semester Course Outline.Rana Gulraiz HassanNo ratings yet

- Alta Fox Capital 2019 Q1 LetterDocument7 pagesAlta Fox Capital 2019 Q1 LetterSmitty WNo ratings yet

- Dalcor Indicative Bids 10-2-14Document3 pagesDalcor Indicative Bids 10-2-14Abner ogegaNo ratings yet

- 4.3. Example Scenario - Pro Forma ProblemsDocument6 pages4.3. Example Scenario - Pro Forma Problemskartik lakhotiyaNo ratings yet

- CardinalStone Research - Seplat Petroleum Development Corporation - Trading UpdateDocument5 pagesCardinalStone Research - Seplat Petroleum Development Corporation - Trading UpdateDhameloolah LawalNo ratings yet