Professional Documents

Culture Documents

Aec64 Audit 2 Notes-22-24

Uploaded by

Althea RubinOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Aec64 Audit 2 Notes-22-24

Uploaded by

Althea RubinCopyright:

Available Formats

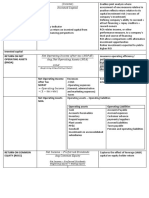

AEC 64 - Auditing and Assurance: Concepts and Applications 2

List of Benefits ● Employee Handbook Completeness Actual return on Income expected from assets in (-)

(Completeness (List of benefits) plan assets the pension plan, including

and Classification ● Accountancy Policy investment income from interest,

procedures in Manual dividends, and capital gains.

accordance with

PAS 19 Employee

Benefits) Gain or loss Actuarial gain or loss refers to an

increase or a decrease in the

Review of ● AVR Completeness, projections used to value a

actuarial ● Payroll Register Valuation corporation's defined benefit

assumptions (assumptions a and c) pension plan obligations.

(Estimates)

➢ Must be reasonable

What are the ❖ Change in value of RBO

assumptions or ➢ Mag-change pag ma

analytics? change ang assumptions

No. of employees ❖ Change in value of plan assets

eligible for

retirement pay. = Net Pension Cost / Expense

Recomputation ● AVR Valuation

of Obligation ❖ Retirement Benefit Obligation (RBO)

❖ Fair Value of Plan Assets (FVPA)

Confirmation of What to confirm: Existence? ➢ Managed by a third party

plan assets 1. Balance as of year end

2. Interest income -

gina-invest ang funds Retirement Benefit Asset FVPA > RBO

sa bonds

Retirement Benefit Obligation RBO < FVPA

[Liability]

Actuarial Assumptions seen in the AVR

1. List/No. of Employees as of year end (12/31)

2. Annual Salary EXPERT

3. Average Working Life - you need: ❖ What to test by auditor?

➢ Hiring date and ➢ Competence

➢ Birthday

■ License, member of professional board

4. Discount rate - risk free rate (PHP BVAL Rate)

5. Mortality rate ➢ Capabilities

6. Future Salary Increase Rate: ■ Geographic location

➢ Auditor needs to do Subsequent Events Testing ■ Time and resources

(Ex. 2021 audit and compare to 2022) ➢ Objectivity

■ Makita ni sa engagement letter between

Notes:

actuary and client, what to check:

➔ FOUND IN PAYROLL REGISTER

● Scope of work

➔ PROVIDED BY DEPT OF FINANCE (GOVT)

● Service fee (significant or not)

Components of Pension Expense

a. Current Service Cost (+) REVISED CORPORATION CODE

b. Past Service Cost (+) - naa sa OCI, hinay-hinayan og transfer AUDIT PROCEDURES ON EQUITYxu

sa P/L (amortized)

EQUITY

COMPONENTS OF PENSION EXPENSE

AUDIT AUDIT EVIDENCE ASSERTION

PROCEDURE

Current service this is the amount that the (+)

cost employee earned for his service in

Equity Roll ● Shareholders list

the current reporting period (which

forward ● Articles of

adds up to the defined benefit

incorporation

obligation)

Confirmation to What to confirm:

Past service cost Past service cost is the change in (+)

Corporate ➢ Shares issued and PRESENTATION

the present value of defined benefit

Secretary outstanding as of year AND

obligations caused by employee

end DISCLOSURE

service in prior periods. This cost

➢ Board of Directors Kay ang

arises from changes in

and corresponding everything else na

post-employment benefits or other

shareholdings (CFO, assertion nabuhat

long-term employee benefits. The

CEO, COO) na sa previous

change in this cost may either be

➢ Board resolutions audit

positive or negative.

(including dividend

declarations)

Interest expense The increase in the overall pension (+) ➢ Minutes of the

obligation due to the passage of Meeting

time.

AEC 64 - Auditing and Assurance: Concepts and Applications 2

Legal ➢ Types of RE (refer b. Contractual cash flow characteristics

Considerations below)

Initial Fair value plus transaction costs

measurement ➔ XCPT - FVPL: Fair value only,

COMPONENTS OF EQUITY transaction costs expensed immediately

Share Capital + Additional Paid-in Capital (icompare with Fair value = market price - transport costs

unappropriated RE)

Retained Earnings Roll forward:

RE, beg. + net income* - dividends = RE, Financial liabilities

end

a. Payables

*already included in audit of income b. Lease liabilities

statement accounts

c. Held for trading liabilities and derivative liabilities

d. Redeemable preference shares issued

TYPES OF RETAINED EARNINGS e. Security deposits and other returnable deposits

1. Appropriate retained earnings

➢ Why mag-appropriate: For future projects

➢ Example:

CHAPTER 10: Investments in Debt

■ Future business expansion - most sikat Securities

na reason ngano mag appropriate ang

From MILLAN IA1 A

entity

■ Dapat naay definite timeline

2. Unappropriated retained earnings

Financial assets at amortized cost

➔ Investment in bonds

CHAPTER 9: Investments ◆ Government (treasury bonds)

From MILLAN IA1 A ◆ Corporations (corporate/private bonds)

Financial Instruments

Bonds

➔ Long-term debt instruments

Financial assets

➔ Offered to the public

a. Cash and cash equivalents

b. Receivables Bond indenture

c. Investments in equity or debt instruments of other entities ➔ contractual arrangement between issuer and bondholders

d. Sinking fund and other long term funds ➔ Restrictive covenants to prevent issuer from taking actions

contrary to the interests of the bondholders

➔ Trustee (bank) appointed to ensure compliance

Initial When the entity becomes a party in the

recognition contractual provisions of the instrument

DISCOUNT acquisition cost < face amount

Subsequent a. Amortized EIR > NR

measurement i. Hold to collect

ii. Solely payments of principal

and interest PREMIUM acquisition cost > face amount

b. FVOCI EIR < NR

i. Hold to collect and sell

ii. SPPI Interest income PV of bonds x original EIR

iii. Irrevocable election at initial

recognition to classify an Interest receivable Outstanding face amount x NR

investment in equity

instruments

Int inc - int rec = Discount or period amortization

c. FVPL

i. If it doesn't meet amortized or

FVOCI

ii. Irrevocable designation at

initial recognition to eliminate

Acquired interest

or significantly reduce

accounting mismatch Unpaid interest has accrued

iii. Held for trading

- Record separately as

Basis:

a. Business model

i. A matter of fact

AEC 64 - Auditing and Assurance: Concepts and Applications 2

Future cash flows x pv factor at x% = PV oci Increase (gain) No effect

decrease (loss)

Sale of bonds prior to maturity

Net disposal proceeds - CA = gain or loss

CHAPTER 14: Investments in Associates

From MILLAN IA1 B

Type of investment Nature of Applicable

relationship with reporting standard

investee

Investment Regular investor PFRS 9

measured at fair

value

Investment in Significant influence PAS 28

associate

Investment in Control PFRS 3 & PFRS 10

subsidiary

Investment in joint Join control PFRS 11 & PAS 28

venture

% of ownership interest Type of investment

<20% Financial assets at fair value

20% - 50% Investment in associate

51% - 100% Investment in subsidiary

Contractually agreed sharing of Investment in joint venture

control

OTHER EVIDENCES OF SIGNIFICANT INFLUENCE

a. Representation on the board of directors or equivalent body

of the investee

b. Participation in policy-making processes

c. Material transactions

d. Interchange of managerial personnel

e. Provision of essential technical information

Equity method

Share in Effect on investment Effect in investment

associate’s in associate income

Profit or loss Increase (profit) Increase (profit)

decrease (loss) decrease (loss)

dividends decrease No effect

You might also like

- Pas 19 Employee BenefitsDocument14 pagesPas 19 Employee BenefitsKelzarineah FludgeNo ratings yet

- 3 Non-Current Assets TopicDocument43 pages3 Non-Current Assets TopicpesseNo ratings yet

- Employee BenefitsDocument18 pagesEmployee BenefitsLavillaNo ratings yet

- Employee Benefits: September 21, 2020Document18 pagesEmployee Benefits: September 21, 2020Andrea BaldonadoNo ratings yet

- ToA.1615 - Employee Benefits PAS19RDocument11 pagesToA.1615 - Employee Benefits PAS19RJay-L TanNo ratings yet

- Fusion HCM Talent Management Student GuideDocument20 pagesFusion HCM Talent Management Student Guidevreddy123No ratings yet

- 03 Accounting For Budgetary Accounts PT 1Document27 pages03 Accounting For Budgetary Accounts PT 1Peterson ManalacNo ratings yet

- IT Audit CH 3Document5 pagesIT Audit CH 3JC MoralesNo ratings yet

- (ENG) Chuong 6 - Quyet Dinh Dau Tu Tai San Dai HanDocument30 pages(ENG) Chuong 6 - Quyet Dinh Dau Tu Tai San Dai HanTiên NguyễnNo ratings yet

- Chapter 2Document10 pagesChapter 2subeyr963No ratings yet

- F2-17 Capital Budgeting and Discounted Cash Flows PDFDocument28 pagesF2-17 Capital Budgeting and Discounted Cash Flows PDFJaved ImranNo ratings yet

- Working Capital Management: 30 July 2016Document44 pagesWorking Capital Management: 30 July 2016Nguyễn Ngọc KhánhNo ratings yet

- Saurabh Resume - Updated 2 PDFDocument4 pagesSaurabh Resume - Updated 2 PDFSaurabh SurveNo ratings yet

- Client Blueprint for Internal Order ProcessDocument7 pagesClient Blueprint for Internal Order ProcessVishal YadavNo ratings yet

- Salaries Asia TADocument24 pagesSalaries Asia TAemaan fatimaNo ratings yet

- Adjusting AccountsDocument43 pagesAdjusting AccountsChowdhury Mobarrat Haider Adnan100% (1)

- Basic accounting for defined benefit plansDocument23 pagesBasic accounting for defined benefit plansKristine Diane CABAnASNo ratings yet

- AS 10 - Property Plant and Equipment: Recognition CriteriaDocument5 pagesAS 10 - Property Plant and Equipment: Recognition CriteriaAshutosh shriwasNo ratings yet

- Business Analysis and Valuation 3 4Document23 pagesBusiness Analysis and Valuation 3 4Budi Yuda PrawiraNo ratings yet

- Ias 19 Employee BenefitsDocument21 pagesIas 19 Employee BenefitszulfiNo ratings yet

- PFRS Updates: PAS 1, PAS 19, PFRS 9, PFRS 10, PFRS 11, PFRS 13Document74 pagesPFRS Updates: PAS 1, PAS 19, PFRS 9, PFRS 10, PFRS 11, PFRS 13Mara Shaira Siega100% (1)

- Saurabh Surve - Updated ResumeDocument4 pagesSaurabh Surve - Updated ResumeSaurabh SurveNo ratings yet

- IAS 19 Employee Benefits GuideDocument9 pagesIAS 19 Employee Benefits GuideRichie BoomaNo ratings yet

- Dec 2021 - Due Diligence in Business Restructuring - Disha GadaDocument6 pagesDec 2021 - Due Diligence in Business Restructuring - Disha GadaPRAGYA RATHINo ratings yet

- FRR Part C Accounting 04Document5 pagesFRR Part C Accounting 04Sarthak GargNo ratings yet

- Notes IAS 19 EMPLOYEE BENEFITSDocument13 pagesNotes IAS 19 EMPLOYEE BENEFITSCunanan, Malakhai JeuNo ratings yet

- FAR210 MFRS116 PPE - Oct23Document28 pagesFAR210 MFRS116 PPE - Oct23Nur Alya DamiaNo ratings yet

- As 15Document12 pagesAs 15abhishekkapse654No ratings yet

- Presentation 5 Chapter 6Document33 pagesPresentation 5 Chapter 6Mia MohsinNo ratings yet

- ROI (Income) Enables joint analysis of return on investment and profitabilityDocument4 pagesROI (Income) Enables joint analysis of return on investment and profitabilityAmelieNo ratings yet

- Aud Prob ReviewerDocument22 pagesAud Prob ReviewerJoy ConstantinoNo ratings yet

- Material No. 3: Capital Budgeting: Laguna State Polytechnic University-Los Baños Laguna (LSPU-LBC)Document7 pagesMaterial No. 3: Capital Budgeting: Laguna State Polytechnic University-Los Baños Laguna (LSPU-LBC)Kristine Joy NolloraNo ratings yet

- Project Financing Valuations ApproachDocument2 pagesProject Financing Valuations ApproachSwatantraNo ratings yet

- Prepared By: Jessy ChongDocument7 pagesPrepared By: Jessy ChongDaleNo ratings yet

- Chapter 6Document16 pagesChapter 6Renese LeeNo ratings yet

- Company Valuation - Course NotesDocument10 pagesCompany Valuation - Course NotesAfonsoNo ratings yet

- Reconstitution Change in Existing Profit Sharing RatioDocument10 pagesReconstitution Change in Existing Profit Sharing RatioanuhyaextraNo ratings yet

- Ms09 - Capital Budgeting (Reviewer's Copy)Document19 pagesMs09 - Capital Budgeting (Reviewer's Copy)Mikka Aira Sardeña100% (1)

- Advances - Deposits - and - Prepayments - Audit - Program - TODDocument20 pagesAdvances - Deposits - and - Prepayments - Audit - Program - TODShohag RaihanNo ratings yet

- 04 Investment Appraisal MNGDocument5 pages04 Investment Appraisal MNGabinet getnet mamoNo ratings yet

- FR 知识点串讲(一)Document23 pagesFR 知识点串讲(一)周于No ratings yet

- MS11 - Capital BudgetingDocument8 pagesMS11 - Capital BudgetingElsie GenovaNo ratings yet

- The Accounting Cycle: Accruals & Deferrals: DR Asma Abdul RehmanDocument41 pagesThe Accounting Cycle: Accruals & Deferrals: DR Asma Abdul RehmanMuskan binte RaisNo ratings yet

- Week 2 - CH 4 - Adjusting Entries - Tas - SVDocument27 pagesWeek 2 - CH 4 - Adjusting Entries - Tas - SVThat kid 246No ratings yet

- DCF-Valuation-Course-Notes-365-Financial-AnalystDocument12 pagesDCF-Valuation-Course-Notes-365-Financial-AnalystArice BertrandNo ratings yet

- Company ValuationDocument10 pagesCompany ValuationJia MakhijaNo ratings yet

- Lecture 9: Budgeting: ACCT10001 Accounting Reports and AnalysisDocument38 pagesLecture 9: Budgeting: ACCT10001 Accounting Reports and AnalysisBáchHợpNo ratings yet

- Notes Payable With Debt RestructuringDocument3 pagesNotes Payable With Debt RestructuringZehra LeeNo ratings yet

- Accountancy Syllabus (Code No. 055) Term-Wise Class-XII (2021-22)Document7 pagesAccountancy Syllabus (Code No. 055) Term-Wise Class-XII (2021-22)Sarthak PithoriyaNo ratings yet

- Tudy Buddy: Ias 36 - Impairment of AssetsDocument2 pagesTudy Buddy: Ias 36 - Impairment of AssetsAbdullah Al Amin MubinNo ratings yet

- Acc 203 FinalsDocument10 pagesAcc 203 Finalspchu4019No ratings yet

- Lecture 05 Completed SlidesDocument27 pagesLecture 05 Completed SlidesJING NIENo ratings yet

- Financial Accounting Analysis Cheat SheetDocument1 pageFinancial Accounting Analysis Cheat SheetMinyu LvNo ratings yet

- 19l (12-00) Develop The Audit Program - COGSDocument1 page19l (12-00) Develop The Audit Program - COGSAnh Tuấn TrầnNo ratings yet

- Mas Handout 1Document13 pagesMas Handout 1Rue Scarlet100% (2)

- Audit Programme Tangible Fixed AssetDocument8 pagesAudit Programme Tangible Fixed AssetfaheemNo ratings yet

- Institute of Space Technology Functional RequirementsDocument62 pagesInstitute of Space Technology Functional RequirementsMaheen AhmedNo ratings yet

- Financial Statements Cheat SheetDocument1 pageFinancial Statements Cheat SheetjmbaezfNo ratings yet

- Korean Business Dictionary: American and Korean Business Terms for the Internet AgeFrom EverandKorean Business Dictionary: American and Korean Business Terms for the Internet AgeNo ratings yet

- Anglo Agriparts Trade CatalogueDocument609 pagesAnglo Agriparts Trade CatalogueJoanne Champion100% (1)

- Sam's Melancholic MorningDocument4 pagesSam's Melancholic Morningali moizNo ratings yet

- Inelastic Response SpectrumDocument10 pagesInelastic Response Spectrummathewsujith31No ratings yet

- PDF Penstock Manual DLDocument160 pagesPDF Penstock Manual DLWilmer Fernando DuarteNo ratings yet

- Quiz Bowl QuestionsDocument8 pagesQuiz Bowl QuestionsKeenan Dave RivoNo ratings yet

- ITC Gardenia LavendreriaDocument6 pagesITC Gardenia LavendreriaMuskan AgarwalNo ratings yet

- The Coffee House-Group 8Document18 pagesThe Coffee House-Group 8Thanh Huyền TrầnNo ratings yet

- Module 6 Questions and AnswersDocument10 pagesModule 6 Questions and AnswersProject InfoNo ratings yet

- Lighting Design: Azhar Ayyub - Akshay Chaudhary - Shahbaz AfzalDocument27 pagesLighting Design: Azhar Ayyub - Akshay Chaudhary - Shahbaz Afzalshahbaz AfzalNo ratings yet

- Stock Market Course ContentDocument12 pagesStock Market Course ContentSrikanth SanipiniNo ratings yet

- The Tibetan Weather Magic Ritual of A MoDocument13 pagesThe Tibetan Weather Magic Ritual of A MoYORDIS PCNo ratings yet

- Birla Institute of Technology and Science, Pilani: Pilani Campus AUGS/ AGSR DivisionDocument5 pagesBirla Institute of Technology and Science, Pilani: Pilani Campus AUGS/ AGSR DivisionDeep PandyaNo ratings yet

- 285519-35126-30-case-studyDocument12 pages285519-35126-30-case-studyapi-737834018No ratings yet

- Guitar Chord Chart For Drop D TuningDocument4 pagesGuitar Chord Chart For Drop D TuningJnewsletter1No ratings yet

- TwistiesDocument2 pagesTwistiesHazwan Hj YusofNo ratings yet

- Map2 PDFDocument72 pagesMap2 PDFValerioNo ratings yet

- Current Openings: The Sirpur Paper Mills LTDDocument3 pagesCurrent Openings: The Sirpur Paper Mills LTDMano VardhanNo ratings yet

- Biology and Aquaculture of Tilapia-Routledge (2022)Document324 pagesBiology and Aquaculture of Tilapia-Routledge (2022)Pablo Antonio Pintos TeránNo ratings yet

- DocxDocument5 pagesDocxFelicya Angel Ivy LynnNo ratings yet

- Ag Tobig Nog Keboklagan and The Guman of DumalinaoDocument5 pagesAg Tobig Nog Keboklagan and The Guman of DumalinaoJessaMae AlbaracinNo ratings yet

- Coping With Frustration, Conflict, and StressDocument7 pagesCoping With Frustration, Conflict, and StressCess Abad AgcongNo ratings yet

- The Routledge Handbook of Translation and Culture by Sue-Ann Harding (Editor), Ovidi Carbonell Cortés (Editor)Document656 pagesThe Routledge Handbook of Translation and Culture by Sue-Ann Harding (Editor), Ovidi Carbonell Cortés (Editor)Rita PereiraNo ratings yet

- Indigenous Peoples SyllabusDocument9 pagesIndigenous Peoples Syllabusapi-263787560No ratings yet

- Business Studies Project: Made By: Rahil JainDocument29 pagesBusiness Studies Project: Made By: Rahil JainChirag KothariNo ratings yet

- Edge Computing As A Service: How Macrometa is Revolutionizing Global Data ProcessingDocument8 pagesEdge Computing As A Service: How Macrometa is Revolutionizing Global Data ProcessingAtlantis-ILIONo ratings yet

- MGT211 RecruitmentDocument16 pagesMGT211 RecruitmentEdward N MichealNo ratings yet

- Sales Confirmation: Alpha Trading S.P.A. Compagnie Tunisienne de NavigationDocument1 pageSales Confirmation: Alpha Trading S.P.A. Compagnie Tunisienne de NavigationimedNo ratings yet

- IN THE COURT OF - SUIT/APPEAL No. - JURISDICTION OF 2017Document1 pageIN THE COURT OF - SUIT/APPEAL No. - JURISDICTION OF 2017Adv Pooja AroraNo ratings yet

- StudenttextDocument29 pagesStudenttextapi-195130729No ratings yet

- All About The Hathras Case - IpleadersDocument1 pageAll About The Hathras Case - IpleadersBadhon Chandra SarkarNo ratings yet