Professional Documents

Culture Documents

Project Financing Valuations Approach

Uploaded by

SwatantraCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Project Financing Valuations Approach

Uploaded by

SwatantraCopyright:

Available Formats

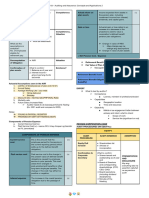

Project Financing – Valuations Approach

Discounted Cash Flow Approaches (DCF)

Measure of

No Formula Why it is Important?

Viability

✓ NPV > = 0 : Viable; NPV < 0 : Nonviable

Rt – Net cash flow

Net Present ✓ NPV is useful when comparing projects similar size of

1 i – Discount rate

Value (NPV) different sectors. However correct estimation of cost of

T – No of time periods

capital is a challenge in NPV estimation

Ct – Net cash inflow during the period ✓ Simplest way to calculate any project viability and no

Internal Rate dependence to calculate the cost of capital

C0 – Total initial investment costs

2 of Return

t – No. of time periods ✓ Not applicable for mutually explosive projects and

(IRR)

IRR – Internal rate of return different terms of project is not considered by IRR method

FVCF – FV of Positive cash ✓ Positive cashflows are reinvested at reinvestment rate

flows discounted and the present value of negative cash flows discounted

Modified

at the reinvestment rate at the financing rate

Internal Rate

3 PVCF – PV of negative

of Return ✓ MIRR provides a more realistic picture of the return on the

cash flows discounted

(MIRR) investment project relative to the standard IRR. The MIRR

at the financing rate

n – the number of periods is commonly lower than the IRR

✓ PI greater than 1 is deemed as a good investment, with

higher values corresponding to more attractive projects

Profitability NPV + Initial Investment

4 Profitability Index (PI) = ✓ PI doesn’t measure the value of a business. It only shows

Index (PI) Initial Investment

the company's ability to generate profits from

investments

Abhinav Sengupta | MBA in Energy & Infrastructure & B.Tech in Mining & Executive Diploma in Business Valuation | Email : abhinavsengupta85@gmail.com | Phone : +919016047552

Project Financing – Valuations Approach

Non-Discounted Cash Flow Approaches

Measure of

No Formula Why it is Important?

Viability

✓ Payback period is simple to use and easy to understand and

Payback Initial Investment useful in case of compare an uncertain investment

1 Payback Period =

Period Cash Flow Per Year ✓ Payback periods ignores the time value of money and

neglects project return on investment as well as profitability

✓ It considered the time value of money while calculating the

Discounted Payback Period = A + B/C payback period and determines the actual risk of the project

(A) = Year before Discounted Payback period occurs ✓ The calculation for discounted payback period can get

Discounted

(B) = Cumulative Discounted Cash flow in year before complex if there are multiple negative cash flows during an

2 Payback

recovery investment period

Period

(C) = Discounted cash flow in year after recovery ✓ It does not consider the project that can last longer than the

payback period. It ignores all the calculations beyond the

discounted payback period

✓ It gives a clear picture of the profitability of a project as It

considers the earnings after tax and depreciation. This is a

Accounting vital factor in the appraisal of an investment proposal

Average Annual Profit

3 Rate of Return Accounting Rate of Return =

(ARR) Initial Investment ✓ On the other hand, It consider the external factors which are

also affecting the profitability of the project. A fair rate of

return can not be determined based on ARR

Abhinav Sengupta | MBA in Energy & Infrastructure & B.Tech in Mining & Executive Diploma in Business Valuation | Email : abhinavsengupta85@gmail.com | Phone : +919016047552

You might also like

- Presentation On Capital BudgetingDocument15 pagesPresentation On Capital BudgetingNahidul Islam IUNo ratings yet

- Capital Budgeting - WorksheetDocument32 pagesCapital Budgeting - WorksheetnerieroseNo ratings yet

- Capital Budgeting: Factors of Consideration Net Investments Net Returns Cost of CapitalDocument2 pagesCapital Budgeting: Factors of Consideration Net Investments Net Returns Cost of CapitalMary Hazell Victori100% (1)

- The Basics of Capital BudgetingDocument5 pagesThe Basics of Capital BudgetingChirrelyn Necesario SunioNo ratings yet

- PMP Cheat Sheet in Plain English (PMBok6) by Jonathan Donado EditedDocument17 pagesPMP Cheat Sheet in Plain English (PMBok6) by Jonathan Donado EditedNguyen Nhat Quang100% (1)

- Capital BudgetingDocument44 pagesCapital Budgetingarian2026No ratings yet

- Ms09 - Capital Budgeting (Reviewer's Copy)Document19 pagesMs09 - Capital Budgeting (Reviewer's Copy)Mikka Aira Sardeña100% (1)

- Applied Corporate Finance. What is a Company worth?From EverandApplied Corporate Finance. What is a Company worth?Rating: 3 out of 5 stars3/5 (2)

- Reviewer Financial ManagementDocument39 pagesReviewer Financial ManagementDerek Dale Vizconde NuñezNo ratings yet

- ACC 123 Quiz 1Document16 pagesACC 123 Quiz 1hwo50% (2)

- Financial For Non Financial CitibanamexDocument147 pagesFinancial For Non Financial CitibanamexRaúl ArellanoNo ratings yet

- 03 Capital BudgetingDocument18 pages03 Capital BudgetingKenneth Marcial Ege100% (1)

- Sale and Purchase Agreement OSCAR ALEJANDRO GALVIS SANTIAGODocument6 pagesSale and Purchase Agreement OSCAR ALEJANDRO GALVIS SANTIAGOTinktas pcsNo ratings yet

- SBLC Offer For A Leased BG-SBLC, Procedure and MemorandumDocument2 pagesSBLC Offer For A Leased BG-SBLC, Procedure and MemorandumSharonNo ratings yet

- F2-17 Capital Budgeting and Discounted Cash Flows PDFDocument28 pagesF2-17 Capital Budgeting and Discounted Cash Flows PDFJaved ImranNo ratings yet

- Project Appraisal PresentationDocument10 pagesProject Appraisal PresentationmudikpatwariNo ratings yet

- 11 Investment AppraisalDocument37 pages11 Investment AppraisalMusthari KhanNo ratings yet

- 04 Investment Appraisal MNGDocument5 pages04 Investment Appraisal MNGabinet getnet mamoNo ratings yet

- Chapter 6Document16 pagesChapter 6Renese LeeNo ratings yet

- Capital Budgeting/Long Term Investment Decisions: Part OneDocument8 pagesCapital Budgeting/Long Term Investment Decisions: Part OneDoreen AwuorNo ratings yet

- Capital Budgeting - NotesDocument7 pagesCapital Budgeting - NotesnerieroseNo ratings yet

- Topic VII Capital Budgeting TechniquesDocument16 pagesTopic VII Capital Budgeting TechniquesSeph AgetroNo ratings yet

- Financial For Non Financial CitibanamexDocument147 pagesFinancial For Non Financial CitibanamexRaúl ArellanoNo ratings yet

- Asis 5 (CH 9) - PertanyaanDocument4 pagesAsis 5 (CH 9) - PertanyaanAndre JonathanNo ratings yet

- AFM - Investment Appraisal - AE - Week 1Document57 pagesAFM - Investment Appraisal - AE - Week 1AwaiZ zahidNo ratings yet

- Capital Budgeting ReviewerDocument4 pagesCapital Budgeting ReviewerLiana Monica LopezNo ratings yet

- CHAPTER 10: Capital Budgeting Techniques: Annual Net IncomeDocument2 pagesCHAPTER 10: Capital Budgeting Techniques: Annual Net IncomeSeresa EstrellasNo ratings yet

- Capital Budgeting: PB Initialinvestment Annual Cashinflow PB E+ B CDocument3 pagesCapital Budgeting: PB Initialinvestment Annual Cashinflow PB E+ B CজহিরুলইসলামশোভনNo ratings yet

- MS-12 (Capital Budgeting With Investment Risks and Returns)Document18 pagesMS-12 (Capital Budgeting With Investment Risks and Returns)musor.as084No ratings yet

- Mindmap Chapter 13 Capital BudgetingDocument1 pageMindmap Chapter 13 Capital BudgetingSimon ErickNo ratings yet

- Eecon FinalsDocument6 pagesEecon FinalsShania Kaye SababanNo ratings yet

- ACCA P4 - Session 2Document24 pagesACCA P4 - Session 2prince senNo ratings yet

- Capital Project Appraisal: ST335, Week 4Document20 pagesCapital Project Appraisal: ST335, Week 4AarohiKanitkarNo ratings yet

- MS11 - Capital BudgetingDocument8 pagesMS11 - Capital BudgetingElsie GenovaNo ratings yet

- Eco For EnggDocument1 pageEco For EnggRAAJ KISHOR R HNo ratings yet

- MS-44L (Capital Budgeting With Risks & Returns)Document18 pagesMS-44L (Capital Budgeting With Risks & Returns)juleslovefenNo ratings yet

- Capital BudgetingDocument17 pagesCapital BudgetingAnirudha GoraiNo ratings yet

- Capital BudgetingDocument53 pagesCapital Budgeting88ak07No ratings yet

- Capital BudgetingDocument13 pagesCapital BudgetingTanya SanjeevNo ratings yet

- 3 Investment Appraisal Discounted Cash Flow TechniquesDocument38 pages3 Investment Appraisal Discounted Cash Flow TechniquesR SidharthNo ratings yet

- Corporate Finance Professional Certificate MOOC: Quick Reference GuideDocument1 pageCorporate Finance Professional Certificate MOOC: Quick Reference GuideShivani AgarwalNo ratings yet

- Capital Budgeting V3Document12 pagesCapital Budgeting V3BMRsnehaNo ratings yet

- 2 - INTRO TO Financial FSDocument19 pages2 - INTRO TO Financial FSmuhammad akbar bahmiNo ratings yet

- (ENG) Chuong 6 - Quyet Dinh Dau Tu Tai San Dai HanDocument30 pages(ENG) Chuong 6 - Quyet Dinh Dau Tu Tai San Dai HanTiên NguyễnNo ratings yet

- Capital Budgeting: Should We Build This Plant?Document38 pagesCapital Budgeting: Should We Build This Plant?Saurabh RinkuNo ratings yet

- MAS-42N (Capital Budgeting With Investment Risks - Returns)Document16 pagesMAS-42N (Capital Budgeting With Investment Risks - Returns)saligumba mikeNo ratings yet

- FinanceDocument4 pagesFinanceSubhojit PoddarNo ratings yet

- Capital Budgeting: Head, Dept. of Commerce S.D.Jain Girls' College Dimapur: NagalandDocument13 pagesCapital Budgeting: Head, Dept. of Commerce S.D.Jain Girls' College Dimapur: NagalandsantNo ratings yet

- RevisionDocument4 pagesRevisionK58 Hà Phương LinhNo ratings yet

- (A+F) NYU Attack OutlineDocument8 pages(A+F) NYU Attack OutlineShawn BuskovichNo ratings yet

- Company ValuationDocument10 pagesCompany ValuationJia MakhijaNo ratings yet

- Capital BudgetingDocument19 pagesCapital BudgetingTreesh Marie MenorNo ratings yet

- MERCADO, Erica Kaye M. Costram A2B November 13, 2019Document3 pagesMERCADO, Erica Kaye M. Costram A2B November 13, 2019Mila MercadoNo ratings yet

- Evaluation of Capital BudgetingDocument24 pagesEvaluation of Capital BudgetingGayathri GopiramnathNo ratings yet

- Chapter 11 SynopsisDocument7 pagesChapter 11 SynopsissajedulNo ratings yet

- Aec64 Audit 2 Notes-22-24Document3 pagesAec64 Audit 2 Notes-22-24Althea RubinNo ratings yet

- Fin Eco Unit 1 - PDFDocument121 pagesFin Eco Unit 1 - PDFBalaji ThyagarajanNo ratings yet

- ACCA P4 - Session 1Document20 pagesACCA P4 - Session 1prince senNo ratings yet

- Capital Budgeting Techniques: Presented byDocument10 pagesCapital Budgeting Techniques: Presented byHarshit SinghNo ratings yet

- Capital Budgeting: By: Umair Majeed ST ID 21558Document14 pagesCapital Budgeting: By: Umair Majeed ST ID 21558Umair MajeedNo ratings yet

- Set 2 PM NotesDocument194 pagesSet 2 PM NotesCarol Rutendo MunjeriNo ratings yet

- SS - 7-8 - Mindmaps - Corporate FinanceDocument38 pagesSS - 7-8 - Mindmaps - Corporate Financehaoyuting426No ratings yet

- Cost-Benefit Analysis: A Checklist For Project ManagersDocument3 pagesCost-Benefit Analysis: A Checklist For Project ManagersHanane KoyakoNo ratings yet

- Assessing Survival Strategies For Agro-Dealers in Chipata and Petauke Districts, Eastern ZambiaDocument6 pagesAssessing Survival Strategies For Agro-Dealers in Chipata and Petauke Districts, Eastern ZambiaThe IjbmtNo ratings yet

- 21 VBHN-BTC 512873Document78 pages21 VBHN-BTC 512873LET LEARN ABCNo ratings yet

- Company ProfileDocument15 pagesCompany ProfileAslam HossainNo ratings yet

- rf1 - PhilhealthDocument6 pagesrf1 - PhilhealthAngelica Radoc SansanNo ratings yet

- 2 Full 5-4a 5-4bDocument82 pages2 Full 5-4a 5-4banurag sonkarNo ratings yet

- Mahindra DetailsDocument30 pagesMahindra DetailsAshwin Hemant LawanghareNo ratings yet

- EPS Bootstrapping Bootstrap Earnings e EctDocument2 pagesEPS Bootstrapping Bootstrap Earnings e Ecthyba ben helalNo ratings yet

- Chapter Four Discounting and Alternative Investment CriteriaDocument22 pagesChapter Four Discounting and Alternative Investment CriteriaYusuf HusseinNo ratings yet

- Presentation On Business Icon: by Ankita Sthapak Roll No.57Document9 pagesPresentation On Business Icon: by Ankita Sthapak Roll No.57Ankita SthapakNo ratings yet

- PayslipDocument1 pagePayslipprathmeshNo ratings yet

- Faizsiz Yapı Modeli-Mehmet Hicabi SEÇKİNERDocument44 pagesFaizsiz Yapı Modeli-Mehmet Hicabi SEÇKİNERMEHMET HİCABİ SEÇKİNERNo ratings yet

- EXPANZS Registration - DayalanDocument1 pageEXPANZS Registration - DayalanManikandan BaskaranNo ratings yet

- Unifi Capital PresentationDocument40 pagesUnifi Capital PresentationAnkurNo ratings yet

- Am113 Module 1-PrelimDocument22 pagesAm113 Module 1-PrelimMaryjel SumambotNo ratings yet

- Microsoft Assignment FRA Group 7Document5 pagesMicrosoft Assignment FRA Group 7Payal AgrawalNo ratings yet

- Revew ExercisesDocument40 pagesRevew Exercisesjose amoresNo ratings yet

- Quiz - SFP With AnswersDocument4 pagesQuiz - SFP With Answersjanus lopezNo ratings yet

- KPMG - IFRS vs. US GAAP - RD CostsDocument8 pagesKPMG - IFRS vs. US GAAP - RD CoststomasslrsNo ratings yet

- Contact List 2020Document14 pagesContact List 2020Crawford BoydNo ratings yet

- Digital BankingDocument5 pagesDigital BankingAmit SinghNo ratings yet

- Bankin and Fin Law Relationship Between Bank and Its CustomersDocument6 pagesBankin and Fin Law Relationship Between Bank and Its CustomersPersephone WestNo ratings yet

- Deutsche Finan ExcelDocument6 pagesDeutsche Finan ExcelAnonymous VVSLkDOAC1No ratings yet

- 7Document31 pages7Chinzorig Tsevegjav100% (1)

- Chapter 2 FACADocument28 pagesChapter 2 FACAAnshumanSinghNo ratings yet

- MCX Deepens Its Footprint in The GIFT City (Company Update)Document3 pagesMCX Deepens Its Footprint in The GIFT City (Company Update)Shyam SunderNo ratings yet

- Risk Assessment Worksheet BlankDocument5 pagesRisk Assessment Worksheet BlankisolongNo ratings yet

- 3c83c989a - Market Hypothesis Testing in Istanbul Stock ExchangeDocument6 pages3c83c989a - Market Hypothesis Testing in Istanbul Stock ExchangeMutahar HayatNo ratings yet