Professional Documents

Culture Documents

EPS Bootstrapping Bootstrap Earnings e Ect

Uploaded by

hyba ben helalOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

EPS Bootstrapping Bootstrap Earnings e Ect

Uploaded by

hyba ben helalCopyright:

Available Formats

Home Finance topics

EPS bootstrapping You are here: Home / Finance topics / Equity valuation / EPS bootstrapping

Alternative investments EPS BOOTSTRAPPING

Finance basics

EPS bootstrapping or the bootstrap earnings e ect is a practice in corporate

Modern portfolio theory

nance used to boost the earnings per share (EPS) and to increase the stock

Bond valuation

price. Bootstrapping in mergers and acquisitions is a common practice that

Equity valuation

investors should be aware of. That’s because the bootstrap e ect has no

Accruals ratio ·

economic bene ts to a company. The merger produces increased earnings per

Acquisition Goodwill ·

share but the combined value of the rms is still equal to the sum of the

Acquisition Method · separate parts.

Adjusted Discount Rate ·

Approach On this page, we explain how EPS bootstrapping works, and provide a

Analyst Perception of · numerical example that illustrates the e ect. We implement the example using

Mispricing

an Excel spreadsheet.

Burmeister, Roll, and ·

Ross model

Capital Structure · E PS BOOT S T R APPI NG

Irrelevance Proposition

Bootstrapping occurs in the context of M&As. In this case, the acquirer buys a

Capitalized Cash Flow ·

Method company with a low Price-Earnings (P/E) through a stock swap. The goal is to

Carhart 4 Factor Model · boost the post-acquisition EPS of the newly created company and to increase

Cash Conversion Cycle · the stock price.

Claims valuation · Thus bootstrapping automatically occurs when acquirer’s Price-Earnings is

approach

higher than the Price-Earnings of the target company and a stock transaction is

Clean Surplus ·

Relationship executed to perform the merger or acquisition. Of course, the whole approach

Combined ratio · is just accounting trickery. In principle, the market will recognize what is

happening and the acquirer’s price will adjust to account for the e ect. In that

Combined Ratio After ·

Dividends (CRAD) case, the P/E of the company will be unchanged.

Conglomerate Discount ·

If, however, investors are not careful in reviewing the actions of the acquiring

Continuing Residual ·

Income company, they may be tricked. In that case, the stock price does not fully adjust

and the stock price may be boosted.

Country risk premium ·

Degree of Operating · BOOT S T R APPI NG E PS E XAMPL E

Leverage

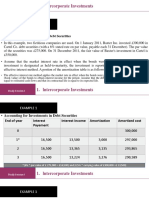

Let’s have a look at a bootstrapping EPS example. Suppose we have two

Diluted Earnings per ·

Share companies, where one company is acquired by the other company.

Discount for Lack Of ·

Control-DLOC

Discount for Lack of ·

Marketability (DLOM)

Dupont Analysis Excel ·

Template

Earnings persistence ·

Economic Value Added · BOOT S T R APPI NG E PS L ONG T E R M E FFE C T S

EPS bootstrapping · While bootstrapping may provide a temporary increase in the stock price if

Equivalent Annual · investors don’t realize the trickery, the e ect will disappear over time. The only

Annuity approach

way to keep the Price-Earnings arti cially high is to continuously buy other

Excess Earnings Method ·

(EEM) companies. This is not possible, so eventually the P/E will adjust and the stock

FCFE Coverage Ratio ·

price will go down.

FCFF vs FCFE ·

Fundamental Factor · S UMMAR Y

Model

We discussed bootstrapping. The bootstrap e ect occurs when a high P/E rm

General Residual Income ·

Model acquires a low P/E rm in a stock transaction. In the process, the acquirer

Gordon Equity Risk · exchanges higher priced shares for lower priced shares.

Premium Model

Grinold and Kroner ·

Model

Growth Accounting ·

Equation

Guideline Public ·

Company Method

T HE ABOV E T OPIC IS RELAT ED T O T HE FOLLOWING SET OF

T OPICS:

H-Model ·

1. CAPE ratio

Ibbotson-Chen model ·

2. Anchoring

Justi ed PE · 3. Justi ed PE

Justi ed Price-to-book · 4. Bootstrapping Spot Rates

multiple 5. Molodovsky e ect

Justi ed Price-to-Sales ·

ratio

Justi ed ratios ·

DOWNLOAD THE EXCEL SPREADSHEET

LBO Model ·

Macroeconomic Factor · Want to have an implementation in Excel? Download the Excel le: EPS

Models Bootstrapping template

Merger motives ·

Pastor-Stambaugh ·

Model

Pecking Order Theory ·

PEG Ratio ·

Piotroski F-score ·

PRAT Model ·

Present Value of Growth ·

Opportunities (PVGO)

Pure-play method ·

Sum Of The Parts ·

Valuation

Venture Capital ·

Valuation Method

Yardeni model ·

Dividend discount model ·

PE ratio ·

CAPE ratio ·

Dividend yield ·

Arbitrage pricing theory ·

Derivative valuation

Performance measurement

Risk management

Behavioral Finance

PAGES

Home

Alternative investments

Behavioral Finance

Bond valuation

Derivative valuation

Equity valuation

Finance basics

Modern portfolio theory

Performance measurement

Risk management

Forex trading

Passive investing

Technical analysis

Copyright - Breaking Down Finance Terms of use Privacy Policy Disclaimer Contact us

You might also like

- Creating Shareholder Value: A Guide For Managers And InvestorsFrom EverandCreating Shareholder Value: A Guide For Managers And InvestorsRating: 4.5 out of 5 stars4.5/5 (8)

- Chapter 7 Prospective Analysis: Valuation Theory and ConceptsDocument9 pagesChapter 7 Prospective Analysis: Valuation Theory and ConceptsIrwan AdimasNo ratings yet

- Key Concepts in Fundamental Analysis For Forex TradersDocument3 pagesKey Concepts in Fundamental Analysis For Forex Tradershyba ben helal50% (2)

- Lululemon Accounting AssignmentDocument20 pagesLululemon Accounting AssignmentBilal AlamNo ratings yet

- Vagh's Guide PDFDocument50 pagesVagh's Guide PDFDownloadingeverydayNo ratings yet

- The Complete Investment Banker ExtractDocument19 pagesThe Complete Investment Banker ExtractJohn MathiasNo ratings yet

- A PROJECT REPORT On Equity Analysis IT SectorDocument75 pagesA PROJECT REPORT On Equity Analysis IT SectorRobin Awathare57% (7)

- Equity Analysis of SBI Bank-1Document69 pagesEquity Analysis of SBI Bank-1mustafe ABDULLAHINo ratings yet

- Chipotle Mexican Grill PitchDocument5 pagesChipotle Mexican Grill PitchKyle PezziNo ratings yet

- Financial Statements Analysis Case StudyDocument17 pagesFinancial Statements Analysis Case StudychrisNo ratings yet

- 15.020 How Does The Earnings Power Valuation Technique (EPV) Work - Stockopedia FeaturesDocument2 pages15.020 How Does The Earnings Power Valuation Technique (EPV) Work - Stockopedia Featureskuruvillaj2217No ratings yet

- Implementation of Corporate Valuation Techniques in PracticeDocument8 pagesImplementation of Corporate Valuation Techniques in Practicematheus.200080No ratings yet

- Market-Based Valuation: Price MultiplesDocument47 pagesMarket-Based Valuation: Price MultiplesSuci Putri LNo ratings yet

- Market Based Valuation 1Document52 pagesMarket Based Valuation 1Karima JaffaliNo ratings yet

- Valuations & Acquisitions CMDocument9 pagesValuations & Acquisitions CMnsnhemachenaNo ratings yet

- Price Multiple Based ValuationDocument31 pagesPrice Multiple Based ValuationNushrat JahanNo ratings yet

- Valuation Theory M& ADocument6 pagesValuation Theory M& AbharatNo ratings yet

- Business Valuation ModelingDocument11 pagesBusiness Valuation ModelingAni Dwi Rahmanti RNo ratings yet

- Market-Based Valuation: Price MultiplesDocument28 pagesMarket-Based Valuation: Price MultiplesShaikh Saifullah KhalidNo ratings yet

- 13 Capital Structure (Slides) by Zubair Arshad PDFDocument34 pages13 Capital Structure (Slides) by Zubair Arshad PDFZubair ArshadNo ratings yet

- Earning MultiplesDocument4 pagesEarning MultiplesKhadija HabibNo ratings yet

- Nism CH 10Document13 pagesNism CH 10Darshan JainNo ratings yet

- DDFDFDocument21 pagesDDFDFJazz TinNo ratings yet

- What Drives Your Return On EquityDocument1 pageWhat Drives Your Return On Equitysilverjade03No ratings yet

- Valuations 1Document26 pagesValuations 1nsnhemachenaNo ratings yet

- Final Assignment CMADocument21 pagesFinal Assignment CMAMahmud KaiserNo ratings yet

- Damodaran ValuationDocument229 pagesDamodaran Valuationbharathkumar_asokanNo ratings yet

- Valuation Methods Used in Mergers & Acquisition: Roshankumar S PimpalkarDocument6 pagesValuation Methods Used in Mergers & Acquisition: Roshankumar S PimpalkarSharad KumarNo ratings yet

- PEG Ratio - What It Is and How To Calculate ItDocument4 pagesPEG Ratio - What It Is and How To Calculate ItPatacoNo ratings yet

- Topic 5 Market Value ApproachDocument4 pagesTopic 5 Market Value ApproachAlliyah KayeNo ratings yet

- FinQuiz - Smart Summary - Study Session 14 - Reading 50Document4 pagesFinQuiz - Smart Summary - Study Session 14 - Reading 50Rafael100% (1)

- Market Multiple Valuation Models-Mod - 4Document20 pagesMarket Multiple Valuation Models-Mod - 4Ravichandran RamadassNo ratings yet

- Topic 9 - Relative ValuationDocument5 pagesTopic 9 - Relative ValuationSurF BreaKNo ratings yet

- Relative Valuation JaiDocument29 pagesRelative Valuation JaiGarima SinghNo ratings yet

- Cost of Capital Investment Firm's Objective of Wealth MaximizationDocument12 pagesCost of Capital Investment Firm's Objective of Wealth MaximizationDharani DharanNo ratings yet

- Value Measurement PresentationDocument18 pagesValue Measurement Presentationrishit_93No ratings yet

- The Ultimate Guide To Stock Valuation - Sample ChaptersDocument11 pagesThe Ultimate Guide To Stock Valuation - Sample ChaptersOld School ValueNo ratings yet

- Goals, Value and PerformanceDocument18 pagesGoals, Value and PerformanceSamridh AgarwalNo ratings yet

- Equity - Reading 49Document28 pagesEquity - Reading 49KiraNo ratings yet

- FIN-573 - Lecture 5 - Feb 18 2021Document41 pagesFIN-573 - Lecture 5 - Feb 18 2021Abdul BaigNo ratings yet

- Residual Income ValuationDocument6 pagesResidual Income ValuationKumar AbhishekNo ratings yet

- Lecture 3.3Document28 pagesLecture 3.3Classinfo CuNo ratings yet

- Unit 2 (Notes 2) - Relative ValuationDocument9 pagesUnit 2 (Notes 2) - Relative ValuationhriddhvpatelNo ratings yet

- READING 9 Relative (Market) Based Equity ValuationDocument52 pagesREADING 9 Relative (Market) Based Equity ValuationDandyNo ratings yet

- Topic 2 FM Presentation Kassahun's EditedDocument17 pagesTopic 2 FM Presentation Kassahun's EditedLidia SamuelNo ratings yet

- Acvalco Q3Document4 pagesAcvalco Q3Angelo Gian CoNo ratings yet

- Equity Vs EVDocument9 pagesEquity Vs EVSudipta ChatterjeeNo ratings yet

- 07 Cafmst14 - CH - 05Document52 pages07 Cafmst14 - CH - 05Mahabub AlamNo ratings yet

- Module 9 - Earnings and Market Approach ValuationDocument46 pagesModule 9 - Earnings and Market Approach Valuationnatalie clyde matesNo ratings yet

- M & ADocument6 pagesM & AiluaggarwalNo ratings yet

- Economic Value AddedDocument26 pagesEconomic Value Addedshagunpal22No ratings yet

- DCF Method and Relative ValuationDocument40 pagesDCF Method and Relative ValuationMeghaNo ratings yet

- BAV Lecture 8 PB PEDocument18 pagesBAV Lecture 8 PB PEle hoangNo ratings yet

- Cost of Capital - NumericalDocument18 pagesCost of Capital - Numericalnaina kishnaniNo ratings yet

- Multiple Comparable Valuation MethodDocument6 pagesMultiple Comparable Valuation MethodMbuh DaisyNo ratings yet

- RSM - MBA - FAV - Lecture 3 - 2016 - EV and Equity Valuation PDFDocument98 pagesRSM - MBA - FAV - Lecture 3 - 2016 - EV and Equity Valuation PDFAli Gokhan KocanNo ratings yet

- Cost of CapitalDocument20 pagesCost of CapitalShiv KothariNo ratings yet

- Using Multiples For ValuationDocument26 pagesUsing Multiples For ValuationmanojbenNo ratings yet

- How To Understand Relative Valuation ModelDocument42 pagesHow To Understand Relative Valuation ModelEric McLaughlinNo ratings yet

- Date Session On Learning From ModuleDocument34 pagesDate Session On Learning From ModuleKishore KintaliNo ratings yet

- MFI Lecture 03Document27 pagesMFI Lecture 03Okba DNo ratings yet

- Valuation Using MultiplesDocument21 pagesValuation Using MultiplesJithu JoseNo ratings yet

- Investing in Competitive Methods: By: Fiona Caramba-Coker For: Dr. Fred DemiccoDocument31 pagesInvesting in Competitive Methods: By: Fiona Caramba-Coker For: Dr. Fred Demiccosagar11s11thumarNo ratings yet

- Valuation Mergers and AcquisitionDocument41 pagesValuation Mergers and AcquisitionSubrahmanya Sringeri100% (1)

- Applied Corporate Finance. What is a Company worth?From EverandApplied Corporate Finance. What is a Company worth?Rating: 3 out of 5 stars3/5 (2)

- Analytical Corporate Valuation: Fundamental Analysis, Asset Pricing, and Company ValuationFrom EverandAnalytical Corporate Valuation: Fundamental Analysis, Asset Pricing, and Company ValuationNo ratings yet

- Chart Patterns Resources PDFDocument1 pageChart Patterns Resources PDFhyba ben helalNo ratings yet

- EPS Bootstrapping: Acquiring Company Target CompanyDocument2 pagesEPS Bootstrapping: Acquiring Company Target Companyhyba ben helalNo ratings yet

- Example 1 PDFDocument9 pagesExample 1 PDFhyba ben helalNo ratings yet

- Business, Finance, and Government Administration (Top Careers in Two Years) by Celia W. Seupel PDFDocument126 pagesBusiness, Finance, and Government Administration (Top Careers in Two Years) by Celia W. Seupel PDFhyba ben helalNo ratings yet

- Factiva 20160512 1910Document119 pagesFactiva 20160512 1910Chong An OngNo ratings yet

- Reliance Petroleum Project ReportDocument52 pagesReliance Petroleum Project ReportDNYANKUMAR SHENDENo ratings yet

- Beginner's Guide: Basics of Indian Stock MarketsDocument25 pagesBeginner's Guide: Basics of Indian Stock MarketsAditi Singh100% (1)

- Customer Satisfaction and Business Performance A Firm-Level AnalysisDocument14 pagesCustomer Satisfaction and Business Performance A Firm-Level AnalysisLongyapon Sheena StephanieNo ratings yet

- Equity Note - Active Fine Chemicals Ltd.Document3 pagesEquity Note - Active Fine Chemicals Ltd.Makame Mahmud DiptaNo ratings yet

- 6 22 2018Document8 pages6 22 2018NorbertCampeauNo ratings yet

- FinMan Module 4 Analysis of FSDocument11 pagesFinMan Module 4 Analysis of FSerickson hernanNo ratings yet

- Multibagger Stock IdeasDocument14 pagesMultibagger Stock IdeasrajanbondeNo ratings yet

- Performance of Fertilizer Industry in India: Dr. Prameela S. Shetty DR - Devaraj K.Document17 pagesPerformance of Fertilizer Industry in India: Dr. Prameela S. Shetty DR - Devaraj K.ganesh joshiNo ratings yet

- Ratio Analysis in Business Decisions@ Bec DomsDocument85 pagesRatio Analysis in Business Decisions@ Bec DomsBabasab Patil (Karrisatte)No ratings yet

- DOLAT Capital - Dissecting FMCG ValuationsDocument24 pagesDOLAT Capital - Dissecting FMCG ValuationsTheloopunNo ratings yet

- Financial Ratios: Click To Edit Master Title StyleDocument20 pagesFinancial Ratios: Click To Edit Master Title Stylevinay dugarNo ratings yet

- CH 14Document11 pagesCH 14Salman ZafarNo ratings yet

- A1119166710 24805 14 2019 RatioAnalysisDocument96 pagesA1119166710 24805 14 2019 RatioAnalysisAshish kumar ThapaNo ratings yet

- Determinants of Price Earnings Ration in The Indian Corporate SectorDocument74 pagesDeterminants of Price Earnings Ration in The Indian Corporate SectorRikesh DaliyaNo ratings yet

- The Value of EquityDocument42 pagesThe Value of EquitySYAHIER AZFAR BIN HAIRUL AZDI / UPMNo ratings yet

- PE, PB and The Present Value of Future DividendsDocument10 pagesPE, PB and The Present Value of Future Dividendsyassine_bnppNo ratings yet

- CH 12Document44 pagesCH 12kevin echiverriNo ratings yet

- Traditional Models of Financial Statements AnalysisDocument4 pagesTraditional Models of Financial Statements AnalysisMary LeeNo ratings yet

- Scientific and Medical Equipment House - Al Rajhi CapitalDocument18 pagesScientific and Medical Equipment House - Al Rajhi Capitalikhan809No ratings yet

- Equity Research TerminologiesDocument19 pagesEquity Research Terminologiesaryait099No ratings yet

- Corporate Finance 5E 2020-1-2Document2 pagesCorporate Finance 5E 2020-1-2Emanuele GennarelliNo ratings yet

- Fme Financial Ratio Formulas Checklist PDFDocument2 pagesFme Financial Ratio Formulas Checklist PDFWahyu WidayatNo ratings yet

- Consistent Compounders: An Investment Strategy by Marcellus Investment ManagersDocument27 pagesConsistent Compounders: An Investment Strategy by Marcellus Investment Managersvra_pNo ratings yet

- Final Exam Analysis of FS and WCM 2Document6 pagesFinal Exam Analysis of FS and WCM 2Naia SNo ratings yet