Professional Documents

Culture Documents

19l (12-00) Develop The Audit Program - COGS

Uploaded by

Anh Tuấn TrầnOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

19l (12-00) Develop The Audit Program - COGS

Uploaded by

Anh Tuấn TrầnCopyright:

Available Formats

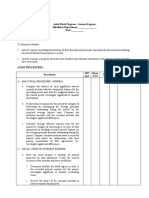

Develop the Audit Program – Revenues and COGS Ref.

:

Page: 1/1

Client: ORION HANEL PICTURE TUBE CO LTD Audit date: 31 Dec 2002

Financial Statement Assertions

Audit Objectives: E/O C R& V/M P&D

O

All sales included in the income statement represent the exchange of goods or

services with customers for cash or other consideration during the period. All

other revenues included in the income statement for the period have accrued to

the entity at the balance sheet date. Revenues applicable to future periods have

been deferred.

All sales and other revenues that accrued to the entity during the period are

included in the income statement.

Sales and other revenues are stated in the income statement at the appropriate

amounts.

Sales and other revenues are properly classified, described, and disclosed in the

financial statements, including notes, in conformity with prescribed accounting

principles.

Assertions:

Existence or Occurrence, Completeness, Rights and Obligations, Valuation or Measurement, Presentation and Disclosure

Audit Procedures to Consider

Assertions Auditor

addressed Check if

by the item is W/P Sign-

procedure applicable Ref. Off

All 1. Obtain schedule of the COGS for the year and agreed total to

G/L.

All 2. Review the fluctuation of COGS and gross margin by month and

discuss with client on any significant fluctuation.

O, C, V 3. Assess the reasonableness of COGS for the period by:

a) Average unit cost of FG uring the year and multiply with

sales quantity

b) Compare the computed amount with client reported revenue

c) Investigate any significant difference noted

O, C, V 4. Compare the relationships of material cost, direct labor cost and

overhead cost to COGS over the year. Investigate significant

fluctuations or the absence of expected fluctuations.

All 5. Check the reasonableness of allocation of depreciation charges

and production wages and salaries into cost of goods sold for the

year.

All 6. Reconcile the COGS (as detail as possible) with stock opening,

produced and closing balances

Date:

e

E&Y SMALL BUSINESS DOCUMENTATION Prepared by:

SB-19l (12-00) Develop the Audit Program - Revenues Reviewed by:

You might also like

- Intermediate Accounting 1: a QuickStudy Digital Reference GuideFrom EverandIntermediate Accounting 1: a QuickStudy Digital Reference GuideNo ratings yet

- Beyond Earnings: Applying the HOLT CFROI and Economic Profit FrameworkFrom EverandBeyond Earnings: Applying the HOLT CFROI and Economic Profit FrameworkNo ratings yet

- Baskin Robbins Franchise AgreementDocument466 pagesBaskin Robbins Franchise AgreementJuliánVenhuizen50% (2)

- NLMK Financial Statements IFRS 12m-2020 USD ENGDocument66 pagesNLMK Financial Statements IFRS 12m-2020 USD ENGНаиль ИсхаковNo ratings yet

- Accounts & Adv Account BookDocument308 pagesAccounts & Adv Account Bookvishnuverma100% (1)

- Audit of Fixed Assets and IntangiblesDocument11 pagesAudit of Fixed Assets and Intangibleshamza dosani100% (3)

- Deed of Sale of Large CattleDocument3 pagesDeed of Sale of Large CattleSean Arcilla100% (3)

- Working Paper TemplatesDocument9 pagesWorking Paper TemplatesTroisNo ratings yet

- Pizza HutDocument24 pagesPizza HutWaqas Aslam KhanNo ratings yet

- SITXFIN003 Helpful For AssignmentDocument15 pagesSITXFIN003 Helpful For AssignmentTikaram Ghimire100% (1)

- BBMF 2023 RBF Group 1 Nestle Malaysia BerhadDocument53 pagesBBMF 2023 RBF Group 1 Nestle Malaysia BerhadKar EngNo ratings yet

- Home Office Supply Calculator Sales EntriesDocument6 pagesHome Office Supply Calculator Sales EntriesErika Repedro100% (2)

- 19l (12-00) Develop The Audit Program - RevenuesDocument2 pages19l (12-00) Develop The Audit Program - RevenuesAnh Tuấn TrầnNo ratings yet

- Audit RequirementsDocument4 pagesAudit RequirementsSamson OlubodeNo ratings yet

- Verifying Trade PayablesDocument14 pagesVerifying Trade PayablesRuwan GunarathnaNo ratings yet

- Manufacturing Procedures AuditDocument32 pagesManufacturing Procedures AuditVera Magdalena HutaurukNo ratings yet

- 01 Property, Plant - EquipmentsDocument21 pages01 Property, Plant - EquipmentsRuwan GunarathnaNo ratings yet

- Chapter 3 Financial Statement AnalysisDocument67 pagesChapter 3 Financial Statement AnalysisAlemtideg AlemayehuNo ratings yet

- FQ4Document16 pagesFQ4Graciela InacayNo ratings yet

- 7721C 9.5 Job Progress ReportDocument3 pages7721C 9.5 Job Progress ReportWILD๛SHOTッ tanvirNo ratings yet

- Administration and Selling ExpensesDocument14 pagesAdministration and Selling ExpensesAhmed FahmyNo ratings yet

- Audit Work Program for Interest ExpenseDocument2 pagesAudit Work Program for Interest ExpenseChinh Le DinhNo ratings yet

- 19h (12-00) Develop The Audit Program - Accrued Liabilities and Deferred IncomeDocument2 pages19h (12-00) Develop The Audit Program - Accrued Liabilities and Deferred IncomeTran AnhNo ratings yet

- U-Ap-2 - Other IncomeDocument3 pagesU-Ap-2 - Other IncomeJoann Saballero HamiliNo ratings yet

- Audit Revenues & ExpensesDocument4 pagesAudit Revenues & ExpensesThe AmaezingNo ratings yet

- HDEC 2021 Annual ReportDocument174 pagesHDEC 2021 Annual Reportagust.abcNo ratings yet

- Project on FSA - detailed document (1) (2)Document13 pagesProject on FSA - detailed document (1) (2)Rohan SinghNo ratings yet

- Audit Program – RevenueDocument27 pagesAudit Program – RevenueShohag RaihanNo ratings yet

- Prof Sunny Sabharwal JgbsDocument28 pagesProf Sunny Sabharwal JgbsVaibhav AgarwalNo ratings yet

- Client Blueprint for Internal Order ProcessDocument7 pagesClient Blueprint for Internal Order ProcessVishal YadavNo ratings yet

- Financial Due Diligence ChecklistDocument1 pageFinancial Due Diligence ChecklistgauravNo ratings yet

- Audit Strategies for Cathode Ray Tube ManufacturerDocument8 pagesAudit Strategies for Cathode Ray Tube ManufacturerTran AnhNo ratings yet

- Cost Accounting Study MaterialDocument188 pagesCost Accounting Study Materialpdd801852No ratings yet

- 9 Framework For Preparation - Presentation of Financial StatementsDocument13 pages9 Framework For Preparation - Presentation of Financial StatementssmartshivenduNo ratings yet

- F3 - Accounting StandardsDocument6 pagesF3 - Accounting Standardsnoor ul anumNo ratings yet

- Credit Audit - Positive Score Areas in Pre Sanction - Tips On Value Statements in Credit Auditable Accounts Upto Rs 50 CRDocument73 pagesCredit Audit - Positive Score Areas in Pre Sanction - Tips On Value Statements in Credit Auditable Accounts Upto Rs 50 CRHaRa TNo ratings yet

- 19b (12-00) Develop The Audit Program - Accounts ReceivableDocument3 pages19b (12-00) Develop The Audit Program - Accounts ReceivableTran AnhNo ratings yet

- Chapter 3 Financial Statement AnalysisDocument68 pagesChapter 3 Financial Statement Analysissolomon takeleNo ratings yet

- Audit Work Program - Interest Expense Subsidiary/Department: DateDocument2 pagesAudit Work Program - Interest Expense Subsidiary/Department: DateChinh Le DinhNo ratings yet

- Lecture Financial MGMT BUDGET SY2023 24 SP BSA 2 1Document17 pagesLecture Financial MGMT BUDGET SY2023 24 SP BSA 2 1Reign Christel EstefanioNo ratings yet

- Audit GKJDocument24 pagesAudit GKJtutuaman603No ratings yet

- Long Lived Assets (Peserta)Document23 pagesLong Lived Assets (Peserta)bush0275No ratings yet

- Annual Report BataDocument18 pagesAnnual Report BataVenna PavanNo ratings yet

- 19f (12-00) Develop The Audit Program - Property, Plant and EquipmentDocument2 pages19f (12-00) Develop The Audit Program - Property, Plant and EquipmentTran AnhNo ratings yet

- 03 Financial Statement AnalysisDocument46 pages03 Financial Statement Analysissimao.lipscombNo ratings yet

- 8.auditing Balance SheetDocument31 pages8.auditing Balance SheetHenok FikaduNo ratings yet

- National Marine Dredging Company Reports and Consolidated Financial Statements For The Year Ended 31 December 2016Document20 pagesNational Marine Dredging Company Reports and Consolidated Financial Statements For The Year Ended 31 December 2016Fatima Ansari d/o Muhammad AshrafNo ratings yet

- Inventory Accounting and ValuationDocument13 pagesInventory Accounting and Valuationkiema katsutoNo ratings yet

- Provisions For Liabilities and ChargesDocument8 pagesProvisions For Liabilities and ChargesStephen Paul EscañoNo ratings yet

- Auditing Project Sem 3 3Document2 pagesAuditing Project Sem 3 3becapim293No ratings yet

- AR and Sales Audit ProgramDocument10 pagesAR and Sales Audit ProgramHarold Dan AcebedoNo ratings yet

- A 1 Financial StatementsDocument7 pagesA 1 Financial Statementsmohit0503No ratings yet

- Audited ReportDocument36 pagesAudited ReportverdeepNo ratings yet

- SECL - Audit Report - FY22 - Sign - ENGDocument101 pagesSECL - Audit Report - FY22 - Sign - ENGJAMES ANDROE TANNo ratings yet

- Audit Costs and ExpensesDocument2 pagesAudit Costs and ExpensesAnh Tuấn TrầnNo ratings yet

- N-AP-1 - Accrued MarkupDocument2 pagesN-AP-1 - Accrued MarkupAung Zaw HtweNo ratings yet

- Dabur ConsolidatedDocument92 pagesDabur ConsolidatedRatla Bhukya Rama KrishnaNo ratings yet

- Financial Statements AnalysisDocument65 pagesFinancial Statements AnalysisJunaid KhanNo ratings yet

- Audits of Financial Statements: An IntroductionDocument12 pagesAudits of Financial Statements: An IntroductionArielson CalicaNo ratings yet

- Audit Report AnalysisDocument4 pagesAudit Report AnalysisGaurav rajNo ratings yet

- BSBFIN401 Assessment 2Document10 pagesBSBFIN401 Assessment 2Kitpipoj PornnongsaenNo ratings yet

- BorrowingsDocument8 pagesBorrowingsStephen Paul EscañoNo ratings yet

- Audit Risk Alert: General Accounting and Auditing Developments, 2017/18From EverandAudit Risk Alert: General Accounting and Auditing Developments, 2017/18No ratings yet

- VFG - Comment On Pit&Fcwt (90403)Document5 pagesVFG - Comment On Pit&Fcwt (90403)Anh Tuấn TrầnNo ratings yet

- Discount MatterDocument3 pagesDiscount MatterAnh Tuấn TrầnNo ratings yet

- Discount LetterDocument1 pageDiscount LetterAnh Tuấn TrầnNo ratings yet

- AllowanceDocument2 pagesAllowanceAnh Tuấn TrầnNo ratings yet

- Audit Costs and ExpensesDocument2 pagesAudit Costs and ExpensesAnh Tuấn TrầnNo ratings yet

- 19j (12-00) Develop The Audit Program - DebtDocument2 pages19j (12-00) Develop The Audit Program - DebtAnh Tuấn TrầnNo ratings yet

- 19k (12-00) Develop The Audit Program - EquityDocument2 pages19k (12-00) Develop The Audit Program - EquityAnh Tuấn TrầnNo ratings yet

- The Mathematics of Money1Document11 pagesThe Mathematics of Money1Ammara MubasharNo ratings yet

- International Product Policy StrategiesDocument36 pagesInternational Product Policy Strategiesdeepakgiri2310No ratings yet

- Math Tutorial Linear Equations Break-EvenDocument2 pagesMath Tutorial Linear Equations Break-Evenveen jhana sekaranNo ratings yet

- A Study On Advertisement and Sales Promotion at Asian PaintsDocument68 pagesA Study On Advertisement and Sales Promotion at Asian PaintsJalpa BhattNo ratings yet

- Business Tax Chapter 7 ReviewerDocument2 pagesBusiness Tax Chapter 7 ReviewerMurien LimNo ratings yet

- Nirma Case Study SummaryDocument2 pagesNirma Case Study SummaryVanshika Srivastava 17IFT017No ratings yet

- FIN-AW3 AnswersDocument18 pagesFIN-AW3 AnswersRameesh DeNo ratings yet

- Qualification of DealerDocument3 pagesQualification of DealerSafayet chowdhuryNo ratings yet

- Exam 1 Cheat SheetDocument2 pagesExam 1 Cheat SheetRosalindNo ratings yet

- Chapter 9 Home Office, Branch and Agency Accounting-PROFE01Document5 pagesChapter 9 Home Office, Branch and Agency Accounting-PROFE01Steffany RoqueNo ratings yet

- Kotler FormattedDocument29 pagesKotler FormattedJustin JacobNo ratings yet

- Minute Maid Case StudyDocument2 pagesMinute Maid Case StudyEhab DanielNo ratings yet

- Why You're Failing to Engage Customers and EmployeesDocument10 pagesWhy You're Failing to Engage Customers and EmployeesRajeswariNo ratings yet

- Mgt211 Final Term Solved McqsDocument7 pagesMgt211 Final Term Solved McqsAsadNo ratings yet

- Solved Simulate The Model PT 14 3 X 0 45-0-55pt 1Document1 pageSolved Simulate The Model PT 14 3 X 0 45-0-55pt 1M Bilal SaleemNo ratings yet

- Basic Core Cardinal PowerDocument41 pagesBasic Core Cardinal PowerKk100% (1)

- Tax and Trade System for Startups in IndiaDocument7 pagesTax and Trade System for Startups in IndiaSUKANT JHA 19BIT0359No ratings yet

- Sample SDMDocument2 pagesSample SDMsuman v bhatNo ratings yet

- Chapter 5 Assignment Introductory Accounting Name: Nguyen Mai PhuongDocument12 pagesChapter 5 Assignment Introductory Accounting Name: Nguyen Mai PhuongMai Phương NguyễnNo ratings yet

- Executive Summary IKEADocument3 pagesExecutive Summary IKEASaad Al Masoud100% (2)

- Managing Channel PartnersDocument16 pagesManaging Channel PartnersSatinder SinghNo ratings yet

- 6a Ethics-of-Marketing-Part-1Document30 pages6a Ethics-of-Marketing-Part-1Casiano SeguiNo ratings yet

- Supporting your improvement planDocument5 pagesSupporting your improvement planLuis Enrique Hernandez RodriguezNo ratings yet

- Recap RFQ 5944-1 PDFDocument3 pagesRecap RFQ 5944-1 PDFRecordTrac - City of OaklandNo ratings yet

- Ingersoll - Rand A, B and C: Submitted By: Group-4Document17 pagesIngersoll - Rand A, B and C: Submitted By: Group-4Adhip PanditaNo ratings yet