Professional Documents

Culture Documents

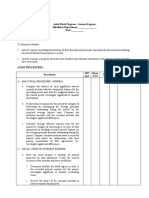

Audit Work Program for Interest Expense

Uploaded by

Chinh Le Dinh0 ratings0% found this document useful (0 votes)

16 views2 pagesOriginal Title

WP_interestexpense

Copyright

© © All Rights Reserved

Available Formats

DOC, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

16 views2 pagesAudit Work Program for Interest Expense

Uploaded by

Chinh Le DinhCopyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

You are on page 1of 2

CONTRIBUTED ON June 5, 2002 BY: JOY CELESTE (jcembudo@splashcorp.

com)

Customized Audit Work Program –

Audit Work Program – Interest Expense

Subsidiary/Department:

Date:

AUDIT OBJECTIVES:

To determine whether:

1. Interest expense (including amortization of debt discount and premium) represents all interest incurred during

the period and has been properly recorded.

2. Interest expense is properly described and classified and adequate disclosures with respect to these amounts

have been made.

AUDIT PROCEDURES:

WP Done

Procedures By Date Comments

Ref. Y/N?

1) ANALYTICAL PROCEDURES—GENERAL

a. Compare the balance of each significant interest

expense account with the comparable balance for the

preceding period and with the budgeted balance for

the current period. Investigate significant or unusual

fluctuations.

b. Predict interest expense for the period by category of

borrowing by multiplying the average principal

amounts outstanding during the period by the

expected average interest rates. Compare the

predicted amounts with the recorded amounts and

investigate significant differences.

c. Calculate average effective interest rates for the

period by category of borrowing or by type of debt

instrument by dividing recorded interest expense by

the average principal amounts outstanding during the

period. Compare calculated interest rates to expected

interest rates based on confirmation with third

parties, examination of debt agreements, etc.

Investigate significant differences.

2) DETAIL TESTS OF INTEREST EXPENSE

a. Have the client prepare a schedule of interest

payments by debt instrument. Verify the clerical

accuracy of the schedule and test it as follows:

1. Determine whether the detail agrees in total to

the recorded interest expense for the period.

Investigate significant or unusual reconciling

items.

2. Review the nature of the amounts included in

interest expense for propriety.

3. Examine ( ) critical forms and documents to

verify the amounts. Scope:( )

4. Cross-reference accrued interest payable at the

end of the period to our testing of accrued

interest payable.

3) ANSWER INTERNAL CONTROL QUESTIONNAIRES

4) SUPERVISION, REVIEW AND CONCLUSIONS

a) Conclude responsive to the audit objectives.

b) Prepare points regarding internal controls and other

business matters.

c) Perform senior review and supervision.

d) Clear senior review points.

e) Clear manager review points.

PERFORMED BY: REVIEWED BY:

Audit Assistant Audit Supervisor

You might also like

- Audit Work Program - Interest Expense Subsidiary/Department: DateDocument2 pagesAudit Work Program - Interest Expense Subsidiary/Department: DateChinh Le DinhNo ratings yet

- Cooperative Audit ProceduresDocument5 pagesCooperative Audit ProceduresGrecio CaguisaNo ratings yet

- E-AP-6 - Bills Discounted and PurchasedDocument3 pagesE-AP-6 - Bills Discounted and PurchasedAung Zaw HtweNo ratings yet

- BorrowingsDocument8 pagesBorrowingsStephen Paul EscañoNo ratings yet

- Audit of Other SFP ItemsDocument13 pagesAudit of Other SFP ItemsArlyn Pearl PradoNo ratings yet

- Chapter 15 Audit of Other Items of Statement of Financial PositionDocument13 pagesChapter 15 Audit of Other Items of Statement of Financial PositionMiaNo ratings yet

- Manufacturing Procedures AuditDocument32 pagesManufacturing Procedures AuditVera Magdalena HutaurukNo ratings yet

- Sample Audit Program For Allowable Costs ReviewsDocument17 pagesSample Audit Program For Allowable Costs ReviewsJazziel FortalizaNo ratings yet

- Provisions For Liabilities and ChargesDocument8 pagesProvisions For Liabilities and ChargesStephen Paul EscañoNo ratings yet

- ANNEX - A.2.6 Audit Program - Current Liabilities Accounts: Accounts PayableDocument3 pagesANNEX - A.2.6 Audit Program - Current Liabilities Accounts: Accounts Payablenoemi alvarezNo ratings yet

- Year Ended - : Wire DisbursementsDocument7 pagesYear Ended - : Wire DisbursementsChinh Le DinhNo ratings yet

- Audit Program Liabilities Against AssetsDocument11 pagesAudit Program Liabilities Against AssetsRoemi Rivera Robedizo100% (3)

- Audit Work Program – Receivables Receivables Audit Work ProgramDocument7 pagesAudit Work Program – Receivables Receivables Audit Work ProgramIrwansyah Iwe100% (1)

- Commercial Lending Audit ProgramDocument13 pagesCommercial Lending Audit Programromuel31No ratings yet

- Long Term Debt ProgramDocument10 pagesLong Term Debt ProgramSyarif Muhammad Hikmatyar100% (1)

- ACCT7103 Tutorial 1 QuestionsDocument3 pagesACCT7103 Tutorial 1 QuestionsStephanie XieNo ratings yet

- Administration and Selling ExpensesDocument14 pagesAdministration and Selling ExpensesAhmed FahmyNo ratings yet

- U-Ap-2 - Other IncomeDocument3 pagesU-Ap-2 - Other IncomeJoann Saballero HamiliNo ratings yet

- Accruals Audit ProgramDocument4 pagesAccruals Audit Programvivek1119No ratings yet

- ABC Company Audit Program - Receivables Department:: 1) Analytical Procedures-GeneralDocument7 pagesABC Company Audit Program - Receivables Department:: 1) Analytical Procedures-Generalvarghese200779% (14)

- Auditing Project Sem 3 3Document2 pagesAuditing Project Sem 3 3becapim293No ratings yet

- Lesson 6 - Liabilities - Substantive Tests of Details of BalancesDocument30 pagesLesson 6 - Liabilities - Substantive Tests of Details of BalancesNiña YastoNo ratings yet

- Notes Compleeting Audit and Post Audit ResponsibilitiesDocument5 pagesNotes Compleeting Audit and Post Audit ResponsibilitiesSherlock HolmesNo ratings yet

- Extracted Chapter 1Document103 pagesExtracted Chapter 1PalisthaNo ratings yet

- I Audit Objectives: Finance & Risk ManagementDocument9 pagesI Audit Objectives: Finance & Risk ManagementChinh Le DinhNo ratings yet

- 19l (12-00) Develop The Audit Program - COGSDocument1 page19l (12-00) Develop The Audit Program - COGSAnh Tuấn TrầnNo ratings yet

- 2009 A-2 Class NotesDocument5 pages2009 A-2 Class Notescome2sayNo ratings yet

- Audit GKJDocument24 pagesAudit GKJtutuaman603No ratings yet

- A424: Chapter 6 Audit Responsibilities and Objectives Preparation QuestionsDocument8 pagesA424: Chapter 6 Audit Responsibilities and Objectives Preparation Questionswgessit14No ratings yet

- E-AP-1 - Short Term Deposits Prepayments and Other ReceivablesDocument6 pagesE-AP-1 - Short Term Deposits Prepayments and Other ReceivablesAung Zaw HtweNo ratings yet

- Unit 02 Section - A - Recognition, - MeasurementDocument93 pagesUnit 02 Section - A - Recognition, - Measurementalru7clashNo ratings yet

- Lesson Plan in Business FinanceDocument9 pagesLesson Plan in Business FinanceEmelen VeranoNo ratings yet

- A 1 Financial StatementsDocument7 pagesA 1 Financial Statementsmohit0503No ratings yet

- ACAI Chapter 17 PowerpointDocument28 pagesACAI Chapter 17 PowerpointKathleenCusipagNo ratings yet

- Unit - 3: 1.preparation Before The Commencement of AuditDocument12 pagesUnit - 3: 1.preparation Before The Commencement of AuditNaga Raju DudalaNo ratings yet

- Chapter Six - Audit of Current LiabilityDocument4 pagesChapter Six - Audit of Current LiabilityBantamkak Fikadu100% (1)

- Group 9 - AUDIT OF THE CAPITAL ACQUISITION AND REPAYMENT CYCLEDocument17 pagesGroup 9 - AUDIT OF THE CAPITAL ACQUISITION AND REPAYMENT CYCLEEsti SetianingsihNo ratings yet

- CH 0222Document91 pagesCH 0222HenryNo ratings yet

- Auditing and Assurance Services 16th Edition Arens Solutions ManualDocument28 pagesAuditing and Assurance Services 16th Edition Arens Solutions Manualgloriaelfleda9twuoe100% (18)

- Fam Chapter 6 21092005Document15 pagesFam Chapter 6 21092005Humayoun Ahmad FarooqiNo ratings yet

- Unit 6 AUDITORS' REPORTSDocument5 pagesUnit 6 AUDITORS' REPORTSzelalem kebedeNo ratings yet

- Chapter 14 AnsDocument9 pagesChapter 14 AnsDave ManaloNo ratings yet

- Audit of LiabilitiesDocument5 pagesAudit of LiabilitiesGille Rosa Abajar100% (1)

- Substantive Testing For Deposit LiabilitiesDocument3 pagesSubstantive Testing For Deposit LiabilitiesChristian PerezNo ratings yet

- Intermediate May 2019 B3Document22 pagesIntermediate May 2019 B3PASTORYNo ratings yet

- Acctg 14Document25 pagesAcctg 14MirasolamperNo ratings yet

- Trade and Other PayablesDocument13 pagesTrade and Other PayablesStephen Paul EscañoNo ratings yet

- HDEC 2021 Annual ReportDocument174 pagesHDEC 2021 Annual Reportagust.abcNo ratings yet

- Homework Audit II - Group 4Document3 pagesHomework Audit II - Group 4Diva GunawanNo ratings yet

- Ejercicio Practico Final Auditoría IDocument6 pagesEjercicio Practico Final Auditoría IAnyi GarciaNo ratings yet

- Questioner IcsDocument19 pagesQuestioner Icsnabila dhiyaNo ratings yet

- Audit Problem (Aaconapps2 - Cash and ReceivablesDocument261 pagesAudit Problem (Aaconapps2 - Cash and ReceivablesDawson Dela CruzNo ratings yet

- Ratio AnalysisDocument68 pagesRatio Analysisgebarap913No ratings yet

- ACAAP2 - Week 8 MODULE - Audit of Prepaid Expenses, Deferred Charges and Other Current LiabilitiesDocument8 pagesACAAP2 - Week 8 MODULE - Audit of Prepaid Expenses, Deferred Charges and Other Current LiabilitiesDee100% (1)

- AP.3407 Audit of LiabilitiesDocument6 pagesAP.3407 Audit of LiabilitiesMonica GarciaNo ratings yet

- Tutorial (2) : Chapter (1) The Auditing Profession: Accounting and Financial Control Department Auditing W 2019Document4 pagesTutorial (2) : Chapter (1) The Auditing Profession: Accounting and Financial Control Department Auditing W 2019youssefasaadNo ratings yet

- AP Long SeatworkDocument7 pagesAP Long SeatworkLeisleiRagoNo ratings yet

- Audit I CH VDocument6 pagesAudit I CH VAhmedNo ratings yet

- Financial Performance Measures and Value Creation: the State of the ArtFrom EverandFinancial Performance Measures and Value Creation: the State of the ArtNo ratings yet

- GG Ifa QMSCL PH v5 3-Gfs Protected enDocument56 pagesGG Ifa QMSCL PH v5 3-Gfs Protected enChinh Le DinhNo ratings yet

- SAP Project Management: Dr. Djamal ZianiDocument14 pagesSAP Project Management: Dr. Djamal ZianiChinh Le DinhNo ratings yet

- PWC Cfo Kpi Survey 2013 PDFDocument20 pagesPWC Cfo Kpi Survey 2013 PDFSteven SimpsonNo ratings yet

- ISO 9001 2008 Gap AssessmentDocument65 pagesISO 9001 2008 Gap AssessmentChinh Le DinhNo ratings yet

- PWC Cfo Kpi Survey 2013 PDFDocument20 pagesPWC Cfo Kpi Survey 2013 PDFSteven SimpsonNo ratings yet

- Execution Internal ControlDocument28 pagesExecution Internal ControlFaizan ChNo ratings yet

- TT MatrixDocument13 pagesTT MatrixChinh Le DinhNo ratings yet

- IA List FilesDocument140 pagesIA List FilesChinh Le DinhNo ratings yet

- NJDOT Risk Management Quantitative AnalysisDocument2 pagesNJDOT Risk Management Quantitative Analysisanalysis of packaging materials department responsible quality control managementNo ratings yet

- Sap MM Role MatrixDocument40 pagesSap MM Role MatrixClarice GuintibanoNo ratings yet

- Best Practice For The Maintenance of Building Assets: Procurement Practices ManualDocument26 pagesBest Practice For The Maintenance of Building Assets: Procurement Practices ManualChinh Le DinhNo ratings yet

- Ops 8level MatrixDocument51 pagesOps 8level MatrixarunradNo ratings yet

- Execution Internal ControlDocument28 pagesExecution Internal ControlFaizan ChNo ratings yet

- ISO 27001 Assessment QuestionnaireDocument10 pagesISO 27001 Assessment QuestionnaireSaid SakrNo ratings yet

- Issue Management TemplateDocument4 pagesIssue Management Templatejindalyash1234No ratings yet

- Process RC MatrixDocument6 pagesProcess RC MatrixChinh Le DinhNo ratings yet

- Apuc Procurement ManualDocument47 pagesApuc Procurement ManualChinh Le DinhNo ratings yet

- ISO 27001 Assessment QuestionnaireDocument10 pagesISO 27001 Assessment QuestionnaireSaid SakrNo ratings yet

- Ops 8level MatrixDocument51 pagesOps 8level MatrixarunradNo ratings yet

- IA List FilesDocument140 pagesIA List FilesChinh Le DinhNo ratings yet

- Best Practice For The Maintenance of Building Assets: Procurement Practices ManualDocument26 pagesBest Practice For The Maintenance of Building Assets: Procurement Practices ManualChinh Le DinhNo ratings yet

- TT MatrixDocument13 pagesTT MatrixChinh Le DinhNo ratings yet

- NJDOT Risk Management Quantitative AnalysisDocument2 pagesNJDOT Risk Management Quantitative Analysisanalysis of packaging materials department responsible quality control managementNo ratings yet

- DA6 - KCN Bac Cu ChiDocument22 pagesDA6 - KCN Bac Cu ChiChinh Le DinhNo ratings yet

- Issue Management TemplateDocument4 pagesIssue Management Templatejindalyash1234No ratings yet

- Sap MM Role MatrixDocument40 pagesSap MM Role MatrixClarice GuintibanoNo ratings yet

- CM TreasuryDocument12 pagesCM TreasuryChinh Le DinhNo ratings yet

- Process RC MatrixDocument6 pagesProcess RC MatrixChinh Le DinhNo ratings yet

- Apuc Procurement ManualDocument47 pagesApuc Procurement ManualChinh Le DinhNo ratings yet

- Treasury Department ApgDocument8 pagesTreasury Department ApgChinh Le DinhNo ratings yet

- 2009 SecDocument805 pages2009 Secericp023No ratings yet

- Quiz in Accounting System Analysis & DesignDocument3 pagesQuiz in Accounting System Analysis & DesignMariel Karen ObedozaNo ratings yet

- IP33 Digi VersionDocument24 pagesIP33 Digi VersiontariqwaeceNo ratings yet

- Scope of HACCP AuditDocument9 pagesScope of HACCP AuditAbdul QaiyuumNo ratings yet

- Audit SopDocument8 pagesAudit Sopchemist_tmaNo ratings yet

- Project Quality Plan: Mps Integrated Service LimitedDocument18 pagesProject Quality Plan: Mps Integrated Service LimitedOGBONNAYA MARTINSNo ratings yet

- Governmental & Non Profit Accounting: TEST BANK Spring 2007Document43 pagesGovernmental & Non Profit Accounting: TEST BANK Spring 2007irish570No ratings yet

- Risks and ControlsDocument43 pagesRisks and ControlsJela Oasin100% (1)

- AIPM Project Manager Professional Competency StandardsDocument35 pagesAIPM Project Manager Professional Competency StandardsAngela VargasNo ratings yet

- Internal Control Questionnaire (ICQs)Document69 pagesInternal Control Questionnaire (ICQs)Ahmad Tariq Bhatti100% (7)

- Process Safety Management (PSMDocument32 pagesProcess Safety Management (PSMMuhammad AshmanNo ratings yet

- Examination Practice Questions 80Document31 pagesExamination Practice Questions 80Amit SinghNo ratings yet

- Audit of Disaster-Related AidDocument39 pagesAudit of Disaster-Related AidLamngeune SamuckhyNo ratings yet

- Professional Ethics Guide Auditors Clients PublicDocument18 pagesProfessional Ethics Guide Auditors Clients PublicMussaNo ratings yet

- Final Incentives Guidelines For Foreign Film Shooting Sent by NFDCDocument13 pagesFinal Incentives Guidelines For Foreign Film Shooting Sent by NFDCT MNo ratings yet

- 12 Chapter 5Document44 pages12 Chapter 5Tushar KapoorNo ratings yet

- ISO 17025 Accreditation RequirementsDocument41 pagesISO 17025 Accreditation Requirementssiddhi jadhavNo ratings yet

- 2018-05-03 St. Mary's County TimesDocument32 pages2018-05-03 St. Mary's County TimesSouthern Maryland OnlineNo ratings yet

- Fielmann 2013 Annual Report Highlights Strong GrowthDocument132 pagesFielmann 2013 Annual Report Highlights Strong GrowthAlexandru GheorgheNo ratings yet

- Whistle Blowing AssignementDocument10 pagesWhistle Blowing AssignementsaadaliNo ratings yet

- The Business Case For A Next Generation SIEMDocument11 pagesThe Business Case For A Next Generation SIEMGheorghica AndreeaNo ratings yet

- LIU-VI-LUNG-Resume Apply For Quality Assurance Engineer at CÔNG TY TNHH VIETNAM SOURCINGDocument2 pagesLIU-VI-LUNG-Resume Apply For Quality Assurance Engineer at CÔNG TY TNHH VIETNAM SOURCINGNguyễn Tiến DũngNo ratings yet

- Leadership Development Plan TemplateDocument4 pagesLeadership Development Plan TemplateVince Earl P. DueñasNo ratings yet

- Assurance Principles Ethics GovernanceDocument3 pagesAssurance Principles Ethics GovernanceJulrick Cubio EgbusNo ratings yet

- Evaluation ResearchDocument282 pagesEvaluation ResearchMark A. FosterNo ratings yet

- DDTAS - V 02 27.5.2020 FinalDocument86 pagesDDTAS - V 02 27.5.2020 FinalRonald AranhaNo ratings yet

- CBOK 2015 Practitioner Study - Overview - FinalDocument5 pagesCBOK 2015 Practitioner Study - Overview - FinaldanielaNo ratings yet

- GE8077 TQM UNIT V NotesDocument14 pagesGE8077 TQM UNIT V NotesdineshbabuNo ratings yet

- English Khmer Glossary of Accounting and Auditing Terminology p1 PDFDocument181 pagesEnglish Khmer Glossary of Accounting and Auditing Terminology p1 PDFKon Khmer100% (4)

- Strategic Management Fred David Chapter 4Document26 pagesStrategic Management Fred David Chapter 4Jake20No ratings yet