Professional Documents

Culture Documents

Auditing Project Sem 3 3

Uploaded by

becapim293Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Auditing Project Sem 3 3

Uploaded by

becapim293Copyright:

Available Formats

C.

Auditor should plan his work based on the clients business to

enable him to conduct an effective audit in an efficient and timely

manner as per AAS 8

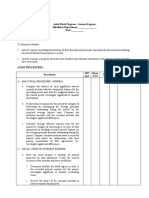

Specimen Audit Plan

Name of Auditee:

Financial Year:

Type of Audit: Statutory /Current/

Person in charge Memb. No. Signature: Experience

Team Members

Qualifications Experience

Name

1.

2.

D. The auditor should design and select an audit sample, perform

audit procedures thereon, and evaluate sample results so as to

provide sufficient appropriate audit evidence as per AAS 15

Audit sampling

Sr Particulars Nos. Total Samp Criteria Date/ Action Person

. Value le for Months/ to be In

Size selectio Period taken charge

N

n of

o.

data in

sample

A. P& L

Income

A Interest

1 earned

A Other

2 income

B. P& L

Expenditur

e

TYPES OF AUDITS:

It is well known that no any day of the year, there will be at least one auditor

working in the bank branch. The following are the popular types of audits

conducted in a bank branch. The titles may be modified in some banks

especially for Internal Audit and system Audit but the content remains the same.

I. Statutory Audit:

This is an annual audit determined by statute and done normally at the

end of the financial year while some of the larger branches are similarly audited

half yearly. A bank’s statutory audit is essentially a balance sheet audit including

the Long Audit Report though there is no scope restriction of the statutory

auditor to perform certain actions of other auditors as part of his duty or if some

findings lead him into the domain of the auditors such as Revenue, inspector

and even concurrent. The statutory auditor performs the following functions.

Verifies the classification of items of the Balance Sheet to assure their correct

placement Basel II accord, which has influenced the prudential norms, has

included the statutory auditor as an active member to assure the proper

execution of the prevailing prudential norms. The direct result of an accurate

classification is the appropriateness of income recognition and thus the effect on

the profitability of the Bank.

II. Concurrent Audit:

In the beginning of the 1990’s, the Great Banking Scam or the

Harshad Mehta Scam rocked the nation. This brought into limelight special

category of audit called concurrent audit or continuous audit. This stemmed

from the need of filling in the gap between the annual statutory audits and the

intervening period between two inspections, which is a period sufficiently large

to cause damage to the Bank. Now, RBI who insisted that at least 50% of the

business of the Bank should be covered under concurrent controlled the

spotlight of the concurrent audit. While some Banks covered very large

branches under the umbrella of concurrent audit. Some banks took the excurse

for improvement by including weak branches though having low volume of

business. Concurrent audit in one sentence will mean checking yesterday’s

transactions today. Let us see the broad areas covered by the Concurrent

Auditor.

A. Revenue Aspects:

1. Interest earned and service charges earned by the Bank

2. Interest Paid

3. All charges paid like cancellation charges, compensation under Court

Directive etc.

You might also like

- Bank Audit Process and TypesDocument33 pagesBank Audit Process and TypesVivek Tiwari50% (2)

- Extracted Chapter 1Document103 pagesExtracted Chapter 1PalisthaNo ratings yet

- Audit GKJDocument24 pagesAudit GKJtutuaman603No ratings yet

- Bank audit process DCH-38Document6 pagesBank audit process DCH-38Parth Chauhan0% (1)

- A 1 Financial StatementsDocument7 pagesA 1 Financial Statementsmohit0503No ratings yet

- Ejercicio Practico Final Auditoría IDocument6 pagesEjercicio Practico Final Auditoría IAnyi GarciaNo ratings yet

- Notes Compleeting Audit and Post Audit ResponsibilitiesDocument5 pagesNotes Compleeting Audit and Post Audit ResponsibilitiesSherlock HolmesNo ratings yet

- Audit Work Program for Interest ExpenseDocument2 pagesAudit Work Program for Interest ExpenseChinh Le DinhNo ratings yet

- Audit of InsuranceDocument26 pagesAudit of Insuranceashokkeeli100% (1)

- Unit - 3: 1.preparation Before The Commencement of AuditDocument12 pagesUnit - 3: 1.preparation Before The Commencement of AuditNaga Raju DudalaNo ratings yet

- Chapter 3 Audit Reports and Audit OpinionDocument29 pagesChapter 3 Audit Reports and Audit OpinionbikilahussenNo ratings yet

- Audit Work Program - Interest Expense Subsidiary/Department: DateDocument2 pagesAudit Work Program - Interest Expense Subsidiary/Department: DateChinh Le DinhNo ratings yet

- Lesson 6 - Liabilities - Substantive Tests of Details of BalancesDocument30 pagesLesson 6 - Liabilities - Substantive Tests of Details of BalancesNiña YastoNo ratings yet

- Bank Audit GuideDocument28 pagesBank Audit GuideShyborg Beep-beepNo ratings yet

- Auditing and Taxation: BY Jean Paul RuhorimbereDocument86 pagesAuditing and Taxation: BY Jean Paul RuhorimbereKabahizi JoelNo ratings yet

- Project On Bank AuditDocument33 pagesProject On Bank AuditShubham utekarNo ratings yet

- Praneel Nag Audit Test 2Document4 pagesPraneel Nag Audit Test 2Praneel NagNo ratings yet

- Manufacturing Procedures AuditDocument32 pagesManufacturing Procedures AuditVera Magdalena HutaurukNo ratings yet

- Accounting Ratio PDFDocument10 pagesAccounting Ratio PDFMuhammad KaleemNo ratings yet

- IAR Auditing ConclusionDocument23 pagesIAR Auditing Conclusionmarlout.sarita100% (1)

- CPA Part (1) Detailed Syllabus For All SubjectsDocument21 pagesCPA Part (1) Detailed Syllabus For All SubjectsLin Aung100% (1)

- Auditing Unit 1 & 2 NotesDocument17 pagesAuditing Unit 1 & 2 NotesGolu YadavNo ratings yet

- English GfiDocument12 pagesEnglish Gfifivero viNo ratings yet

- Presentation 1Document24 pagesPresentation 1Maitree ShuklaNo ratings yet

- Statement of Financial PositionDocument25 pagesStatement of Financial Positiontamorromeo908No ratings yet

- FINANCIAL STATEMENT LECTUREDocument33 pagesFINANCIAL STATEMENT LECTUREkacaribuantonNo ratings yet

- 1 Altprob 6eDocument3 pages1 Altprob 6eJane ChungNo ratings yet

- Auditing Chapter 6$7Document14 pagesAuditing Chapter 6$7Getachew JoriyeNo ratings yet

- Auditing ACC0048 Review Assignment: AnswerDocument7 pagesAuditing ACC0048 Review Assignment: AnswerQais AfghanNo ratings yet

- Introduction to Accounting PrinciplesDocument8 pagesIntroduction to Accounting PrinciplesMinhaz UddinNo ratings yet

- D41180681 - Nada Naurarita Bustami - Assignment 3Document4 pagesD41180681 - Nada Naurarita Bustami - Assignment 3blue 0610No ratings yet

- Mod4 Part 1 Essence of Financial StatementsDocument16 pagesMod4 Part 1 Essence of Financial StatementsAngeline de SagunNo ratings yet

- Kompre 78 HalamanDocument78 pagesKompre 78 HalamanCenxi TVNo ratings yet

- 2019 AICPA Questions-AUDDocument54 pages2019 AICPA Questions-AUDweb.citizen.01No ratings yet

- Principles and Practice of AuditingDocument55 pagesPrinciples and Practice of Auditingdanucandy2No ratings yet

- Chapter FourDocument16 pagesChapter FourGebrekiros ArayaNo ratings yet

- Accounting Principles Volume 1 Canadian 7th Edition Geygandt Test BankDocument48 pagesAccounting Principles Volume 1 Canadian 7th Edition Geygandt Test BankJosephWilliamsostmdNo ratings yet

- Auditing Theory 100 QuestionsDocument16 pagesAuditing Theory 100 QuestionsmichaelllaNo ratings yet

- Auditing Theory Question BankDocument38 pagesAuditing Theory Question BankBapu FinuNo ratings yet

- Year Ended - : Wire DisbursementsDocument7 pagesYear Ended - : Wire DisbursementsChinh Le DinhNo ratings yet

- Principles of Audit and AssuranceDocument20 pagesPrinciples of Audit and AssuranceUnique OfficialsNo ratings yet

- 1st Mid Term Exam Fall 2014 AuditingDocument6 pages1st Mid Term Exam Fall 2014 AuditingSarahZeidat100% (1)

- AsssssDocument42 pagesAsssssRabex BekeleNo ratings yet

- 15-61. The Following Are Independent Audit Situations For Which You Are To Recommend AnDocument4 pages15-61. The Following Are Independent Audit Situations For Which You Are To Recommend AnSomething ChicNo ratings yet

- Audit MethodologyDocument20 pagesAudit MethodologyVikasAgarwalNo ratings yet

- ACCA - Audit and Assurance (AA) - September Mock Exam - Answers - 2019Document20 pagesACCA - Audit and Assurance (AA) - September Mock Exam - Answers - 2019Amir ArifNo ratings yet

- Question Bank Auditing B.com 6th SemDocument35 pagesQuestion Bank Auditing B.com 6th SemViraja Guru79% (14)

- Section B Questions and Answers. Each Question Carries 5 Marks 1. Distinguish Between Accounting and Auditing. (2012, 2013)Document8 pagesSection B Questions and Answers. Each Question Carries 5 Marks 1. Distinguish Between Accounting and Auditing. (2012, 2013)sadathnooriNo ratings yet

- Q.No.3 Distinguish Between Auditing and Accounting?Document12 pagesQ.No.3 Distinguish Between Auditing and Accounting?Shahzad HussainNo ratings yet

- E-AP-6 - Bills Discounted and PurchasedDocument3 pagesE-AP-6 - Bills Discounted and PurchasedAung Zaw HtweNo ratings yet

- Session 2Document11 pagesSession 2Sarika ThoratNo ratings yet

- C1. Planning Memorandum - Chapmans 18Document6 pagesC1. Planning Memorandum - Chapmans 18Munashe ChimutandaNo ratings yet

- Notes On Audit Planning, Evidence, DocumentationDocument15 pagesNotes On Audit Planning, Evidence, DocumentationNurul Hannani SazaliNo ratings yet

- Audit Report Basics Format and ContentDocument4 pagesAudit Report Basics Format and ContentWalid AmanNo ratings yet

- Understanding Audit ReportsDocument7 pagesUnderstanding Audit ReportsDanielle VasquezNo ratings yet

- The Overview of AuditingDocument4 pagesThe Overview of AuditingJelyn RuazolNo ratings yet

- Audit Pihak Berelasi - Prosedur Analitis - Aset Tetap - ARDocument46 pagesAudit Pihak Berelasi - Prosedur Analitis - Aset Tetap - ARfelianiNo ratings yet

- Commercial Lending Audit ProgramDocument13 pagesCommercial Lending Audit Programromuel31No ratings yet

- "The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"From Everand"The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"No ratings yet

- 2018 AFR GCs Volume I PDFDocument768 pages2018 AFR GCs Volume I PDFJenniferNo ratings yet

- Everett School District Audit Management LetterDocument2 pagesEverett School District Audit Management LetterJessica OlsonNo ratings yet

- Training Report - PARI - MarGEnDocument19 pagesTraining Report - PARI - MarGEnFazle RabbaniNo ratings yet

- AAS Slides Chapter 6Document38 pagesAAS Slides Chapter 6Yousef M. AqelNo ratings yet

- FINANCIAL FORENSIC Accounting PDFDocument11 pagesFINANCIAL FORENSIC Accounting PDFWendy ArponNo ratings yet

- 6.list Action AuditDocument5 pages6.list Action Auditinkasa jayaNo ratings yet

- LettersDocument8 pagesLettersTatanyaNo ratings yet

- Banking Industry Key Success FactorsDocument3 pagesBanking Industry Key Success FactorsAdam AmruNo ratings yet

- NET PRESENT VALUE AND MODIFIED INTERNAL RATE OF RETURN: THE SAME DECISIONDocument7 pagesNET PRESENT VALUE AND MODIFIED INTERNAL RATE OF RETURN: THE SAME DECISIONAida PekicNo ratings yet

- Revenue and Collection Cycle ControlsDocument3 pagesRevenue and Collection Cycle Controlsjustin morenoNo ratings yet

- BBA ProjectDocument54 pagesBBA ProjectAffy LoveNo ratings yet

- MEMORANDUM D17-1-5: in BriefDocument39 pagesMEMORANDUM D17-1-5: in Briefbiharris22No ratings yet

- Siwes Report On TransportationDocument20 pagesSiwes Report On TransportationStephen OgundareNo ratings yet

- Ca TextbookDocument248 pagesCa TextbookAnvitha ChelluriNo ratings yet

- VAT Module OverviewDocument9 pagesVAT Module OverviewCSJNo ratings yet

- Tutorial Letter 202/1/2015: Semester 1Document11 pagesTutorial Letter 202/1/2015: Semester 1Denver CordonNo ratings yet

- Quality Assurance PolicyDocument10 pagesQuality Assurance Policy1sourcecomponentsNo ratings yet

- Inventory ControlDocument23 pagesInventory ControlKomal RatraNo ratings yet

- Hall - AIS 7e PP - ch15Document47 pagesHall - AIS 7e PP - ch15ontykerlsNo ratings yet

- Environmental Law GuideDocument53 pagesEnvironmental Law GuidemathibettuNo ratings yet

- Chapter 02 AnsDocument9 pagesChapter 02 AnsDave Manalo100% (1)

- Stock Incentive PlanDocument22 pagesStock Incentive PlanSourabh GargNo ratings yet

- CIA Part 2 Zain Academy 2019 PDFDocument64 pagesCIA Part 2 Zain Academy 2019 PDFʚïɞ Fi Fi ʚïɞ100% (2)

- Fisher Valley College BSA Qualifying ExamsDocument3 pagesFisher Valley College BSA Qualifying ExamsNolram LeuqarNo ratings yet

- Sbi - Loan Application FormDocument4 pagesSbi - Loan Application FormRaghav BihaniNo ratings yet

- Internal Environment - Strategic ManagementDocument9 pagesInternal Environment - Strategic ManagementCha DumpyNo ratings yet

- 46 - Internal Audit Report FormatDocument9 pages46 - Internal Audit Report FormatGurvinder Mann Singh PradhanNo ratings yet

- Chapter 4 and 5 ReviewerDocument4 pagesChapter 4 and 5 ReviewerMildea Gabuya RabangNo ratings yet

- Audit Matrix Program - Revenue Cycle Review Test Area: InvoicingDocument3 pagesAudit Matrix Program - Revenue Cycle Review Test Area: InvoicingAnupam SrivastavaNo ratings yet

- COA's Authority to Audit Government ContractsDocument1 pageCOA's Authority to Audit Government ContractsMae EstanisloaNo ratings yet