Professional Documents

Culture Documents

Homebuyer Tax Credit Word

Uploaded by

DonnaAntonucciOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Homebuyer Tax Credit Word

Uploaded by

DonnaAntonucciCopyright:

Available Formats

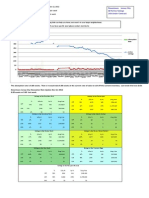

Homebuyer Tax Credit Changes

Congress has extended and expanded the homebuyer tax credit. The modifications in the column

labeled “December 1 – April 30th 2010” become effective when President Obama Signs the bill.

All changes made to the current credit become effective on that date, as well.

Feature Jan 1 – Nov 30, 2009 Rules December 1 – April 30, 2010

as enacted February 2009 Rules as enacted Nobember

2009

First time Buer – $8,000 $8,000

Amount of Credit ($4,000 married filing ($4,000 married filing

separately) separately)

First time Buyer – May not have had an Same

Definition for Eligibility interest in a principal

residence for 3 years prior

to purchase

Current Homeowner – No Provision $6,500

Amount of Credit ($3,250 married filing

separately)

Effective Date – current No Provision Date of Enactment

owner

Current Homeowner – No Provision Must have used the home sold

Definition for Eligibility or being sold as a principal

residence consecutively for 5

of the previous 8 years

Termination of Credit Purchases after November Purchases after April 30, 2010

30, 2009. (Becomes April

30, 2010 on Date of

Enactment.)

Binding Contract Rule None So long as written binding

contract to purchase is in effect

on April 30, 2010 the

purchases will have until July

1, 2010 to close.

Income Limits –(Note: $75,000 – single $125,000 – single

Increased income limits $150,000 – married $225,000 – married

are effective as of date Additional $20,000 phase Additional $20,000 phase out.

of enactment of bill) out

Limitation on Cost of None $800,000 Effective Date of

Purchased Home Enactment

Purchase by a No Provision Ineligible Effective Date of

Dependent Enactment

Anti-fraud Rule None Purchaser must attach

documentation of purchase to

tax return

You might also like

- Homebuyer Tax Credit SDDocument1 pageHomebuyer Tax Credit SDjosephcuevasNo ratings yet

- Fs 10 06Document3 pagesFs 10 06sjrooks1No ratings yet

- About The First Home Buyers Assistance SchemeDocument2 pagesAbout The First Home Buyers Assistance SchemeIshan SaneNo ratings yet

- CIVMB T3-3 Preliminaryassessment v2Document6 pagesCIVMB T3-3 Preliminaryassessment v2Forin NeimNo ratings yet

- The IssueDocument8 pagesThe IssuessfinservNo ratings yet

- Investment News: First-Time Home Buyer Tax CreditDocument14 pagesInvestment News: First-Time Home Buyer Tax CreditKim in Kansas City100% (2)

- RentToOwn Brochure ART Nov 2020Document28 pagesRentToOwn Brochure ART Nov 2020Shahzad AhmedNo ratings yet

- Homebuyer Tax Credit Overview - SDDocument1 pageHomebuyer Tax Credit Overview - SDjosephcuevasNo ratings yet

- BAR ResidentialAffordability 2023 09 01 0336Document3 pagesBAR ResidentialAffordability 2023 09 01 0336adeel.a.bhattiNo ratings yet

- Debbie Bremner's Market SummaryDocument1 pageDebbie Bremner's Market Summaryapi-26176222No ratings yet

- More - Info - Purchase - House - D5 - 11062014Document7 pagesMore - Info - Purchase - House - D5 - 11062014sambasivammeNo ratings yet

- TAX 25-9-2020 DeductionsDocument3 pagesTAX 25-9-2020 DeductionsChitraNo ratings yet

- Rebates For First Time BuyersDocument5 pagesRebates For First Time BuyersjohnNo ratings yet

- 2010 Tax Credit For New Home / First-Time BuyerDocument3 pages2010 Tax Credit For New Home / First-Time Buyerapi-26176222No ratings yet

- STEP 1 (Menentukan Annual Payment/Cicilan Periodik)Document13 pagesSTEP 1 (Menentukan Annual Payment/Cicilan Periodik)romaricheNo ratings yet

- Addition Urgent Ist OctDocument7 pagesAddition Urgent Ist Octজয়দীপ সেনNo ratings yet

- MeenaRenno MCC ProgramDocument1 pageMeenaRenno MCC ProgramAnonymous L9hO6tLQlONo ratings yet

- Tax Reform Law Chart: Prior Law vs. New LawDocument1 pageTax Reform Law Chart: Prior Law vs. New LawAaron Frank TorresNo ratings yet

- Module 4 Hire PurchaseDocument12 pagesModule 4 Hire PurchaseJuhi JethaniNo ratings yet

- Interpretation and Implementation: IjarahDocument22 pagesInterpretation and Implementation: IjarahBang Bid ChannelNo ratings yet

- 21 Creative Financing Terms For Your Real Estate Investing ToolboxDocument3 pages21 Creative Financing Terms For Your Real Estate Investing ToolboxAdetokunbo Ademola100% (1)

- Mortgage Exam Ontario CheatsheetDocument22 pagesMortgage Exam Ontario CheatsheetAnanya Sharma100% (3)

- Tenants' Guide To Charges: Permitted Charges in Accordance With The Tenant Fee Act 2019Document1 pageTenants' Guide To Charges: Permitted Charges in Accordance With The Tenant Fee Act 2019Florin BataruNo ratings yet

- 02 Future Proof Declaration FormatDocument3 pages02 Future Proof Declaration FormatLucy SapamNo ratings yet

- Buy or RentDocument3 pagesBuy or RentSundeepNo ratings yet

- Rent and Late FeesDocument2 pagesRent and Late FeesAnna MNo ratings yet

- Pag Ibig Info - CIMBDocument19 pagesPag Ibig Info - CIMBReynaldo PogzNo ratings yet

- Information For Applicants - Cambridge ResidentialDocument5 pagesInformation For Applicants - Cambridge Residentialadrian aNo ratings yet

- Tenants GuideDocument13 pagesTenants GuideShashi Shekhar MahajanNo ratings yet

- AccountingDocument2 pagesAccountingmanan tyagiNo ratings yet

- Non Contentious Busines RulesDocument13 pagesNon Contentious Busines Rulesrmprskgwk5No ratings yet

- Ittp Case Study 2Document3 pagesIttp Case Study 2Kiran AnvattiNo ratings yet

- Agreement 9961F4FDE286Document18 pagesAgreement 9961F4FDE286m9rwpbrm89No ratings yet

- Purchase of Land Legal ChecklistDocument3 pagesPurchase of Land Legal Checklistravi1214No ratings yet

- Sunshine ContractDocument13 pagesSunshine Contractnick wilkinsonNo ratings yet

- Running Head: TAX CONSEQUENCES 1Document5 pagesRunning Head: TAX CONSEQUENCES 1Rosalia Anabell LacuestaNo ratings yet

- RENEWAL Business RegistrationDocument2 pagesRENEWAL Business RegistrationJasmine JacksonNo ratings yet

- Financial WorksheetDocument4 pagesFinancial Worksheetoscar5607No ratings yet

- Idfc Long Term Infrastructure BondsDocument2 pagesIdfc Long Term Infrastructure Bondsnaav_adnaavNo ratings yet

- Purchase Agreement: Customer Information: Ship To: SameDocument2 pagesPurchase Agreement: Customer Information: Ship To: SameCarly Stefany Hernández BobadillaNo ratings yet

- Law of Limitation in BankingDocument13 pagesLaw of Limitation in Bankingeknath2000100% (1)

- Decision - Should I Rent or Buy A House? Option 1 Buy Your Own HomeDocument5 pagesDecision - Should I Rent or Buy A House? Option 1 Buy Your Own HomeVikas GajpalNo ratings yet

- Bank Debt: (Type The Company Name)Document11 pagesBank Debt: (Type The Company Name)Sudhakar AyyagariNo ratings yet

- Purchase of LandDocument5 pagesPurchase of LandpoovizhiNo ratings yet

- Smith Attaway: Dollar General Valley Center, KSDocument9 pagesSmith Attaway: Dollar General Valley Center, KSandrewackNo ratings yet

- Mortgage Commitment DobleDocument4 pagesMortgage Commitment DobleHarvey SpiegelNo ratings yet

- Lessee Company On January 1 2010 Enters Into A 5 YearDocument1 pageLessee Company On January 1 2010 Enters Into A 5 YearM Bilal SaleemNo ratings yet

- BLL Lecture 1Document24 pagesBLL Lecture 1Moazzam MangiNo ratings yet

- Interact MaterialsDocument2 pagesInteract MaterialsJays DomeNo ratings yet

- Investment Declaration From 12BB 22-23Document3 pagesInvestment Declaration From 12BB 22-23Kewal GuglaniNo ratings yet

- Chapter 7 Home OwnershipDocument33 pagesChapter 7 Home OwnershipandymengNo ratings yet

- GHL Mortgage ProductsDocument16 pagesGHL Mortgage ProductsBen ApawNo ratings yet

- Authority and Liability of An Agent Indian Contract LawDocument61 pagesAuthority and Liability of An Agent Indian Contract Lawashrahman52No ratings yet

- Finance Lease LesseeDocument11 pagesFinance Lease LesseeAngel Queen Marino SamoragaNo ratings yet

- Affiliated Business (RESPA)Document1 pageAffiliated Business (RESPA)Thomas JordanNo ratings yet

- Everything About SSDDocument21 pagesEverything About SSDSG PropTalkNo ratings yet

- Housing Loan: Philippine Veterans Bank CTBC Bank Corp. Philippine Trust CompanyDocument4 pagesHousing Loan: Philippine Veterans Bank CTBC Bank Corp. Philippine Trust CompanyAngelouNo ratings yet

- BDO Biñan BranchDocument4 pagesBDO Biñan BranchRosel Aubrey RemigioNo ratings yet

- Tax Sales for Rookies: A Beginner’s Guide to Understanding Property Tax SalesFrom EverandTax Sales for Rookies: A Beginner’s Guide to Understanding Property Tax SalesNo ratings yet

- Creating Residential Income: How to Get Your Money to Work For YouFrom EverandCreating Residential Income: How to Get Your Money to Work For YouNo ratings yet

- Jersey City Stats Public Archive Till Dec 2012Document28 pagesJersey City Stats Public Archive Till Dec 2012DonnaAntonucciNo ratings yet

- JC Stats Archive (Public) - 01-2012 To 05-2012Document16 pagesJC Stats Archive (Public) - 01-2012 To 05-2012DonnaAntonucciNo ratings yet

- Hoboken Price ReductionDocument69 pagesHoboken Price ReductionDonnaAntonucciNo ratings yet

- Exclusive Right To SellDocument1 pageExclusive Right To SellDonnaAntonucciNo ratings yet

- One To 4 Family Home Sales For Q1, Q2, Q3 2011.: Mls # Address City Class Status Price TypeDocument5 pagesOne To 4 Family Home Sales For Q1, Q2, Q3 2011.: Mls # Address City Class Status Price TypeDonnaAntonucciNo ratings yet

- 1212 Washington - PottsDocument2 pages1212 Washington - PottsDonnaAntonucciNo ratings yet

- Hoboken Revolt Questionnaire 2011 - CunninghamlDocument4 pagesHoboken Revolt Questionnaire 2011 - CunninghamlDonnaAntonucciNo ratings yet

- BOE Questionnaire12 - 10Document1 pageBOE Questionnaire12 - 10DonnaAntonucciNo ratings yet

- One To 4 Fam 2010Document6 pagesOne To 4 Fam 2010DonnaAntonucciNo ratings yet

- Earthquake Lesson Plan 2022Document5 pagesEarthquake Lesson Plan 2022Maylyn Grace Dalumpines-Colon EbonaloNo ratings yet

- E5170s-22 LTE CPE - Quick Start Guide - 01 - English - ErP - C - LDocument24 pagesE5170s-22 LTE CPE - Quick Start Guide - 01 - English - ErP - C - LNelsonNo ratings yet

- Police Forces and The Administration of Justice in Tanzania.Document6 pagesPolice Forces and The Administration of Justice in Tanzania.Praygod Manase100% (2)

- China Email ListDocument3 pagesChina Email ListRosie Brown40% (5)

- NMC CBT Sample Q&a Part 3 AcDocument14 pagesNMC CBT Sample Q&a Part 3 AcJoane FranciscoNo ratings yet

- Govt Considers Putting ShahbazDocument27 pagesGovt Considers Putting ShahbazWanderer123No ratings yet

- Resume For Singapore Spass Civil EngineerDocument8 pagesResume For Singapore Spass Civil EngineerArul SD100% (1)

- Convention Concerning The Protection of The WorldDocument41 pagesConvention Concerning The Protection of The WorldMonica Ardeleanu100% (1)

- Catalogue Mega EnglishDocument40 pagesCatalogue Mega EnglishInotech Outillage Nouvelle CalédonieNo ratings yet

- Manuale捲板機Document96 pagesManuale捲板機Andy WuNo ratings yet

- Projects & Operations: IN: NE Power Systm ImprvmDocument5 pagesProjects & Operations: IN: NE Power Systm ImprvmGaurang PatelNo ratings yet

- Material Safety Data Sheet: Manufacturer Pt. Bital AsiaDocument3 pagesMaterial Safety Data Sheet: Manufacturer Pt. Bital AsiaediNo ratings yet

- Checklist-Telephone - Mobile ExpenseDocument2 pagesChecklist-Telephone - Mobile ExpenseMichelle Domanacal UrsabiaNo ratings yet

- Students List - All SectionsDocument8 pagesStudents List - All SectionsChristian RiveraNo ratings yet

- This Study Resource WasDocument2 pagesThis Study Resource Waskaye nicolasNo ratings yet

- The Appropriate Biochemical Oxygen Demand Concentration For Designing Domestic Wastewater Treatment PlantDocument8 pagesThe Appropriate Biochemical Oxygen Demand Concentration For Designing Domestic Wastewater Treatment PlantabdulNo ratings yet

- Qualitative Research Chapter 1-5Document16 pagesQualitative Research Chapter 1-5Mikhaela Centeno100% (1)

- The Magical Diaries of Ethel ArcherDocument7 pagesThe Magical Diaries of Ethel Archerleeghancock100% (1)

- Ratio & Proportion Part 1Document5 pagesRatio & Proportion Part 1P Singh KarkiNo ratings yet

- Antibullying Presentation 1Document23 pagesAntibullying Presentation 1Martin Ceazar HermocillaNo ratings yet

- Glide Reflection Folding InstructionsDocument1 pageGlide Reflection Folding Instructionsapi-355107616No ratings yet

- The Case For A Concentrated Portfolio 6-30-16Document4 pagesThe Case For A Concentrated Portfolio 6-30-16Maria Gabriela PopaNo ratings yet

- BArch Thesis Proposal Form - 27march 2023 1 PDFDocument3 pagesBArch Thesis Proposal Form - 27march 2023 1 PDFDevkalpaNo ratings yet

- AutoPIPE Tutorial PDFDocument156 pagesAutoPIPE Tutorial PDFdhaktodesatyajitNo ratings yet

- QAS M001 SLPS Quality Assurance ManualDocument49 pagesQAS M001 SLPS Quality Assurance ManualMHDNo ratings yet

- Wipro Home Office RangeDocument8 pagesWipro Home Office RangePrashant RawatNo ratings yet

- Demand, Elasticity of Demand and Demand ForecastingDocument16 pagesDemand, Elasticity of Demand and Demand Forecastingankit thapliyal100% (1)

- Creative Thesis ExamplesDocument8 pagesCreative Thesis Examplescatherinebitkerrochester100% (2)

- Math Studies Financial MathsDocument7 pagesMath Studies Financial MathsGirish MishraNo ratings yet

- Ksiidc and KssidcDocument13 pagesKsiidc and KssidckasperNo ratings yet