Professional Documents

Culture Documents

Medicare Part B Premium Fact Sheet

Uploaded by

Terry PetersonOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Medicare Part B Premium Fact Sheet

Uploaded by

Terry PetersonCopyright:

Available Formats

CENTERS FOR MEDICARE & MEDICAID SERVICES

★

★

★

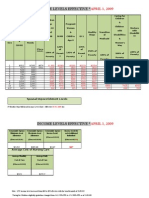

Medicare Part B Premium Costs in 2010

The Part B premium is increased each year, if necessary, to fund about 25% of the

projected cost of Part B. In 2010, most people will continue to pay the 2009 Part B

premium of $96.40, even though the 2010 standard monthly Part B premium is $110.50.

Why will most people continue to pay $96.40 for their

Part B premium?

Most people have their Part B premium deducted from their monthly Social Security

benefit check. In 2010, Social Security benefits won’t include a cost-of-living

adjustment (COLA), which means Social Security benefit checks won’t increase.

However, the Social Security Act protects most people from having a decrease in their

Social Security benefits from one year to the next because of an increase in the Part B

premium. This means that most people who have the Part B premium deducted from

their Social Security benefit check will continue to pay $96.40 each month.

Who will pay $110.50 (or more) for their Part B premium?

In 2010, the following people aren’t protected and will pay the standard $110.50 or

more for their Part B premium:

• People who get Part B beginning January 1, 2010, or later (new enrollees) will pay the

increased premium.

• People with incomes above certain amounts will pay the premiums listed in the table

below.

Your Yearly Income in 2008

You Pay a Part B

File Individual Tax Return File Joint Tax Return

premium of

$85,001–$107,000 $170,001–$214,000 $154.70

$107,001–$160,000 $214,001–$320,000 $221.00

$160,001–$214,000 $320,001–$428,000 $287.30

above $214,000 above $428,000 $353.60

★

Who will pay $110.50 (or more) for their Part B premium?

(continued)

• People who have Part B but don’t get Social Security benefits will pay the increased

Part B premium.

States that pay the Part B premium on behalf of people with Medicaid will pay the

increased Part B premium.

For more information about your Part B premium

Call Social Security at 1-800-772-1213 if you have questions about your Part B

premium or COLA. TTY users should call 1-800-325-0778. You can also visit

www.socialsecurity.gov.

CMS Product No. 11444

November 2009

You might also like

- Compensation LetterDocument5 pagesCompensation LetterJonathan Adams100% (1)

- The Field Health Service Information System (FHSIS)Document22 pagesThe Field Health Service Information System (FHSIS)i_love_quinn86% (56)

- IRWE Request TemplateDocument3 pagesIRWE Request TemplateTerry PetersonNo ratings yet

- Pubh1000 - M2-S1-2021Document4 pagesPubh1000 - M2-S1-2021kikiNo ratings yet

- MEDICAID Edit CodesDocument62 pagesMEDICAID Edit Codesslk2477No ratings yet

- Spath Workbook 2-3Document2 pagesSpath Workbook 2-3AmyNo ratings yet

- TaxDocument14 pagesTaxXinyi JiangNo ratings yet

- Employee Health Assistance FundDocument6 pagesEmployee Health Assistance Fundkatiejones26No ratings yet

- Crosswalk CPA Review: Tax Inflation Adjustments 2021Document15 pagesCrosswalk CPA Review: Tax Inflation Adjustments 2021Adhira VenkatNo ratings yet

- Crosswalk CPA Review: Tax UpdateDocument4 pagesCrosswalk CPA Review: Tax UpdateAdhira VenkatNo ratings yet

- 11579Document4 pages11579api-309082881No ratings yet

- Medicare: Issue BriefDocument7 pagesMedicare: Issue BriefDave McCarronNo ratings yet

- Income Tax Proof Submission GuidelinesDocument11 pagesIncome Tax Proof Submission Guidelinesdeepakraj610No ratings yet

- Solution 1: Calculation of Total Assessable Income, Taxable Income, Tax LiabilityDocument14 pagesSolution 1: Calculation of Total Assessable Income, Taxable Income, Tax LiabilityDevender SharmaNo ratings yet

- Income Tax Material: Unit 9 - DeductionsDocument9 pagesIncome Tax Material: Unit 9 - DeductionsKARAN WADHWA 2012168No ratings yet

- Chapter 10Document4 pagesChapter 10张心怡No ratings yet

- Section by Section Hr4872Document7 pagesSection by Section Hr4872nchc-scribdNo ratings yet

- Tax Rates 2078-79 - 20210719125127Document17 pagesTax Rates 2078-79 - 20210719125127shankarNo ratings yet

- Tax Law Snapshot 2014Document4 pagesTax Law Snapshot 2014HosameldeenSalehNo ratings yet

- Payroll Accounting 2015 1st Edition Landin Test Bank 1Document106 pagesPayroll Accounting 2015 1st Edition Landin Test Bank 1dorothy100% (47)

- DS0433Document2 pagesDS0433Shann KerrNo ratings yet

- OthInvestment Declaration Help Document F Y 2021-22-1Document12 pagesOthInvestment Declaration Help Document F Y 2021-22-1Gurprit SinghNo ratings yet

- Tax Rates 2079-80 PDFDocument18 pagesTax Rates 2079-80 PDFKumar SubediNo ratings yet

- State of Personal Income 2nd Q 2020Document13 pagesState of Personal Income 2nd Q 2020WWMTNo ratings yet

- Taxable Income Lecturer: Mr. S.RameshDocument4 pagesTaxable Income Lecturer: Mr. S.RameshthineshlaraNo ratings yet

- Individual Deductions Solutions Manual ProblemsDocument10 pagesIndividual Deductions Solutions Manual ProblemsSarah Marie Layton50% (2)

- 2011 Tax Reference GuideDocument11 pages2011 Tax Reference GuideSaver PlusNo ratings yet

- Income Tax Rates FY 2022-23 SummaryDocument16 pagesIncome Tax Rates FY 2022-23 Summaryrabin khatriNo ratings yet

- Ga Lifeline ApplicationDocument5 pagesGa Lifeline ApplicationAnonymous RISeUg4No ratings yet

- Expanded Economic Recovery Grants Overview Webinar SlidesDocument18 pagesExpanded Economic Recovery Grants Overview Webinar SlidesEthan BakuliNo ratings yet

- Coronavirus-Related Withdrawal: SECTION 1: What's Included in This KitDocument10 pagesCoronavirus-Related Withdrawal: SECTION 1: What's Included in This KitandryNo ratings yet

- Income Tax Proof Guidelines FY. 2022-23Document11 pagesIncome Tax Proof Guidelines FY. 2022-23Ghousia BegumNo ratings yet

- NMIMS Global Access School For Continuing Education (NGA-SCE) Course: Taxation-Direct and Indirect Internal Assignment Applicable For June 2020 ExaminationDocument10 pagesNMIMS Global Access School For Continuing Education (NGA-SCE) Course: Taxation-Direct and Indirect Internal Assignment Applicable For June 2020 ExaminationAnkit SharmaNo ratings yet

- Family Tax Benefit Payment Details and Important InformationDocument3 pagesFamily Tax Benefit Payment Details and Important InformationAriful RussellNo ratings yet

- Personal Financial PlanningDocument10 pagesPersonal Financial PlanningTam PhamNo ratings yet

- ADF Army Recruit Course Day by Day V8 PDFDocument1 pageADF Army Recruit Course Day by Day V8 PDFR ShoosmithNo ratings yet

- Comparing Medicare Reform ProposalsDocument1 pageComparing Medicare Reform ProposalsDonald SjoerdsmaNo ratings yet

- Successfully Submitted Benefits - Complete Required FormsDocument4 pagesSuccessfully Submitted Benefits - Complete Required FormsEmme WeaverNo ratings yet

- Income From House Property Income From Business or Profession Capital Gains Income From Other SourcesDocument4 pagesIncome From House Property Income From Business or Profession Capital Gains Income From Other SourcesPooja TanejaNo ratings yet

- Frequently Asked Questions: 1. How Is The Withholding Tax On Commission Calculated?Document9 pagesFrequently Asked Questions: 1. How Is The Withholding Tax On Commission Calculated?vanguardNo ratings yet

- Budget Brief Head 55Document36 pagesBudget Brief Head 55Anonymous UpWci5No ratings yet

- TCS AnniversaryDocument5 pagesTCS AnniversaryVitlesh PanditaNo ratings yet

- Payroll Deductions ExplainedDocument11 pagesPayroll Deductions ExplainedheenimNo ratings yet

- Payroll Accounting 2019 5th Edition Landin Solutions ManualDocument17 pagesPayroll Accounting 2019 5th Edition Landin Solutions Manualsilingvolumedvh2myq100% (22)

- Payroll Accounting 2019 5Th Edition Landin Solutions Manual Full Chapter PDFDocument38 pagesPayroll Accounting 2019 5Th Edition Landin Solutions Manual Full Chapter PDFentrickaretologyswr100% (8)

- ICAB Knowledge Level Taxation-I Suggested Answer May June 2010 - Nov Dec 2017Document150 pagesICAB Knowledge Level Taxation-I Suggested Answer May June 2010 - Nov Dec 2017Optimal Management Solution91% (11)

- Taxation - Direct and Indirect 2022Document10 pagesTaxation - Direct and Indirect 2022Sagar JindalNo ratings yet

- Document 1944 2629Document63 pagesDocument 1944 2629caninerawboned.2rfl40No ratings yet

- What Is Dearness Allowance (D.A.) ?Document12 pagesWhat Is Dearness Allowance (D.A.) ?a_14sNo ratings yet

- Receiving A Redundancy Payment: 1. Unused Annual LeaveDocument2 pagesReceiving A Redundancy Payment: 1. Unused Annual Leaverajkrishna03No ratings yet

- Group Work #1 With SolutionsDocument3 pagesGroup Work #1 With SolutionsShadi MorakabatiNo ratings yet

- SCHEDULE IN-112 Vermont Tax Adjustments and CreditsDocument3 pagesSCHEDULE IN-112 Vermont Tax Adjustments and Creditsjim deeznutzNo ratings yet

- IRS Publication Highlights Major 2008 Tax ChangesDocument38 pagesIRS Publication Highlights Major 2008 Tax ChangesgrosofNo ratings yet

- Actuarial Report For The Bermuda Health CouncilDocument28 pagesActuarial Report For The Bermuda Health CouncilAnonymous UpWci5No ratings yet

- 2 20150101 Bcbsil M Il PDFDocument26 pages2 20150101 Bcbsil M Il PDFAnonymous OAXhc7TwNkNo ratings yet

- Info Card 2016-17Document12 pagesInfo Card 2016-17Nick KNo ratings yet

- DEDUCTION PROVISIONSDocument11 pagesDEDUCTION PROVISIONSdevasrisaivNo ratings yet

- 2025 Membership Info Global - ENGLISH (11!01!2023)Document16 pages2025 Membership Info Global - ENGLISH (11!01!2023)ravi.rnrfreedomNo ratings yet

- Income Tax Guide FY 2023-24Document11 pagesIncome Tax Guide FY 2023-24akshay yadavNo ratings yet

- Dear Niharika,: Bebo Technologies Private LimitedDocument11 pagesDear Niharika,: Bebo Technologies Private LimitedEr Niharika KhuranaNo ratings yet

- AQC WebinarDocument69 pagesAQC WebinarMonirul Islam MoniirrNo ratings yet

- ND SSI StatsDocument2 pagesND SSI StatsTerry PetersonNo ratings yet

- 2010-04-02 - Health Care Reform ArticleDocument4 pages2010-04-02 - Health Care Reform ArticleTerry PetersonNo ratings yet

- Bylaws of SCGC - 2010Document17 pagesBylaws of SCGC - 2010Terry PetersonNo ratings yet

- Blind Work Expense RequestDocument2 pagesBlind Work Expense RequestTerry PetersonNo ratings yet

- Fy09 DFC Final RfaDocument99 pagesFy09 DFC Final RfaTerry Peterson100% (1)

- IM 5062 ATTACHED CHART 2009 Medicaid Income Level Chart - Effective 04-01-09Document2 pagesIM 5062 ATTACHED CHART 2009 Medicaid Income Level Chart - Effective 04-01-09Terry Peterson100% (1)

- Earnings Release 82508 (1) - MarkDocument1 pageEarnings Release 82508 (1) - MarkTerry PetersonNo ratings yet

- BPQY Release 90508 Final IIDocument2 pagesBPQY Release 90508 Final IITerry PetersonNo ratings yet

- BPQY Release 90808 #1Document1 pageBPQY Release 90808 #1Terry PetersonNo ratings yet

- BPQY Release 90508 Final IIDocument2 pagesBPQY Release 90508 Final IITerry PetersonNo ratings yet

- Earnings Release 82508 (1) - MarkDocument1 pageEarnings Release 82508 (1) - MarkTerry PetersonNo ratings yet

- Deeming Chart 2009Document1 pageDeeming Chart 2009Terry Peterson100% (3)

- Earnings Release 82508 #2Document1 pageEarnings Release 82508 #2Terry PetersonNo ratings yet

- TCS Helath Insurance - Domiciliary Claim Reimbursement GuidelinesDocument1 pageTCS Helath Insurance - Domiciliary Claim Reimbursement GuidelinesAmritaNo ratings yet

- Danielle Nesbit: Work ExperienceDocument4 pagesDanielle Nesbit: Work ExperienceNav SethNo ratings yet

- What Is Managed CareDocument18 pagesWhat Is Managed CareYOGESHNo ratings yet

- Matron Job Description - Healthcare InfoGuideDocument8 pagesMatron Job Description - Healthcare InfoGuideOzie Ruha100% (1)

- Analysing The Impact of Technological Innovation On Health Service Delivery A Case Study of NHS UKDocument68 pagesAnalysing The Impact of Technological Innovation On Health Service Delivery A Case Study of NHS UK9d8zctrzm6No ratings yet

- Business Intelligence in Health Care IndustryDocument2 pagesBusiness Intelligence in Health Care IndustrysasiarchieNo ratings yet

- ASHP Guidelines On PNTCDocument10 pagesASHP Guidelines On PNTCNosheen KhizarNo ratings yet

- MHM Syllabus for WBUHSDocument65 pagesMHM Syllabus for WBUHSArpit Gupta100% (1)

- Ehr at Blue ShieldDocument6 pagesEhr at Blue Shieldapi-240946281No ratings yet

- TB MDR CirebonDocument98 pagesTB MDR Cirebonnana kahnayaNo ratings yet

- Informatics and The Healthcare IndustryDocument21 pagesInformatics and The Healthcare IndustryWilbur TateNo ratings yet

- E - Knowledge Wireless Health Care SystemDocument3 pagesE - Knowledge Wireless Health Care SystemTaju DeenNo ratings yet

- DUPIXENT MyWay English Enrollment FormDocument5 pagesDUPIXENT MyWay English Enrollment FormJhoanna Marie MonterolaNo ratings yet

- BFHI Case Studies FINAL PDFDocument61 pagesBFHI Case Studies FINAL PDFYhana Fheb Nabus BayacsanNo ratings yet

- Marilyn K. Gard Recognized As A Professional of The Year by Strathmore's Who's Who Worldwide PublicationDocument3 pagesMarilyn K. Gard Recognized As A Professional of The Year by Strathmore's Who's Who Worldwide PublicationPR.comNo ratings yet

- Pharmacoeconomics principles methods economic drug evaluationDocument9 pagesPharmacoeconomics principles methods economic drug evaluationliaNo ratings yet

- Chennai Based Startups - PipeCandy - Contact Data - 31.01.2023Document4 pagesChennai Based Startups - PipeCandy - Contact Data - 31.01.2023Sivakumar VairavelNo ratings yet

- KombiglyzeXR Savings CardDocument1 pageKombiglyzeXR Savings CardRodolfo ArangoNo ratings yet

- NDC Cheat SheetDocument3 pagesNDC Cheat SheetSara E Alcantara RNo ratings yet

- VT - Pharm Programs Handbook - 2019 - Final-2 (Somali) PDFDocument21 pagesVT - Pharm Programs Handbook - 2019 - Final-2 (Somali) PDFnimco haamud100% (1)

- Strokescenarioinindia Isp 170727022013Document10 pagesStrokescenarioinindia Isp 170727022013Ajjugal SushmajaNo ratings yet

- Hospital Supply Chain ManagementDocument39 pagesHospital Supply Chain ManagementFatima Naz0% (1)

- Healthcare EconomicsDocument2 pagesHealthcare EconomicsNikki VillanuevaNo ratings yet

- 2012conference Detailedschedule2Document4 pages2012conference Detailedschedule2api-171700653No ratings yet

- Strategi Dan Metode PromkesDocument14 pagesStrategi Dan Metode Promkespenyelenggara dataNo ratings yet

- Hipaa: Health Insurance Portability and Accountability Act of 1996 (HIPAA)Document5 pagesHipaa: Health Insurance Portability and Accountability Act of 1996 (HIPAA)Nayeema KhowserNo ratings yet