Professional Documents

Culture Documents

Cash Priority Program

Uploaded by

yela garciaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Cash Priority Program

Uploaded by

yela garciaCopyright:

Available Formats

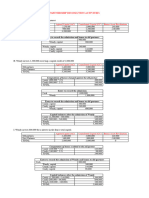

(Cash priority program; Statement of liquidation)

On January 1, 2002, Partners Kho, Lagman, and Magno decided to liquidate their

partnership. Prior to their liquidation ,the partners had a cash of P12,000,non-

cash assets of P146,000,liabilities to outsider of P36,000 and the notes payable

to partner Magno of P14,000 .The capital balances of the partners were : Kho –

P36,000 ; Lagman –P54,000 ; Magno –P18,000.The partners share profit and

losses in the ratio of 3:3:4,respectively.

During January 2009, the partnership received cash of P30, 000 from the sale of

assets with a book value of P38, 000 and paid P3, 600 of liquidation expenses.

During February ,the partnership realized P44,000 from the sale of assets with

the book value of P35,000 and paid Liquidation expenses of P8,400 .During

March ,the remaining assets were sold for P36,000 .The partners agreed to

distribute cash at the end of each month.

Instructions:

1. Prepare a cash priority program.

2. Prepare a statement of liquidation.

3. Prepare the necessary journal entries to record the liquidation process.

(Distribution of cash)

Aguilar and Bernardo share earnings in a 60:40 ratio. They have decided to

liquidate their partnership. A portion of the assets has been sold but other asses

with the carrying amount of P84, 000 still must be realized .All liabilities have

been paid, and cash of P40, 000 is available for distribution to partners. The

capital accounts show balance of P80, 000 for Aguilar and P44, 000 for Bernardo.

Instructions: Determine how should the cash of P40, 000 be divided.

You might also like

- Iv: Accounting For Dissolution (Changes in Membership) of A PartnershipDocument18 pagesIv: Accounting For Dissolution (Changes in Membership) of A PartnershipBerhanu ShancoNo ratings yet

- Partnership Dissolution TheoriesDocument4 pagesPartnership Dissolution TheoriesShiela Mae BautistaNo ratings yet

- Basic Concepts of PartnershipDocument7 pagesBasic Concepts of PartnershipKhim CortezNo ratings yet

- Chapter 16 Test Bank Dissolution and Liquidation of A PartnershipDocument23 pagesChapter 16 Test Bank Dissolution and Liquidation of A Partnershipjosh lunarNo ratings yet

- Chapter 2 5Document36 pagesChapter 2 5Jaztine Danikka GimpayaNo ratings yet

- Partnership Liquidation Q10docx 4 PDF FreeDocument1 pagePartnership Liquidation Q10docx 4 PDF FreecamillaNo ratings yet

- BAM 201 Second Periodical Exam AnswersDocument5 pagesBAM 201 Second Periodical Exam AnswersCai De JesusNo ratings yet

- PARTNERSHIP2Document13 pagesPARTNERSHIP2Anne Marielle UyNo ratings yet

- Qualifying Exam (Basic & ParCor)Document7 pagesQualifying Exam (Basic & ParCor)Rommel CruzNo ratings yet

- ParCor Chapter 5 - Hernandez - BSA 1-1 PDFDocument5 pagesParCor Chapter 5 - Hernandez - BSA 1-1 PDFBSA 1-1No ratings yet

- 361 Chapter 4 MC SolutionsDocument23 pages361 Chapter 4 MC Solutionsyela garcia70% (10)

- Corporation ProblemsDocument5 pagesCorporation ProblemsKathleenNo ratings yet

- Mas 1 Quiz ReviewDocument2 pagesMas 1 Quiz Reviewyela garcia50% (2)

- THEORIES AND COMPUTATIONSDocument5 pagesTHEORIES AND COMPUTATIONSThomas MarianoNo ratings yet

- Accounting for Partnership LiquidationDocument4 pagesAccounting for Partnership LiquidationSteffany RoqueNo ratings yet

- Partnership Operations Sample Problems SEODocument31 pagesPartnership Operations Sample Problems SEOJUARE MaxineNo ratings yet

- EXAM. MIDTERM. April 20, 2022Document15 pagesEXAM. MIDTERM. April 20, 2022Raziel Angelo AnsusNo ratings yet

- PreweekSol (Advacc)Document91 pagesPreweekSol (Advacc)Rommel Cruz100% (2)

- Partnership Dissolution ActivitiesDocument9 pagesPartnership Dissolution Activitieschrstncstllj100% (1)

- PFRS 1 9Document22 pagesPFRS 1 9Apol AsusNo ratings yet

- PARTNERSHIP LIQUIDATIONDocument24 pagesPARTNERSHIP LIQUIDATIONJesseca TuboNo ratings yet

- Accountancy Liquidation ProceduresDocument3 pagesAccountancy Liquidation ProceduresJizelle BianaNo ratings yet

- FAR 2 Q2 - Sample Problems With Solutions - FOR EMAILDocument11 pagesFAR 2 Q2 - Sample Problems With Solutions - FOR EMAILJoyce Anne GarduqueNo ratings yet

- FAR2 CHAPTER 1 (PG 1-13)Document13 pagesFAR2 CHAPTER 1 (PG 1-13)Layla MainNo ratings yet

- MC 6 SolutionDocument16 pagesMC 6 SolutionkylaNo ratings yet

- Partnership Liquidation ProceduresDocument90 pagesPartnership Liquidation ProceduresStork EscobidoNo ratings yet

- Chapter 6 Lumpsum LiquidationDocument24 pagesChapter 6 Lumpsum LiquidationJenny BernardinoNo ratings yet

- PROBLEM 13 Distribution of Profits or Losses Based On Partner's AgreementDocument1 pagePROBLEM 13 Distribution of Profits or Losses Based On Partner's AgreementRea PanganibanNo ratings yet

- Dissolution and Liquidation ProceduresDocument28 pagesDissolution and Liquidation ProceduresCAMILLE100% (1)

- 1.2. Partnership Operations and Distributions of Profits or LossesDocument4 pages1.2. Partnership Operations and Distributions of Profits or LossesKPoPNyx EditsNo ratings yet

- Chapt 4 Partnership Dissolution - Asset Revaluation & BonusDocument8 pagesChapt 4 Partnership Dissolution - Asset Revaluation & BonusDaenaNo ratings yet

- ACFAR 1231 - Cash and Cash Equivalents AssignmentDocument2 pagesACFAR 1231 - Cash and Cash Equivalents AssignmentkakaoNo ratings yet

- Assignment and Quiz 2 Accounting For CashDocument5 pagesAssignment and Quiz 2 Accounting For CashGab BautroNo ratings yet

- Exercise 3: 1. Initial Capital Investments (Compound Entry) DR CRDocument4 pagesExercise 3: 1. Initial Capital Investments (Compound Entry) DR CRasdfNo ratings yet

- Inventories (PROBLEM 10-6) : Allyna Rose V. Ojera BSA-2ADocument18 pagesInventories (PROBLEM 10-6) : Allyna Rose V. Ojera BSA-2AOJERA, Allyna Rose V. BSA-1BNo ratings yet

- Intermediate Accounting - ReceivablesDocument3 pagesIntermediate Accounting - ReceivablesDos Buenos100% (1)

- FAR2 Classwork PDFDocument7 pagesFAR2 Classwork PDFBarley ManilaNo ratings yet

- Cfas ReviewerDocument7 pagesCfas ReviewerDarlene Angela IcasiamNo ratings yet

- Business Cup Level 1 Quiz BeeDocument28 pagesBusiness Cup Level 1 Quiz BeeRowellPaneloSalapareNo ratings yet

- Pre FinactDocument6 pagesPre FinactMenardNo ratings yet

- Partnership Theories - OperationsDocument90 pagesPartnership Theories - OperationsBrIzzyJ100% (1)

- Problem 1 Accrual of Interest ExpenseDocument1 pageProblem 1 Accrual of Interest ExpenseJhanin BuenavistaNo ratings yet

- Qa PartnershipDocument9 pagesQa PartnershipFaker MejiaNo ratings yet

- AIS Journal Entries and Adjusting EntriesDocument2 pagesAIS Journal Entries and Adjusting EntriesIeva Francheska Agustin83% (6)

- Module 3 - Accounts Receivable Part II - 111702467Document11 pagesModule 3 - Accounts Receivable Part II - 111702467shimizuyumi53No ratings yet

- Partnership Accounting Liquidation - InstallmentDocument4 pagesPartnership Accounting Liquidation - InstallmentMerielyn MetilloNo ratings yet

- Partnership Accounting Problems and SolutionsDocument3 pagesPartnership Accounting Problems and SolutionsAidreil LeeNo ratings yet

- AssignmentDocument9 pagesAssignmentBaekhunnie ByunNo ratings yet

- Parcor Chap 6 DoneDocument10 pagesParcor Chap 6 DoneJohn Carlo CastilloNo ratings yet

- Partnership Admission Problems and Journal EntriesDocument2 pagesPartnership Admission Problems and Journal EntriesKaren Joy Jacinto ElloNo ratings yet

- Problem 1: Lump Sum LiquidationDocument2 pagesProblem 1: Lump Sum LiquidationAina Aguirre100% (2)

- Exercise 1: Required: Classify The Reports in Part A-E Into One of The Three Major Purposes of Accounting Systems OnDocument2 pagesExercise 1: Required: Classify The Reports in Part A-E Into One of The Three Major Purposes of Accounting Systems OnMyunimintNo ratings yet

- A Partnership Has To File Its Partnership Agreement and Register Its FirmDocument2 pagesA Partnership Has To File Its Partnership Agreement and Register Its FirmJoana TrinidadNo ratings yet

- Quizzer Acctg2Document1 pageQuizzer Acctg2elminvaldez0% (1)

- Cabutotan Jennifer 2ADocument12 pagesCabutotan Jennifer 2AJennifer Mamuyac CabutotanNo ratings yet

- Cfas (Pas 16)Document7 pagesCfas (Pas 16)Niña Mae VerzosaNo ratings yet

- Cost Formulas, LCNRV, and Purchase CommitmentsDocument6 pagesCost Formulas, LCNRV, and Purchase CommitmentsJorufel PapasinNo ratings yet

- IntAcc Quiz 1 PDFDocument9 pagesIntAcc Quiz 1 PDFMyles Ninon LazoNo ratings yet

- Partnership Liquidation 1Document17 pagesPartnership Liquidation 1Shoyo HinataNo ratings yet

- Estimate Variable and Fixed Costs of Truck Operation Using High-Low MethodDocument2 pagesEstimate Variable and Fixed Costs of Truck Operation Using High-Low MethodTanvir Ahmed ChowdhuryNo ratings yet

- 1partnership Installment LiquidationDocument2 pages1partnership Installment LiquidationAlexa LeeNo ratings yet

- CH 021Document2 pagesCH 021Joana TrinidadNo ratings yet

- Keyboard Note Print OutDocument1 pageKeyboard Note Print OutBrett Doc HockingNo ratings yet

- See You Againpdf Music Sheets PDFDocument2 pagesSee You Againpdf Music Sheets PDFyela garciaNo ratings yet

- Assignment Joint 1.Document3 pagesAssignment Joint 1.yela garciaNo ratings yet

- New Microsoft Office Word DocumentDocument35 pagesNew Microsoft Office Word Documentyela garciaNo ratings yet