Professional Documents

Culture Documents

CH 021

Uploaded by

Joana TrinidadOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CH 021

Uploaded by

Joana TrinidadCopyright:

Available Formats

1.

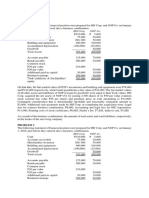

Mickey, Donald, and Minnie are partners sharing profit and loss in the ratio of 2:1:1,

respectively. Their capital balances are P400,000 for Mickey, P200,000 for Donald and

P100,000 for Minnie. Claims of suppliers amounted to 500,000 including the loan

extended by Minnie, P50,000. The cash balance amounted to P300,000 and it increased

to P1,050,000 as a result of the sale of the non-cash assets.

● How much cash was received by Donald in the final settlement?

162,500

● How much cash was received by Mickey in the final settlement?

325,000

● How much was the non-cash assets of the partnership?

900,000

● How much was the loss from sale of non-cash assets?

150,000

● How much was the cash proceeds from sale of non-cash assets?

750,000

● How much cash will Minnie receive?

112,500

2. As of December 31, the books of AME Partnership showed capital balances of: A-

P40,000; M-P25,000; E-P5,000. The partners’ profit and loss ratio was 3:2:1,

respectively. The partners decided to dissolve and liquidate. They sold all the non-cash

assets for P37,000 cash. After settlement of all liabilities amounting to P12,000, they still

have P28,000 cash left for distribution.

● The loss on the realization of the non-cash assets was

P42,000

● Assuming that any partner’s capital debit balance is uncollectible, the share of A

in the 28,000 cash for distribution would be

P17,800

3. The statement of financial position of the partnership A, B, and C shows: Cash, P22,400;

Other Assets, P212,000; Liabilities, P38,400; A, Capital (50%) P76,000; B, Capital (25%)

P64,000, and C, Capital (25%) P56,000.

● If B received a total of P31,000 from partnership liquidation, how much was the

loss on realization?

P127,000

You might also like

- This Study Resource Was: Quiz On Receivable FinancingDocument3 pagesThis Study Resource Was: Quiz On Receivable FinancingKez MaxNo ratings yet

- Philippine Deposit Insurance Corporation (PDIC) Law SummaryDocument11 pagesPhilippine Deposit Insurance Corporation (PDIC) Law SummaryElmer JuanNo ratings yet

- Cpa Review School of The Philippines Mani LaDocument2 pagesCpa Review School of The Philippines Mani LaAljur SalamedaNo ratings yet

- AdvaccDocument3 pagesAdvaccMontessa GuelasNo ratings yet

- Auditing fraud risk factors and responsibilitiesDocument2 pagesAuditing fraud risk factors and responsibilitiesnhbNo ratings yet

- Chapter 28 AnsDocument9 pagesChapter 28 AnsDave ManaloNo ratings yet

- Home Office & Branch Accounting Problems SolvedDocument3 pagesHome Office & Branch Accounting Problems SolvedChristianAquinoNo ratings yet

- Ira Shalini M. YbañezDocument5 pagesIra Shalini M. YbañezIra YbanezNo ratings yet

- At 3rd Evals ExamDocument12 pagesAt 3rd Evals ExamJohn Remy SamsonNo ratings yet

- Bus Combination 2Document8 pagesBus Combination 2Angelica AllanicNo ratings yet

- ACTExamsDocument36 pagesACTExamsKaguraNo ratings yet

- Partnership Accounting QuestionsDocument15 pagesPartnership Accounting QuestionsNhel AlvaroNo ratings yet

- Pure ProblemsDocument7 pagesPure Problemschristine anglaNo ratings yet

- Practical Accounting 2 Review Prelim Exam SolutionsDocument5 pagesPractical Accounting 2 Review Prelim Exam SolutionsRen EyNo ratings yet

- Quiz On Partnership LiquidationDocument4 pagesQuiz On Partnership LiquidationTrisha Mae AlburoNo ratings yet

- CH 023Document2 pagesCH 023Joana TrinidadNo ratings yet

- Acp 101 MexamDocument5 pagesAcp 101 MexamLyca SorianoNo ratings yet

- Nfjpia Nmbe Far 2017 Ans-1Document10 pagesNfjpia Nmbe Far 2017 Ans-1Stephen ChuaNo ratings yet

- Problem 3 5 6 Special TransactionDocument5 pagesProblem 3 5 6 Special TransactionBabyann BallaNo ratings yet

- BS Accountancy Sample ThesisDocument8 pagesBS Accountancy Sample ThesisBUENA SANGELNo ratings yet

- Partnership Dissolution and Liquidation DrillsDocument6 pagesPartnership Dissolution and Liquidation DrillsMa. Yelena Italia TalabocNo ratings yet

- Problems: Problem 4 - 1Document4 pagesProblems: Problem 4 - 1KioNo ratings yet

- Accounting 4 Note Payable and Debt RestructureDocument2 pagesAccounting 4 Note Payable and Debt RestructurelorenNo ratings yet

- ACC117-CON09 Module 3 ExamDocument16 pagesACC117-CON09 Module 3 ExamMarlon LadesmaNo ratings yet

- Name: - Score: - Course & Section: - DateDocument5 pagesName: - Score: - Course & Section: - DateRendyel PagariganNo ratings yet

- AndrewDocument1 pageAndrewCristine Salvacion Pamatian50% (2)

- PFRS 3 - Business Combination PDFDocument2 pagesPFRS 3 - Business Combination PDFMaria LopezNo ratings yet

- baitap-sinhvien-IAS 21Document12 pagesbaitap-sinhvien-IAS 21tonight752No ratings yet

- Notes On Partnership FormationDocument11 pagesNotes On Partnership FormationSarah Mae EscutonNo ratings yet

- Statement of Comprehensive Income: Irene Mae C. Guerra, CPA, CTTDocument21 pagesStatement of Comprehensive Income: Irene Mae C. Guerra, CPA, CTTRuaya AilynNo ratings yet

- MOD2 Corporate LiquidationDocument4 pagesMOD2 Corporate LiquidationJasper Andrew AdjaraniNo ratings yet

- Question Text: Retained Earnings Retained Earnings Retained Earnings Retained EarningsDocument32 pagesQuestion Text: Retained Earnings Retained Earnings Retained Earnings Retained EarningsYou're WelcomeNo ratings yet

- Audit Adjusting Entries for Cash and Cash EquivalentsDocument5 pagesAudit Adjusting Entries for Cash and Cash EquivalentsKenneth Christian WilburNo ratings yet

- Business Combination Problems Quiz 2Document7 pagesBusiness Combination Problems Quiz 2PrankyJellyNo ratings yet

- FINACC-Homework Exercise 2Document3 pagesFINACC-Homework Exercise 2Jomel BaptistaNo ratings yet

- Far - Pre BoardDocument17 pagesFar - Pre BoardClene DoconteNo ratings yet

- This Is RealDocument17 pagesThis Is RealCheemee LiuNo ratings yet

- BS ACCOUNTANCY TRUE OR FALSE STATEMENTSDocument1 pageBS ACCOUNTANCY TRUE OR FALSE STATEMENTSSheena ClataNo ratings yet

- Vbook - Pub Business Combination QuizDocument3 pagesVbook - Pub Business Combination QuizRialeeNo ratings yet

- Chapter 1 - Overview of Government AccountingDocument4 pagesChapter 1 - Overview of Government AccountingChris tine Mae MendozaNo ratings yet

- Dhis Special Transactions 2019 by Millan Solman PDFDocument158 pagesDhis Special Transactions 2019 by Millan Solman PDFQueeny Mae Cantre ReutaNo ratings yet

- Completion of Audit Quiz ANSWERDocument9 pagesCompletion of Audit Quiz ANSWERJenn DajaoNo ratings yet

- Sinking Fund and DerivativesDocument4 pagesSinking Fund and DerivativesCharice Anne VillamarinNo ratings yet

- Consolidated Statement of Financial Position - Date of Acquisition AnalysisDocument2 pagesConsolidated Statement of Financial Position - Date of Acquisition AnalysisKharen Valdez0% (1)

- Logo Here Auditing Theory Philippine Accountancy Act of 2004Document35 pagesLogo Here Auditing Theory Philippine Accountancy Act of 2004KathleenCusipagNo ratings yet

- Mock Cpa Board Exams - Rfjpia r-12 - W.ansDocument17 pagesMock Cpa Board Exams - Rfjpia r-12 - W.anssamson jobNo ratings yet

- Quiz 3 Cash Bank Recon Past Exam CompressDocument8 pagesQuiz 3 Cash Bank Recon Past Exam CompressAubrey Shaiyne OfianaNo ratings yet

- Colegio de La Purisima Concepcion: School of The Archdiocese of Capiz Roxas CityDocument5 pagesColegio de La Purisima Concepcion: School of The Archdiocese of Capiz Roxas CityJhomel Domingo GalvezNo ratings yet

- Accounting For Special TransactionsDocument3 pagesAccounting For Special TransactionsnovyNo ratings yet

- Calculation For Liquidation Value at Closure Date Is Somewhat Like The Book Value CalculationDocument3 pagesCalculation For Liquidation Value at Closure Date Is Somewhat Like The Book Value CalculationALYZA ANGELA ORNEDONo ratings yet

- Research 4-P4Document3 pagesResearch 4-P4Jesusa CapuaNo ratings yet

- Audit Quiz 2Document1 pageAudit Quiz 2Von Andrei MedinaNo ratings yet

- Auditing Problems Test Banks - PPE Part 2Document5 pagesAuditing Problems Test Banks - PPE Part 2Alliah Mae ArbastoNo ratings yet

- 11.11.2017 Audit of PPEDocument9 pages11.11.2017 Audit of PPEPatOcampoNo ratings yet

- A Government Employee May Claim The Tax InformerDocument3 pagesA Government Employee May Claim The Tax InformerYuno NanaseNo ratings yet

- Lump Sum LiquidationDocument3 pagesLump Sum LiquidationJose Mariano MelendezNo ratings yet

- Partnership FormationDocument3 pagesPartnership FormationJules AguilarNo ratings yet

- AFST Practice Set 02 Partnership (Part 2)Document3 pagesAFST Practice Set 02 Partnership (Part 2)Alain CopperNo ratings yet

- Partnership Liquidation Q10docx 4 PDF FreeDocument1 pagePartnership Liquidation Q10docx 4 PDF FreecamillaNo ratings yet

- Partnership ExercisesDocument2 pagesPartnership ExercisesKoreangelica ChipeNo ratings yet

- Partnership capital and profit ratios questionsDocument1 pagePartnership capital and profit ratios questionsJoana TrinidadNo ratings yet

- CH 025Document2 pagesCH 025Joana TrinidadNo ratings yet

- CH 026Document2 pagesCH 026Joana TrinidadNo ratings yet

- CH 023Document2 pagesCH 023Joana TrinidadNo ratings yet

- CH 022Document2 pagesCH 022Joana TrinidadNo ratings yet

- Partnership profit sharing, admission, withdrawal problemsDocument2 pagesPartnership profit sharing, admission, withdrawal problemsJoana TrinidadNo ratings yet

- Partnership LiquidationDocument2 pagesPartnership LiquidationJoana TrinidadNo ratings yet

- CH 024Document2 pagesCH 024Joana TrinidadNo ratings yet

- CH 017Document1 pageCH 017Joana TrinidadNo ratings yet

- Partnership capital balances after admissions and retirementsDocument2 pagesPartnership capital balances after admissions and retirementsJoana Trinidad100% (1)

- CH 013Document2 pagesCH 013Joana TrinidadNo ratings yet

- Pdpe 1Document1 pagePdpe 1Von Andrei MedinaNo ratings yet

- CH 016Document2 pagesCH 016Joana TrinidadNo ratings yet

- There Is Revaluation of Assets Equal To P50,000Document2 pagesThere Is Revaluation of Assets Equal To P50,000Joana TrinidadNo ratings yet

- Response: (250000) Response: 100000 Response: (600000)Document1 pageResponse: (250000) Response: 100000 Response: (600000)Joana TrinidadNo ratings yet

- Partnership bonus method and capital accountsDocument1 pagePartnership bonus method and capital accountsJoana TrinidadNo ratings yet

- CH 009Document2 pagesCH 009Joana TrinidadNo ratings yet

- CH 008Document1 pageCH 008Joana TrinidadNo ratings yet

- If The Profits After Salaries and Bonuses Are To Be Divided Equally, and The Profits OnDocument2 pagesIf The Profits After Salaries and Bonuses Are To Be Divided Equally, and The Profits OnJoana TrinidadNo ratings yet

- CH 010Document2 pagesCH 010Joana TrinidadNo ratings yet

- CH 008Document1 pageCH 008Joana TrinidadNo ratings yet

- CH 010Document2 pagesCH 010Joana TrinidadNo ratings yet

- Response: (250000) Response: 100000 Response: (600000)Document1 pageResponse: (250000) Response: 100000 Response: (600000)Joana TrinidadNo ratings yet

- CH 009Document2 pagesCH 009Joana TrinidadNo ratings yet

- CH 004Document2 pagesCH 004Joana TrinidadNo ratings yet

- If The Profits After Salaries and Bonuses Are To Be Divided Equally, and The Profits OnDocument2 pagesIf The Profits After Salaries and Bonuses Are To Be Divided Equally, and The Profits OnJoana TrinidadNo ratings yet

- Partnership Operations Enabling AssessmentDocument2 pagesPartnership Operations Enabling AssessmentJoana TrinidadNo ratings yet

- On A Ratio Based Average Capital BalancesDocument2 pagesOn A Ratio Based Average Capital BalancesJoana TrinidadNo ratings yet

- CH 005Document2 pagesCH 005Joana TrinidadNo ratings yet