Professional Documents

Culture Documents

Dissolution and Liquidation Procedures

Uploaded by

CAMILLE100%(1)100% found this document useful (1 vote)

216 views28 pagesOriginal Title

Lumpsum liquidation.pptx

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

100%(1)100% found this document useful (1 vote)

216 views28 pagesDissolution and Liquidation Procedures

Uploaded by

CAMILLECopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 28

Dissolution

Conditions resulting to dissolution

• Admission

• Retirement or withdrawal of a

partner

• Death, incapacity or insolvency of

a partner

• Incorporation of a partnership

Formation of a new partnership

Partnership Liquidation

• Refers to dissolution of the partnership

leading to the termination of the business

activities carried on by the partnership

• and the winding up of partnership’s business

affairs to going out of business.

Partnership dissolution with liquidation may be

caused by any of the following factors:

1. The accomplishment of the purpose for which

the partnership was organized

2. The termination of the term/period covered by

the partnership contract.

3. The bankruptcy of the firm.

4. The mutual agreement among the partners to

close the business

TYPES OF LIQUIDATION

• Lump-sum liquidation or liquidation by totals.

– This is a type of liquidation whereby the distribution of

cash to the partners is done only after all the non-cash

assets have been realized, the total amount of gain or loss

on realization is known, and all liabilities have been paid.

• Liquidation by instalment or piece-meal liquidation

– This is a type of liquidation whereby assets are realized on a

piecemeal basis and cash is distributed to partners on a

periodic basis as it becomes available, that is, even before all

non-assets are converted into cash.

PROCEDURES IN LUMP-SUM LIQUIDATION

1. Sale of non-cash assets

2. Distribution or allocation of gain or loss on

realization among the partners according to

their residual profit and loss ratios (salary

and interest factors disregarded) unless

liquidation ratios are specified in the

partnership agreement.

When realization of assets results in a loss, the loss is

carried to the capital accounts of the partners as a

deduction.

• If a partner’s capital account results in a debit balance

(called capital deficiency), the deficiency can be

eliminated by

– Making additional cash investment, if the deficient

partner is solvent.

– Charging the deficiency as additional loss to the

remaining partners, if the deficient partner is insolvent.

3.Distribution of cash to creditors

4. Distribution of cash to partners. In this

procedure, the provisions of the marshalling of

assets and the exercise of the right of offset are

applied

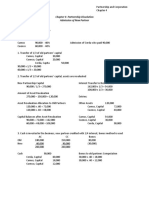

STATEMENT OF LIQUIDATION

STATEMENT OF LIQUIDATION

• The statement of liquidation is a

prepared to summarize the liquidation

process.

• It is the basis of the journal entries made

to record liquidation.

DEFINITION OF TERMS

1. Dissolution - the termination of a partnership as a going

concern; it is the termination of the life of a partnership.

2. Winding up - the process of settling the business Or

partnership affairs; it is synonymous to liquidation.

3. Termination - the point in time when all partnership affairs

are ended.

4. Liquidation - the interval of time between dissolution and

termination of partnership affairs; it is also the process of

winding up a business which normally consists of

conversion of assets into cash, payment of liabilities and

distribution of remaining cash among the partners.

5.Realization — the process of converting noncash

assets into cash.

6. Gain on realization - the excess of the selling price

over the cost or book value of the assets disposed or

sold through realization.

7. Loss on realization — the excess of the cost or book

value over the selling price of the assets disposed or

sold through realization.

8. Capital deficiency — the excess of a partner’s share

on losses over his capital.

9.Deficient partner - a partner with a debit balance in

his capital account after receiving his share on the loss

on realization.

10.Right of offset — the legal right to apply part or all

of the amount owing to a partner on a loan balance

against deficiency in his capital account resulting from

losses in the process of liquidation.

11.Partner’s interest — the sum of a partner’s capital,

loan balance and advances to the partnership.

Marshalling of Assets

Marshalling of Assets

• involves the order of creditors’ rights against the

partnership’s assets and the personal assets of the individual

partners.

• The order in which claims against the partnership’s assets

will be marshalled is as follows: 1. Partnership creditors other

than partners

2. Partners’ claims other than capital and profits, such as loans

payable and accrued interest payable

3. Partners’ claim to capital or profits, to the extent of credit

balances in capital accounts.

Illustrative Problem

1. Other assets were sold for 140,000

Entries

1. Cash 140,000

Other Assets 136,000

Gain on realization of assets 4,000

To record realization of non cash assets.

2. Gain on realization of assets 4,000

Encina, Capital 1,600

Endrada, Capital 1,600

Elina, Capital 800

To distribute gain to partners.

3. Liabilities 44,800

Cash 44,800

To settle obligations.

4. Loans Payable –Endrada 2,000

- Elina 3,200

Encina, Capital 39,600

Endrada, Capital 25,600

Elina, Capital 32,800

Cash 103,200

Final distribution to partners

2. Other assets were sold for P74,000

Entries

1. Cash 74,000

Loss on realization of assets 62,000

Other Assets 136,000

To record realization of non cash assets.

2. Encina, Capital 24,800

Endrada, Capital 24,800

Elina, Capital 12,400

Loss on realization of assets 62,000

To distribute loss to partners.

3. Liabilities 44,800

Cash 44,800

To settle obligations.

4. Loans Payable- Enrada 800

Endrada, Capital 800

Right to offset,

5. Loans Payable Endrada 1,200

-Elina 3,200

Encina, Capital 13,200

Elina, Capital 19,600

Cash 37,200

3. Other assets were sold for P68,000 and

deficient partner is solvent

Entries for Scenario 3

1.Cash 68,000

Loss on realization of assets 68,000

Other Assets 136,000

To record realization of non cash assets.

2. Encina, Capital 27,200

Endrada, Capital 27,200

Elina, Capital 13,600

Loss on realization of assets 68,000

To distribute loss to partners.

3. Liabilities 44,800

Cash 44,800

To settle obligations.

4. Loans Payable- Enrada 2,000

Endrada, Capital 2,000

Right to offset,

5. Loans Payable- Elina 3,200

Encina, Capital 10,800

Elina, Capital 18,400

Cash 37,200

Distribution of payments to partners.

4. Other assets were sold for P68,000 and

deficient partner is insolvent

Entries for Scenario 3

1.Cash 68,000

Loss on realization of assets 68,000

Other Assets 136,000

To record realization of non cash assets.

2. Encina, Capital 27,200

Endrada, Capital 27,200

Elina, Capital 13,600

Loss on realization of assets 68,000

To distribute loss to partners.

3. Liabilities 44,800

Cash 44,800

To settle obligations.

4. Loans Payable- Enrada 2,000

Endrada, Capital 2,000

Right to offset,

5. Encina, Capital 800

Elina, Capital 400

Endrada, Capital 1,200

Capital deficiency absorption of insolvent partner.

Pls take note in the slide that its not additional cash but rather

the solvent partners shall absorb the deficiency of the

insolvent partner

6.Loans Payable- Elina . 3,200

Encina, Capital 10,000

Elina, Capital 18,000

Cash 31,200

Distribution of payments to partners.

You might also like

- St. Vincent College of Cabuyao: Brgy. Mamatid, City of Cabuyao, Laguna Advance Financial Accounting and ReportingDocument3 pagesSt. Vincent College of Cabuyao: Brgy. Mamatid, City of Cabuyao, Laguna Advance Financial Accounting and ReportingGennelyn Grace Peñaredondo100% (1)

- Chapter 5 PartnershipDocument3 pagesChapter 5 PartnershipRose Ayson0% (1)

- Advanced Accounting Part 1 Quiz SolutionsDocument20 pagesAdvanced Accounting Part 1 Quiz SolutionsNikki GarciaNo ratings yet

- Business Cup Level 1 Quiz BeeDocument28 pagesBusiness Cup Level 1 Quiz BeeRowellPaneloSalapareNo ratings yet

- Midterm Exam Parcor 2020Document1 pageMidterm Exam Parcor 2020John Alfred CastinoNo ratings yet

- AC 3 - Intermediate Acctg' 1 (Ate Jan Ver)Document119 pagesAC 3 - Intermediate Acctg' 1 (Ate Jan Ver)John Renier Bernardo100% (1)

- SolutionDocument8 pagesSolutionIts meh SushiNo ratings yet

- Property, Plant and Equipment Chapter 15Document9 pagesProperty, Plant and Equipment Chapter 15Kiminosunoo LelNo ratings yet

- FOA - 3rd Summative AssessmentDocument1 pageFOA - 3rd Summative AssessmentJohniel MartinNo ratings yet

- ParCor Chapter 4 - Hernandez - BSA 1-1 PDFDocument7 pagesParCor Chapter 4 - Hernandez - BSA 1-1 PDFBSA 1-1No ratings yet

- MC 6 SolutionDocument16 pagesMC 6 SolutionkylaNo ratings yet

- EXAM. MIDTERM. April 20, 2022Document15 pagesEXAM. MIDTERM. April 20, 2022Raziel Angelo AnsusNo ratings yet

- 2.6. Retained EarningsDocument5 pages2.6. Retained EarningsKPoPNyx Edits100% (1)

- Warren's Sporting Goods Rework CostDocument1 pageWarren's Sporting Goods Rework CostWendelyn LingayuNo ratings yet

- Pre FinactDocument6 pagesPre FinactMenardNo ratings yet

- List of Local Commercial BanksDocument4 pagesList of Local Commercial Bankskristine_lazarito100% (1)

- If The Profits After Salaries and Bonuses Are To Be Divided Equally, and The Profits OnDocument2 pagesIf The Profits After Salaries and Bonuses Are To Be Divided Equally, and The Profits OnJoana TrinidadNo ratings yet

- Receivables Discussion QuestionDocument17 pagesReceivables Discussion QuestionAngelica TalledoNo ratings yet

- Accounting Quizzes Answer KeyDocument11 pagesAccounting Quizzes Answer KeyRae SlaughterNo ratings yet

- Group Activity 5Document2 pagesGroup Activity 5Jeremy James AlbayNo ratings yet

- Farparcor 2 Chapter 1 Exercises Problem AnswersDocument10 pagesFarparcor 2 Chapter 1 Exercises Problem AnswersWillnie Shane LabaroNo ratings yet

- Qa PartnershipDocument9 pagesQa PartnershipFaker MejiaNo ratings yet

- Receivable FinancingDocument15 pagesReceivable FinancingshaneNo ratings yet

- Partnership Operations ActivityDocument2 pagesPartnership Operations ActivityNedelyn PedrenaNo ratings yet

- Quizzer Acctg2Document1 pageQuizzer Acctg2elminvaldez0% (1)

- FAR2 Classwork PDFDocument7 pagesFAR2 Classwork PDFBarley ManilaNo ratings yet

- Assignment 2.1 AccountingDocument7 pagesAssignment 2.1 AccountingColine DueñasNo ratings yet

- Suggested AnswersDocument18 pagesSuggested AnswersEl YangNo ratings yet

- Notes On Partnership FormationDocument11 pagesNotes On Partnership FormationSarah Mae EscutonNo ratings yet

- Classifications of PartnershipDocument3 pagesClassifications of PartnershipFely MaataNo ratings yet

- Partnership Operation 003Document12 pagesPartnership Operation 003John GacumoNo ratings yet

- Robredo Consulting Firm's Comprehensive Accounting ProblemDocument1 pageRobredo Consulting Firm's Comprehensive Accounting ProblemDavid Con RiveroNo ratings yet

- Week 4 5 ULOc Lets Analyze Activities SolutionDocument3 pagesWeek 4 5 ULOc Lets Analyze Activities Solutionemem resuentoNo ratings yet

- Answers:: Mimi, Capital 2,250 Lulu, Capital 2,250Document2 pagesAnswers:: Mimi, Capital 2,250 Lulu, Capital 2,250Janrey RomanNo ratings yet

- Prequalifying ExaminationDocument7 pagesPrequalifying Examinationablay logeneNo ratings yet

- Property, Plant and EquipmentDocument40 pagesProperty, Plant and EquipmentNatalie SerranoNo ratings yet

- Chapter 1 Partnership Basic Considerations and FormationDocument20 pagesChapter 1 Partnership Basic Considerations and FormationMIKASANo ratings yet

- Valuation of Contributions of PartnersDocument3 pagesValuation of Contributions of Partnersfinn mertensNo ratings yet

- Partnership Operation 004Document2 pagesPartnership Operation 004John GacumoNo ratings yet

- Test I - Multiple Choice - TheoryDocument6 pagesTest I - Multiple Choice - Theorycute meNo ratings yet

- Multiple Choice Answers and Solutions: PAR Boogie BirdieDocument19 pagesMultiple Choice Answers and Solutions: PAR Boogie BirdieNelia Mae S. VillenaNo ratings yet

- Quiz 2 Partnership OperationsDocument4 pagesQuiz 2 Partnership OperationsChelit LadylieGirl FernandezNo ratings yet

- Assignment 10 Partnership DissolutionDocument8 pagesAssignment 10 Partnership DissolutionSova ShockdartNo ratings yet

- Problem 9 (CRC-ACE)Document5 pagesProblem 9 (CRC-ACE)Tk KimNo ratings yet

- Chapter 11 SampleDocument6 pagesChapter 11 SamplePattraniteNo ratings yet

- Chapt 4 Partnership Dissolution - Asset Revaluation & BonusDocument8 pagesChapt 4 Partnership Dissolution - Asset Revaluation & BonusDaenaNo ratings yet

- Jedah Noel - ASSIGNMENT 1 - Partnership FormationDocument2 pagesJedah Noel - ASSIGNMENT 1 - Partnership FormationJeddieh NoelNo ratings yet

- Partnership LiquidationDocument5 pagesPartnership LiquidationChristian PaulNo ratings yet

- Partnership and CorporationDocument41 pagesPartnership and CorporationJoana TatacNo ratings yet

- Quiz On Partnership LiquidationDocument4 pagesQuiz On Partnership LiquidationTrisha Mae AlburoNo ratings yet

- Batch 2021 - Corporation AccountingDocument34 pagesBatch 2021 - Corporation AccountingZia NuestroNo ratings yet

- Partnership Liquidation - Lump SumDocument11 pagesPartnership Liquidation - Lump Summicaella pasionNo ratings yet

- Lumpsum LDocument20 pagesLumpsum LCharles LaspiñasNo ratings yet

- Liquidation ParcorDocument47 pagesLiquidation ParcorRealyn Tayco CalinisanllNo ratings yet

- Partnership Corp. Chapter4Document21 pagesPartnership Corp. Chapter4deniseanne clementeNo ratings yet

- Module 4 PARTNERSHIP LiquidationFEB 2021Document53 pagesModule 4 PARTNERSHIP LiquidationFEB 2021Grace RoqueNo ratings yet

- HHHHDocument7 pagesHHHHleejongsukNo ratings yet

- Partnership Liquidation StatementDocument16 pagesPartnership Liquidation StatementAisea Juliana VillanuevaNo ratings yet

- Partnership - Liquidation Multiple Choice and ProblemsDocument8 pagesPartnership - Liquidation Multiple Choice and Problemskogigi2205No ratings yet

- D. DemandDocument26 pagesD. DemandCAMILLENo ratings yet

- MS Lecture Notes PDFDocument74 pagesMS Lecture Notes PDFAnuragNo ratings yet

- Test Bank Law 1 CparDocument26 pagesTest Bank Law 1 CparJoyce Kay Azucena73% (22)

- Test Bank Law 1 CparDocument26 pagesTest Bank Law 1 CparJoyce Kay Azucena73% (22)

- Test Bank Law 1 CparDocument26 pagesTest Bank Law 1 CparJoyce Kay Azucena73% (22)

- Test Bank Law 1 CparDocument26 pagesTest Bank Law 1 CparJoyce Kay Azucena73% (22)

- Test Bank Law 1 CparDocument26 pagesTest Bank Law 1 CparJoyce Kay Azucena73% (22)

- Test Bank Law 1 CparDocument26 pagesTest Bank Law 1 CparCAMILLENo ratings yet

- FAR Test BankDocument36 pagesFAR Test BankMangoStarr Aibelle VegasNo ratings yet

- Badminton - FinalDocument53 pagesBadminton - FinalCAMILLENo ratings yet

- JCT Contract in A Cold Climate 1 - NotesDocument16 pagesJCT Contract in A Cold Climate 1 - NotesXiaowen AnNo ratings yet

- TAX1 Compilation of CasesDocument3 pagesTAX1 Compilation of CasesYvet KatNo ratings yet

- Son - S Pious ObligationDocument7 pagesSon - S Pious ObligationTanya RajNo ratings yet

- Oblicon Notes UribeDocument4 pagesOblicon Notes UribeChic PabalanNo ratings yet

- Rescissible Contract: Everything You Need To Know: Types of ContractsDocument17 pagesRescissible Contract: Everything You Need To Know: Types of ContractsStacy Pancho LumanogNo ratings yet

- Leucadia National 2012 Letter To SharholdersDocument11 pagesLeucadia National 2012 Letter To SharholdersabaklajianNo ratings yet

- Holding and Subsidiary Co.Document14 pagesHolding and Subsidiary Co.Aswini Sankar100% (1)

- Bulk Sales Law: Reference: Reviewer of Commercial Law 2014 Ed. by JR Sundiang SR, and TB Aquino Rex BookstoreDocument17 pagesBulk Sales Law: Reference: Reviewer of Commercial Law 2014 Ed. by JR Sundiang SR, and TB Aquino Rex BookstoreJaneth NavalesNo ratings yet

- UCC1 InstructionsDocument2 pagesUCC1 InstructionsALexander Onetto100% (13)

- AFAR - Free Online Class Handout Part 2 - 05162020Document4 pagesAFAR - Free Online Class Handout Part 2 - 05162020Pritz Marc Bautista MorataNo ratings yet

- In Re Cooley - Rescission Complete Defense To ForeclosureDocument12 pagesIn Re Cooley - Rescission Complete Defense To Foreclosuretwebster321No ratings yet

- Bureau of Internal Revenue v. MisajonDocument11 pagesBureau of Internal Revenue v. MisajonsNo ratings yet

- INSTA SUBJECT TEST - 21 2023 (WWW - Upscmaterial.online)Document108 pagesINSTA SUBJECT TEST - 21 2023 (WWW - Upscmaterial.online)youpsc2024No ratings yet

- Motion For Relief From Stay Alvin Marrero Vs Pesquera PRPDDocument48 pagesMotion For Relief From Stay Alvin Marrero Vs Pesquera PRPDEmily RamosNo ratings yet

- Admission Cum Retirement DeedDocument8 pagesAdmission Cum Retirement DeedRohit Yadav50% (2)

- EuroBusiness - Billion-Dollar CircusDocument5 pagesEuroBusiness - Billion-Dollar CircusFormulaMoneyNo ratings yet

- Preferential TransactionDocument6 pagesPreferential Transactionakira menonNo ratings yet

- Corporate Failure Prediction Models AppliedDocument4 pagesCorporate Failure Prediction Models AppliedMatt AttardNo ratings yet

- XBMA 2017 Q2 Quarterly ReviewDocument22 pagesXBMA 2017 Q2 Quarterly Reviewvfb74No ratings yet

- Imerys Chapter 11 - J&J's January 5, 2021 Supplemental Objection To Latest Version of Plan DisclosureDocument279 pagesImerys Chapter 11 - J&J's January 5, 2021 Supplemental Objection To Latest Version of Plan DisclosureKirk HartleyNo ratings yet

- Court affirms hotel's rehabilitation planDocument2 pagesCourt affirms hotel's rehabilitation plannathNo ratings yet

- Bankruptcy ActDocument60 pagesBankruptcy ActBoikobo MosekiNo ratings yet

- The 1913 Federal Reserve Act and How the US Government Became BankruptDocument3 pagesThe 1913 Federal Reserve Act and How the US Government Became Bankruptwideawak350% (2)

- Banco FilipinoDocument3 pagesBanco Filipinovillalonriel100% (1)

- Mergers, Acquisitions and Corporate RestructuringDocument107 pagesMergers, Acquisitions and Corporate Restructuringbenelliott1989No ratings yet

- KATHERINE JACKSON V AEG Live Transcripts of William Ackerman - Forensic Accountant) August 13th 2013Document92 pagesKATHERINE JACKSON V AEG Live Transcripts of William Ackerman - Forensic Accountant) August 13th 2013TeamMichaelNo ratings yet

- Investment Banking Interview GuideDocument228 pagesInvestment Banking Interview GuideNeil Grigg100% (2)

- Plan Termination and LiabilityDocument130 pagesPlan Termination and LiabilityWhodisbithxNo ratings yet

- Jomo Kenyatta University of Agriculture and Technology, Nairobi, Kenya E-MailDocument16 pagesJomo Kenyatta University of Agriculture and Technology, Nairobi, Kenya E-MailShariff MohamedNo ratings yet

- Effects of Fulfillment, Loss, Deterioration and Improvement in Conditional ObligationsDocument144 pagesEffects of Fulfillment, Loss, Deterioration and Improvement in Conditional Obligationsanalie villaNo ratings yet