Professional Documents

Culture Documents

IT Declaration 2011-12

Uploaded by

Vijaya Saradhi PeddiCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

IT Declaration 2011-12

Uploaded by

Vijaya Saradhi PeddiCopyright:

Available Formats

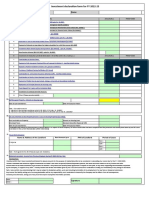

Declaration to obtain deductions from Total Taxable Income for the FY 2011 - 12

Emp No PAN

Employee Name Address

Date of Joining

1 To qualify for deduction of House Rent allowance, I hereby declare that during April 2011 to March 2012, I will be paying a

monthly rent of Rs.

2 I will be paying Rs.____________________ by cheque towards the Medical Insurance Premium under Sec 80 D.

[ Insurance taken on self, spouse, children and dependent parents and dependent children - Max of Rs.35,000 ]

3

I will be incurring Rs._____________________ towards maintenance including medical treatment of a dependent who is a

person with disability u/s 80 DD [ Max of Rs.50,000 and it is Rs.75,000 if the dependent is a person with sever disability ]

4 I will be incurring Rs._____________________ towards medical treatment of specified disease or ailment prescribed in IT

Rules u/s 80 DDB [ incurred for self or dependent - Max of Rs.40,000 and for senior citizens - Max Rs.60,000 ]

5 I will be repaying Rs.______________________ towards repayment of Educational loan taken for higher education from

___________________________________________bank u/s 80 E [ Only Interest Portion ]

6

I will be paying Rs. towards interest on Housing Loan taken from bank towards purchase / construction of

house property. Further, I hereby confirm that the said house is occupied by me and not rented out during FY 2011-12.

7

I am eligible for the deduction of Rs._______________, u/s 80U-Deduction in case of a person with disability. I will be

providing the necessary certificate for the same. (Rs.50,000 for person suffering from not less than 40% of any disability. A

higher deduction of Rs.75,000 will be allowed in case of severe disability.

8

The Expenditure on account of my medical treatment or treatment of member/s of my family during the financial year 2011-

2012 would amounts to Rs_______________________. I hereby undertake to provide the original bills for the medical

expenditure incurred

9 To qualify for deduction from income, I will be investing the following sums, out of the chargeable income

[ Allowed only on payment basis ]

a PF Contribution [12% of Basic+VDA]

b Contribution to Pension Funds U/s 80 CCC

c LIC Premium [ taken on self, spouse, children and a married daughter ]

d Contribution to notified pension fund set up by Mutual Fund or UTI

e Contribution to 15 Year Public Provident Fund (Max Rs.70,000)

f Subscription to National Savings Certificates, VIII Issue

g Contribution to Unit-Linked Insurance Plan (ULIP) of UTI

h

Contribution to Unit-Linked Insurance Plan (ULIP) of the LIC Mutual Fund

i Amount deposited in a fixed deposit for 5 years or more with scheduled bank in

accordance with a scheme framed and notified by the Central Government

j Payment for notified annuity plan of LIC (i.e., New Jeevan Dhara & New

Jeevan Akshay, New Jeevan Dhara I, New Jeevan Akshay I and New Jeevan

Akshay II)

k Subscription towards notified units of Mutual Fund or UTI

l Tuition Fees paid for the education of children

m Repayment of Housing Loan Principal taken from ____________________

bank towards purchase/construction of house property. Further, I hereby

confirm that the said house is occupied by me and not rented out during the

year

Total Investment [ Max of Rs.100,000 ] -

10

I am eligible for the deduction of Rs.____________, u/s 80CCF-Deduction in case of investment in Long Term Infrastructure

Bonds. I will be providing the necessary certificate for the same.

I declare that the aforesaid investments will be made out of my current years income chargeable to tax

I further undertake to inform the company in writing if there are any changes in any of the figures declared above during the year

I also undertake to indemnify in the event of the company being called upon to pay any tax or penalty or interest due to the deficiency of

my above declaration

I am attaching Form-12B, giving details of my previous employment along with Tax Computation sheet or Form-16 issued by my

previous employers [ As Applicable ]

Date :

Place : Signature_______________________________

IT Declaration Format 2010-11 Page 1

For Individuals the Tax Rates as below for the FY 2011-12.

Income Rate of Income Tax

*Upto Rs.1,80,000 NIL

Rs.1,80,001 to Rs.5,00,000 10% Income Above Rs.1,80,000

Rs.5,00,001 to Rs.8,00,000 Rs.32,000 +20% of Income Above Rs.5,00,000

Rs.8,00,001 and Above Rs.92,000+30% of Income Above Rs.8,00,000

For Women NIL

Income Rate of Income Tax

*Upto Rs.1,90,000 NIL

Rs.1,90,001 to Rs.5,00,000 10% Income Above Rs.1,90,000

Rs.5,00,001 to Rs.8,00,000 Rs.31,000 +20% of Income Above Rs.5,00,000

Rs.8,00,001 and Above Rs.91,000+30% of Income Above Rs.8,00,000

Note:

1.Education Cess @3% as applicable

You might also like

- Investment Declaration Form For The Financial Year 2014 - 15Document7 pagesInvestment Declaration Form For The Financial Year 2014 - 15devanyaNo ratings yet

- Frequently Asked Questions (Faqs) Tax Deduction at Source On BOB Staff Pension PaymentsDocument4 pagesFrequently Asked Questions (Faqs) Tax Deduction at Source On BOB Staff Pension PaymentsMayur khichiNo ratings yet

- Tax Planning For Year 2010Document24 pagesTax Planning For Year 2010Mehak BhargavaNo ratings yet

- Form C GuidelinesDocument9 pagesForm C GuidelinesaminashNo ratings yet

- Investment Declaration Form - 2022-2023Document3 pagesInvestment Declaration Form - 2022-2023Bharathi KNo ratings yet

- Deductions From Gross Total Income: Deductions Allowable Under Various Sections of Chapter VIA of Income Tax ActDocument8 pagesDeductions From Gross Total Income: Deductions Allowable Under Various Sections of Chapter VIA of Income Tax ActalisagasaNo ratings yet

- Tax Declaration Form 2021 22Document4 pagesTax Declaration Form 2021 22Kasiviswanathan ChinnathambiNo ratings yet

- Income Tax ProjectDocument6 pagesIncome Tax Projectdipmoip2210No ratings yet

- IT DeclarationDocument5 pagesIT Declarationkalpanagupta_purNo ratings yet

- Income Tax NitDocument6 pagesIncome Tax NitrensisamNo ratings yet

- Section 80 CDocument5 pagesSection 80 CAmit RoyNo ratings yet

- Assignment of Economic and Business Legislature: Submitted To-Submitted byDocument7 pagesAssignment of Economic and Business Legislature: Submitted To-Submitted byMohit SahniNo ratings yet

- Investment Declaration Form - 1314 - IshitaDocument5 pagesInvestment Declaration Form - 1314 - IshitaIshita AwasthiNo ratings yet

- What Is TaxDocument5 pagesWhat Is TaxVenkatesh YerramsettiNo ratings yet

- Portal Investment Proof Verification Guidelines 2022 23Document11 pagesPortal Investment Proof Verification Guidelines 2022 23yfiamataimNo ratings yet

- Pensioners - IT Declaration Form - Annexure1Document3 pagesPensioners - IT Declaration Form - Annexure1Sudeep MitraNo ratings yet

- Investment Declaration FY 2024-25Document6 pagesInvestment Declaration FY 2024-25Kumar BhaskarNo ratings yet

- Shreha Shah (Ba LLB Vii)Document7 pagesShreha Shah (Ba LLB Vii)Shreha VlogsNo ratings yet

- Income Tax Law & PracticeDocument29 pagesIncome Tax Law & PracticeMohanNo ratings yet

- Notes To Investment Proof SubmissionDocument10 pagesNotes To Investment Proof SubmissionVinayak DhotreNo ratings yet

- How To Save Tax For FY 2017-18Document14 pagesHow To Save Tax For FY 2017-18Srinivas Pavan KumarNo ratings yet

- VFN Tax and Tax Saving Session 2015Document27 pagesVFN Tax and Tax Saving Session 2015Sumit BawejaNo ratings yet

- 1 .Income Tax On Salaries - (01.06.2015)Document57 pages1 .Income Tax On Salaries - (01.06.2015)yvNo ratings yet

- Section 80C To 80U 1Document41 pagesSection 80C To 80U 1karanmasharNo ratings yet

- Instructions For Filing Investment Declaration Form: A. Permanent Account Number (PAN)Document7 pagesInstructions For Filing Investment Declaration Form: A. Permanent Account Number (PAN)subodh-mittal-7817No ratings yet

- The ABC Foundation: Investment Declaration Form For Tax Saving For Financial Year 2018-2019 The Akshaya Patra FoundationDocument1 pageThe ABC Foundation: Investment Declaration Form For Tax Saving For Financial Year 2018-2019 The Akshaya Patra FoundationLantNo ratings yet

- IT Declaration Form 2011-2012Document1 pageIT Declaration Form 2011-2012Shishir RoyNo ratings yet

- Chapter 12 TaxdeductionsDocument16 pagesChapter 12 TaxdeductionsRiya SharmaNo ratings yet

- IT Declaration Form FY 2018-19Document3 pagesIT Declaration Form FY 2018-19sgshekar3050% (2)

- Income From House Property Income From Business or Profession Capital Gains Income From Other SourcesDocument4 pagesIncome From House Property Income From Business or Profession Capital Gains Income From Other SourcesPooja TanejaNo ratings yet

- Section 80C To 80UDocument41 pagesSection 80C To 80UanupchicheNo ratings yet

- Deductions 2021 22Document5 pagesDeductions 2021 22Karan RajakNo ratings yet

- IT Assignment 2Document7 pagesIT Assignment 2Srinivasulu Reddy PNo ratings yet

- Complete Tax DetailsDocument23 pagesComplete Tax DetailsAnish GuptaNo ratings yet

- A Guide To Income Tax Benefits For Senior CitizensDocument18 pagesA Guide To Income Tax Benefits For Senior CitizensAshutosh JaiswalNo ratings yet

- Presented By: Dhruv Singh Priya Puri Nikhil Singhal Shantanu SaritaDocument22 pagesPresented By: Dhruv Singh Priya Puri Nikhil Singhal Shantanu SaritaDhruv singhNo ratings yet

- Tax Proof Submission FY 2021-22Document10 pagesTax Proof Submission FY 2021-22cutieedivyaNo ratings yet

- Maulana Azad National Urdu University: CircularDocument4 pagesMaulana Azad National Urdu University: CircularDebasish BiswalNo ratings yet

- ASSESSMENT YEAR 2014 Tax Rates and DetailsDocument6 pagesASSESSMENT YEAR 2014 Tax Rates and Detailsamit2201No ratings yet

- Tax Slabs & Tax Saving Strategies For New Tax Payers 2011-12Document5 pagesTax Slabs & Tax Saving Strategies For New Tax Payers 2011-12channaveer sgNo ratings yet

- Tax SavingsDocument32 pagesTax Savingsh946073000850% (2)

- Deduction Under Income Tax For IndividualsDocument20 pagesDeduction Under Income Tax For IndividualsAnanya RoyNo ratings yet

- Income Tax Rates 2011-12 Exemption Deduction Tax Calculation Income Tax Ready Reckoner FreeDocument6 pagesIncome Tax Rates 2011-12 Exemption Deduction Tax Calculation Income Tax Ready Reckoner FreevickycdNo ratings yet

- ClubbingDocument8 pagesClubbingSiddharth VaswaniNo ratings yet

- Importan Tips - AccountsDocument15 pagesImportan Tips - AccountsthomasmundaplackalNo ratings yet

- Circular / Office OrderDocument10 pagesCircular / Office OrderrockyrrNo ratings yet

- Deductions On Section 80CDocument12 pagesDeductions On Section 80CViraja GuruNo ratings yet

- Session 23-25 Permissible Deduction From Gross Total IncomeDocument14 pagesSession 23-25 Permissible Deduction From Gross Total Incomeomar zohorianNo ratings yet

- Guideline On ITDocument19 pagesGuideline On ITmikekikNo ratings yet

- HRA, Chapter VI A - 80CCD, 80C, 80D, Other IncomeDocument9 pagesHRA, Chapter VI A - 80CCD, 80C, 80D, Other Incomefaiyaz432No ratings yet

- DeductionsDocument11 pagesDeductionsguest1No ratings yet

- The Financial Kaleidoscope - July 19 PDFDocument8 pagesThe Financial Kaleidoscope - July 19 PDFhemanth1128No ratings yet

- Income Tax Ready Reckoner 2011-12Document28 pagesIncome Tax Ready Reckoner 2011-12kpksscribdNo ratings yet

- Chapter ViaDocument4 pagesChapter ViaCA Gourav JashnaniNo ratings yet

- Deductions U/S 80C TO 80U: By: Sumit BediDocument69 pagesDeductions U/S 80C TO 80U: By: Sumit BediKittu NemaniNo ratings yet

- Notes To Investment Proof SubmissionDocument10 pagesNotes To Investment Proof SubmissionnikunjrnanavatiNo ratings yet

- Salaries PresentationDocument21 pagesSalaries PresentationDipika PandaNo ratings yet

- 5 Tax-Planning Tips For Salaried People: Share ThisDocument3 pages5 Tax-Planning Tips For Salaried People: Share ThisPriya DubeyNo ratings yet

- Income Tax2022 GuidelinesDocument4 pagesIncome Tax2022 GuidelinesSANDEEP SAHUNo ratings yet

- Dhulikhel RBB PDFDocument45 pagesDhulikhel RBB PDFnepalayasahitya0% (1)

- OD - SAP Connector UtilityDocument22 pagesOD - SAP Connector UtilityShivani SharmaNo ratings yet

- Materials Selection in Mechanical Design - EPDF - TipsDocument1 pageMaterials Selection in Mechanical Design - EPDF - TipsbannetNo ratings yet

- T-61.246 Digital Signal Processing and Filtering T-61.246 Digitaalinen Signaalink Asittely Ja Suodatus Description of Example ProblemsDocument35 pagesT-61.246 Digital Signal Processing and Filtering T-61.246 Digitaalinen Signaalink Asittely Ja Suodatus Description of Example ProblemsDoğukan TuranNo ratings yet

- Zoomlion Gulf FZE Introduction: 1.1 ME Service Support 1.2 Construction CasesDocument13 pagesZoomlion Gulf FZE Introduction: 1.1 ME Service Support 1.2 Construction CasesArk TradingNo ratings yet

- Flyweis Services Pvt. LTDDocument11 pagesFlyweis Services Pvt. LTDFlyweis TechnologyNo ratings yet

- Cs09 404 Programming Paradigm (Module 1 Notes)Document24 pagesCs09 404 Programming Paradigm (Module 1 Notes)Rohith BhaskaranNo ratings yet

- BTL Marketing CompanyDocument30 pagesBTL Marketing Companypradip_kumarNo ratings yet

- 10.ULABs Presentation Camiguin FinalDocument55 pages10.ULABs Presentation Camiguin FinalKaren Feyt MallariNo ratings yet

- Software Requirements SpecificationDocument9 pagesSoftware Requirements SpecificationSu-kEm Tech LabNo ratings yet

- Read The Text and Answer The QuestionsDocument5 pagesRead The Text and Answer The QuestionsDanny RuedaNo ratings yet

- Rubber DamDocument78 pagesRubber DamDevanshi Sharma100% (1)

- Understand Fox Behaviour - Discover WildlifeDocument1 pageUnderstand Fox Behaviour - Discover WildlifeChris V.No ratings yet

- IFE Level 4 Certificate in Fire InvestigationDocument16 pagesIFE Level 4 Certificate in Fire InvestigationMarlon FordeNo ratings yet

- RELATIVE CLAUSES 1º Bachillerato and KeyDocument3 pagesRELATIVE CLAUSES 1º Bachillerato and Keyrapitanoroel0% (2)

- 1and5.microscopes, Specializedstem Cells, Homeostasis - Answer KeyDocument1 page1and5.microscopes, Specializedstem Cells, Homeostasis - Answer KeyMCarmen López CastroNo ratings yet

- 05271/MFP YPR SPL Sleeper Class (SL)Document2 pages05271/MFP YPR SPL Sleeper Class (SL)Rdx BoeNo ratings yet

- Esp-2000 BSDocument6 pagesEsp-2000 BSByron LopezNo ratings yet

- International Beach Soccer Cup Bali 2023 October 4-7 - Ver 15-3-2023 - Sponsor UPDATED PDFDocument23 pagesInternational Beach Soccer Cup Bali 2023 October 4-7 - Ver 15-3-2023 - Sponsor UPDATED PDFPrincess Jasmine100% (1)

- Provable Security - 8th International Conference, ProvSec 2014Document364 pagesProvable Security - 8th International Conference, ProvSec 2014alahbarNo ratings yet

- Teacher Resource Disc: Betty Schrampfer Azar Stacy A. HagenDocument10 pagesTeacher Resource Disc: Betty Schrampfer Azar Stacy A. HagenRaveli pieceNo ratings yet

- 04 - Crystallogaphy III Miller Indices-Faces-Forms-EditedDocument63 pages04 - Crystallogaphy III Miller Indices-Faces-Forms-EditedMaisha MujibNo ratings yet

- FoodhallDocument3 pagesFoodhallswopnilrohatgiNo ratings yet

- English ExerciseDocument2 pagesEnglish ExercisePankhuri Agarwal100% (1)

- Week 1 Lab #2 - Microscopy & Microscopic Examination of Living MicroorganismsDocument53 pagesWeek 1 Lab #2 - Microscopy & Microscopic Examination of Living MicroorganismsNgoc PhamNo ratings yet

- Case Study Managed ServicesDocument2 pagesCase Study Managed ServicesAshtangram jhaNo ratings yet

- List of Every National School Walkout PDF LinksDocument373 pagesList of Every National School Walkout PDF LinksStephanie Dube Dwilson100% (1)

- Antibiotic I and II HWDocument4 pagesAntibiotic I and II HWAsma AhmedNo ratings yet

- SBR 2019 Revision KitDocument513 pagesSBR 2019 Revision KitTaskin Reza Khalid100% (1)

- Esp 1904 A - 70 TPH o & M ManualDocument50 pagesEsp 1904 A - 70 TPH o & M Manualpulakjaiswal85No ratings yet