Professional Documents

Culture Documents

Scarafoni - Transcript Applications & Agreement

Uploaded by

iBerkshires.com0 ratings0% found this document useful (0 votes)

1K views30 pagesDocuments relating to North Adams, Mass., City Council agreements for tax incentives for the purchase of the North Adams Transcript building by Scarafoni Associates and an application for state incentives by Scarafoni to renovate and lease the building to the nonprofit Brien Center.

Original Title

Scarafoni_Transcript Applications & Agreement

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentDocuments relating to North Adams, Mass., City Council agreements for tax incentives for the purchase of the North Adams Transcript building by Scarafoni Associates and an application for state incentives by Scarafoni to renovate and lease the building to the nonprofit Brien Center.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

1K views30 pagesScarafoni - Transcript Applications & Agreement

Uploaded by

iBerkshires.comDocuments relating to North Adams, Mass., City Council agreements for tax incentives for the purchase of the North Adams Transcript building by Scarafoni Associates and an application for state incentives by Scarafoni to renovate and lease the building to the nonprofit Brien Center.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 30

CITY OF NORTH ADAMS, MASSACHUSETTS

Office of the Mayor Richard J. Alcornbrighr

May 10, 2011 #24

The North Adams City Council North Adams, Massachusetts

Re: TIF Agreement with Scarafoni Associates Nominee Trust

Dear Honorable Members:

Due to several very minor changes made to the TIF Agreement previously voted by Council, I would ask Council to rescind Council Paper 11,145 dated April 12, 2011.

Richard J. Alcombright Mayor

10 Main Street • North Adams, Massachusetts 01247 (413) 662-3000

QIit\! of tJ'ortq ~bam5

~lt aIitu ClIoultril

" .. , ,' , , ~~.Y.., ~9 ,' ~q.~.~."

<ll)rh.ereb:

WHEREAS, City Council Paper 11,145 was adopted on April 12, 2011, by this Honorable Body pertaining to certain matters regarding a Tax Increment Financing Agreement ("TIF Agreement") to be entered into between the City and David G. Carver, Trustee of Scarafoni Associates Nominee Trust and the Brien Center for Mental Health and Substance Abuse Services, Inc.; and

WHEREAS, since the adoption of such Order the parties have made certain revisions and amendments to the Agreement.

NOW THEREFORE, BE IT VOTED AS FOLLOWS:

That Council Paper 11,145, adopted by this Honorable Body on April 12, 2011, be and is hereby rescinded.

CITY OF NORTH ADAMS, MASSACHUSETTS

Office of the Mayor Richard J. Alcombright

May 10.2011 #25

The North Adams City Council North Adams, Massachusetts

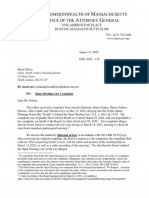

Re: Economic Opportunity Area Application

Dear Honorable Members:

For your information. I have included the entire application packet for the ScarafoniJBrien project.

This communication is asking the council to approve the "Application for Designation of Economic Opportunity Area" (EOA Application) in connection with this project. The approval of this designation is required by the Massachusetts Office of Business Development and is the final piece being brought before council allowing this project to move forward.

The EOA Application as well as all documentation in front of you has been fully reviewed and approved by the City Solicitor. Massachusetts Office of Business Development and the attorneys for both parties.

I respectfully request adoption of the EOA Application as presented.

Sincerely.

Richard Mayor

10 Main Street • North Adams, Massachusetts 01247 (413) 662-3000

(11 ity of N llrtq l\~ttttt!i ~u QIit\! QIoltlttiI

May 10, 2011

• ~ I ~ •••••••••••• ~~"""""""'" , •••••• _ ••••• 0," ~ •••••• _

WHEREAS. the City of North Adams acting by and through its Mayor desires to apply under the Massachusetts Economic Development Incentive Program for the designation of a certain area as an Economic Opportunity Area ("EGA").

NOW THEREFORE, BE IT RESOLVED AND VOTED AS FOLLOWS:

That the application for designation of an Economic Opportunity Area, attached to this Resolution as Exhibit A, be and is hereby approved, and that Richard 1. Alcombright, Mayor of the City of North Adams, be and is hereby authorized to file the application on behalf of the City.

CITY OF NORTH ADAMS, MASSACHUSETTS

Office of the Mayor Richard J. Alcombright

May 10,2011

#26

The North Adams City Council North Adams, Massachusetts

Re: TIF Agreement with Scarafoni Associates Nominee Trust

Dear Honorable Members:

In your packet of Brien/Scarafoni materials, I have included an updated TIF Agreement. At the suggestion of Massachusetts Office of Business Development, several very minor changes have been made to the Agreement previously voted by Council on April 12, 2011.

For your convenience, I have highlighted the changes and will review them at the meeting.

I would respectfully request adoption of the revised TIF Agreement.

Sincerely,

Mayor

10 Main Street • North Adams, Massachusetts 01247 (413) 662-3000

<llittl of ~llrtq ~ltant5

~n aIitg aIouncil

May 10, 2011

WHEREAS, David G. Carver, Trustee of the Scarafoni Associates Nominee Trust, uJdJt dated December 27, 1984, as amended, (the "Trust") (or its Nominee, also referenced herein as the Trust) intends to renovate and upgrade and construct new office and client facilities at the former North Adams Transcript Building, 124 American Legion Drive, North Adams, Massachusetts, (the "Site") with an estimated capital investment of more than One Million ($1,000,000.00) Dollars by December 31, 2011; and

WHEREAS, the Site is located within the boundaries of the North Adams Economic Target Area ("ETA" as that term is used in Massachusetts General Laws, Chapter 23A, Section 3D), and within the North Adams Economic Opportunity Area ("EOA" as that term is used in Massachusetts General Laws, Chapter 23A, Section 3E); and

WHEREAS, the Trust is seeking a Tax Increment Financing Agreement (the "TIF Agreement"), from the City in accordance with the Massachusetts Economic Development Incentive Program and Massachusetts General Laws Chapter 23A, Section 3E and Chapter 40, Section 59; and regulations issued pursuant thereto ("EDIP"); and

WHEREAS, the City is willing to enter into the TIP Agreement between the City, and the Trust and the Brien Center for Mental Health and Substance Abuse Services, Inc., in order to support increased economic development, to retain existing employment, to provide additional jobs for residents of the ETA and the City, to expand commercial Activity in the City, and to develop a healthy economy and stronger tax base.

NOW THEREFORE BE IT VOTED AS FOLLOWS:

That the TIF Agreement attached to this Order as Exhibit A be and is hereby adopted;

That the Site, as further described in the TIF Agreement and attachments thereto, and as further described in the application for designation of an Economic Opportunity Area to be filed under the Massachusetts Economic Development Incentive Program, be and is hereby designed as a TIF Zone; and

That Richard 1. Alcombright, Mayor of the City of North Adams, be and is hereby authorized to execute the TIF Agreement on behalf of the City.

TAX INCREMENT FINANCING AGREEMENT BY AND AMONG

THE CITY OF NORTH ADAMS, SCARAFONI ASSOCIATES NOMINEE TRUST AND THE BRIEN CENTER FOR

MENTAL HEALTH AND SUBSTANCE ABUSE SERVICES, INC.

This AGREEMENT is made this 10th day of May, 2011 by and among the City of North Adams, a municipal corporation duly organized under the laws of the Commonwealth of Massachusetts, having a principal place of business at Town Hall, 10 Main Street, North Adams Massachusetts 01247, acting through its City Council, (hereinafter referred to as the "CITY"), David G. Carver, Trustee of the Scarafoni Associates Nominee Trust, uldJt dated December 27, 1984, as amended, (the "Trust"), with a principal place of business located at 103 Main Street, North Adams, Massachusetts 01247 and The Brien Center for Mental Health and Substance Abuse Services, Inc., a charitable corporation organized under the laws of the Commonwealth of Massachusetts with a principal place of business located at 359 Fenn Street, Pittsfield, Massachusetts (hereinafter referred to as the "Brien Center") (collectively the "PARTIES").

PRELIMINARY STATEMENT

WHEREAS, the TRUST (or its Nominee, also referenced herein as the Trust) intends to renovate and upgrade and construct new office and client facilities at the former North Adams Transcript Building, 124 American Legion Drive, North Adams, Massachusetts, (the "Site"). The legal description for the Site is set forth on Exhibit A. On the site, the Trust intends to effect the building upgrades and renovations with an estimated capital investment of more than One Million Dollars ($1 million) by December 31, 2011 (the "Expansion Project"); and

WHEREAS, the Trust intends to exercise its option to purchase the Site; and

WHEREAS, the Expansion Project is to be built in order to accommodate a long-term lease between the Trust and the Brien Center, which is, in substantial part, a net lease that requires the Brien Center to pay costs including, but not limited to taxes on the Site; and

WHEREAS, the Site is located within the boundaries ofthe North Adams Economic Target Area ("ETA" as that term is used in Massachusetts General Laws, Chapter 23A, Section 3D); and

WHEREAS, the Site is located within the Brien Center Economic Opportunity Area ("EOA" as that term is used in Massachusetts General Laws, Chapter 23A, Section 3E); and

WHEREAS, The Brien Center expects to retain the employment of more than 60 employees through the consolidation and creation of a new location for its services at the Site, and anticipates the addition of new permanent full-time jobs; and

WHEREAS, the Trust and the Brien Center are seeking a Tax Increment Financing Agreement from the City in accordance with the Massachusetts Economic Development Incentive Program and Massachusetts General Laws Chapter 23A. §3E and Chapter 40, § 59; and regulations issued pursuant thereto ("EDIP"); and

WHEREAS, the City is willing to enter into a Tax Increment Financing Agreement in order to support increased economic development, to retain existing employment, to provide additional jobs for residents of the ETA and the City, to expand commercial activity in the City, and to develop a healthy economy and stronger tax base; and

WHEREAS, the Expansion Project will further the economic development goals and the criteria established for the ETA and the EOA; and

WHEREAS, the current assessed valuation for the Site for the fiscal year ending June 30, 2010 is $767,200.00, resulting in $21,200 in annual property taxes for the City.

NOW, THEREFORE, in consideration of mutual promises contained herein and other good and valuable consideration, the receipt and sufficiency of which is hereby acknowledged, the parties do mutually agree as follows:

1. The CITY, as authorized by the City Council on May 10,2011, hereby enters into a Tax Increment Financing Exemption with the Trust and the Brien Center with respect to the Site and the Expansion Project.

2. The TRUST acknowledges that, subject to the terms and conditions of a lease and other agreements between TRUST and the BRIEN CENTER, the BRIEN CENTER is responsible under its lease for all real estate taxes on the Site during the Exemption Period. Consequently, the Trust and the BRIEN CENTER will benefit from the Tax Increment Financing Exemption defined in this Agreement.

3. The Tax Increment Financing Exemption granted herein shall be in effect for a term of ten (10) years, commencing on July 1,2012 and expiring on June 30, 2022.

4. The Tax Increment Financing Exemption formula for the Site will be calculated as described by Mass. General Laws and regulated by the Department of Revenue and shall apply to the incremental difference in the assessed real property tax valuation of the Site for the next fiscal year ending on June 30, 2011 (the "Base Year") and its assessed valuation for each of the ten (10) fiscal years between July 1,2012 and June 30, 2022. The Base Valuation for the fiscal year ending June 30, 2011 is $767,200 (the "Base VaIuation").

5. The CITY hereby grants the Tax Increment Financing Exemption (the "Exemption") to the Trust (or its Nominee) and the Brien Center in accordance with G.L. c. 23A, § 3E; G.L. c. 40, § 59; and G.L. c. 59, § 5, clause 51. The Exemption shall be for a period of ten (10) years (the "Exemption Period") commencing with the fiscal year 2012 (which

2

begins July 1,2011) and ending with the fiscal year 2022 (which ends June 30,2022) and shall provide for an exemption from the increased value of the Site resulting from the Expansion Project.

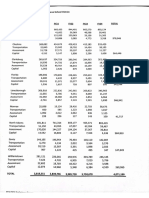

6. The Exemption Schedule applicable to the Expansion Project is as follows:

Fiscal Year TIF Year Exemption %

FY12 1 100%

FY13 2 100%

FY14 3 100%

FY15 4 100%

FY16 5 100%

FY17 6 100%

FY18 7 100%

FY19 8 100%

FY20 9 100%

FY21 10 100% 7. The CITY grants the Exemption in consideration of the commitment to and performance of the following by the TRUST and/or the Brien Center:

(a) The Trust shall invest no less than $1,000,000 (including any amounts invested by the Trust on the Brien Center's behalf) in qualified capital improvements at the Site on or before December 31,2011, including all costs, expensed or capitalized, incurred by the Trust related to the Site including but not limited to: demolition, renovation, and building leasehold improvements (including, without limitation, all electrical, mechanical, plumbing, HV AC, control and other building systems). The exemptions contained in this agreement apply ONLY to real estate taxes and do not apply to personal property of any nature.

(i) The number of full-time jobs created, jobs retained and the number of people hired from within the City for the annual period and on a cumulative basis; and

(b) The Brien Center shall submit annual reports onjob retention, job creation and new investment on the Site to the City by July 31 st of each year for which the tax benefits granted herein are enjoyed. Reports shall be submitted each year for the year starting July 1, 2012 and ending June 30, 2022, for the duration of the Tax Increment Financing Exemption. The annual report shall include:

(ii) The value of capital improvements invested in the Expansion Project annually and on a cumulative basis; and

(iii) the number of construction jobs created and the number of residents hired from the City for fiscal year ending June 2012, if applicable.

3

Nothing in this TIF Agreement shall require the Brien Center to create additional jobs at the Site. The intent of this TIF Agreement is to facilitate investment in the Site by the Trust and the retention of jobs in the City by providing an appropriate facility for the Brien Center.

c) The Brien Center commits to work with the Mayor's office, the McCann Technical and Drury High School employment/placement offices and in developing an employment/placement program to provide job opportunities within the Expansion Project and for ongoing Brien Center operations employment opportunities.

(d) The Trust shall use diligent efforts to utilize qualified North Adams, Berkshire County and Massachusetts region based businesses wherever commercially reasonable to construct, operate and maintain the Expansion Project.

(e) The Brien Center is a charitable, nonprofit organization and believes that it is entitled to obtain a charitable exemption from property tax if it owns real property that is operated for its charitable mission. The Brien Center may exercise an option to purchase the Site during the period that the TIF agreement is in effect. In the event that the Brien Center purchases the property, during the period that the TIF agreement is in effect, it hereby commits to continuing the payment of real estate taxes or an amount equal to the real estate taxes due under the terms of this agreement as a payment in lieu of taxes, owed on the Site during the term of this TIF agreement.

8. The Trust and the Brien Center agree to timely pay all real estate taxes they owe on the

Site over the Term of this Agreement.

9. The Trust and the Brien Center agree to allow the City to monitor and enforce the

Agreement.

10. If the Trust andlor the Brien Center fail to comply with the terms of this Agreement, the

City, acting through its City Council, may, at its sole discretion, take action to request decertification of the project by the Economic Assistance Coordinating Council ("EACC"), after written notice to the Trust and the Brien Center, and a reasonable opportunity to cure any such non-compliance. If the Trust or the Brien Center fails promptly to cure such non-compliance and the Expansion Project is thereafter decertified, the City shall discontinue the Exemption benefits provided to the Trust as set forth herein, commencing with the fiscal year in which such failure occurs. The Parties acknowledge that the obligations, covenants, or agreements on the part of Trust andlor the Brien Center are material and important to the realization of economic benefits from the Expansion Project, but are solely conditions to the receipt of the tax exemptions provided herein. The City's sole and exclusive remedies at law or in equity for a failure by the Trust andlor the Brien Center to satisfy any such conditions, is to request revocation of this Agreement by the Economic Assistance Coordinating Council (EACC) or its successor agency.

11. If the BRIEN CENTER materially reduces its business operations at the Site by reducing

employment at the Site to less than 50 employees and no other tenant leases the Site that provides an equivalent number of jobs, , then the City may seek decertification as provided in Section 10 of this Agreement. Notwithstanding anything to the contrary herein contained, the

4

Brien Center shall have the right to assign or transfer its interest in this Agreement to an Affiliated Entity (as defined below), and (b) a Successor (as defined below), provided that (i) prior to or simultaneously with the effective date of any assignment (taking into account any requirement of the Brien Center for confidentiality at the time of such transfer), such Affiliated Entity or Successor, as the case may be, and the Brien Center may execute and deliver to the City an assignment and assumption agreement in form and substance reasonably satisfactory to the City whereby such Affiliated Entity or Successor, as the case may be, shall agree to be independently bound by all applicable provisions of this Agreement (an "Assumption Agreement"). For the purposes hereof, an "Affiliated Entity" shall be defined as any United States legal entity which is controlled by, is under common control with, or which controls the Brien Center. For the purposes hereof, a "Successor" shall be defined as any entity into or with which the Brien Center is merged, or with which the Brien Center is consolidated, or which acquires all or substantially all of the Brien Center's stock or assets.

12. Notices. Notices to be delivered under this Agreement shall be delivered to the addresses set forth below (which addresses may be changed by a notice to the other party given pursuant to the terms hereof) by courier, recognized overnight delivery service, certified mail or by facsimile (so long as a copy of any facsimile is also delivered pursuant to one of the previously described methods):

If to the CITY:

Mayor Richard Alcombright, City Hall,

10 Main Street,

North Adams, Massachusetts 01240,

If to the TRUST:

David G. Carver, Trustee Scarafoni Associates

103 Main Street

North Adams, MA 01247

With a copy to:

Elisabeth C. Goodman, Esq. Ware & Goodman

377 Main Street

Williamstown, Massachusetts 01267

5

If to the BRIEN CENTER:

Katherine Dougherty The Brien Center 359 Fenn Street Pittsfield, MA 01201

With a copy to:

John Gobel, Esq. Gobel and Hollister 106 Wendell Ave. Pittsfield, MA 01201

13. This Agreement shall be binding upon all Parties, shall run with title to the Property and

bind successors in interest in the Property, and be binding upon the Brien Center and its successors and assigns as provided in Section 11 above, so long as the Expansion Project has not been decertified.

IN WITNESS WHEREOF, each of the Parties, intending to be legally bound, has executed this TIF Agreement as a sealed instrument by their duly authorized representatives and the City has caused this Agreement to be executed in its name and behalf and its seal duly affixed by its City Councilors and its Mayor on the day and year first written above.

City of North Adams

Scarafoni Associates Nominee Trust

David G. Carver

By its City Council

By: _

Its Trustee

Brien Center for Mental Health and Substance Abuse Services, Inc.

By: _

Title:

--------------------

Mayor, City Of North Adams

The Honorable Richard Alcombright

6

EXHIBIT A: DEED REFERENCE FOR THE SITE

See the deed from Berkshire Newspapers, Inc. to the North Adams Publishing Company, dated April 30, 1996 and recorded with the Berkshire Northern District Registry of Deeds in Book 914, Page 936. See merger recorded at Book 1147, Page 510.

7

Scarafoni Associates

AprilS,2011

The Honorable Mayor Richard Alcombright City of North Adams

10 Main Street

North Adams, MA

RE: Intent to Apply For Massachusetts Economic Development Program (EDIP) in (M unicipall'ty)

Dear Mayor Alcombright:

This letter is a letter of intent from Scarafoni Associates (or its Nominee) as required pursuant to the Economic Development Incentive Program, (EDIP).

On March 10, 2011 my company met with you to discuss the EDIP Program and the various incentives available in order to facilitate investment in the property located at 124 American Legion Drive which is under utilized and has been for sale for several years. Scarafoni Associates intends to renovate and upgrade the building by constructing new office and client facilities. Scarafoni Associates intends to make an estimated capital investment of more than One Million Dollars ($ I million) by December 31, 2011 as part of a long-term lease between the Scarafoni Associates and the Brien Center. The Brien Center is one of Berkshire County's largest employers and this project is intended to create modem office space for its North County operations necessary for continued accreditation and expansion of its programs. Scarafoni Associates is a real estate management and. development company operating throughout Berkshire County. A significant portion of its development work involves the adaptive re-use of vacant or underutilized buildings.

Scarafoni Associates is therefore requesting that you accept this letter as the formal letter of intent required under the Economic Development Incentive Program. (EDIP).

lJJJc~

David G. Carver

Managing Partner, Scarafoni Associates

cc: EDJP Director Regional Director

~

Economic Assistance _.ling Council LOCAL TAX INCENTIVE ONLY PROJECTS

1. APPLICANTlS) INFORMATION

Business Names of Applicant(s): Scarafoni Associates (or its Nominee)

Business Address of Applicants: 103 Main Street, North Adams, MA

FEIN #: 04-2907588

Executive Officer: David G. Carver, Trustee

Contact Person (If different):

Email: dcarver@scarafoniassociates.com

Phone: 413 664-4539 ext. 12 I Fax: I 413664-4735

2. NATURE AND HISTORY OF THE APPLICANT BUSINESS

Please provide a general description of the applicant's business, history and reason for the project (for

example, the company outgrew its existing space).

Founded in 1984, Scarafoni Associates is a real estate management and development company operating

throughout Berkshire County, Massachusetts. The company has a diversified portfolio of properties that

include market rate apartments, condominiums, affordable apartments, office space, and retail space. We

have expanded through acquisition of existing properties and development of new properties. Many of

our projects have involved significant investments in the substantial renovation and adaptive reuse of

historic downtown properties in Pittsfield, Adams, North Adams and Williamstown. Please see attached.

3. PROJECT and LOCAL TAX INCENTIVE INFORMATION

Project Name: Brien Center

Economic Opportunity Area and Project Address: 124 American Legion Drive

Municipality: North Adams

Local Tax Incentive: Please identify whether Tax Increment Financing or Special Tax Assessment

Agreement, the duration of the incentive and percentage exemption (for example, 5 Year TIF (50-

40-30-20-10):

Years cg]TIF DSTA Exemption Schedule: 10 years at 100% of any increase

Base Taxable Value of Property: $767,000

Projected total value of local real estate tax exemption: Assessor still determining

Projected total value of local personal property tax None

exemption:

Start of TIF I ST A: July 1,2012

If applicable, bas tbe building been 75% vacant for 24 montbs or DYes [ZjNo ON/A

more?

Project Job Creation (Full Time, Permanent): 0

Project Job Retention (Full Time, Permanent): 0 Economic Assistance Coordinating Council Non EDlP-ITC Projects Only Application 4129/2011

10f4

Project Investment: $1~700,OOO

As a result of the project, will there be any consolidation, ~Yes ONo

relocation or closing of Massachusetts' facilities? If yes,

please explain. This project relocates aU local offices to

one center.

Will the project facility be owned or leased by the applicant? OwnedI8}

If leased, please identify property owner and confirm that Leased D

property tax savings will be provided to the EDIP applicant. Property Owner:

All local property tax savings provided

to EDIP applicant business 0

4. NATURE AND PURPOSE OF PROPOSED PROJECT

Please provide a summary description of the applicant's project including (a) detail and the proposed time line of

a purchase I lease and I or construction and occupation, (b) equipment purchases, (c) skills needed for new

employees and hiring methods. Please explain why local incentives are necessary for the project to move

forward.

See attached

5. MUNICIPAL INFORMATION

Municipal Contact: Mayor Richard Alcombright

Municipal Address: 10 Main Street

Municipal Email: mayor _ alcombright@northadams-ma.gov

Municipal Phone: 413 6623000 I Municipal Fax: 1413662

3010

6. LOCAL APPROVAL and CERTIFICATE OF GOOD STANDING

Date Municipality Approved Local Tax Incentive: April 12, 2011

Approving Authority: City Council

Attach Municipal Vote Approving Incentive: TRT

Attach TIF/STA Agreement [gI

Certificate of Good Standing ~ Provide proof of good tax standing in the

Commonwealth of Massachusetts via a Massachusetts Department of Revenue

Certifleate of Good Standing for each of the businesses intending to take

advantage of the state tax incentives. To obtain a Certificate of Good Standing Attached 0

go to t

htt~s:1 /wfb.dor .sta tc.ma. us/wcbtilc/C ertiflcate/Pu blic/W eb F 0 rms/Wclcom e.asl2

x Economic Assistance Coordinating Council Project Application: Local Tax Incentives Only 4/27/2011

20f4

PARTII. LABOR AFFIRMATION

Part A:

k6J As an applicant requesting Certified Project approval,David Carver, Trustee. affirms

(check box) that this business will not unlawfully misclassify workers as self-

employed or as independent contractors, and certifies compliance with applicable

state and federal employment laws and regulations, including but not limited to

minimum wages, unemployment insurance, workers' compensation, child labor, and

the Massachusetts Health Care Reform Law, Chapter 58 of the Acts of2006, as

amended.

C8J As an applicant requesting Certified Project approval, David G. Carver, Trustee.

affirms (check box) that this business will not knowingly employ developers,

subcontractors, or other third parties that unlawfully miscJassify workers as self-

employed or as independent contractors, or that fail to comply with applicable state

and federal employment laws and regulations, including but not limited to minimum

wages, unemployment insurance, workers' compensation, child labor, and the

Massachusetts Health Care Reform Law, Chapter 58 of the Acts of 2006, as amended.

Part B: Within the past five years, has the applicant or any of its officers, directors,

employees, agents, or subcontractors of which the applicant has knowledge, been

the subject of (if yes, please provide details):

(a) an indictment, judgment, conviction, or

grant of immunity, including pending actions, DYes I2JNo

for any business-related conduct constituting

a crime under state or federal law; Details:

(b) a government suspension or debarment, DYes [glNo

rejection of any bid or disapproval of any

proposed contract subcontract, including Details:

pending actions, for lack ofresponsibility,

denial or revocation of pre qualification or

a voluntary exclusion agreement; or

(c) any governmental determination of a DYes C8'JNo

violation of any public works law or

regulation. or labor law or regulation or Details:

any OSHA violation deemed "serious or

willful?" Economic Assistance Coordinating Council Project Application: Local Tax Incentives Only 4/27/2011

30f4

-- .- .. _--_. __ .. -.-------------------------------

UWeDavid G. Carver, Trustee (names and titles) of the applicant business applying for approval C! tax incentives from the Commonwealth of Massachusetts, Economic Assistance Coordinating Council hereby certify that I1we have been authorized to fife this application and to provide the information within and accompanying this application and that the information provided herein is true and complete and

that it reflects the applicant's intentions for investment and job creation Ilwe understand that the information provided with this application will be relied upon by the Commonwealth in deciding whether to approve tax incentives and that the Commonwealth reserves the right to take action against the applicant or any other beneficiary of the tax incentives if the Commonwealth discovers that the applicant intentionally provided misleading, inaccurate, or false information. l/we make this certification under the pains and penalties of perjury.

AND Certification as to accuracy and Public Records Law acknowledgement:

The signatories herby certify that the answers in this application and the documents submitted in support thereof are accurate and complete representations of the applicant. They also hereby acknowledge that, under the Public Records law of the Commonwealth of 'Massachusetts, this

application and ocume s bmitted in support thereof are public records under the

provisions of ass h Is G. ., Ch. 4, sec. 7 (26).

Title

Title

Date

Economic Assistance Coordinating Council Project Application: Local Tax Incentives Only 4/27/2011

40f4

Item 2

Applicant's business, history and reason for the project, con't,

This project includes the acquisition of the former headquarters of The Transcript, the local Northern Berkshire county newspaper. The building has been more than 50% vacant for the past two years. The acquisition cost for the bui lding, located at 124 American Legion Drive, will be $700,000. Renovations to accommodate the Brien Center are estimated to cost in excess of $1 million dollars. The Brien Center currently occupies two smaller facilities in North Adams, one located at 25 Marshall Street and the other at 420 Curran Highway. Both facilities are leased and the services provided at these two locations will be consolidated at the new location. Acquisition of the site and renovation work is expected to be performed between July 2011 and January 2012. Completion of the project will enable the Brien Center to retain its principal Northern Berkshire County offices within the City of North Adams.

The Brien Center has connected with Scarafoni Associates because Scarafoni Associates is an experienced developer. It has the expertise and capability of designing and supervising the renovation work necessary to accommodate the Brien Center facilities. A total of 60 employees work in the two Brien Center facilities currently located in North Adams, and all of these employees will be relocated to the new facility.

See part 4 of this application for a detailed description of the Brien Center operations.

Item 4

This project involves the purchase and renovation of the property by Scarafoni Associates for a long term lease to the Brien Center.

The Brien Center provides mental health and substance abuse services to all segments of the Berkshire County population in Western Massachusetts. The Brien Center serves over 10,000 clients annually, more than 500 whom are chronically mentally ill. The largest percentage of outpatient services is for treatment of individuals who suffer from anxiety and depression. Over 4,000 of its clients are children. The Brien Center is the primary mental health and substance abuse provider for the region and is the sole provider for the uninsured and the under-insured. The Brien Center believes that health care is a right and not a privilege. The Brien Center currently provide Berkshire County-wide services that include the following: residential; rehabilitation; educational; employment; outreach; housing support; nursing; wellness support; psychiatric services; medication

management; and medical and social day support for elderly and younger disabled adults.

The Brien Center has been conducting a search for a new and modem North County facility for several years and has selected this site in North Adams as its first choice among several options available. lfthe financing and TIF agreements are approved it is anticipated that permitting will commence in May of 20 11 followed by construction

... _--- _ .. '-" _ .. - _------------

which could begin in August of201} and be completed in early 2012. The Brien Center and Scarafoni Associates has determined that a stabilized commercial real estate tax is essential to provide budget certainty needed to obtain private financing for the developer and the Brien Center programs.

o

o

o 0

o

o

o 0

o

o

o

o 0

o

o

o

o

o

o

o

o

o

o

o

o

o

o

o

..

J 1

i

'8

,.

..

j!

I

I it '6

,.

I I

o

o

o

o

o

In

..

!

I

:I 32 !

~

'6

,.

The Massachusetts Economic Development Incentive Program

APPLICATION FOR DESIGNATION OF ECONOMIC OPPORTUNITY AREA(S)

PART A: Applicant Information

1. Please check one:

_xx This is an application for designation of a new EOA within a previously approved ETA.

This is a request to amend an EOA previously approved by the EACC.

Name of proposed EOA(s): Brien Center

2. Community submitting this application: City of North Adams

PART B: MANDATORY REQUIREMENTS FOR THE PROPOSED EOA

1. Location of Proposed EOA(s):

Provide a detailed map of each proposed EOA, indicating the existing streets, highways, waterways, natural boundaries, and other physical features, along with a legally binding written description of the EOA boundaries (with parcel numbers if appropriate). If the written description is longer than one paragraph, please submit on 3 112" computer disk.

2. Description of EOA(s):

Describe why each proposed EOA was chosen for designation. Include a brief, descriptive narrative of each area which helps to explain the particular situations, issues, or reasons why EOA designation is requested.

The City of North Adams recognizes the Brien Center as the major provider of Mental Health and ancillary support services in the City. The Brien Center, currently located Marshall Street in North Adams and headquartered at 359 Fenn Street in Pittsfield will be moving from their current North Adams location into the former Transcript building via a lease agreement with Scarafoni Associates Nominee Trust. The trust will be doing renovations in excess of $1 ,000,000 to facilitate this move. In order to accommodate this development opportunity and more importantly keep the Brien Center and the jobs and services they provide in the city, the City of North Adams will enter into a TIF agreement with the parties. To finalize this arrangement, the City respectfully requests that the site, detailed in Part B, section 1, be declared an Economic Opportunity Area for this purpose. TIF agreement, Scarafoni letter of intent, and mayor's letter to council are attached.

EOA Application - Page 2

3. Basis for EOA Designation: Check the applicable category or categories (see definitions in attachment at back of application) for each proposed EOA:

___ The area proposed for designation as an EOA is a "blighted open area. 11

___ The area proposed for designation as an EOA is a "decadent area."

_xx_ The area proposed for designation as an EOA is a "substandard area."

___ The area proposed for designation as an EOA has experienced a plant closing or permanent layoffs resulting in a cumulative job loss of2,000 or more full-time employees within the four years prior to the date of filing this application.

4. Effective Time Period for EOA Designation: How long do you propose to maintain the EOA

designation? The EOA designation may remain in effect for a minimum of five (5) years and a maximum of twenty (20) years. 20 Years

5. Local Criteria for Designation of EO As: Describe how each proposed EOA meets your criteria

for designation of EO As, as specified in your application for designation of the ETA.

The building in question has been on the market for approximately three years with no promising development in sight.

The North Adams TranscriptlNew England Newspapers (current owners) moved the bulk of their printing, news and advertising operations to their sister paper the Berkshire Eagle taking with it many jobs and leaving the building almost vacant.

The Brien Center with Scarafoni Associates Nominee Trust have established a plan to resurrect the building to house the Brien Center allowing for continuance of mental health services in North Adams and North Berkshire while retaining up to 70 jobs

6. Economic Development Goals: Describe the economic development goals for each proposed

EOA during the first five years of EO A designation.

Retention of mental health services Retention of 70 jobs in North Adams

$1,000,000 in new improvements to an existing all but vacant building

TIF agreement that assures a fixed assessment on the building for 10 years further providing a minimum of $250,000 in tax revenue to the city

TIF also provides PILOT language should the Brien Center (501 c3) purchase the building at anytime within the 10 year TIF that would assure tax payments for the entire 10 year period

EOA Application - Page 3

7. Local Services: Describe the manner and extent to which the municipality intends to provide for an increase in the efficiency of the delivery of local services within the proposed EOA(s) (i.e. streamlining permit application and approval procedures, increasing the level of services to meet new demand, changing management structure for service delivery).

Delivery of services will be maintained through this agreement

8. Compliance with Community Reinvestment Act: Include a copy of a municipal plan or policy,

if any exists, which links the municipality's choice of banking institutions to the bank's compliance with the requirements of the Community Reinvestment Act.

There is no municipal plan or policy regarding choice of banking institutions in the EOA.

9. Project Approval:

(a) Identify the municipal official or group/board which shall be authorized to review project proposals for and on behalf of the municipality,

Project proposals for this EOA will initially be reviewed by Mayor Richard J. Alcombright for City of North Adams. Any TIF agreements approved in this EOA will be approved by the City of North Adams City Council. All redevelopment and changes of use in the EOA require site plan approval and a site plan special permit from the City of North Adams Planning Board.

EOA Application - Page 4

(b) Indicate the standards and procedures for review of project proposals, including the application procedures, the time frame for review and determination, and the criteria and process for approval of project proposals. If you intend to use supplemental application material (i.e, municipal cover letter with instructions, job commitment signoff sheet, supplemental questions to be required by the municipality, ete.), it must be mentioned here and must be approved by the Economic Assistance Coordinating Council (EACC). Please attach (if appropriate).

10. Intent of Businesses to Locate in EOA:

Identify the names and the nature of businesses, if any, that have indicated an intention to locate or expand in the proposed EOA(s). If possible, include letters of intent from the businesses, outlining the number of jobs that would likely be created and providing a timetable for development of the projects.

The Brien Center.

This project involves the purchase and renovation of the former headquarters of The Transcript, the local Northern Berkshire county newspaper by Scarafoni Associates or its nominee. The building has been more than 50% vacant for the past two years. The acquisition cost for the building, located at 124 American Legion Drive, will be $700,000. Renovations to accommodate the Brien Center are estimated to cost in excess of$1 million dollars. The Brien Center currently occupies two smaller facilities in North Adams, one located at 25 Marshall Street and the other at 420 Curran Highway. Both facilities are leased and the services provided at these two locations will be consolidated at the new location. Acquisition of the site and renovation work is expected to be performed between July 2011 and January 2012. Completion ofthe project will enable the Brien Center to retain its principal Northern Berkshire County offices within the City of North Adams.

The Brien Center has connected with Scarafoni Associates because Scarafoni Associates is an experienced developer. It has the expertise and capability of designing and supervising the renovation work necessary to accommodate the Brien Center facilities. A total of 60 employees work in the two Brien Center facilities currently located in North Adams, and all of these employees will be relocated to the new facility.

The Brien Center provides mental health and substance abuse services to all segments of the Berkshire County population in Western Massachusetts. The Brien Center serves over 10,000 clients annually, more than SOD whom are chronically mentally ill. The largest percentage of outpatient services is for treatment of individuals who suffer from anxiety and depression. Over 4,000 of its clients are children. The Brien Center is the primary mental health and substance abuse provider for the region and is the sole provider for the uninsured and the under-insured. The Brien Center believes that health care is a right and not a privilege. The Brien Center currently provide Berkshire County-wide services that include the following: residential; rehabilitation; educational; employment; outreach; housing support; nursing; wellness support; psychiatric services; medication management; and medical and social day support for elderly and younger disabled adults.

The Brien Center has been conducting a search for a new and modem North County facility for several years and has selected this site in North Adams as its first choice among several options available. The Brien Center and Scarafoni Associates has determined that a stabilized commercial real estate tax is essential to provide budget certainty needed to obtain private financing for the developer and the Brien Center programs.

EOA Application - Page 5

PART C: SPECIAL REQUIREMENTS FOR LARGE MUNICIPALITIES

This section must be completed by any municipality or member of a regional ETA with a population that exceeds fifty thousand (50,000) people. The population threshold should be calculated based on the most recent statistics available from the U.S. Bureau of the Census.

1. Permit Streamlining:

(a) List each officer, board, commission or other decision-making authority in the municipality that issues permits, approvals, and licenses and indicate the type of permit, approval or license issued by each authority.

(b) Provide a proposal and plan to streamline the municipality's permit, approval and license procedures. The plan should reduce the number of steps required to obtain approvals for new development. For example, the municipaIitycould combine two separate application forms into one form, provide for joint review by two or more decision making authorities, and set firm deadlines for final decisions on permits, approvals, or licenses.

If the municipality has already implemented a plan to streamline the permit and approval process, describe that plan, indicating the strengths and weaknesses of the plan and provide a revised plan to improve upon the weaknesses.

EOA Application- Page 6

2. Municipal Services in Proposed EOAs:

(a) Provide an analysis of the existing infrastructure support and municipal services, including transportation access, water and sewer hook-ups, lighting, and fire and police protection to and for certified projects within the proposed EOA(s). Indicate if the existing level of services and infrastructure is adequate to support the anticipated development in the proposed EOA(s).

Current levels of service are adequate

(b) Provide a proposal for meeting additional demand for municipal services and infrastructure improvement, including costs and funding sources available for these

improvements.

3. Job Training Programs:

Describe the municipality's plans to secure access to publicly or privately sponsored training programs for employees of certified projects and for residents of the municipalitylETA.

EOA Application - Page 7

4. Local Community Involvement:

Describe the municipality's plans to increase the level of private sector involvement and the level of involvement by community development organizations in the economic revitalization ofthe area proposed for designation. For example, local involvement could include commitments from private persons to provide jobs andjob training to residents or to employees who for certified projects in the proposed EOA(s).

PART D: COMMITMENT TO PROVIDE LOCAL PROPERTY TAX RELIEF

The municipality completing this application must provide a binding written offer to provide either tax increment financing or a special tax assessment to each certified project located within the proposed EOA(s).

Please attach a copy of the municipality's binding written offer.

• In cities, this shall be in the form of a City Council Order or Resolution, along with a Certified Vote by the City Clerk.

• In towns with Town Meeting form of government, this shall be in the form of a Town Meeting Motion, along with a Certified Vote by the Town Clerk.

• In towns with Town Council form of government, this shall be in the form of a Town Council Order or Resolution, along with a Certified Vote by the Town Clerk.

-rt m CI> =i m

»

8 .E:

o

("") z

Gl ,g.

::r

i=

Cl>U>

GlGl

z z

-< a

wWWto..)r-..)NN""';::::;: oOOU)(QCOtotO('D

gggg8gg8~

!;

:::I a.

..................................... _..:.. ....... __..~

~ ~~~~~~~~(1)

("") o

3 3

CD

a

r: '" _... ........................ _Nt'>,3a.

~ ~ ~~_~~"t::3!::::l ~

wwmO"JO)(])tOtot:

gggggggg(1)

-I o

OlO'locn_'_'-.I-...J-.J§t

~§::j~~~~eJ~

:"":",,,r...,wt.,..,1,.:,C,o'i--.JE' ggggggggco

("")

a

Ql ~ "C

~a

G') en ;0 (D

-

to 00 o

::0:"

C) _.. »0 ;0 _"

o

-i ...... 0 CO-i .t;:..» ~r

» en en m en en m o

...... 0")

...... N o o

365.11 '

66'

140

\~

124

TRANSCRIPT

1-6~

\ \ L_j

rv; 81.1

v....J _

L()

, "

o

77.7' 0.1

90.94'

You might also like

- Jersey City Census Appeal ContractDocument34 pagesJersey City Census Appeal ContractThe Jersey City IndependentNo ratings yet

- Letter To Mayor 1.31.20Document3 pagesLetter To Mayor 1.31.20Adrian MojicaNo ratings yet

- O-2018-07 Birchwood PILOT (FINAL - Revised) PDFDocument4 pagesO-2018-07 Birchwood PILOT (FINAL - Revised) PDFCranford1No ratings yet

- AGENDApacket 01-03-17 1133 591Document123 pagesAGENDApacket 01-03-17 1133 591Brad TabkeNo ratings yet

- Medford City Council: Motions, Orders and Resolutions 12-039Document7 pagesMedford City Council: Motions, Orders and Resolutions 12-039Medford Public Schools and City of Medford, MANo ratings yet

- North Lake Highlands PID Petition With Exhbits A and BDocument6 pagesNorth Lake Highlands PID Petition With Exhbits A and BChristina Hughes BabbNo ratings yet

- MeetingAgenda05 20 10Document4 pagesMeetingAgenda05 20 10mikerich24No ratings yet

- City Council January 10, 2012 AgendaDocument8 pagesCity Council January 10, 2012 AgendaMedford Public Schools and City of Medford, MANo ratings yet

- First Version of FC Cincinnati Community Benefits AgreementDocument24 pagesFirst Version of FC Cincinnati Community Benefits AgreementCincinnatiEnquirerNo ratings yet

- Multiple Documents Related To Rice Memorial Hospital Lease and Affiliation With CentraCareDocument24 pagesMultiple Documents Related To Rice Memorial Hospital Lease and Affiliation With CentraCareWest Central TribuneNo ratings yet

- Response To The Monterey County Civil Grand Jury 09-01-15Document18 pagesResponse To The Monterey County Civil Grand Jury 09-01-15L. A. PatersonNo ratings yet

- City of Carmel-By-The-Sea: City Council Staff ReportDocument9 pagesCity of Carmel-By-The-Sea: City Council Staff ReportL. A. PatersonNo ratings yet

- City Council Agenda For 8-15-16Document60 pagesCity Council Agenda For 8-15-16NicoleNo ratings yet

- Conditional Veto For A2578Document31 pagesConditional Veto For A2578pokerplayersallianceNo ratings yet

- Radio Tower OrdinanceDocument22 pagesRadio Tower OrdinanceAsbury Park PressNo ratings yet

- February 23 2010 Committee Meeting Agenda 2Document3 pagesFebruary 23 2010 Committee Meeting Agenda 2Greg aymondNo ratings yet

- City of Taylor, TIFA Lawsuit Against Wayne CountyDocument132 pagesCity of Taylor, TIFA Lawsuit Against Wayne CountyDavid KomerNo ratings yet

- City of Carmel-By-The-Sea: City Council Staff ReportDocument4 pagesCity of Carmel-By-The-Sea: City Council Staff ReportL. A. PatersonNo ratings yet

- Royals NegotiationsDocument2 pagesRoyals NegotiationsGreg DaileyNo ratings yet

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byDocument3 pagesCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byL. A. PatersonNo ratings yet

- Conflict of Interest Code 09-13-16Document25 pagesConflict of Interest Code 09-13-16L. A. PatersonNo ratings yet

- Sup 3-Item 24-Downtown Entertainment and Sports CenterDocument7 pagesSup 3-Item 24-Downtown Entertainment and Sports CenterIsaac GonzalezNo ratings yet

- Village (At Avon) Litigation Settlement Financial Questions and AnswersDocument18 pagesVillage (At Avon) Litigation Settlement Financial Questions and AnswersvaildailyNo ratings yet

- Harriet Tubman Center EastDocument6 pagesHarriet Tubman Center EastSenateDFLNo ratings yet

- City of Carmel-By-The-Sea: City Council Staff ReportDocument9 pagesCity of Carmel-By-The-Sea: City Council Staff ReportL. A. PatersonNo ratings yet

- MBACC Sued by Lake AgencyDocument11 pagesMBACC Sued by Lake AgencyMyrtleBeachSC newsNo ratings yet

- City of Carmel-By-The-Sea: City Council Staff ReportDocument17 pagesCity of Carmel-By-The-Sea: City Council Staff ReportL. A. PatersonNo ratings yet

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed BYDocument4 pagesCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed BYL. A. PatersonNo ratings yet

- 2012october CovertminutesDocument7 pages2012october CovertminutesDory HippaufNo ratings yet

- Beth Knezevich Candidate QuestionnaireDocument2 pagesBeth Knezevich Candidate QuestionnaireDevon UrchinNo ratings yet

- Endorsed: /Ufeb-S PM 21Document29 pagesEndorsed: /Ufeb-S PM 21api-217376109No ratings yet

- Daniel J. Ursu For Richmond Heights MayorDocument2 pagesDaniel J. Ursu For Richmond Heights MayorThe News-HeraldNo ratings yet

- Resolution Number R-3 0 7 5 3 9 Date of Final Passage Jun 2 8 2012Document38 pagesResolution Number R-3 0 7 5 3 9 Date of Final Passage Jun 2 8 2012MurtazaBaxamusaNo ratings yet

- Mayor and City Council: Work SessionDocument40 pagesMayor and City Council: Work SessionTown of Ocean CityNo ratings yet

- January 7, 2014 - PacketDocument75 pagesJanuary 7, 2014 - PacketTimesreviewNo ratings yet

- LAURA K. LEONE: Revere Chamber of Commerce NWSLTR Feb 10Document4 pagesLAURA K. LEONE: Revere Chamber of Commerce NWSLTR Feb 10Laurie Wilfong LeoneNo ratings yet

- PC AFS BackupDocument8 pagesPC AFS Backupbee5834No ratings yet

- Amendment To PSA Financial Consulting Services 09-12-17Document4 pagesAmendment To PSA Financial Consulting Services 09-12-17L. A. PatersonNo ratings yet

- 7-6-2020 Agenda New Haven Board of AldersDocument6 pages7-6-2020 Agenda New Haven Board of AldersHelen BennettNo ratings yet

- EID Service Provider ApplicationDocument12 pagesEID Service Provider ApplicationStatesman JournalNo ratings yet

- Lake Highlands North PID June 28Document10 pagesLake Highlands North PID June 28Christina Hughes BabbNo ratings yet

- McWhinney ComplaintDocument20 pagesMcWhinney ComplaintspeifNo ratings yet

- Councilmember Richard Fimbres - Ward 5 April 2013 NewsletterDocument13 pagesCouncilmember Richard Fimbres - Ward 5 April 2013 NewsletterRichard G. FimbresNo ratings yet

- MTT 30Document24 pagesMTT 30newspubincNo ratings yet

- Plainview Grocery Store CID and TIF in Wichita, KansasDocument15 pagesPlainview Grocery Store CID and TIF in Wichita, KansasBob WeeksNo ratings yet

- City of Carmel-By-The-SeaDocument3 pagesCity of Carmel-By-The-SeaL. A. PatersonNo ratings yet

- For Immediate Release: TCTU Press Conference To Oppose $278M Downtown Civil Courthouse BondDocument2 pagesFor Immediate Release: TCTU Press Conference To Oppose $278M Downtown Civil Courthouse BondCahnmanNo ratings yet

- State of The City 2015Document7 pagesState of The City 2015MNCOOhioNo ratings yet

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byDocument12 pagesCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byL. A. PatersonNo ratings yet

- City of Scranton LetterDocument1 pageCity of Scranton LetterPAindyNo ratings yet

- Bag Tax ComplaintDocument7 pagesBag Tax ComplaintboulderlawNo ratings yet

- PSA With Native Solutions 02-03-15Document15 pagesPSA With Native Solutions 02-03-15L. A. PatersonNo ratings yet

- 10.5 KC Royals Response to H. Hardwick Counteroffer Email Attachment - 10.20.23 (2)Document2 pages10.5 KC Royals Response to H. Hardwick Counteroffer Email Attachment - 10.20.23 (2)The Kansas City StarNo ratings yet

- Corp b18Document4 pagesCorp b18Mark ReinhardtNo ratings yet

- CMSDocument2 pagesCMSRecordTrac - City of OaklandNo ratings yet

- Lewis County Board of Legislators Agenda Feb. 6, 2024Document20 pagesLewis County Board of Legislators Agenda Feb. 6, 2024NewzjunkyNo ratings yet

- City of Carmel-By-The-SeaDocument4 pagesCity of Carmel-By-The-SeaL. A. PatersonNo ratings yet

- Northampton City Council AgendaDocument38 pagesNorthampton City Council AgendaThe Republican/MassLive.comNo ratings yet

- CDF Funding and Management Agreement - Affordable Housing Trust Fund FEDocument19 pagesCDF Funding and Management Agreement - Affordable Housing Trust Fund FEWVXU NewsNo ratings yet

- McCann Technical School Assessments FY24Document1 pageMcCann Technical School Assessments FY24iBerkshires.comNo ratings yet

- CARES Project Complete ReportDocument64 pagesCARES Project Complete ReportiBerkshires.comNo ratings yet

- Dalton Annual Town Meeting 2023Document4 pagesDalton Annual Town Meeting 2023iBerkshires.comNo ratings yet

- Williamstown Select Board - Ceasefire Resolution - 20240212Document2 pagesWilliamstown Select Board - Ceasefire Resolution - 20240212iBerkshires.comNo ratings yet

- Determination - 4-25-2023 - Oml 2023-65 - North Adams City CouncilDocument4 pagesDetermination - 4-25-2023 - Oml 2023-65 - North Adams City CounciliBerkshires.comNo ratings yet

- Student Chromebook Deployment Survey ResultsDocument10 pagesStudent Chromebook Deployment Survey ResultsiBerkshires.comNo ratings yet

- Pittsfield Pickleball CourtsDocument8 pagesPittsfield Pickleball CourtsiBerkshires.comNo ratings yet

- Adams Capital Budget Fiscal 2024Document1 pageAdams Capital Budget Fiscal 2024iBerkshires.comNo ratings yet

- Wahconah Park Design ProposalDocument72 pagesWahconah Park Design ProposaliBerkshires.com100% (1)

- North Adams Planning Board OML ViolationDocument3 pagesNorth Adams Planning Board OML ViolationiBerkshires.comNo ratings yet

- Short-Term Rental RegulationsDocument7 pagesShort-Term Rental RegulationsiBerkshires.comNo ratings yet

- Pittsfield Pickleball Facility Siting Study Final ReportDocument15 pagesPittsfield Pickleball Facility Siting Study Final ReportiBerkshires.comNo ratings yet

- Pittsfield Tobacco RegulationsDocument17 pagesPittsfield Tobacco RegulationsiBerkshires.comNo ratings yet

- North Adams Draft Short-Term Rental OrdinanceDocument7 pagesNorth Adams Draft Short-Term Rental OrdinanceiBerkshires.comNo ratings yet

- Williamstown Select Board OML ViolationDocument5 pagesWilliamstown Select Board OML ViolationiBerkshires.comNo ratings yet

- Draft Tobacco Regulations For DaltonDocument18 pagesDraft Tobacco Regulations For DaltoniBerkshires.comNo ratings yet

- Four New Pittsfield Job DescriptionsDocument9 pagesFour New Pittsfield Job DescriptionsiBerkshires.comNo ratings yet

- North Adams 40R Smart Growth Design StandardsDocument12 pagesNorth Adams 40R Smart Growth Design StandardsiBerkshires.comNo ratings yet

- Pittsfield Bike Lane Report 2022Document30 pagesPittsfield Bike Lane Report 2022iBerkshires.comNo ratings yet

- Dalton Drive-Thru Bylaw Final DraftDocument2 pagesDalton Drive-Thru Bylaw Final DraftiBerkshires.comNo ratings yet

- Pittsfield Cellular Telephone Co. v. Board of Health of The City of PittsfieldDocument10 pagesPittsfield Cellular Telephone Co. v. Board of Health of The City of PittsfieldiBerkshires.comNo ratings yet

- Citizens Civil Complaint Against Pittsfield, Cell TowerDocument65 pagesCitizens Civil Complaint Against Pittsfield, Cell ToweriBerkshires.comNo ratings yet

- Pittsfield Board of Health Masking DirectiveDocument2 pagesPittsfield Board of Health Masking DirectiveiBerkshires.comNo ratings yet

- FY 22 Tax Classification Hearing North AdamsDocument15 pagesFY 22 Tax Classification Hearing North AdamsiBerkshires.comNo ratings yet

- Pittsfield Election Results 2021Document7 pagesPittsfield Election Results 2021iBerkshires.comNo ratings yet

- North Adams FY2022 Budget ProposalDocument71 pagesNorth Adams FY2022 Budget ProposaliBerkshires.comNo ratings yet

- Pediatric Vaccine Info SheetDocument1 pagePediatric Vaccine Info SheetiBerkshires.comNo ratings yet

- Audit Report: Berkshire County Arc IncDocument41 pagesAudit Report: Berkshire County Arc InciBerkshires.comNo ratings yet

- Bernard Testimony To The Board of Elementary and Secondary EducationDocument4 pagesBernard Testimony To The Board of Elementary and Secondary EducationiBerkshires.comNo ratings yet

- North Adams School FY22 Budget PresentationDocument16 pagesNorth Adams School FY22 Budget PresentationiBerkshires.comNo ratings yet