Professional Documents

Culture Documents

GameStop Equity Research Report

Uploaded by

adib_motiwalaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

GameStop Equity Research Report

Uploaded by

adib_motiwalaCopyright:

Available Formats

GameStop Corp (NYSE: GME)

Recommendation Buy Company description:

Recent Price $19.22

Market Cap (millions) $3270 GameStop is the largest video game

Shares outstanding (millions) 164.7 retailer in the world and sells new and used

Average daily volume (millions) 5.57 video game software, hardware and

52 week range 17.12 – 32.82 accessories for video game systems from

Institutional ownership 95% Sony, Nintendo, and Microsoft. In addition,

Insider ownership 5% the company sells PC entertainment software,

Analyst coverage 18 and related accessories.

Fiscal year end Jan 31, 2010

Investment thesis

Merits:

• Largest video game retailer in

terms of sales and market share.

• Valuation is very cheap

• Business generates lot of FCF.

• Balance sheet is less levered than

the average retail company.

• Company has announced a $300

million stock buyback program.

Revenue (ttm) $9050 million

Net Income (ttm) $393.67 million

FCF /Share $2.4 Risks:

EPS (ttm) $2.35

BV / Share (ttm) $15.8 • Increased competition from big box

Total Assets $5036 million retailers will erode profit margins

Dividend - • Digital downloading / streaming of

Cash / LT Debt $292/ 447 million games

ROIC 17.9%

• Alternative platforms for gaming

ROE 17.3%

such as the Apple IPhone and

ROA 8.8%

Valuation social media such as FaceBook

P/E 7.84

P/FCF 8

Intrinsic value $29

Margin of Safety 33%

I am recommending a BUY for shares of GameStop. At around 8x FY2009E FCF, Gamestop (GME) is

priced extremely cheap compared to its retail peers and also compared to its historical valuation.

Gamestop is the largest video game retailer in the world that sells new and used video game software,

hardware and accessories for video game systems from Sony, Nintendo, and Microsoft. In addition,

the company sells PC entertainment software, related accessories and other merchandise. Gamestop

operates around 6400 stores in US, Canada, Australia and Europe. Gamestop is headquartered in

Grapevine, Texas. Gamestop also operates several e-commerce sites including gamestop.com and

publishes the Game Informer magazine that has about 3.5 million subscribers.

Gamestop shares are down more than 66% from its highs of $60 in Jan 2008. In fiscal 2008,

Gamestop revenues increased by 24% and eps increased by 36%. In the first three quarters of fiscal

2009, Gamestop SSS have been affected due to a variety of reasons from the economic conditions,

reduced consumer spending, fewer blockbuster games from game publishers, reduced spending on

hardware and tough comparisons with outstanding quarters in fiscal 2008. Despite this, Gamestop has

increased sales in the first and third quarters of fiscal 2009, has been profitable and continues to

generate FCF. Gamestop has paid down debt from $963 million at the end of FY2005 to about $450

million as of 3Q2009. GameStop has $292 million cash on the balance sheet and interest is well

covered at 13x.

Gamestop has four product categories - New video game hardware ( 21% of revenue, 5% gross

profit), new video game software (42%, 34%), used video game products (23%, 43%), accessories

and pc software (14%, 18%). Hardware sales have come under pressure in 2009 due to reduced

consumer spending as well as price cuts effected by Sony, Microsoft and Nintendo on their gaming

devices. The bright spot for Gamestop has always been its used video game category. Gamestop has

historically earned 45%-48% gross margins in its buy-sell business model. This segment has

continued to grow at close to 20% YoY even during 2008 and in 2009. The installed base of video

game hardware systems in the United States, based on original sales, totaled over 185 million units of

handheld and console video game systems. As this base keeps growing, there is an increasing demand

for games, both new and used games. This shift in product mix should help increase gross margins as

margins are much higher for new games and used products.

Industry: The market for video game products and PC entertainment software exceeded $45 billion in

2008 in places where GME operates. Out of the $22 billion market in the United States,$21.3 billion

was attributable to video game products, excluding sales of used video game products, and

approximately $700 million was attributable to PC entertainment software, $19.8 billion in Europe in

2008, Canada was approximately $2.1 billion, Australia approximately $1.9 billion. The Entertainment

Software Association (“ESA”) estimates that 65% of all American households play video or computer

games, 40% of all electronic game players are female.

Seasonal business: This business is seasonal and the company generates most of its income and free

cash flow in the holiday season of the 4th quarter. During Fiscal 2008, GME generated 40% of its sales

and about 56% of the operating earnings during the fourth quarter.

Store expansion: Gamestop has grown by opening new stores and acquisitions both in the US and

internationally. Its largest acquisition was EB Games in 2005 with about 2500 stores. In 2008, it

acquired Micromania, a 332 store company in France as well as acquisitions in Norway and

Newzealand. It paid for the acquisitions with cash on hand and FCF generated through the business.

Its largest operations outside the US are in Canada (325 stores), Australia (350 stores) and France

(332 stores). The company has been opening new stores both in the US and overseas and plans to

spend $200 million on opening new stores in 2010 and reserve another $100 million for acquisitions.

GameStop Corp. (GME) ---- Analyst : Adib Motiwala

The company has grown revenues from about $3 billion in 2005 to $8.8 billion in 2008, with store

count going from 4490 to 6207, eps increasing from $0.81 to $2.38 and FCF/share from $1.5 to $2.4

Customer loyalty program: Gamestop has a customer loyalty program via the ‘Edge’ card. By buying

an annual subscription to the Game Informer magazine, GameStop customers get the ‘Edge’ card. The

edge card gives customers 10% discounts on used games, used accessories and importantly a 10%

bonus trade credit when trading used games/ accessories in stores.

Prelaunch marketing: This is another aspect of GameStop stores that set it apart from the

competition. GameStop stores host events at midnight during game launches where gaming

enthusiasts get to play the new game before its official release, participate in contests.

GameStop’s unique reservation process, trade currency, exclusive content, and prelaunch marketing

increasingly drive the new game consumer to them as the preferred source for new titles. Vast

physical network for stores in US and overseas helps it drive deals from publishers and platform

owners.

What the bears are saying:

Digital downloads of games will make Gamestop irrelevant

Here is why these fears are blown out of proportion.

(1) Game availability: I visited a GameStop and BestBuy store and checked on the latest and best

selling games. These games (Call of Duty: Modern Warfare 2, Final Fantasy 13, God of War

III, Super Mario Galaxy II) are not available as a digital download.

(2) Game Storage: Most of these games are huge in terms of storage needs. They tend to be

anywhere from 10GB – 30GB in size. The typical hard drive on the current consoles is 64-

128GB, 256 GB is an exception. Hard drives come with their own set of issues such as stoage

limit, physical back up requirements, disk fragmentation, slow down.

(3) Internet Speeds: Even if the new games were available for download, consider the time it

would take to download such a huge game – anywhere from 30minutes to 3 hours, depending

on your internet connection. In many parts of the world, high speed broadband connections

are not so prevalent and they are expensive as well. ISPS usually charge for bandwidth usage.

Downloading large games can become very expensive in such countries. So, while its all good

to say digital downloads is the future, that trend is yet to play out and the infrastructure to

support it does not exist.

(4) The consumer mindset: With digital downloads, you get an activation key that makes the

game tied up to a specific console. You cannot then download it on your friends console when

you go to visit him. You cannot exchange/loan games to your friends. The game publishers are

trying to prevent piracy, but this works to the disadvantage to the consumer. A gamer would

much rather prefer to carry his collection of games to his friends’ house. Also, you cannot

possibly sell the digital games. So if a consumer bought a game he is not happy with after a

while, he is stuck with it and has lost $40-$50. Also, game rentals would be impossible.

(5) With the advent of online streaming movies and movie downloads, a similar argument has

been made in the past against NetFlix. However, DVDs are still popular and people rent them

from NetFlix and also use the Netflix streaming service. Similarly, Gamestop has made moves

towards digital distribution. It intends to expand its ecommerce sites in the countries it

operates in and integrate them closely with the physical operations. It also has acquired a

majority stake in Jolt Games who makes browser based games. Last I checked even though

downloading music on iTunes was ubiquitous, major booksellers and even Amazon are still

selling physical music CDs. Trends are not instantaneous as they are made out.

GameStop Corp. (GME) ---- Analyst : Adib Motiwala

OnLive Streaming Service

OnLive is a new cloud computing based on-demand game service that will launch in June 2010. The

concept of OnLive is gaming without consoles and games being stores on servers in the cloud. Games

would be accessed via a PC or Mac or using a hardware devices connected to a TV. This service could

potentially disrupt both the console makers and also retailers that sell the physical games. Monthly

subscription to access the service is set at $14.99. There will extra cost to rent / buy the games. The

service will be initially launched in the US market. This is yet another potential threat to GameStop,

but it has yet to be played out.

Competition from other big box retailers

Retailers such as Walmart and Best Buy have competed with GameStop in the new software and

hardware for a long time. Despite this Gamestop has continued to grow profitably and take market

Best Buy’s video game business was down 10.9% in the third quarter, the same quarter that

share.

GameStop announced video game sales were up 4% for new games and 19% for used games. In

3Q2009, their market share for new game software increased by 150bps over last year.

Competition in used segment

In recent quarters, Walmart and Bestbuy had initiated a pilot program where they placed in-store

kiosks that would accept pre-owned games from customers and give them store credit / cash. I spoke

to a BestBuy employee who said that the kiosk would hardly ever be noticed by customers and the

program was a total failure. There was no human element to this and he did not see how this would

be successful. The company that made these kiosks, e-Play LLC, has suspended operations as can be

seen from their website http://www.e-play.com/. Amazon also started a games trade-in program

where customers ship games to Amazon for free and get a gift card. The success of this is yet to be

seen. Gamestop’s customers typically sell their used games for store credit (that is valid in any

GameStop Store and never expires) and with that they usually purchase other new or used games.

There is a certain element of instant gratification in this transaction that is being ignored by the

analysts and media. Yes, some of the patient casual games could sell their games to Amazon or Ebay,

however the typical gaming enthusiast would like to get his hands on the next game. Also, there is a

certain science and expertise to the used game business that is grossly misunderstood. GameStop has

proprietary programs and processes in place that help them decide the price levels for the used

games, inventory and stocking at different stores based on demand. The company also operates

several refurbishment centers in major markets, where used games are reconditioned, tested and sent

back for sale to the stores. There is an entire infrastructure behind the success of the used game

segment that could be taken for granted. This business has grown at 15-20% for the last several

years for GameStop.

Competition from games on smart phones/ social media gaming

In recent times, gaming on smart phones especially on Apple’s IPhone has taken off. Smaller

publishers and big names such as EA have made games available for the IPhone. However, these

games sell for much less ($5-$10) compared to the $50-$60 for games sold on the consoles. Also, the

experience of playing games on these devices is much different than that on big screens. Also, it can

be argued that some consumers would be introduced to gaming via these devices and then they may

turn around and increase demand for console based games.

GameStop Corp. (GME) ---- Analyst : Adib Motiwala

CFO left the company after a very short stay

Catherine Smith who had been with the company for only six months resigned to take a position at

Walmart international. While that is a concern, at this point, there is nothing to indicate that this is

due to any accounting issues.

Gamestop is exposed to European macro factors

Gamestop has expanded aggressively into Europe and has increased store count from 25 (FY2004) to

1201 at the end of 2008. Sales have been increasing in Europe pretty well. One aspect where Europe

lags behind the mature US operations is in gross margins. Management is committed to deploying US

best practices such as hardware and software refurbishment, stock balancing, and inventory

management which will bring European used margins in line with the historical US performance.

Catalysts for value unlocking

Sheer value: GameStop shares trade at the lowest end of their historical valuation over the last 5

years. A lot of negativity and reduced earnings expectations are already priced into the share price.

On an EV / EBITDA basis, GameStop is priced cheaper than similar retailers at 4x versus 6x for

BestBuy and 5.6x for RadioShack. GameStop is traded at 7.6x FY2010E earnings versus 12x for

BestBuy and 11.35x for RadioShack. As sales and earnings recover, GameStop shares should

appreciate both from increased earnings and multiple expansion ( reversion to mean)

Gamestop is currently valued at a market cap of $3.17 billion and EV of $3.32 billion (based on

10/31/09 balance sheet). FCF in 2009 is expected to land somewhere between $400-$425 million, so

the current EV/FCF multiple is around 8.4x or P/FCF is around 8x. This means that if GameStop were

to merely maintain its current earn, with no growth whatsoever, investors could expect to achieve

returns of 13-15% per year. If I project FCF to grow by a very conservative 5% with a 12% discount

rate, I get an intrinsic value of $29. GameStop has grown FCF by a much higher rate historically. This

gives plenty of room for upside and a 33% margin of safety.

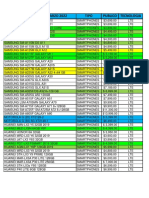

Company Gamestop BestBuy Walmart Radioshack Conns Average

Ticker GME BBY WMT RSH CONN

Trailing P/E 8 15.34 14.58 14 11.72 12.7

Forward P/E 7.36 12 12.36 11.8 15.91 11.9

P/FCF 8.0 29 17.60 17.40 18.0

P/S 0.36 0.34 0.5 0.67 0.17 0.4

P/B 1.40 2.98 2.9 2.72 0.46 2.1

EV/EBITDA 4.07 5.92 7.7 5.661 4.76 5.6

ROIC 17.9% 16% 13.66 12 7.3 6.7

ROE 17.3% 22 21.19 21.48 4.2 13.8

ROA 8.8% 6.37 8.96 9.9 5.22 6.1

Market Cap

($million) 3209.74 16770 205090 2860 161 45618.1

Operating Margins 7.3% 3.90% 5.87% 8.64% 4.78% 6%

Share buyback: Gamestop should generate about $400-$425 million in FCF in FY 2009. Along with

the $290 million cash on the balance sheet, the company should be able to buy back $300 million of

GameStop Corp. (GME) ---- Analyst : Adib Motiwala

stock. At today’s prices, it would be accretive to earnings by about $0.23 per share. This should

provide support to the stock and help drive it up.

Strong game lineup for 2010: Already 2010 has had an excellent line up of games released such as

Final Fantasy 13, Mass Effect 2, God of War III. There are several highly expected games lined up for

2010 that should help drive sales for both new and used games, which in turn helps increase margins

favorably for GameStop.

Free Cash Flow: FCF has grown from $57.7 million in 2001 to $366 million in 2008. This company has

consistently increased FCF despite growing store count and making acquisitions.

Easier comparisons against double digit industry declines: SSS for GameStop fell by 1.5%, 14.1% and

7.8% in the first three quarters of 2009 and with expectations of decline in SSS in the fourth quarter

as well. FY2010 should have easier comparisons with FY2009 and there is a solid game lineup which

was missing in 2009.

Improving economy: As the economic conditions improve further, it can only mean good news for

GameStop.

Conclusion:

Gamestop faces some challenges, but it is far from a broken model about to be made irrelevant in the

video game industry. The company generates ongoing positive FCF and has cash on the balance sheet

to buy back shares, fund future expansion and pay down debt. Analyst will remain negative or

cautious for so long as SSS do not recover and GameStop reports improved gross margins. Because a

true turn in the fundamentals may be more than 12 months away, that largely explains the

extraordinarily low valuation offered today of around 8x FCF. That said, if sales pick up due to the new

game lineup than currently anticipated, the turn in the stock could happen sooner than expected.

GameStop Corp. (GME) ---- Analyst : Adib Motiwala

You might also like

- DiamondDocument44 pagesDiamondmichaelkan1No ratings yet

- A Mathematical Analysis of Oregon Lottery Keno - 2017Document15 pagesA Mathematical Analysis of Oregon Lottery Keno - 2017Ned ThaiNo ratings yet

- Winning at BlackjackDocument13 pagesWinning at Blackjackvk1000No ratings yet

- How Do They Do It? Paper Bills Edition - Money Learning for Kids | Children's Growing Up & Facts of Life BooksFrom EverandHow Do They Do It? Paper Bills Edition - Money Learning for Kids | Children's Growing Up & Facts of Life BooksNo ratings yet

- Summary of Gambler: Secrets from a Life at Risk | A Guide To Billy Walters' BookFrom EverandSummary of Gambler: Secrets from a Life at Risk | A Guide To Billy Walters' BookNo ratings yet

- Mba802 Assignment - Betting Sa. FinalDocument16 pagesMba802 Assignment - Betting Sa. FinalSeun -nuga DanielNo ratings yet

- GameStop Acquisition ReportDocument15 pagesGameStop Acquisition ReportAlexander J. PompeeNo ratings yet

- 4Document2 pages4Гриша ВийNo ratings yet

- Money LeaksDocument16 pagesMoney LeaksAlan MatamorosNo ratings yet

- Membership of Credit Information Companies (CICs) by Co-Operative BanksDocument2 pagesMembership of Credit Information Companies (CICs) by Co-Operative Banksdeepu.srivasNo ratings yet

- Bitconnect Spreadsheet Compound Interest CalulatorDocument72 pagesBitconnect Spreadsheet Compound Interest CalulatorMuhammad Awal NewazNo ratings yet

- Standoff 2 Hack Generator Gold Money No Human VerificationDocument3 pagesStandoff 2 Hack Generator Gold Money No Human VerificationMark yozNo ratings yet

- 10ForeverStocks Growth 419Document13 pages10ForeverStocks Growth 419pkeschenatNo ratings yet

- Black Market Guns For SaleDocument8 pagesBlack Market Guns For SaleBobby MooreNo ratings yet

- Hammerlock Craps Best Online CasinoDocument134 pagesHammerlock Craps Best Online Casinogracia666gracia666No ratings yet

- p5 How Credit Cards Work 1Document4 pagesp5 How Credit Cards Work 1api-496312891No ratings yet

- Ideal Growth Hormonal Agent Pile Ideal Development Hormonal Agent Peptide PilehaetrDocument3 pagesIdeal Growth Hormonal Agent Pile Ideal Development Hormonal Agent Peptide Pilehaetrtrowelmuseum13No ratings yet

- Emeralde PMCCDocument49 pagesEmeralde PMCCsgdgtfNo ratings yet

- K32LCDDocument2 pagesK32LCDenachealexNo ratings yet

- Quantcast Top Million Websites November 2012Document16,667 pagesQuantcast Top Million Websites November 2012AmmoLand Shooting Sports NewsNo ratings yet

- United States v. Schlei, 122 F.3d 944, 11th Cir. (1997)Document79 pagesUnited States v. Schlei, 122 F.3d 944, 11th Cir. (1997)Scribd Government DocsNo ratings yet

- Casino CoinDocument8 pagesCasino Cointore giudiceNo ratings yet

- PayWave IssuerDocument18 pagesPayWave IssuerJagjeet AjmaniNo ratings yet

- Casino Players Profiling: A Conceptualization AttemptDocument7 pagesCasino Players Profiling: A Conceptualization Attemptapi-26125512100% (1)

- AAM - High 50 Dividend Strategy 2019-3QDocument4 pagesAAM - High 50 Dividend Strategy 2019-3Qag rNo ratings yet

- How Bitcoin Casinos WorkDocument2 pagesHow Bitcoin Casinos WorkAnonymous Bitcoin CasinosNo ratings yet

- Tax CardsDocument1 pageTax CardsZeeshan JaveedNo ratings yet

- GTA Online Money Making Tutorial BookDocument23 pagesGTA Online Money Making Tutorial BookAzam AfzalNo ratings yet

- Demystifying Slot Machines and Their Impact in The United States (Stewart, 2010) PDFDocument32 pagesDemystifying Slot Machines and Their Impact in The United States (Stewart, 2010) PDFLes WissmanNo ratings yet

- KSA Fines For Providing Online Gambling Services in The NetherlandsDocument3 pagesKSA Fines For Providing Online Gambling Services in The NetherlandsMark van WeerenNo ratings yet

- How To Reset A Windows Password With UbuntuDocument17 pagesHow To Reset A Windows Password With UbuntuBNo ratings yet

- BibDocument9 pagesBibapi-209902261No ratings yet

- Atm-Code 1Document7 pagesAtm-Code 1Robert GallanesNo ratings yet

- Introduction To The BIOS Setup ProgramDocument26 pagesIntroduction To The BIOS Setup ProgramkushaprakashNo ratings yet

- RFID0950 Elevator ID Card Manual: Core Lift Accessories Co.,LtdDocument8 pagesRFID0950 Elevator ID Card Manual: Core Lift Accessories Co.,LtdmohammedalathwaryNo ratings yet

- The 75 Skills Every Man Should MasterDocument11 pagesThe 75 Skills Every Man Should MasterrupertandturtleNo ratings yet

- Earth 2150 CheatsDocument3 pagesEarth 2150 CheatsKetapang TerengganuNo ratings yet

- Forged Prescriptions PDFDocument2 pagesForged Prescriptions PDFRahman Batteries BannuNo ratings yet

- Junk Vehicle Affidavit - Washington StateDocument2 pagesJunk Vehicle Affidavit - Washington StatePRMurphyNo ratings yet

- CryptoCasino 0day Exploit Make Big Cash in MinutesDocument1 pageCryptoCasino 0day Exploit Make Big Cash in MinutesXANAXMANENo ratings yet

- Zte Secret CodesDocument1 pageZte Secret CodesBaong TeaNo ratings yet

- Voucher GameDocument23 pagesVoucher GameRudy KawaiiNo ratings yet

- NFL & Walmart Sponsorship ProposalDocument26 pagesNFL & Walmart Sponsorship ProposalnazNo ratings yet

- Scrip Hack FreeBitcoin by BenenllirDocument1 pageScrip Hack FreeBitcoin by BenenllirBarbosa JhonnyNo ratings yet

- Bank Certified ListDocument196 pagesBank Certified ListFAZILAHMEDNo ratings yet

- Mortal Kombat IIDocument9 pagesMortal Kombat IIAchmad Bahtiar Rifa'i100% (1)

- Amazon Integration With OsCommerceDocument10 pagesAmazon Integration With OsCommercemmalam81No ratings yet

- Money Printing in 2020Document15 pagesMoney Printing in 2020Zerohedge100% (5)

- Bully Breeds by David Harris - Excerpts Re Rare Bulldog BreedsDocument7 pagesBully Breeds by David Harris - Excerpts Re Rare Bulldog BreedsWiksterNo ratings yet

- Standard Chartered: Credit CardsDocument26 pagesStandard Chartered: Credit CardsjaslikethatNo ratings yet

- Q1 2023 Cap Rate Report AYDocument4 pagesQ1 2023 Cap Rate Report AYKevin ParkerNo ratings yet

- Winning Roulette - Three Simple StepsDocument8 pagesWinning Roulette - Three Simple Stepssubmissions43810% (1)

- How To Use Volatility - v2Document65 pagesHow To Use Volatility - v2John SedoskiNo ratings yet

- Manual e - Operating (C5.x.x) 2.1Document61 pagesManual e - Operating (C5.x.x) 2.1daniel mainaNo ratings yet

- PKTGD 0005 PocketguideDocument37 pagesPKTGD 0005 PocketguideBianel PeraltaNo ratings yet

- BCC Bitconnect Lending PlanDocument8 pagesBCC Bitconnect Lending PlanJenny SharmaNo ratings yet

- Best Buy: Not The Best Buy in ChinaDocument31 pagesBest Buy: Not The Best Buy in ChinaHoa PhạmNo ratings yet

- Best Buy Analysts PresentationDocument55 pagesBest Buy Analysts PresentationMinnesota Public Radio100% (4)

- MPNsDocument68 pagesMPNsAyoub CrawloNo ratings yet

- Marca Modelo Fabricação ArmazenamentoDocument15 pagesMarca Modelo Fabricação ArmazenamentoAlan Marques AlvarengaNo ratings yet

- Samsung Mobile Rates 02-02-2021Document1 pageSamsung Mobile Rates 02-02-2021muhammad harabNo ratings yet

- Best Buy Case Report #2Document3 pagesBest Buy Case Report #2МенчеВучковаNo ratings yet

- OEM Model No. Name, Carrier If ApplicableDocument1 pageOEM Model No. Name, Carrier If ApplicableBala SubramaniamNo ratings yet

- Efas, Ifas, Sfas TableDocument3 pagesEfas, Ifas, Sfas TableMaida Jill Banua Mendez33% (3)

- SM-G935F Galaxy S7 EdgeDocument2 pagesSM-G935F Galaxy S7 EdgeJhonn arcila50% (2)

- Best Buy Case StudyDocument17 pagesBest Buy Case Studyyan86% (7)

- Brand AuthenticityDocument17 pagesBrand AuthenticitySuryaWigunaNo ratings yet

- Producto Stock Precio Sku: Emitido El: 20-12-2022, FATIMA CAMPOS, 0939991111Document4 pagesProducto Stock Precio Sku: Emitido El: 20-12-2022, FATIMA CAMPOS, 0939991111FatyCamposNo ratings yet

- Case Study 1Document2 pagesCase Study 1Bizuwork Simeneh100% (2)

- Unit II Best Buy Co Inc.Document12 pagesUnit II Best Buy Co Inc.Hạnh NguyễnNo ratings yet

- Situation Analysis (Best Buy)Document5 pagesSituation Analysis (Best Buy)Oksana ZhytnytskaNo ratings yet

- Samsung Galaxy s3 .م.حسن عفشDocument12 pagesSamsung Galaxy s3 .م.حسن عفشJridette WalidNo ratings yet

- Daily Cashier ReportDocument1 pageDaily Cashier ReportArif Wahyu KurniawanNo ratings yet

- Case Study SummaryDocument3 pagesCase Study Summary4 7No ratings yet

- Best Buy Case StudyDocument7 pagesBest Buy Case StudyDeyanelys NavarroNo ratings yet

- I BD 20130821Document45 pagesI BD 20130821cphanhuyNo ratings yet

- COMM 223 Team ProjectDocument14 pagesCOMM 223 Team ProjectAna100% (2)

- Progress Test 3Document7 pagesProgress Test 3tati_kiknaNo ratings yet

- Samsung Galaxy J3 SM-J320M (Dual Sim)Document7 pagesSamsung Galaxy J3 SM-J320M (Dual Sim)Reinald Alseco100% (1)

- w1s3 Angels and Devils Best BuyDocument11 pagesw1s3 Angels and Devils Best BuyYuvraj DuggalNo ratings yet

- Top 100 US Speciality RetailersDocument20 pagesTop 100 US Speciality RetailersRaymond Chong100% (5)

- Best Buy Financial AnalyisDocument11 pagesBest Buy Financial Analyiskrishy19s0% (1)

- The Stores Part Best BuyDocument13 pagesThe Stores Part Best Buyknights16No ratings yet

- Examples of FailuresDocument23 pagesExamples of FailuresgodthisisawfulNo ratings yet

- Final AssessmentDocument8 pagesFinal AssessmentPatricio CarrascoNo ratings yet

- Lista de Precios Payjoy 14 Marzo 2022Document1 pageLista de Precios Payjoy 14 Marzo 2022ESTRELLA FANYA SERRANO RAMIREZNo ratings yet