Professional Documents

Culture Documents

Euro-Expansion: Whither The Prospects?

Uploaded by

German Marshall Fund of the United StatesOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Euro-Expansion: Whither The Prospects?

Uploaded by

German Marshall Fund of the United StatesCopyright:

Available Formats

Economic Policy Program

September 2011

Summary: Euro-expansion is alive and well, despite widespread doubts about the future of the currency. For a small European country with an open economy dependent on trade with the big economies on the continent, it makes sense to have a currency peg and economic and monetary union with the rest of the continent. But to reap these greater rewards, candidate countries must become leaner and more efficient, by first implementing underlying structural reforms in their economies, which would put them on a path to greater convergence with the current eurozone economies.

Euro-Expansion: Whither the Prospects?

by Miguel Rodrigues

1744 R Street NW Washington, DC 20009 T 1 202 745 3950 F 1 202 265 1662 E info@gmfus.org

Euro-expansion is alive and well, despite widespread doubts about the future of the euro should contagion spread from Greece to Italy and Spain. This paper builds upon views expressed at a recent roundtable gathering of experts and embassy representatives held under the Chatham House rule at the German Marshall Fund. Public enthusiasm for joining the euro varies by region in Europe: The Baltic countries are euro-enthusiasts, inspired by Estonias successful adoption of the euro on January 1, 2011, and euro-accession remains a strategic goal for Latvia and Lithuania. For a small European country with an open economy dependent on trade with the big economies on the continent, it makes sense to have a currency peg and Economic and Monetary Union (EMU) with the rest of the continent, as this would eliminate currency risk, lower borrowing costs, and open up access to liquidity from the European Central Bank. But to reap these greater rewards, candidate countries must become leaner and more efficient, by first implementing underlying structural reforms in their economies, which would put them on a path to greater convergence with the current eurozone economies. The Eastern Europeans are required to adopt the euro under the terms

of the treaties governing their entry to the EU, but the treaties, while requiring that these countries meet the Maastricht convergence criteria, do not specify a deadline by which they must do so. Joining the euro would be a good thing, both for the current eurozone and the acceding countries. It would demonstrate that the dream of greater European unity is alive and well, and that the European project is capable of weathering adverse circumstances. It would expand the collective experience in good governance (in the case of the Baltics) to the current eurozone, and it would make Europe a larger, more competitive economy on the world stage. To successfully join the euro, however, it is critical for a country to keep its economic house in order. This is what the Baltic countries did in response to the East European financial crisis of 2008-09, when, during the sudden credit crunch following the excess capital inflows of the boom years, they reduced their budget deficits by 8-10 percent of GDP in 2009 by slashing wages and costs and tackling difficult health and educational sector reforms. The lack of liquidity available from abroad also spurred higher domestic savings in these countries. Their currency boards helped foster

Economic Policy Program

fiscal discipline and structural reform as the best way to tackle their budget deficits. The Baltic governments implemented austerity programs, and their publics went along with the shared sacrifice involved, viewing this as the cost of enjoying hard-fought freedoms in their now-sovereign, independent countries. Estonia, Latvia, and Lithuania thus consolidated and improved their public finances and public sector balance sheets. As a result, Estonia met all the Maastricht convergence criteria and was admitted to EMU on January 1, 2011. Lithuania is also doing quite well, having set euro-accession as its official goal for 2014. Its budget deficit is down to 2.8 percent of GDP from 5.3 percent in 2009, and it expects to continue meeting the 3 percent Maastricht budget deficit criterion in 2012. It has achieved these metrics by severe budgetary cuts to pensions and other outlays, and like Estonia and Latvia, is sustaining its public finances by implementing important reforms in the healthcare, pensions, and social security sectors. The Lithuanian finance ministry forecasts 5.8 percent growth for 2011 based on new export markets and growth in the manufacturing and service sectors, and this will surely strengthen the countrys fiscal position. Latvias progress was particularly impressive. It faced severe problems at the time of the financial crisis, with a total decline in GDP of 25 percent, and a current account deficit of 23 percent of GDP in 2007, which it turned into a surplus of 9.4 percent of GDP in 2009. However, in the larger Eastern European countries, such as Poland, the situation is somewhat more complex. During the financial crisis, Poland, with its floating exchange rate and inflation-targeting monetary policy, was the only Eastern European country to record positive growth in 2009. The Polish government, the current holder of the EU presidency, supports euro-accession, viewing the euro as an instrument to achieve greater European integration, but favors a less enthusiastic approach, as suggested by recent comments from government authorities. Poland considers the current crisis of the euro to be a byproduct of the difficulties associated with European integration, and is optimistic that the euro will survive the current turmoil and that Europe will be strengthened as a result. Buoyed along by GDP growth of 3.8 percent, which is forecast to increase to 4 percent this year, Polands public debt is at 55 percent of GDP, below the Maastricht threshold, and is expected to decline. Its path to the euro will not, however, be without challenges inflation is at 4.2 percent and the budget deficit, expected at 5-6 percent of GDP this year, is still above the 3 percent Maastricht cut-off. The Polish government hopes to decrease the budget deficit to 2.9 percent in 2012. Other large Eastern European countries, such as Hungary and the Czech Republic, are more or less in the same boat as Poland, but their positions and prospects vis-vis euro-accession lie beyond the scope of this paper. By their successful reforms and the hard choices they made during the financial crisis, the Baltic countries showed that the economic targets under the Maastricht criteria are achievable. Western European nations including Greece and Portugal need to embark on similar overdue reforms to their health sectors, state enterprises, and tax administrations. Indeed, for more than ten years, these countries have not played by the rules. Greece, for instance, was accepted to the euro even though its public debt at the time was only 95 percent of GDP, exceeding the Maastricht cutoff (the criterion requires that public debt should not surpass 60 percent of GDP). And Greece has hardly been the only offender within the eurozone Belgium and Italy entered with excessively high public debt levels, at 117 and 115 percent of GDP respectively. Germany in 2002-05 and France from 2002-04 exceeded the Maastricht budget deficit ceiling of 3 percent of GDP. In 2006, Lithuania was denied entry to the eurozone because its inflation rate was just 0.1 percentage point above the reference value, although in the same year, EMU members Portugal and Ireland both exceeded the Maastricht budget deficit ceiling of 3 percent of GDP. Greece has taken steps to rectify its situation, promising a fiscal adjustment of 6 percent of GDP a year, but many question whether this is enough. They suggest that Athens may need to take bolder steps, including more significant structural reforms than those currently proposed. This includes more cuts to public expenditure rather than increases in revenue intake to reduce its fiscal imbalance. Currently, the Greek ratio is 50/50. This is quite different from the Baltic countries example of a 75/25 ratio of cuts in expenses to revenue augmentation, a ratio recommended by experts for deficit reduction. Greeces actions have consequences for the decisions of other countries watching from the sidelines. Unless Greece and other crisis-

Economic Policy Program

plagued Western European countries continue to vigorously pursue serious reforms, Eastern European countries may be discouraged from pursuing euro-integration further or pursuing it actively, wondering why they should subject themselves to strict economic and fiscal discipline and take the Maastricht criteria seriously, as long as the current eurozone members do not adequately do so even though their economies may be in dire straits. Moreover, why should a country like Estonia feel obliged to pay the bill for the larger and more established countries missteps? And Estonia is hardly the only country that may feel this way Slovakia balked at participating in the first Greek bailout and Slovenia has taken a negative attitude as well. Sustainable growth of the eurozone requires structural reforms within the current member countries, particularly with respect to governance, and is being watched closely by potential candidates as they make decisions about how vigorously to pursue euro-accession. Real convergence is critical for candidate countries to achieve, even more so than is compliance with the Maastricht convergence criteria. For this, euro-aspirants need to first become full-fledged members of the EU and fully implement existing measures to enhance and deepen the single market. They must focus on implementing structural reforms and necessary legislation. And they must demonstrate that they can meet the Maastricht criteria over the long term, and show real convergence on issues of competitiveness. Only through real convergence will the new entrants become solid members of the eurozone. Finally, politicians should help shape public opinion in favor of the euro and not let swings in public opinion away from the euro deter them from their goal, or affect the commitment with which they pursue euro-integration. Too often politicians are put off from doing the right thing out of concern that their re-election may be endangered. But strong leaders pursue responsible policies, restore order to public finances, and promote real convergence, while at the same time making vigorous efforts to engage their publics on the rationale behind their policies, and bring them along on the benefits of joining the euro. It is entirely possible to do this and still get re-elected. Two examples come to mind. In Latvia, Prime Minister Dombrovskis was re-elected with an increased parliamentary majority for his coalition despite having implemented tough austerity measures during the East European Financial Crisis. And in Estonia, the government steadfastly pursued its goal of euro-accession although public opinion was well below 50 percent in favor and explained its rationale to the people along the way, with the result that public support in that country now exceeds 60 percent. Euro-accession is good for the euro as well as for Europe at a time of rising euro-skepticism and doubts about the longterm future of the euro, more Europe is needed, not less.

About the Author

Dr. Miguel Rodrigues is a visiting fellow at the German Marshall Fund on detail from the U.S. Department of State. The views expressed in this article are those of the author, and do not necessarily reflect those of the U.S. Department of State, the U.S. government, or the German Marshall Fund.

About GMF

The German Marshall Fund of the United States (GMF) is a non-partisan American public policy and grantmaking institution dedicated to promoting better understanding and cooperation between North America and Europe on transatlantic and global issues. GMF does this by supporting individuals and institutions working in the transatlantic sphere, by convening leaders and members of the policy and business communities, by contributing research and analysis on transatlantic topics, and by providing exchange opportunities to foster renewed commitment to the transatlantic relationship. In addition, GMF supports a number of initiatives to strengthen democracies. Founded in 1972 through a gift from Germany as a permanent memorial to Marshall Plan assistance, GMF maintains a strong presence on both sides of the Atlantic. In addition to its headquarters in Washington, DC, GMF has seven offices in Europe: Berlin, Paris, Brussels, Belgrade, Ankara, Bucharest, and Warsaw. GMF also has smaller representations in Bratislava, Turin, and Stockholm.

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Cooperation in The Midst of Crisis: Trilateral Approaches To Shared International ChallengesDocument34 pagesCooperation in The Midst of Crisis: Trilateral Approaches To Shared International ChallengesGerman Marshall Fund of the United StatesNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Russia's Military: On The Rise?Document31 pagesRussia's Military: On The Rise?German Marshall Fund of the United States100% (1)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- AKParty Response To Criticism: Reaction or Over-Reaction?Document4 pagesAKParty Response To Criticism: Reaction or Over-Reaction?German Marshall Fund of the United StatesNo ratings yet

- Seeing The Forest For The Trees: Why The Digital Single Market Matters For Transatlantic RelationsDocument36 pagesSeeing The Forest For The Trees: Why The Digital Single Market Matters For Transatlantic RelationsGerman Marshall Fund of the United StatesNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Russia's Long War On UkraineDocument22 pagesRussia's Long War On UkraineGerman Marshall Fund of the United States100% (1)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Plus Ça Change: Turkey and The Upcoming ElectionsDocument3 pagesPlus Ça Change: Turkey and The Upcoming ElectionsGerman Marshall Fund of the United StatesNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Atlantic Currents 2015: An Annual Report On Wider Atlantic Perspectives and PatternsDocument172 pagesAtlantic Currents 2015: An Annual Report On Wider Atlantic Perspectives and PatternsGerman Marshall Fund of the United StatesNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Turkish Perceptions Survey 2015Document17 pagesTurkish Perceptions Survey 2015German Marshall Fund of the United StatesNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Astm E53 98Document1 pageAstm E53 98park991018No ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Appendix - 5 (Under The Bye-Law No. 19 (B) )Document3 pagesAppendix - 5 (Under The Bye-Law No. 19 (B) )jytj1No ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- ACIS - Auditing Computer Information SystemDocument10 pagesACIS - Auditing Computer Information SystemErwin Labayog MedinaNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Getting StartedDocument45 pagesGetting StartedMuhammad Owais Bilal AwanNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- HRO (TOOLS 6-9) : Tool 6: My Family and My Career ChoicesDocument6 pagesHRO (TOOLS 6-9) : Tool 6: My Family and My Career ChoicesAkosi EtutsNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Fernando Salgado-Hernandez, A206 263 000 (BIA June 7, 2016)Document7 pagesFernando Salgado-Hernandez, A206 263 000 (BIA June 7, 2016)Immigrant & Refugee Appellate Center, LLCNo ratings yet

- Aircraftdesigngroup PDFDocument1 pageAircraftdesigngroup PDFsugiNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- EXTENDED PROJECT-Shoe - SalesDocument28 pagesEXTENDED PROJECT-Shoe - Salesrhea100% (5)

- Saet Work AnsDocument5 pagesSaet Work AnsSeanLejeeBajan89% (27)

- CodebreakerDocument3 pagesCodebreakerwarrenNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Building New Boxes WorkbookDocument8 pagesBuilding New Boxes Workbookakhileshkm786No ratings yet

- 3125 Vitalogic 4000 PDFDocument444 pages3125 Vitalogic 4000 PDFvlaimirNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- BMA Recital Hall Booking FormDocument2 pagesBMA Recital Hall Booking FormPaul Michael BakerNo ratings yet

- M J 1 MergedDocument269 pagesM J 1 MergedsanyaNo ratings yet

- SM Land Vs BCDADocument68 pagesSM Land Vs BCDAelobeniaNo ratings yet

- 30 Creative Activities For KidsDocument4 pages30 Creative Activities For KidsLaloGomezNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Guide For Overseas Applicants IRELAND PDFDocument29 pagesGuide For Overseas Applicants IRELAND PDFJasonLeeNo ratings yet

- Capital Expenditure DecisionDocument10 pagesCapital Expenditure DecisionRakesh GuptaNo ratings yet

- Arduino Based Voice Controlled Robot: Aditya Chaudhry, Manas Batra, Prakhar Gupta, Sahil Lamba, Suyash GuptaDocument3 pagesArduino Based Voice Controlled Robot: Aditya Chaudhry, Manas Batra, Prakhar Gupta, Sahil Lamba, Suyash Guptaabhishek kumarNo ratings yet

- Income Statement, Its Elements, Usefulness and LimitationsDocument5 pagesIncome Statement, Its Elements, Usefulness and LimitationsDipika tasfannum salamNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

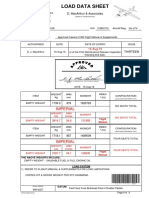

- Load Data Sheet: ImperialDocument3 pagesLoad Data Sheet: ImperialLaurean Cub BlankNo ratings yet

- Supergrowth PDFDocument9 pagesSupergrowth PDFXavier Alexen AseronNo ratings yet

- Mid Term Exam 1Document2 pagesMid Term Exam 1Anh0% (1)

- The Art of Blues SolosDocument51 pagesThe Art of Blues SolosEnrique Maldonado100% (8)

- Properties of Moist AirDocument11 pagesProperties of Moist AirKarthik HarithNo ratings yet

- Topic 4: Mental AccountingDocument13 pagesTopic 4: Mental AccountingHimanshi AryaNo ratings yet

- Urun Katalogu 4Document112 pagesUrun Katalogu 4Jose Luis AcevedoNo ratings yet

- My CoursesDocument108 pagesMy Coursesgyaniprasad49No ratings yet

- Assignment - 2: Fundamentals of Management Science For Built EnvironmentDocument23 pagesAssignment - 2: Fundamentals of Management Science For Built EnvironmentVarma LakkamrajuNo ratings yet

- Lockbox Br100 v1.22Document36 pagesLockbox Br100 v1.22Manoj BhogaleNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)