Professional Documents

Culture Documents

Sample Assessment Questions: Formative Activity: / Summative Assessment

Uploaded by

Eli_HuxOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Sample Assessment Questions: Formative Activity: / Summative Assessment

Uploaded by

Eli_HuxCopyright:

Available Formats

Junior Bookkeeper: Payroll and Monthly SARS Returns

Sample assessment questions

Formative Activity: / Summative Assessment

Introduction

As we have explained before, you need to complete THREE Formative Activities and TWO Formative Evaluation questions for inclusion in your PoE. At EDGE Learning Media, we believe that every learner that enrols for an ICB programme needs to know how he/she will be assessed. You will soon be tasked to complete Formative Activity 3 on the answer templates in your Activity Answer Book provided in your PoE. Remember that the solutions to the Formative Activities and Formative Evaluations will never be provided. It is for this reason that we provide you with a series of questions with solutions below that will adequately prepare you for these two assessments. Work through all of these sample assessment questions and solutions before you attempt the actual assessments for submission.

Topics covered

All the work covered during the course is examinable in the Summative Assessment paper. However, the most important topics to be covered in Formative Activity 3 and the Summative Assessment are: . VAT returns. This is covered in Learning Module 2. Multiple choice questions on Learning Module 8. No samples are included. Payroll calculations. This is covered in Learning Module 5. Accounting for payroll calculations. This is covered in Learning Module 6.

EDGE Learning Media CC 1

Junior Bookkeeper: Payroll and Monthly SARS Returns Sample Assessment Questions Formative Activity 3 & Summative Assessment

Sample assessment questions

Sample assessment question 1 (Topic: VAT returns)

Marge Simpson is the owner of Marge Magazine trading as The Magazine World. The business is a registered VAT vendor and accounts for VAT on the invoice basis. You have been supplied with the following information for the January/February 20.10 VAT period. Business information: Address: 56 Hill View Road, Benoni, Johannesburg, 1589 VAT number: 4895625894 VAT area code: 52 Tax period code: 02/10 SARS office telephone number: - 011 7896542 Business telephone number: - 011 8653521 Business fax number: - 011 8653522 Marge completes and pays all her VAT returns on the penultimate day for rendering returns/payments. She pays the return by cheque. Note: All amounts include VAT unless VAT is not applicable. Transactions with non-vendors are indicated with a *

EDGE Learning Media CC 2

Junior Bookkeeper: Payroll and Monthly SARS Returns Sample Assessment Questions Formative Activity 3 & Summative Assessment

Cheques issued:

Cheque no. 10 452 10 453 10 454 10 455 10 456 10 457 10 458 10 459 10 460 10 461 10 462 10 463 10 464 10 465 Particulars General store The SPAR Broll Property Group Southern Municipality Southern Municipality The Garage Waltons Cash SA Printers Entertainment world Bellkom SARS A. Venter Pete the Plumber Trading inventory Office refreshments Rent paid Licence for motor vehicle Property tax Amenities Diesel Postage and stationery (for business use) Wages Printing equipment Pool table for staff room Telephone VAT for November/December 20.8 Repayment to creditor Plumbing services* Allocation Amount ( R ) 10 556.00 211.12 4 855.76 316.68 131.95 475.02 591.14 306.12 12 667.20 36 946.00 11 611.60 1 583.40 3 377.92 5 911.36 522.60

Debits on the bank statement: Bank charges, R 240.40. Stop order for short term insurance on delivery vehicle, R 1 881.36. Interest on overdraft, R313.56. Credits on the bank statement: Receipt nos 1214 to 1356 for cash sales, R 80 225.60. Receipt from a debtor, A. Andrews, R 6 793.80.

EDGE Learning Media CC 3

Junior Bookkeeper: Payroll and Monthly SARS Returns Sample Assessment Questions Formative Activity 3 & Summative Assessment

Receipts not included above: On 14 January 20.10, an amount of R 13 195.00 was transferred from the U.S.A for goods, which were sold there. On 27 January 20.10, The Magazine World issued an original cash invoice for Editing fees, R 2 322.32. On 20 January 20.10 an old delivery vehicle was sold for cash, R 11 400.48. On 17 January 20.10 the business received an insurance payout on an accident damaged delivery vehicle, R 9 500.40 Other transactions Credit losses written off, R 209.04. Credit notes issued (on standard-rated goods previously sold), R 156.78. On 31 January 20.10, Marge Simpson passed a journal entry for interest on the overdue account of a debtor, A. Jones for R 263.90. On 19 January 20.10, Doctors Inc. purchased goods for R 3 483.48 on credit from The Magazine World. The amount was still outstanding on 25 February 20.10. Required: Calculate the total input and output VAT which Marge Simpson can claim or account for on the above mentioned transactions for January/February 20.10 and complete the VAT return for remittance provided in your answer book. Note: All amounts include VAT where applicable. Transactions with non-registered vendors are indicated with a *.

EDGE Learning Media CC 4

Junior Bookkeeper: Payroll and Monthly SARS Returns Sample Assessment Questions Formative Activity 3 & Summative Assessment

Proposed solution:

Calculation of input tax: Purchases (R 10 556.00 x 14/114) Purchases of inventory from a VAT vendor is a standard rated supply. Office refreshments - (Although this may have been purchased from a VAT vendor and VAT paid, it may not be regarded as VAT input because it is a non-allowable item) Rent paid (R 4 855.76 x 14/114) - This is a standard rated supply and will be deductible as VAT input if the invoice is a tax invoice. Licence for motor vehicle (This is an exempt supply) Property tax (Property taxes are a tax in themselves and therefore do not attract VAT and is therefore an Exempt supply) Amenities (R 475.02 x 14/114) Amenities such as water, refuge and electricity are standard rated supplies and therefore deductible if supplied by a registered VAT vendor Diesel (zero-rated supply) Postage and stationery (for business use) (R 306.12 x 14/114) A standard rated supply. Wages (not a supply of goods or services) Printing equipment (R 36 946.00 x 14/114) Printing equipment is a capital asset that will be used in the production of income and therefore VAT input may be claimed. Pool table for staff room (Although the pool table may have been supplied by a VAT vendor and thus VAT paid, it may not be deducted because the asset is not used in the production of income and is therefore a non-allowable item) Telephone (R 1 583.40 x 14/114) The telephone account is a standard rated supply. VAT for November/December 20.8 (not a supply of goods or services) This is a payment. No goods or services have been supplied. Repayment to creditor (not a supply of goods or services) This is a payment. No goods or services have been supplied. Remember: the business is registered on the invoice basis. Plumbing services (not a VAT vendor) Although an invoice for plumbing services would constitute a standard rated supply, the supplier of the service in this instance is not a registered VAT vendor and would thus not have supplied a tax invoice. Bank charges (R 240.40 x 14/114) Bank charges are a standard rated supply. The bank statement serves as the tax invoice. Stop order for short term insurance on delivery vehicle (R 1 881.36 x 14/114). Short term insurance premiums do constitute standard rated supplies and thus the business can claim VAT input. Interest on overdraft (All interest are VAT exempt supplies) Credit losses written off (R 209.04 x 14/114) Credit losses are a standard rated supply. Credit notes issued (R 156.78 x 14/114) Just as VAT output will be charged to a client on the sale of goods or services, so VAT input must be recorded upon the return of such goods or services. Total input VAT The sum of all the VAT input amounts. VAT input on VAT 201 Capital goods or services: Printing equipment. The VAT input on capital (asset) amounts is disclosed separately in Block 14 of the VAT 201. Other goods or services (R 1 296.35 + R 596.32 + R 58.34 + R 37.59 + R 194.45 + R 29.52 + R 231.04). This figure is included in block 15. Credit losses are disclosed separately in block 17 Other: Credit notes issued. The credit notes are also disclosed separately under other in block 18. The total VAT input amount is summed in block 19 R 4 537.23 2 443.61 25.67 19.25 R 7 025.76 VAT input R 1 296.35 0.00 596.32 0.00 0.00 58.34 0.00 37.59 0.00 4 537.23 0.00 194.45 0.00 0.00 0.00 29.52 231.04 0.00 25.67 19.25 R 7 025.76

EDGE Learning Media CC 5

Junior Bookkeeper: Payroll and Monthly SARS Returns Sample Assessment Questions Formative Activity 3 & Summative Assessment

Calculation of output tax: Cash sales (R 80 225.60 x 14/114) Sales of inventory by a VAT vendor are standard rated supplies. Exports (Goods or services sold in foreign countries are zero-rated supplies) Credit sales (R 3 483.48 x 14/114) When accounting for VAT on the invoice basis VAT output is charged when the tax invoice is issued and not when the amount owing is received. Receipt from a debtor (not a supply of goods or services) This is a receipt. VAT would have been recorded when the goods or services were sold and the tax invoice issued. Interest on overdue debtors account Interest is always a VAT exempt supply as it is regarded as a supply of financial services. Editing fees (R 2 322.32 x 14/114) This is a sale of services and therefore a standard rated supply. Old delivery vehicle (R 11 400.48 x 14/114) The purchase of the delivery vehicle would have resulted in a Vat input being paid, thus the sale of the capital asset must include VAT output. This is a standard rated supply. Insurance payout on an accident damaged delivery vehicle (R 9 500.40 x 14/114) Just as VAT input can be claimed on the short term insurance premiums, so VAT output is charged on a pay out from such insurance. Total output VAT The sum of all the VAT output amounts.

VAT output R 9 852.27 0.00 R 427.80 0.00 0.00 285.20 1 400.06 1 166.72 *R 13 132.05

VAT output on VAT 201 Standard rated supplies excl. capital goods (R 80 225.60 + R 3 483.48 + R 2 322.32) Block 1 must contain the VAT output on standard rated supplies excluding capital goods and/or services. The VAT on such supply is then inserted in block 4. Standard rated supplies on capital goods. The supply total for capital goods or services is included in block 1A and the VAT output on such supplies in included in block 4A. Adjustments: Insurance payout on an accident damaged delivery vehicle. Insurance payouts are disclosed separately under Other in block 12. The total VAT output amount is summed in block 13

Supply R 86 031.40 R 11 400.48 R 9 500.40

VAT R 10 565.26 R 1 400.06 R 1 166.72 *R 13 132.04

Total VAT payable (R 13 132.04 - R 7 025.76) This is the amount in block 20.

R 6 106.28

* Please note: Minor rounding errors will occur.

The completed VAT return is included on the following page:

EDGE Learning Media CC 6

Junior Bookkeeper: Payroll and Monthly SARS Returns Sample Assessment Questions Formative Activity 3 & Summative Assessment

EDGE Learning Media CC 7

Junior Bookkeeper: Payroll and Monthly SARS Returns Sample Assessment Questions Formative Activity 3 & Summative Assessment

Sample assessment question 2 (Topic: Payroll calculations)

You have been provided with the following information for HD Audio CC for the month of May 2010.

Taxable portion of travel allowance Taxable Taxable value of portion of company medical aid car R 0.00 ? R 0.00 R 0.00 R 0.00

May 2010 Oliver Stander Novak Oscar Charlie Bravo Echo Totals

Age 33 45 22 66 64 25 45

Salary R 5 820.00 R 32 011.00 R 17 461.00 R 20 371.00 R 6 693.00 R 6 693.00 R 7 275.00 R 96 324.00

Travel allowance R 1 164.00 R 8 003.00 R 0.00 R 3 667.00 R 0.00 n/a n/a R 12 834.00

Commission R 0.00 R 4 321.00 R 0.00 R 2 546.00 R 569.00 n/a n/a R 7 436.00

Pension fund deduction

PAYE/SDL remuneration

UIF remuneration

PAYE deduction

? ?

R 0.00

?

R 0.00 n/a n/a R 10 267.20

?

n/a n/a R3 728.07

? ? ? ?

n/a n/a R 2 805.19

? ? ? ? ?

n/a n/a R 6 176.72

? ? ? ? ? ? ?

R 114 383.74

? ? ? ? ? ? ?

R 61 432.43

? ? ? ? ? ? ?

R 23 585.26

Additional information: 1. The following tax sliding scale for individuals applied for the year ended 28 February 2011:

TAXABLE INCOME R 0 140 001 221 001 305 001 431 001 552 001 R 140 000 221 000 25 200 305 000 45 450 431 000 70 650 552 000 114 750 and over 160 730 + + + + + R 18% of every R1 25% of the amount over 30% of the amount over 35% of the amount over 38% of the amount over 40% of the amount over 140 000 221 000 305 000 431 000 552 000 RATES OF TAX R

EDGE Learning Media CC 8

Junior Bookkeeper: Payroll and Monthly SARS Returns Sample Assessment Questions Formative Activity 3 & Summative Assessment

2. 3. 4. 5. 6. 7. 8. 9. 10.

11.

Both Novak and Oscar receive a 13th cheque. The business smoothes the tax on the bonus throughout the year. Charlie has the full use of a company car. This car (a delivery vehicle) had cost the business R 170 000.00 (including VAT) when it was bought and allocated to him last year. Car allowances are taxed at 2.50% p.m. on cost. Permanent employees contribute 7.50% of their basic salary to the Old Pension Fund (13 th cheques are also pensionable). SA Trading CC contributes to the pension fund on a rand-for-rand basis. Bravo and Echo are part time employees that worked for 25 and 18 hours for the month respectively. Employees are not entitled to housing, cellphone or computer allowances. There are no independent contractors or employees on registered learnerships. Only 80.00% of the travel allowance is taxable Assume a maximum UIF funding salary of R 12 478.00. All permanent employees belong to the Strong Health Scheme, a registered medical scheme and have all provided adequate proof of membership to their employer. The company pays the whole contribution to the medical aid. The following tax concessions apply to medical fund contributions: R 670.00 for the sole member. R 670.00 for the first additional dependant. An additional R 410.00 is allowed as a deduction per additional dependant other than the first dependant. All contributions paid for an employee aged 65 or older are allowed as a deduction. The staff members have the following number of dependants and medical aid contributions:

Employee Oliver Stander Novak Oscar Charlie No. of dependants 1 2 1 4 0 Total monthly contribution paid to medical aid R 698.40 R 3 841.32 R 1 920.71 R 3 259.36 R 803.16

12.

The rebates allowed in the South African tax system are as follows for the 2010/2011 tax year: Primary rebate R 10 260.00 Secondary rebate R 5 675.00

Required: (a) (b) Complete the table provided in your answer book. Make use of the sliding scale schedule. Complete the abbreviated EMP201 in your answer book.

Note: Show all your calculations

EDGE Learning Media CC 9

Junior Bookkeeper: Payroll and Monthly SARS Returns Sample Assessment Questions Formative Activity 3 & Summative Assessment

Proposed solution:

(a)

May 2010 Oliver Stander Novak Oscar Charlie Bravo Echo Totals

Age 33 45 22 66 64 25 45

Salary R 5 820.00 R 32 011.00 R 17 461.00 R 20 371.00 R 6 693.00 R 6 693.00 R 7 275.00 R 96 324.00

Travel allowance R 1 164.00 R 8 003.00 R 0.00 R 3 667.00 R 0.00 n/a n/a R 12 834.00

Commission R 0.00 R 4 321.00 R 0.00 R 2 546.00 R 569.00 n/a n/a R 7 436.00

Taxable portion of travel allowance R 931.20 R 6 402.40 R 0.00 R 2 933.60 R 0.00 n/a n/a R 10 267.20

Taxable value of company car R 0.00 R 0.00 R 0.00 R 0.00 R 3 728.07 n/a n/a R 3 728.07

Taxable portion of medical aid R 0.00 R 2 091.32 R 580.71 R 0.00 R 133.16 n/a n/a R 2 805.19

Pension fund deduction R 436.50 R 2 400.83 R 1 309.58 R 1 527.83 R 501.98 n/a n/a R 6 176.72

PAYE/SDL remuneration R 6 314.70 R 42 424.89 R 16 732.13 R 24 322.77 R 10 621.25 R 6 693.00 R 7 275.00 R 114 383.74

UIF remuneration R 6 751.20 R 12 478.00 R 12 478.00 R 12 478.00 R 10 554.23 R 6 693.00 n/a R 61 432.43

PAYE deduction R 281.65 R 11 180.62 R 2 847.85 R 4 726.31 R 1 056.83 R 1 673.25 R 1 818.75 R 23 585.26

EDGE Learning Media CC 10

Junior Bookkeeper: Payroll and Monthly SARS Returns Sample Assessment Questions Formative Activity 3 & Summative Assessment

Calculations: 1. Calculation of monthly PAYE/SDL and UIF remuneration

Taxable portion of monthly travel allowance (60 %) (b) R 931.20 R 6 402.40 R 0.00 R 2 933.60 R 0.00 Monthly Monthly taxable Monthly value of portion of commission company car medical aid (c) fringe benefit fringe benefit (d) (e) R 0.00 R 4 321.00 R 0.00 R 2 546.00 R 569.00 R 7 436.00 R 0.00 R 0.00 R 0.00 R 0.00 R 3 728.07 R 3 728.07 R 0.00 R 2 091.32 R 580.71 R 0.00 R 133.16 R 2 805.19 Monthly Pension fund deduction (f) R 436.50 R 2 400.83 R 1 309.58 R 1 527.83 R 501.98 PAYE/SDL UIF remuneration remuneration (g) = (a) + (b) (h) = (g) - (c) + + (c) + (d) + (f) but limited (e) - (f) to R 12 478 R 6 314.70 R 42 424.89 R 16 732.13 R 24 322.77 R 10 621.25 R 6 693.00 R 7 275.00 R 6 751.20 R 12 478.00 R 12 478.00 R 12 478.00 R 10 554.23 R 6 693.00 n/a R 61 432.43

Employee

Age

Monthly salary (a)

Oliver Stander Novak Oscar Charlie Bravo Echo Totals

33 45 22 66 64 25 45

R 5 820.00 R 32 011.00 R 17 461.00 R 20 371.00 R 6 693.00 R 6 693.00 R 7 275.00

R 96 324.00 R 10 267.20

R 6 176.72 R 114 383.74

2.

Calculation of monthly PAYE deduction

Annual PAYE as per the sliding scale/flat rate before rebates (e) R 13 639.75 R 144 427.50 R 44 434.25 R 72 650.74 R 22 941.90 R 20 079.00 R 21 825.00 R 339 998.14

Employee

Monthly PAYE Annual bonus remuneration (b) (a) R 6 314.70 R 42 424.89 R 16 732.13 R 24 322.77 R 10 621.25 R 6 693.00 R 7 275.00 R 114 383.74 R 0.00 R 0.00 R 17 461.00 R 20 371.00 R 0.00 R 37 832.00

Pension on annual bonus (c) R 0.00 R 0.00 R 1 309.58 R 1 527.83 R 0.00 -

Annual taxable income (d) = (a) + (b) - (c) R 75 776.40 R 509 098.68 R 216 936.98 R 310 716.41 R 127 455.00 R 80 316.00 R 87 300.00

Total applicable rebates (f) R 10 260.00

Annual PAYE payable (g) = (e) - (f) R 3 379.75

Monthly PAYE deduction (h) = (g)/12 R 281.65 R 11 180.62 R 2 847.85 R 4 726.31 R 1 056.83 R 1 673.25 R 1 818.75 R 23 585.26

Oliver Stander Novak Oscar Charlie Bravo Echo Totals

R 10 260.00 R 134 167.50 R 10 260.00 R 15 935.00 R 10 260.00 R 34 174.25 R 56 715.74 R 12 681.90 R 20 079.00 R 21 825.00

R 2 837.41 R 1 407 599.47

R 56 975.00 R 283 023.14

EDGE Learning Media CC 11

Junior Bookkeeper: Payroll and Monthly SARS Returns Sample Assessment Questions Formative Activity 3 & Summative Assessment

(b)

Name of business: Return for: Submission date: Payment Details

Elite Traders CC May 2010 On or before 7 June 2010

EMP 201 "Extract" For illustrative purposes only

PAYE R Amounts payable 4 c R 23 585.26 5 R

SDL c R 1 143.84 R 6 c R 25 957.75 R

UIF c R 1 228.65

Control total (4 + 5 + 6 = 7)

EDGE Learning Media CC 12

Junior Bookkeeper: Payroll and Monthly SARS Returns Sample Assessment Questions Formative Activity 3 & Summative Assessment

Sample assessment question 3 (Topic: Accounting for payroll)

The information what follows relates to the salaried employees of SA Trading CC for the month of May 2010. Assume a maximum UIF funding salary of R 12 478.00. Ignore voluntary deductions. Assume that all payroll creditors were paid in full by EFT on 30 May 2010.

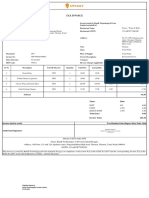

Salaries register of SA Trading CC - May 2010 Deductions Net salary UIF (324) Andrews (325) Burtram (326) Cool (327) Deawalt (328) Nkosi (329) Ndlovu (330) Pillay 7 872.00 32 674.00 22 545.00 24 536.00 7 413.00 6 832.00 7 426.00 109 298.00 69.34 124.78 124.78 124.78 107.79 n/a 74.26 625.73 PAYE 546.52 8 542.03 3 663.09 4 365.32 637.02 1 708.00 1 856.50 21 318.48 Pension fund 386.17 2 123.81 1 158.43 1 351.55 444.08 5 464.04 Total/ balance 1 002.03 10 790.62 4 946.30 5 841.65 1 188.89 1 708.00 1 930.76 27 408.25 6 869.97 21 883.38 17 598.70 18 694.35 6 224.11 5 124.00 5 495.24 Medical aid 712.92 3 920.88 1 960.42 3 326.88 819.84 Pension fund 386.17 2123.81 1158.43 1351.55 444.08 5 464.04 UIF 69.34 124.78 124.78 124.78 107.79 n/a 74.26 625.73

SR 5

Employers contributions SDL 72.91 327.21 208.52 231.93 109.16 68.32 74.26 1 092.31

Employee no. & name

Gross salary

81 889.75 10 740.94

Required:

Open, post to and balance the following accounts in the general ledger of SA Trading CC: EMP201 control (B7) Creditors for salaries (B8) Plong Pension Fund (B9) Fit Health Scheme (B10) Salaries expense (N8) Medical aid contributions (N9) UIF contributions (N10) SDL contributions (N11) Pension contributions (N12)

EDGE Learning Media CC 13

Junior Bookkeeper: Payroll and Monthly SARS Returns Sample Assessment Questions Formative Activity 3 & Summative Assessment

Proposed solution:

General ledger of SA Trading CC

EMP201 control Date 2010 May. 31 Bank CBP5 23 662.25 Details Fol. Amount Date 2010 May. 31 Salaries expense (UIF) Salaries expense (PAYE) UIF contributions SDL contributions 23 662.25 Details

B7 Fol. Amount

SR5 SR5 SR5 SR5

625.73 21 318.48 625.73 1 092.31 23 662.25

Creditors for salaries Date 2010 May. 31 Bank CBP5 81 889.75 Details Fol. Amount Date 2010 May. 31 Salaries expense Details

B8 Fol. Amount

SR5

81 889.75

Plong Pension Fund Date 2010 May. 31 Bank CBP5 10 928.08 Details Fol. Amount Date 2010 May. 31 Salaries expense Pension contributions 10 928.08 Details

B9 Fol. Amount

SR5 SR5

5 464.04 5 464.04 10 928.08

Fit Health Scheme Date 2010 May. 31 Bank CBP5 10 740.94 Details Fol. Amount Date 2010 May. 31 Medical aid contributions Details

B10 Fol. Amount

SR5

10 740.94

Salaries expense Date 2010 May. 31 Gross salaries SR5 109 298.00 Details Fol. Amount Date Details

N8 Fol. Amount

EDGE Learning Media CC 14

Junior Bookkeeper: Payroll and Monthly SARS Returns Sample Assessment Questions Formative Activity 3 & Summative Assessment

Medical aid contributions Date 2010 May. 31 Fit Health Scheme SR5 10 740.94 Details Fol. Amount Date Details

N9 Fol. Amount

UIF contributions Date 2009 Oct. 31 EMP201 control SR10 625.73 Details Fol. Amount Date Details

N10 Fol. Amount

SDL contributions Date 2010 May. 31 EMP201 control SR5 1 092.31 Details Fol. Amount Date Details

N11 Fol. Amount

Pension contributions Date 2010 May. 31 Plong Pension Fund SR5 5 464.04 Details Fol. Amount Date Details

N12 Fol. Amount

EDGE Learning Media CC 15

You might also like

- Yasmin MogahedDocument2 pagesYasmin MogahedAbs TroyNo ratings yet

- Unified Compliance Framework The Ultimate Step-By-Step GuideFrom EverandUnified Compliance Framework The Ultimate Step-By-Step GuideNo ratings yet

- Marketing Strategy For IslamicDocument16 pagesMarketing Strategy For IslamicTamim Arefi100% (1)

- COntingency TheoryDocument38 pagesCOntingency Theoryhhazlina66No ratings yet

- Report On Islamic Bank - FinalDocument52 pagesReport On Islamic Bank - FinalAli Huzaifa0% (1)

- Savings Groups: What Are They?Document64 pagesSavings Groups: What Are They?Jason WolfeNo ratings yet

- Villa College Degree ProgramsDocument33 pagesVilla College Degree ProgramsAmjeyoMaldives100% (1)

- Future of Islamic BankingDocument12 pagesFuture of Islamic BankingHammad AhmedNo ratings yet

- RKC Grade Report - CRKC7007 - Final Assessment (P373930)Document21 pagesRKC Grade Report - CRKC7007 - Final Assessment (P373930)Leena SalamNo ratings yet

- MurabahaDocument32 pagesMurabahagoodfriend123499No ratings yet

- In March 2010 MC Donald S Corp Announced A Policy ToDocument1 pageIn March 2010 MC Donald S Corp Announced A Policy Totrilocksp SinghNo ratings yet

- Financial Statement Analysis of ACI Ltd.Document34 pagesFinancial Statement Analysis of ACI Ltd.Saad60% (5)

- Career Goal Analysis and Action Plan-1-1Document9 pagesCareer Goal Analysis and Action Plan-1-1api-314537200No ratings yet

- Chapter 01 Long Term Investing and Financial DecisionsDocument30 pagesChapter 01 Long Term Investing and Financial DecisionsNida FatimaNo ratings yet

- Strategic Management Task 1Document31 pagesStrategic Management Task 1Niculescu IrinaNo ratings yet

- MNL Sim336 149082402Document32 pagesMNL Sim336 149082402Tuấn Chung100% (1)

- Innovation and Enterprise: Foundation Degree in Business and Management (Year 1)Document3 pagesInnovation and Enterprise: Foundation Degree in Business and Management (Year 1)Palak ShahNo ratings yet

- Business PlanDocument26 pagesBusiness PlanDinushka RajapakshaNo ratings yet

- V1 Submission Sheet Personal Leadership Development As A Strategic Manager Copy 2 (1) (1) .Docx - 1Document20 pagesV1 Submission Sheet Personal Leadership Development As A Strategic Manager Copy 2 (1) (1) .Docx - 1Saima AsadNo ratings yet

- Important Definations - Risk ManagmentDocument11 pagesImportant Definations - Risk ManagmentomerNo ratings yet

- Reason For Success of SeasonsDocument3 pagesReason For Success of SeasonsAamera Jiwaji100% (1)

- What Are The 5 Stages of Team DevelopmentDocument7 pagesWhat Are The 5 Stages of Team DevelopmentFelix GamQuiNo ratings yet

- Assignment On Business CommunicationDocument15 pagesAssignment On Business Communicationshilpi_kesarwani50% (2)

- Digital Financial InclusionDocument4 pagesDigital Financial InclusionCGAP PublicationsNo ratings yet

- Etchical Threat ACCA f8Document2 pagesEtchical Threat ACCA f8tiyasNo ratings yet

- Business Communication Class Notes PDFDocument36 pagesBusiness Communication Class Notes PDFMridul Thakur100% (1)

- Complete Gap Analysis Report ExampleDocument42 pagesComplete Gap Analysis Report ExampleflorenciaNo ratings yet

- Presentation On Asian Development Bank (ADB) : Prepared BYDocument7 pagesPresentation On Asian Development Bank (ADB) : Prepared BYRahul DeyNo ratings yet

- Poverty of The Soul by Yasmin MogahedDocument2 pagesPoverty of The Soul by Yasmin MogahedEmina Ceca MujčićNo ratings yet

- Human Resourse ManagementDocument30 pagesHuman Resourse ManagementAbbasNo ratings yet

- The Role of Integrity in Individual and Effective Corporate LeadershipDocument7 pagesThe Role of Integrity in Individual and Effective Corporate LeadershipBalqis NabilahNo ratings yet

- Hallmarks of Scientific InvestigationDocument23 pagesHallmarks of Scientific InvestigationSaad Bin Tariq100% (2)

- SIBL Internship ReportDocument78 pagesSIBL Internship ReportShuvo Taufiq AhmedNo ratings yet

- BUSI1475 Contemporary Issues in Managementpartner Course Handbook 2016-17 FTDocument19 pagesBUSI1475 Contemporary Issues in Managementpartner Course Handbook 2016-17 FTJamie LucasNo ratings yet

- UN Stress Management BookletDocument45 pagesUN Stress Management BookletHayat Ur Rehman Khan100% (1)

- Ethics and Business For FinalDocument162 pagesEthics and Business For FinalSazzad ShahriarNo ratings yet

- Conflict ManagementDocument30 pagesConflict Managementpatrick wafula100% (1)

- Research Based QuestionsDocument6 pagesResearch Based QuestionsshahzadkhanafridiNo ratings yet

- WhitePaper CRM PsDocument16 pagesWhitePaper CRM PsalexNo ratings yet

- Philps Curve of BangladeshDocument27 pagesPhilps Curve of BangladeshMd Azizul HaqueNo ratings yet

- Suzanne Assignment Part 1 Task 1 Last Edit 1Document20 pagesSuzanne Assignment Part 1 Task 1 Last Edit 1api-590858093No ratings yet

- Textbook Chapter 1 Strategic Management EssentialsDocument36 pagesTextbook Chapter 1 Strategic Management EssentialsNhân PhongNo ratings yet

- Executive SummaryDocument22 pagesExecutive SummaryHabibur RahmanNo ratings yet

- BBI2424 SCL WORKSHEET 2 (WEEK 3-4) - CITATION & - REFERENCING CONVENTIONSDocument4 pagesBBI2424 SCL WORKSHEET 2 (WEEK 3-4) - CITATION & - REFERENCING CONVENTIONSRon ChongNo ratings yet

- Challenges of International Financial ManagementDocument17 pagesChallenges of International Financial ManagementAkash Gowda C KNo ratings yet

- Questionnaire A. Personal InformationDocument6 pagesQuestionnaire A. Personal Informationmanisha manuNo ratings yet

- Missed Out: The Role of Local Actors in The Humanitarian Response in The South Sudan ConflictDocument40 pagesMissed Out: The Role of Local Actors in The Humanitarian Response in The South Sudan ConflictOxfamNo ratings yet

- Final Term MADS 6601 Financial AdministrationDocument81 pagesFinal Term MADS 6601 Financial AdministrationPavan Kumar VadlamaniNo ratings yet

- An Entrepreneur Is A Person Who Has Possession of A New EnterpriseDocument12 pagesAn Entrepreneur Is A Person Who Has Possession of A New EnterpriseJose ThomasNo ratings yet

- Bba Question PapersDocument48 pagesBba Question Papersdevilrestored64% (14)

- A Framework For Strategic Sustainable DevelopmentDocument15 pagesA Framework For Strategic Sustainable Developmentvietatula100% (1)

- Overview of Islamic Financial SystemDocument11 pagesOverview of Islamic Financial SystemRyuzanna JubaidiNo ratings yet

- Corporate Social Responsibility of Standard Chartered BankDocument31 pagesCorporate Social Responsibility of Standard Chartered BankAhmed Faizan100% (4)

- Project Report - Banking CrisisDocument10 pagesProject Report - Banking CrisisSagarika SadiNo ratings yet

- Company Services ProfileDocument14 pagesCompany Services ProfilempdharmadhikariNo ratings yet

- Comparative Study On Performance of Islamic Banks and Conventional Banks: Evidence From OmanDocument7 pagesComparative Study On Performance of Islamic Banks and Conventional Banks: Evidence From OmanAbdullah SiddiqNo ratings yet

- TallyDocument38 pagesTallyDhananjay RokadeNo ratings yet

- SAP HANA Calculation ViewDocument3 pagesSAP HANA Calculation ViewEli_HuxNo ratings yet

- Learn The Essentials of DebuggingDocument4 pagesLearn The Essentials of DebuggingEli_HuxNo ratings yet

- Introduction To SAP HANA Database-For BeginnersDocument3 pagesIntroduction To SAP HANA Database-For BeginnersEli_HuxNo ratings yet

- IBM Rational Rose: Make Your Vision RealityDocument8 pagesIBM Rational Rose: Make Your Vision RealityOscarBuNo ratings yet

- C TAW12 731 Sample QuestionsDocument5 pagesC TAW12 731 Sample QuestionsVic VegaNo ratings yet

- C BOBIP 40 Sample QuestionsDocument5 pagesC BOBIP 40 Sample QuestionsMuralidhar MuppaneniNo ratings yet

- Sample Questions C AUDSEC 731Document5 pagesSample Questions C AUDSEC 731Eli_HuxNo ratings yet

- P SOA EA 70 Sample ItemsDocument4 pagesP SOA EA 70 Sample ItemsEli_HuxNo ratings yet

- Sap Abap BasicsDocument9 pagesSap Abap BasicsErshad ShaikNo ratings yet

- C BobipDocument4 pagesC BobipEli_HuxNo ratings yet

- Sample Questions C DS 41Document5 pagesSample Questions C DS 41Eli_HuxNo ratings yet

- Boc330 en Col91 FV Part LTRDocument124 pagesBoc330 en Col91 FV Part LTRamondaca100% (1)

- Sabsa Matrix 2009Document1 pageSabsa Matrix 2009Eli_HuxNo ratings yet

- C BOBIP 40 Sample QuestionsDocument5 pagesC BOBIP 40 Sample QuestionsMuralidhar MuppaneniNo ratings yet

- Sample Questions C DS 41Document5 pagesSample Questions C DS 41Eli_HuxNo ratings yet

- Data Modeler Tutor I ADocument5 pagesData Modeler Tutor I AEli_HuxNo ratings yet

- Application Server For DevelopersDocument15 pagesApplication Server For DevelopersEli_HuxNo ratings yet

- The Awesome Notes Tax On RC, NRC, RaDocument8 pagesThe Awesome Notes Tax On RC, NRC, RaMay Anne NangleganNo ratings yet

- Income From Business and ProfessionDocument24 pagesIncome From Business and ProfessionTaher JamilNo ratings yet

- Income Taxation Module Compilation FinalsDocument107 pagesIncome Taxation Module Compilation FinalsJasmine CardinalNo ratings yet

- Bills of Exchange ProjectDocument7 pagesBills of Exchange ProjectNishaTambe100% (1)

- PB Enterprise - Main Page 99000000000Document2 pagesPB Enterprise - Main Page 99000000000Zarif Ahmed AnikNo ratings yet

- Missioner vs. Javier 199 SCRA 824Document4 pagesMissioner vs. Javier 199 SCRA 824Lord AumarNo ratings yet

- Nashik CorrectDocument8 pagesNashik Correctrompal decorationNo ratings yet

- 20 - 22 September 2007. Chennai, India.: The 6th EditionDocument10 pages20 - 22 September 2007. Chennai, India.: The 6th EditionkavenindiaNo ratings yet

- Account Statement PDFDocument12 pagesAccount Statement PDFBull's EyeNo ratings yet

- Bir Form 2307Document8 pagesBir Form 2307Alex CalannoNo ratings yet

- Registration Form: Cspa@colburnschool - EduDocument3 pagesRegistration Form: Cspa@colburnschool - EduSean YanNo ratings yet

- Sage Payroll CSV TemplatesDocument50 pagesSage Payroll CSV TemplatesJosh Moore33% (3)

- Handnotes SelfStudy Guid Report PDFDocument15 pagesHandnotes SelfStudy Guid Report PDFPankaj S ChandelNo ratings yet

- 3 Key Features of The GICC Protocol - American ExpressDocument232 pages3 Key Features of The GICC Protocol - American Expressvanitha gunasekaranNo ratings yet

- Estmt - 2023 10 19Document6 pagesEstmt - 2023 10 19lansingj48No ratings yet

- 캐나다 CLC 토론토 CLC - reg - formDocument2 pages캐나다 CLC 토론토 CLC - reg - formJoins 세계유학No ratings yet

- Corporate Tax in DubaiDocument10 pagesCorporate Tax in DubaishayanNo ratings yet

- Villanueva V City of IloiloDocument1 pageVillanueva V City of IloilorobbyNo ratings yet

- 10.20.22 Letter Gretchen Sierra CTC PRDocument2 pages10.20.22 Letter Gretchen Sierra CTC PRMetro Puerto RicoNo ratings yet

- Residential-Agricultural Discount ProgramDocument2 pagesResidential-Agricultural Discount ProgramSean MagersNo ratings yet

- January 2024 PayslipDocument1 pageJanuary 2024 PayslipSilas AnkorahNo ratings yet

- Doing Business in The UkDocument20 pagesDoing Business in The UkMalena BerardiNo ratings yet

- StatementOfAccount 6354576294 02012024 172901Document5 pagesStatementOfAccount 6354576294 02012024 172901sugumarNo ratings yet

- PreviewDocument5 pagesPreviewFaz AliNo ratings yet

- G.R. NO. 190102 ACCENTURE, INC., Petitioner,: PrincipleDocument3 pagesG.R. NO. 190102 ACCENTURE, INC., Petitioner,: PrincipleEmmanuel BurcerNo ratings yet

- CIR v. PAL (Ortega)Document5 pagesCIR v. PAL (Ortega)Peter Joshua OrtegaNo ratings yet

- DIGEST - CIR v. Cebu Toyo CorporationDocument4 pagesDIGEST - CIR v. Cebu Toyo CorporationAgatha ApolinarioNo ratings yet

- Taco 0067596020700018Document1 pageTaco 0067596020700018Meera CompanyNo ratings yet

- Taxation Review Final Income TaxDocument4 pagesTaxation Review Final Income TaxGendyBocoNo ratings yet

- Deferred Compensation OutlineDocument45 pagesDeferred Compensation OutlineEli ColmeneroNo ratings yet