Professional Documents

Culture Documents

The Comp Part 1 Payphones Application - ABR

Uploaded by

Mark GoldbergOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The Comp Part 1 Payphones Application - ABR

Uploaded by

Mark GoldbergCopyright:

Available Formats

ABRIDGED

BEFORE THE CANADIAN RADIO-TELEVISION AND TELECOMMUNICATIONS COMMISSION

IN THE MATTER OF AN APPLICATION BY BELL ALIANT REGIONAL COMMUNICATIONS, LIMITED PARTNERSHIP, BELL CANADA AND TLBEC, SOCIT EN COMMANDITE PURSUANT TO PART 1 OF THE CANADIAN RADIO-TELEVISION AND TELECOMMUNICATIONS COMMISSION RULES OF PRACTICE AND PROCEDURE AND SECTIONS 25 AND 27.1 OF THE TELECOMMUNICATIONS ACT

PAY TELEPHONE RATE INCREASE

17 JANUARY 2012

ABRIDGED Table of Contents Page

ABRIDGED 1.0 INTRODUCTION

1.

Pursuant to Part 1 of the CRTC Telecommunications Rules of Practice and

Procedure and in light of Order Issuing a Direction to the CRTC on Implementing the Canadian Telecommunications Policy Objectives, P.C. 2006-1534, 14 December 2006 (the Policy Direction), Bell Aliant Regional Communications, Limited Partnership (Bell Aliant), Bell Canada and Tlbec, Socit en commandite (Tlbec) (collectively, the Companies) submit this Application requesting that the Commission grant them the flexibility to increase their pay telephone (payphone) rates up to a maximum of $1.00 for each originating local call that is paid with coins deposited in the payphone coin collecting device (local cash calls) and to increase the rate up to a maximum of $2.00 for each originating local call that is paid using an authorized cash card or an authorized debit card of an approved institution or organization, (local non-cash calls).

2.

The Companies seek increased flexibility to experiment with different rates for

payphone calls in order to determine the appropriate rate levels that will permit them to recover the costs associated with upgrading their payphones to handle the new coins that will be introduced in early 2012 as a result of the Government of Canada's currency modernization plan, as well as to ensure payphone profitability and availability in the future. The new one dollar coins will have different characteristics than the current ones and so will not be recognized by the current coin validation systems. Permitting the Companies to recover the costs associated with upgrading their payphones to accept the new one dollar coin through rate increases for local payphone calls will also assist the Companies in slowing down the decommissioning of payphones, as profitability will be more likely. Such reliance on market forces is consistent with the Policy Objectives of the Telecommunications Act (the Act) as well as with the Policy Direction.

3.

Pursuant to section 39 of the Act, certain information in this Application is being

provided in confidence to the Commission. Release of this information on the public record would allow existing and potential competitors to formulate more effective business plans and marketing strategies based on the Companies' usage data following a rate change. Such disclosure would therefore prejudice the Companies' competitive position

-2-

ABRIDGED

and cause specific direct harm to the Companies. An abridged version is provided for the public record.

4.

All data that follows is based on Bell Canada and Bell Aliant data in Ontario and

Qubec (Central Region); however, similar occurrences and results can reasonably be expected in Bell Aliants Atlantic Region and for Tlbec. 2.0 PAYPHONE USE IS IN DECLINE

5.

In Telecom Decision CRTC 2007-27, Price cap framework for large incumbent The Commission recognized that payphone rates had not

local exchange carriers (Decision 2007-27) the Commission considered pricing issues related to payphones. increased for most ILECs for almost 25 years and approved "the flexibility for all ILECs to increase the local call charge for a cash call up to a maximum rate of $0.50, and to increase collect, third number, Calling Card or commercial credit card charges up to a maximum rate of $1.00."1 The Commission also reaffirmed its findings in Telecom Decision CRTC 2004-47, Access to Payphone Service (Decision 2004-47) and accurately noted that a lack of rate flexibility could lead to further payphone removals: In Decision 2004-47, the Commission re-affirmed the ILEC's right to remove and/or relocate pay telephones, with the only restriction being proper notification when the last pay telephone in a community was to be removed. The Commission continues to consider pay telephone service a necessary and valuable public service. The Commission considers that without the flexibility to increase pay telephone rates, the ILECs may remove unprofitable pay telephones which would result in consumers having reduced access to the service.2 [Emphasis added]

6.

Indeed, payphone usage has been on a steady decline for several years as a

result of increased substitution from wireless phones. Consequently, declining profitability related to payphone usage has left the Companies with no choice but to decommission payphones. In 2011, the average cost for Bell Canada and Bell Aliant (Central Region) to keep one payphone in service was #. The average revenue made on each #, as demonstrated in payphone after expenses, but before income tax, depreciation and amortization was #. The average annual revenue decline of approximately Figure 1 below, adds pressure to the revenue forecast for 2012 and beyond.

1 2

Decision 2007-27, paragraph 114. Ibid., paragraph 113.

-3-

ABRIDGED

# Filed in confidence with the CRTC. Figure 1: Declining Local Call Revenues in Ontario and Qubec #

7.

At present, approximately

# of the

# payphones in operation in

Ontario and Qubec only generate enough revenue just to cover the cost of ensuring they have a dial tone (the line cost). These payphones do not generate sufficient revenue to cover other costs like those associated with repairs, cash collection, booth cleaning, directory placement, backbone network costs or vandalism clean-up. As a result, these payphones are essentially being subsidized by the rest of the payphone base. Consequently, many, if not all, of these phones will be subject to removal based on their negative contribution. 3.0 CURRENCY MODERNIZATION AND THE NEW ONE DOLLAR COINS

8.

In its 2010 Budget announcement, and affirmed in the 2011 Budget

announcement,3 the Government of Canada announced that it would be modernizing Canada's currency and, in so doing, that the Royal Canadian Mint (the Mint) would be changing the composition and characteristics of one dollar and two dollar coins. The new "multi-ply plated steel" coins are expected to be launched into the marketplace at the

3

Government of Canada, Canada's Economic Action Plan Year 2, Budget 2010: Leading the Way on Jobs and Growth, 4 March 2010 at page 117 http://www.budget.gc.ca/2010/pdf/budget-planbudgetaire-eng.pdf and Modernizing Canada's Currency (Budget 2011) http://actionplan.gc.ca/initiatives/eng/index.asp?mode=2&initiativeID=225.

-4-

ABRIDGED

beginning of 2012, pending final sign-off from the Treasury Board, which the Companies understand is imminent.

# Filed in confidence with the CRTC.

9.

As a result of this currency modernization plan, the Companies will have to incur

significant capital expenditures to upgrade their payphones to ensure that their coin validation systems will recognize and accept the new one dollar coins, as these coins will be lighter and will have different characteristics than the one dollar coins currently in circulation.

10.

In 2011, approximately

# one dollar coins were collected from # of the total cash collected by the

payphones, an amount that translates to roughly

Companies for all cash calls. In fact, at least 95% of local calls are paid for using coins, and without the ability for the Companies' payphones to accept the new one dollar coins when these coins are put into circulation, many payphone users already accustomed to using one dollar coins in payphones will not be able to do so. Not only will this result in customer frustration, but it will also mean reduced payphone revenues and increased call volumes to the operator and the repair service numbers, for which the Companies do not receive compensation.

11.

As indicated above, Bell Canada and Bell Aliant (Central Region) have # payphones in service across Ontario and Qubec. Significant capital

approximately expenditures are required to upgrade the Companies' payphones to ensure that these phones can accommodate the new one dollar coins. Specifically, it is estimated that the upgrades will #, which is approximately and second years and cost approximately # for the first # per payphone. These upgrades are likely to

take 30 to 36 months to roll out, with anticipated expenditures of

# for the third year of the roll-out. The upgrades will

require technicians to visit each payphone and perform the software upgrade. During the upgrade period, the Companies will also need to provide additional customer support through operator and repair line services to answer questions regarding any rejections of the new coins. The costs associated with the provision of these services to address

-5-

ABRIDGED

customer complaints and feedback are not included in the above cost estimate and are not recouped by the Companies through any additional charges; however, the Companies anticipate #

12.

that

these

costs #.

could

potentially

In time, without increased profitability, or on the other hand decreased negative # to # payphones face

contributions, it is anticipated that at least an additional expenditures # Filed in confidence with the CRTC.

decommissioning in this territory in response to declining usage and the increased

associated with the necessary payphone upgrades. Figure 2 demonstrates the foreseeable decommissioning of payphones by contrasting what is projected to occur through natural attrition compared to the proactive removal of payphones in response to the inability to recover the expenditures required to upgrade the payphone validators so that they all accept the new one dollar coin. Figure 2: Actual and Projected Decommissions #

4.0 FLEXIBILITY IS NEEDED

13.

The Companies require additional flexibility to increase the payphone rates for

both local cash calls and local non-cash calls up to a maximum of $1.00 and $2.00, respectively. Rate increases within this range would help offset the expenditures required to accommodate consumers who wish to pay for their calls using cash, and more specifically one dollar coins.

-6-

ABRIDGED

14.

While the flexibility for rate increases is being sought in order to permit the

Companies to recover some or all of the cost associated with the necessary modifications to payphones to handle the use of the new one dollar coin for local calls, the Companies are asking for the flexibility to increase the rates for both cash and non-cash local calls. This would enable the Companies to continue to maintain a rate differential for local calls placed using alternate payment methods which is a differential that exists today as well. Maintaining this rate differential is an accepted practice that the Commission itself had endorsed in various prior decisions, such as Decision 2007-27, at paragraph 114, where it approved the flexibility for all ILECs to increase the local call rate for cash calls up to a maximum rate of $0.50 and the local call rate for the non-cash options up to a maximum of $1.00. # Filed in confidence with the CRTC.

15.

As discussed in section 2.0, the number of local cash calls made on a monthly #, as demonstrated

basis continues to decline at an annual rate of approximately

below in Figure 3. However, there is correspondingly little incentive to increase rates except for the purpose of offsetting the expense to update payphones and only to the extent that the market will bear an incremental increase. Figure 3: Payphone Usage Chart for Local Cash Calls4

#

4

Charting for non-cash calls would demonstrate very similar declines.

-716.

ABRIDGED

Figure 3 shows that the number of local cash calls made on a monthly basis #. A dramatic drop in calls is

continues to decline, at an annual rate of approximately

evident in mid-2007 when the rate per local cash call went from $0.25 to $0.50. This drop in usage demonstrates that it is not necessarily in the best interest of the Companies to apply a 100% rate increase, but it may (or may not) be enough to increase rates from, for example, $0.50 to $0.60 per local cash call. The Companies do not want to witness another sharp decline in usage relating to rate increases like that seen in 2007 and so require flexibility in payphone rate setting, within the bounds identified in this Application, to experiment and determine the optimal rates. As a result, the Companies hope to minimize incentives, for the Companies and for payphone location providers, to remove payphones.

# Filed in confidence with the CRTC.

17.

Nevertheless, as noted by the Commission in Decision 2007-106, most

payphone rates are already at $0.50 for cash calls and $1.00 for non-cash calls, the maximum levels permitted by the Commission. These caps are no longer adequate to address the declining profitability of payphones, and more importantly, are not adequate enough to permit recovery of the cost associated with the necessary upgrades to the Companies' payphones to accept the new coins once currency modernization is completed.

18.

Given the above, the Companies request the flexibility to experiment with

different rates and find the right balance between recapturing expenditures and market tolerance for increased local call rates. With a maximum permissible rate of $1.00 per local cash call and $2.00 per local non-cash call, the Companies will be able to experiment and slowly move the rates to where they need to be to ensure that fewer payphones are decommissioned and to avoid another sharp decline in usage, like that seen in mid-2007. 5.0 CONCLUSION

19.

As demonstrated above, significant capital expenditures will be required over a

three-year period to upgrade payphones to ensure that they can accommodate the new one dollar coins that will be introduced into the marketplace starting in early 2012.

-8-

ABRIDGED

20.

With payphone use and revenues continuing to decline on an average of

# per

year, the Companies request the flexibility to experiment with different rates for local cash and non-cash payphone calls to find the rates that the market can bear and that will generate additional revenue towards recovering the cost associated with the necessary payphone upgrades that would accommodate the use of the new one dollar coins. In doing so, the Companies believe that the decommissioning of payphones will be much slower than would otherwise be the case.

21.

In short, the Companies submit that flexibility to set the rates for local calls up to

$1.00 and $2.00 for cash and non-cash calls, respectively would ensure that payphone accessibility is maximized by allowing payphone providers to experiment with different rates, recover capital costs associated with the Government's currency modernization plan, improve the payphone business case and correspondingly slow down the decommissioning of payphones. Such a reliance on market forces is consistent with the Act as well as with the Policy Direction and as such, the Companies respectfully request that their Application be granted. # Filed in confidence with the CRTC. *** End of Document ***

You might also like

- Call TerminationDocument7 pagesCall TerminationcizarNo ratings yet

- BT Market AnalysisDocument137 pagesBT Market AnalysisEmirDzindoNo ratings yet

- Entry BarierDocument4 pagesEntry BarierSaket KumarNo ratings yet

- 11 Views of ODocument22 pages11 Views of OYekaterina BayguzinaNo ratings yet

- CC C C CC C CC C: CCCCCCCCCCCCCCCCCCCCDocument17 pagesCC C C CC C CC C: CCCCCCCCCCCCCCCCCCCCNupur RoyNo ratings yet

- Telecom Regulatory Policy CRTC 2011-703: Billing Practices For Wholesale Residential High-Speed Access ServicesDocument56 pagesTelecom Regulatory Policy CRTC 2011-703: Billing Practices For Wholesale Residential High-Speed Access ServicespndigitalNo ratings yet

- Radio One AnswerDocument3 pagesRadio One AnswerAditya Consul50% (6)

- Interim Rates For Wholesale Residential and Business High Speed Access ServicesDocument4 pagesInterim Rates For Wholesale Residential and Business High Speed Access ServicesMark GoldbergNo ratings yet

- Complainant - Versus-: - CN Case NO 2012-155Document85 pagesComplainant - Versus-: - CN Case NO 2012-155lucky joy domingoNo ratings yet

- TracoDocument47 pagesTracokiran rajNo ratings yet

- Pooja SavitaDocument89 pagesPooja SavitaPooja SavitaNo ratings yet

- High Cost Further Inquiry RepliesDocument20 pagesHigh Cost Further Inquiry RepliesMAG-NetNo ratings yet

- Before The Canadian Radio-Television and Telecommunications CommissionDocument26 pagesBefore The Canadian Radio-Television and Telecommunications CommissionMark GoldbergNo ratings yet

- Afs-Srf 3Document215 pagesAfs-Srf 3lucky joy domingoNo ratings yet

- 1 Inroduction of IndustryDocument6 pages1 Inroduction of IndustryJames SnyderNo ratings yet

- Corporate Finance: Submitted ToDocument13 pagesCorporate Finance: Submitted ToalirazaNo ratings yet

- PR - May 11, 2014Document2 pagesPR - May 11, 2014Bayan Muna Party-listNo ratings yet

- Tle Doc PlanDocument19 pagesTle Doc PlanJP Sacro100% (1)

- DTH Operators Association of IndiaDocument7 pagesDTH Operators Association of Indiacnugoud2011No ratings yet

- Partner Communications: Company and Financial OverviewDocument27 pagesPartner Communications: Company and Financial OverviewMunniNo ratings yet

- Zee Entertainment Enterprises Limited (ZEEL) PDFDocument46 pagesZee Entertainment Enterprises Limited (ZEEL) PDFDEVESH BHOLE100% (1)

- 8Document19 pages8pcrao2011No ratings yet

- The Evolution of Voip: A Look Into How Voip Has Proliferated Into The Global Dominant Platform It Is TodayDocument48 pagesThe Evolution of Voip: A Look Into How Voip Has Proliferated Into The Global Dominant Platform It Is TodayBradley SusserNo ratings yet

- Project Report On Income Tax: Advantage & Disadvantages To Telecom Sector in IndiaDocument6 pagesProject Report On Income Tax: Advantage & Disadvantages To Telecom Sector in IndiaShalini MahawarNo ratings yet

- 201305061248472877423bharati Airtel LTD - 0Document8 pages201305061248472877423bharati Airtel LTD - 0Aashish ChhajedNo ratings yet

- Calling Card Consultation Paper - 14.11Document18 pagesCalling Card Consultation Paper - 14.11Vaibhav JoshiNo ratings yet

- Telecomm Products Marketing PlanDocument21 pagesTelecomm Products Marketing PlanReshma WalseNo ratings yet

- Memorandum Circular No. 05-08-2005 Subject: Voice Over Internet Protocol (Voip)Document4 pagesMemorandum Circular No. 05-08-2005 Subject: Voice Over Internet Protocol (Voip)purplebasketNo ratings yet

- Salford Annual Report 2008-09Document15 pagesSalford Annual Report 2008-09parkingeconomicsNo ratings yet

- CRM Project Report PDFDocument12 pagesCRM Project Report PDFSobhra SatpathyNo ratings yet

- Bharat Sanchar Nigam LTDDocument10 pagesBharat Sanchar Nigam LTDBrijesh YadavNo ratings yet

- Background: How Voip Works What Kind of Equipment Do I Need?Document4 pagesBackground: How Voip Works What Kind of Equipment Do I Need?engr_faimNo ratings yet

- O I G C B: Investigative Report SynopsisDocument11 pagesO I G C B: Investigative Report SynopsisChris BerinatoNo ratings yet

- TWC/Charter OrderDocument93 pagesTWC/Charter OrderJon CampbellNo ratings yet

- CRTC's Review of The Regulatory Framework For Text-Based Message Relay ServicesDocument42 pagesCRTC's Review of The Regulatory Framework For Text-Based Message Relay ServicesSameer ChhabraNo ratings yet

- Answers To TRAI CP Paper by TEMA Telecom Equipment Manufacturers Association of India-Prof NK Goyal, Chairman Emeritus, 98 111 29879Document4 pagesAnswers To TRAI CP Paper by TEMA Telecom Equipment Manufacturers Association of India-Prof NK Goyal, Chairman Emeritus, 98 111 29879deeepkaNo ratings yet

- What Is Number Portability?: General OverviewDocument3 pagesWhat Is Number Portability?: General OverviewshashiyNo ratings yet

- Nonfiction Writing 179 StudyDocument2 pagesNonfiction Writing 179 Studypedritocaralarga121No ratings yet

- 1328 - enrBROADBAND FREE PDFDocument15 pages1328 - enrBROADBAND FREE PDFLoraMorrisonNo ratings yet

- Information Note To The Press (Press Release No. 61 /2010)Document5 pagesInformation Note To The Press (Press Release No. 61 /2010)santy9562No ratings yet

- Connect America Fund and Intercarrier Compensation Reform Order and FNPRMDocument7 pagesConnect America Fund and Intercarrier Compensation Reform Order and FNPRMFederal Communications CommissionNo ratings yet

- Corporate Raider Criticizes One-Hurdle Rate Approach of TeletechDocument8 pagesCorporate Raider Criticizes One-Hurdle Rate Approach of TeletechRyan Teichmann0% (1)

- B4RN Business Plan v4.1Document26 pagesB4RN Business Plan v4.1b4rnNo ratings yet

- Bell 2016-37Document8 pagesBell 2016-37Mark GoldbergNo ratings yet

- Case1 SolutionDocument15 pagesCase1 SolutionRoy Sarkis100% (1)

- ECE LAWS - Report.ScriptDocument3 pagesECE LAWS - Report.Scriptms violeNo ratings yet

- Seminar ShimlaTR DuaDocument33 pagesSeminar ShimlaTR Duabalu15031987No ratings yet

- How To Treat The Costs of Shared Voice and Video Networks in A Post-Regulatory Age, Cato Policy AnalysisDocument13 pagesHow To Treat The Costs of Shared Voice and Video Networks in A Post-Regulatory Age, Cato Policy AnalysisCato InstituteNo ratings yet

- Porter Five Forces WordDocument11 pagesPorter Five Forces WordvinodvahoraNo ratings yet

- ICAI's Asked For Comments On Technical Guide For Revene Recognition For Telecom OperatorsDocument27 pagesICAI's Asked For Comments On Technical Guide For Revene Recognition For Telecom OperatorsSaurabh MohanNo ratings yet

- Another Fine Mess For African TelecomsDocument8 pagesAnother Fine Mess For African TelecomsPNG networksNo ratings yet

- Summary - Telecom Sector .DecryptedKLRDocument7 pagesSummary - Telecom Sector .DecryptedKLRSaranya VillaNo ratings yet

- NTC Buildi 9 - , BIR RR Ad, East Trianglc, Dili Ir An, Quezon Icy E-Mail Me (R N PH - HLTPDocument3 pagesNTC Buildi 9 - , BIR RR Ad, East Trianglc, Dili Ir An, Quezon Icy E-Mail Me (R N PH - HLTPEddie Bulwayan Endeken Jr.100% (1)

- Telecoms Complaints Data: Mis-selling/Slamming - Fixed LineDocument5 pagesTelecoms Complaints Data: Mis-selling/Slamming - Fixed LineQasimNo ratings yet

- WorldCom Case StudyDocument9 pagesWorldCom Case Studyfrazmaker0% (1)

- Telecom Egypt Credit RatingDocument10 pagesTelecom Egypt Credit RatingHesham TabarNo ratings yet

- Papers on the field: Telecommunication Economic, Business, Regulation & PolicyFrom EverandPapers on the field: Telecommunication Economic, Business, Regulation & PolicyNo ratings yet

- Overview of Some Voice Over IP Calls and SMS Verifications Services ProvidersFrom EverandOverview of Some Voice Over IP Calls and SMS Verifications Services ProvidersNo ratings yet

- Telecommunications Reseller Revenues World Summary: Market Values & Financials by CountryFrom EverandTelecommunications Reseller Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Wireless Telecommunications Carrier Revenues World Summary: Market Values & Financials by CountryFrom EverandWireless Telecommunications Carrier Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Federal Court: T-1335-21 May 16 2022Document71 pagesFederal Court: T-1335-21 May 16 2022Mark GoldbergNo ratings yet

- Scotiabank Telecommunication ServicesDocument8 pagesScotiabank Telecommunication ServicesMark GoldbergNo ratings yet

- DM#3900357 - Procedural Request - 200804-Bell Mobility - TNC 2019-57 - Competition Bureau Matrix Report - ATT - ABR PDFDocument9 pagesDM#3900357 - Procedural Request - 200804-Bell Mobility - TNC 2019-57 - Competition Bureau Matrix Report - ATT - ABR PDFMark GoldbergNo ratings yet

- World Mobile Press Release 20221128Document4 pagesWorld Mobile Press Release 20221128Mark GoldbergNo ratings yet

- Factum - Federal Court of AppealDocument48 pagesFactum - Federal Court of AppealMark GoldbergNo ratings yet

- 200804-Bell Mobility - TNC 2019-57 - Procedural Request - Competition Bureau Matrix Report-1Document7 pages200804-Bell Mobility - TNC 2019-57 - Procedural Request - Competition Bureau Matrix Report-1Mark GoldbergNo ratings yet

- CRTC Policy Direction Signed OrderDocument7 pagesCRTC Policy Direction Signed OrderMark GoldbergNo ratings yet

- Decision - Federal Court - Shoan V A-G - 2 September 2016 PDFDocument51 pagesDecision - Federal Court - Shoan V A-G - 2 September 2016 PDFMark GoldbergNo ratings yet

- The 2017 Canadian Telecom Summit BrochureDocument6 pagesThe 2017 Canadian Telecom Summit BrochureMark GoldbergNo ratings yet

- Federal Court: TELUS Spectrum TransferDocument38 pagesFederal Court: TELUS Spectrum TransferMark GoldbergNo ratings yet

- Federal Court: GoldTV Blocking Order Date: 20191115Document47 pagesFederal Court: GoldTV Blocking Order Date: 20191115Mark GoldbergNo ratings yet

- Iristel Answer 20161213Document33 pagesIristel Answer 20161213Mark GoldbergNo ratings yet

- Mandate Letter To JP BlaisDocument2 pagesMandate Letter To JP BlaisMark GoldbergNo ratings yet

- Bell 2016-37Document8 pagesBell 2016-37Mark GoldbergNo ratings yet

- Rogers Comments On Videotron Unlimited Music - CRTC File No 8661-P8-201510199Document11 pagesRogers Comments On Videotron Unlimited Music - CRTC File No 8661-P8-201510199Mark GoldbergNo ratings yet

- The 2016 Canadian Telecom Summit AdDocument1 pageThe 2016 Canadian Telecom Summit AdMark GoldbergNo ratings yet

- The 2016 Canadian Telecom Summit BrochureDocument6 pagesThe 2016 Canadian Telecom Summit BrochureMark GoldbergNo ratings yet

- Letter From Industry CanadaDocument3 pagesLetter From Industry CanadaMark GoldbergNo ratings yet

- Assassin 20140706Document2 pagesAssassin 20140706Mark GoldbergNo ratings yet

- Cleric Spreading Hate' On Local TV: New Year'S Treat: Canada Versus U.SDocument1 pageCleric Spreading Hate' On Local TV: New Year'S Treat: Canada Versus U.SMark GoldbergNo ratings yet

- The 2014 Canadian Telecom SummitDocument6 pagesThe 2014 Canadian Telecom SummitMark GoldbergNo ratings yet

- Scotia Capital TELUS - Mobilicity 3 Times A Charm?Document8 pagesScotia Capital TELUS - Mobilicity 3 Times A Charm?Mark GoldbergNo ratings yet

- IRR of RA 9295 2014 Amendments - Domestic Shipping Development ActDocument42 pagesIRR of RA 9295 2014 Amendments - Domestic Shipping Development ActIrene Balmes-LomibaoNo ratings yet

- JC Sales Registration FormDocument1 pageJC Sales Registration FormAli RazaNo ratings yet

- Maximo Change Management Quick Reference Guide v1.0Document5 pagesMaximo Change Management Quick Reference Guide v1.0ajayc50No ratings yet

- J.P. Morgan Reiterates OREX With Overweight and $12 Price Target - May 8Document9 pagesJ.P. Morgan Reiterates OREX With Overweight and $12 Price Target - May 8MayTepper100% (1)

- Credit Application 2023Document1 pageCredit Application 2023Jean Pierre PerrierNo ratings yet

- Gemba Walk Introduction 20150226Document7 pagesGemba Walk Introduction 20150226lorenzordzrmzNo ratings yet

- NBFC Project Report by MS. Sonia JariaDocument34 pagesNBFC Project Report by MS. Sonia JariaSonia SoniNo ratings yet

- Options Trading Strategies: Understanding Position DeltaDocument4 pagesOptions Trading Strategies: Understanding Position Deltasubash1983No ratings yet

- Indigo Flight Sample PDFDocument2 pagesIndigo Flight Sample PDFRupam Dutta75% (4)

- Multinational Inventory ManagementDocument2 pagesMultinational Inventory ManagementPiyush Chaturvedi75% (4)

- 320C10Document59 pages320C10Kara Mhisyella Assad100% (2)

- The Ashok Leyland WayDocument15 pagesThe Ashok Leyland WayShreyas HNNo ratings yet

- Sources of Exchange-Rate Volatility: Impulses or Propagation?Document14 pagesSources of Exchange-Rate Volatility: Impulses or Propagation?Anonymous xjWuFPN3iNo ratings yet

- Presentation of Managerial Economics On: Banking Sector in IndiaDocument16 pagesPresentation of Managerial Economics On: Banking Sector in IndiaArchana PawarNo ratings yet

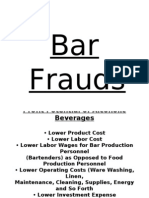

- Bar Frauds & FormsDocument41 pagesBar Frauds & FormsOm Singh100% (6)

- Empanel OrgDocument292 pagesEmpanel OrgAnand100% (1)

- Industry Analysis: Consumer ElectronicsDocument11 pagesIndustry Analysis: Consumer ElectronicsHEM BANSALNo ratings yet

- Statement of Applicability For ISMS - IsO 27001Document5 pagesStatement of Applicability For ISMS - IsO 27001pvendaraNo ratings yet

- Home First Finance CompanyDocument12 pagesHome First Finance CompanyJ BNo ratings yet

- Reflection PaperDocument2 pagesReflection PaperJoceter DangiNo ratings yet

- Problems and Solution 3Document6 pagesProblems and Solution 3sachinremaNo ratings yet

- BCT 6.x - Business ConneCT Brochure - EnglishDocument16 pagesBCT 6.x - Business ConneCT Brochure - Englishdavid51brNo ratings yet

- Ebenezer Sathe: ProfileDocument2 pagesEbenezer Sathe: ProfileRaj ShNo ratings yet

- Chinese CurencyDocument36 pagesChinese CurencyAtish JainNo ratings yet

- Uniform General Conditions For Construction Contracts, State of Texas, 2010 (UGC) - ConstructionDocument11 pagesUniform General Conditions For Construction Contracts, State of Texas, 2010 (UGC) - ConstructionsbunNo ratings yet

- 15.910 Draft SyllabusDocument10 pages15.910 Draft SyllabusSaharNo ratings yet

- Sig Ar 0405Document84 pagesSig Ar 0405kapoorvikrantNo ratings yet

- Linda Meza Kolbe ReportDocument8 pagesLinda Meza Kolbe ReportLinda MezaNo ratings yet

- Marketing Analytics: Assignment 3: Discriminant AnalysisDocument13 pagesMarketing Analytics: Assignment 3: Discriminant AnalysisHarsh ShuklaNo ratings yet

- MillWorker EnglishDocument10 pagesMillWorker EnglishRajveer SinghNo ratings yet