Professional Documents

Culture Documents

LIC Jeevan Ankur Never Invested

LIC Jeevan Ankur Never Invested

Uploaded by

kirang gandhiCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

LIC Jeevan Ankur Never Invested

LIC Jeevan Ankur Never Invested

Uploaded by

kirang gandhiCopyright:

Available Formats

LIC JEEVAN ANKUR A PATHETIC PLAN

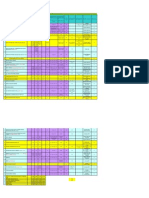

1. Product Number : 807 Product Name : Jeevan Ankur Illustration 2 Age at entry: 35 years Policy term: 10 years Mode of premium payment: Yearly Amount of annual premium: Rs.9055/- * Sum Assured: Rs. 100,000/End Total of Premiums Year Paid Till End Of Year Amount Amount payable on Maturity at the end of year Payable Variable Total on Scenario Scenario Scenario Scenario Death 1 2 1 2 during Guaranteed the Year ** 100000 100000 100000 100000 100000 100000 100000 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0

Page 1

1 2 3 4 5 6 7

9055 18110 27165 36220 45275 54330 63385

www.fpindia.in

8 9 10

72440 81495 90550

100000 100000 100000

0 0 100000

0 0 0

0 0 20000

0 0

0 0

100000 120000

* Note:- The annual premium shown above is exclusive of Service Tax. ** In addition to Basic Sum Assured an amount equal to 10% of the Basic Sum Assured (referred to as Income Benefit) shall be payable on each policy anniversary, from the policy anniversary coinciding with or next following the date of death of Life Assured, till the end of policy term to the nominee. Total Premium pay as per LIC illustration 2 Rs.91908/- ( S.T.INCLUSIVE ) AND AS PER 6@ ILLUSRTATION GUREENTED AMOUNT IS RS.1,00,000/- THE REURN IN IRR CALCULATING IS 1.53% ONLY If you add the loyalty addition of Rs.10000/- ( not guaranteed ) then total amount is Rs.110000/- means in IRR CALCULATOR return is 3.24% only .If you cover insurance of Rs.100000/-then mortality charges as per mortality rate is Rs.8415/-

2. Product Number : 807 Product Name : Jeevan Ankur Illustration 4 Age at entry: 35 years Policy term: 10 years Mode of premium payment: Single Amount of annual premium: Rs.62565/- * Sum Assured: Rs. 100,000/End Total of Premiums Year Paid Till End Of Year Amount Amount payable on Maturity at the end of year Payable Variable Total on Scenario Scenario Scenario Scenario Death Guaranteed 1 2 1 2 during the Year ** 100000 100000 100000 100000 100000 100000 100000 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0

1 2 3 4 5 6 7

62565 62565 62565 62565 62565 62565 62565

www.fpindia.in

Page 2

8 9 10

62565 62565 62565

100000 100000 100000

0 0 100000

0 0 0

0 0 36000

0 0

0 0

100000 136000

* Note:- The single premium shown above is exclusive of Service Tax. ** In addition to Basic Sum Assured an amount equal to 10% of the Basic Sum Assured (referred to as Income Benefit) shall be payable on each policy anniversary, from the policy anniversary coinciding with or next following the date of death of Life Assured, till the end of policy term to the nominee. For 1 time premium as per LIC TABLE Rs 62565/- ( S.TAX EXTRA ) After 10 years will receive 1 lakh only (which is also non guaranteed as return in Notes ) 3. Product Number : 807 Product Name : Jeevan Ankur Rs. 46,245.00/- p.a. if you total premiumRs.786185/- ( S.T.EXTRA ) pay for 17 years then you can get 10,00,000/- for child education as per 6% AS PER LIC table coz of tradition plan Notes : i) This illustration is applicable to a standard (from medical, life style and occupation point of view) life. ii) The non-guaranteed benefits (1) and (2) in above illustration are calculated so that they are consistent with the Projected Investment Rate of Return assumption of 6% p.a.(Scenario 1) and 10% p.a. (Scenario 2) respectively. In other words, in preparing this benefit illustration, it is assumed that the Projected Investment Rate of Return that LIC will be able to earn throughout the term of the policy will be 6% p.a. or 10% p.a., as the case may be. The Projected Investment Rate of Return is not guaranteed. iii) The main objective of the illustration is that the client is able to appreciate the features of the product and the flow of benefits in different circumstances with some level of quantification.

Actual cost of Child Education with Todays Cost of Education Child Age 0 year Faculty BBA MBA ENGG. MEDICAL Indian Education Fees 2 LAKH 4 LAKH 6 LAKH 40 LAKH Overseas Edu. Fees 5 LAKH 10 LAKH 15 LAKH 1 CRORE

www.fpindia.in

Page 3

After 17 years Required with min. 6% Inflation Child At 17 Years Faculty BBA MBA ENGG. MEDICAL Indian Education Fees 5 LAKH 10 LAKH 16 LAKH 1 CRORE Overseas Edu. Fees 13.50 LAKH 27 LAKH 40 LAKH 2.70 CRORE

Is there any sense for buy this plan for return in IRR of 1.53% only If our Inflation is more then 6% then our investment return should be more then that and also without any charges we already published a lots of article that insurance is never become a god investment due to heavy charges and others. So Hire a Good Independent Financial Planner who is really independent not belongs to any company for good knowledge and create good wealth according to your Goals.. We will not recommended you to invest in LIC JEEVAN ANKUR Investment Solution to : Individual, Corporate, HNI, Trust,NRI, HUF etc... Write Us your Query for any kind of Investment to kirang.gandhi@gmail.com or Kirang_gandhi@yahoo.co.in Expert Advice : Financial Literacy and Knowledge Coaching Personal Financial Planning, Comprehensive Financial Planning Financial Health check up, Net worth Analysis, Asset Allocation strategy, Cash flow Planning, Budget Planning, Tax Planning, Emergency Fund Planning, Insurance Planning,

www.fpindia.in Page 4

Health Insurance Planning, Child Future / Retirement Planning, Other Financial Goals, Emergency Fund Planning, Risk Analysis ( Investment ), Investment Review, Investment Planning, Estate Planning, Debt Advisory, Insurance Policy Analysis

Note : Meeting priority to appt. only

For Further Details kindly Contact :

Thanks And Regards, Kirang Gandhi Independent Financial Planner www.fpindia.in www.kgandhi.anindia.in M-9028142155,9271267305

www.fpindia.in

Page 5

You might also like

- ATLS Adult - ScenarioDocument16 pagesATLS Adult - ScenarioAisha Mousa100% (12)

- AlgorithimDocument26 pagesAlgorithimAschalew GirmaNo ratings yet

- Transnational Horror Cinema, Bodies of Excess and The Global GrotesqueDocument250 pagesTransnational Horror Cinema, Bodies of Excess and The Global GrotesqueMichelle Meza100% (6)

- Chapter 14Document29 pagesChapter 14Baby Khor100% (1)

- Life Link Pension SP LeafletDocument2 pagesLife Link Pension SP LeafletSarvesh MishraNo ratings yet

- Httplicjeevansaral - in 7Document6 pagesHttplicjeevansaral - in 7abdulyunus_amirNo ratings yet

- How LIC SIIP Plan WorksDocument4 pagesHow LIC SIIP Plan WorksHarshalNo ratings yet

- ICICI Benefit IllustrationDocument4 pagesICICI Benefit Illustrationudupiganesh3069No ratings yet

- Gsip For 15 YrsDocument3 pagesGsip For 15 YrsJoni SanchezNo ratings yet

- Illustration of GSIPDocument3 pagesIllustration of GSIPAjinkya ChalkeNo ratings yet

- HDFC Life Sampoorn Samridhi Insurance Plan (SPL) IllustrationDocument0 pagesHDFC Life Sampoorn Samridhi Insurance Plan (SPL) IllustrationAakash MazumderNo ratings yet

- HDFC Life Click 2 Invest - Ulip - GJ - IllustrationDocument3 pagesHDFC Life Click 2 Invest - Ulip - GJ - IllustrationYashpal SinghNo ratings yet

- SIP Insure PresentationDocument20 pagesSIP Insure PresentationbghanshyamNo ratings yet

- An Honest Review of HDFC Life Sanchay Par Advantag+Document11 pagesAn Honest Review of HDFC Life Sanchay Par Advantag+Sanjay S RayNo ratings yet

- GSIP BrochureDocument2 pagesGSIP Brochureabdul.nm4064No ratings yet

- IDBI Federal Incomesurance Endowment and Money Back Plan - Benefit IllustrationDocument3 pagesIDBI Federal Incomesurance Endowment and Money Back Plan - Benefit IllustrationVipul KhandelwalNo ratings yet

- Why Loyalty Additions Not Conventional Regular Bonus in Lic Jeevan Saral Policy?Document1 pageWhy Loyalty Additions Not Conventional Regular Bonus in Lic Jeevan Saral Policy?uketechNo ratings yet

- Actuarial CT5 General Insurance, Life and Health Contingencies Sample Paper 2011Document11 pagesActuarial CT5 General Insurance, Life and Health Contingencies Sample Paper 2011ActuarialAnswers50% (2)

- ICICI Prudential Retirement Income Solution Presentation For Mr. MR Ramprakash KDocument4 pagesICICI Prudential Retirement Income Solution Presentation For Mr. MR Ramprakash Kram_webNo ratings yet

- Make Investments: Save On Income TaxDocument30 pagesMake Investments: Save On Income TaxMelinda BartleyNo ratings yet

- Whole Life Surance Savings Plan 116414681443669413Document2 pagesWhole Life Surance Savings Plan 116414681443669413msneha1No ratings yet

- All You Wanted To Know About Pension Plans!: Share ThisDocument10 pagesAll You Wanted To Know About Pension Plans!: Share ThisAbhi SharmaNo ratings yet

- Why Decreasing Term Life InsuranceDocument12 pagesWhy Decreasing Term Life InsurancepatelshreyasNo ratings yet

- MONEY BACK PLAN - (Table No. 75) Benefit IllustrationDocument4 pagesMONEY BACK PLAN - (Table No. 75) Benefit IllustrationVinayak DhotreNo ratings yet

- 75 93 Money Back PlansDocument15 pages75 93 Money Back PlansVinayak Dhotre0% (1)

- Illustration: Survival BenefitsDocument4 pagesIllustration: Survival BenefitsPrudhvi NannamNo ratings yet

- Aadhaar StambhDocument16 pagesAadhaar StambhAbhijeetNo ratings yet

- Policy Math - 10-03-2024 - 10.14.49Document4 pagesPolicy Math - 10-03-2024 - 10.14.49Blaze Rapper AniketNo ratings yet

- Mr. Basit HassanDocument4 pagesMr. Basit HassanBasit Hassan QureshiNo ratings yet

- How Much Commission Mutual Fund Agent GetsDocument19 pagesHow Much Commission Mutual Fund Agent GetsjvmuruganNo ratings yet

- Analysis of Tax05Document19 pagesAnalysis of Tax05kharemixNo ratings yet

- Jeevan VriddhiDocument4 pagesJeevan VriddhihemukariaNo ratings yet

- Tata AIA Life Insurance Sampoorna Raksha+: FeaturesDocument6 pagesTata AIA Life Insurance Sampoorna Raksha+: Featuressenthilkumar.sNo ratings yet

- Deductions From Total IncomeDocument38 pagesDeductions From Total IncomeVikas WadmareNo ratings yet

- One From Everyone NEWDocument14 pagesOne From Everyone NEWPratik KathuriaNo ratings yet

- Receive Payouts Once Every 5 YearsDocument6 pagesReceive Payouts Once Every 5 YearsSheetal IyerNo ratings yet

- Instruments of Tax SavingDocument10 pagesInstruments of Tax Savinganilpipaliya117No ratings yet

- Proposal For MR Gupta: Some Achievements of LICDocument6 pagesProposal For MR Gupta: Some Achievements of LIClabdhi123456No ratings yet

- Smartkid RPDocument6 pagesSmartkid RPRajbir Singh YadavNo ratings yet

- Income Tax InfDocument15 pagesIncome Tax InfAman GujralNo ratings yet

- Poddar International College, Jaipur: A Project Report ON Training Undertaken atDocument8 pagesPoddar International College, Jaipur: A Project Report ON Training Undertaken atrahulsogani123No ratings yet

- Presenting: New Money BackDocument15 pagesPresenting: New Money BackVarun BansalNo ratings yet

- Insurance Pension PlansDocument35 pagesInsurance Pension Plansedrich1932No ratings yet

- LIC Jeevan Anand HomeDocument3 pagesLIC Jeevan Anand HomeAnkit AgarwalNo ratings yet

- LIC Samridhi PlusDocument5 pagesLIC Samridhi PlusBaap Ji BhaiNo ratings yet

- Presenting .: UTI - Unit Linked Insurance PlanDocument21 pagesPresenting .: UTI - Unit Linked Insurance PlanSudipto MajumderNo ratings yet

- Tax Saving Investments: A Guide To The Instruments That Can Help You Achieve The Goal of Low Risk and High Capital GainsDocument10 pagesTax Saving Investments: A Guide To The Instruments That Can Help You Achieve The Goal of Low Risk and High Capital Gainsashit_rasquinhaNo ratings yet

- What Would You Like To Do ?: DisclamerDocument25 pagesWhat Would You Like To Do ?: Disclamerminnalmaruthu4611No ratings yet

- Ajeevan Sampatti Benefit IllustrationDocument5 pagesAjeevan Sampatti Benefit IllustrationSurya GudipatiNo ratings yet

- Redefining GovernanceDocument16 pagesRedefining Governancerajamanickam511925No ratings yet

- Assignment of Economic and Business Legislature: Submitted To-Submitted byDocument7 pagesAssignment of Economic and Business Legislature: Submitted To-Submitted byMohit SahniNo ratings yet

- CFP Retirement Planning and Employee Benefits Monk Test.Document27 pagesCFP Retirement Planning and Employee Benefits Monk Test.Vandana ReddyNo ratings yet

- Lakshya Plus v1Document10 pagesLakshya Plus v1Mahadevan VenkatesanNo ratings yet

- Lic of India LTDDocument4 pagesLic of India LTDAnish PenmahaleNo ratings yet

- Vibhu Verma PTP Project Section 80cDocument12 pagesVibhu Verma PTP Project Section 80cJatin JainNo ratings yet

- Ulip Plan of SbiDocument23 pagesUlip Plan of SbiRohit JadavNo ratings yet

- Project BJDocument69 pagesProject BJgaurav_boy001No ratings yet

- Are Your Savings Flying Away?Document20 pagesAre Your Savings Flying Away?livin2dieNo ratings yet

- One-Pager-POS Saral Nivesh-1Document2 pagesOne-Pager-POS Saral Nivesh-1abilashvincentNo ratings yet

- Some of The Most Popular LIC Plans: Monday, January 30, 2012Document15 pagesSome of The Most Popular LIC Plans: Monday, January 30, 2012sakthifgNo ratings yet

- Illustration For Your HDFC Life Click 2 Protect PlusDocument1 pageIllustration For Your HDFC Life Click 2 Protect PlusBalachandar SathananthanNo ratings yet

- IllustrationDocument3 pagesIllustrationDevender Singh RautelaNo ratings yet

- How to Reverse Recession and Remove Poverty in India: Prove Me Wrong & Win 10 Million Dollar Challenge Within 60 DaysFrom EverandHow to Reverse Recession and Remove Poverty in India: Prove Me Wrong & Win 10 Million Dollar Challenge Within 60 DaysNo ratings yet

- A Haven on Earth: Singapore Economy Without Duties and TaxesFrom EverandA Haven on Earth: Singapore Economy Without Duties and TaxesNo ratings yet

- April F.D.Document14 pagesApril F.D.kirang gandhiNo ratings yet

- FD Ready Recknor (Fresh Deposits) : (Trust) For 14 Months (Ind)Document2 pagesFD Ready Recknor (Fresh Deposits) : (Trust) For 14 Months (Ind)kirang gandhiNo ratings yet

- Health Insurance Comparison Chart NEWDocument10 pagesHealth Insurance Comparison Chart NEWkirang gandhiNo ratings yet

- Income Tax Calculator 2013-14Document2 pagesIncome Tax Calculator 2013-14kirang gandhiNo ratings yet

- Structure of Intrest RateDocument6 pagesStructure of Intrest Ratekirang gandhiNo ratings yet

- Germany's Bundesbank Remains Opposed To ECB Bond BuyingDocument1 pageGermany's Bundesbank Remains Opposed To ECB Bond Buyingkirang gandhiNo ratings yet

- Cash Reserve Ratio and Interest RatesDocument24 pagesCash Reserve Ratio and Interest Rateskirang gandhiNo ratings yet

- Why Interest Rates ChangeDocument4 pagesWhy Interest Rates Changekirang gandhiNo ratings yet

- Circular From Rbi For Home Loan ClosureDocument1 pageCircular From Rbi For Home Loan Closurekirang gandhiNo ratings yet

- Saes J 200Document6 pagesSaes J 200milton1987No ratings yet

- Group 10 Battle of SiffinDocument2 pagesGroup 10 Battle of SiffinMuhammad IbrahimNo ratings yet

- This Document Defines and Describes The NSN Recommended Relevant Features Used For Service Projects GloballyDocument99 pagesThis Document Defines and Describes The NSN Recommended Relevant Features Used For Service Projects GloballyAnonymous uUFj1s48nNo ratings yet

- Case Scenario 3Document7 pagesCase Scenario 3Minette BucioNo ratings yet

- Ilovepdf - Mergedm WssdddssssDocument71 pagesIlovepdf - Mergedm Wssdddssss7022211485aNo ratings yet

- Odyssey Grammar LessonDocument2 pagesOdyssey Grammar Lessonapi-300424583No ratings yet

- 01 TryExponent NotesDocument3 pages01 TryExponent NotesAnthony B100% (1)

- Freemasonry of RizalDocument2 pagesFreemasonry of RizalWayne TysonNo ratings yet

- Farr Et Al-2011-Language and Linguistics Compass PDFDocument16 pagesFarr Et Al-2011-Language and Linguistics Compass PDFFareena BaladiNo ratings yet

- Pulling Oil Karach ArticleDocument3 pagesPulling Oil Karach Articlepacocasad67No ratings yet

- CTAP For NGFW - Data Privacy NoticeDocument3 pagesCTAP For NGFW - Data Privacy NoticeGiovanni -No ratings yet

- Sprawl and Public Space, Redressing The MallDocument116 pagesSprawl and Public Space, Redressing The Mallcicik-micsunicaNo ratings yet

- Police Violence Against Sex Workers in Bangalore: An Interim ReportDocument24 pagesPolice Violence Against Sex Workers in Bangalore: An Interim ReportDarshanaNo ratings yet

- Site Characterization For Engineering Design And: Construction PurposesDocument14 pagesSite Characterization For Engineering Design And: Construction Purposeslalo111095No ratings yet

- Scheme of Work 2010Document22 pagesScheme of Work 2010Sivabalan BionicNo ratings yet

- Health PromotionDocument4 pagesHealth PromotionJithendra KumarNo ratings yet

- MS Access FundamentalsDocument373 pagesMS Access Fundamentalskggan8678No ratings yet

- Wave Interference - Short Questions With Answer - Physics Class 12Document11 pagesWave Interference - Short Questions With Answer - Physics Class 12Mohan Raj100% (1)

- Dire Dawa Institute of Technology Department of Construction Technology and Management COTM6041-Construction Law and ContractDocument147 pagesDire Dawa Institute of Technology Department of Construction Technology and Management COTM6041-Construction Law and ContractAshenafi shamenaNo ratings yet

- Sel F-Learning Module: Bpe 2 YearDocument9 pagesSel F-Learning Module: Bpe 2 YearGleza SabridoNo ratings yet

- Comparative Analysis of Direct Banking Services of Kotak With Other BanksDocument105 pagesComparative Analysis of Direct Banking Services of Kotak With Other Bankssuruchiathavale221234No ratings yet

- How To Install SmartPlant 3DDocument5 pagesHow To Install SmartPlant 3Dshiva_ssk17No ratings yet

- Work Study (Case Study) PresentationDocument36 pagesWork Study (Case Study) PresentationMeet JaiswalNo ratings yet

- A Social Evil: EditorialDocument10 pagesA Social Evil: EditorialDaisuke InoueNo ratings yet

- CGI Programming in CDocument27 pagesCGI Programming in CPiya BaradNo ratings yet

- Analysis of Unity of MindsDocument1 pageAnalysis of Unity of MindsNikhil GuptaNo ratings yet