Professional Documents

Culture Documents

The Real Deals (26-04-2012)

Uploaded by

SG PropTalkOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The Real Deals (26-04-2012)

Uploaded by

SG PropTalkCopyright:

Available Formats

Co.

Reg No: 198700034E MICA (P) : 099/03/2012

Singapore

THEREALDEALS Ins&OutsofSingaporeRealEstate

Reaching for the Sky

Bishan was once a quiet rural area with an old cemetery, which was established in 1870 by immigrants who largely came from Guangdong Province in China. The burial ground was called Pi Shan Ting, which translates to pavilions on the green; hence, the name Bishan. Initial fears of living on top of a graveyard in the belief that bad luck would follow for disturbing the dead proved unfounded. Today, Bishan is one of the most popular HDB towns and has brought homeowners prosperity in the form of higher property valuations. Private sector developers have also sought a foothold in Condo sizes at Sky Habitat this centrally located estate. The new kid on the block is No. of BR Size (sq ft) No. of units % Sky Habitat, a joint venture between CapitaLand (60% 635-969 66 13% stake), Mitsubishi Estate (25%) and Shimizu (10%). The 1BR consortium paid a SGD118m premium over the second2BR 721-1485 149 29% highest bid for the land parcel last year, which implied a land cost of SGD869.4 psf ppr with an estimated 3BR 1216-1862 218 43% breakeven price of SGD1,300 psf. The rollout of the 1787-2259 68 13% iconic 38-storey condominium had been eagerly 4BR anticipated and it achieved an ASP of SGD1,700 psf on PH 2562-3638 8 2% average when it was launched two weekends ago. Source: CapitaLand Anecdotally, the success of Sky Habitat would suggest that the price gap between city centre and suburban homes is narrowing. This could be because land supply in the traditional prime areas (ie, districts 9, 10 and 11) has become more limited, forcing developers to innovate to differentiate their products in the suburbs, in particular, the mature estates. We take a look at the sales supply in Bishan to find out more.

Artists impression of Sky Habitat

26 April 2012

Source: CapitaLand

SEE APPENDIX I FOR IMPORTANT DISCLOSURES AND ANALYST CERTIFICATIONS

HE EAL EALS Ins&OutsofSingaporeRealEstate

In and Around Bishan Remaining new-sale supply

Resale transactions of condos in Bishan

1400 1200 1000 800 600 400 200 Jul-98 Source: URA Dec-99 Apr-01 Sep-02 Jan-04 May-05 Oct-06 Feb-08 Jul-09 Nov-10 Apr-12 Bishan 8 Clover by the Park Rafflesia Bishan Loft

Condos near Sky Habitat Bishan 8 Project Developer Far East Location 61 Bishan Street Total no. of units 200 Tenure 99 Yr (fm 1996) TOP 2000 Past Yr ASP (psf) SGD1,118 Median rental yield 3.6%

Source: Maybank KE

Bishan Loft (EC) Chip Eng Seng 31-35 Bishan Street 384 99 Yr (fm 2000) 2003 SGD981 n.a

Rafflesia Condo Far East 31-33 Bishan Street 230 99 Yr (fm 1997) 2003 SGD1,046 4.1%

Clover by the Park Sim Lian Group 2 Bishan Street 616 99 Yr (fm 2007) 2012 SGD1,048 3.6%

Condominium prices in Bishan have been climbing up steadily in the past five years, rising by 50% from approximately SGD700 psf to todays SGD1,050 psf. Bishan Lofts five-year Minimum Occupation Period expired in 2006 and unit prices have since seen an aggressive jump a la its older neighbour, Bishan 8. The last private condo in Bishan to receive its Temporary Occupation Permit (TOP) was Clover by the Park in 2012. It saw subsale prices rising long before the TOP date but we note that sales did stagnate at one point due to the 09 crisis. Among our selection of Bishan condos, Rafflesia Condominium achieved the highest median rental of SGD3.58 psf for 3Q11, implying a yield of 3.9-4.5%.

Rental trends

Project name Clover by the Park Gardens at Bishan, The +2.9% Chg in median rental $ psf pm 25th percentile 2.96 3.35 3.16 3.04 +9.7% Rafflesia Condominium Bishan 8

Source: URA

Median 3.23 3.53 3.36 3.42 3.10 3.58 3.35 3.35

75th percentile 3.36 3.83 3.61 3.57 3.33 3.90 3.70 3.44

No. of contracts 22 20 21 18 25 10 15 11

Quarter 4Q11 4Q11 3Q11 2Q11 1Q11 3Q11 3Q11 2Q11

2.80 3.44 3.21 3.22

0%

26 April 2012

Page 2 of 8

HE EAL EALS Ins&OutsofSingaporeRealEstate

Appeal of Mature Estates

We highlight two private condos that were launched in the heart of HDB towns and attempt to draw similarities between them and Sky Habitat. They are Trevista in Toa Payoh and Centro Residences in Ang Mo Kio. The developers target audiences are the HDB upgraders who are looking to live close to their extended families and the amenities that they have got used to. Both condos have extensive facilities, including a tennis court, swimming pool, fitness area and childrens playground. The units are spacious compared to some of the latest project launches and there are 2- and 3-bedders specially tailored for families. Transportation facilities are also elaborate, with MRT and bus interchange stations just minutes away from the development. The take-up rates for both projects were strong, suggesting pent-up demand from HDB upgraders seeking to move into the private market. Trevista is a 590-unit condo developed by NTUC Choice Homes and recently received its TOP. It was the first private development in Toa Payoh since 1996, which explained the strong take-up rate. The developer sold 89% of the 490 units in the first month of launch in 2009, with ASP starting from SGD955 psf. The latest transactions are done at SGD1,200 psf, with 40 deals YTD. Centro Residences was developed by Far East Organization and 35% of its buyers were HDB upgraders, while the rest were private investors. The 329-unit condo will receive its TOP in 2015. The site is adjacent to AMK Hub and opposite the Ang Mo Kio MRT station. Units on the higher floors facing the MRT station will have a scenic view of the Ang Mo Kio Town Garden East. The project sold for an average of SGD1,200 psf when it was launched in 2009. Since the beginning of the year, there were 20 transactions and the latest ASP has breached above SGD1,500 psf.

Artists impressions of Trevista (from left), Centro Residences and Sky Habitat

Source: NTUC Choice Homes, Far East Organization, CapitaLand

New launches in mature estates 1700 1600 1500 1400 1300 1200 1100 1000 900 800 Jul-09 Source: URA Oct-09 Jan-10 May-10 Aug-10 Nov-10 Feb-11 Jun-11 Sep-11 Dec-11 Apr-12 Centro Residences Trevista

26 April 2012

Page 3 of 8

HE EAL EALS Ins&OutsofSingaporeRealEstate

MARKET SNAPSHOT

Recent resale transactions

Project Bishan 8 Clover by the Park Clover by the Park Clover by the Park Bishan 8 Rafflesia Bishan 8 Rafflesia Bishan 8 Clover by the Park Rafflesia Bishan 8 Clover by the Park Rafflesia Bishan 8 Clover by the Park Bishan 8 Clover by the Park Clover by the Park Clover by the Park Clover by the Park Clover by the Park Clover by the Park Clover by the Park Bishan 8 Clover by the Park Bishan Loft Clover by the Park Clover by the Park Clover by the Park Bishan 8

Source: URA

25 April 2012

Analyst: Alison FOK 65-6433 5745 alisonfok@kimeng.com

Property Price Indices

Contract month Mar-12 Mar-12 Mar-12 Mar-12 Mar-12 Mar-12 Mar-12 Mar-12 Mar-12 Mar-12 Mar-12 Feb-12 Feb-12 Feb-12 Feb-12 Feb-12 Feb-12 Feb-12 Jan-12 Jan-12 Jan-12 Dec-11 Dec-11 Dec-11 Dec-11 Dec-11 Dec-11 Dec-11 Nov-11 Nov-11 Nov-11

Size (sq m) 108 161 149 325 110 85 130 85 111 167 111 111 167 111 109 161 109 116 120 161 162 120 170 162 108 147 184 120 162 134 110

Price ($psf) 1204 1108 999 988 971 1093 929 1093 1088 801 1000 996 1027 1129 1009 1068 1039 926 1004 1038 1101 982 900 1147 1265 999 919 1161 1079 1096 929

Index SRPI Overall (Dec 11) URA PPI (1Q12) HDB Resale (1Q12)

Level 165.4 206.0 191.0

Change -0.8% -0.1% +0.6%

Government Land Sales (GLS)

Recently Awarded Sites

Site Site area (k sqm) Units Awarded to Land price (S$m) Psf. ppr

Jalan Lempeng Kovan Road / Simon Road Jervois Road Bedok South Avenue 3 Hillview Avenue Up Serangoon View/ Up Serangoon Rd

(EC)

68.4 35.7 12.5 60.2 35.4

685 360 140 595 370

IOI Corp Hoi Hup consortium Singapore Land Far East/ Frasers/ Sekisui House Kingsford Development Ho Lee Group Pte & Evia Real Estate Qingjian Realty (South Pacific) Group Peak Living Pte Elitist Development

Site area (k sqm)

408 195 119 346 243

554 507 881 534 638

43.4

435

142

303

Punggol Central/ Edgefield (EC) Fernvale Lane

(EC)

13.2 22.0 32.7

395 770 295

137 245 166

320 296 461

Elias Rd/ Pasir Ris Dr 3

Confirmed List

Site Woodlands Ave 5/ Woodlands Dr 16 Tampines Central 7/ Tampines Ave 7/ Tampines Av 9 Tampines Avenue 10 (Parcel A) Sengkang Square/ Compassvale Drive Pasir Ris Dr Buangkok Drive/ Sengkang Central

Units Tender Closing

25.8 20.8 56.2 60.7 22.3 18.3

720 580 600 710 670 620

3-May 10-May 17-May 31-May 5-June 12-June

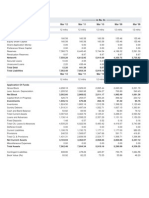

Property Stocks

Name Price CapitaLand 2.97 CityDev 10.45 Ho Bee 1.395 HPL 1.955 KepLand 3.2 SC Global 1.06 SingLand 5.93 UOL 4.57 Wheelock 1.84 Wing Tai 1.24 N.A. = No Coverage Disc/ Prem to RNAV RNAV NTA/share* 4.95 -40% 3.51 12.4 -16% 7.51 3.18 -56% 2.34 4.39 -55% 2.7 5.77 -45% 3.64 3.6 -71% 1.59 9.82 -40% 10.74 N.A. N.A. 6.43 N.A. N.A. 2.35 2.81 -56% 2.47 *As at latest reported Disc/ Prem to NTA/share -15% 39% -40% -28% -12% -33% -45% -29% -22% -50%

Reserve List (Recently Open for Tender)

Site area (k sqm)

Jalan Jurong Kechil Stirling Road Boon Lay Way (Jurong Gateway) Tampines Av 10 (Parcel B) Farrer Dr & Rd Alexandra View Punggol Way/ Punggol Walk Source: HDB, URA

14.2 88.6 48.7 47.9 10.0 41.2 18.7

Units 240 1045 600 515 140 455 560

26 April 2012

Page 4 of 8

HE EAL EALS Ins&OutsofSingaporeRealEstate

MARKET SNAPSHOT(CONTD)

Primary Market

Total no. of units Units sold todate Take -up rate (%) 73% 26% 82% 99% 95% 47% 28% 30% 50% 87% 41% 61% 87% 47% 92% 57% 51% 58% 51% 48% 24% 68%

100%

25 April 2012

Analyst: Alison FOK 65-6433 5745 alisonfok@kimeng.com

Secondary Market

Units sold (Mar) 14 9 54 69 41 34 31 30 25 20 20 18 10 93 83 41 38 27 19 326 102 74 12 369 118 115 98 86 48 45 39 37 28 27 19 18 10 56 56 30 15 153 41 40 14 13

Median

($psf) 2,092 3,265 1,270 1,379 1,242 1,448 1,308 1,735 1,267 1,330 1,100 1,236 1,131 1,074 1,309 1,388 1,330 1,229 1,397 883 860 905 849 725 890 880 1162 1,246 1048 1437 834 695 1,342 1,001 1,282 900 940 738 1334 1,412 704 798 1038 882 869 827

City & Southwest (1-8) Skyline Residences 283 208 Orchard / Tanglin / Holland (9-10) The Scotts Tower 231 60 Newton / Bukit Timah / Clementi (11,21) Thomson Grand 361 296 Balestier / MacPherson / Geylang (12-14) Millage 70 69 Levenue 43 41 Smart Suites 72 34 Cradels 125 35 18 Woodsville 101 30 Ness 62 31 Centra Residences 78 68 Riviera 38 102 42 Primedge 36 22 Vacanza @ East 473 410 East Coast (15-16) Archipelago 577 271 East Village 90 83 Sycamore Tree 96 55 The Cristallo 74 38 Flamingo Valley 393 226 The Lush 37 19 Changi / Pasir Ris (17-18) Ripple Bay 679 326 Palm Isles 429 102 The Palette 892 609 NV Residences 642 642 Serangoon / Thomson (19-20) Twin Waterfall (EC) 728 625 The Minton 1145 1062 590 310 Riversound Residences Seletar Park Residence 276 98 Bartley Residences 702 251 The Luxurie 622 322 Casa Cambio 198 192 Parc Vera 452 287 540 493 Austville Residences (EC) Watertown 992 935 Terrasse 414 382 Cardiff Residences 163 124 Boathouse Residences 493 374 A Treasure Trove 882 820 West (22-24) The Rainforest (EC) 466 408 Natura@Hillview 193 56 The Hillier 528 478 Blossom Residences(EC) 602 505 North (25-28) Tampines Trilliant (EC) 670 338 Parc Rosewood 689 607 The Nautical 435 251 The Miltonia Residences 410 358 Eight Courtyards 654 555 Source: URA

District City & Southwest Orchard/Tanglin/Holland Newton/Bukit Timah/Clementi Balestier/MacPherson/Geylang East Coast Changi/Pasir Ris Serangoon/Thomson West North Source: URA

$psf Feb12 1,347 1.776 1,207 928 977 774 899 793 710

$psf Mar12 1,336 1,692 1,263 995 1,026 805 887 764 728

MoM % change -0.8 -4.7 4.6 7.2 5.0 4.1 -1.3 -3.7 2.5

Rental Market

District City & Southwest Orchard/Tanglin/Holland Newton/Bukit Timah/Clementi Balestier/MacPherson/Geylang East Coast Changi/Pasir Ris Serangoon/Thomson West North Source: URA $psf pm Jan12 4.8 4.6 3.2 3.2 3.2 2.9 3.1 2.9 2.7 $psf pm Feb12 4.8 4.6 3.6 3.2 3.3 2.8 3.1 2.8 3.0 MoM % change -0.5 0.2 -11.7 -0.4 -2.1 3.1 1.6 1.2 -9.4

Top 5 Resale Transactions by $psf

Project Helio Residences Marina Collection Grange Residences Ardmore II The Metz Source: URA Tenure Freehold 99 Yr (fm 2007) Freehold Freehold Freehold District 9 4 10 10 9 $psf 3,402 2,800 2,671 2,570 2,560

86% 93% 53% 36% 36% 52% 97% 63% 91% 94% 92% 76% 76% 93% 88% 29% 91% 84% 50% 88% 58% 87% 85%

Bottom 5 Resale Transactions by $psf

Project Lakeside Tower Windermere Chinatown Plaza Lakeside Apartments Lakepoint Condo Source: URA Tenure 99 Yr (fm 1975) 99 Yr (fm 1997) Freehold 99 Yr (fm 1977) 99 Yr (fm 1983) District 22 23 2 22 22 $psf 460 513 551 552 557

26 April 2012

Page 5 of 8

HE EAL EALS Ins&OutsofSingaporeRealEstate

DEVELOPERS LANDBANK

Developer District 3 6 9 10 10 11 17 18 18 18 18 19 19 19 23 23 Sentosa Landbank

25 April 2012

Analyst: Alison FOK 65-6433 5745 alisonfok@kimeng.com

Tenure 99yr 99yr Freehold Freehold Freehold Freehold 99yr 99yr 99yr 99yr Freehold 99yr 99yr 99yr 99yr 99yr 99yr

Unsold Units 545 118 122 203 178 5 150 283 1,517 605 135 451 785 58 97 207 545 5,459 68 620 286 307 234 94 300 1,909

City Dev

Alexandra Road GLS site South Beach (Beach Road) Futura (Leonie Road) Boulevard Hotel (Cuscaden Road) Lucky Tower (Grange Road) Buckley Classique (Buckley Road) Hedges Park (Flora Road) NV Residences (Pasir Ris) The Palette (Pasir Ris) Pasir Ris Drive 8 (4 + 5) (Pasir Ris) Tampines/Upp Changi Rd North H2O Residences (Sengkang West Ave) Bartley Residences (Bartley Road) Mount Vernon GLS site (Bartley) The Rainforest (EC) (Choa Chu Kang Drive) Blossom Residences (EC) (Segar Road) Residences at W (Sentosa Cove) Total Unsold Units Marina Bay Suites (Marina Bay) Keppel & GE Towers site (Tanjong Pagar) Reflections at Keppel Bay (Keppel Bay) Keppel Bay Plot 3 (Keppel Bay) Keppel Bay Plot 4 (Keppel Bay) Keppel Bay Plot 5 (Keppel Bay) Sengkang GLS site (Sengkang Square) Total Unsold Units

KepLand

1 2 4 4 4 4 19

99yr Freehold 99yr 99yr 99yr 99yr 99yr

CapitaLand

3 9 10 10 15 16 20 26

The Interlace (Gillman Heights) Urban Resort (Cairnhill Rd) Dleedon (Farrer Rd) The Nassim (Nassim Rd) Marine Point (Marine Parade) Bedok Residences(Bedok Central) Sky Habitat (Bishan Street 14) Yio Chu Kang site (Yio Chu Kang Rd) Total Unsold Units

99yr Freehold 99yr Freehold Freehold 99yr 99yr Freehold

336 39 1,249 55 150 72 509 140 2,550 110 357 467 11 306 317 187 131 248 147 60 20 793 74 84 158

Ho Bee

Sentosa Sentosa

Seascape at Sentosa Cove (Sentosa Cove) Pinnacle at Sentosa Cove (Sentosa Cove) Total Unsold Units Spottiswoode Residences (Spottiswoode Park) Archipelago (Bedok Reservoir Rd) Total Unsold Units Skysuites @ Anson (Enggor Street) The Surrento (West Coast Road) RV Residences (River Valley) RiverBay (Mar Thoma Rd) Riviera 38 (Mar Thoma Rd) The Cascadia (Bukit Timah Road) Total Unsold Units

99yr 99yr

UOL

2 16

Freehold 99yr

Allgreen

2 5 9 12 12 21

99yr Freehold 999yr 999yr 999yr Freehold

Wheelock

9 10

Scotts Square (Scotts Road) Ardmore 3 (Ardmore Park) Total Unsold Units

Freehold Freehold

26 April 2012

Page 6 of 8

HE EAL EALS Ins&OutsofSingaporeRealEstate

DEVELOPERS LANDBANK (CONTD)

Developer District 2 10 26 Landbank Guocoland

25 April 2012

Analyst: Alison FOK 65-6433 5745 alisonfok@kimeng.com

Tenure 99yr 99yr Freehold

Unsold Units 500 381 36 917 75 55 24 88 221 80 232 80 855 249 197 23 595 97 327 119 47 103 99 1,856 17 64 38 42 157 35 276 629 32 70 65 353 32 520 35 208 23 50 31 347 16,809

Tanjong Pagar GLS white site (Peck Seah/Choon Guan) Leedon Residence (Leedon Heights) The Waterline (Yio Chu Kang Rd) Total Unsold Units Skyline Residences (Telok Blangah) The Vermont on Cairnhill (Cairnhill Rd) Paterson Suites (Paterson Rd) Paterson Suites II (Paterson Rd) St Thomas Walk (St Thomas Walk) Watercove Villes (Wak Hassan Drive) Nim Road (Nim Road) Luxus Hills (Seletar Green) Total Unsold Units

Bt Sembawang

4 9 9 9 9 27 28 28

Freehold Freehold Freehold Freehold Freehold Freehold Freehold 999yr

Frasers Centrepoint

9 15 16 16 18 18 19 19 19 27

Starhub Centre (Cuppage Rd) Flamingo Valley (Siglap Rd) Waterfront Isle (Bedok Reservoir Rd) Bedok South GLS site (Bedok South Avenue 3) Seastrand (Pasir Ris Drive 3) Palm Isles (Flora Drive) Boathouse Residences (Hougang) Watertown (Punggol) Twin Waterfalls (Punggol Way / Punggol Field) Eight Courtyards (Yishun Ave 2) Total Unsold Units Ascentia Sky (Redhill) HELIOS Residence (Cairnhill Circle) Belle Vue Residences (Oxley Walk) Le Nouvel Ardmore (Ardmore Park) Anderson 18 (Ardmore Park) L'VIV (Newton Rd) Foresque Residences (Petir Road) Total Unsold Units

99yr Freehold 99yr 99yr 99yr 99yr 99yr 99yr 99yr 99yr

Wing Tai

3 9 9 10 10 11 23

99yr Freehold Freehold Freehold Freehold Freehold 99yr

MCL Land

10 10 15 17 19

Palms @ Sixth Avenue (6 avenue) NOB Hill (Ewe Boon Rd) Casa Nassau (East Coast Rd) Ripple Bay (Jalan Loyang Besar) Terrasse (Hougang Ave 2) Total Unsold Units

Freehold Freehold Freehold 99yr 99yr

SC Global

9 9 9 10 Sentosa

The Marq (Paterson Hill) Hilltops (Cairnhill Circle) Martin No. 38 (Martin Rd) The Ardmore (Ardmore Road) Seven Palms (Sentosa Cove) Total Unsold Units Grand Total

Freehold Freehold Freehold Freehold 99yr

Source:HDB,URA

26 April 2012

Page 7 of 8

HE EAL EALS Ins&OutsofSingaporeRealEstate

APPENDIX I: TERMS FOR PROVISION OF REPORT, DISCLOSURES AND DISCLAIMERS

This report, and any electronic access to it, is restricted to and intended only for clients of Maybank Kim Eng Research Pte. Ltd. ("MAYBANK KERPL") or a related entity to MAYBANK KERPL (as the case may be) who are institutional investors (for the purposes of both the Singapore Securities and Futures Act (SFA) and the Singapore Financial Advisers Act (FAA)) and who are allowed access thereto (each an "Authorised Person") and is subject to the terms and disclaimers below. IF YOU ARE NOT AN AUTHORISED PERSON OR DO NOT AGREE TO BE BOUND BY THE TERMS AND DISCLAIMERS SET OUT BELOW, YOU SHOULD DISREGARD THIS REPORT IN ITS ENTIRETY AND LET KER OR ITS RELATED ENTITY (AS RELEVANT) KNOW THAT YOU NO LONGER WISH TO RECEIVE SUCH REPORTS. This report provides information and opinions as reference resource only. This report is not intended to be and does not constitute financial advice, investment advice, trading advice or any other advice. It is not to be construed as a solicitation or an offer to buy or sell any securities or related financial products. The information and commentaries are also not meant to be endorsements or offerings of any securities, options, stocks or other investment vehicles. The report has been prepared without regard to the individual financial circumstances, needs or objectives of persons who receive it. The securities discussed in this report may not be suitable for all investors. Readers should not rely on any of the information herein as authoritative or substitute for the exercise of their own skill and judgment in making any investment or other decision. Readers should independently evaluate particular investments and strategies, and are encouraged to seek the advice of a financial adviser before making any investment or entering into any transaction in relation to the securities mentioned in this report. The appropriateness of any particular investment or strategy whether opined on or referred to in this report or otherwise will depend on an investors individual circumstances and objectives and should be confirmed by such investor with his advisers independently before adoption or implementation (either as is or varied). You agree that any and all use of this report which you make, is solely at your own risk and without any recourse whatsoever to KER, its related and affiliate companies and/or their employees. You understand that you are using this report AT YOUR OWN RISK. This report is being disseminated to or allowed access by Authorised Persons in their respective jurisdictions by the Maybank Kim Eng affiliated entity/entities operating and carrying on business as a securities dealer or financial adviser in that jurisdiction (collectively or individually, as the context requires, "Maybank Kim Eng") which has, vis--vis a relevant Authorised Person, approved of, and is solely responsible in that jurisdiction for, the contents of this publication in that jurisdiction. Maybank Kim Eng, its related and affiliate companies and/or their employees may have investments in securities or derivatives of securities of companies mentioned in this report, and may trade them in ways different from those discussed in this report. Derivatives may be issued by Maybank Kim Eng its related companies or associated/affiliated persons. Maybank Kim Eng and its related and affiliated companies are involved in many businesses that may relate to companies mentioned in this report. These businesses include market making and specialised trading, risk arbitrage and other proprietary trading, fund management, investment services and corporate finance. Except with respect the disclosures of interest made above, this report is based on public information. Maybank Kim Eng makes reasonable effort to use reliable, comprehensive information, but we make no representation that it is accurate or complete. The reader should also note that unless otherwise stated, none of Maybank Kim Eng or any third-party data providers make ANY warranties or representations of any kind relating to the accuracy, completeness, or timeliness of the data they provide and shall not have liability for any damages of any kind relating to such data. Proprietary Rights to Content. The reader acknowledges and agrees that this report contains information, photographs, graphics, text, images, logos, icons, typefaces, and/or other material (collectively Content) protected by copyrights, trademarks, or other proprietary rights, and that these rights are valid and protected in all forms, media, and technologies existing now or hereinafter developed. The Content is the property of Maybank Kim Eng or that of third party providers of content or licensors. The compilation (meaning the collection, arrangement, and assembly) of all content on this report is the exclusive property of Maybank Kim Eng and is protected by Singapore and international copyright laws. The reader may not copy, modify, remove, delete, augment, add to, publish, transmit, participate in the transfer, license or sale of, create derivative works from, or in any way exploit any of the Content, in whole or in part, except as specifically permitted herein. If no specific restrictions are stated, the reader may make one copy of select portions of the Content, provided that the copy is made only for personal, information, and non-commercial use and that the reader does not alter or modify the Content in any way, and maintain any notices contained in the Content, such as all copyright notices, trademark legends, or other proprietary rights notices. Except as provided in the preceding sentence or as permitted by the fair dealing privilege under copyright laws, the reader may not reproduce, or distribute in any way any Content without obtaining permission of the owner of the copyright, trademark or other proprietary right. Any authorised/permitted distribution is restricted to such distribution not being in violation of the copyright of Maybank Kim Eng only and does not in any way represent an endorsement of the contents permitted or authorised to be distributed to third parties. Additional information on mentioned securities is available on request. Jurisdiction Specific Additional Disclaimers: THIS RESEARCH REPORT IS STRICTLY CONFIDENTIAL TO THE RECIPIENT, MAY NOT BE DISTRIBUTED TO THE PRESS OR OTHER MEDIA, AND MAY NOT BE REPRODUCED IN ANY FORM AND MAY NOT BE TAKEN OR TRANSMITTED INTO THE REPUBLIC OF KOREA, OR PROVIDED OR TRANSMITTED TO ANY KOREAN PERSON. FAILURE TO COMPLY WITH THIS RESTRICTION MAY CONSTITUTE A VIOLATION OF SECURITIES LAWS IN THE REPUBLIC OF KOREA. BY ACCEPTING THIS REPORT, YOU AGREE TO BE BOUND BY THE FOREGOING LIMITATIONS. THIS RESEARCH REPORT IS STRICTLY CONFIDENTIAL TO THE RECIPIENT, MAY NOT BE DISTRIBUTED TO THE PRESS OR OTHER MEDIA, AND MAY NOT BE REPRODUCED IN ANY FORM AND MAY NOT BE TAKEN OR TRANSMITTED INTO MALAYSIA OR PROVIDED OR TRANSMITTED TO ANY MALAYSIAN PERSON. FAILURE TO COMPLY WITH THIS RESTRICTION MAY CONSTITUTE A VIOLATION OF SECURITIES LAWS IN MALAYSIA. BY ACCEPTING THIS REPORT, YOU AGREE TO BE BOUND BY THE FOREGOING LIMITATIONS. Without prejudice to the foregoing, the reader is to note that additional disclaimers, warnings or qualifications may apply if the reader is receiving or accessing this report in or from other than Singapore. As of 26 April 2012, Maybank Kim Eng Research Pte. Ltd. and the covering analyst do not have any interest in the stocks mentioned. Analyst Certification: The views expressed in this research report accurately reflect the analyst's personal views about any and all of the subject securities or issuers; and no part of the research analyst's compensation was, is, or will be, directly or indirectly, related to the specific recommendations or views expressed in the report. 2012 Maybank Kim Eng Research Pte Ltd. All rights reserved. Except as specifically permitted, no part of this presentation may be reproduced or distributed in any manner without the prior written permission of Maybank Kim Eng Research Pte. Ltd. Maybank Kim Eng Research Pte. Ltd. accepts no liability whatsoever for the actions of third parties in this respect.

Stephanie Wong CEO, Maybank Kim Eng Research

www.maybank-ke.com | www.kimengreseach.com.sg 26 April 2012 Page 8 of 8

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Broader Market Rally to Continue in 2019Document132 pagesBroader Market Rally to Continue in 2019Arka Prava Chaudhuri0% (1)

- CPPIB's Private Equity Strategy vs Fund of FundsDocument3 pagesCPPIB's Private Equity Strategy vs Fund of FundsJitesh Thakur100% (1)

- Betting On The Blind Side - Vanity FairDocument3 pagesBetting On The Blind Side - Vanity FairSww WisdomNo ratings yet

- Nism 5 A - Mutual Fund Exam - Practice Test 6 - Copy - PDF (Secured) - Adobe ReaderDocument24 pagesNism 5 A - Mutual Fund Exam - Practice Test 6 - Copy - PDF (Secured) - Adobe ReaderNithin VarghzzNo ratings yet

- Var, CaR, CAR, Basel 1 and 2Document7 pagesVar, CaR, CAR, Basel 1 and 2ChartSniperNo ratings yet

- Corvex Capital - Restoring The Health To Commonwealth - 2013.02.26Document69 pagesCorvex Capital - Restoring The Health To Commonwealth - 2013.02.26Wall Street WanderlustNo ratings yet

- Savills - 2Q2015Document4 pagesSavills - 2Q2015SG PropTalkNo ratings yet

- Savills' Private Residential Sales Briefing - May 2015Document4 pagesSavills' Private Residential Sales Briefing - May 2015SG PropTalkNo ratings yet

- Colliers Report - Aug2014Document7 pagesColliers Report - Aug2014SG PropTalkNo ratings yet

- Cantonese Idioms and What They MeanDocument3 pagesCantonese Idioms and What They MeanSG PropTalkNo ratings yet

- Colliers Singapore Private Residential Maket Report - 3Q2014Document5 pagesColliers Singapore Private Residential Maket Report - 3Q2014SG PropTalkNo ratings yet

- Edinburgh City Index 2Q2014Document2 pagesEdinburgh City Index 2Q2014SG PropTalkNo ratings yet

- HSR Report - 3 Oct 2014 (Narrowing CCR Vs OCR-RCR Spread)Document4 pagesHSR Report - 3 Oct 2014 (Narrowing CCR Vs OCR-RCR Spread)SG PropTalkNo ratings yet

- Colliers SG Private Residential Sales 1Q2015Document5 pagesColliers SG Private Residential Sales 1Q2015SG PropTalkNo ratings yet

- Resurgence of Mixed Use Developments in Singapore CBDDocument8 pagesResurgence of Mixed Use Developments in Singapore CBDSG PropTalkNo ratings yet

- Asia Property Market Sentiment Report (H2) 2014Document141 pagesAsia Property Market Sentiment Report (H2) 2014SG PropTalkNo ratings yet

- Revised Guidelines For Strata Landed Housing Developments (22 Aug 2014)Document3 pagesRevised Guidelines For Strata Landed Housing Developments (22 Aug 2014)SG PropTalkNo ratings yet

- Pine Grove Transactions (Aug 2011 - Aug 2014)Document10 pagesPine Grove Transactions (Aug 2011 - Aug 2014)SG PropTalkNo ratings yet

- Singapore Residential Demand 1Q2014Document8 pagesSingapore Residential Demand 1Q2014SG PropTalkNo ratings yet

- Savills SG Residential Sales Briefing Q2-2014Document4 pagesSavills SG Residential Sales Briefing Q2-2014SG PropTalkNo ratings yet

- Sky Vue: Media ReleaseDocument3 pagesSky Vue: Media ReleaseSG PropTalkNo ratings yet

- Sky Vue: Fact SheetDocument1 pageSky Vue: Fact SheetSG PropTalkNo ratings yet

- DBS Interest GuardDocument4 pagesDBS Interest GuardSG PropTalkNo ratings yet

- Art On The Park - MelbourneDocument3 pagesArt On The Park - MelbourneSG PropTalkNo ratings yet

- Singapore Property (16-04-2013)Document6 pagesSingapore Property (16-04-2013)SG PropTalkNo ratings yet

- The Mews - BrochureDocument13 pagesThe Mews - BrochureSG PropTalkNo ratings yet

- Singapore Property Update (17-12-2012)Document6 pagesSingapore Property Update (17-12-2012)SG PropTalkNo ratings yet

- Citigold Property Insights Q42012Document7 pagesCitigold Property Insights Q42012SG PropTalkNo ratings yet

- The Real Deals (25-10-2012)Document9 pagesThe Real Deals (25-10-2012)chow_ck6055No ratings yet

- Kim Eng ReportDocument9 pagesKim Eng ReportSG PropTalkNo ratings yet

- The Real Deals (22-11-2012)Document9 pagesThe Real Deals (22-11-2012)SG PropTalkNo ratings yet

- Tampines CourtDocument4 pagesTampines CourtSG PropTalkNo ratings yet

- The Real Deals (20-12-2012)Document9 pagesThe Real Deals (20-12-2012)SG PropTalkNo ratings yet

- Singapore Residential Update 301012Document8 pagesSingapore Residential Update 301012SG PropTalkNo ratings yet

- TheEdge (October 8, 2012)Document1 pageTheEdge (October 8, 2012)SG PropTalkNo ratings yet

- Kim Eng Research (09-10-2012)Document7 pagesKim Eng Research (09-10-2012)SG PropTalkNo ratings yet

- Attica Gold Company 8880 300 300Document1 pageAttica Gold Company 8880 300 300Gopi NarahariNo ratings yet

- Marketing Căn B N - PhilipkotlerDocument384 pagesMarketing Căn B N - Philipkotlerngochan00595No ratings yet

- Nikko AM Shenton Singapore Dividend Equity Fund SGD - Fund Fact SheetDocument3 pagesNikko AM Shenton Singapore Dividend Equity Fund SGD - Fund Fact SheetSaran SNo ratings yet

- Option PricingDocument30 pagesOption Pricingkfir goldburdNo ratings yet

- Airasia If GroupDocument17 pagesAirasia If Groupamirul asyrafNo ratings yet

- Awareness Study on Mutual Funds Among InvestorsDocument18 pagesAwareness Study on Mutual Funds Among InvestorsSimran lalchandaniNo ratings yet

- Data Interpretation Level 1 QuestionsDocument19 pagesData Interpretation Level 1 Questionsaish2ksNo ratings yet

- Life Insurance and Annuity Models for Multiple LivesDocument16 pagesLife Insurance and Annuity Models for Multiple LivesFion TayNo ratings yet

- Ferrous at The LMEDocument4 pagesFerrous at The LMEericmNo ratings yet

- Q&A-Company ActDocument22 pagesQ&A-Company ActairDeal LimitedNo ratings yet

- Financial Analysis SpreadsheetDocument76 pagesFinancial Analysis SpreadsheettimothytroyNo ratings yet

- Assets Liabilities and EquityDocument16 pagesAssets Liabilities and EquityYahlianah LeeNo ratings yet

- Anglo Annual Report 2009Document180 pagesAnglo Annual Report 2009grumpyfeckerNo ratings yet

- 2 ACC5215 2020 M11 Associates and JV All SlidesDocument23 pages2 ACC5215 2020 M11 Associates and JV All SlidesDev GargNo ratings yet

- 10 Years of Growth and InnovationDocument194 pages10 Years of Growth and Innovationram binod yadavNo ratings yet

- Balance Sheet and P&L of CiplaDocument2 pagesBalance Sheet and P&L of CiplaPratik AhluwaliaNo ratings yet

- Regulations On Fdi, Adr, GDR, Idr, Fii &ecbDocument59 pagesRegulations On Fdi, Adr, GDR, Idr, Fii &ecbAvinash SinghNo ratings yet

- VHSSDocument1 pageVHSSArush SinhalNo ratings yet

- IA 3 - BVPS and EPS - SolutionsDocument22 pagesIA 3 - BVPS and EPS - SolutionsPatríck LouieNo ratings yet

- Merchant Banking in IndiaDocument66 pagesMerchant Banking in IndiaNitishMarathe80% (40)

- List of Regd Sub BrokersDocument435 pagesList of Regd Sub BrokersPramod RawalNo ratings yet

- Roe FX TCR 4.3.1Document24 pagesRoe FX TCR 4.3.1Prasad NayakNo ratings yet

- Accounting For ValueDocument15 pagesAccounting For Valueolst100% (5)

- MBSA 1323 - Strategic Innovative Marketing Case Study 1Document3 pagesMBSA 1323 - Strategic Innovative Marketing Case Study 1黄伟伦No ratings yet