Professional Documents

Culture Documents

Organisational Design For R&D

Uploaded by

Ricky RichardOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Organisational Design For R&D

Uploaded by

Ricky RichardCopyright:

Available Formats

Organizational Designs for R&D Author(s): Garardine DeSanctis, Jeffrey T.

Glass, Ingrid Morris Ensing Source: The Academy of Management Executive (1993-2005), Vol. 16, No. 3 (Aug., 2002), pp. 55-66 Published by: Academy of Management Stable URL: http://www.jstor.org/stable/4165868 . Accessed: 29/09/2011 05:45

Your use of the JSTOR archive indicates your acceptance of the Terms & Conditions of Use, available at . http://www.jstor.org/page/info/about/policies/terms.jsp JSTOR is a not-for-profit service that helps scholars, researchers, and students discover, use, and build upon a wide range of content in a trusted digital archive. We use information technology and tools to increase productivity and facilitate new forms of scholarship. For more information about JSTOR, please contact support@jstor.org.

Academy of Management is collaborating with JSTOR to digitize, preserve and extend access to The Academy of Management Executive (1993-2005).

http://www.jstor.org

Academy of Management

Executive, 2002, Vol. 16, No. 3

.......................................................................................................................................................................

Organizational designs

for

R&D

Gerardine DeSanctis, Jeffrey T. Glass, and Ingrid Morris Ensing Executive Overview

Research and development is becoming increasingly business-oriented, and corporate reliance on new technology and innovation is greater than ever. How can R&D activities be organized to yield the greatest value for the enterprise? A study of 14 leading technology-intensive companies in six industries illustrates how three organizational designs are being used to manage distributed, flexible R&D organizations: (1) decentralized, (2) networked, and (3) integrated. Decentralized designs limit the role of a central R&D group; they direct R&D resources more toward products and markets rather than basic scientific activities. Networked designs push the boundaries of R&D outside the confines of a central R&D group and the firm as a whole. Integrated models use sophisticated communication linkages to tie centralized, science-based activities with the business needs of the corporation. Within the three design approaches, there are design variants, each with its positive and negative tradeoffs. We show how some designs for R&D are more effective than others and provide suggestions for how companies in search of an ideal organization design for R&D can select among possible configurations to promote adaptive, value-oriented R&D organizations.

How can R&D activities be organized to yield the greatest value for the enterprise? In an era when corporate strategy and survival can depend heavily on a firm's ability to innovate rapidly, with maximum business impact and rigorous cost control, organization design issues have moved to the foreground.' The dilemma is classic: how to simultaneously yield value from centralized and decentralized forms of organizing; but the context is new: a heightened pace of innovation, reduced product life cycles, a global marketplace, growing reliance on intellectual property rather than hard-core technologies, and the massive infusion of electronic communication systems for creating and coordinating knowledge work.2 Organizations are moving from reliance on hierarchy and rigidity of structure to new forms that are flatter, cross-functional, and dynamic.

global and local, disciplined and flexible. Mastering paradox is paramount.3 The head of R&D for. GlaxoSmithKline recently put the issue this way: "We need to be big and small at the same time."4 More than ever, companies seek value from their R&D initiatives. The potential payoffs from organizing R&D effectively are enormous and the costs of ineffective organization structures extremely high. Executives confront a quandary: how to construct an ideal organization design for R&D among a sea of possible configurations. Trends and Tensions Historically R&D operations were centralized, and this organization design persisted long after World War II. Even as organizations grew, diversified, and spread across the globe, R&D remained centralized for many companies. Well-documented problems, however, arose out of centralized structures, among them weak links between R&D efforts and meeting the needs of customers and product lines. Product development cycles were perceived to be too slow and R&D costs too high. R&D was viewed as overly scientific and out of touch with the business enterprise. By the late 1980s, most large technology companies had decentralized R&D operations, breaking down (though not neces55

How can R&D activities be organized to yield the greatest value for the enterprise?

Within this context, R&D activities are increasingly business-oriented and capital-intensive. Firms seek to be both innovative and efficient,

56

Academy of Management Executive

August

corporate laboratories and sarily eliminating) moving R&D activities closer to business units.5 A move from a central R&D (CRD) design to a business unit R&D (BU-R&D)design shifted the strategy of R&D away from one of hope toward one of acis, from heavy emphasis on pure retion-that search to heavy emphasis on product development.6 Without doubt, R&D in technology companies has become more business relevant. But organization design choices for R&D are not without controversy. Classic tensions in R&D management persist. (See Figure 1.) Companies continually struggle with how best to reconcile the competing pressures associated with organizing R&D around science versus organizing R&D around products or markets. Executives wish for the benefits of both science and business-oriented R&D; however, developing both centralized and business-unit R&D groups is costly, and coordination needs become more complex as R&D activities spread throughout the enterprise.7 The organization design dilemma is that decentralized structures and formal accountability for R&D are more likely to bring more new products and incremental innovations, but major technology advancements are more likely when R&D is centralized and informal.8 These tensions are evident in industries as varied as chemicals, electronics, aerospace, communications, and pharmaceuticals.

Companies continually struggle with how best to reconcile the competing pressures associated with organizing R&D around science versus organizing R&D around products or markets.

Insights from Leading Companies We examined 14 leading technology companies from six major industries with the goal of identifying the various organizational structures that firms are using to arrange their R&D units. We sought out large, profitable, multinational firms with reputations for technology strong, established leadership and significant R&D investments. All of the firms rely on technology to support their core business strategies, and all have been operational for at least 10 years. On average, the firms we studied spend over $1.7 billion annually, or 8% of revenue, on R&D. They employ over 122,000 people and generate approximately $303,000 of sales annually per employee. With one exception the companies have a history of maintaining large corporate laboratory facilities and attracting the best scientists and engineers in their industries.9 We identified the dominant organization designs for R&D in these firms. We compared and contrasted the firms on some basic financial parameters and then documented in detail how centralizationdecentralization tradeoffs were managed via organization design. Because theorists emphasize paradox in new organizational forms, we were especially interested in the structures used to meet basic science and product development needs simultaneously.10 Organization Designs for R&D We observed that three general models are being used today for design of R&D: (1) decentralized models, (2) networked models, and (3) integrated models. Decentralized models place R&D close to or within BUs, limiting the role of any centralized R&D function. Networked models link BUs to R&D sources inside and outside of the organization. Integrated models combine centralized with decentralized R&D structures and use special communication mechanisms to tie these structures together. All of the models address current pressures to simultaneously meet the competing R&D goals of long-term research and short-term product development. Figure 2 summarizes some basic financial and related parameters and shows the dominant organization design associated with each of the firms in

Central R&D (CRD) * Services the needs of the corporation * Permits long-range thinking * Brings frame-breaking to product innovation * Encourages risk taking ? Attracts leading-edge and engineers * Emphasizes research scientists science

Business Unit R&D (BU-R&D)

* Services the needs of

a .

* * *

* The balance of power within the management structure tends toward centralization

the market or product line Pushes short-term results Develops technology in response to business needs Promotes product success Attracts business-savvy technologists Emphasizes development The balance of power within the management structure tends toward decentralization

FIGURE 1 Competing Organization Design Pressures in R&D

2002

DeSanctis, Glass, and Ensing

Firm's Percent of Industry Revenue 13.70% 3.53% 11.61% 1.41% 7.56% 4.59%

57

Company' F E A B Average L P C

Organization Design for R&D DECENTRALIZED DECENTRALIZED DECENTRALIZED DECENTRALIZED NETWORK NETWORK NETWORK

Annual R&D Expenditures2 2279 3524 394 92 1572 3648

Annual Revenue3 33900 23200 15128 2363 18648 30147

Total Employees 251900 234000 70400 150000 176575 141600

Firm's Percent of Industry R&D Expenditures 37.04% 5.96% 7.92% 0.34% 12.82% 6.17%

Value Ratio4 01.47 02.53 20.81 27.92 13.18 05.25

1308

1020

39150

8458

101000

15000

16.51%

1.73%

18.67%

1.29%

11.20

49.72

Average G I

M T D X H Average Overall Average

INTEGRATED INTEGRATED

INTEGRATED INTEGRATED INTEGRATED INTEGRATED INTEGRATED

1992 1930 5046

1297 2674 807 701 35 1784 1768

25918 100469 81667

8648 26273 18441 4809 1300 34515 28140

85867 293000 291067

31800 64500 39029 25000 2000 106628 122164

8.14% 31.37% 8.54%

16.37% 4.53% 10.18% 2.56% 0.41% 10.57% 10.69%

8.18% 40.60% 12.43%

4.12% 4.00% 8.80% 2.87% 0.18% 10.44% 9.13%

22.06 04.42 05.00

07.92 13.70 22.13 44.75 216.19 44.87 30.93

1 Companies E, L, C. T, and I are in the information and electronics industry. Companies P, D, and M are in the chemicals industry. industry. Companies F and G are in the machinery and equipment industry. Companies B and X are in the medical/pharmaceuticals Company A is in aerospace, and Company H is in the industrial materials industry. of U.S. dollars. 2Millions 3 Millions of U.S. dollars. as ((Firm's % of Industry Revenue/Firm's % of Industry R&D) * 1,000,000)/total employees. The larger the ratio, 4 The ratio is calculated the more revenue the firm generates from R&D expenditures, relative to industry averages and controlling for firm size.

FIGURE 2 Organization Design, Size, and Financial Measures for the 14 Companies

our study. The integrated model is the most popular, and this is probably due to its many advantages relative to the other design types, as we shall discuss below. Note that there is no dominant organization design type as a function of industry. For example, firms in the information and electronics industry fall across the three organization design categories. The data in Figure 2 reflect a few general patterns. Firms that adopt the decentralized approach to organization design have smaller R&D budgets, generate less revenue, and employ more people than firms adopting the other two organization design models. Firms that adopt the network organization design are smaller, relatively speaking, in terms of number of employees, and spend more on R&D than firms using the decentralized and integrated models. Firms using the integrated design are mid-range in the size of their R&D budgets and number of employees, yet they generate the highest corporate revenue, on average. To account for variations in R&D budgets and revenue across industries, we calculated for each firm its percentage of overall industry R&D expenditures and its percent of industry revenue." So, for example,

firms using the decentralized designs spend an average of 12.8% of their industry's R&D budget, yet generate only 7.6% of industry revenue. In contrast, firms using integrated designs expend about 10.5%of industry R&D budgets and generate about the same portion of industry revenue. As a simple measure of each firm's ability to generate value from R&D within its industry, we divided each firm's percent of industry revenue by its percent of industry R&D expenditures. To account for firm size, we then divided the result by the firm's number of employees.'2 The larger this ratio, the more revenue the firm generates from R&D expenditures, relative to industry averages and controlling for firm size. The data in Figure 2 are displayed in order of increasing values of this ratio for each organization design type. On average, integrated designs are associated with greater value generation from R&D, but it is important to note that there is wide variation in value ratios within each design category. Looking across the three right-hand columns of Figure 2, it seems that integrated and network designs are associated with lower cost and greater value generation from R&D relative to decentralized designs. The

58

Academy of Management

Executive

August

variation between companies within each organization design category, however, suggests that specific implementation of the models varies across firms. Value generation is possible within each organization design approach, perhaps depending on the specific ways in which firms apply the models. With the data in Figure 2 as a backdrop, we can now look more deeply into the organization designs of the 14 companies.

Integrated and network designs are associated with lower cost and greater value generation from R&D relative to decentralized designs.

(1) Decentralized Models

Four of the fourteen firms maintain a decentralized approach to R&D management, though their strategies and approaches to decentralization suggest three forms. (See Figure 3). Companies A and B adopt the first form, whereas companies F and E use the second and third forms, respectively. Note that companies A and B are more successful in

Chief Technology Officer

their use of the decentralized approach-in terms of achieving value relative to their industries. (See the value ratios in Figure 2.) Decentralized designs hold in common the fact that they limit the role of a central R&D group. In the purest form of decentralization, there is no central R&D at all. All R&D activity takes place within the BUs. R&D groups across BUs may or may not be coordinated through a central office, such as the Chief Technology Officer. This purely decentralized approach puts R&D close to the customer or product and is consistent with what Miles and Snow labeled a defender strategy.13 Scientific and engineering expertise is directed toward the specific product and/or market domains of the business, and any innovation effort tends to be highly targeted. If R&D budgets are held relatively low, monies can be directed toward projects with high payoff, thus yielding value from R&D activities. Despite these advantages, there is little learning or leveraging of R&D capabilities across the enterprise as a whole, because the R&D group of one business unit is not likely to interact with the R&D groups of other BUs. Research support for firmwide strategic initiatives is difficult if not impos-

No CRD

0 >>>fi>

Segmented CRD

CRD

1 BUR&D~~~~~~~~~~~R

BU 2 R&D BU2~

~ ~ ~~~~B

D3R&

R&D R&D

...................

Dispersed

BU 1| R&D 1 BU 1 R&D2

\

CRDD Product

LU2

BU

R&D, p< BU4 R&D

\~~~~~~~trtg

group 1 Figure Legend

=

= =

3

\\ eas

\

\ t strategy group 2

}D

Product strategy grop 3=

person

department or division cross-functional computer system team

Decentralized

FIGURE 3 Models for R&D Organization

Design

2002

DeSanctis, Glass, and Ensing

59

sible. Economies of scale from R&D spending are not available, since laboratories and scientists are duplicated and not shared across the enterprise. Companies E and F have attempted to overcome some of the downsides of the no-CRD approach but with mixed success. Company F adopts a segmented CRD model in which R&D personnel associated with specific markets or products are consolidated into a central location but operate independently of one another. CRD is essentially a shell operation, a physical location and/or logistical unit for managing R&D personnel and related resources. The major advantage of the segmented model over the no-CRD model is that it increases for knowledge transfer across the possibilities R&D groups of the various BUs. Co-location can facilitate informal collaboration and joint problemsolving. Further, this model offers cost advantages. Scientists and engineers in co-located laboratories can be managed together, thus streamlining hiring, training, and other personnel costs. On the other hand, co-located BU-R&D groups risk becoming out of touch with the BUs that they were designed to serve. Company F is not achieving high value from its segmented model, perhaps because the firm's R&D strategy is not consistent with its organization design. Company F is pursuing what Miles and Snow would call a prospector strategy; the firm is very aggressive with regard to searching for opportunities beyond immediate customer and product lines, and the BU-R&D groups are having trouble staying aligned with BU needs due to their distant location from them. R&D expenses are very high relative to industry averages, and value from R&D expenses is difficult to achieve. Like the no-CRD approach, a segmented model may be better used with a defender approach to R&D strategy, since in the segmented model R&D remains organized along product or market-oriented lines. The dispersed model for R&D management scatters R&D throughout the enterprise, anywhere and everywhere there is deemed to be opportunity and business need. Company E in our sample exemplifies this model. BUs that need and can afford R&D create R&D groups. Some BUs may have more than one R&D group. Other BUs may have no R&D. Cross-unit product-strategy groups form on an asneeded basis to develop and/or support new technologies. In the dispersed model, there may or may not be a CRD. Where a CRD exists, its role is not so much to coordinate R&D efforts as it is to take on special projects that fulfill particular productdevelopment needs that cannot be met inside of the BUs. In Company E there is no central coordination or control unit for R&D. Rather, there is

continual (though not monitored or required) informal information exchange among the many, diffuse R&D activities. Informal information exchange occurs via electronic discussion groups, seminars, and workshops made available to technical employees.

The dispersed model for R&D management scatters R&D throughout the enterprise, anywhere and everywhere there is deemed to be opportunity and business need.

The advantage of the dispersed approach is that it fosters a culture of product innovation and experimentation. The model fits a prospector approach to R&D strategy. As one manager in Company E put it, "New product ideas come from anywhere and everywhere." The problem, of course, is that ensuring adequate information exchange is difficult when operations are scattered, and good ideas and research resources can be squandered in the fray. Recognizing this potential weakness, Company E has established an "ideas database" into which technology development ideas from throughout the enterprise can be placed for later use by others. Still, the reliance on an information system to integrate R&D information, without an organizational unit or other authority role, is problematic. The dispersed model risks becoming decentralization run amuck, and although value through growth may be achieved in the long run, it is an extremely expensive approach to organization design. (2) Networked Models Much is written today extolling the value of the so-called network organization design in which the walls of corporate divisions or BUs-or indeed the organization itself-are opened, allowing fluid exchange of information across corporate and BU boundaries.'4 For R&D, networked models facilitate transactions-on-demand in which R&D resources are applied when and where they are needed, regardless of where the technical capabilities lie-whether inside a CRD, inside a BU, or outside of the organization. Networked models are compatible with the prospector approach to R&D strategy, as they deliberately aim to link basic technology developments to business needs. Firms adopting a networked approach create and nurture a set of relationships to link basic technology sources to business demands. As business needs change, new relationships are established, and so

60

Academy of Management

Executive

August

there is flexibility in R&D ventures. We observed three networked models. (See Figure 4.) The internal-market model relies on informal interaction between CRD and BUs whereby BUs scout for relevant projects within CRD, and CRD groups, in turn, seek BU sponsors for basic science initiatives. Specific CRD groups are not necessarily designated to work with specific BUs; rather, linkages are developed depending on how a research group's technology or expertise can be applied to the BU. In Company L, where we observed this model in action, no single person within CRD is assigned to manage CRD-BU relationships; the incentives for all of the researchers are designed to encourage proactive, targeted relationships with BUs. In turn, BUs are free to approach researchers in CRD with requests for technical assistance or full-blown research projects. Project milestones and costs are negotiated to meet the specific needs at hand. Extensive CRD-BU interaction is promoted via face-to-face meetings, regular visits to project teams, job rotation between CRD and BUs, conferences and discussion groups around research areas, and various social functions. Ongoing interaction between BU and CRD personnel increases the likelihood of successful initiatives. An incentive structure can also be used to reward employees who take initiative to cross the BU-CRD boundary.

The acquisition model is based on forming R&D relationships with entities outside the firm. Technologies are imported in accordance with the firm's strategy and specific needs, and then integrated into the firm's existing product-development efforts inside BUs. The acquisition model inin the of technology cludes the purchasing broadest sense, whether research data or methods, R&D staff, or even entire organizations surrounding the technology. Several companies in our sample use the acquisition approach on a limited basis to acquire risky, cutting-edge technologies from small and start-up firms. Only one company we as its acquisition C-uses studied-Company dominant organization design. The acquisition approach allows it to keep its R&D costs relatively low and its value ratio high as acquisitions substitute for a corporate CRD function, transferring external R&D resources to BUs as they are needed. The advantage of this outreach model is that it reduces the internal need for scientific staff and laboratories and, more importantly, facilitates rapid fulfillment of specific R&D needs. It also reduces the risk of R&D investments since acquisitions can be made after desired technology development milestones have been achieved. On the other hand, identifying and developing external relationships require special business and legal

Internal-Market Model

Acquisition Model

BU 3BCp3

Companyy

BU 4

4 ~~~~~BU

Cmpany

R&D done in acquisitions

Extended-Enterprise

Model

I BU

Figure Legend URjniversity BU_ Research C]

=

person external entity

= department or division

=

CorporateR&D Partnerships

FIGURE 4 Networked Models for R&D Organization

Design

2002

DeSanctis, Glass, and Ensing

61

skills. Further, the company is dependent on a vibrant external marketplace to meet its internal R&D needs. model pushes the netThe extended-enterprise work notion further to include formation of R&D relationships with a wide set of internal and external partners. For example, CRD may form alliances or joint R&D ventures with government laboratories, universities, or other companies; the R&D department of one BU may form an agreement to support the R&D needs of another BU; or the CRD may work with university laboratories to supply specific R&D needs of several BUs. The idea is to form R&D relationships that meet R&D needs, no matter where the R&D source might be located. CRD may broker these relationships for the BUs, but BUs are not bounded by CRD and can form relationships with external parties or with one another on an as-needed basis. There has been a general trend among technology companies toward external sourcing of R&D from universities, start-ups, private labs, alliances, and so on.'5 Among the firms we studied, Company P is using the extended enterprise as its dominant organization design for R&D. Many others practice external sourcing on a limited basis, relying more heavily on internal CRD and/or BU-R&D resources. The findings from our interviews suggest that the extended-enterprise model requires organizational incentives that foster coordination and collaboration efforts across organizational boundaries. For example, both BU and CRD staff should feel free to identify and create research contracts or partnerships without concern for turf wars when dealing with a common external lab or research site.

tionships can be scaled back in times of economic downturn. In a sense, networked models replace the traditional, centralized CRD organization with modern twists: either an open CRD or location of basic scientific activities outside of firm boundaries. Successful implementation of networked models requires a host of corporate capabilities-monitoring and support of the internal and/or external R&D marketplace, careful review and selection of available technologies, and strong internal socialization and leadership skills to broker relationships. R&D success is dependent on the network of relationships. Networked models offer high potential value, but they are tricky to implement, especially as dominant organization designs.

(3) Integrated Models

Integrated organization designs for R&D incorporate both short-term product development initiatives and basic science initiatives with long-run potential. Integrated models practice a "mixed mode" strategy for innovation, and CRD takes on a key governance role in implementing this strategy. The strong governance role of CRD differentiates firms with integrated organization designs from companies with dominantly decentralized or networked models. CRD is not necessarily large in size, but it takes on an R&D leadership role for the corporation. CRD serves as an important hotbed of scientific energy and as a hub in the wheel of R&D efforts throughout the enterprise. There is a strong philosophy that "technology belongs to the corporation, not the business units." The goal of CRD is to help BUs "steal freely," as one manager in our study put it, by developing cross-unit technology platforms and meaningful information sharing in order to "look for exploitations and assure that the company will not be blindsided by new technology developments." CRD may have some laboratories that are isolated to pursue basic research, but CRD as a unit is anything but isolated. It has vibrant ties to the BUs. CRD links BUs with one another, and it links firm R&D efforts with the company's overall, strategic goals. Among integrated models, the typical CRD includes dedicated research project teams, laboratories, and functional support groups. Some companies have only central R&D facilities (e.g., Companies G, I, M, T, and X), whereas others also have BU-R&D groups (e.g., Company D and Company H.) Both approaches can be effective. For example, Companies X and H are yielding great value from R&D, yet they have different balances of BU and CRD resources for R&D. Company X has

There has been a general trend among technology companies toward external sourcing of R&D from universities, startups, private labs, alliances, and so on.

In addition, effective external partnerships require recognition of parties' common and differing needs, and the ability to coordinate technology plans and negotiate conflicts as they arise. Sophisticated legal, technical, and business skills are needed to manage a wider range of relationships than in the internal market or acquisition models. But the payoff can be high for companies that are able to manage a multitude of ventures. The extended-enterprise approach is particularly attractive for simultaneous support of basic scientific research along with fast-paced growth; and rela-

62

Academy of Management

Executive

August

a large CRD unit with many laboratories and functional groups. CRD is responsible for supporting the R&D needs of the corporation and promoting new product development, both short term and long term; almost no R&D is conducted inside of BUs. In contrast, Company H conducts R&D ventures largely within specific BUs or via cross-BU R&D projects rather than inside CRD. The CRD unit has no laboratories, but it does have a visible, prestigious group of managers and scientists who set leadership direction and facilitate firm-wide scientific support for R&D ventures. In both Company X and Company H, CRD is directly funded by the corporation and not from a "tax" or chargeback system to BUs on a project basis. Within the integrated-design approach, the choice of whether to develop CRD as a large or small entity is secondary to the decision of how to coordinate extensive corporate-wide R&D efforts. We observed two general approaches to structuring interaction between CRD and the BUs. (See Figure 5.) Team-based coordination involves formal mediating groups that consist of BU and CRD personnel. For example, Company H has standing tech teams and tech services groups that include BU members and CRD members organized around specific types of technology. Usually these teams include members from multiple BUs. As other examples, Company M has joint BU/CRD groups associated with each major product line, and Company X creates ad hoc project teams with CRD personnel to address specific BU research needs.

Liaison-based coordination occurs when managers within CRD are given designated responsibility for linking CRD to the BUs. As an example, relationship managers Company G appoints within CRD to serve as the interface between CRD and BUs. There is one designated relationship manager per BU. These relationship managers have no line responsibility, but they are provided with enormous implicit authority by reporting to the head of CRD. They are an integral part of the strategic planning for CRD, and each relationship manager is evaluated in part by the success of joint CRD-BU projects. Relationship managers who have been transferred to CRD from a BU view the position as a rotation that is good both for the BU and CRD. Other relationship managers have been long-time CRD researchers who are well informed about corporate R&D capabilities. Regardless of whether teams or individual liaisons serve to mediate CRD-BU relationships, as they work with a particular BU on technical issues these facilitators become knowledgeable about R&D strategy and specific BU needs. This outcome encourages a high probability of matching BU needs to CRD capabilities and R&D activities to corporate strategic directions. Along with a formal coordination structure, constant communication is a cultural imperative in firms adopting integrated organization designs. Most firms that we studied use R&D information systems that are accessible by both BUs and CRD. The information collected for these systems may

Team-based coordination

BU 1 BU 2 BU 3 Or CRD

Liaison-based

B

coordination

R

R&D~~~~~~~~~~&

BU 4 R&D

Cross-unit t

rr

ABU

SR&D

R&D information support system Figure Legend / Rela[tionship G Remantogers R&D information support system

technology tea:ms

O = person

IEI

= = =

department or division cross-functional team computer system

FIGURE 5 Integrated Models

2002

DeSanctis, Glass, and Ensing

63

include market intelligence, technology discussion databases, information on competitors' R&D initiatives, research data, R&D project tracking systems, and so on. Though it may be tempting for companies to rely on these systems in place of we more traditional forms of communication, found that the most successful firms rely as heavily on people-based communication mechanisms as on computer-based systems. For example, Companies D, G, H, and I use R&D information systems support, but they take care to design and groups and managers for support mediating knowledge transfer. Further, they promote a culture of communication via multiple methods, such as bulletins, conferences, and discussion groups. Information systems are used to support the R&D organization design, but they do not replace it.

Along with a formal coordination structure, constant communication is a cultural imperative in firms adopting integrated organization designs.

A Value-Driven Approach Figure 6 summarizes the major advantages, disadvantages, strategy, and other implementation guidelines for the three major models of R&Dorganization design. Reviewing these models, we find that there is no "one best" organization design. Indeed, a host of factors might dictate the specific model implemented by any given firm, such as firm goals, resources, existing infrastructure, mar-

Organization Design DECENTRALIZED

Advantages

* Supports a business

Disadvantages

* Difficult to share

Preferred R&D Strategy Defender: Innovation is targeted toward improving existing products or searching for new technologies within specific product or market lines Prospector: new product and market opportunities are aggressively pursued; exploration of new technologies is wide in scope

To implement for success.. . Use when R&D needs are decidedly different across business units * Avoid this approach if a prospector strategy is to be pursued . Keep R&D expenditures low through careful targeting of projects within business units * Use to support growth in new markets or new product ventures . Troll for value opportunities that lie outside of the firm (acquisition or extendedenterprise models) * Invest in skills and processes to support effective management of relationships

* Invest in coordination

orientation in R&D * Focuses R&D efforts on current customers needs * Short-term benefits from R&D investments are emphasized

knowledge or leverage R&D capabilities across the enterprise * Research support for firmwide strategic initiatives is difficult * Economies of scale in R&D facilities, personnel, etc., are difficult to achieve

* Requires business,

NETWORK

. Can be used to support basic scientific research at lower cost than traditional CRD * Effective matching process puts research resources when and where they are needed * Relationships are flexible and can be expanded or reduced as research or business needs change

* Mixed mode of business

legal, and social skills for developing effective relationships between parties in the network . Network dependencies are created, thus increasing risk if parties withdraw or do not meet commitments * Tends to be more costly if network reaches only inside the firm (internal market model)

* Requires cross-functional

INTEGRATED

and science orientation in R&D . Supports both shortand long-term R&D projects * Helps link R&D to the strategic direction of the technology-based firm

teams or designated relationship managers to coordinate CRD-BU relationships * CRD can be high relative to most decentralized and network models

Analyzer: a mixed mode approach to strategy, with targeted R&D for some products or markets and aggressive pursuit of new opportunities in other areas

structures and communication mechanisms to link CRD with BUs . Empower CRD with a governance role for R&D * Build a reputation for R&D excellence that is recognized inside and outside the firm

Summary of Advantages,

FIGURE 6 Disadvantages, Strategy, and Implementation Organization Design Models

Guidelines

for the

64

Academy of Management

Executive

August

ket opportunities, and so on. Most important is that executives recognize the tradeoffs associated with the design choices they make and take steps to realize specific design advantages and overcome We synthesized the atpotential disadvantages. tributes of effective R&D management from across the three design types found in our sample to suggest the general recommendations for organization design that follow.

(3) An Entrepreneurial, Communications-Oriented Culture Value-driven organizations engage in continual interaction between the BUs and R&D groups. They not only create relationship managers, project teams, R&D information systems, and so on; they use these mechanisms constantly. This constant level of communication contributes to a sense of partnership between general managers and R&D managers and reinforces the importance of innovation as a value in the firm. In this way, the managerial matrix between BUs and R&D operates well beyond the reporting structure and deep within the company.

(1) Strategic Mechanisms Regardless of the specific corporate strategy, value-driven companies adopt practices to link R&D ventures and progress with the corporation's strategic goals. In Company H, for example, R&D appointments are considered important and given an elite status. Company D has established an intellectual property department with intellectual asset managers who undertake valuation analysis for each R&D project. The value of the technology to the market and/or to the firm is assessed as a project is approved and as funding is renewed. Company M uses information systems to bring R&D progress and updated technical information to customers. Company A has a chief growth officer who scouts for high-potential projects from BUR&D units and then advocates them for executivelevel sponsorship

This constant level of communication contributes to a sense of partnership between general managers and R&D managers and reinforces the importance of innovation as a value in the firm.

(4) Putting Sharing Where It Matters firms overcome the isolation of Value-driven R&D from the rest of the company by promoting sharing where it matters, rather than haphazardly or everywhere. For example, teams are created where the payoff is likely to be greatest, and chief technology officers or relationship managers target high-probability projects. Most importantly, formalities are replaced by expedited review procedures and ad hoc methods of selecting people for projects and getting work done with the highest level of excellence possible. For example, Company G has replaced elaborate methods for selecting and managing projects with the use of simple evaluative spreadsheets and project milestones that can be specified rapidly, usually within a few hours. Company D has replaced pacing of project requests with R&D there is a need. requests on demand-whenever One manager referred to this approach as a "pick-up basketball game" as opposed to the "formal league games" typical of previous years.

(2) Executive-Level

Attention

To extract value from whatever organization design is implemented, the executive level of the firm devotes significant attention to R&D. This attention feeds downward and outward into all R&D operations. Executive involvement can be very heavy, such as in Company G where R&D projects of $lM or more require executive council approval. In some companies a corporate executive council determines all R&D initiatives. The CRD director may also be the chief technology officer and serve on an executive council (e.g., Company G) or even on the company's board of directors (e.g., Company P). Executive appointments and ongoing involvement in R&D reflect the recognition that nearly every In aspect of the company is technology-based. Company H the CEO sends out weekly reports prepared by R&D, adding comments and stressing the importance of various R&D activities to everyone in the company. As one executive put it, "Research is the basis of our business, not something we do on the side."

(5) Externally-Oriented

R&D

Value comes from using capabilities both inside and outside of R&D, and both inside and outside of the firm, to create new technology-based options. Value-driven R&D organizations look for scientific and business opportunities outside traditional R&D walls- to individuals, groups, companies,

2002

DeSanctis, Glass, and Ensing

65

and information systems both inside and outside the firm. Technology found in the marketplace might be the basis of a new product line, provide incremental development, or fill in the missing piece of an ongoing R&D effort. Though specific laboratories and projects may operate in isolation from time to time, BU-R&D and CRD operations are run with business objectives in mind, and managers are customer or product oriented. They recognize the need for collaboration and engage in ongoing scouting for new ideas and opportunities. (6) Willingness to Mix and Match Structures Varying R&D needs across a business enterprise can require different degrees of CRD and/or BUR&D attention, or different types of teams to coordinate R&D efforts. Dynamic economic conditions, corporate consolidations, or moves to spin off or acquire businesses likewise put pressure on R&D organizations to be flexible in their organization designs and use different structural or communication mechanisms as R&D demands change. Value-driven companies meet these challenges by recognizing that there is no one-size-fits-all approach to organization design; they maintain a coherent overall structure for R&D but vary the specific design attributes as needed. As one example, Company P in our study relies on an extended enterprise model as its dominant organization design but complements this with use of joint CRD/BU R&D teams for technology transfer. Both technologists and general managers are willing to use different R&D structures for different products or at different periods in time. Achieving Value from R&D To conclude, organization design does not directly determine corporate success, but it is one critical factor that comes into play in determining whether companies are able to yield value from their R&D spending. Both science-oriented companies and business-driven companies can use new organizational forms to yield value. The integrated model is an excellent starting point for most firms as it accommodates both product development and basic science initiatives. From there, organizing R&D for value means pursuing centralized and decentralized R&D activities that collectively facilitate the firm's overall strategic objectives. To design mechanisms to accommodate scientific and business units in the firm, executives can review the range of possible organization design options and identify the advantages and disadvantages of each model in light of organizational

resources and goals. They can then take steps to implement the kinds of structural, communication, and other mechanisms we have described to break down organizational boundaries and satisfy research and development needs when and where they arise. The result is an adaptive and progressive model of organizing for R&D directed toward achieving value for the enterprise. Acknowledgment

Gerardine DeSanctis would like to thank INSEAD for sponsoring her sabbatical leave during which this article was completed.

Endnotes

' Daft, R. L., & Lewin, A. Y. 1993. Where are the theories for the "new" organizational forms? Organization Science, 4(4): i-vi; and DeSanctis, G., & Fulk, J. (Eds.). 1999. Shaping organization form: Communication, connection, and community. Newbury Park, CA: Sage. 2Drucker, P. F. 1999. Knowledge-worker productivity: The biggest challenge. California Management Review, 41(2): 79-94; and Doz, Y., Santos, J., & Williamson, P. 2001. From global to metanational: How companies win in the knowledge economy. Boston: Harvard Business School Press. 3 Child, J., & McGrath, R. G. 2001. Organizations unfettered: Organizational form in an information-intense economy. Academy of Management Journal, 44(6): 1135-1148. 4Dyer, G. GSK considers spinning off its research units. Companies & Markets. Financial Times, 25 January 2002, 15. 5Jankowski, J. E. 1998. R&D foundation for innovation. Research Technology Management, 41(March-April): 20; and Larson, C. F. 1998. Industrial R&D in 2008. Research Technology Management, 41(November-December): 19-24. 6In this paper we use the term Business Unit (BU) to refer generically to any product, customer, or other business-oriented group within the organization. Central R&D (CRD) refers to any stand-alone R&D group that reports to corporate headquarters rather than to a business unit. Business Unit R&D (BU-R&D) refers to any R&D group that reports to a product, customer, or other business-oriented unit. 7 Birkinshaw, J., & Hagstrom, P. (Eds.). 2000. The flexible firm: Capability management in networked organizations. New York: Oxford University Press; Kreiner, K., & Schultz, M. 1993. Informal collaboration in R&D: The formation of networks across organizations. Organization Studies, 14(2): 189-205; and Kuemmerle, W. 1997. Building effective R&D capabilities abroad. Harvard Business Review (March-April): 61ff. 8 Ettlie J. E., Bridges, W. P., & O'Keefe, R. D. 1984. Organization strategy and structural differences for radical versus incremental innovation. Management Science, 30 (June): 682-695; and Van den Bulte, C., & Moenaert, R. K. 1998. The effects of R&D team co-location on communication patterns among R&D, marketing, and manufacturing. Management Science. 44(11): Sl-S18. 9 The exception is Company C. We conducted in-depth interviews with key informants in each company. We also reviewed documents and reports made available to us by the companies and by publicly available sources such as annual reports, industry publications, and SEC filings. The companies participated in our study with the understanding that they would not be identified by name.

66

Academy of Management Executive

August

? Child &McGrath,op. cit.; and Heydebrand, W. V. 1989.New 323-57. organizational forms. Workand Occupations, 16(3): " Industry figures are based on data provided by the Office of Technology Policy of the U.S. Department of Commerce and the Division of Science Resources Studies in the Directorate for Social, Behavioral, and Economic Sciences of the National Science Foundation. See U.S. Corporate R&D:Volume 1: Top 500 Firms in R&Dby Industry Category, September 1999;and U.S. Corporate R&DInvestment, October 2001. 12 To aid interpretation of the value ratio, we multiplied each ratio by $1,000,000,which is the denomination of the revenue and R&Dbudget numbers shown in Figure 2. 13 Miles and Snow outlined four types of corporate strategy for innovation: reactors, defenders, analyzers, and prospectors. See Figure 6 for definitions. Miles, R., & Snow, C. 1978.Organizational strategy, structure, and process. New York: McGrawHill. This framework is widely used in research on corporate strategy. For example, see Forte, M.,Hoffman,J.J.,Lamont,B. T., & Brockmann,E. N. 2000.Organizational form and environment: An analysis of between-form and within-form responses to environmental change. Strategic Management Journal, 21(7): 753-773.

14 For example, see Ebers, M. (Ed.). 1997. The formation of inter-organizational networks. Oxford:Oxford University Press; and Birkinshaw & Hagstrom, op. cit. 15See R&Dtrends forecast for 2001, a report published by the Industrial Research Institute, November 2000, http://www.irinc.

orglwebl.

Gerardine DeSanctis is the Thomas F. Keller Professor of Management in the Fuqua School of Business at Duke University, Durham, North Caro-

a_

lina. Her interests are in the

general area of organization design, especially the growing role of information technology in new forms of organizing. She holds a Ph.D. degree in business administration from Texas Tech University. Contact: gd@ mailduke.edu

Jeffrey T. Glass is the Joseph F. Toot, Jr. Professor of Engineering and Co-Director of The Institute for the Integration of Management and Engineering at Case Western Reserve University. He received his Ph.D. in materials science and engineering from the University of Virginia and his Global Executive MBAfrom Duke University. Contact: jtg4@po.cwru.edu.

Ingrid Morris Ensing is a doctoral student in management at the Fuqua School of Business, Duke University. She holds an MBA from Kellogg Graduate School, Northwestern University, with majors in organizational behavior and strategy. She also holds a BAwith honors in economics from Claremont McKenna College. Her areas of research include organizational structure, organizational learning, and knowledge management. Contact: icm@mail. duke.edu.

You might also like

- Target International ExpansionDocument48 pagesTarget International ExpansionxebraNo ratings yet

- HR MGMTDocument3 pagesHR MGMTVina ArianiNo ratings yet

- Mckinsey Assessment GridDocument42 pagesMckinsey Assessment GridAssesaHDNo ratings yet

- Chapter 6 PPT Organizatioanl Structure and DesignDocument53 pagesChapter 6 PPT Organizatioanl Structure and DesignNabin GautamNo ratings yet

- 2 Diagnosing Organisation ASIN IO 2017Document12 pages2 Diagnosing Organisation ASIN IO 2017Rosyta Nur Azizah100% (1)

- BroadbandingDocument12 pagesBroadbandingShree ShreeNo ratings yet

- Mod 7 Managing Knowledge WorkersDocument25 pagesMod 7 Managing Knowledge WorkersDarshan GaragNo ratings yet

- Managing Organizational Structure and CultureDocument60 pagesManaging Organizational Structure and CultureSaloni Arora SharmaNo ratings yet

- Chapter 6 Assessment in Affective Domain FinalDocument37 pagesChapter 6 Assessment in Affective Domain FinalNoriel Aranza100% (2)

- Good HR PracticesDocument15 pagesGood HR Practicestuffy0234No ratings yet

- Discretionary BehaviourDocument2 pagesDiscretionary BehaviourMarius TobaNo ratings yet

- Ar 263 Building Utilities 1Document3 pagesAr 263 Building Utilities 1Ivan GonzalesNo ratings yet

- Essentials For A Thriving Learning Culture - ATD's Handbook For Training and Talent DevelopmentDocument37 pagesEssentials For A Thriving Learning Culture - ATD's Handbook For Training and Talent DevelopmentsyedasadmahmoodNo ratings yet

- Module 2 - Business Enterprise Simulation-1Document42 pagesModule 2 - Business Enterprise Simulation-1CYRILLE LARGO75% (4)

- Strategic MGT MidtermDocument15 pagesStrategic MGT MidtermFayaz ThaheemNo ratings yet

- w6 Benchmark - Clinical Field Experience D Leading Leaders in Giving Peer Feedback Related To Teacher PerformanceDocument5 pagesw6 Benchmark - Clinical Field Experience D Leading Leaders in Giving Peer Feedback Related To Teacher Performanceapi-559674827No ratings yet

- Total Quality Management: Pakistan International AirlinesDocument6 pagesTotal Quality Management: Pakistan International AirlineshamidjavaidNo ratings yet

- How Management Accounting Drives Sustainable SuccessDocument5 pagesHow Management Accounting Drives Sustainable SuccessDavid OparindeNo ratings yet

- General Shaping PaperDocument39 pagesGeneral Shaping PaperRuth WellNo ratings yet

- Programmer Competency Matri..Document3 pagesProgrammer Competency Matri..liyun3No ratings yet

- Organizational StructuresDocument28 pagesOrganizational StructuresDeepak DadhichNo ratings yet

- Presentation On Strategic HR Management From HR Philipppines Eyeball Learning SessionDocument34 pagesPresentation On Strategic HR Management From HR Philipppines Eyeball Learning SessionEdwin Ebreo100% (1)

- PM 241 - 1 - 13Document332 pagesPM 241 - 1 - 13Daniel Sorianosos100% (2)

- (Ulrich, D. Younger, J. Brockbanl, W. & Ulrich, M., 2012) - HR Talent and The New HR CompetenciesDocument8 pages(Ulrich, D. Younger, J. Brockbanl, W. & Ulrich, M., 2012) - HR Talent and The New HR CompetenciesJoana CarvalhoNo ratings yet

- Programmer Competency Matrix - Sijin JosephDocument12 pagesProgrammer Competency Matrix - Sijin JosephAndres SantamariaNo ratings yet

- Organisational Design and DevelopmentDocument75 pagesOrganisational Design and DevelopmentKNOWLEDGE CREATORSNo ratings yet

- Balance Scorecard Implementation Case StudyDocument10 pagesBalance Scorecard Implementation Case StudyAnonymous AGkPX6No ratings yet

- Change Managemaent ModelsDocument8 pagesChange Managemaent ModelsSibtain KazmiNo ratings yet

- Overview Article About BPM - BurltonDocument7 pagesOverview Article About BPM - BurltonWillian LouzadaNo ratings yet

- Portfolio Management For New Product Development: Results of An Industry Practices StudyDocument39 pagesPortfolio Management For New Product Development: Results of An Industry Practices StudyvemurirajaNo ratings yet

- Global R&D Project Management and Organization: A TaxonomyDocument19 pagesGlobal R&D Project Management and Organization: A TaxonomyLuis Filipe Batista AraújoNo ratings yet

- CH 02Document22 pagesCH 02Hoàng LongNo ratings yet

- Tor E Learning PDFDocument8 pagesTor E Learning PDFNatasa ZdravkovskaNo ratings yet

- Wage Structure DesignDocument19 pagesWage Structure DesignShamim Hasan PlabonNo ratings yet

- CH 02 - Job DesignDocument32 pagesCH 02 - Job DesignJawad KhanNo ratings yet

- Career PathDocument3 pagesCareer PathfmunaawaNo ratings yet

- Automated Material Handling SystemDocument6 pagesAutomated Material Handling SystemSuraj Prakash100% (1)

- Management Theory and Practice - Assignment December 2016 MIHHoMyT0HDocument2 pagesManagement Theory and Practice - Assignment December 2016 MIHHoMyT0HSaurav PandaNo ratings yet

- Learning Organization DraftDocument12 pagesLearning Organization DraftOlDirtyTravisNo ratings yet

- Knowledge Management For The Public Sector (2013) PDFDocument94 pagesKnowledge Management For The Public Sector (2013) PDFMiguel GómezNo ratings yet

- Cohort Analysis A Complete Guide - 2020 EditionFrom EverandCohort Analysis A Complete Guide - 2020 EditionRating: 1 out of 5 stars1/5 (1)

- Zungu SM 22158820 2019 PGDPM Essay Managing ProjectsDocument10 pagesZungu SM 22158820 2019 PGDPM Essay Managing ProjectsSiboniso Zungu100% (1)

- Principles of ManagementDocument16 pagesPrinciples of ManagementSumit ChakrabortyNo ratings yet

- HRM Assignment 3Document8 pagesHRM Assignment 3Asad A. KhanNo ratings yet

- Evp PDFDocument30 pagesEvp PDFDana StanNo ratings yet

- Swot Analysis: S W O TDocument38 pagesSwot Analysis: S W O TA Sailesh ChandraNo ratings yet

- Learning Organization of ExcoDocument28 pagesLearning Organization of ExcobahmanyarNo ratings yet

- The Loss of A "Key Person": Risk To The Enterprise How To Manage It?Document7 pagesThe Loss of A "Key Person": Risk To The Enterprise How To Manage It?International Organization of Scientific Research (IOSR)No ratings yet

- Survey-Employee Motivation QuestionaireDocument4 pagesSurvey-Employee Motivation QuestionaireVarsha SinghNo ratings yet

- Human Resources PictionaryDocument17 pagesHuman Resources PictionaryAndresbenitez BenitezNo ratings yet

- MintzbergDocument4 pagesMintzbergdan2donNo ratings yet

- A Failure of Focus - KodakDocument155 pagesA Failure of Focus - KodakchangumanguNo ratings yet

- Mis Assignment: Submitted By-Gayatri Panjwani Bba Iii 28Document13 pagesMis Assignment: Submitted By-Gayatri Panjwani Bba Iii 28Gayatri PanjwaniNo ratings yet

- R&D Organization StructureDocument56 pagesR&D Organization StructureIstiaque AhmedNo ratings yet

- PPM NotesDocument14 pagesPPM NotesNilabjo Kanti PaulNo ratings yet

- Thompson Chapter 2Document32 pagesThompson Chapter 2gahap100% (2)

- #1 Introduction To HRMDocument19 pages#1 Introduction To HRMRahulRNo ratings yet

- Information Systems in Business TodayDocument3 pagesInformation Systems in Business Todaytvinaykumar22No ratings yet

- New Clause 49 Vs SOXDocument13 pagesNew Clause 49 Vs SOXprateek007soniNo ratings yet

- CSR StrategyDocument1 pageCSR StrategyMomena MalikNo ratings yet

- National Policy Framework: Vistas of Prosperity and SplendourDocument80 pagesNational Policy Framework: Vistas of Prosperity and SplendourAda Derana100% (2)

- Organizational Behaviour and TheoryDocument126 pagesOrganizational Behaviour and TheorySekar MNo ratings yet

- I HRD: Ntroduction ToDocument70 pagesI HRD: Ntroduction ToJouie N Joan TabilinNo ratings yet

- Process AnalysisDocument46 pagesProcess AnalysisProfessor GowthamNo ratings yet

- Mis AssgmntDocument7 pagesMis AssgmntRaziya SultanaNo ratings yet

- Organisations and Leadership during Covid-19: Studies using Systems Leadership TheoryFrom EverandOrganisations and Leadership during Covid-19: Studies using Systems Leadership TheoryNo ratings yet

- FS Module 1 16Document178 pagesFS Module 1 16Michael SantosNo ratings yet

- TopTutorJob - Teach in China 2020 Cities&Salaries Full Report PDFDocument96 pagesTopTutorJob - Teach in China 2020 Cities&Salaries Full Report PDFRustam MztvNo ratings yet

- Uploadingcirculating Medal ListDocument7 pagesUploadingcirculating Medal ListGal LucyNo ratings yet

- MWL101 - Task 2Document16 pagesMWL101 - Task 2LiamNo ratings yet

- BSBXTW401 Assessment Task 2 PDFDocument38 pagesBSBXTW401 Assessment Task 2 PDFBig OngNo ratings yet

- Call For Admission 2020 Per Il WebDocument4 pagesCall For Admission 2020 Per Il WebVic KeyNo ratings yet

- AchievementsDocument4 pagesAchievementsapi-200331452No ratings yet

- Grade Six 4Ps Reading AssessmentDocument8 pagesGrade Six 4Ps Reading AssessmentMarilyn Estrada DullasNo ratings yet

- Syllabus SPRING 2012Document5 pagesSyllabus SPRING 2012Soumya Rao100% (1)

- 0620 - w19 - Ms - 61 Paper 6 Nov 2019Document6 pages0620 - w19 - Ms - 61 Paper 6 Nov 2019Zion e-learningNo ratings yet

- New Let TosDocument2 pagesNew Let TosRhailla NOORNo ratings yet

- New Sams Paper 2H Qu.7 (A7, A11 - Ao2) : 2. AlgebraDocument3 pagesNew Sams Paper 2H Qu.7 (A7, A11 - Ao2) : 2. AlgebraDahanyakage WickramathungaNo ratings yet

- Online Exam Information Handout For IDBI Executives Exam 2018Document15 pagesOnline Exam Information Handout For IDBI Executives Exam 2018KshitijaNo ratings yet

- Final ReflectionDocument2 pagesFinal Reflectionapi-563509052No ratings yet

- Self-Diagnosis Table: Behavior Yes No X X X X X X X X X XDocument2 pagesSelf-Diagnosis Table: Behavior Yes No X X X X X X X X X XCarmen Maria CordovaNo ratings yet

- Second 2023Document85 pagesSecond 2023hussainahmadNo ratings yet

- Activities To Promote EntrepreneurshipDocument12 pagesActivities To Promote EntrepreneurshipRichell PayosNo ratings yet

- India Course Exam PricesDocument6 pagesIndia Course Exam PricesElankumaran PeriakaruppanNo ratings yet

- MedVance Institute Lawsuit For False AdvertisingDocument34 pagesMedVance Institute Lawsuit For False AdvertisingMatthew Seth SarelsonNo ratings yet

- Spacing and Lag Effects in Free Recall of Pure Lists: Michael J. KahanaDocument10 pagesSpacing and Lag Effects in Free Recall of Pure Lists: Michael J. KahanadaveparagNo ratings yet

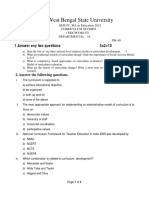

- West Bengal State University: 1.answer Any Two Questions: 5x2 10Document3 pagesWest Bengal State University: 1.answer Any Two Questions: 5x2 10Cracked English with Diganta RoyNo ratings yet

- Personal Space Lesson PlanDocument5 pagesPersonal Space Lesson Planapi-392223990No ratings yet

- Cps High School Biography ProjectDocument6 pagesCps High School Biography Projectapi-240243686No ratings yet