Professional Documents

Culture Documents

The Real Deals (17-05-2012)

Uploaded by

SG PropTalkOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The Real Deals (17-05-2012)

Uploaded by

SG PropTalkCopyright:

Available Formats

Co.

Reg No: 198700034E MICA (P) : 099/03/2012

Singapore

THEREALDEALS Ins&OutsofSingaporeRealEstate

Renewed interest in Farrer Road

The Urban Redevelopment Authority (URA) has accepted an application last Friday from a developer for a residential site at Farrer Drive to be put up for sale by public tender. The land parcel, which was made available through the Reserve List system on 16 Apr 2012, will be launched for sale by next week. The triggering bid came in at SGD88.9m, or SGD823 psf ppr. The 99-year leasehold site has a maximum GFA of 107,963 sq ft and is estimated to yield 100 dwelling units. Separately, a second site located at Farrer Road was placed under the Reserve List system in January this year. This plot of land is situated right next to Lutheran Towers and Dukes Residence and can yield around 40 residential units. Farrer Road is known for the collective sales done in the area, largely due to its concentration of older freehold estates and attractive central location. The last successful en bloc deal was the sale of Farrer Court in 2007; the site is now being developed into DLeedon, which is expected to obtain its Temporary Occupation Permit (TOP) in 2014. At the time, the sale of the 618-unit condominium made history when it was bought for a record SGD1.34b with another SGD500m of differential premium. The buyers were a consortium led by CapitaLand and comprising Hotel Properties Limited (HPL), a Morgan Stanley real estate fund and Wachovia Development Corp. Based on the sites maximum GFA of 2.35m sq ft, the price worked out to around SGD783 psf ppr. The estimated breakeven and average selling price were SGD1,300 psf and SGD1,750 psf, respectively. However, not all en bloc sales have a happy ending. Tulip Garden, a 162-unit project, was on the brink of sale to a consortium led by Bravo Building Construction in 2007 when the buyers backed out after failing to raise adequate funds for the acquisition. The last asking price for Tulip Garden was lowered from SGD650m in Jan 2011 to SGD600m in Jun 2011, translating to SGD1,118 psf ppr. This meant an estimated breakeven price of SGD1,450 psf. The price difference between an en bloc sale and one under the Government Land Sales (GLS) programme clearly indicates that private sellers are asking for unreachable prices, and this may push developers to turn to the GLS to replenish their landbank.

Location of Farrer Drive site earmarked for sale by public tender

17 May 2012

DLeedon Sommerville Grandeur Gallop Green

Spanish Village Gallop Gables The Levelz The Wilshire

Source: onemap.sg

Farrer Drive site

SEE APPENDIX I FOR IMPORTANT DISCLOSURES AND ANALYST CERTIFICATIONS

HE EAL EALS Ins&OutsofSingaporeRealEstate

Farrer Road/Farrer Drive

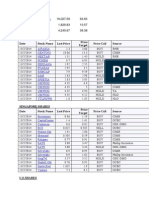

Supply of private residential units along Farrer Road/Farrer Drive No. of Units 1,715 102 96 456 226 44 162 20 162 132 3,115 Transaction price (SGD psf) 1,780 1,704 1,657 1,591 1,571 1,549 1,486 769 1,264 1,504 Latest contract date 10-Apr-2012 3-Apr-2012 8-Aug-2011 11-Apr-2012 4-Apr-2012 14-Jun-2010 2-Apr-2012 13-Apr-2011 15-Mar-2012 20-Apr-2012 Project DLeedon Gallop Gables Sommerville Grandeur Sommerville Park Spanish Village Sutton Place The Levelz The Wilshire Tulip Garden Waterfall Gardens

Source: URA

Tenure 99 Year Freehold Freehold Freehold Freehold Freehold Freehold Freehold Freehold Freehold

Developer TOP CapitaLand (lead) 2015 Stratis Dev/Atbara Holdings 1997 Sommerville Properties 1996 Sommerville Properties 1985 Glory Realty 1987 Peak Properties 1989 CapitaLand 2004 Sungtze Intl 1984 City Developments 1985 MCL Land 2010 Total Units

Resale prices of projects in the Farrer Road/Farrer Drive vicinity have risen close to those of new sales in a move to block bidders trying to win a ticket to the en bloc arena. We would monitor the smaller projects with higher plot ratios, such as Sommerville Grandeur, Sutton Place and The Wilshire, for more favourable en bloc opportunities.

Transaction prices of private residential units along Farrer Road/Farrer Drive

1,800

1,600

Waterfall Gardens Tulip Gardens The Wilshire

1,400

The Levelz Sutton Place Spanish Village

1,200

1,000

Sommerville Park Sommerville Grandeur Gallop Gables

Oct-09 Jan-10 May-10 Aug-10 Nov-10 Feb-11 Jun-11 Sep-11 Dec-11 Apr-12

800

600 Jul-09 Source: URA

En bloc sale attempts along Farrer Road Asking price Date Project (SGD m) Jun-11 Tulip Garden 600 Jan-11 650 Jul-07 516 Jul-08 Oct-07 Feb-06 Apr-07 Feb-07 Gallop Gables Gallop Green (partial) Spanish Village Waterfall Gardens & 2 adjoining sites Farrer Court Leedon Heights 162 878 132 1.43 835

Buyer NA Bravo Building Construction NA NA MCL Land CapitaLand GuocoLand

GFA (sqft) 557,400

Selling price (SGD psf ppr) 1,118 1,153 1,018

Successful? X X X X

108,170 331,457 160,932 838,488 835,716

964-996 1,700 550 850 1,062

Source: propertyguru.com.sg

17 May 2012

Page 2 of 7

HE EAL EALS Ins&OutsofSingaporeRealEstate

MARKET SNAPSHOT

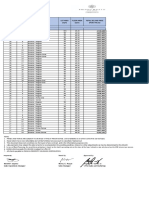

Recent resale transactions

Project WATERFALL GARDENS SOMMERVILLE PARK SPANISH VILLAGE GALLOP GABLES THE LEVELZ SOMMERVILLE PARK SOMMERVILLE PARK SOMMERVILLE PARK TULIP GARDEN SOMMERVILLE PARK THE LEVELZ THE LEVELZ THE LEVELZ SOMMERVILLE PARK THE LEVELZ THE LEVELZ SOMMERVILLE PARK SOMMERVILLE PARK THE LEVELZ SOMMERVILLE GRANDEUR SOMMERVILLE PARK WATERFALL GARDENS GALLOP GABLES WATERFALL GARDENS GALLOP GABLES THE LEVELZ SOMMERVILLE GRANDEUR SOMMERVILLE PARK THE LEVELZ WATERFALL GARDENS WATERFALL GARDENS

Source: URA

17 May 2012

Analyst: Alison FOK 65-6433 5745 alisonfok@kimeng.com

Property Price Indices

Contract month Apr-12 Apr-12 Apr-12 Apr-12 Apr-12 Mar-12 Mar-12 Mar-12 Mar-12 Mar-12 Feb-12 Feb-12 Dec-11 Dec-11 Nov-11 Nov-11 Oct-11 Sep-11 Aug-11 Aug-11 Aug-11 Jul-11 Jul-11 Jul-11 Jun-11 Jun-11 Jun-11 Jun-11 Jun-11 Jun-11 Jun-11

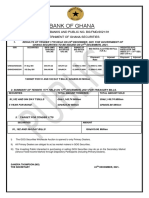

Farrer Drive** Jalan Jurong Kechil Stirling Road Tampines Av 10 (Parcel B) NAV /share 3.51 7.66 2.15 2.34 3.81 3.53 1.56 11.78 3.16 6.49 2.35 2.51 Disc/ Prem to NAV -26% 33% -25% -50% -24% -42% -38% -52% -21% -33% -29% -48% Farrer Rd Alexandra View Punggol Way/ Punggol Walk (EC) Bishan Street 14 Source: HDB, URA

Size (sq ft) 2,196 1,948 1,604 3,111 807 1,948 1,302 1,948 1,701 624 1,001 786 786 1,948 743 786 1,302 624 797 1,841 1,302 2,583 2,669 1,830 1,163 797 1,830 1,302 807 2,196 1,830

Price ($psf) 1,650 1,591 1,571 1,704 1,486 1,540 1,605 1,488 1,264 1,663 1,498 1,553 1,502 1,636 1,586 1,565 1,420 1,490 1,538 1,657 1,559 1,529 1,600 1,639 1,581 1,550 1,667 1,574 1,486 1,750 1,620

Index SRPI Overall (Mar 12) URA PPI (1Q12) HDB Resale (1Q12)

Level 165.4 206.0 191.0

Change +0.8% -0.1% +0.6%

Government Land Sales (GLS)

Recently Awarded Sites

Site Site area (k sqm) Units Awarded to Land price (S$m) $psf ppr

Kovan Road / Simon Road Jervois Road Bedok South Avenue 3 Hillview Avenue Up Serangoon View/ Up Serangoon Rd

(EC)

35.7 12.5 60.2 35.4 43.4 13.2 22.0 32.7 25.8 20.8

360 140 595 370 435 395 770 295 720 580

Punggol Central/ Edgefield (EC) Fernvale Lane (EC) Elias Rd/ Pasir Ris Dr 3 Woodlands Ave 5/ Woodlands Dr 16

(EC)

Hoi Hup consortium Singapore Land Far East/ Frasers/ Sekisui House Kingsford Development Ho Lee Group Pte & Evia Real Estate Qingjian Realty (South Pacific) Peak Living Pte Elitist Development Hao Yuan Investment Singxpress, Creative Inv, Kay Lim

Site area (k sqm)

195 119 346 243 142 137 245 166 247 234

507 881 534 638 303 320 296 461 318 374

Tampines Central 7/ Tampines Ave 7/ Tampines Av 9 (EC)

Confirmed List

Site Tampines Avenue 10 (Parcel A) Boon Lay Way (Jurong Gateway) Sengkang Square/ Compassvale Drive Pasir Ris Dr 3 Buangkok Drive/ Sengkang Central

Units Tender closing

56.2 48.7 60.7 22.3 18.3

600 590 710 670 620

17-May 29-May 31-May 5-June 12-June

Reserve List (Recently Open for Tender)

Site area (k sqm)

10.0 14.2 88.6 47.9 2.7 41.2 18.7 11.2

Units 100 240 1045 515 40 455 560 590

Property Stocks

Disc to Company Price RNAV RNAV CapitaLand 2.6 5.03 -48% City Dev 10.19 12.62 -19% Guocoland 1.615 NA NA Ho Bee 1.17 3.18 -63% Keppel land 2.89 5.77 -50% OUE 2.04 NA NA SC Global 0.965 3.49 -72% Singapore Land 5.61 9.71 -42% UIC 2.5 NA NA UOL 4.34 NA NA Wheelock 1.67 NA NA Wing Tai 1.3 2.81 -54% N.A. = No Coverage *As at latest reported

**Accepted application on 11 May, site to be launched in two weeks time.

17 May 2012

Page 3 of 7

HE EAL EALS Ins&OutsofSingaporeRealEstate

MARKET SNAPSHOT(CONTD)

Primary Market

Total no. of units Units sold todate Take -up rate (%) 66% 6% 69% 75% 84% 22% 73% 92% 46% 59% 55% 90% 100% 63% 93% 64% 75% 48% 66% 72% 58% 56% 72% 49% 86% 26% 65% 99% 100% 93% 75% 58% 97% 57% 40% 96% 66% 37% 53% 88% 91% 86% 66% 48% 87% 78% 85% Units sold (Apr) 87 26 14 12 19 16 46 32 23 18 15 15 244 91 27 26 19 16 15 174 153 39 35 13 13 131 106 69 68 60 54 49 35 34 33 20 13 154 51 25 24 18 36 36 15 14 13

Median

17 May 2012

Analyst: Alison FOK 65-6433 5745 alisonfok@kimeng.com

($psf) 2,485 1,337 1,164 2,675 1,434 1,939 1,806 1,430 1,541 1,196 1,162 1,136 1,708 1,062 1,463 1,259 1,400 1,493 1,334 876 871 805 905 1,214 738 1,583 1,189 927 1,292 717 829 865 1,279 1042 1,263 1,008 1,366 1,054 1,326 705 771 1297 876 1,161 829 1529 827

City & Southwest (1-8) Eon Shenton 132 87 Seahill 454 26 Interlace 1040 718 Marina Bay Suites 221 165 Newton / Bukit Timah / Clementi (11,21) Rochelle at Newton 129 108 8 Bassein 74 16 Balestier / MacPherson / Geylang (12-14) 18 Woodsville 101 74 Smart Suites 72 66 Cradels 125 57 Idyllic Suites 71 42 Riviera 38 102 56 Vacanza @ East 473 425 East Coast (15-16) Katong Regency 244 244 Archipelago 577 361 91 Marshall 30 28 Flamingo Valley 393 252 Sycamore Tree 96 72 The Seawind 222 107 The Cristallo 74 49 Changi / Pasir Ris (17-18) Ripple Bay 679 491 Palm Isles 429 250 Tampines Trilliant 670 375 The Palette 892 643 My Manhattan 301 147 Arc at Tampines 574 492 Serangoon / Thomson (19-20) Sky Habitat 509 131 164 106 The Promenade@Pelikat 1145 1129 The Minton Thomson Grand 361 361 Twin Waterfalls 728 676 Parc Vera 452 341 Riversound Residence 590 342 36 35 Presto@Upper Serangoon 622 356 The Luxurie Bartley Residences 702 284 Terrasse 414 399 Bliss@Kovan 140 92 West (22-24) Hillsta 416 154 Natura@Hillview 193 103 Blossom Residences 602 527 The Rainforest 466 425 Qube Suites 21 18 North (25-28) The Nautical 435 286 276 133 Seletar Park Residences Eight Courtyards 654 570 The Springside 76 59 Eight Courtyards 654 555 Source: URA

District City & Southwest Orchard/Tanglin/Holland Newton/Bukit Timah/Clementi Balestier/MacPherson/Geylang East Coast Changi/Pasir Ris Serangoon/Thomson West North Source: URA

$psf Feb12 1,347 1,776 1,207 928 977 774 899 793 710

$psf Mar12 1,347 1,743 1,233 990 1,031 802 880 791 743

MoM % change 0.0 -1.9 2.2 6.7 5.5 3.7 -2.2 -0.2 4.7

Rental Market

District City & Southwest Orchard/Tanglin/Holland Newton/Bukit Timah/Clementi Balestier/MacPherson/Geylang East Coast Changi/Pasir Ris Serangoon/Thomson West North Source: URA $psf pm Feb12 4.8 4.6 3.6 3.2 3.3 2.8 3.1 2.8 3.0 $psf pm Mar12 4.6 4.5 3.5 3.1 3.2 2.7 3.1 2.8 2.6 MoM % change -5.2 -1.4 -3.2 -3.9 -2.0 -2.0 1.3 1.4 -12.9

Top 5 Resale Transactions by $psf

Project Helio Residences 8 Napier Marina Collection Nassim 9 Belle Vue Residences Source: URA Tenure Freehold Freehold 99 Yr (fm 2007) Freehold Freehold District 9 10 4 10 9 $psf 3,516 3204 2,825 2800 2,685

Bottom 5 Resale Transactions by $psf

Project Lakeside Tower Lakepoint Condo Picardy Gardens Elias Green Rosewood Source: URA Tenure 99 Yr (fm 1975) 99 Yr (fm 1983) Freehold 99 Yr (fm 1991) 99 Yr (fm 2000) District 22 22 16 18 25 $psf 460 580 599 600 603

Secondary Market

17 May 2012 Page 4 of 7

HE EAL EALS Ins&OutsofSingaporeRealEstate

DEVELOPERS LANDBANK

Developer District 1 3 6 9 10 10 10 10 11 17 18 18 18 19 19 19 19 23 23 Sentosa 1 2 4 4 4 4 19 Landbank

17 May 2012

Analyst: Alison FOK 65-6433 5745 alisonfok@kimeng.com

Tenure 99Yr 99Yr 99Yr Freehold Freehold Freehold Freehold Freehold Freehold 99Yr 99Yr 99Yr Freehold 99Yr 99Yr 99Yr 99Yr 99Yr 99Yr 99Yr 99yr Freehold 99yr 99yr 99yr 99yr 99yr

Unsold Units 20 545 118 122 203 178 1 156 5 138 249 1,517 605 135 418 785 90 41 75 207 5,608 56 620 283 307 234 94 266 1,860

City Dev

One Shenton (Marina Bay) Alexandra Road GLS site (Alexandra Road) South Beach (Beach Road) Futura (Leonie Road) Boulevard Hotel (Cuscaden Road) Lucky Tower (Grange Road) Volari (Balmoral Road) Nouvel 18 (Anderson Road) Buckley Classique (Buckley Road) Hedges Park (Flora Road) The Palette (Pasir Ris) Pasir Ris Drive 8 (4 + 5) (Pasir Ris) Tampines/Upp Changi Rd North (Tampines/Upp Changi Rd North) H2O Residences (Sengkang West Ave) Bartley Residences (Bartley Road) Mount Vernon GLS site (Bartley Road) HAUS@Serangoon Garden (Serangoon Garden Way) The Rainforest (EC) (Choa Chu Kang Drive) Blossom Residences (EC) (Segar Road) Residences at W (Sentosa Cove) Total Unsold Units Marina Bay Suites (Marina Bay) Keppel & GE Towers site (Tanjong Pagar) Reflections at Keppel Bay (Keppel Bay) Keppel Bay Plot 3 (Keppel Bay) Keppel Bay Plot 4 (Keppel Bay) Keppel Bay Plot 6 (Keppel Bay) The Luxurie (Sengkang Square) Total Unsold Units

KepLand

CapitaLand

3 9 9 9 10 10 15 16 20 26 Sentosa Sentosa 11

The Interlace (Gillman Heights) Urban Resort (Cairnhill Rd) Orchard Residences (Orchard Road) Wharf Residence (Tong Watt Road) D'Leedon (Farrer Rd) The Nassim (Nassim Rd) Marine Point (Marine Parade) Bedok Residences (Bedok Central) Sky Habitat (Bishan Street 14) Yio Chu Kang site (Yio Chu Kang Rd) Total Unsold Units Seascape at Sentosa Cove (Sentosa Cove) Pinnacle at Sentosa Cove (Sentosa Cove) Trilight (Newton Road) Total Unsold Units

99Yr Freehold 99Yr 999Yr 99Yr Freehold Freehold 99Yr 99Yr Freehold 99yr 99yr 99Yr

322 39 15 5 1,245 55 150 68 378 140 2,277 110 357 7 467

Ho Bee

UOL

2 16 2 5 9 10 12 12 21 23 23 9 10

Spottiswoode Residences (Spottiswoode Park) Archipelago (Bedok Reservoir Rd) Total Unsold Units Skysuites @ Anson (Enggor Street) The Surrento (West Coast Road) RV Residences (River Valley) Holland Residences (Taman Warna) Riverbay (Mar Thorma Rd) Riviera 38 (Mar Thorma Rd) The Cascadia (Bukit Timah Road) Pavilion Park (Phase 1D) (Bukit Batok Road) Pavilion Park (Phase 2) (Bukit Batok Road) Total Unsold Units Scotts Square (Scotts Road) Ardmore 3 (Ardmore Park) Total Unsold Units

Freehold 99yr 99Yr Freehold 999Yr Freehold 999Yr 999Yr Freehold Freehold Freehold Freehold Freehold

33 216 249 178 131 248 5 147 46 20 2 79 856 74 84 158

Allgreen

Wheelock

17 May 2012

Page 5 of 7

HE EAL EALS Ins&OutsofSingaporeRealEstate

DEVELOPERS LANDBANK (CONTD)

Developer District 2 9 10 10 26 4 9 9 9 9 27 28 28 9 15 16 16 18 18 19 19 19 27 3 9 9 10 10 11 23 11 10 15 16 17 19 9 9 9 9 10 Sentosa Landbank Guocoland

17 May 2012

Analyst: Alison FOK 65-6433 5745 alisonfok@kimeng.com

Tenure 99Yr Freehold 99Yr Freehold Freehold Freehold Freehold Freehold Freehold Freehold Freehold Freehold 999yr Total Unsold Units 99yr Freehold 99yr 99yr 99yr 99yr 99yr 99yr 99yr 99yr 99yr Freehold Freehold Freehold Freehold Freehold 99yr Total Unsold Units Freehold Freehold Freehold Freehold 99Yr 99Yr Total Unsold Units Freehold Freehold Freehold Freehold Freehold 99Yr Total Unsold Units

Unsold Units 500 2 381 76 34 993 66 54 24 88 221 80 232 70 835 249 141 21 595 92 179 107 54 52 84 1,574 14 64 38 42 157 27 265 607 32 70 65 23 188 15 370 35 203 23 35 50 31 377

Tanjong Pagar GLS white site (Peck Seah / Choon Guan) Sophia Residence (Mount Sophia) Leedon Residence (Leedon Heights) Goodwood Residence (Bukit Timah Road) The Waterline (Yio Chu Kang Rd) Total Unsold Units Skyline Residences (Telok Blangah) The Vermont on Cairnhill (Cairnhill Rd) Paterson Suites (Paterson Rd) Paterson Suites II (Paterson Rd) St Thomas Walk (St Thomas Walk) Watercove Villes (Wak Hassan Drive) Nim Road (Nim Road) Luxus Hills (Seletar Green) Starhub Centre (Cuppage Rd) Flamingo Valley (Siglap Rd) Waterfront Isle (Bedok Reservoir Rd) Bedok South GLS site (Bedok South Avenue 3) Seastrand (Pasir Ris Drive 3) Palm Isles (Flora Drive) Boathouse Residences (Hougang) Watertown (Punggol) Twin Waterfalls (Punggol Way / Punggol Field) Eight Courtyards (Yishun Ave 2) Total Unsold Units Ascentia Sky (Redhill) HELIOS Residence (Cairnhill Circle) Belle Vue Residences (Oxley Walk) Le Nouvel Ardmore (Ardmore Park) Anderson 18 (Ardmore Park) L'VIV (Newton Rd) Foresque Residences (Petir Road) Palms @ Sixth Avenue (Six Avenue ) NOB Hill (Ewe Boon Rd) Casa Nassau (East Coast Rd) Uber 388 (Upper East Cost) Ripple Bay (Jalan Loyang Besar) Terrasse (Hougang Ave 2) The Marq (Paterson Hill) Hilltops (Cairnhill Circle) Martin No. 38 (Martin Rd) Sculptura Ardmore (Ardmore Park) The Ardmore (Ardmore Park) Seven Palms (Sentosa Cove)

Bt Sembawang

Frasers Centrepoint

Wing Tai

MCL Land

SC Global

Grand Total Source:HDB,URA

16,417

17 May 2012

Page 6 of 7

HE EAL EALS Ins&OutsofSingaporeRealEstate

APPENDIX I: TERMS FOR PROVISION OF REPORT, DISCLOSURES AND DISCLAIMERS

This report, and any electronic access to it, is restricted to and intended only for clients of Maybank Kim Eng Research Pte. Ltd. ("MAYBANK KERPL") or a related entity to MAYBANK KERPL (as the case may be) who are institutional investors (for the purposes of both the Singapore Securities and Futures Act (SFA) and the Singapore Financial Advisers Act (FAA)) and who are allowed access thereto (each an "Authorised Person") and is subject to the terms and disclaimers below. IF YOU ARE NOT AN AUTHORISED PERSON OR DO NOT AGREE TO BE BOUND BY THE TERMS AND DISCLAIMERS SET OUT BELOW, YOU SHOULD DISREGARD THIS REPORT IN ITS ENTIRETY AND LET KER OR ITS RELATED ENTITY (AS RELEVANT) KNOW THAT YOU NO LONGER WISH TO RECEIVE SUCH REPORTS. This report provides information and opinions as reference resource only. This report is not intended to be and does not constitute financial advice, investment advice, trading advice or any other advice. It is not to be construed as a solicitation or an offer to buy or sell any securities or related financial products. The information and commentaries are also not meant to be endorsements or offerings of any securities, options, stocks or other investment vehicles. The report has been prepared without regard to the individual financial circumstances, needs or objectives of persons who receive it. The securities discussed in this report may not be suitable for all investors. Readers should not rely on any of the information herein as authoritative or substitute for the exercise of their own skill and judgment in making any investment or other decision. Readers should independently evaluate particular investments and strategies, and are encouraged to seek the advice of a financial adviser before making any investment or entering into any transaction in relation to the securities mentioned in this report. The appropriateness of any particular investment or strategy whether opined on or referred to in this report or otherwise will depend on an investors individual circumstances and objectives and should be confirmed by such investor with his advisers independently before adoption or implementation (either as is or varied). You agree that any and all use of this report which you make, is solely at your own risk and without any recourse whatsoever to KER, its related and affiliate companies and/or their employees. You understand that you are using this report AT YOUR OWN RISK. This report is being disseminated to or allowed access by Authorised Persons in their respective jurisdictions by the Maybank Kim Eng affiliated entity/entities operating and carrying on business as a securities dealer or financial adviser in that jurisdiction (collectively or individually, as the context requires, "Maybank Kim Eng") which has, vis--vis a relevant Authorised Person, approved of, and is solely responsible in that jurisdiction for, the contents of this publication in that jurisdiction. Maybank Kim Eng, its related and affiliate companies and/or their employees may have investments in securities or derivatives of securities of companies mentioned in this report, and may trade them in ways different from those discussed in this report. Derivatives may be issued by Maybank Kim Eng its related companies or associated/affiliated persons. Maybank Kim Eng and its related and affiliated companies are involved in many businesses that may relate to companies mentioned in this report. These businesses include market making and specialised trading, risk arbitrage and other proprietary trading, fund management, investment services and corporate finance. Except with respect the disclosures of interest made above, this report is based on public information. Maybank Kim Eng makes reasonable effort to use reliable, comprehensive information, but we make no representation that it is accurate or complete. The reader should also note that unless otherwise stated, none of Maybank Kim Eng or any third-party data providers make ANY warranties or representations of any kind relating to the accuracy, completeness, or timeliness of the data they provide and shall not have liability for any damages of any kind relating to such data. Proprietary Rights to Content. The reader acknowledges and agrees that this report contains information, photographs, graphics, text, images, logos, icons, typefaces, and/or other material (collectively Content) protected by copyrights, trademarks, or other proprietary rights, and that these rights are valid and protected in all forms, media, and technologies existing now or hereinafter developed. The Content is the property of Maybank Kim Eng or that of third party providers of content or licensors. The compilation (meaning the collection, arrangement, and assembly) of all content on this report is the exclusive property of Maybank Kim Eng and is protected by Singapore and international copyright laws. The reader may not copy, modify, remove, delete, augment, add to, publish, transmit, participate in the transfer, license or sale of, create derivative works from, or in any way exploit any of the Content, in whole or in part, except as specifically permitted herein. If no specific restrictions are stated, the reader may make one copy of select portions of the Content, provided that the copy is made only for personal, information, and non-commercial use and that the reader does not alter or modify the Content in any way, and maintain any notices contained in the Content, such as all copyright notices, trademark legends, or other proprietary rights notices. Except as provided in the preceding sentence or as permitted by the fair dealing privilege under copyright laws, the reader may not reproduce, or distribute in any way any Content without obtaining permission of the owner of the copyright, trademark or other proprietary right. Any authorised/permitted distribution is restricted to such distribution not being in violation of the copyright of Maybank Kim Eng only and does not in any way represent an endorsement of the contents permitted or authorised to be distributed to third parties. Additional information on mentioned securities is available on request. Jurisdiction Specific Additional Disclaimers: THIS RESEARCH REPORT IS STRICTLY CONFIDENTIAL TO THE RECIPIENT, MAY NOT BE DISTRIBUTED TO THE PRESS OR OTHER MEDIA, AND MAY NOT BE REPRODUCED IN ANY FORM AND MAY NOT BE TAKEN OR TRANSMITTED INTO THE REPUBLIC OF KOREA, OR PROVIDED OR TRANSMITTED TO ANY KOREAN PERSON. FAILURE TO COMPLY WITH THIS RESTRICTION MAY CONSTITUTE A VIOLATION OF SECURITIES LAWS IN THE REPUBLIC OF KOREA. BY ACCEPTING THIS REPORT, YOU AGREE TO BE BOUND BY THE FOREGOING LIMITATIONS. THIS RESEARCH REPORT IS STRICTLY CONFIDENTIAL TO THE RECIPIENT, MAY NOT BE DISTRIBUTED TO THE PRESS OR OTHER MEDIA, AND MAY NOT BE REPRODUCED IN ANY FORM AND MAY NOT BE TAKEN OR TRANSMITTED INTO MALAYSIA OR PROVIDED OR TRANSMITTED TO ANY MALAYSIAN PERSON. FAILURE TO COMPLY WITH THIS RESTRICTION MAY CONSTITUTE A VIOLATION OF SECURITIES LAWS IN MALAYSIA. BY ACCEPTING THIS REPORT, YOU AGREE TO BE BOUND BY THE FOREGOING LIMITATIONS. Without prejudice to the foregoing, the reader is to note that additional disclaimers, warnings or qualifications may apply if the reader is receiving or accessing this report in or from other than Singapore. As of 17 May 2012, Maybank Kim Eng Research Pte. Ltd. and the covering analyst do not have any interest in the stocks mentioned. Analyst Certification: The views expressed in this research report accurately reflect the analyst's personal views about any and all of the subject securities or issuers; and no part of the research analyst's compensation was, is, or will be, directly or indirectly, related to the specific recommendations or views expressed in the report. 2012 Maybank Kim Eng Research Pte Ltd. All rights reserved. Except as specifically permitted, no part of this presentation may be reproduced or distributed in any manner without the prior written permission of Maybank Kim Eng Research Pte. Ltd. Maybank Kim Eng Research Pte. Ltd. accepts no liability whatsoever for the actions of third parties in this respect.

Stephanie Wong CEO, Maybank Kim Eng Research

www.maybank-ke.com | www.kimengreseach.com.sg 17 May 2012 Page 7 of 7

You might also like

- Stepping Up with Green, Citygreen Issue 7From EverandStepping Up with Green, Citygreen Issue 7No ratings yet

- Cut Stone & Stone Products World Summary: Market Values & Financials by CountryFrom EverandCut Stone & Stone Products World Summary: Market Values & Financials by CountryNo ratings yet

- The Real Deals (22-09-2111)Document8 pagesThe Real Deals (22-09-2111)SG PropTalkNo ratings yet

- The Real Deals (29-03-2012)Document7 pagesThe Real Deals (29-03-2012)SG PropTalkNo ratings yet

- The Real Deals (22-11-2012)Document9 pagesThe Real Deals (22-11-2012)SG PropTalkNo ratings yet

- The Real Deals (22-12-2011)Document7 pagesThe Real Deals (22-12-2011)SG PropTalkNo ratings yet

- The Real Deals (23-08-2012)Document9 pagesThe Real Deals (23-08-2012)SG PropTalkNo ratings yet

- The Real Deals (15-09-2011)Document8 pagesThe Real Deals (15-09-2011)SG PropTalkNo ratings yet

- The Real Deals (20-09-2012)Document10 pagesThe Real Deals (20-09-2012)SG PropTalkNo ratings yet

- The Real Deals (13-10-2011)Document9 pagesThe Real Deals (13-10-2011)SG PropTalkNo ratings yet

- The Real Deals (19-04-2012)Document8 pagesThe Real Deals (19-04-2012)SG PropTalkNo ratings yet

- The Real Deals (19-07-2012)Document9 pagesThe Real Deals (19-07-2012)SG PropTalkNo ratings yet

- Top 5 Deals (By Absolute Quantum) : Non-Landed Core Central RegionDocument2 pagesTop 5 Deals (By Absolute Quantum) : Non-Landed Core Central Regionnssj1234No ratings yet

- Nine Residences E - BrochureDocument86 pagesNine Residences E - BrochureLester SimNo ratings yet

- 141 Sqfoot ReportDocument34 pages141 Sqfoot ReportRogerHuangNo ratings yet

- HE EAL Eals: Price Decline or Higher Cost?Document8 pagesHE EAL Eals: Price Decline or Higher Cost?SG PropTalkNo ratings yet

- Singapore Retail 4Q 2012Document15 pagesSingapore Retail 4Q 2012joni_p9mNo ratings yet

- All Information Contained Herewithin Is Subjected To Changes Without Prior NoticeDocument27 pagesAll Information Contained Herewithin Is Subjected To Changes Without Prior NoticeLester SimNo ratings yet

- Singapore Property Weekly Issue 37Document18 pagesSingapore Property Weekly Issue 37Propwise.sgNo ratings yet

- The Grand - Email BriefDocument2 pagesThe Grand - Email Briefapi-239234604No ratings yet

- Anderson Road Quarry Site R2-2 R2-3 R2-4Document12 pagesAnderson Road Quarry Site R2-2 R2-3 R2-4Hoi TungNo ratings yet

- Gurgaon Commercial PresentationDocument24 pagesGurgaon Commercial PresentationankurNo ratings yet

- Licence List GGNDocument60 pagesLicence List GGNSumit SavaraNo ratings yet

- 2012 Oct1 No543 CC ThedgesporeDocument12 pages2012 Oct1 No543 CC ThedgesporeThe Edge SingaporeNo ratings yet

- Gurugram Properties Demand Supply-2Document14 pagesGurugram Properties Demand Supply-2Arvin DabasNo ratings yet

- Annex A Information On Bto Flats in Feb 2016 Exercise Alkaff OasisDocument9 pagesAnnex A Information On Bto Flats in Feb 2016 Exercise Alkaff OasisbernteoNo ratings yet

- Singapore Property Weekly Issue 47Document17 pagesSingapore Property Weekly Issue 47Propwise.sgNo ratings yet

- SMCPP - Sample Project DescDocument26 pagesSMCPP - Sample Project DescManna PintoNo ratings yet

- Forest Woods Sales KitDocument23 pagesForest Woods Sales KitWilliam ChuiNo ratings yet

- SS Group New Launch 28062012 FinalDocument21 pagesSS Group New Launch 28062012 FinalPankaj KumarNo ratings yet

- 0411 001Document8 pages0411 001None None NoneNo ratings yet

- Potential LDocument36 pagesPotential LAnna SeeNo ratings yet

- Osk Report My Tilb Results Review 20150213Document8 pagesOsk Report My Tilb Results Review 20150213bijueNo ratings yet

- Watercolours Singapore - EbrochureDocument36 pagesWatercolours Singapore - EbrochureLester SimNo ratings yet

- Gurugram Properties Demand SupplyDocument29 pagesGurugram Properties Demand SupplyArvin DabasNo ratings yet

- Singapore Property Weekly Issue 57Document14 pagesSingapore Property Weekly Issue 57Propwise.sgNo ratings yet

- UpdateCapeCoral Oct2013 IssueDocument8 pagesUpdateCapeCoral Oct2013 IssueRandall PaladaNo ratings yet

- Keppel Corp: 4QFY12 Results ReviewDocument10 pagesKeppel Corp: 4QFY12 Results ReviewphuawlNo ratings yet

- Singapore Investment Market q3 2018 5905Document3 pagesSingapore Investment Market q3 2018 5905Bedraggle KiddNo ratings yet

- Final Chydro Gemini Presentation With AnimationsDocument29 pagesFinal Chydro Gemini Presentation With Animationsapi-59751528No ratings yet

- 3Q2011 Results Presentation: October 2011Document37 pages3Q2011 Results Presentation: October 2011AmitMalhotraNo ratings yet

- Galileo Core System GCS Galileo Basic Reservation EntriesDocument9 pagesGalileo Core System GCS Galileo Basic Reservation EntriesRizwan Syed100% (3)

- CoveringDocument1 pageCoveringKhairil Sani Gobal Beng TattNo ratings yet

- Daily Report 20141212Document3 pagesDaily Report 20141212Joseph DavidsonNo ratings yet

- ASPI Ends Flat S&P SL20 Falls With Liquid Big Caps : Thursday, February 13, 2014Document6 pagesASPI Ends Flat S&P SL20 Falls With Liquid Big Caps : Thursday, February 13, 2014Randora LkNo ratings yet

- 2011 Summer SalesDocument2 pages2011 Summer SalesResortQuest Perdido KeyNo ratings yet

- Ho Bee - Kim EngDocument8 pagesHo Bee - Kim EngTheng RogerNo ratings yet

- LBS Bina GroupDocument13 pagesLBS Bina GroupNorazmi Abdul RahmanNo ratings yet

- Boho Omdraft 051618rDocument86 pagesBoho Omdraft 051618rmacconsaNo ratings yet

- Property Sector Update: Latest Land Deal Not Reflective of Market Value - 20/09/2010Document2 pagesProperty Sector Update: Latest Land Deal Not Reflective of Market Value - 20/09/2010Rhb InvestNo ratings yet

- Jadual Harga Dan Sewa WPKL H1 2023Document47 pagesJadual Harga Dan Sewa WPKL H1 2023naufalm44No ratings yet

- The Earls Court Project: Summary of Planning ApplicationsDocument8 pagesThe Earls Court Project: Summary of Planning ApplicationsscribdstorageNo ratings yet

- Morning Pack: Regional EquitiesDocument59 pagesMorning Pack: Regional Equitiesmega_richNo ratings yet

- Private Residential Property Transactions With Caveats LodgedDocument12 pagesPrivate Residential Property Transactions With Caveats LodgedSG PropTalkNo ratings yet

- Gurgaon Aug 15Document64 pagesGurgaon Aug 15TTT50% (6)

- Daily Trade Journal - 16.05.2013Document6 pagesDaily Trade Journal - 16.05.2013Randora LkNo ratings yet

- Aily Review: Market Statistics All Share Price IndexDocument10 pagesAily Review: Market Statistics All Share Price IndexRandora LkNo ratings yet

- Kija Investor Presentation May 2014finalpptDocument19 pagesKija Investor Presentation May 2014finalpptPoull SteeadyNo ratings yet

- Gurgaon ProjectsDocument1 pageGurgaon ProjectsDeepa GuptaNo ratings yet

- Malaysia Stock News 14-02Document3 pagesMalaysia Stock News 14-02Chia CyNo ratings yet

- Colliers Singapore Private Residential Maket Report - 3Q2014Document5 pagesColliers Singapore Private Residential Maket Report - 3Q2014SG PropTalkNo ratings yet

- Colliers Report - Aug2014Document7 pagesColliers Report - Aug2014SG PropTalkNo ratings yet

- Colliers SG Private Residential Sales 1Q2015Document5 pagesColliers SG Private Residential Sales 1Q2015SG PropTalkNo ratings yet

- Savills - 2Q2015Document4 pagesSavills - 2Q2015SG PropTalkNo ratings yet

- Savills' Private Residential Sales Briefing - May 2015Document4 pagesSavills' Private Residential Sales Briefing - May 2015SG PropTalkNo ratings yet

- Resurgence of Mixed Use Developments in Singapore CBDDocument8 pagesResurgence of Mixed Use Developments in Singapore CBDSG PropTalkNo ratings yet

- Asia Property Market Sentiment Report (H2) 2014Document141 pagesAsia Property Market Sentiment Report (H2) 2014SG PropTalkNo ratings yet

- Pine Grove Transactions (Aug 2011 - Aug 2014)Document10 pagesPine Grove Transactions (Aug 2011 - Aug 2014)SG PropTalkNo ratings yet

- Revised Guidelines For Strata Landed Housing Developments (22 Aug 2014)Document3 pagesRevised Guidelines For Strata Landed Housing Developments (22 Aug 2014)SG PropTalkNo ratings yet

- HSR Report - 3 Oct 2014 (Narrowing CCR Vs OCR-RCR Spread)Document4 pagesHSR Report - 3 Oct 2014 (Narrowing CCR Vs OCR-RCR Spread)SG PropTalkNo ratings yet

- Edinburgh City Index 2Q2014Document2 pagesEdinburgh City Index 2Q2014SG PropTalkNo ratings yet

- The Mews - BrochureDocument13 pagesThe Mews - BrochureSG PropTalkNo ratings yet

- Singapore Residential Demand 1Q2014Document8 pagesSingapore Residential Demand 1Q2014SG PropTalkNo ratings yet

- Art On The Park - MelbourneDocument3 pagesArt On The Park - MelbourneSG PropTalkNo ratings yet

- Sky Vue: Media ReleaseDocument3 pagesSky Vue: Media ReleaseSG PropTalkNo ratings yet

- Savills SG Residential Sales Briefing Q2-2014Document4 pagesSavills SG Residential Sales Briefing Q2-2014SG PropTalkNo ratings yet

- Cantonese Idioms and What They MeanDocument3 pagesCantonese Idioms and What They MeanSG PropTalkNo ratings yet

- DBS Interest GuardDocument4 pagesDBS Interest GuardSG PropTalkNo ratings yet

- Sky Vue: Fact SheetDocument1 pageSky Vue: Fact SheetSG PropTalkNo ratings yet

- Kim Eng ReportDocument9 pagesKim Eng ReportSG PropTalkNo ratings yet

- Citigold Property Insights Q42012Document7 pagesCitigold Property Insights Q42012SG PropTalkNo ratings yet

- Singapore Property (16-04-2013)Document6 pagesSingapore Property (16-04-2013)SG PropTalkNo ratings yet

- Singapore Property Update (17-12-2012)Document6 pagesSingapore Property Update (17-12-2012)SG PropTalkNo ratings yet

- The Real Deals (20-12-2012)Document9 pagesThe Real Deals (20-12-2012)SG PropTalkNo ratings yet

- Singapore Residential Update 301012Document8 pagesSingapore Residential Update 301012SG PropTalkNo ratings yet

- Tampines CourtDocument4 pagesTampines CourtSG PropTalkNo ratings yet

- TheEdge (October 8, 2012)Document1 pageTheEdge (October 8, 2012)SG PropTalkNo ratings yet

- Kim Eng Research (09-10-2012)Document7 pagesKim Eng Research (09-10-2012)SG PropTalkNo ratings yet

- The Real Deals (25-10-2012)Document9 pagesThe Real Deals (25-10-2012)chow_ck6055No ratings yet

- ChangesDocument8 pagesChangesBożena KontilaNo ratings yet

- Price ElasticityDocument19 pagesPrice ElasticityPrateek VyasNo ratings yet

- Final Quiz All TopicsDocument2 pagesFinal Quiz All TopicsNikki GarciaNo ratings yet

- Xyberspace ConsultingDocument4 pagesXyberspace ConsultingAkshayNo ratings yet

- Sonubhai Solar QutationDocument1 pageSonubhai Solar Qutationarpit patelNo ratings yet

- PMSJ Pricelist - HDMF 1Document1 pagePMSJ Pricelist - HDMF 1Ren Irene MacatangayNo ratings yet

- Laskasas New Catalogue 2020 Portuguese Furniture DesignsDocument122 pagesLaskasas New Catalogue 2020 Portuguese Furniture DesignsSharon Paul HarrisNo ratings yet

- Guru Gobind Singh Indraprastha University, DelhiDocument1 pageGuru Gobind Singh Indraprastha University, DelhiHarsh AggarwalNo ratings yet

- SQ00001544 SICIM RFQ SA010-MR-005 REV.A MANUAL BALL VALVES - UnpricedDocument4 pagesSQ00001544 SICIM RFQ SA010-MR-005 REV.A MANUAL BALL VALVES - UnpricedMohamed Wasim ShaikhNo ratings yet

- Process Costing TEST BANK PDFDocument7 pagesProcess Costing TEST BANK PDFJohn Brian D. Soriano100% (1)

- Electrical SOQ EVDocument16 pagesElectrical SOQ EVjaiNo ratings yet

- DK Automation ComplaintDocument48 pagesDK Automation ComplaintDhruv PandeyNo ratings yet

- Samsung The Frame Bezel 2021 TV (50 Inch) : Grand Total 8974.00Document1 pageSamsung The Frame Bezel 2021 TV (50 Inch) : Grand Total 8974.00Anil ChanduriNo ratings yet

- Marketing StrategyDocument15 pagesMarketing StrategyDimbag Gold WilliyantoNo ratings yet

- Materi Webinar SA 500 Bukti Audit - Audit Berbasis ISA Studi Kasus Di Indonesia, Australia, Dan SingapuraDocument37 pagesMateri Webinar SA 500 Bukti Audit - Audit Berbasis ISA Studi Kasus Di Indonesia, Australia, Dan SingapuraIkhsan Uiandra Putra SitorusNo ratings yet

- MathGazine QADocument14 pagesMathGazine QAMarianne AdarayanNo ratings yet

- AfriansyahDocument28 pagesAfriansyah20312262No ratings yet

- Auctresults 1778Document1 pageAuctresults 1778Fuaad DodooNo ratings yet

- M2 Bradley M3 Turret Organizational Maintenance TM 9-2350-252!20!2!2!1984Document891 pagesM2 Bradley M3 Turret Organizational Maintenance TM 9-2350-252!20!2!2!1984Евгений McNo ratings yet

- Chapter 3Document25 pagesChapter 3HayamnotNo ratings yet

- Intersection DesignDocument19 pagesIntersection DesignNatukunda NathanNo ratings yet

- REVALUATIONDocument10 pagesREVALUATIONJames Ryan AlzonaNo ratings yet

- Ground FloorDocument1 pageGround FloorAyad GamalNo ratings yet

- Catalog CV Cipta Abadi 2022Document61 pagesCatalog CV Cipta Abadi 2022EMPAT ANUGERAH SYUKUR ,PTNo ratings yet

- FTKF BDocument2 pagesFTKF BPads PrietoNo ratings yet

- Week12-Elgin F. Hunt, David C. Colander - Social Science - An Introduction To The Study of Society-Routledge (2016) (Dragged)Document16 pagesWeek12-Elgin F. Hunt, David C. Colander - Social Science - An Introduction To The Study of Society-Routledge (2016) (Dragged)MuhammetNo ratings yet

- LetterDocument1 pageLetterNaman JadwaniNo ratings yet

- Managerial Economics Term PaperDocument12 pagesManagerial Economics Term PaperJason BourneNo ratings yet

- 1.04 Role of Federal ReserveDocument2 pages1.04 Role of Federal ReserveFUD Apple100% (1)

- Porter's Five Forces Model AnalysisDocument2 pagesPorter's Five Forces Model AnalysisLika OragvelidzeNo ratings yet