Professional Documents

Culture Documents

Market Structure - Economics

Uploaded by

ABARAJOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Market Structure - Economics

Uploaded by

ABARAJCopyright:

Available Formats

In economics, market structure is the number of firms producing identical products.

The types of market structures include the following:

Monopolistic competition, also called competitive market, where there is a large number of firms, each having a small proportion of the market share and slightly differentiated products. Oligopoly, in which a market is dominated by a small number of firms that together control the majority of the market share. o Duopoly, a special case of an oligopoly with two firms. Monopsony, when there is only one buyer in a market. Oligopsony, a market where many sellers can be present but meet only a few buyers. Monopoly, where there is only one provider of a product or service. o Natural monopoly, a monopoly in which economies of scale cause efficiency to increase continuously with the size of the firm. A firm is a natural monopoly if it is able to serve the entire market demand at a lower cost than any combination of two or more smaller, more specialized firms. Perfect competition, a theoretical market structure that features no barriers to entry, an unlimited number of producers and consumers, and a perfectly elastic demand curve.

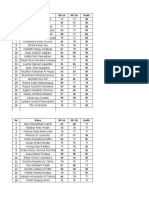

The imperfectly competitive structure is quite identical to the realistic market conditions where some monopolistic competitors, monopolists, oligopolists, and duopolists exist and dominate the market conditions. The elements of Market Structure include the number and size distribution of firms, entry conditions, and the extent of differentiation. These somewhat abstract concerns tend to determine some but not all details of a specific concrete market system where buyers and sellers actually meet and commit to trade. Competition is useful because it reveals actual customer demand and induces the seller (operator) to provide service quality levels and price levels that buyers (customers) want, typically subject to the sellers financial need to cover its costs. In other words, competition can align the sellers interests with the buyers interests and can cause the seller to reveal his true costs and other private information. In the absence of perfect competition, three basic approaches can be adopted to deal with problems related to the control of market power and an asymmetry between the government and the operator with respect to objectives and information: (a) subjecting the operator to competitive pressures, (b) gathering information on the operator and the market, and (c) applying incentive regulation.[1] Quick Reference to Basic Market Structures Market Seller Entry Seller Buyer Entry Structure Barriers Number Barriers Perfect No Many No Competition Monopolistic No Many No competition Oligopoly Yes Few No Oligopsony No Many Yes

Buyer Number Many Many Many Few

Quick Reference to Basic Market Structures Market Seller Entry Seller Buyer Entry Buyer Structure Barriers Number Barriers Number Monopoly Yes One No Many Monopsony No Many Yes One The correct sequence of the market structure from most to least competitive is perfect competition, imperfect competition, oligopoly, and pure monopoly. The main criteria by which one can distinguish between different market structures are: the number and size of producers and consumers in the market, the type of goods and services being traded, and the degree to which information can flow freely.

http://www.scaruffi.com/politics/gnp.html Country USA Japan Germany Britain France China Italy Canada Brazil Spain Mexico GNP Per Capita

$10,533 $38 $4,852 $2,242 $1,544 $1,543 $1,329 $1,260 $760 $715 $651 $578 $38 $27 $26 $26 $1 $22 $24 $4 $16 $6 $11 $0.5 $24 $27

South Korea $515 India Australia Netherlands $510 $444 $429

Taiwan Argentina Switzerland Sweden Belgium Russia Austria Turkey Poland Indonesia Thailand

$363 $300 $286 $275 $264 $252 $226 $212 $188 $174 $132

$16 $8 $39 $31 $26 $2 $27 $3 $5 $0.8 $2

Country % of Global GDP % of World Population USA Japan Germany Britain France China Italy Canada Mexico Spain 32.9% 13.4% 6.0% 4.6% 4.2% 3.7% 3.5% 2.3% 2.0% 1.9% 4.65% 2.09% 1.36% 0.99% 0.97% 20.84% 0.95% 0.51% 1.62% 0.65%

Purchasing-power parity (2003)

Rank PPP total PPP/capita Population ($ billions) ($) (million) European Union 10,840 28,600 379 USA 10,400 37,600 290 Country

1.

2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. 15. 16. 17. 18. 19. 20. 21. 22. 23 . 24.

China (mainland) Japan India Germany France Britain Italy Russia Brazil South Korea Canada Mexico Spain Indonesia Australia Turkey Iran Netherlands South Africa Thailand Taiwan Argentina Poland

5,700 3,550 2,660 2,180 1,540 1,520 1,440 1,350 1,340 931 923 900 828 663 528 468 456 434 432 429 406 391 368

4,400 28,000 2,540 26,600 25,700 25,300 25,000 9,300 7,600 19,400 29,400 9,000 20,700 3,100 27,000 7,000 7,000 26,900 10,000 6,900 18,000 10,200 9,500

1,287 127 1,049 82 60 60 57 144 182 48 32 104 40 234 19 68 68 16 42 70 22 38 38

You might also like

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Tan vs. Macapagal, 43 SCRADocument6 pagesTan vs. Macapagal, 43 SCRANikkaDoriaNo ratings yet

- Short-Term Load Forecasting by Artificial Intelligent Technologies PDFDocument446 pagesShort-Term Load Forecasting by Artificial Intelligent Technologies PDFnssnitNo ratings yet

- Data Science Online Workshop Data Science vs. Data AnalyticsDocument1 pageData Science Online Workshop Data Science vs. Data AnalyticsGaurav VarshneyNo ratings yet

- HIS Unit COMBINES Two Birthdays:: George Washington's BirthdayDocument9 pagesHIS Unit COMBINES Two Birthdays:: George Washington's BirthdayOscar Panez LizargaNo ratings yet

- WHAT - IS - SOCIOLOGY (1) (Repaired)Document23 pagesWHAT - IS - SOCIOLOGY (1) (Repaired)Sarthika Singhal Sarthika SinghalNo ratings yet

- Layos vs. VillanuevaDocument2 pagesLayos vs. VillanuevaLaura MangantulaoNo ratings yet

- Chapter 019Document28 pagesChapter 019Esteban Tabares GonzalezNo ratings yet

- E 05-03-2022 Power Interruption Schedule FullDocument22 pagesE 05-03-2022 Power Interruption Schedule FullAda Derana100% (2)

- DSLP CalculationDocument7 pagesDSLP Calculationravi shankar100% (1)

- Motivational Speech About Our Dreams and AmbitionsDocument2 pagesMotivational Speech About Our Dreams and AmbitionsÇhärlöttë Çhrístíñë Dë ÇöldëNo ratings yet

- Shrek FSCDocument5 pagesShrek FSCMafer CastroNo ratings yet

- Distributing Business Partner Master Data From SAP CRMDocument28 pagesDistributing Business Partner Master Data From SAP CRMJarko RozemondNo ratings yet

- Public Service Media in The Networked Society Ripe 2017 PDFDocument270 pagesPublic Service Media in The Networked Society Ripe 2017 PDFTriszt Tviszt KapitányNo ratings yet

- How To Create Partner Function in SAP ABAPDocument5 pagesHow To Create Partner Function in SAP ABAPRommel SorengNo ratings yet

- Urinary Tract Infection in Children: CC MagbanuaDocument52 pagesUrinary Tract Infection in Children: CC MagbanuaVanessa YunqueNo ratings yet

- A Lei Do Sucesso Napoleon Hill Download 2024 Full ChapterDocument23 pagesA Lei Do Sucesso Napoleon Hill Download 2024 Full Chapterdavid.brown752100% (12)

- Biosphere Noo Sphere Infosphere Epistemo PDFDocument18 pagesBiosphere Noo Sphere Infosphere Epistemo PDFGeorge PetreNo ratings yet

- How Is Extra-Musical Meaning Possible - Music As A Place and Space For Work - T. DeNora (1986)Document12 pagesHow Is Extra-Musical Meaning Possible - Music As A Place and Space For Work - T. DeNora (1986)vladvaidean100% (1)

- Multiple Linear RegressionDocument26 pagesMultiple Linear RegressionMarlene G Padigos100% (2)

- 2,3,5 Aqidah Dan QHDocument5 pages2,3,5 Aqidah Dan QHBang PaingNo ratings yet

- Delaware Met CSAC Initial Meeting ReportDocument20 pagesDelaware Met CSAC Initial Meeting ReportKevinOhlandtNo ratings yet

- Working Capital Management-FinalDocument70 pagesWorking Capital Management-FinalharmitkNo ratings yet

- New VibesDocument12 pagesNew VibesSangeeta S. Bhagwat90% (20)

- Faringitis StreptococcusDocument16 pagesFaringitis StreptococcusnurNo ratings yet

- PETE 689 Underbalanced Drilling (UBD) : Well Engineering Read: UDM Chapter 5 Pages 5.1-5.41Document74 pagesPETE 689 Underbalanced Drilling (UBD) : Well Engineering Read: UDM Chapter 5 Pages 5.1-5.41Heris SitompulNo ratings yet

- Dark Witch Education 101Document55 pagesDark Witch Education 101Wizard Luxas100% (2)

- Strategic Risk ManagementDocument46 pagesStrategic Risk ManagementNuman Rox100% (1)

- Introduction To Public HealthDocument54 pagesIntroduction To Public HealthKristelle Marie Enanoria Bardon50% (2)

- DissertationDocument59 pagesDissertationFatma AlkindiNo ratings yet