Professional Documents

Culture Documents

AMGN

Uploaded by

beacon-docsOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

AMGN

Uploaded by

beacon-docsCopyright:

Available Formats

Analyst: Victor Sula, Ph.D.

Initial Report

January 9th, 2008

AMGNdaily 01/8/09

62

60

58

56

54

52

50

48

46

volume © BigCharts.com

Amgen Inc.

30

One Amgen Center Drive

Millions

Thousand Oaks, CA 20

91320-1799 10

0

Phone: +1 805-447-1000 Nov Dec 09

Fax: +1 805-447-1010

Website: www.amgen.com

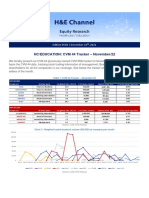

MARKET DATA

Share Statistics NASDAQ 9m 9m

(12/23/08) 2006 2007 %Chg 2007 2008 %Chg

Symbol AMGN Revenues, $ Mn. 13,858 14,311 3.3% 11,026 11,252 2.0%

Current price $57.93 Gross margin 85.3% 82.8% -2.5 b.p. 82.4% 84.5% 2.1 b.p.

Low/ High 52 weeks $39.16 - 66.51 Operating margin 26.9% 26.9% 0.0 b.p. 26.5% 36.2% 9.7 b.p.

Average Volume 6,040,625 Net margin 20.7% 21.4% 0.7 b.p. 21.1% 28.8% 7.7 b.p.

Market Capitalization $22.014 Bn

Shares Outstanding 1,059 Mn EPS, $ 3.51 3.86 10.0% 2.05 3.00 46.3%

Source: Yahoo Finance, Analyst Estimates

Background

Amgen Inc. (AMGN, the Company) is a global biotechnology company en-

gaged in the discovery, development, manufacture and commercialization

of human therapeutics based on advances in cellular and molecular biology.

The Company has research programs in metabolic disorders and osteoporo-

sis, inflammation, oncology, neuroscience and hematology. AMGN is consid-

ered to be the largest independent biotechnology company in the U.S., and

the only business that succeeded to transform itself from a drug development

company into a pharmaceutical manufacturer with solid sales.

The Company’s principal products include: Aranesp (darbepoetin alfa) and

EPOGEN (Epoetin alfa), which stimulate the production of red blood cells

to treat anemia and belong to a class of drugs referred to as erythropoiesis-

stimulating agents (ESAs); Neulasta (pegfilgrastim) and NEUPOGEN (Fil-

grastim), which selectively stimulate the production of neutrophils, a type

of white blood cell that helps the body fight infections; and ENBREL (etan-

ercept) that blocks the biologic activity of tumor necrosis factor by inhibiting

Amgen Inc. (NASDAQ: AMGN) 1

Analyst: Victor Sula, Ph.D.

Initial Report

January 9th, 2008

TNF, a substance induced in response to inflammatory and immunological responses, such as rheumatoid ar-

thritis and psoriasis. Other marketed products include Sensipar, Nplate and Vectibix.

The Company’s research facilities are located in California, Massachusetts, Washington, Canada and Germany.

AMGN operates manufacturing facilities in California, Colorado, Rhode Island, Washington and Puerto Rico. It

markets its products to healthcare providers including physicians or their clinics, dialysis centers, hospitals and

pharmacies primarily in the United States, Europe, Canada and Australia. The Company was founded in 1980

and is based in Thousand Oaks, California.

Highlights

A strong track record of revenues

The Company’s revenue has almost doubled in the last six years, going from $7.9 billion in 2003 to approxi-

mately $15.1 billion in 2008. AMGN earns approximately 97% of revenues from the sales of human therapeutic

products. For 2007 and 2008, AMGN reported a modest growth of product sales due to a drop in the sales of

Aranesp, AMGN’s flagship anemia drug. However, the decline in Aranesp was offset by a greater demand for

ENBREL and Neulasta®/NEUPOGEN. International product sales in 2008 are likely to represent 22% of total

product sales. In late December 2008, Reuters ranked the Company third among the top 10 best performers for

the year in the S&P 500 index, in terms of percentage gains.

Revenue, $ Mn

Source: SEC filings; Yahoo Finance;;

High profitability margins

AMGN is one of the most gainful companies in the industry in terms of profitability. AMGN’s gross and net

margins remained strong over the last four quarters. The Company’s gross margin onQ3 2008 sales rang in at

82.5%. The slight decrease of the margin in third quarter of fiscal 2008 was primarily due to a decline in domestic

Amgen Inc. (NASDAQ: AMGN) 2

Analyst: Victor Sula, Ph.D.

Initial Report

January 9th, 2008

demand for its flagship drug Aranesp, as well as pricing pressures.

Gross Margin, %

Source: SEC filings;

Restructuring plan to improve the cost structure

In the second half of 2007, AMGN announced a plan to restructure its worldwide operations in order to improve

the cost structure while continuing to make significant R&D investments, and to build the framework for the fu-

ture growth. Through September 30, 2008, the Company has completed a majority of the actions initially included

in the restructuring plan: (i) worldwide staff reductions aggregating approximately 2,500 positions, (ii) ratio-

nalization of worldwide network of manufacturing facilities in order to gain cost efficiencies, while continuing

to meet future commercial and clinical demand for its products and product candidates and, to a lesser degree,

changes to certain R&D capital projects and (iii) abandoning leases primarily for certain R&D facilities that will

not be used in its operations. Through September 30, 2008, AMGN incurred a total cost with respect to these ac-

tions of $790 million. The total cost of restructuring program was projected to near $925 million.

Solid balance sheet and operating cash flow

As of September 30, 2008, the Company has a strong balance sheet, with approximately $9.8 billion in cash, cash

equivalents and short-term investments. The Company also reported significant cash flows from operations that

neared $4.5 billion for the first nine months of 2008.

2009

Amgen Inc. (NASDAQ: AMGN) 3

Analyst: Victor Sula, Ph.D.

Initial Report

January 9th, 2008

Selected balance sheet data, $ Bn

31-Dec-07 30-Sep-08

Total Assets, including 34.6 37.0

Cash and cash equivalents 7.2 9.8

Liabilities, including 16.8 17.2

Debt 11.2 11.2

Equity 17.9 19.8

Source : SEC Filings.

Despite the financial crisis, the Company, due to its conservative investment portfolio, does not have exposure

to subprime mortgages and other risky investments.

Heavy investments in R&D to support a solid pipeline of drug candidates

For about 30 years, the Company has been an innovator in the identification, isolation, production and use of

human proteins as therapeutic agents. In building its pipeline, AMGN focuses on products with significant

differentiation from existing drugs and delivers a number of innovative products that provide important treat-

ments for patients around the world. In addition to internal R&D efforts, AMGN acquires companies, acquires

and licenses certain product and technology rights and establishes R&D collaborations.

The Company follows a large, sustained and smart R&D investment strategy. Each year AMGN tries to invest on

the order of 20% of its revenues in research and development. Since 2001, the Company has invested more than

$17 billion to expand its R&D capabilities; its R&D pipeline has more than doubled.

In 2001, the Company had two blockbuster products and today it has five blockbusters on the market. Over the

next five years AMGN plans to have three more drugs, which could achieve blockbuster status. In addition, the

Company is anticipating 17 key phase 2 and 3 clinical study results in 2009 and 2010, including for denosumab

(oncology), AMG 386 and AMG 655 for various cancer indications, and its Sensipar/Mimpara EVOLVE trial, an

outcomes study in dialysis patients.

Denosumab the next blockbuster drug for AMGN

In July 2008, the Company reported that its new drug – Denosumab, the

first fully human monoclonal antibody, which significantly reduces the

risk of bone fracture in post-menopausal women, had passed the FDA

phase 3 trials. AMGN seeks Denosumab’s approval for two purposes:

treatment and prevention of osteoporosis in post-menopausal women;

and prevention and treatment of osteoporosis in breast cancer and in

prostate cancer patients who have had hormone therapy.

AMGN submitted its Biological License Application for Denosumab to

the FDA on December 19, 2008. If all goes well, the company could begin

marketing Denosumab by the end of 2009. The drug is set to become a

Amgen Inc. (NASDAQ: AMGN) 4

Analyst: Victor Sula, Ph.D.

Initial Report

January 9th, 2008

blockbuster and is seen as AMGN’s biggest growth driver over the next five years, with sales forecast to range

from of $1.5 billion to $3 billion by 2012.

Aranesp sales in the U.S. are set to decline due to significantly restricted Medicare reimbursement for use of

Aranesp

The launch of Aranesp for the treatment of chemotherapy-induced anemia was in the mid-year 2002. Already in

2003, worldwide Aranesp sales were $1.5 billion. The sales of the drug peaked in 2006 when sales of more than

$4.1 billion were reported, representing 30% of the Company’s total revenues.

However, since 2007, AMGN is experiencing a decrease in the Aranesp sales, driven mainly by the U.S. regulatory

and reimbursement developments, as well as specific events, including a slight decline in share, price pressures,

new oncology label/REMS, contract changes and the development of biosimilars (Europe). The Company is ex-

pecting an additional decline of 10%-20% in Aranesp sales before a longer-term stability is achieved in 2009.

Favorable industry outlook

The biotechnology industry has been an engine of innovation for the U.S. healthcare system and, more generally,

the U.S. economy. The biotechnology industry has expanded rapidly since 1992, with revenues increasing from $8

billion in 1992 to more than $60 billion presently. It is one of the most research-intensive industries in the world,

spending in 2006 more than $20 billion. Within the biotechnology market, oncology will continue to be an area of

prime focus for many organizations, with strong product lines as well as strong pipelines.

Investment sentiment

AMGN is a leading human therapeutics company in the biotechnology

industry, which has pioneered the scientific discovery and innovation to

advance the practice of medicine for more than 25 years.

Despite the recent problems such as clinical trial setbacks and safety con-

cerns surrounding its Aranesp and Epogen drugs, the Company is recov-

ering with investment in R&D that more than double the size of AMGN’s

pipeline. In addition, the Company is likely to weather the current finan-

cial storm and, moreover, it expects to take advantage of the current finan-

cial crisis that will cause hundreds of small biotechnology companies to

turn to their larger counterparts in coming months.

The Company’s future growth driver is expected to be Denosumab, which

is estimated by analysts to have peak yearly sales in the range of $1 billion to $2 billion. Thus, if Denosumab will

be a runaway success, AMGN is poised to be among the top companies in terms of revenue and earnings growth

in the industry over the next five years.

Despite the many macro in the market, the big biotechnology companies have solid positions and are poised

to improve their pipelines of drug candidates since the smaller research companies are facing liquidity issues.

AMGN is currently trading at 12.48x times 2009 EPS consensus estimate, which is in line with the peer group

median. However, we expect AMGN to trade closer Genetech (DNA) multiples given the future sales potential of

Denosumab.

Amgen Inc. (NASDAQ: AMGN) 5

Analyst: Victor Sula, Ph.D.

Initial Report

January 9th, 2008

Comparative analysis

Price Mrkt.

Company Name Ticker per Cap. P/E P/S

5-Jan-09 symbol Share,$ $ Mn 2008 2009 2008 2009

Genentech Inc. DNA 84.74 89,150 24.71 21.56 6.66 6.17

Bristol-Myers Squibb Co. BMY 22.49 44,520 13.31 11.42 2.14 2.01

Merck & Co. Inc. MRK 29.24 61,780 8.86 8.94 2.59 2.57

GlaxoSmithKline plc GSK 38.84 99,230 10.85 10.85 2.85 2.86

Median 12.08 11.13 2.72 2.71

Amgen Inc. AMGN 58.42 61,890 12.84 12.48 4.11 4.01

Source : Yahoo Finance

Taking in consideration the solid results reported for the last years, the favourable outlook for the biotechnology

market and the blockbuster potential of Denosumab, we rate AMGN as a “Buy.”

Amgen Inc. (NASDAQ: AMGN) 6

Analyst: Victor Sula, Ph.D.

Initial Report

January 9th, 2008

Disclaimer

DO NOT BASE ANY INVESTMENT DECISION UPON ANY MATERIALS FOUND ON THIS REPORT. We are not registered as a securities broker-dealer or

an investment adviser either with the U.S. Securities and Exchange Commission (the “SEC”) or with any state securities regulatory authority. We are neither

licensed nor qualified to provide investment advice.

The information contained in our report should be viewed as commercial advertisement and is not intended to be investment advice. The report is not provided

to any particular individual with a view toward their individual circumstances. The information contained in our report is not an offer to buy or sell securities.

We distribute opinions, comments and information free of charge exclusively to individuals who wish to receive them.

Our newsletter and website have been prepared for informational purposes only and are not intended to be used as a complete source of information on any

particular company. An individual should never invest in the securities of any of the companies profiled based solely on information contained in our report.

Individuals should assume that all information contained in the report about profiled companies is not trustworthy unless verified by their own independent

research.

Any individual who chooses to invest in any securities should do so with caution. Investing in securities is speculative and carries a high degree of risk; you

may lose some or all of the money that is invested. Always research your own investments and consult with a registered investment advisor or licensed stock

broker before investing.

Information contained in our report will contain “forward looking statements” as defined under Section 27A of the Securities Act of 1933 and Section 21B of the

Securities Exchange Act of 1934. Subscribers are cautioned not to place undue reliance upon these forward looking statements. These forward looking state-

ments are subject to a number of known and unknown risks and uncertainties outside of our control that could cause actual operations or results to differ ma-

terially from those anticipated. Factors that could affect performance include, but are not limited to, those factors that are discussed in each profiled company’s

most recent reports or registration statements filed with the SEC. You should consider these factors in evaluating the forward looking statements included in

the report and not place undue reliance upon such statements.

We are committed to providing factual information on the companies that are profiled. However, we do not provide any assurance as to the accuracy or com-

pleteness of the information provided, including information regarding a profiled company’s plans or ability to effect any planned or proposed actions. We

have no first-hand knowledge of any profiled company’s operations and therefore cannot comment on their capabilities, intent, resources, nor experience and

we make no attempt to do so. Statistical information, dollar amounts, and market size data was provided by the subject company and related sources which

we believe to be reliable.

To the fullest extent of the law, we will not be liable to any person or entity for the quality, accuracy, completeness, reliability, or timeliness of the information

provided in the report, or for any direct, indirect, consequential, incidental, special or punitive damages that may arise out of the use of information we provide

to any person or entity (including, but not limited to, lost profits, loss of opportunities, trading losses, and damages that may result from any inaccuracy or

incompleteness of this information).

We encourage you to invest carefully and read investment information available at the websites of the SEC at http://www.sec.gov and FINRA at http://www.

finra.org.

All decisions are made solely by the analyst and independent of outside parties or influence.

I, Victor Sula, Ph.D, the author of this report, certify that the material and views presented herein represent my personal opinion regarding the content and

securities included in this report. In no way has my opinion been influenced by outside parties, nor has my compensation been either directly or indirectly

tied to the performance of any security listed. I certify that I do not currently own, nor will own and shares or securities in any of the companies featured in

this report.

Victor Sula, Ph.D. - Senior Analyst

Victor Sula, Ph.D. has held the position of Senior Analyst with several independent investment research firms since 2004. Prior to 2004, Mr. Sula held Senior

Financial Consultant positions within the World Bank sponsored Agency for Restructuring and Enterprise Assistance and TACIS sponsored Center for Produc-

tivity and Competitiveness of Moldova, where he was involved in corporate reorganization and liquidation. He is also employed as Associate Professor at the

Academy of Economic Studies of Moldova. Mr. Sula earned his Ph.D. degree in 2001 and bachelor’s degree in Finance in 1997 from the Academy of Economic

Studies of Moldova. Mr. Sula is currently a level III candidate in the CFA program.

Amgen Inc. (NASDAQ: AMGN) 7

You might also like

- Dinner Theater Business PlanDocument21 pagesDinner Theater Business PlanBhumika KariaNo ratings yet

- Solution Problem 1 Problems Handouts MicroDocument25 pagesSolution Problem 1 Problems Handouts MicrokokokoNo ratings yet

- Lean Six Sigma in the Age of Artificial Intelligence: Harnessing the Power of the Fourth Industrial RevolutionFrom EverandLean Six Sigma in the Age of Artificial Intelligence: Harnessing the Power of the Fourth Industrial RevolutionRating: 5 out of 5 stars5/5 (1)

- Ferrovial / BAA - A Transforming Acquisition: 3rd July 2006Document38 pagesFerrovial / BAA - A Transforming Acquisition: 3rd July 2006Andrew YangNo ratings yet

- Placement Report 2018-20 (Mumbai Campus)Document16 pagesPlacement Report 2018-20 (Mumbai Campus)AwesomePeopleNo ratings yet

- Archivo Reporte Simulacion Homer ProDocument15 pagesArchivo Reporte Simulacion Homer ProJORGE ARIEL CHICAIZA CHILUIZANo ratings yet

- Background: Initial Report December 29th, 2008 Initial Report December 29th, 2008Document6 pagesBackground: Initial Report December 29th, 2008 Initial Report December 29th, 2008beacon-docsNo ratings yet

- Global Financial CrisisDocument32 pagesGlobal Financial CrisisBünyamin100% (1)

- 2008 09 18 Wachovia Capital Markets Equity Research Semiconductor IndustryDocument80 pages2008 09 18 Wachovia Capital Markets Equity Research Semiconductor IndustryJohnnyPageNo ratings yet

- JP Morgan FundsDocument118 pagesJP Morgan FundsArmstrong CapitalNo ratings yet

- E Learning Multimodular Treatment in Head and Neck Squamous Cell Carcinoma HNSCCDocument96 pagesE Learning Multimodular Treatment in Head and Neck Squamous Cell Carcinoma HNSCChsfbjbfsNo ratings yet

- FRM Part 2 BooksDocument228 pagesFRM Part 2 BooksNishant DsouzaNo ratings yet

- Initial Report August 13Th, 2008: Analyst: Victor Sula, PHDDocument16 pagesInitial Report August 13Th, 2008: Analyst: Victor Sula, PHDbeacon-docsNo ratings yet

- Return On Capital EmplyedDocument7 pagesReturn On Capital EmplyedKAMAL SARINNo ratings yet

- GWEGWEDocument10 pagesGWEGWECarlos AlphonceNo ratings yet

- HC/EDUCATION: CVM 44 Tracker - November/22: Edition #548 - December 16, 2022Document4 pagesHC/EDUCATION: CVM 44 Tracker - November/22: Edition #548 - December 16, 2022CAIO HENRIQUE FIORDELIZNo ratings yet

- Carteras Recomendadas de Cedears: Ideas de InversiónDocument13 pagesCarteras Recomendadas de Cedears: Ideas de InversiónPanchoNo ratings yet

- Claroty Sample Risk Assessment ReportDocument29 pagesClaroty Sample Risk Assessment ReportTuan MA100% (1)

- Realisasi Kunjungan Dan Penjualan Harian 132400 - CV. WIJAYA RAYADocument2 pagesRealisasi Kunjungan Dan Penjualan Harian 132400 - CV. WIJAYA RAYAZul PhaduraNo ratings yet

- Report 1Document17 pagesReport 1Francis MokogwuNo ratings yet

- ACER ASPIRE S7 Wistron Storm - 12223-1 R-1 0625Document102 pagesACER ASPIRE S7 Wistron Storm - 12223-1 R-1 0625sam tabNo ratings yet

- EDITION 1/2022: Niclas Weimar & Dricus de RooijDocument17 pagesEDITION 1/2022: Niclas Weimar & Dricus de RooijWepa BizNo ratings yet

- Credit Risk Measurement and Management: Books CenterDocument460 pagesCredit Risk Measurement and Management: Books CenterNishant DsouzaNo ratings yet

- Background: Intuitive Surgical, IncDocument6 pagesBackground: Intuitive Surgical, Incbeacon-docsNo ratings yet

- April Startup Activity Report by Sling HubDocument11 pagesApril Startup Activity Report by Sling HubEduardoNo ratings yet

- Max International Convention GuideDocument56 pagesMax International Convention GuideBryan Edson M. YcoNo ratings yet

- Career Guide To Energy IndustryDocument172 pagesCareer Guide To Energy Industryamitpathak28No ratings yet

- Baltica Beer - Capital Market DayDocument21 pagesBaltica Beer - Capital Market DayLim KeakruyNo ratings yet

- Sinovoltaics Energy Storage Manufacturer Ranking Report Edition 3 2022Document17 pagesSinovoltaics Energy Storage Manufacturer Ranking Report Edition 3 2022Trường Nguyễn PhúNo ratings yet

- Sinovoltaics Energy Storage Manufacturer Ranking Report Edition 3 2020Document16 pagesSinovoltaics Energy Storage Manufacturer Ranking Report Edition 3 2020Camelot colindresNo ratings yet

- Reporte HOMER WIND 5kW-PV 6.36kWDocument10 pagesReporte HOMER WIND 5kW-PV 6.36kWlandoa junNo ratings yet

- Simply Wall ST - Big Green SnowflakesDocument2 pagesSimply Wall ST - Big Green SnowflakesbrandonNo ratings yet

- Stats TripDocument42 pagesStats TripAlexandra JanicNo ratings yet

- Business - Analysis - and - Valuation - Text - and - Cases-Palepu-Third Edition-Trang-301-330Document30 pagesBusiness - Analysis - and - Valuation - Text - and - Cases-Palepu-Third Edition-Trang-301-330Nguyễn LinhNo ratings yet

- Time Series Analysis: Averaging Trend SeasonalityDocument17 pagesTime Series Analysis: Averaging Trend SeasonalityCorlise le RouxNo ratings yet

- ANEXA 1 Raport PVDocument13 pagesANEXA 1 Raport PVAlexandra AntonNo ratings yet

- Micro Economics AssignmentDocument9 pagesMicro Economics AssignmentYosef MitikuNo ratings yet

- Manual Performa NC 07022590050Document180 pagesManual Performa NC 07022590050paae upiicsaNo ratings yet

- BUY BUY BUY BUY: Manhattan Associates IncDocument5 pagesBUY BUY BUY BUY: Manhattan Associates Incderek_2010No ratings yet

- Prediction Method For Winding Parameters in Label Converting Process With Data Mining ToolsDocument8 pagesPrediction Method For Winding Parameters in Label Converting Process With Data Mining ToolsEsteban CorderoNo ratings yet

- Sell Sell Sell Sell: Alteryx IncDocument5 pagesSell Sell Sell Sell: Alteryx IncHsiehNo ratings yet

- Operating Instructions: EpilatorDocument7 pagesOperating Instructions: EpilatorMohamed HassanNo ratings yet

- NABIl Bank DaitailDocument16 pagesNABIl Bank Daitailrameshchaudhary008899No ratings yet

- Forward Biased-Silicon DiodeDocument1 pageForward Biased-Silicon DiodeHARSH AGNIHOTRINo ratings yet

- Fundamental Analysis: Sunday - March 7, 2021Document44 pagesFundamental Analysis: Sunday - March 7, 2021purtamadre RonNo ratings yet

- Electrical systems-Yamaha50G 60F 70B 75C 90ADocument38 pagesElectrical systems-Yamaha50G 60F 70B 75C 90AСЕРГЕЙNo ratings yet

- Cementos Pacasmayo Fox PDFDocument17 pagesCementos Pacasmayo Fox PDFAnonymous sdjKy0wKxNo ratings yet

- Ishares Msci Brazil Etf: Fact Sheet As of 03/31/2020Document2 pagesIshares Msci Brazil Etf: Fact Sheet As of 03/31/2020SupermanNo ratings yet

- Chesapeake (CHK) WriteupDocument2 pagesChesapeake (CHK) WriteuptkyawlNo ratings yet

- Supplement: 7-8 Years 12%Document3 pagesSupplement: 7-8 Years 12%kzNo ratings yet

- Rayos X Odontologíco IntraOs - 70 - V4.0 - ENG - Service - Installation PDFDocument52 pagesRayos X Odontologíco IntraOs - 70 - V4.0 - ENG - Service - Installation PDFJuancho VargasNo ratings yet

- Acer 5517 Amd LA-5481PDocument47 pagesAcer 5517 Amd LA-5481Pwt.snjrNo ratings yet

- Article Impairment Study 2008Document12 pagesArticle Impairment Study 2008Aung Kyaw MyoNo ratings yet

- Assignment #2 Confidence Interval EstimationDocument5 pagesAssignment #2 Confidence Interval EstimationRania ChoucheneNo ratings yet

- Statistical Case Solve CH 3Document10 pagesStatistical Case Solve CH 3Ashik Uz ZamanNo ratings yet

- 09-01-20 Web 2.0 WeeklyDocument18 pages09-01-20 Web 2.0 WeeklyDavid Shore100% (2)

- Scope:: About The Screensim - Single Spreadsheet ..Document2 pagesScope:: About The Screensim - Single Spreadsheet ..Rolando QuispeNo ratings yet

- 01-74 Read Measuring Value BlockDocument3 pages01-74 Read Measuring Value BlockBogdan CojocaruNo ratings yet

- Sinovoltaics Energy Storage Manufacturers Ranking Report Edition 2 2020Document16 pagesSinovoltaics Energy Storage Manufacturers Ranking Report Edition 2 2020Malik NaumanNo ratings yet

- Sinovoltaics PV Module Manufacturer Ranking Report Edition 3 2020Document18 pagesSinovoltaics PV Module Manufacturer Ranking Report Edition 3 2020Camelot colindresNo ratings yet

- DICOM Conformance Statement FluorostarDocument65 pagesDICOM Conformance Statement Fluorostarkhawar mukhtarNo ratings yet

- Earnings Quality Matters - DDDDocument7 pagesEarnings Quality Matters - DDDTom JacobsNo ratings yet

- Background: Initial Report February 25th, 2009 Initial Report February 25th, 2009Document6 pagesBackground: Initial Report February 25th, 2009 Initial Report February 25th, 2009beacon-docsNo ratings yet

- OOILDocument9 pagesOOILbeacon-docsNo ratings yet

- Company Introduction: Empire Film Group IncDocument17 pagesCompany Introduction: Empire Film Group Incbeacon-docsNo ratings yet

- Company Introduction: Carbon Sciences IncDocument7 pagesCompany Introduction: Carbon Sciences Incbeacon-docs100% (4)

- Background: Intuitive Surgical, IncDocument6 pagesBackground: Intuitive Surgical, Incbeacon-docsNo ratings yet

- Company Introduction: China Energy Recovery IncDocument17 pagesCompany Introduction: China Energy Recovery Incbeacon-docsNo ratings yet

- Background: Initial Report February 6th, 2009 Initial Report February 6th, 2009Document6 pagesBackground: Initial Report February 6th, 2009 Initial Report February 6th, 2009beacon-docsNo ratings yet

- PLTGDocument20 pagesPLTGbeacon-docs100% (1)

- Company Introduction: Tombstone Exploration CorpDocument16 pagesCompany Introduction: Tombstone Exploration Corpbeacon-docsNo ratings yet

- Company Introduction: China Energy Recovery IncDocument17 pagesCompany Introduction: China Energy Recovery Incbeacon-docsNo ratings yet

- Company Introduction: Supportsave Solutions, IncDocument17 pagesCompany Introduction: Supportsave Solutions, Incbeacon-docsNo ratings yet

- Company Introduction: Universal Bioenergy IncDocument18 pagesCompany Introduction: Universal Bioenergy Incbeacon-docsNo ratings yet

- GSPIDocument8 pagesGSPIbeacon-docsNo ratings yet

- Company Introduction: Initial Report October 15th, 2008Document19 pagesCompany Introduction: Initial Report October 15th, 2008beacon-docsNo ratings yet

- Company Introduction: Initial Report October 2nd, 2008Document17 pagesCompany Introduction: Initial Report October 2nd, 2008beacon-docsNo ratings yet

- Company Introduction: Neohydro Technologies, CorpDocument17 pagesCompany Introduction: Neohydro Technologies, Corpbeacon-docs100% (1)

- Initial Report September 22nd, 2008: Analyst: Lisa Springer, CFADocument17 pagesInitial Report September 22nd, 2008: Analyst: Lisa Springer, CFAbeacon-docsNo ratings yet

- Initial Report September 9th, 2008: Analyst: Victor Sula, PH.DDocument18 pagesInitial Report September 9th, 2008: Analyst: Victor Sula, PH.Dbeacon-docsNo ratings yet

- Company Introduction: Report Updated September 29th, 2008Document8 pagesCompany Introduction: Report Updated September 29th, 2008beacon-docsNo ratings yet

- Initial Report August 7Th, 2008: Analyst: Victor Sula, PHDDocument18 pagesInitial Report August 7Th, 2008: Analyst: Victor Sula, PHDbeacon-docsNo ratings yet

- Initial Report August 27Th, 2008: Analyst: Victor Sula, PHDDocument19 pagesInitial Report August 27Th, 2008: Analyst: Victor Sula, PHDbeacon-docs100% (1)

- Initial Report August 13Th, 2008: Analyst: Victor Sula, PHDDocument16 pagesInitial Report August 13Th, 2008: Analyst: Victor Sula, PHDbeacon-docsNo ratings yet

- Initial Report September 17th, 2008: Analyst: Victor Sula, PH.DDocument21 pagesInitial Report September 17th, 2008: Analyst: Victor Sula, PH.Dbeacon-docsNo ratings yet

- Initial Report September 4th, 2008: Analyst: Lisa Springer, CFADocument22 pagesInitial Report September 4th, 2008: Analyst: Lisa Springer, CFAbeacon-docs100% (1)

- Study On Color Fastness To Rubbing by Crock MeterDocument4 pagesStudy On Color Fastness To Rubbing by Crock Metertushar100% (5)

- Reliability EngineerDocument1 pageReliability EngineerBesuidenhout Engineering Solutions and ConsultingNo ratings yet

- DOL, Rotor Resistance and Star To Delta StarterDocument8 pagesDOL, Rotor Resistance and Star To Delta StarterRAMAKRISHNA PRABU GNo ratings yet

- MAYA1010 EnglishDocument30 pagesMAYA1010 EnglishjailsondelimaNo ratings yet

- Paper - 1: Principles & Practice of Accounting Questions True and FalseDocument29 pagesPaper - 1: Principles & Practice of Accounting Questions True and FalsePiyush GoyalNo ratings yet

- Q2 Module 2 CESC WEEK 2Document17 pagesQ2 Module 2 CESC WEEK 2rectojhon7100% (1)

- Air Passenger Bill of RightsDocument12 pagesAir Passenger Bill of RightsAldan Subion Avila100% (1)

- Forod 2bac en s2 6 PDFDocument4 pagesForod 2bac en s2 6 PDFwwe foreverNo ratings yet

- 556pm 42.epra Journals-5691Document4 pages556pm 42.epra Journals-5691Nabila AyeshaNo ratings yet

- Boeing 247 NotesDocument5 pagesBoeing 247 Notesalbloi100% (1)

- Class Assignment 2Document3 pagesClass Assignment 2fathiahNo ratings yet

- Link Belt Rec Parts LastDocument15 pagesLink Belt Rec Parts LastBishoo ShenoudaNo ratings yet

- Table of Contents - YmodDocument4 pagesTable of Contents - YmodDr.Prakher SainiNo ratings yet

- Governance of Cyber Security Research ProposalDocument1 pageGovernance of Cyber Security Research ProposalAleksandar MaričićNo ratings yet

- 101 Union of Filipro Employees Vs Vivar (Labor)Document1 page101 Union of Filipro Employees Vs Vivar (Labor)Kayelyn Lat100% (1)

- BACS2042 Research Methods: Chapter 1 Introduction andDocument36 pagesBACS2042 Research Methods: Chapter 1 Introduction andblood unityNo ratings yet

- DX DiagDocument16 pagesDX DiagMihaela AndronacheNo ratings yet

- Ruggedbackbone Rx1500 Rx1501Document13 pagesRuggedbackbone Rx1500 Rx1501esilva2021No ratings yet

- Civil Law 1Document2 pagesCivil Law 1Len Sor Lu100% (3)

- DS TEGO Polish Additiv WE 50 e 1112Document3 pagesDS TEGO Polish Additiv WE 50 e 1112Noelia Gutiérrez CastroNo ratings yet

- Tutorial 1 Process Heat TransferDocument4 pagesTutorial 1 Process Heat TransferSuraya JohariNo ratings yet

- State of The Art Synthesis Literature ReviewDocument7 pagesState of The Art Synthesis Literature Reviewfvdddmxt100% (2)

- Project Management PDFDocument10 pagesProject Management PDFJamalNo ratings yet

- Gears, Splines, and Serrations: Unit 24Document8 pagesGears, Splines, and Serrations: Unit 24Satish Dhandole100% (1)

- Khrone 5 Beam Flow Meter DatasheetDocument16 pagesKhrone 5 Beam Flow Meter DatasheetAnoop ChulliyanNo ratings yet

- Research On The Marketing Communication Strategy of Tesla Motors in China Under The Background of New MediaDocument5 pagesResearch On The Marketing Communication Strategy of Tesla Motors in China Under The Background of New MediaSiddharth ChaudharyNo ratings yet

- Argus Technologies: Innovative Antenna SolutionsDocument21 pagesArgus Technologies: Innovative Antenna SolutionsРуслан МарчевNo ratings yet