Professional Documents

Culture Documents

Consumer Service Finrep en

Consumer Service Finrep en

Uploaded by

sgoswami_1Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Consumer Service Finrep en

Consumer Service Finrep en

Uploaded by

sgoswami_1Copyright:

Available Formats

CONSUMER SATISFACTION SURVEY

FINAL REPORT

May 2007

BY

IPSOS INRA for THE EUROPEAN COMMISSION Health & Consumer Protection Directorate - General

____________________________________________________________________________________________________________

Table of Contents

Executive Summary ............................................................................. 8 A. 1. 2. 3. GENERAL INTRODUCTION ...............................................................19 Context and objectives of the consumer satisfaction survey.....................19 Methodology ..............................................................................21 Satisfaction indicators ..................................................................23 3.1. Defining Consumer Satisfaction Indicators ....................................23 3.2. Structure of the final report.....................................................29 DESCRIPTIVE ANALYSIS OF THE SURVEY RESULTS ...................................30 Electricity supply ........................................................................30 1.1. 1.2. 1.3. 1.4. 1.5. 2. Overall results .....................................................................30 Differences between EU Member States.......................................31 Differences by socio-economic group ..........................................33 Other key observations arising from the survey ..............................34 Advanced analyses ................................................................35

B. 1.

Gas supply.................................................................................40 2.1. 2.2. 2.3. 2.4. 2.5. Overall results .....................................................................40 Differences between EU Member States.......................................41 Differences by socio-economic group ..........................................43 Other key observations arising directly from the survey ...................44 Advanced analyses ................................................................45

3.

Water distribution .......................................................................50 3.1. 3.2. 3.3. 3.4. 3.5. Overall results .....................................................................50 Differences between EU Member States.......................................51 Differences by socio-economic group ..........................................53 Other key observations resulting directly from the survey .................54 Advanced analyses ................................................................55

4.

Fixed telephone service ................................................................59 4.1. 4.2. 4.3. 4.4. 4.5. Overall results .....................................................................59 Differences between EU Member States.......................................60 Differences by socio-economic group ..........................................62 Other key observations arising directly from the survey ...................63 Advanced analyses ................................................................64

| FINAL REPORT CONSUMER SATISFACTION DG SANCO

____________________________________________________________________________________________________________

5.

Mobile phone service ....................................................................68 5.1. 5.2. 5.3. 5.4. 5.5. Overall results .....................................................................68 Differences between EU Member States.......................................69 Differences by socio-economic group ..........................................70 Other key observations arising directly from the survey ...................71 Advanced analyses ................................................................73

6.

Urban transport ..........................................................................77 6.1 6.2. 6.3. 6.4. 6.5. Overall results .....................................................................77 Differences between EU Member States.......................................78 Differences by socio-economic group ..........................................80 Other key observations arising directly from the survey ...................81 Advanced analyses ................................................................82

7.

Extra-urban transport ...................................................................87 7.1. 7.2. 7.3. 7.4. 7.5. Overall results .....................................................................87 Differences between EU Member States.......................................88 Differences by socio-economic group ..........................................90 Other key observations arising directly from the survey ...................91 Advanced analyses ................................................................93

8.

Air transport ..............................................................................97 8.1. 8.2. 8.3. 8.4. 8.5. Overall results .....................................................................97 Differences between EU Member States.......................................98 Differences by socio-economic characteristics ............................. 100 Other key observations arising directly from the survey ................. 101 Advanced analyses .............................................................. 102

9.

Postal services.......................................................................... 106 9.1. 9.2. 9.3. 9.4. 9.5. Overall results ................................................................... 106 Differences between EU Member States..................................... 107 Differences by socio-economic characteristics ............................. 108 Other key observations arising directly from the survey ................. 109 Advanced analyses .............................................................. 110

10. Retail banking .......................................................................... 114 10.1. 10.2. 10.3. 10.4. 10.5. Overall results.................................................................. 114 Differences between EU Member States ................................... 115 Differences by socio-economic characteristics ........................... 116 Other key observations arising directly from the survey ................ 117 Advanced analyses............................................................. 118

FINAL REPORT CONSUMER SATISFACTION DG SANCO

____________________________________________________________________________________________________________

11. Insurance services ..................................................................... 122 11.1. 11.2. 11.3. 11.4. 11.5. C. 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. 15. 16. 17. 18. 19. 20. 21. 22. 23. 24. 25. 26. Overall results.................................................................. 122 Differences between EU Member States ................................... 123 Differences by socio-economic characteristics ........................... 125 Other key observations resulting directly from the survey ............. 126 Advanced analyses............................................................. 127

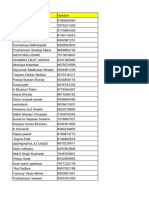

DESCRIPTIVE ANALYSIS OF THE SURVEY RESULTS BY COUNTRY ................ 131 EU25 ..................................................................................... 132 Austria ................................................................................... 133 Belgium .................................................................................. 134 Cyprus ................................................................................... 135 Czech Republic ......................................................................... 136 Denmark................................................................................. 137 Estonia................................................................................... 138 Germany................................................................................. 139 Greece ................................................................................... 140 Finland................................................................................... 141 France ................................................................................... 142 Hungary.................................................................................. 143 Ireland ................................................................................... 144 Italy ...................................................................................... 145 Latvia .................................................................................... 146 Lithuania ................................................................................ 147 Luxembourg............................................................................. 148 Malta ..................................................................................... 149 Netherlands ............................................................................. 150 Poland ................................................................................... 151 Portugal ................................................................................. 152 Slovakia.................................................................................. 153 Slovenia ................................................................................. 154 Spain ..................................................................................... 155 Sweden .................................................................................. 156 United Kingdom ........................................................................ 157

| FINAL REPORT CONSUMER SATISFACTION DG SANCO

____________________________________________________________________________________________________________

D. 1.

OVERALL FINDINGS AND RECOMMENDATIONS...................................... 158 Consumers overall satisfaction ..................................................... 158 1.1. Average score .................................................................... 158 1.2. Percentages of satisfied and dissatisfied consumers ...................... 159 Criteria that contribute to consumers overall satisfaction .................... 161 2.1. Consumers satisfaction with quality, pricing and image................. 161 2.2. The relative importance of Quality, Pricing and Image in consumers overall satisfaction with SGIs.................................................. 161 Differences between EU Member States ........................................... 163 3.1. Differences between EU15 and NMS10 countries........................... 163 3.2. Differences between individual Member States ............................ 164 Other key findings ..................................................................... 168 4.1. The socio-economic characteristics of consumers ......................... 168 4.2. Market issues ..................................................................... 169 4.3. Opportunities for priority actions ............................................ 170 Recommendations ..................................................................... 172 5.1. Questionnaire and survey design ............................................. 172 5.2. Areas for further research ..................................................... 173

2.

3.

4.

5.

FINAL REPORT CONSUMER SATISFACTION DG SANCO

____________________________________________________________________________________________________________

Table of graphs

EL. 1 EL. 2 EL. 3 EL. 4 Electricity supply: proportion of satisfied vs. dissatisfied consumers - percentages (2006) ........ 30 Electricity supply: proportion of satisfied vs. dissatisfied consumers by country percentages (2006) ................................................................................................. 31 Electricity supply: proportion of satisfied vs. dissatisfied consumers by socio-economic category percentage (2006) .................................................................................................. 33 Two-dimensional analysis - Electricity .......................................................................... 37 40 41 43 47 50 51 53 56 59 60 62 65 68 69 70 74 77 78 80 84 87 88 90 94

GAS. 1 Gas supply: proportion of satisfied vs. dissatisfied consumers - percentages (2006) ................. GAS. 2 Gas supply: proportion of satisfied vs. dissatisfied consumers by country - percentages (2006) .. GAS. 3 Gas supply: proportion of satisfied vs. dissatisfied consumers by socio-economic category percentages (2006) ................................................................................................. GAS. 4 Two-dimensional analysis - Gas .................................................................................. WAT. 1 Water distribution: percentages of satisfied vs. dissatisfied consumers - percentages (2006) ..... WAT. 2 Water distribution: percentage of satisfied vs. dissatisfied consumers by country percentages (2006) ................................................................................................. WAT. 3 Water supply: percentages of satisfied vs. dissatisfied consumers by socio-economic category percentages (2006) ................................................................................................. WAT. 4 Two-dimensional analysis Water ............................................................................... FT. 1 FT. 2 FT. 3 FT. 4 MP. 1 MP. 2 MP. 3 MP. 4 UT. 1 UT. 2 UT. 3 UT. 4 Fixed telephony: percentage of satisfied vs. dissatisfied consumers - percentages (2006) ......... Fixed telephone: percentage of satisfied vs. dissatisfied consumers by country percentages (2006) ................................................................................................. Fixed telephony: percentage of satisfied vs. dissatisfied consumers by socio-economic category - percentages (2006).................................................................................... Two-Dimensional analysis Fixed telephone .................................................................. Mobile phone: percentage of satisfied vs. dissatisfied consumers - percentages (2006)............. Mobile phone: percentages of satisfied vs. dissatisfied consumers by country percentages (2006) ................................................................................................. Mobile phone: percentages of satisfied vs. dissatisfied consumers by socio-economic category - percentages (2006)................................................................................... Two-dimensional analysis Mobile phone ...................................................................... Urban transport: percentage of satisfied vs. dissatisfied consumers - percentages (2006) ......... Urban transport: percentages of satisfied vs. dissatisfied consumers by country percentages (2006) ................................................................................................. Urban transport: percentages of satisfied vs. dissatisfied consumers by socioeconomic category - percentages (2006).................................................................................... Two-dimensional analysis Urban transport...................................................................

EUT. 1 Extra-urban transport: percentages of satisfied vs. dissatisfied consumers - percentages (2006). EUT. 2 Extra-urban transport: percentages of satisfied vs. dissatisfied consumers by country percentages (2006) ................................................................................................. EUT. 3 Extra-urban transport: percentages of satisfied vs. dissatisfied consumers by socioeconomic category - percentages (2006).................................................................................... EUT. 4 Two-dimensional analysis Extra-urban transport ........................................................... AT. 1 AT. 2 AT. 3 AT. 4

Air transport: percentages of satisfied vs. dissatisfied consumers - percentages (2006) ............ 97 Air transport: percentages of satisfied vs. dissatisfied consumers by country percentages (2006) ................................................................................................. 98 Air transport: percentages of satisfied vs. dissatisfied consumers by socio-economic category percentages (2006) ................................................................................................ 100 Two-dimensional analysis Air transport...................................................................... 103

| FINAL REPORT CONSUMER SATISFACTION DG SANCO

____________________________________________________________________________________________________________

PS. 1 PS. 2 PS. 3 PS. 4 RB. 1 RB. 2 RB. 3 RB. 4 INS. 1 INS. 2 INS. 3 INS. 4

Postal services: percentages of satisfied vs. dissatisfied consumers - percentages (2006)......... 106 Postal services: percentages of satisfied vs. dissatisfied consumers by country - percentages (2006)................................................................................................................. 107 Postal services: percentages of satisfied vs. dissatisfied consumers by socio-economic category - percentages (2006)................................................................................... 108 Two-dimensional analysis Postal services ................................................................... 111 Retail banking: percentages of satisfied vs. dissatisfied consumers - percentages (2006) ......... 114 Retail banking: percentages of satisfied vs. dissatisfied consumers by country percentages (2006) ................................................................................................ 115 Retail banking: percentages of satisfied vs. dissatisfied consumers by socio-economic category percentages (2006) ................................................................................................ 116 Two-dimensional analysis Retail banking.................................................................... 119 Insurance: percentages of satisfied vs. dissatisfied consumers - percentages (2006) ............... 122 Insurance: percentages of satisfied vs. dissatisfied consumers by country - percentages (2006). 123 Insurance: percentages of satisfied vs. dissatisfied consumers by socio-economic category percentages (2006) ................................................................................................ 125 Two-dimensional analysis - Insurance.......................................................................... 128

FINAL REPORT CONSUMER SATISFACTION DG SANCO

____________________________________________________________________________________________________________

Executive Summary

1. CONTEXT

In 2003 and 2004 a pilot study on consumer satisfaction was carried out by INRA and Deloitte for the Health and Consumer Protection Directorate-General of the European Commission. This aim of the study was to develop a methodology for producing consumer satisfaction indicators in the European Union and to carry out a pilot survey. In 2005, the European Commissions Health and Consumer Protection Directorate-General launched a call for tender to prepare, implement and analyse an EU-wide consumer satisfaction survey using the methodology developed during the pilot study. INRA, which has become part of the Ipsos Group, was given this assignment together with Deloitte and some independent experts. The consumer satisfaction survey was held in all of the 25 countries that were members of the European Union at that time and covered 11 services of general interest: Electricity Supply Gas Supply Water Distribution Fixed Telephony Mobile Telephony Urban Transport Extra-Urban Transport Air Transport Postal Services Retail Banking Insurance Services.

2.

A ROBUST METHODOLOGY

The questionnaire used for the pilot survey was slightly changed in line with the recommendations of the pilot study itself and the Commissions requirement for the survey to be based on face-to-face rather than telephone interviews. With the assistance of a Scientific Committee, the survey was designed so that it would guarantee a sufficiently large sample size per service to run the satisfaction model whilst at the same time staying within the agreed budget. For the purposes of the survey, consumers were defined as people (18+) having used the service in the past 12 months. Satisfaction was defined as the consumers assessment of a product or service in terms of the extent to which that product or service has met his/her needs or expectations. Consumer satisfaction was measured both directly (observed satisfaction) and after the responses to specific questions were statistically processed (calculated satisfaction). The model developed during the pilot study allowed us to gain an understanding of the factors that contributed most to consumer (dis)satisfaction for each of the services. A robust and homogeneous methodology was used across countries and services, including over 29,000 interviews in the 25 EU member states. There were on average 500 interviews per service and country. The interviews were face-to-face, took place at the respondents homes, lasted 45 to 60 minutes each and covered 4 to 5 different services per respondent.

| FINAL REPORT CONSUMER SATISFACTION DG SANCO

____________________________________________________________________________________________________________

3.

EUROPEAN CONSUMERS ARE FAIRLY SATISFIED WITH SERVICES OF GENERAL INTEREST

Overall, European consumers appear to be fairly satisfied with services of general interest. For each service surveyed they gave an average score (on a scale from 1 to 10) ranging from 7.04 for Urban Transport to 7.96 for Air Transport, as can be seen in the table below:

Average score Air Transport Mobile Telephony Insurance services Retail Banking Water Distribution Gas supply Electricity supply Postal Services Fixed Telephony Extra Urban Transport Urban Transport 7.96 7.91 7.92 7.82 7.73 7.64 7.61 7.42 7.30 7.05 7.04

If consumers give a service a score of 8, it usually means that they are very satisfied with it. Therefore, looking at the average scores obtained for each service, it is fair to say that: European consumers are particularly satisfied with air transport, mobile telephony, insurance services and retail banking European consumers are less satisfied (or are more neutral in their opinion) with utility services (gas, electricity, water) They are least satisfied with extra-urban and urban transport.

FINAL REPORT CONSUMER SATISFACTION DG SANCO

____________________________________________________________________________________________________________

4.

CONSUMERS IN THE EU25 ARE LEAST SATISFIED WITH URBAN AND EXTRA-URBAN TRANSPORT

Another way of looking at overall satisfaction is to calculate the proportions of satisfied consumers and dissatisfied consumers. Satisfied consumers are people who gave the service a rating of 8, 9 or 10 while dissatisfied consumers are people who gave the service a rating of 4 or less. The proportions of satisfied consumers are displayed in the following graph:

Overall, to what extent are you satisfied with your supplier?

% satisfied customers - EU25

66.1

65.9

64.4

63.1 60.2 57.9 57.6 52.9 52 45.6 44.5

Air transport

Mobile phone

Insurances

Banking retail

Water

Gas

Electricity

Postal services

Fixed phone Extra-urban transport

Urban transport

The majority of EU consumers said they were satisfied with most of the services surveyed, especially with air transport, mobile telephony, insurance services and retail banking. The only exceptions are urban and extra-urban transport: less than 5 consumers out of 10 said that they were satisfied with them.

10 | FINAL REPORT CONSUMER SATISFACTION DG SANCO

____________________________________________________________________________________________________________

A third way of looking at overall satisfaction is displaying the proportion of dissatisfied consumers:

Overall, to what extent are you satisfied with your supplier?

% dissatisfied customers - EU25

10.3 9.4 8.4

6.9 5.4

5.3 4.6 4.4 4.1 3.5 3

Extra-urban transport

Urban transport

Fixed phone

Postal services

Water

Electricity

Banking retail

Gas

Mobile phone

Air transport Insurances

While EU consumers are least satisfied with urban and extra-urban transport, only 10% of them said that they were dissatisfied with both services.

FINAL REPORT CONSUMER SATISFACTION DG SANCO

| 11

____________________________________________________________________________________________________________

5.

PRICE IS VERY IMPORTANT FOR EU CONSUMERS

EU consumers were asked to evaluate each service according to three criteria: Quality, Image and Pricing. For each of these three criteria, they were asked to say whether they agreed or not (by giving a score from 1 to 10) with a list of statements. The following table shows the average satisfaction scores for each criterion and each service.

Service Mobile Telephony Retail Banking Air Transport Insurance Gas Supply Postal Services Water Distribution Fixed Telephony Electricity Supply Extra Urban Transport Urban Transport

Quality 8.1 8.0 8.0 8.0 7.8 7.3 7.6 7.5 7.7 7.0 7.0

Pricing 7.5 7.3 7.6 7.4 6.4 6.8 6.8 6.7 6.6 6.5 6.6

Image 8.0 7.8 7.9 7.8 7.3 7.2 7.4 7.2 7.4 6.8 6.9

Overall, EU consumers tend to be more satisfied with the quality of service offered than the image of the service provider and the prices offered by their provider. However, advanced statistical analyses show that pricing tends to be the main element that determines the extent to which consumers are satisfied with a service. This is the case in 6 out of 11 services surveyed i.e. insurance, electricity supply, retail banking, fixed telephony, mobile telephony and water distribution. In other words, for these services, reducing prices would have the greatest impact on overall consumer satisfaction. Trying to improve consumer satisfaction with a better quality service would have less of an impact on overall satisfaction. On the other hand, image is the key factor that determines consumer satisfaction for service providers for postal services, urban transport and extra-urban transport. In other words, consumers who believe their supplier has a negative image will tend to be less satisfied than those who believe their supplier has a positive image.

12 | FINAL REPORT CONSUMER SATISFACTION DG SANCO

____________________________________________________________________________________________________________

6.

COMPARISON OF COUNTRY RESULTS

A majority of EU25 consumers (more than 50%) are satisfied with 9 out of the 11 SGIs evaluated, especially air transport, mobile phone, insurance, retail banking and water distribution services. Consumers are least satisfied with extra-urban (45.6%) and urban transport (44.5%) services. Results diverging from the EU average are found below: Austria Austrians tend to be more satisfied than the EU average with all 11 services evaluated. They tend also to be less dissatisfied than the EU average with all these services. Belgium Consumers tend to be more satisfied than the EU average with retail banking, mobile phone, insurance, electricity, gas, water, fixed phone and urban and extra-urban transport and less satisfied with air transport and postal services. They tend to be less dissatisfied than the EU average with all the 11 services. Cyprus Consumers tend to be more satisfied than the EU average with all the services, except urban transport (23% of satisfied against 44.5% at the EU level). They tend to be more dissatisfied than the EU average with urban transport (53.8% of dissatisfied against 9.4% at the EU level). Czech Republic Consumers tend to be more satisfied than the EU average with air transport, mobile phone, retail banking and gas distribution and less satisfied with fixed phone. They tend to be more dissatisfied than the EU average with all the services except mobile phone. Denmark Danes tend to be more satisfied than the EU average with the three utilities (water, electricity and gas), insurance, retail banking, mobile phone and fixed phone and less satisfied with extra-urban services. They tend to be more dissatisfied than the EU average with postal services, urban and extra-urban transport. Estonia Consumers in Estonia tend to be more satisfied than the EU average with retail banking, mobile phone, electricity, postal services, fixed phone, insurance, gas distribution, urban and extra-urban transport and less satisfied with water distribution. They tend to be more dissatisfied than the EU average with water distribution and less dissatisfied with extraurban transport.

FINAL REPORT CONSUMER SATISFACTION DG SANCO

| 13

____________________________________________________________________________________________________________

Germany German consumers are most satisfied than the EU average with all the services except extra-urban transport. They tend to be more dissatisfied than the EU average extra-urban transport and less dissatisfied with fixed phone. Greece In Greece, consumers tend to be more satisfied than the EU average with gas distribution, air transport, mobile phone, postal services, insurance and extra-urban transport and less satisfied with electricity and fixed phone. They tend to be more dissatisfied than the EU average with water and electricity distribution and less dissatisfied with postal services and extra-urban transport. Finland Finns tend to be more satisfied than the EU average with all SGIs. In addition, they tend to be less dissatisfied than the EU average with urban and extra-urban transport and fixed phone. France French consumers tend to be more satisfied than the EU average with extra-urban transport and less satisfied air transport, retail banking, mobile phone, water distribution and postal services. They tend to be less dissatisfied than the EU average with extra-urban transport. Hungary Hungarians tend to be more satisfied than the EU25 average with almost all SGIs except with urban transport (37.7% against a EU25 average of 44.5%). However, they tend to be more dissatisfied than the EU average with electricity, insurance, gas, urban and extraurban transport. Ireland Consumers are more satisfied than the EU average with all the SGIs surveyed, except with Air transport (where the proportion of satisfied is equal to the EU average). They tend to be less dissatisfied than the EU average with postal services, fixed phone, urban and extraurban transport.

14 | FINAL REPORT CONSUMER SATISFACTION DG SANCO

____________________________________________________________________________________________________________

Italy Italians tend to be less satisfied than the EU average with all the SGIs. They tend to be more dissatisfied than the EU average with urban and extra-urban transport, postal services and fixed phone. Latvia Latvians tend to be more satisfied than the EU average with all the SGIs, except with water distribution (50.5% are satisfied against 60.2% at the EU level). They tend to be more dissatisfied than the EU average with water distribution and less dissatisfied with urban and extra-urban transport and fixed phone. Lithuania Lithuanians are more satisfied than the EU average with all the SGIs surveyed, except with water distribution (where the proportion of satisfied is equal to the EU average). They tend to be less dissatisfied than the EU average with gas and electricity distribution, retail banking, postal services, air transport, insurance, fixed phone and extra-urban transport but are more dissatisfied with water distribution. Luxembourg Consumers are more satisfied than the EU average with all the SGIs surveyed, except with mobile phone and air transport (where the proportions of satisfied are in line with the EU average). They tend to be less dissatisfied than the EU average with water, electricity and gas distribution, fixed phone, postal services and extra-urban transport. Malta Consumers in Malta tend to be more satisfied than the EU average with mobile phone, retail banking, fixed phone, insurance and postal services and tend to be less satisfied with water and electricity distribution and urban transport. They tend to be less dissatisfied than the EU average with fixed phone and more dissatisfied with insurance, water and electricity distribution and urban transport. Netherlands Just as with Italy, Dutch consumers tend to be less satisfied than the EU average with all the SGIs. However, they also tend to be less dissatisfied than the EU average with water distribution, air transport, postal services, insurance, fixed phone, urban and extra-urban transport. Poland In Poland, consumers tend to be more satisfied than the EU average with postal services and insurance and tend to be less satisfied with fixed phone and urban transport. They tend to be less dissatisfied than the EU average with air transport and tend to be more dissatisfied with fixed phone.

FINAL REPORT CONSUMER SATISFACTION DG SANCO

| 15

____________________________________________________________________________________________________________

Portugal Portuguese consumers tend to be more satisfied than the EU average with postal services and extra-urban transport and tend to be less satisfied with water, gas and electricity distribution, insurance and fixed phone. They tend to be less dissatisfied than the EU average with postal services, retail banking, air transport and urban/extra-urban transport and they tend to be more dissatisfied with water and electricity distribution and fixed phone. Slovakia Slovaks tend to be more satisfied than the EU average with mobile phone and postal services and tend to be less satisfied with insurance, water, electricity and gas distribution, urban and extra-urban transport. In addition, they tend to be more dissatisfied than the EU average with air transport, insurance, water, electricity and gas distribution and urban and extra-urban transport. Slovenia Consumers are more satisfied than the EU average with all the SGIs surveyed, except with urban transport (where the proportion of satisfied is in line with the EU average). In addition, they tend to be less dissatisfied than the EU average with electricity and gas distribution and postal services. Spain Spaniards tend to be less satisfied than the EU average with insurance, retail banking, postal, gas, water and electricity distribution, air transport, mobile phone, fixed phone and urban transport. In addition, they tend to be less dissatisfied than the EU average with postal services and extra-urban transport but tend to be more dissatisfied with air transport and mobile phone. Sweden Consumers are more satisfied than the EU average with water distribution, retail banking, gas, mobile phone, fixed phone and extra-urban transport and tend to be less satisfied with air transport and postal services. They also tend to be less dissatisfied than the EU average with water and gas distribution and retail banking but tend to be more dissatisfied electricity, postal services and urban transport. United Kingdom Consumers in the UK tend to be more satisfied than the EU average with fixed phone, retail banking and extra-urban transport services. In addition, they tend to be less dissatisfied than the EU average with fixed phone and extra-urban transport.

16 | FINAL REPORT CONSUMER SATISFACTION DG SANCO

____________________________________________________________________________________________________________

7.

EU CONSUMERS FACE DIFFICULTIES WHEN IT COMES TO CHANGING SERVICE PROVIDER

Overall, a large proportion of EU consumers (more than 5 out of 6) think that they will stay with their current provider for the next 12 months. This is the case for most of the sectors, except for air transport and fixed telephony, where 3 consumers out of 4 think that they will stay with their current provider for the next 12 months. Even in markets where there is more than one provider, changing from one supplier to another is often difficult. The only exceptions are in fixed telephony, mobile telephony, retail banking, insurance and especially air transport services. In these cases, at least 2 EU consumers out of 3 who can choose between at least 2 providers state that is easy to change. Buying services from another country is only considered possible and even of potential interest in the case of air transport (4 consumers out 5), and, to a lesser extent, retail banking and mobile telephone services (48% and 41% respectively). A very large majority of users prefer to deal with a national supplier (more than 90% of consumers). This is less the case for air transport services (60%).

8.

Pricing

PRIORITY ACTIONS SHOULD FOCUS ON PRICING

As mentioned earlier, pricing issues are major factors determining consumer satisfaction for most of the services surveyed. Among these components, price levels are identified as the main issue in all the services. Consumers tend to think they pay too much for services of general interest. In addition, EU25 consumers tend to think that suppliers do not offer enough by way of special tariffs for specific target groups or specific usage. Actions designed to increase consumer satisfaction should therefore focus on these price components for maximum effect. Image Consumer satisfaction with urban transport, extra-urban transport and postal services is mostly influenced by the image their supplier has on the market. More specifically, in these sectors, elements such as the reputation of the supplier, its willingness to put the client first and its flexibility are of great importance for consumers.

FINAL REPORT CONSUMER SATISFACTION DG SANCO

| 17

____________________________________________________________________________________________________________

Quality Quality of service is the element that has the least influence on overall consumer satisfaction and yet people are most satisfied with this element when evaluating SGIs. This statement tends to prove that consumers take quality of service for granted. Consequently, long-term actions are appropriate in this area. Making the consumers aware of the quality of the services they are using could improve satisfaction with these services in the long term. Urban and extra-urban transport Urban and extra-urban transport are clearly the services with which consumers are least satisfied. Moreover, this observation applies to almost all the countries. Actions to improve satisfaction could target the maintenance of transport networks and vehicles, reliability of the services (frequency of service, punctuality, etc.) and the way the problems and questions raised by consumers are handled.

9.

RECOMMENDATIONS

Overall, the questionnaire and design of this survey appears to be robust. The questionnaire survey and the underlying model and methodology could be used without major changes for future surveys. One hypothesis that emerges from the results of this survey is that consumer satisfaction in certain services e.g. air transport, retail banking - is affected by the extent to which people are familiar with the internet (since those who are may benefit more from certain services). In order to test this hypothesis, a question on this topic might be included in future surveys. With the current survey approach, an analysis of complaints is difficult to carry out because of the low number of complaints made by the respondents. Since the option of much larger sample sizes is likely to be rejected due to cost implications, this issue may have to be dealt with in another way, e.g. by asking other types of related questions for which the response rates are likely to be higher. Further investigation would need to be done to see whether there is a link between consumer satisfaction and the extent to which a sector has been liberalised. An interesting exercise would be to examine whether any form of statistical clustering of countries and/or services makes sense. This would allow the Commission to answer the question as to where particular consumers have similar attitudes across sectors and countries. It might even lead to the definition of a typology for EU consumers. This could help in predicting consumer behaviour towards changes in market structures and service offers. A final thought is that the way the survey and model has been constructed allows for its extension into other services and also the retailing of consumer goods. If the Commission were to consider the inclusion of new service categories in the future, a small preliminary study and small pilot survey could be undertaken in order to design and test the survey questions that should be included in the questionnaire.

18 | FINAL REPORT CONSUMER SATISFACTION DG SANCO

____________________________________________________________________________________________________________

A. GENERAL INTRODUCTION 1. Context and objectives of the consumer satisfaction survey

Services of General Interest (SGIs) are of great importance in achieving the fundamental objectives of the European Union. The provision of high quality, accessible and affordable services of general interest meeting the needs of consumers is essential for the social and economic inclusion of all EU citizens and the territorial integrity of the EU. Therefore, understanding EU citizens perceptions of SGIs and the problems they have experienced with SGIs through various studies and opinion surveys is one of the priorities of the Commission and in particular of the Directorate-General Health and Consumer Protection (DG SANCO). Indeed, DG SANCO has been building up an 'evidence base' regarding services of general interest in order to improve policymaking and integrate consumer concerns into other EU policies. In addition, data facilitates the monitoring and evaluation of EU and national policies. For this purpose, DG SANCO has been carrying out regular quantitative surveys (e.g. Eurobarometers) and qualitative studies (e.g. focus groups) to measure consumer satisfaction with services of general interest. Qualitative studies are organised in connection with issues raised in Eurobarometers in order to have a better understanding of consumers views and cross-check Eurobarometer results. Data related to services of general interest are also made available in the publication entitled Consumers in Europe Facts and Figures. A special edition of Consumers in Europe - Facts and Figures, devoted to Services of General Interest, is to be published in 2007. In 2003, DG SANCO launched an open call for tender on the Development of consumer satisfaction indicators; pilot survey on consumer satisfaction. Together with Deloitte, INRA won this call. The assignment had three objectives: o To develop a methodology for the construction of consumer satisfaction indicators in the European Union. This methodology had to be practical and have a sound scientific basis, reflecting recent insights into consumer satisfaction and its measurement; o To develop and carry out a pilot survey based on the proposed methodology. The purpose of this pilot survey was to test the methodology and its underlying modelling and to propose a preliminary set of indicators; o To analyse the outcomes of the pilot survey in order to indicate possible adaptations to the methodology developed in the first stage. INRA and Deloitte developed an appropriate survey framework (e.g. questionnaires, population and sampling, survey methods, etc.) and proposed statistical methods to be used and methods for calculating and presenting the consumer satisfaction indicators.

FINAL REPORT CONSUMER SATISFACTION DG SANCO

| 19

____________________________________________________________________________________________________________

Another open call for tender was launched in 2004 to prepare, implement and analyse the consumer satisfaction survey using the methodology developed during the first assignment. INRA (now Ipsos Belgium), which had become part of the Ipsos Group, won the contract. In order to gather the most effective resources for this contract, Ipsos decided to continue its partnership with Deloitte, which acted as policy analysts and advisers and selected two independent experts to work on the pilot survey: Dominique Vanmarsenille and Professor Vanhoof (Hasselt University). The survey outcomes should serve as a tool to support EU consumer policy-making in SGIs. The satisfaction indicators that were developed are sector-based and should enable DG SANCO to: o o o o o understand how consumers perceive certain SGIs, what their main requirements are and how key service areas meet their expectations; benchmark performance amongst EU member states within particular SGIs; benchmark the performance of SGIs within a specific country or at the EU level; identify priorities for improvement - in other words the areas where improvements will produce the greatest gain in consumer satisfaction; set goals for improvement and monitor progress.

The indicators resulting from the survey ought to become a reference tool for EU policymakers in SGIs, which would allow them to gauge both overall consumer satisfaction levels and to measure the specific elements that determine satisfaction levels in individual areas. The consumer satisfaction indicators proposed should be able to help EU policymakers define and review EU policy in these areas. The indicators provide signals of whether SGIs are functioning properly and whether corrective regulatory or enforcement measures should be considered. The scope of the project focuses on 11 services of general interest across all 25 EU members: gas, water, electricity, postal services, mobile telephone, fixed telephone, urban transport (within towns/cities: tram, bus, underground, rail/RER), extra urban transport (between towns/cities: rail, bus), air transport, retail banking and insurance.

20 | FINAL REPORT CONSUMER SATISFACTION DG SANCO

____________________________________________________________________________________________________________

2. Methodology

Ipsos INRA applied a robust and homogeneous methodology across all the countries in order to guarantee a complete benchmark in terms of results: 500 interviews per sector and per country (250 for sectors of low levels of usage); Face to face data collection, at home, with interviews lasting an average of 55 minutes; Representative random sample of users for each sector in the past 12 months, via sampling procedures based on a stratification of each country according to region and urbanisation degree, gender, age and occupation.

The questionnaire collects observed dimensions (i.e. easily observable criteria for consumers) among users and drivers of consumer satisfaction, including common and specific items adapted for each sector: Overall satisfaction with the service: overall satisfaction with the service extent to which the requirements of consumers are met; Price: price level transparency (i.e. tariffs and invoices are clear and easy to understand) payment process (i.e. it is easy to pay ones supplier invoices) affordability (i.e. the services cost more than one can afford to pay) accuracy (i.e. the suppliers invoices are correct) commercial offer (i.e. suppliers have attractive special tariffs for specific target groups) profitability (i.e. the supplier shares their profit with consumers) overall price; Quality: reliability of the service provided service safety offer relevance (i.e. the service meets consumers needs) information (i.e. suppliers regularly inform their customers about their services and special tariffs) technical support (i.e. the supplier offers high quality technical assistance) handling questions and problems (i.e. suppliers react promptly and appropriately) availability of the supplier professional, helpful and friendly staff confidentiality (i.e. the supplier respects customers privacy/discretion when dealing with delicate problems) investment and maintenance of infrastructures points of sales order ease (how easy it is to make an order or a booking) transport comfort transport network overall quality; Image: suppliers reputation relationship between supplier and customers uniqueness of the suppliers image familiarity of customers with their suppliers services popularity of the supplier flexibility of the supplier suppliers customer mindedness (i.e. the supplier puts always customers first) state of the art (i.e. supplier is technologically innovative) environment (i.e. supplier respects the environment) overall image; Market and personal factors: enough competition ability to move (change supplier) accessibility of the services cross-border purchasing national preference (i.e. a prefer for dealing with a national supplier);

FINAL REPORT CONSUMER SATISFACTION DG SANCO

| 21

____________________________________________________________________________________________________________

Commitment to the service (i.e. the consumer will still use his/her service supplier/change supplier/stop using the service); Negative experiences with the services and complaints: number of problems experienced with suppliers complaints (i.e. did the consumer communicate his/her problem) satisfaction with the way the problems were solved.

The individual rating of each consumer satisfaction item is based on a 1 to 10 scale which allows consumers to carry out a nuanced evaluation. Regarded by the community of satisfaction research experts as the most academic and commonly accepted scale, it is also the most consistent scale able to measure satisfaction across borders, across sectors and over time.

22 | FINAL REPORT CONSUMER SATISFACTION DG SANCO

____________________________________________________________________________________________________________

3. Satisfaction indicators

3.1. DEFINING CONSUMER SATISFACTION INDICATORS

In order to take into consideration the complexity and multifaceted nature of consumer satisfaction, the analysis presented in this report provides the reader with two groups of indicators measuring consumers satisfaction towards SGI sectors: A. Primary indicators, reporting direct consumer feedback on their satisfaction levels in each sector both at overall and component levels (i.e. for price, quality and image). B. Added value indicators, calculating a consumer satisfaction level that integrates consumers expectations for each component (i.e. expectations towards price, quality and image) with their satisfaction, helping to identify and prioritise action that needs to be taken (i.e. criteria raising high levels of expectation among consumers but showing current low levels of satisfaction).

A) PRIMARY INDICATORS

The first level of analysis aims to describe consumers feelings about services of general interest and about elements that constitute suppliers services as well as the problems encountered when using these services. This analysis is built in such a way as to allow meaningful comparisons (and aggregations) of how consumers feel: across sectors in one member state; in one sector across member states (EU25, EU15, NMS10); and (at a later stage) over time. For each sector and all elements measured in the questionnaire (see Section 2), we calculate two basic and complementary indicators that are commonly used in satisfaction research area: o Average levels of satisfaction: for each sector, people were asked to evaluate, on a scale from 1 (not satisfied at all) to 10 (fully satisfied), the extent to which they are satisfied with their supplier. On the basis of individual scores, average scores are calculated for each sector. Example: the average satisfaction score with sector x is 7.8 out of 10 Levels of satisfaction and dissatisfaction: the research experts community widely admits that the average satisfaction score (as described above) is necessary but requires a complementary approach that helps distinguish between satisfied, neutral and dissatisfied consumers. As stated in most satisfaction surveys in Europe and confirmed in this survey - the average value of satisfaction on a 10 point-scale is not the arithmetical average of 5 but is closer to 7. There is therefore an inherent bias in the use of 1-10 scales in satisfaction surveys. In order to correct this standard bias the research community generally uses the Top 3 Bottom 4 model that says: Consumers rating 1, 2, 3 or 4 are considered as dissatisfied Consumers rating 5, 6 or 7 are considered as neutral Consumers rating 8, 9 or 10 are considered as satisfied

FINAL REPORT CONSUMER SATISFACTION DG SANCO

| 23

____________________________________________________________________________________________________________

Based on this grouping rule, we can more easily measure the percentage of satisfied and dissatisfied consumers for each sector and each criterion. The graph below shows the two complementary indicators of satisfaction (average / satisfied-dissatisfied) from a typical distribution of individual scores. Typical distribution of satisfaction scores (1-10 scale)

6

Neutral

9

Satisfaction = 45%

10

Dissatisfaction =9%

Average Satisfaction = 7,7

In addition, other key indicators are provided in the analysis: o o Average numbers of consumer complaints. Example: On average, consumers have experienced 3 problems with their supplier in the last 12 months. Breakdown analysis by consumer demographic profile (age, gender, occupation level etc.). Example: 60% of men and 40% of women are satisfied with sector x.

B) ADDED VALUE INDICATORS

While the main objective of the first level of analysis was to measure key satisfaction indicators and give an overall picture of a given service sector/country, the second level intends to make use of more advanced statistical methods in order determine the interaction of these key indicators so as to explain consumers overall satisfaction.

24 | FINAL REPORT CONSUMER SATISFACTION DG SANCO

____________________________________________________________________________________________________________

The results of this advanced analysis will provide useful information for the Commission and DG SANCO in particular, which could be used to determine the areas of priority and the appropriate actions to be taken in order to improve satisfaction in a given sector/country. It will also be a useful tool for monitoring consumer satisfaction by country/sector over time and for evaluating the impact of a policy on consumer satisfaction. In the rest of the section we set out details of the two statistical tools that were used: the satisfaction model and the two-dimensional analysis. B1) Satisfaction model A statistical model has been specifically built for DG SANCO and was previously validated during the pilot stage. This model offers a range of possible added-value analysis and allows especially to explain the contribution of observed variables to overall satisfaction, allowing us to determine the levels of consumers expectations. Contribution of observed variables to overall satisfaction The satisfaction model uses two types of variables: Driving factors i.e. variables explaining satisfaction: (perceived) quality (perceived) price image Performance indicators: variables that are a consequence of satisfaction i.e. commitment complaints

The model helps explain the level of overall satisfaction observed for a given sector with the help of the above-mentioned variables. In other words, the model indicates the level of contribution made by each variable to overall satisfaction. This contribution is calculated through a regression analysis, which determines the weight of each variable. These weightings can take a value ranging from 0 to 1. The more a weighting is close to 1, the more the variable is contributing to overall satisfaction, or, in other words, the higher consumers expectations are. For example, if the regression coefficients are the following: 0.4 (price), 0.35 (image) and 0.25 (quality). This means that price is the variable that contributes to satisfaction most, i.e. where consumers expectations are the highest. The model also indicates the variables that are a consequence of satisfaction and the contribution of overall satisfaction to these variables for a given sector. Here again, weightings are calculated in order to quantify the contribution of the overall satisfaction to the commitment and complaints level. The relationship between overall satisfaction and the above-mentioned variables provides useful information for policy-making.

FINAL REPORT CONSUMER SATISFACTION DG SANCO

| 25

____________________________________________________________________________________________________________

For example, lets suppose that, for a given sector, the level of satisfaction is low and that price is the variable that contributes most to this level of satisfaction. In addition, lets suppose that complaints are the main consequence of this low level of satisfaction. Policy-makers should then focus their attention on price as it contributes to dissatisfaction and consequently to complaints. The model can also be used to set and test further hypotheses and assess the potential impact of actions, as in the following hypothetical example: In the fixed phone sector within the EU25, an increase of 10% in consumer satisfaction regarding prices would improve the overall consumer satisfaction level to 33% Policymakers efforts could therefore be focused first on price transparency and information. B2) Two-dimensional analysis The two-dimensional analysis is one of the most common approaches to be carried out on consumer satisfaction data and helps in the presentation of the final results. The aim of this analysis is to summarise the opportunities for action (i.e. areas where the SGI does not perform so well and where actions to change the situation are needed in order to improve consumer satisfaction) and areas where no action is needed (i.e. areas where the SGI performs well and where no action is required), on a simple mapping system that takes into account: the score of each variable on a 10-point scale (satisfaction); the regression coefficient in other words consumers expectation levels - of the 3 drivers of satisfaction (quality, price, image). As mentioned before, these coefficients express the importance (contribution) of each of these 3 drivers in the overall satisfaction. The regression coefficient can have a value from 0 to 1. This mapping system is particularly useful in providing a visual representation of priority areas for improvement for the European Commission and DG SANCO to take into account. Example: lets suppose that we find regression coefficients of 0.40 for price, 0.25 for quality and 0.35 for image. This means that price accounts for 40% of the observed satisfaction; quality accounts for 25% of it and image 35%. In other words, price contributes most to overall satisfaction; this is the most important factor. This said, if price reaches a low satisfaction score, it therefore becomes a priority area of action for policy-makers to increase the overall satisfaction of the sector.

26 | FINAL REPORT CONSUMER SATISFACTION DG SANCO

____________________________________________________________________________________________________________

Four quadrants are formed: the upper left quadrant corresponds to a priority action i.e. situation where the items satisfaction scores are below average whereas consumers expectations for these variables are quite high (i.e. these variables contribute a large amount to overall satisfaction). Consumers are not very satisfied with the items falling into this quadrant whereas these are important items for them. This quadrant defines the policy areas where action will have the greatest effect on overall consumer satisfaction. the upper right quadrant corresponds to an ideal situation, i.e. an area where no action is needed. This is a situation where the items satisfaction scores are above average and consumer expectations are quite high for these variables. Consumers are very satisfied with the items falling into this quadrant. In addition, these contribute most to consumer satisfaction. This quadrant defines the policy areas where action will have the least effect on overall consumer satisfaction. the lower left quadrant corresponds to a low importance area i.e. a situation where the items satisfaction scores are below average and expectations are quite low for these variables. Attention should not be focused on these variables as they are secondary factors. This is not a priority for the moment. This quadrant defines the policy areas where action will have a small effect on overall consumer satisfaction. The lower right quadrant corresponds to a long-term action i.e. a situation where the items satisfaction scores are above average whereas expectations are quite low for these variables. Consumers are quite satisfied with the items falling into this quadrant but these items do not contribute much to the overall satisfaction. Although these are not priority areas, there may be an opportunity for raising consumers awareness about the importance of these items. This quadrant defines the policy areas where action could have a longer term effect on overall consumer satisfaction.

Example: For a given sector, we find the following: Satisfaction scores: 5.5 for price level (PRICE) and 7.9 for payment process (PRICE); 6.0 for points of sale (QUALITY) and 7.5 for staff professionalism (QUALITY); 7.25 for reputation (IMAGE) and 6.8 for customer mindedness (IMAGE) Regression coefficient: 0.4 for PRICE, 0.35 for IMAGE and 0.25 for QUALITY Average score: 6.83

FINAL REPORT CONSUMER SATISFACTION DG SANCO

| 27

____________________________________________________________________________________________________________

Expectations + Priority actions Price level (5.5) Customer mindedness (6.8) Ideal situation Payment process (7.9) Reputation (7.25)

Satisfaction +

Satisfaction -

Low importance area Points of sale (6.0)

Long-term actions Staff professionalism (7.5)

Expectations -

Price level and customer mindedness are two priority areas for the sector given as an example. These two items are of high importance to consumers (they make a considerable contribution to overall satisfaction) whereas they obtain low satisfaction scores (compared to the average). An action in these two areas would have the greatest effect on consumer satisfaction.

28 | FINAL REPORT CONSUMER SATISFACTION DG SANCO

____________________________________________________________________________________________________________

On the other hand, consumers are quite satisfied with payment process and reputation as these items obtained satisfaction scores above the average. These two items correspond to an ideal situation as they play an important role in consumer satisfaction. No action is required in these areas. Staff professionalism performs very well as the satisfaction score is above the average. For the moment, this item is of less importance (it does not contribute much to overall satisfaction). Communication in this area should raise consumer awareness of the importance of this item. Action taken in the area of point of sales would have little effect on consumer satisfaction as peoples expectations in this area are low.

3.2.

STRUCTURE OF THE FINAL REPORT

The first part will present a descriptive analysis of the survey results for each sector - at the EU and country level for each of the main topics assessed by the respondents. The results of the survey will be analysed by socio-economic group. Advanced analysis based on the satisfaction model will complete this descriptive part. In the second part we use graphs to show the percentage of consumers who are satisfied or dissatisfied with the eleven SGIs (services of general interest) by country and for the EU25 as a whole. The last part of this report will highlight the main findings of the survey. We will also conclude with recommendations for future improvements and research.

FINAL REPORT CONSUMER SATISFACTION DG SANCO

| 29

____________________________________________________________________________________________________________

B. DESCRIPTIVE ANALYSIS OF THE SURVEY RESULTS 1. Electricity supply

1.1. OVERALL RESULTS

EU consumers are fairly satisfied with electricity supply: the average score at EU25 level is 7.6 (on a scale of 1 to 10). Compared to the EU15, there are relatively more satisfied consumers (those giving a score from 8 to 10) in the new member states (62%) but also relatively more dissatisfied consumers (7% of respondents gave a score from 1 to 4). This result suggests that consumers from the new member states pay more attention to this service than EU15 consumers but it could also point to higher differences in quality and/or perception levels within these countries. The percentages of satisfied and dissatisfied consumers are displayed in the following graph:

EL. 1 Electricity supply: proportion of satisfied vs. dissatisfied consumers - percentages (2006)

Overall, to what extent are you satisfied with your electricity supplier?

% Satisfied vs. Dissatisfied

EU25

57.6

5.3

Satisfied Dissatisfied EU15 56.5 4.9

NMS10

62.3

6.7

20

40

60

80

100

30 | FINAL REPORT CONSUMER SATISFACTION DG SANCO

____________________________________________________________________________________________________________

1.2.

DIFFERENCES BETWEEN EU MEMBER STATES

The following graph shows the percentage of satisfied and dissatisfied consumers per country:

EL. 2 Electricity supply: proportion of satisfied vs. dissatisfied consumers by country - percentages (2006)

Overall, to what extent are you satisfied with your electricity supplier? Satisfied vs. Dissatisfied (% by country)

LT AT DK SI IE LV DE HU EE LU CY BE FI NMS10 FR PL CZ UK EU25 EU15 SE SK EL MT ES NL PT IT 0

81.6 79.5 78.9 73.5 73.2 73.1 72.7 72.6 71.8 71.5 70.1 65.2 63.2 62.3 60.4 59.9 58.3 58.2 57.6 56.5 53.2 52.8 48.1 47 42.7 41.1 36.4 34.8 20 8.3 40 60 4 6.4 12.8 9.5 17.4 3.1 6.4 9.2 6.6 5.3 4.9 11.5 8.5 2.1 6.1 6.7 2.5 3.5 3.2 2.4 8.6 4.4 2.1 6.4

1.6 2 2.2

Satisfied Dissatisfied

80

100

At country level, the proportion of satisfied consumers ranges from 35 % (Italy) to 82 % (Lithuania).

FINAL REPORT CONSUMER SATISFACTION DG SANCO

| 31

____________________________________________________________________________________________________________

Based on the proportion of satisfied consumers, EU countries can be divided into two groups: 1. The first group includes countries where consumers are more satisfied than the EU25 on average. In descending order, these are: Lithuania, Austria, Denmark, Slovenia, Ireland, Latvia, Germany, Hungary, Estonia, Luxembourg, Cyprus, Belgium and Finland. Most of the new member states (6 out of the 10) are in this first group. 2. The second group contains countries where consumers are less satisfied than the EU25 on average: Slovakia, Greece, Malta, Spain, the Netherlands, Portugal and Italy. In Portugal and Italy less than 40% of consumers say they are satisfied with their electricity supply. The survey results also show that the proportion of dissatisfied consumers in Malta, Portugal and Sweden is higher than 10% (it is even 17 % in Malta). At the other extreme fewer than 3% of consumers say they are dissatisfied in Lithuania, Austria, Belgium, Luxembourg, Denmark, Germany and Slovenia.

32 | FINAL REPORT CONSUMER SATISFACTION DG SANCO

____________________________________________________________________________________________________________

1.3.

DIFFERENCES BY SOCIO-ECONOMIC GROUP

The following graph displays the proportion of satisfied and dissatisfied consumers for different socio-economic groups:

EL. 3 Electricity supply: proportion of satisfied vs. dissatisfied consumers by socio-economic category percentage (2006)

Overall, to what extent are you satisfied with your electricity supplier?

% by socio-demographics

Gender

Men

57.6

Women

57.6

5.5

18-34

57.3

5.5

Age

35-54

56

6.4

55+

59.7

3.9

Up to 15 years

54.6

5.7

Education

16-19 years

58.3

5.5

20 years +

59

4.6

Still studying

56.8

4.5

Self-employed

52.5

6.9

Managers

62

3.7

Other white collars

56.7

5.2

Satisfied Dissatisfied

Occupation

Blue collars

60

4.6

Students

55.3

5.4

House-persons

50.5

6.6

Unemployed

58.8

8.7

Retired

60.9

3.9

FINAL REPORT CONSUMER SATISFACTION DG SANCO

| 33

____________________________________________________________________________________________________________

In terms of occupation, the graph shows the following results: 1. Managers (62%), retired consumers (61%) and blue collar workers (60%) tend to be more satisfied than those belonging to other professional categories while the selfemployed and house-persons are the least satisfied; 2. The unemployed tend to be more dissatisfied than the others with respect to electricity supply. In terms of age, people over 55 years old are more satisfied (60%) than the other categories and than the EU25 on average. Lastly, consumers who completed their secondary school studies tend to be more satisfied than those who dropped out of school early.

1.4.

OTHER KEY OBSERVATIONS ARISING FROM THE SURVEY

A) OVERALL IMAGE

In Austria, Cyprus, Luxembourg and Ireland, more than 7 consumers out of 10 consider their electricity provider to have a positive image overall (as against an EU25 average of 51%). Only 28% of consumers in the Netherlands, 31% in Portugal and Malta, 33% in Italy and 35% in Spain and Sweden consider their electricity provider to have a positive image overall.

B) OVERALL QUALITY

For the majority of EU25 consumers (57%), their electricity provider offers a quality service. Austrians are the most satisfied consumers as far as the overall quality of electricity distribution is concerned (80% of consumers say they are satisfied).

C) OVERALL PRICE

Only 35% of consumers say that their providers prices are fair given the services provided. Luxembourg, Slovenia, Finland and Germany are the only countries where an absolute majority (from 50% to 52%) agrees with this statement.

D) COMMITMENT

In countries where consumers have the choice between electricity providers, i.e. in Austria, Belgium, the Czech Republic, Denmark, Spain, Germany, Finland, the Netherlands, Sweden and the UK, the vast majority of consumers have no intention of changing supplier in the short run (within a year). The only exception is Belgium, where only 46% say they are committed to their supplier.

34 | FINAL REPORT CONSUMER SATISFACTION DG SANCO

____________________________________________________________________________________________________________

E) MARKET AND PERSONAL FACTORS

More than 8 consumers out of 10 prefer to deal with a national electricity provider. The same proportion think that the services of these providers are available for everybody and available everywhere. In liberalised markets, almost two thirds of consumers think that there is enough competition. In the UK and the Netherlands, this idea is shared by 84% and 77% of users respectively, whereas only 28% of Czech consumers think so. However, when asked about changing their provider, consumers are less convinced that this would be easy to do: only 54% believe that there are no barriers. The Czechs, Danes, Austrians and Belgians are the least convinced. 18% of Czechs, 22% of Danes, 35% of Austrians and 36% of Belgians believe that it is easy to change from one supplier to another. Finally, only 23% of EU consumers think that it is possible to buy electricity from an electricity supplier outside their country. A majority (41%) of them could not give an answer.

1.5.

ADVANCED ANALYSES

A) CRITERIA THAT CONTRIBUTE TO CONSUMERS OVERALL SATISFACTION

As mentioned at the beginning of this report, before taking any action to improve consumers overall satisfaction, it is important to determine the criteria or elements that influence and explain consumers overall satisfaction. These criteria are quality, pricing and image. This contribution to consumers overall satisfaction is calculated through a regression analysis which determines the relative weighting of quality, pricing and image in overall satisfaction. The weighting of each of these criteria (regression coefficient1) calculated for the electricity supply service is shown in the following table: Regression coefficients Quality Image Pricing 0.302 0.314 0.493

These weightings can take a value ranging from 0 to 1, with 0 meaning that the criteria has no influence on overall satisfaction and 1 meaning that it contributes fully to overall satisfaction. FINAL REPORT CONSUMER SATISFACTION DG SANCO

| 35

____________________________________________________________________________________________________________

The regression coefficients show that all three factors are important. However, pricing has the biggest impact on satisfaction (i.e. consumers expectations as to price are higher than for quality and image). This result can be partially explained by the fact that in the electricity market the price elasticity of demand is low (an increase in the electricity price level causes a less than proportional decrease in domestic demand). Another part of the explanation is probably that, in a mature market with few differentiated products, the main (or remaining) factor that influences consumer satisfaction and choice of supplier is price all other factors are considered to be good enough. In other words, efforts to improve consumers overall satisfaction with the electricity supply service need to be focused on pricing issues to a large extent and then on image and quality.

B) OPPORTUNITIES FOR ACTION

In order to define precise and concrete actions to improve consumers satisfaction with the electricity supply service, another advanced analysis needs to be performed: the twodimensional analysis. The aim is to determine: the areas where the SGI does not perform well and where actions to change the situation is needed in order to improve consumers satisfaction; the areas where the SGI performs well and where no action is needed.

This is done by mean of a diagram taking into account the following information: The average satisfaction score given by consumers to each criterion related to quality, pricing and image (marked as Satisfaction on the X-axis of the map) The weighting or contribution of each criterion (quality, pricing and image) to consumers satisfaction - this weighting represents the extent to which each criterion is important to consumers (marked as Importance on the Y-axis of the map).

The diagram on the following page shows the areas where priority actions are needed in order to improve consumers satisfaction with the electricity supply service.

36 | FINAL REPORT CONSUMER SATISFACTION DG SANCO

____________________________________________________________________________________________________________

EL. 4

Two-dimensional analysis - Electricity Importance + Priority actions Transparency (7.05) Overall price (6.56) Commercial offer (6.41) Price level (5.81) Environmentally friendly actions (7.22) Familiarity (7.15) Ease (7.07) Customer service mentality (6.86) Uniqueness (6.74) Ideal situation Payment process (7.92) Accuracy (7.37) Popularity (7.75) State of the art technology (7.49) Overall image(7.43) Relationship (7.38 Reputation (7.27)

Satisfaction +

Satisfaction -

Low importance area Points of sale (6.64) Information (6.56)

Long term actions Safety (8.11) Reliability( 7.96) Offer relevance (7.89) Overall quality (7.71) Confidentiality (7.69) Order ease (7.58) Staff professionalism (7.55) Infrastructure (7.53) Technical support (7.34) Availability (7.29) Questions/problem handling (7.29)

Importance -

FINAL REPORT CONSUMER SATISFACTION DG SANCO

| 37

____________________________________________________________________________________________________________

OVERALL OBSERVATIONS In the previous section, the diagram shows that perceived price is the element that has the greatest influence on consumer satisfaction with their electricity supply service. In addition, consumers are not fully satisfied with price issues. Therefore, it can be assumed that most of the opportunities for improvement are related to improving consumers perception of price and that these improvements would consequently influence overall consumers satisfaction with this service. Given the weighting of the pricing criteria (near to 0.5), any action that would lead to an increase of 10% of consumers who are satisfied with the price of their electricity supply service would lead to an increase of 5% in overall consumers satisfaction with this service. SPECIFIC AREAS OF INTEREST PRICING The elements of pricing that consumers are particularly dissatisfied with and that need special attention are: the price level charged by suppliers for electricity distribution services; commercial offers i.e. there are not enough attractive special tariffs for specific groups of consumers; the transparency of tariffs.