Professional Documents

Culture Documents

Question Bank Babi

Uploaded by

amishk007Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Question Bank Babi

Uploaded by

amishk007Copyright:

Available Formats

QUESTION BANK- BABI 1. Briefly describe the structure of the Indian Banking Sector. 2.

Write a note on: - Commercial Banks - Co-operative Banks - RRBs - Exchange Banks - Development Banks 3. What is the difference between Commercial & Co-operative Banks? 4. What are the Problems faced by Regional Rural Banks & suggest measures for improvement. 5. What are the defects in the working of Exchange Banks in India & suggest measures for improvement. 6. Write a note on: - IFCI - NABARD - EXIM Bank - UTI - SFC - IRDA - Committee for Banking Sector Reforms/ Narsimham Committee 1998. 7. Describe the various sources of funds for a bank 8. Describe the various deposits of a bank 9. What are the principles on which a bank lends money? 10. Write a note on the types of advances of a bank 11. What are Bills of Exchange & Bill discounting? What are the different types of bills? 12. What is a letter of credit? Write a note in the process of issue of a letter of credit? Describe the types of Letters of Credit. 13. Write a note on the origin & role of RBI. 14. Describe in brief the various functions of the RBI. 15. Describe the agency functions of banks. 16. What is Merchant Banking? What are the functions of a Merchant Banks? 17. What is Venture Capital? What are the Stages in financing Venture Capital? 18. Explain the Innovations in the Banking Sector. 19. What is E banking? Explain its advantages, disadvantages & importance. 20. Describe the E Banking services 21. What is E Commerce? Explain its advantages, disadvantages & importance. 22. What is a NBFC? What is the difference between a Bank & a NBFC? 23. How are NBFCs classified? Explain in brief. 24. Explain the regulations that a NBFC is subjected to. 25. What is Insurance? Bring out the relationship between risk & insurance 26. What are the functions of insurance? What is its significance to business? 27. What are the opportunities & challenges in the Insurance sector?

28. What is General Insurance? Explain in detail the types of General Insurance. 29. What is re-insurance? What are its characteristics? 30. What is Bancassurance? What are the challenges for Bancassurance? 31. What is Nomination Assignment & Surrender Value? 32. What is a claim? Explain the two types of Claims. 33. Explain the problems & reforms suggested by the Narsimham Committee 1991. 34. What is Life Insurance? Case Study on Types of Life Insurance. [ As per the case identify if a particular type of insurance is suitable to a particular person] 35. Explain in detail the Principles of Insurance with examples. [ As per the case, identify which principle is applicable]

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Demo - Graphy - of - THDDocument3 pagesDemo - Graphy - of - THDAmish KokateNo ratings yet

- Jaiib - Paper IDocument2 pagesJaiib - Paper IkirthikasingaramNo ratings yet

- 11 - Indian Bra Nds Support The L - G - B - T CommuniDocument15 pages11 - Indian Bra Nds Support The L - G - B - T Communiamishk007No ratings yet

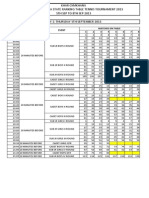

- T e N N I SjkasnjcnkjancDocument13 pagesT e N N I Sjkasnjcnkjancamishk007No ratings yet

- T e N N I SjkasnjcnkjancDocument13 pagesT e N N I Sjkasnjcnkjancamishk007No ratings yet

- Name: - Age: - Organization (Optional) : - PostDocument5 pagesName: - Age: - Organization (Optional) : - Postamishk007No ratings yet

- Initiatives Are Being Taken Which Aimed at Capitalization ofDocument1 pageInitiatives Are Being Taken Which Aimed at Capitalization ofamishk007No ratings yet

- History 2013 5thStateRanking Schedule FIXTUREDocument4 pagesHistory 2013 5thStateRanking Schedule FIXTUREAmish KokateNo ratings yet

- Read MeDocument1 pageRead MeLucas BocchiNo ratings yet

- Read MeDocument1 pageRead MeLucas BocchiNo ratings yet

- AMU PorbprojectDocument3 pagesAMU Porbprojectamishk007No ratings yet

- 5 Mahesh PPDocument6 pages5 Mahesh PPTan Aik Boon KeithNo ratings yet

- "Stress Management": Saab Marfin MbaDocument134 pages"Stress Management": Saab Marfin MbaAyaz MumtazNo ratings yet

- Service Manual For The Dell lAPTOP Dell ™ Inspiron ™ N5110Document90 pagesService Manual For The Dell lAPTOP Dell ™ Inspiron ™ N5110amishk007No ratings yet

- Jai Hind College ScheduleDocument1 pageJai Hind College Scheduleamishk007No ratings yet

- Student Respose Sheet For Icsi Executive StudentsDocument2 pagesStudent Respose Sheet For Icsi Executive Studentsamishk007No ratings yet

- Scoresheet MEN Table TennisDocument1 pageScoresheet MEN Table Tennisamishk007No ratings yet

- Student Respose Sheet For Icsi Executive StudentsDocument2 pagesStudent Respose Sheet For Icsi Executive Studentsamishk007No ratings yet

- Jai Hind College ScheduleDocument1 pageJai Hind College Scheduleamishk007No ratings yet

- Student Respose Sheet For Icsi Executive StudentsDocument2 pagesStudent Respose Sheet For Icsi Executive Studentsamishk007No ratings yet

- RBI Assistants Exam Model Question PapersDocument40 pagesRBI Assistants Exam Model Question PapersSarath ChandraNo ratings yet

- PhyDocument8 pagesPhyamishk007No ratings yet

- ReasoningDocument35 pagesReasoningSree RajNo ratings yet

- Student Respose Sheet For Icsi Executive StudentsDocument2 pagesStudent Respose Sheet For Icsi Executive Studentsamishk007No ratings yet

- Student Respose Sheet For Icsi Executive StudentsDocument2 pagesStudent Respose Sheet For Icsi Executive Studentsamishk007No ratings yet

- ReasoningDocument35 pagesReasoningSree RajNo ratings yet

- Basic InformationDocument1 pageBasic Informationamishk007No ratings yet

- Fixtures For A Table Tennis TournamentDocument2 pagesFixtures For A Table Tennis Tournamentamishk007No ratings yet

- Basic InformationDocument1 pageBasic Informationamishk007No ratings yet