Professional Documents

Culture Documents

LLS-Chapter 3: Operating Decisions and The Income Statement

LLS-Chapter 3: Operating Decisions and The Income Statement

Uploaded by

choivickyOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

LLS-Chapter 3: Operating Decisions and The Income Statement

LLS-Chapter 3: Operating Decisions and The Income Statement

Uploaded by

choivickyCopyright:

Available Formats

LLS- Chapter 3: Operating Decisions and the Income Statement

Vicky Choi

Buad280(#14517)

Professor Ogneva

9/5/2012

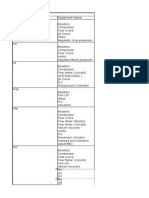

E3-13*

Traveling Gourment, Inc. (March)

T Accounts:

Assets

Cash

beg. 0

a. 80,000

c. 50,000

e. 2,600

f. 11,900

b. 72,000

d. 10,830

h. 363

i. 6,280

j. 600

k. 70,000

bal. 15,573

Accounts Receivable(A/R)

beg. 0

a. 2,000

e. 1,600

Supplies

beg. 0

a. 1,200

Equipment

beg. 0

a. 5,300

a. 13,000

k. 50,000

Building

b. 360,000

k. 20,000

bal. 3,600

bal. 1,200

bal. 68,300

bal. 380,000

Liabilities

Accounts Payable(A/P)

beg. 0

g. 420

Notes Payable

beg. 0

c. 50,000

bal. 420

Stockholder's Equity

Contributed Capital/Common Stock

beg. 0

a. 101,500

bal. 101,500

Mortgage Payable

beg. 0

b. 288,000

bal. 50,000

bal. 288,000

Retained Earnings

beg. 0

j. 600

bal. 600

Revenues

Food Sales Revenue

beg. 0

f. 11,900

Catering Sales Revenue

beg. 0

e. 4,200

bal. 11,900

bal. 4,200

Expenses

Supplies Expense

beg. 0

d. 10,830

Utilities Expense

beg. 0

g. 420

Wages Expense

beg. 0

i. 6,280

Fuel Expense

beg. 0

h. 363

bal. 10,830

bal. 420

bal. 6,280

bal. 363

Notes:

Accounting Equation is Balanced

A = L+ SE

437,527= 338,420 + 99,107

Yellow=

Cyan=

Normal Debit Balance (Assets, Expenses)

Normal Credit Balance (Liabilities, Stockholder's Equity, Revenues)

You might also like

- The Mechanics of Securitization: A Practical Guide to Structuring and Closing Asset-Backed Security TransactionsFrom EverandThe Mechanics of Securitization: A Practical Guide to Structuring and Closing Asset-Backed Security TransactionsNo ratings yet

- Fianl AccountsDocument10 pagesFianl AccountsVikram NaniNo ratings yet

- Case - Polar SportsDocument12 pagesCase - Polar SportsSagar SrivastavaNo ratings yet

- 3rd AGM AgendaDocument12 pages3rd AGM Agendapuchongputeri12No ratings yet

- Polar Sports, Inc SpreadsheetDocument19 pagesPolar Sports, Inc Spreadsheetjordanstack100% (3)

- Harmonization and Standardization of Bond Market Infrastructures in ASEAN+3: ASEAN+3 Bond Market Forum Sub-Forum 2 Phase 3 ReportFrom EverandHarmonization and Standardization of Bond Market Infrastructures in ASEAN+3: ASEAN+3 Bond Market Forum Sub-Forum 2 Phase 3 ReportNo ratings yet

- Answers S3T1P1Document7 pagesAnswers S3T1P1mananleo88No ratings yet

- Financial Accounting - Paper 1 SolutionsDocument10 pagesFinancial Accounting - Paper 1 Solutionsahmad.khalif9999No ratings yet

- Project Report For DairyDocument20 pagesProject Report For DairyKaushik KansaraNo ratings yet

- KlikBCA Individual JULI 2013Document2 pagesKlikBCA Individual JULI 2013Joshua SentosaNo ratings yet

- Work Sample ccl3 Budget 2011-12Document1 pageWork Sample ccl3 Budget 2011-12api-267444521No ratings yet

- Tools of Financial Analysis & PlanningDocument68 pagesTools of Financial Analysis & Planninganon_672065362100% (1)

- ExcelDocument10 pagesExcelWaseem TajNo ratings yet

- FORM L 3 Balance Sheet - Mar11Document1 pageFORM L 3 Balance Sheet - Mar11Mukesh Kumar MukulNo ratings yet

- Bueno MarketingDocument27 pagesBueno MarketingPatrick WaltersNo ratings yet

- Venugopal Karwa 2007-08Document24 pagesVenugopal Karwa 2007-08Yash KarwaNo ratings yet

- Accounting Principle Kieso 8e - Ch04Document45 pagesAccounting Principle Kieso 8e - Ch04Sania M. JayantiNo ratings yet

- Solution: SAMPLE PAPER-3 (Solved) Accountancy Class - XIIDocument8 pagesSolution: SAMPLE PAPER-3 (Solved) Accountancy Class - XIIKumar GautamNo ratings yet

- (A) (B) (C) (D) (E) (F) (G) : Cacwo Fundamentals of AccountingDocument53 pages(A) (B) (C) (D) (E) (F) (G) : Cacwo Fundamentals of AccountingacademianotesNo ratings yet

- Formation & OperationDocument4 pagesFormation & OperationRudolf Christian Oliveras UgmaNo ratings yet

- HorngrenIMA14eSM ch07Document57 pagesHorngrenIMA14eSM ch07Aries Siringoringo50% (2)

- Bueno MarketingDocument31 pagesBueno MarketingEnges Formula100% (1)

- Jawaban PR Pertemuan 4Document30 pagesJawaban PR Pertemuan 4ninarizkitaNo ratings yet

- Investment: Details Subtotal TotalDocument2 pagesInvestment: Details Subtotal TotalRagunath SoundararajanNo ratings yet

- HorngrenIMA14eSM ch07Document57 pagesHorngrenIMA14eSM ch07manunited83100% (3)

- Polar Sports X Ls StudentDocument9 pagesPolar Sports X Ls StudentBilal Ahmed Shaikh0% (1)

- 08MBA14 May - June 2010Document3 pages08MBA14 May - June 2010nitte5768No ratings yet

- Cochin International Airport Limited: Annexure-IDocument2 pagesCochin International Airport Limited: Annexure-Ipravit08No ratings yet

- ACCT 1005 Worksheet 5 Suggested Solutions 2012Document10 pagesACCT 1005 Worksheet 5 Suggested Solutions 2012ChakShaniqueNo ratings yet

- IPC No 10-Rev 1 (Check)Document80 pagesIPC No 10-Rev 1 (Check)Nguyen Hoành QuảngNo ratings yet

- Sources of FundsDocument1 pageSources of FundsTarun KathiriyaNo ratings yet

- Aud PWDocument16 pagesAud PWJikaNo ratings yet

- Ratio Calculation in An Easiest WayDocument1 pageRatio Calculation in An Easiest WayrajdeeppawarNo ratings yet

- BCI Consulting SB 2010Document5 pagesBCI Consulting SB 2010rachel333No ratings yet

- Completing The Accounting CycleDocument33 pagesCompleting The Accounting CycleCharmaine Bernados BrucalNo ratings yet

- Baj Audit Account 1.0Document8 pagesBaj Audit Account 1.0vrlthaker6128No ratings yet

- Acchw 4Document1 pageAcchw 4Chan SoknaranNo ratings yet

- Balance Sheet of North Delhi Power Limited (2007-2011) : ParticularsDocument5 pagesBalance Sheet of North Delhi Power Limited (2007-2011) : ParticularsBhavika AroraNo ratings yet

- M/S Multimetals LTD., Kota: A Presentation ofDocument23 pagesM/S Multimetals LTD., Kota: A Presentation ofmanishbansalkotaNo ratings yet

- Accounting Project Level IVDocument80 pagesAccounting Project Level IVEdom50% (6)

- Chapter 3 SolutionsDocument100 pagesChapter 3 SolutionssevtenNo ratings yet

- Annual Investment Plan 2011: Account Object of Expenditures Code Appropriation ObligationDocument3 pagesAnnual Investment Plan 2011: Account Object of Expenditures Code Appropriation Obligationbunso2012No ratings yet

- Assignment Questions - Suggested Answers (E3-7, E3-10, E3-11, P3-4, P3-6) E3-7. (Dollars in Millions)Document10 pagesAssignment Questions - Suggested Answers (E3-7, E3-10, E3-11, P3-4, P3-6) E3-7. (Dollars in Millions)Ivy KwokNo ratings yet

- Financial Projection TemplateDocument88 pagesFinancial Projection TemplateChuks NwaGodNo ratings yet

- John Crane Dash BoardDocument44 pagesJohn Crane Dash BoardYogaditya ModukuriNo ratings yet

- Acc 566Document18 pagesAcc 566Happy MountainsNo ratings yet

- NotesDocument40 pagesNotesTicktactoe100% (1)

- Loyola College (Autonomous), Chennai - 600 034 Loyola College (Autonomous), Chennai - 600 034 Loyola College (Autonomous), Chennai - 600 034Document3 pagesLoyola College (Autonomous), Chennai - 600 034 Loyola College (Autonomous), Chennai - 600 034 Loyola College (Autonomous), Chennai - 600 034Mohan MuthusamyNo ratings yet

- Statement of Operations (Example) - Sample Corp: A B C D E F G H IDocument1 pageStatement of Operations (Example) - Sample Corp: A B C D E F G H Ishahood786No ratings yet

- Statement of Operations (Example) - Sample Corp: A B C D E F G H IDocument1 pageStatement of Operations (Example) - Sample Corp: A B C D E F G H IIrum AbdullahNo ratings yet

- Preparation of Accounting Statements: VA (18) JDDocument39 pagesPreparation of Accounting Statements: VA (18) JDpenguinpowerrrrNo ratings yet

- Annex HDocument45 pagesAnnex HImelda BugasNo ratings yet

- Tutorial ACW 162 Chapter 3Document13 pagesTutorial ACW 162 Chapter 3raye brahmNo ratings yet

- ACC121 SEM3 ExamplesDocument12 pagesACC121 SEM3 ExamplesTia1977No ratings yet

- Art 'N' Tex Balance Sheet As On 30Th June, 2008: 2008 2007 2008 2007 Capital Rupees Assets Fixed AssetsDocument9 pagesArt 'N' Tex Balance Sheet As On 30Th June, 2008: 2008 2007 2008 2007 Capital Rupees Assets Fixed AssetsSamad RehmanNo ratings yet

- Socio-Economic Aspect PAGES 70, 71, 72Document4 pagesSocio-Economic Aspect PAGES 70, 71, 72Rain SamuelNo ratings yet

- Wiley Practitioner's Guide to GAAS 2017: Covering all SASs, SSAEs, SSARSs, and InterpretationsFrom EverandWiley Practitioner's Guide to GAAS 2017: Covering all SASs, SSAEs, SSARSs, and InterpretationsNo ratings yet

- Wiley Practitioner's Guide to GAAS 2016: Covering all SASs, SSAEs, SSARSs, PCAOB Auditing Standards, and InterpretationsFrom EverandWiley Practitioner's Guide to GAAS 2016: Covering all SASs, SSAEs, SSARSs, PCAOB Auditing Standards, and InterpretationsNo ratings yet

- Unloved Bull Markets: Getting Rich the Easy Way by Riding Bull MarketsFrom EverandUnloved Bull Markets: Getting Rich the Easy Way by Riding Bull MarketsNo ratings yet

- Codification of Statements on Auditing Standards: Numbers 122 to 133, January 2018From EverandCodification of Statements on Auditing Standards: Numbers 122 to 133, January 2018No ratings yet