Professional Documents

Culture Documents

10 Forex Quotes IB. Sess 16

Uploaded by

Kapil PrabhuCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

10 Forex Quotes IB. Sess 16

Uploaded by

Kapil PrabhuCopyright:

Available Formats

International Business International Forex Quotations

Prof Bharat Nadkarni

International Business

Forex Market has its own unique style of quoting currency rates. In transactions, initially two parties agree to exchange two different currencies. This date of agreement is termed as contract date. The day on which actual transfer of two currencies takes place at a previously arranged price is called settlement or value date. Transactions in foreign exchange market are classified with respect to settlement dates. Transactions in foreign exchange markets are of three types: Spot, Forward and Swap. Spot Foreign Exchange Rate is defined as price of on currency quoted in terms of another currency for a transaction to be effected within two working days. (Ex. Indian buying perfumes for USD 100 @ Rs 45.56. Inquires in FE market and settles within two working days)

International Business

Forward Exchange Rate is defined as price of one currency quoted in terms of another currency for a transaction to be effected beyond two working days. (Ex. Indian buying a Boiler for USD 10,000 on 10th Feb. with settlement date of three months. The date of actual payment would be 10 + 2 + 3 months = 12th May.) Forward contracts are typically for whole number of months. i.e. 1,2,3,6,9,12. Banks also offer broken date or odd date contracts, say for 68 days. The difference between spot and forward rate is called a swap rate or swap points. The annualized percentage difference between spot and forward rate is called as forward premium (+) or forward discount (-). Forward premium indicates that foreign currency is worth more in the forward market. If its worth less, its forward discount.

Forward Premium / Discount = n-day forward rate spot rate X 365 X 100 spot rate n

International Business

Swap Exchange Contract is defined as simultaneous purchase and sale of identical amounts of a currency at different value dates. In most cases swap is a combination of a spot and a forward in the opposite direction. In few cases it would be a combination of two forward contracts of different value dates in opposite direction. (Ex. One bank enters into a contract with another bank to buy 1 million JY for USD in spot market and also simultaneously agrees with the same bank to sell 1 million JY for USD after 60 days. Exchange rates for both the transactions are agreed at the time of contract.) This is a swap deal. Most of the forward contracts are accompanied by an equivalent spot deal. Thus most of the forward contracts are actually part of a swap deal. Forward contracts without an accompanying spot deal are called as outright forward contracts. Usually, 70% of turnover in markets is spot, 25% in swaps and 5% in outright forward contracts.

International Business

Forex Quotation Indian corporate (customer) approaches a banker (trader) for a USD quote, which is given as : 46.0501 46.2051 Rs / $. 46.0501 is called Bid rate and 46.2051 is called Ask rate. The difference between bid-ask rate is called spread. It is margin to cover transactions cost and other costs. Vehicle Currency It is a common currency through which a trade is effected between two non-common traded currencies. For instance, if Indian Rupee is to be exchanged for Israeli sequel, then neither Indian or Israeli banks would have ready rate available. Then they would use Rupee-USD rate and Sequel-USD rate to compute effective rate between Rupee and Sequel. Since USD is the currency for routing the trade, it is called a Vehicle currency. Most common VCs are USD, Euro, Pound and Yen.

International Business

Illustration 1. Can$/US$ : 1.3333 1.63 Rs/US$ : 47.3104 47.3240 At what rate Indian importer will get the Canadian dollar? At what rate Indian exporter will get the Indian Rupees? Illustration 2. From the following rates, find out Rs/UAE Dirham relationship? Rs/US$ : 47.9710 / 48.0101 UAE DIR/US$ : 3.6701 / 3.6859 Illustration 3. From following quotes, what is Sing $ / STP rate? Rs 75/STP and Rs 26.52/Sing $.

International Business

Ans: Illustration 1. : (a) Rs 35.4949/Can $ (b) Rs 35.4040/Can $

Illustration 2. : Rs/UAE Dir : 13.0147 13.0814 Illustration 3. : Sing $ 2.8281 / STP

International Business

Quotations on Forward Markets There are outright forward contracts as well as swap contracts. Forward rates are quoted for different maturities such as one month, two months, three months, six months and one year. There are also broken date contracts to cater to client need. Forward quotations may be given either in outright manner or swap points. Outright rates indicate complete figures for buying and selling, as given in the table. (Rs / Euro quotation)

Buying Rate

Spot 1-month Forward 3-month Forward 6-month Forward 47.9525 47.9625 47.9750 48.0000

Selling Rate

47.9580 47.9700 47.9835 48.0090

Spread

55 points 75 points 85 points 90 points

International Business

If the forward rate is higher than the spot rate, the foreign currency is said to be at forward premium with respect to the domestic currency. This means foreign currency is likely to appreciate vis--vis domestic currency. Apart from the outright form, quotations can also be made with swap points. Number of points represents the difference between forward rate and spot rate. Since currencies are generally quoted in four digits after the decimal point, a point represents unit of currency.

Spot 1-month Forward 3-month Forward 6-month Forward 47.9525 / 80 100 / 120 225 / 255 475 / 510

International Business

Looking at the table trader can easily understand whether it is a premium or discount. If bid points are less than ask points, then it is premium, otherwise discount. Premium points are to be added to the spot quote and discount points to be subtracted.

You might also like

- Direct Quotations Can Be Converted Into Indirect Quotations and Vice VersaDocument6 pagesDirect Quotations Can Be Converted Into Indirect Quotations and Vice VersaLeo the BulldogNo ratings yet

- Foreign Exchange Market: Dr. Amit Kumar SinhaDocument67 pagesForeign Exchange Market: Dr. Amit Kumar SinhaAmit SinhaNo ratings yet

- CURRENCY DERIVATIVES MARKET OVERVIEWDocument39 pagesCURRENCY DERIVATIVES MARKET OVERVIEWNandita ShahNo ratings yet

- Exchange Rate Calculation Types Spot ForwardDocument6 pagesExchange Rate Calculation Types Spot ForwardRohit AggarwalNo ratings yet

- INTERNATIONAL FINANCIAL SYLLABUSDocument90 pagesINTERNATIONAL FINANCIAL SYLLABUSTarini MohantyNo ratings yet

- Lesson 2.1 Foreign Exchange MarketDocument19 pagesLesson 2.1 Foreign Exchange Marketashu1286No ratings yet

- Lecture 10-Foreign Exchange MarketDocument42 pagesLecture 10-Foreign Exchange MarketfarahNo ratings yet

- Foreign Exchange ManagementDocument6 pagesForeign Exchange ManagementkesavanaiduNo ratings yet

- Neelakshi Saini Assistant ProfessorDocument29 pagesNeelakshi Saini Assistant ProfessorPrasanjit BiswasNo ratings yet

- Foreign Exchange TranscationDocument7 pagesForeign Exchange TranscationBooth NathNo ratings yet

- Unit I: Foreign Exchange Market & TransactionsDocument31 pagesUnit I: Foreign Exchange Market & TransactionsAnkita DevnathNo ratings yet

- BCCM International Finance Module Provides Insight into Foreign Exchange MarketsDocument83 pagesBCCM International Finance Module Provides Insight into Foreign Exchange MarketsSingmay MoralNo ratings yet

- UntitledDocument15 pagesUntitledWi SilalahiNo ratings yet

- The meaning and factors of foreign exchange ratesDocument5 pagesThe meaning and factors of foreign exchange ratesRohini ManiNo ratings yet

- Foreign Exchange Markets: Prof Mahesh Kumar Amity Business SchoolDocument47 pagesForeign Exchange Markets: Prof Mahesh Kumar Amity Business SchoolasifanisNo ratings yet

- BFM Module A in Very BriefDocument15 pagesBFM Module A in Very BriefMOHAMED FAROOKNo ratings yet

- The Study On Foreign ExchangeDocument9 pagesThe Study On Foreign ExchangeRs KailashNo ratings yet

- Currency Futures NivDocument37 pagesCurrency Futures Nivpratibhashetty_87No ratings yet

- International Banking General Bank Management (Module-A)Document39 pagesInternational Banking General Bank Management (Module-A)Dhirendra Singh patwalNo ratings yet

- Currency Swap or FX Swap Introduction and Pricing GuideDocument6 pagesCurrency Swap or FX Swap Introduction and Pricing GuideNgoc Nguyen MinhNo ratings yet

- Unit 2Document15 pagesUnit 2Aryan RajNo ratings yet

- Currency Is Online: DerivativesDocument22 pagesCurrency Is Online: DerivativesSachin ShintreNo ratings yet

- Currency Derivative1Document47 pagesCurrency Derivative1IubianNo ratings yet

- (A& F) - IfM-Foreign Exchange MarketsDocument24 pages(A& F) - IfM-Foreign Exchange Marketsudayraju2007No ratings yet

- Forex For CAIIBDocument6 pagesForex For CAIIBkushalnadekarNo ratings yet

- Forex by NageshDocument44 pagesForex by NageshNagesh KumarNo ratings yet

- Forex MarketDocument102 pagesForex Marketbiker_ritesh100% (1)

- 3-Forward ExchangeDocument6 pages3-Forward Exchangeyaseenjaved466No ratings yet

- Foreign Exchange RateDocument3 pagesForeign Exchange RatesamchannuNo ratings yet

- Foreign Exchange MarketDocument29 pagesForeign Exchange MarketRavi SistaNo ratings yet

- Evolution and Future of ForexDocument44 pagesEvolution and Future of Forexsushant1903No ratings yet

- Foreign Exchange MarketDocument9 pagesForeign Exchange MarketMithila PatelNo ratings yet

- Understanding The Basics of ForexDocument2 pagesUnderstanding The Basics of ForexvasusantNo ratings yet

- Introduction to Currency Derivatives and HedgingDocument27 pagesIntroduction to Currency Derivatives and HedgingPriya SubramanianNo ratings yet

- INTERNATIONAL BANKING MANAGEMENTDocument39 pagesINTERNATIONAL BANKING MANAGEMENTaabha06021984No ratings yet

- Foreign Exchange Rates CalculationsDocument14 pagesForeign Exchange Rates Calculationsnenu_1000% (1)

- Foreign Exchange Market: Financial Markets and InstitutionsDocument12 pagesForeign Exchange Market: Financial Markets and Institutionsbiz19No ratings yet

- 17 Currency MarketDocument26 pages17 Currency MarketGarv JainNo ratings yet

- Kavita IbDocument19 pagesKavita IbKaranPatilNo ratings yet

- Trading Begins in The Asia-Pacific Region Followed by The Middle East, Europe, and AmericaDocument5 pagesTrading Begins in The Asia-Pacific Region Followed by The Middle East, Europe, and AmericaEzhilarasan AravendanNo ratings yet

- Foreign Exchange Markets GuideDocument28 pagesForeign Exchange Markets GuideAnshulGuptaNo ratings yet

- Exchange Rates and Forex BusinessDocument26 pagesExchange Rates and Forex BusinessJanakiraman SanthoshNo ratings yet

- Understand the Foreign Exchange Market in 40 CharactersDocument11 pagesUnderstand the Foreign Exchange Market in 40 CharactersRahul Kumar AwadeNo ratings yet

- Forward Contracts Are Agreements Between Two Parties To Exchange Two DesignatedDocument3 pagesForward Contracts Are Agreements Between Two Parties To Exchange Two Designatedరఘువీర్ సూర్యనారాయణNo ratings yet

- Role of RBI in FOREX MarketDocument14 pagesRole of RBI in FOREX Marketcoolboy60375% (8)

- Business Risk:: It Includes Strategic Risk, Macro Economic Risk, Competition Risk and Technological Innovation RiskDocument23 pagesBusiness Risk:: It Includes Strategic Risk, Macro Economic Risk, Competition Risk and Technological Innovation RiskAbhishek NandiNo ratings yet

- Foreign Exchange ManagementDocument2 pagesForeign Exchange ManagementobreroeldojohnNo ratings yet

- Forex Markets: International Finance - Group 3 Roll No-11, 16, 30, 45, 47, 58Document34 pagesForex Markets: International Finance - Group 3 Roll No-11, 16, 30, 45, 47, 58Pradyumna SwainNo ratings yet

- SM 9 PDFDocument20 pagesSM 9 PDFROHIT GULATINo ratings yet

- Foreign Exchange MarketsDocument25 pagesForeign Exchange MarketsHimansh SagarNo ratings yet

- Forex Hedging Project Summer Internship Training At: Stuti Jain, MBA (G) of Batch 2020-2019Document9 pagesForex Hedging Project Summer Internship Training At: Stuti Jain, MBA (G) of Batch 2020-2019Stuti JainNo ratings yet

- Paul WilmottDocument3 pagesPaul Wilmottkylie05No ratings yet

- Unit 17 Exchange RatesDocument15 pagesUnit 17 Exchange Ratesujjwal kumar 2106No ratings yet

- Foreign Exchange MarketDocument27 pagesForeign Exchange MarketMD SHUJAATULLAH SADIQNo ratings yet

- Instruments of Foreign ExchangeDocument14 pagesInstruments of Foreign ExchangeMansi KoliyanNo ratings yet

- Lala Lajpatrai College of Commerce & EconomicsDocument26 pagesLala Lajpatrai College of Commerce & EconomicsvorachiragNo ratings yet

- Foreign Exchange Rate MarketDocument92 pagesForeign Exchange Rate Marketamubine100% (1)

- Kapil Final Project Sem 4Document56 pagesKapil Final Project Sem 4Kapil PrabhuNo ratings yet

- 13 International Business Q BankDocument4 pages13 International Business Q BankKapil PrabhuNo ratings yet

- 10 Int'l Capital Mkts. Sess 16Document7 pages10 Int'l Capital Mkts. Sess 16Kapil PrabhuNo ratings yet

- International Business Answers Q1. What Are The Various Entry Methods For International Business?Document32 pagesInternational Business Answers Q1. What Are The Various Entry Methods For International Business?Kapil PrabhuNo ratings yet

- 12 Int. Biz Org Structure Sess 19Document6 pages12 Int. Biz Org Structure Sess 19Kapil PrabhuNo ratings yet

- 12 Int Biz. Pricing Sess 19Document6 pages12 Int Biz. Pricing Sess 19Kapil PrabhuNo ratings yet

- 11 Intl Business M & A Sess 17 18Document6 pages11 Intl Business M & A Sess 17 18Kapil PrabhuNo ratings yet

- International Business: Foreign Direct InvestmentDocument23 pagesInternational Business: Foreign Direct InvestmentKapil PrabhuNo ratings yet

- 07 Int Biz Evolotion of Banks 12Document10 pages07 Int Biz Evolotion of Banks 12Kapil PrabhuNo ratings yet

- 07 LC-A Professional Outlook Sess 10Document4 pages07 LC-A Professional Outlook Sess 10Kapil PrabhuNo ratings yet

- Int L Biz Trans Eco. Session 9Document4 pagesInt L Biz Trans Eco. Session 9pritesh125No ratings yet

- 07 Int Busi. Int Fin & Trade Orgs. Sess 10, 11, 12Document25 pages07 Int Busi. Int Fin & Trade Orgs. Sess 10, 11, 12Kapil PrabhuNo ratings yet

- 09 Indianising The Western Brand Sess 15Document11 pages09 Indianising The Western Brand Sess 15Kapil PrabhuNo ratings yet

- International Banking & Finance: Foreign Exchange Risks and Country RisksDocument4 pagesInternational Banking & Finance: Foreign Exchange Risks and Country Risksamansrivastava007No ratings yet

- 02 Intl Biz Environ Challenges Session 4 & 5Document18 pages02 Intl Biz Environ Challenges Session 4 & 5Kapil PrabhuNo ratings yet

- 04 Int. Biz Strategies of Cooperation Sess 6 & 7Document16 pages04 Int. Biz Strategies of Cooperation Sess 6 & 7Kapil PrabhuNo ratings yet

- 06 Int'l Biz Marketing Session 9Document11 pages06 Int'l Biz Marketing Session 9Kapil PrabhuNo ratings yet

- 05 Intl Biz Globalisation Session 7 & 8Document21 pages05 Intl Biz Globalisation Session 7 & 8Kapil PrabhuNo ratings yet

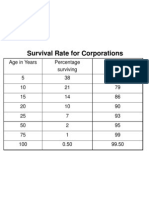

- 01 Int'l Biz Survival Rate of CorpDocument1 page01 Int'l Biz Survival Rate of CorpKapil PrabhuNo ratings yet

- 03 Intl Biz Entry Strategy Sess 5 & 6Document24 pages03 Intl Biz Entry Strategy Sess 5 & 6Kapil PrabhuNo ratings yet

- 02 Impact of Culture .Example Sess 4Document1 page02 Impact of Culture .Example Sess 4Kapil PrabhuNo ratings yet

- 01 IntBiz - Theories Session 1, 2 & 3Document24 pages01 IntBiz - Theories Session 1, 2 & 3Kapil PrabhuNo ratings yet

- Updated DGFT Regional Contact Offices in Delhi Mumbai Kolkata Chennai and BangloreDocument7 pagesUpdated DGFT Regional Contact Offices in Delhi Mumbai Kolkata Chennai and BangloreKapil PrabhuNo ratings yet

- EEB An IntroductionDocument6 pagesEEB An IntroductionKapil PrabhuNo ratings yet