Professional Documents

Culture Documents

Table B7: Bank-Wise Gross Non-Performing Assets, Gross Advances and Gross Npa Ratio of Scheduled Commercial Banks - 2009

Table B7: Bank-Wise Gross Non-Performing Assets, Gross Advances and Gross Npa Ratio of Scheduled Commercial Banks - 2009

Uploaded by

Saketh RajOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Table B7: Bank-Wise Gross Non-Performing Assets, Gross Advances and Gross Npa Ratio of Scheduled Commercial Banks - 2009

Table B7: Bank-Wise Gross Non-Performing Assets, Gross Advances and Gross Npa Ratio of Scheduled Commercial Banks - 2009

Uploaded by

Saketh RajCopyright:

Available Formats

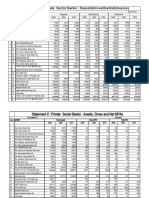

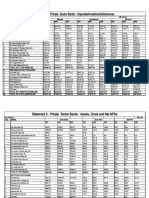

TABLE B7: BANK-WISE GROSS NON-PERFORMING ASSETS, GROSS ADVANCES AND

GROSS NPA RATIO OF SCHEDULED COMMERCIAL BANKS - 2009

(Amount in Rs. lakh)

As on March 31, 2009

Banks

Gross NPAs

Gross Advances

Gross NPA Ratio (%)

(1)

(2)

(3)

State Bank of Bikaner & Jaipur

49034

3008810

1.63

State Bank of Hyderabad

48604

4393772

1.11

1634564

54929681

2.98

State Bank of Indore

30128

2174658

1.39

State Bank of Mysore

36761

2586988

1.42

State Bank of Patiala

57390

4396081

1.31

State Bank of Travancore

54902

3297158

1.67

107825

5944340

1.81

36814

4442760

0.83

Bank of Baroda

184293

14484487

1.27

Bank of India

247088

14473156

1.71

79841

3481728

2.29

Canara Bank

216797

13903691

1.56

Central Bank of India

231655

8674027

2.67

Corporation Bank

55922

4892712

1.14

Dena Bank

62077

2918536

2.13

143569

10391507

1.38

45918

5183064

0.89

Indian Overseas Bank

192341

7580954

2.54

Oriental Bank of Commerce

105812

6906472

1.53

16104

2469810

0.65

Punjab National Bank

276746

15609845

1.77

Syndicate Bank

159454

8249504

1.93

UCO Bank

153951

6966905

2.21

Union Bank of India

192335

9826485

1.96

United Bank of India

101956

3572745

2.85

69882

3587463

1.95

State Bank of India & its Associates

State Bank of India

Nationalised Banks

Allahabad Bank

Andhra Bank

Bank of Maharashtra

IDBI Bank Limited

Indian Bank

Punjab & Sind Bank

Vijaya Bank

Note : Data are provisional. Figures are rounded off. Data pertain to the balance-sheets of banks.

Source : Department of Banking Supervision, RBI.

210

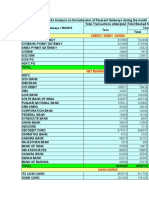

TABLE B7: BANK-WISE GROSS NON-PERFORMING ASSETS, GROSS ADVANCES AND

GROSS NPA RATIO OF SCHEDULED COMMERCIAL BANKS - 2009 (Contd.)

(Amount in Rs. lakh)

As on March 31, 2009

Banks

Gross NPAs

Gross Advances

Gross NPA Ratio (%)

(1)

(2)

(3)

265

2861

9.26

84409

1713740

4.93

Abu Dhabi Commercial Bank

1413

15145

9.33

American Express Banking Corp.

4525

71259

6.35

Antwerp Diamond Bank

2641

70320

3.76

BNP Paribas

7513

375308

2.00

70

335663

0.02

1176

29863

3.94

Bank of Ceylon

477

5009

9.52

Bank of Nova Scotia

200

480728

0.04

123475

1130065

10.93

91

176390

0.05

15011

0.00

208693

4095617

5.10

24340

896600

2.71

3443

274235

1.26

154006

2873771

5.36

6148

75511

8.14

JSC VTB Bank #

965

0.00

Krung Thai Bank pcl

926

0.00

Mashreq Bank

977

0.01

636

112551

0.57

Oman International Bank

192

0.00

Shinhan Bank

45760

0.00

Societe Generale

36584

0.00

122

1161

10.53

105751

3805944

2.78

State Bank of Mauritius

30266

0.00

The Bank of Tokyo - Mitsubishi UFJ

299132

0.00

UBS AG #

0.00

Foreign Banks

AB Bank

ABN AMRO Bank

Bank of America

Bank of Bahrain & Kuwait

Barclays Bank

Calyon Bank

China Trust Commercial Bank

Citibank

Deutsche Bank

Development Bank of Singapore

Hongkong & Shanghai Banking Corporation

JP Morgan Chase Bank

Mizuho Corporate Bank

Sonali Bank

Standard Chartered Bank

Note

: Data are provisional. Figures are rounded off. Data pertain to the balance-sheets of banks.

# See Explanatory Notes .

Source : Department of Banking Supervision, RBI.

211

TABLE B7: BANK-WISE GROSS NON-PERFORMING ASSETS, GROSS ADVANCES AND

GROSS NPA RATIO OF SCHEDULED COMMERCIAL BANKS - 2009 (Concld.)

(Amount in Rs. lakh)

As on March 31, 2009

Banks

Gross NPAs

Gross Advances

Gross NPA Ratio (%)

(1)

(2)

(3)

Axis Bank

89048

8212012

1.08

Bank of Rajasthan

16092

788464

2.04

Catholic Syrian Bank

17178

376372

4.56

City Union Bank

10208

568622

1.80

Development Credit Bank

30555

348005

8.78

6443

323160

1.99

58954

2290680

2.57

HDFC Bank

198392

10023935

1.98

ICICI Bank

964931

22362109

4.32

IndusInd Bank

25502

1584653

1.61

ING Vysya Bank

20939

1675437

1.25

Jammu & Kashmir Bank

55927

2121971

2.64

Karnataka Bank

44320

1212297

3.66

Karur Vysya Bank

20586

1056290

1.95

Kotak Mahindra Bank

73071

1695921

4.31

Lakshmi Vilas Bank

14405

531978

2.71

Nainital Bank

1898

113900

1.67

Ratnakar Bank

1728

81294

2.13

461

31534

1.46

26056

1196516

2.18

8493

1244686

0.68

7006342

303158730

2.31

Other Scheduled Commercial Banks

Dhanalakshmi Bank

Federal Bank

SBI Commercial & International Bank

South Indian Bank

Yes Bank

All Scheduled Commercial Banks

Note

: Data are provisional. Figures are rounded off. Data pertain to the balance-sheets of banks.

Source : Department of Banking Supervision, RBI.

212

You might also like

- ATM & Card Statistics For March 2018 POS AtmsDocument6 pagesATM & Card Statistics For March 2018 POS AtmsMathews KunnekkadanNo ratings yet

- NPA2008Document2 pagesNPA2008vishwanathNo ratings yet

- Table B6: Bank-Wise Non-Performing Assets (Npas) of Scheduled Commercial Banks: 2004 (Amount in Rs - Crore) As On March 31 Bank Name Gross Npas Gross Advances Gross Npa Ratio %Document2 pagesTable B6: Bank-Wise Non-Performing Assets (Npas) of Scheduled Commercial Banks: 2004 (Amount in Rs - Crore) As On March 31 Bank Name Gross Npas Gross Advances Gross Npa Ratio %abcNo ratings yet

- BankWise Performance 2018-19 1Document15 pagesBankWise Performance 2018-19 1YASHASVI SHARMANo ratings yet

- TB6 STST1118Document3 pagesTB6 STST1118rajsirwaniNo ratings yet

- Table 49: Net Non-Performing Assets (Npa) and Capital Adequacy Ratio (Car) of Scheduled Commercial Banks - 1996Document15 pagesTable 49: Net Non-Performing Assets (Npa) and Capital Adequacy Ratio (Car) of Scheduled Commercial Banks - 1996anumavi75No ratings yet

- Appendix: Table 8.1: Non Performing Assets of Different BanksDocument8 pagesAppendix: Table 8.1: Non Performing Assets of Different Banksshreeya salunkeNo ratings yet

- Return On Assets in 2006 (%) : Number of Branches Vs AtmsDocument2 pagesReturn On Assets in 2006 (%) : Number of Branches Vs AtmsAbhishek Kumar SinghNo ratings yet

- 42A Branch Network Mar21Document1 page42A Branch Network Mar21ANKIT DWIVEDINo ratings yet

- Annexure-I Regionwise Deployment of Atms For The Quarter Ended March 2020Document2 pagesAnnexure-I Regionwise Deployment of Atms For The Quarter Ended March 2020JNR ENTERPRISESNo ratings yet

- Analysis of Banking Industry: - Presented By-Santanu Banik Gourab Biswas Asish Kr. RoyDocument18 pagesAnalysis of Banking Industry: - Presented By-Santanu Banik Gourab Biswas Asish Kr. RoybgourabNo ratings yet

- Banking Out Lets ATM Details04032020Document980 pagesBanking Out Lets ATM Details04032020vemulanagendrababu12345No ratings yet

- Data Analysis: Pradhan Mantri Jan-Dhan Yojana (Pmjdy)Document13 pagesData Analysis: Pradhan Mantri Jan-Dhan Yojana (Pmjdy)vivek adkineNo ratings yet

- Base RatesDocument8 pagesBase Ratesaditya_pandya_4No ratings yet

- STRBI Table No. 08 Exposure To Sensitive Sectors of Scheduled Commercial BanksDocument114 pagesSTRBI Table No. 08 Exposure To Sensitive Sectors of Scheduled Commercial BanksRishiNo ratings yet

- Top Banks (Pmjjby, Pmsby & Apy) Including Their RrbsDocument1 pageTop Banks (Pmjjby, Pmsby & Apy) Including Their RrbsBasavaraj MtNo ratings yet

- STRBI Table No. 02 Earnings and Expenses of Scheduled Commercial BanksDocument466 pagesSTRBI Table No. 02 Earnings and Expenses of Scheduled Commercial BanksSai KishoreNo ratings yet

- Major Bank Performance IndicatorsDocument35 pagesMajor Bank Performance IndicatorsAshish MehraNo ratings yet

- Term Deposit DataDocument587 pagesTerm Deposit Datahritiks2801No ratings yet

- PSB Comparison - Q1 FY 22-23Document1 pagePSB Comparison - Q1 FY 22-23MehanNo ratings yet

- 8.5. Agriculture Advances As at DECEMBER 2019Document2 pages8.5. Agriculture Advances As at DECEMBER 2019samNo ratings yet

- Bank Wise Non-Performing Assets As Percentage of Total Assets Table 1-Gross Npas To Total AssetsDocument12 pagesBank Wise Non-Performing Assets As Percentage of Total Assets Table 1-Gross Npas To Total AssetsAnkit GuptaNo ratings yet

- POs Pre Joining Study Material PDFDocument152 pagesPOs Pre Joining Study Material PDFKushagra Pratap SinghNo ratings yet

- Statement I: Foreign Banks in India: Deposits/Investments/AdvancesDocument8 pagesStatement I: Foreign Banks in India: Deposits/Investments/Advancesramkumar6388No ratings yet

- Other STRBI Table No 20. Bank-Wise and Bank Group-Wise Gross Non-Performing Assets, Gross Advances, and Gross NPA Ratio of Scheduled Commercial BanksDocument6 pagesOther STRBI Table No 20. Bank-Wise and Bank Group-Wise Gross Non-Performing Assets, Gross Advances, and Gross NPA Ratio of Scheduled Commercial BanksPrasad KhandekarNo ratings yet

- Statement I: Private Sector Banks: Deposits/Investments/AdvancesDocument8 pagesStatement I: Private Sector Banks: Deposits/Investments/AdvancesGyanendra AgrawalNo ratings yet

- Statement I: Private Sector Banks: Deposits/Investments/AdvancesDocument8 pagesStatement I: Private Sector Banks: Deposits/Investments/Advancesprakasht_1No ratings yet

- Statement I: Private Sector Banks: Deposits/Investments/AdvancesDocument8 pagesStatement I: Private Sector Banks: Deposits/Investments/AdvancesanandbhawanaNo ratings yet

- Statement I: Public Sector Banks: Deposits/Investments/AdvancesDocument8 pagesStatement I: Public Sector Banks: Deposits/Investments/AdvancesNirmal SinghNo ratings yet

- STRBI Table No. 09 Maturity Profile of Selected Items of Liabilities and Assets of Scheduled Commercial BanksDocument732 pagesSTRBI Table No. 09 Maturity Profile of Selected Items of Liabilities and Assets of Scheduled Commercial BanksRishiNo ratings yet

- Annex 258 AU1514Document4 pagesAnnex 258 AU1514madhavjadhav2018No ratings yet

- Annex 262 AU223Document4 pagesAnnex 262 AU223rajautoprincNo ratings yet

- Statement I: Public Sector Banks: Deposits/Investments/AdvancesDocument8 pagesStatement I: Public Sector Banks: Deposits/Investments/AdvancesSyed Mahammad AshifNo ratings yet

- Npa PSUDocument1 pageNpa PSUketansanwalNo ratings yet

- AyushSingla PGP10076 MFISDocument466 pagesAyushSingla PGP10076 MFISayush singlaNo ratings yet

- BankWise Performance 2021-22Document3 pagesBankWise Performance 2021-22sgrfgrNo ratings yet

- Year Banks Total Assets 3A.1. Demand Deposits - x000DDocument105 pagesYear Banks Total Assets 3A.1. Demand Deposits - x000Dayush singlaNo ratings yet

- NETC Ecosystem StatisticsDocument1 pageNETC Ecosystem StatisticsAshwin RowNo ratings yet

- KFI Poush 20791 PDFDocument1 pageKFI Poush 20791 PDFRajendra NeupaneNo ratings yet

- Rs. Crore Rs. Crore Rs. Crore Rs. Crore Rs. Crore Rs. Crore P Per Emply Interest Inc Interest Exp Total Depst DMND Dep Assets Loans&Adv Rs. CroreDocument14 pagesRs. Crore Rs. Crore Rs. Crore Rs. Crore Rs. Crore Rs. Crore P Per Emply Interest Inc Interest Exp Total Depst DMND Dep Assets Loans&Adv Rs. CrorePrekshaGargNo ratings yet

- Non-Performing AssetsDocument20 pagesNon-Performing AssetsSagar PawarNo ratings yet

- Annexure - 2 (A) - IDocument12 pagesAnnexure - 2 (A) - IUttamJainNo ratings yet

- Provisioning Coverage Ratio - Part IIDocument4 pagesProvisioning Coverage Ratio - Part IIJayakrishnaraj AJDNo ratings yet

- Acp Target Bank Wise 2023-24Document124 pagesAcp Target Bank Wise 2023-24manas.23pgdm157No ratings yet

- Problems and Prospects of Agent Banking in Coastal Area of BangladeshDocument21 pagesProblems and Prospects of Agent Banking in Coastal Area of BangladeshAhmed RiajNo ratings yet

- Overall Banks: Sector Wise PercentageDocument8 pagesOverall Banks: Sector Wise PercentagePriya TiwariNo ratings yet

- Lok Sabha Un-Starred Question No. 2311Document5 pagesLok Sabha Un-Starred Question No. 2311nafa nuksanNo ratings yet

- OropDocument1 pageOropkapsicumadNo ratings yet

- Private Sector Banks 2020-22Document8 pagesPrivate Sector Banks 2020-22Sidharth Sankar RathNo ratings yet

- Net NPA As Percentage of Net Advance Public & Private Sector BanksDocument1 pageNet NPA As Percentage of Net Advance Public & Private Sector BanksPankaj MaryeNo ratings yet

- LS 164Document4 pagesLS 164Shubh SharmaNo ratings yet

- Irctc 1Document2 pagesIrctc 1adityachak20No ratings yet

- STRBI Table 2 PDFDocument456 pagesSTRBI Table 2 PDFRitesh RamanNo ratings yet

- Statement I: Foreign Banks in India: Deposits/Investments/AdvancesDocument25 pagesStatement I: Foreign Banks in India: Deposits/Investments/Advancesmkapoor5686No ratings yet

- Bank FinstatementDocument19 pagesBank FinstatementCool BuddyNo ratings yet

- Comparison 22banks 7 YearsDocument58 pagesComparison 22banks 7 YearsArul pratheebNo ratings yet

- Private Sec Banks 3806Document9 pagesPrivate Sec Banks 3806Ganesh RamaiyerNo ratings yet

- Bank Exam Solved Question PapersDocument1 pageBank Exam Solved Question Paperssekarc97% (184)

- SBI AB-Contact DetailsDocument3 pagesSBI AB-Contact Detailsjmaccen123No ratings yet

- 54 Punjab National BankDocument200 pages54 Punjab National BankmailabhikeshNo ratings yet

- Rev 1wp Name Contribution 1000Document22 pagesRev 1wp Name Contribution 1000Vilas ParabNo ratings yet

- Stat Is e Fek 20190329Document123 pagesStat Is e Fek 20190329Fadel Khalif MuhammadNo ratings yet

- Operation Supercharge II Giovanni MesseDocument56 pagesOperation Supercharge II Giovanni MesseKyal Sinn MinNo ratings yet

- Bank Statements AY 2020-21Document21 pagesBank Statements AY 2020-21rohit madeshiyaNo ratings yet

- Daily Monitoring 29 September 2020Document11 pagesDaily Monitoring 29 September 2020nada cintakuNo ratings yet

- Acknowledge ReceiptDocument4 pagesAcknowledge ReceiptLEGEND PLAYERNo ratings yet

- Jobsheet PMDocument49 pagesJobsheet PMwindhy fitrianaNo ratings yet

- resoLUTION For Change SignatoriesDocument10 pagesresoLUTION For Change SignatoriesNawal AbdulgaforNo ratings yet

- Wa0039.Document50 pagesWa0039.shraddhaNo ratings yet

- Real Estate Regulation Development Act 2016 Rera Implementation Progress Report - 24 08 2019Document2 pagesReal Estate Regulation Development Act 2016 Rera Implementation Progress Report - 24 08 2019deepikajain.csrlNo ratings yet

- SBI - Post Merger List of OLD and NEW BIC For Erstwhile Associate BanksDocument8 pagesSBI - Post Merger List of OLD and NEW BIC For Erstwhile Associate BanksTamil GoodReturnsNo ratings yet

- 16.72 US Dollars To Indonesia Rupiahs. Convert USD in IDR (Currency Matrix)Document1 page16.72 US Dollars To Indonesia Rupiahs. Convert USD in IDR (Currency Matrix)Fahira AnwarNo ratings yet

- Sarah Collection Laporan Penghasilan Sewa VCD Mar-15Document12 pagesSarah Collection Laporan Penghasilan Sewa VCD Mar-15Samuel MarpaungNo ratings yet

- Asian Countries CurrencyDocument2 pagesAsian Countries CurrencyJericho MarquezNo ratings yet

- IFCBDocument108 pagesIFCBchunnilal_munnilalNo ratings yet

- Currency Exchange RateDocument4 pagesCurrency Exchange Ratelyra915No ratings yet

- International Shipping: Price ListDocument2 pagesInternational Shipping: Price ListYuki TeeNo ratings yet

- BSP and Dof Floor Plan GFDocument1 pageBSP and Dof Floor Plan GFKarl Anton ClementeNo ratings yet

- MHRD 14 SelDocument1,030 pagesMHRD 14 SelNinad MgNo ratings yet

- PD List Midc AreaDocument50 pagesPD List Midc AreaPriyanka sharmaNo ratings yet

- FIRMS ContactsDocument25 pagesFIRMS Contactspratyush1200No ratings yet

- E-Way Bill SystemDocument1 pageE-Way Bill SystemGyan AwarenessNo ratings yet

- MockDocument17 pagesMockObaweki OrukpeNo ratings yet

- GRADE 2 MATH (Philippine Coins and Bills)Document51 pagesGRADE 2 MATH (Philippine Coins and Bills)jomel friasNo ratings yet

- UNIT 5 Money MattersDocument9 pagesUNIT 5 Money MattersNurainna Binti Mazlan0% (1)

- Dpu Kader JatiwaringinDocument14 pagesDpu Kader JatiwaringinparamitaNo ratings yet

- Script Position Rate: TipscontrolDocument195 pagesScript Position Rate: TipscontrolRajesh Chowdary ParaNo ratings yet