Professional Documents

Culture Documents

Continuation Sheet For Schedule J (Form 990)

Continuation Sheet For Schedule J (Form 990)

Uploaded by

Francis Wolfgang UrbanOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Continuation Sheet For Schedule J (Form 990)

Continuation Sheet For Schedule J (Form 990)

Uploaded by

Francis Wolfgang UrbanCopyright:

Available Formats

SCHEDULE J-1 (Form 990)

Department of the Treasury Internal Revenue Service

OMB No. 1545-0047

Continuation Sheet for Schedule J (Form 990)

Attach to Form 990 to list additional information for Schedule J (Form 990), Part II. See Instructions for Schedule J (Form 990).

2009

Open to Public Inspection

Employer identification number

Name of the organization

Part I

Continuation of Officers, Directors, Trustees, Key Employees, and Highest Compensated Employees (Schedule J, Part II)

(B) Breakdown of W-2 and/or 1099-MISC compensation (A) Name (i) (ii) (i) (ii) (i) (ii) (i) (ii) (i) (ii) (i) (ii) (i) (ii) (i) (ii) (i) (ii) (i) (ii) (i) (ii) (i) (ii) (i) (ii) (i) (ii) (i) (ii) (i) (ii)

(i) Base compensation (ii) Bonus & incentive compensation (iii) Other reportable compensation (C) Retirement and other deferred compensation (D) Nontaxable benefits (E) Total of columns (B)(i)(D) (F) Compensation reported in prior Form 990 or Form 990-EZ

For Privacy Act and Paperwork Reduction Act Notice, see the Instructions for Form 990.

Cat. No. 51027H

Schedule J-1 (Form 990) 2009

You might also like

- Continuation Sheet For Form 990: Open To Public InspectionDocument1 pageContinuation Sheet For Form 990: Open To Public InspectionFrancis Wolfgang UrbanNo ratings yet

- Continuation Sheet For Schedule I (Form 990)Document2 pagesContinuation Sheet For Schedule I (Form 990)Francis Wolfgang UrbanNo ratings yet

- Continuation Sheet For Schedule F (Form 990)Document3 pagesContinuation Sheet For Schedule F (Form 990)Francis Wolfgang UrbanNo ratings yet

- Continuation Sheet For Schedule N (Form 990 or 990-EZ)Document2 pagesContinuation Sheet For Schedule N (Form 990 or 990-EZ)Francis Wolfgang UrbanNo ratings yet

- Instructions For Schedule A (Form 990 or 990-EZ) : General Instructions Specific InstructionsDocument10 pagesInstructions For Schedule A (Form 990 or 990-EZ) : General Instructions Specific InstructionsJermaine BrownNo ratings yet

- Instructions For Schedule A (Form 990 or 990-EZ)Document19 pagesInstructions For Schedule A (Form 990 or 990-EZ)Билгүүдэй ТөмөрNo ratings yet

- The Gazette of India: Extraordinary (P Ii-S - 3 (I) ) : ART ECDocument212 pagesThe Gazette of India: Extraordinary (P Ii-S - 3 (I) ) : ART ECWaning PersonaNo ratings yet

- Instructions For Schedule A (Form 990 or 990-EZ)Document10 pagesInstructions For Schedule A (Form 990 or 990-EZ)IRSNo ratings yet

- RMC No 42-2018 PDFDocument1 pageRMC No 42-2018 PDFAna DocallosNo ratings yet

- U.S. Congress Washington, DC 20515: Congressional Budget OfficeDocument2 pagesU.S. Congress Washington, DC 20515: Congressional Budget OfficeGrace WylerNo ratings yet

- Instructions For Schedule A (Form 990) : Internal Revenue ServiceDocument8 pagesInstructions For Schedule A (Form 990) : Internal Revenue ServiceIRSNo ratings yet

- SAS Part-1 SyllabusDocument7 pagesSAS Part-1 Syllabusnagarjuna_upsc100% (1)

- FreedomWorks Inc 521349353 2005 0263603DSearchableDocument18 pagesFreedomWorks Inc 521349353 2005 0263603DSearchablecmf8926No ratings yet

- US Internal Revenue Service: F5500si - 2002Document6 pagesUS Internal Revenue Service: F5500si - 2002IRSNo ratings yet

- Barbara and Barrie Seid Foundation 363342443 2010 077d83fesearchableDocument20 pagesBarbara and Barrie Seid Foundation 363342443 2010 077d83fesearchablecmf8926No ratings yet

- Notification 21 2022Document165 pagesNotification 21 2022Shaikh Mohd HuzaifaNo ratings yet

- Indian Income Tax Return: Assessment YearDocument3 pagesIndian Income Tax Return: Assessment YearEpsita PaulNo ratings yet

- Return of Organization Exempt From Income Tax: Employer Identification NumberDocument31 pagesReturn of Organization Exempt From Income Tax: Employer Identification NumberThe Futuro Media GroupNo ratings yet

- Instructions For Schedule A (Form 990) : Internal Revenue ServiceDocument8 pagesInstructions For Schedule A (Form 990) : Internal Revenue ServiceIRSNo ratings yet

- Annex 1Document1 pageAnnex 1ramNo ratings yet

- Instruction To Fill Form St3Document9 pagesInstruction To Fill Form St3Dhanush GokulNo ratings yet

- Form 91: Income CalculationsDocument7 pagesForm 91: Income CalculationsTroy StrawnNo ratings yet

- US Internal Revenue Service: I990sa - 1998Document8 pagesUS Internal Revenue Service: I990sa - 1998IRSNo ratings yet

- Supplemental Information To Form 990 or 990-EZDocument3 pagesSupplemental Information To Form 990 or 990-EZBilboDBagginsNo ratings yet

- in The Said Rules, After FORM GSTR-8, The Following FORMS Shall Be Inserted, NamelyDocument12 pagesin The Said Rules, After FORM GSTR-8, The Following FORMS Shall Be Inserted, Namelyhemanvshah892No ratings yet

- Gis Intrest RatesDocument9 pagesGis Intrest RatesdayakarNo ratings yet

- 2022 Mayo Clinic 990 PublicDocument201 pages2022 Mayo Clinic 990 Publicinforumdocs100% (1)

- 2020 - USSF - 990 - PD Copy FY21Document86 pages2020 - USSF - 990 - PD Copy FY21Alex MatthewsNo ratings yet

- UFCW 1776 2012 Financials Wendell YoungDocument38 pagesUFCW 1776 2012 Financials Wendell YoungbobguzzardiNo ratings yet

- GO (RT) No698 2023 FinDated28 01 2023 - 17Document2 pagesGO (RT) No698 2023 FinDated28 01 2023 - 17Assistant Director KHRINo ratings yet

- Rev SCH III - Sent PDFDocument18 pagesRev SCH III - Sent PDFAjay DesaleNo ratings yet

- Sixteen Thirty Fund's 2022 Tax FormsDocument101 pagesSixteen Thirty Fund's 2022 Tax FormsJoeSchoffstallNo ratings yet

- Form PDF 958500510240722Document6 pagesForm PDF 958500510240722Hks HksNo ratings yet

- Return of Organization Exempt From Income Tax: WWW - Irs.gov/form990 For Instructions and The Latest InformationDocument50 pagesReturn of Organization Exempt From Income Tax: WWW - Irs.gov/form990 For Instructions and The Latest InformationNBC MontanaNo ratings yet

- Return of Organization Exempt From Income Tax: MS, Ee11oiiiDocument18 pagesReturn of Organization Exempt From Income Tax: MS, Ee11oiiicmf8926No ratings yet

- Instructions For Form W-2: Wage and Tax StatementDocument8 pagesInstructions For Form W-2: Wage and Tax StatementIRSNo ratings yet

- Form PDF 338831280310722Document6 pagesForm PDF 338831280310722Sumit SainiNo ratings yet

- AppdDocument28 pagesAppdCrystalNo ratings yet

- TandaTerima Invoice DTDTDTDocument1 pageTandaTerima Invoice DTDTDTMuhammad RoziNo ratings yet

- Notification No. G.S.R. 332E Income Tax Dated 03.04.2018Document179 pagesNotification No. G.S.R. 332E Income Tax Dated 03.04.2018kshitijsaxenaNo ratings yet

- Annual Report of Reliance General Insurance As On 2010Document45 pagesAnnual Report of Reliance General Insurance As On 2010bhagathnagarNo ratings yet

- Read The Following:-: Amount Authorized Now As Addl. FundsDocument1 pageRead The Following:-: Amount Authorized Now As Addl. Fundsnmsusarla999No ratings yet

- Form 8-K: United States Securities and Exchange Commission Washington, D.C. 20549Document21 pagesForm 8-K: United States Securities and Exchange Commission Washington, D.C. 20549yiyitan12No ratings yet

- NVF 2020 Public Disclosure Copy 1Document209 pagesNVF 2020 Public Disclosure Copy 1Raheem KassamNo ratings yet

- Gates Foundation 2009 IRS 990Document235 pagesGates Foundation 2009 IRS 990jointhefutureNo ratings yet

- Tripadvisor, Inc.: FORM 10-QDocument13 pagesTripadvisor, Inc.: FORM 10-Qcamiro13No ratings yet

- Threshold Foundation 2007 990Document28 pagesThreshold Foundation 2007 990TheSceneOfTheCrimeNo ratings yet

- TPI234444Document98 pagesTPI234444Jayarama RamNo ratings yet

- Articles On The Basics of Monetary and Fiscal Policy Budget Basics: How The Books Are (Not) BalancedDocument11 pagesArticles On The Basics of Monetary and Fiscal Policy Budget Basics: How The Books Are (Not) Balancedsawhneynikita132854No ratings yet

- 2010 GAO Audit ReportDocument30 pages2010 GAO Audit ReportkaligelisNo ratings yet

- Instructions For Schedule A (Form 990 or 990-EZ) : Pager/SgmlDocument13 pagesInstructions For Schedule A (Form 990 or 990-EZ) : Pager/SgmlIRSNo ratings yet

- Instructions For Form 990-EZ: Department of The TreasuryDocument16 pagesInstructions For Form 990-EZ: Department of The TreasuryIRSNo ratings yet

- Heroes ActDocument1,815 pagesHeroes ActLiberty NationNo ratings yet

- Coronavirus Relief BillDocument1,815 pagesCoronavirus Relief BillBrandon Conradis44% (9)

- (See Rule 80) : Form GSTR - 9Document5 pages(See Rule 80) : Form GSTR - 9Sourav ThakyalNo ratings yet

- Form GSTR 9.f9bef216 HsDocument10 pagesForm GSTR 9.f9bef216 HsShahar hetNo ratings yet

- CostAudit Rules 30nov2012Document3 pagesCostAudit Rules 30nov2012Saibaba YadavNo ratings yet

- Bangladeesh Budget Fiscal Year 2020Document2 pagesBangladeesh Budget Fiscal Year 2020Mohammad AmjadNo ratings yet

- Using Economic Indicators to Improve Investment AnalysisFrom EverandUsing Economic Indicators to Improve Investment AnalysisRating: 3.5 out of 5 stars3.5/5 (1)

- Shed Material List Part (1 of 9)Document2 pagesShed Material List Part (1 of 9)nwright_besterNo ratings yet

- Shed PlansDocument1 pageShed PlansFrancis Wolfgang UrbanNo ratings yet

- Shed PlansDocument1 pageShed PlansFrancis Wolfgang UrbanNo ratings yet

- Shed PlansDocument1 pageShed PlansFrancis Wolfgang UrbanNo ratings yet

- Figure E Small Roof: 2x4 Nailers 2x4 Rafter 2x4 Subfascia 1x2 Fascia Trim 24" 32" 29-3/4"Document1 pageFigure E Small Roof: 2x4 Nailers 2x4 Rafter 2x4 Subfascia 1x2 Fascia Trim 24" 32" 29-3/4"Francis Wolfgang UrbanNo ratings yet

- Shed PlansDocument1 pageShed PlansFrancis Wolfgang Urban50% (2)

- Shed PlansDocument16 pagesShed PlansFrancis Wolfgang Urban100% (7)

- Figure A Trusses: Inner (Common) Truss (9 Req'd)Document1 pageFigure A Trusses: Inner (Common) Truss (9 Req'd)Francis Wolfgang UrbanNo ratings yet

- Shed PlansDocument1 pageShed PlansFrancis Wolfgang UrbanNo ratings yet

- 25 Foot CabinDocument28 pages25 Foot Cabinapi-3708365100% (1)

- 15 Foot SailDocument4 pages15 Foot SailjdogheadNo ratings yet

- 10 Dollar Telescope PlansDocument9 pages10 Dollar Telescope Planssandhi88No ratings yet

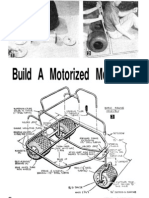

- 3 Wheel 2Document5 pages3 Wheel 2jii_907001No ratings yet

- 6 Inch Reflector PlansDocument12 pages6 Inch Reflector PlansSektordrNo ratings yet

- 3inchrefractorDocument6 pages3inchrefractorGianluca SalvatoNo ratings yet

- IRS Publication Form Instructions 8853Document8 pagesIRS Publication Form Instructions 8853Francis Wolfgang UrbanNo ratings yet

- IRS Publication Form Instructions 2106Document8 pagesIRS Publication Form Instructions 2106Francis Wolfgang UrbanNo ratings yet

- IRS Publication Form Instructions 1099 MiscDocument10 pagesIRS Publication Form Instructions 1099 MiscFrancis Wolfgang UrbanNo ratings yet

- IRS Publication Form 8919Document2 pagesIRS Publication Form 8919Francis Wolfgang UrbanNo ratings yet