Professional Documents

Culture Documents

lADC/SPE 39325 Drill String Management To Reduce Drilling Risks

Uploaded by

Rashid Ali SheikhOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

lADC/SPE 39325 Drill String Management To Reduce Drilling Risks

Uploaded by

Rashid Ali SheikhCopyright:

Available Formats

ew

Society of Petroleum Engineers

lADC/SPE 39325 Drill String Management to Reduce Drilling Risks

M.A. Summers,* PetrEX Intl. Inc., and S.R. Crabtree, Technical and Quality Solutions, Inc.

companies, and repair facilities. Yet in the absence of a shared-risk or turnkey con= the tisk of a drill string failure is borne by the operator. Case histories in the literature12 indicate that this risk can b quite sizable. While even the cheapest of failures, such as drill pipe tube washouts, result in lost rig time invested in an extra trip, it shotid also be rmized that more severe problems Me drill string twistoffs can junk the well. As a resd~ there is considerable incentive for operators to manage their use of drill strings by working productively through tool and seMce providers whose wre business is drill strings.

Abstract Inmeases in recent and projected rig activity are putting

Management of drill strings means: 1. Understanding the business drivers of the various suppliers providing tools and serviws in this arena to establish win-wi33working agreements, 2. Assessing the technical requirements and drilling risks of the drill string application% 3. Assigning responsibility and accountability for drill string wmponents to qual~led suppliers. -h of these activities will be discussed in detaiL

tremendous strains on current inventories of drilling tools and on the industry supply chain attempting to bolster those inventories. Additiondly, while much of the new activity is untered in established oil provinms and using established technologies, many projects are on the frontier, both in terms of their geographical location and their technol~ applications. The frontier projects tien must deal with strained supply lines and makeshift local infmstructure as wll as down hole tool stresses which wre never envisioned when the tools were first introduced. The linkage of high demand with limited supply can result in a ten&ncy to accept lomr qtiity materials to increase availability and meet driUing schedules. This tien increases the risk of drill string failures and associated cost overruns due to lost time, lost hole, lost tools, fishing and sidetracks. This paper will explore how drill string management techniques have addressed these inventory and infrastructure issues with the objective of miti~ting drilling risks. Case histories are reviewed where various actions have been formtiated to meet the specific &mands of frontier drilling projects and the drilling cost savings that have resulted

Introduction The objective of drill sting management is to reduce the cost

Background

During the 1970s and 1980s, operators spent si@lcant engineering time optimizing casing and tubing string designs, including metallurgy, heat treating and conn~on styles. This was time wll spent since these drilling and production tubtiar goods represent a large fraction @ their expenditures on a w1l. The design requirements that operators pl~d on the OCTG supply chain resdted in an explosion of new products and seMws that w continue to bentit from today. However, drill strings have not benefited from similar attention from operators since the development of the current API S@lcations and Recommended Fractiws34$documents throughout the 1950s and 1%0s. M of the reason for this may k that the operators have not historically been the owners of the drill strings, as is the case with most casing and tubi~ Rather, they have rented them either as part of a contract-drilling Fkage or as a standalone iteq for intermittent use as and when needed. As a result, drill strings have traditionrdly been the wntractors responsibiliw.

of a drilling project by reducing the probability of down hole drilling tool failure. And it truly is a management fbnction. Drill strings are not part of an operators core business like they are for drilling contractors, rental companies, inspection

287

SUMMERS,

M. A. AND CRABTREE,

S. R.

iADC/SPE -

As a part of their core business then, drilling contractors and rental companies have maintained serviceable strings in or&r to stay in business. The average rig probably has on the order Of US$ 1.0 MM in drill stiw inventory, incl~g all MU pipe, heavyweight, and drill mllar strings. While this is a signtilcant investment typical day rate contracts make it the responsibility of the operator to pay any costs that result from The drilling drill string failures and associated losses. contractor is usually responsible for most down hole wear and any handling damage. Many of these costs are a~egated into drilling costs that may be labeled as rig day rates and unfortunately, un=hednled event costs, such as fishing and sidetracks whew in r~ty, they include costs tied to choices that are made regarding drill strings. Consequently, the true costs operators incur for drill string usage are often hidden within other costs. The true total rests of drill string usage are reflected in Table 1. The manner in which these costs are allocated bewen prator and contractor is the realm of drill string management. Clearly, several of the proactive expenditures (inspection and prevention) may be necessmy in order to ~ the reactive expenditures (~overy and losses). Current business practices may need to be re-examined to ensure that the party primarily benefiting from the expenditure (the real customer) is the party controlling the expenditure. On those where multiple parties bnefh, all should agree on a qualfled su~lier and the costs should& shared Scope of the Challenge As a basis for understanding the scope of the drill string management chaUenge, an assumption is made that while the operators -t to mitigate the risk of drill string failure, they do not want to b in the drill string business. Therefore, the success of the drill string management effort depends upon business relationships that provi& correct incentives to all participants and upon the sharing of various twhnical responsibilities. Business Challenges WY of the challenges of managing the drill string aspects of the drilling business are the same challenges that currently face the driUing industry as a whole. Imbalances in supply and &mand for drilling rigs are driving up day rates for rigs of all types, thereby increasing the cost of the wells. Higher wll costs increase risk to the operator, driving the operator to nemr drill strings to reduce risk, Unfortunately, as with many drilling tools, there is increasing demand for drill strings as drilling activity intensifies and a lag in the capacity to respond within the supply chain. This is resulting in much longer lead times and higher cost for replacement strings. The current invento~ of drill strings is the result of a @ of drill pipe production in the early 1980s followed by a dramatic slowing of purchases into the early 1990s, as 288

indicated by the demand for the most popular 5-in drill pipe size shown in Figure 16. The average age of the pipe represented in Figure 1 is over 9.4 years. While some of the pipe in Figure 1 is no longer in service, it is clear that drill string inventory replacement will be a major priority for the next few years as this pipe continues to age. A mend series of business challenges are those presenti by the shortage of experienced drilling personnel and increased activity in remote and logistically critical areas of the world Figure 2 represents the distribution of the total number of hours of Unxheduled events due to drill string failures for a series of over 125 development and exploratw wells. While the general character of the development and exploratory well curves are similar, the exploratory wells show consistently higher lost time than the development rolls. This is probably due to several factors, including less familiarity with the exploratory drilling conditions, poor local infrastructure, Wlcult logistics, and instilcient planning time. As exploration operations continue to move out from established oil provinces and into frontier regions around the globe, this type of relative failure frequen~ behavior might be expect~ which is to say double to triple the lost time due to drill string failures as compared to au average development well. Additiomdly, it is worth noting that both the development and exploratory well curves in Figure 2 exhibit marked changes in slope at about the 30-hour lost time mark It is believed that this represents a characteristic cheap failure cutoff, i.e. recove~ activities ranging from a simple round trip for a washout up to a clean fishing job where the fish is recovered on the f~st attempt. About 70% of the failure occurrences in explomtory W1lS and about 88% in development wells fall into this cheap range. Of course, 30 hours of rig time shodd never be considered cheap, especially when the choice to s~nd a fraction of the expected failure rmve~ cost on appropriate prevention measures would have si~lcantly reduced the probability of the failure occnrrene in the first place. Beyond about 30 hours of lost time, recovery from the more expnsive failures may include ~ldt fishing jfi up to major sidetracks and redrills. On the extreme end of the scale, a small prcentage of the drill string failure occurrences (approximately 4% in development wells and 8% in explomtory wells) resulted in lost rig time in excess of 300 hem. Project managers and those responsible for evaluating drill strings being proposed by suppliers, especially for use on remote projects, should consider these trends when determining the cost-effectiveness of various drill stig options. Technical Challenges In addition to ever-broadening g~aphic frontiers, many drilling Operations are pushing conventiomd API drill strings These into applications on the frontiers of technology.

lADC/SPE -

DRILL STRING MANAGEMENT

TO REDUCE DRILLING RISKS

applications may include very high curvature (600+/100 ft dog leg severity) and elevated torque and drag in highly deviated wells. The drill string is an integral part of the circulatio~ rate of Penetration%and wll control drilling subsystems. Yet in todays short-fused drilling team environments, specification of drill string components often extends no tier than stabilizer placements or &nt housing settings on the motor. It is ordy the rarest of applications where detailed string requirements are spec~led from the top drive to the bit. Without these requirements to compare agains~ it cannot be determined whether the string being supplied by a prospective drilling contractor or rental company has adequate capacity for the anticipated loads in the W1l. Additionally, the vast mjority of the drilling tmls placed in drill strings are * meaning that the tool probably has less capacity to handle the loads to which it is subjected than when it was new. The next question is Is it good enough? The string does not have to perfect but it should be demonstrably adequate for the project at hand Too ofte~ drill strings are acquired as part of the rig equipment and are not specKled to meet the demands of the wI1. Typical contracts require API Premium Class acceptance criteria but this is certainly no guarantee that the pipe will be up to the * especially in frontier applications. Rather, all drill string components Shodd k specKle4 inspect~ and selected based upon their performance properties as required by the well.

Actions

Also, a grovp of qualtiled vendors is required to support the inspection and veMlcation program. An auditing process is recommended for all vendors supplying equipment or machining servims (drilling contractor, rental company, ins-ion company, repair machine shop, directional company, etc.). Lastly, training and supervision is a must. From the engineer doing the design tasks to the rig crew making and breaking connections, the drilling team should be aware of the daily drill string decisions that are tndy cost-effective and those that are merely convenient9>10.As indicated in Figure 3, Conoco shoti by the experiences they documented in West Africal that mrking to improve vendor quality and improving rig operations can deliver big benefhs. Acquire New Inventory When anew API drill string components for future operations, fiere are several mechanical, metallurgic, and dimensional attributes to specify, some of which are addressed adequately by API and some of which can &nefit from enhancement. There are also several components used every day which have no governing API spec~lcation such as heavyweight drill pipe and stabiltirs. These components may need review of the manufacturing design assumptions in addition to many of the API-style materials requirement Shell Expro2 shoti that si~lcant ben<s can be gained by influencing the spectilcation of drill string component proprties required during purchases made for their projects. See Figure 4. For normal weight drill pipe, API adequately addresses several of the most important mechanical and dimensiomd properties. Howver, certain properties for some grades might benefit from more detailed s@lcation by the purchaser. These attributes are &tailed in Table 2 with recommendations for improving the spee~lc attribute. When procuring BHA equipment covered by API (drill collars and drill stem subs), there are again attributes which are ben&lcial to control which are either not addressed or are listed as an optiomd feature by API. A few of these attributes are listed in Table 3. Material toughness is the mechanical property that dews the growth of fatigue cracks and allows the material to sustain a larger crack before it failsll. Higher toughness values in both drill pipe tube and BHA component material can be a very cost-effective investment in extending the fatiWe life of these tools and combating the primary cause for their failure. API does not address the alignment of the BHA bore except through verifying the bore with a M mandrel. The purchaser should ve@ the amount of variation allo~ per the manufacturers specification for the centralization of the bore and the body wall thickness. tis.till. elR more balanced BHA and reduce drilling wbratlons . rOti& a 289

The proactive steps to implement as part of a drill string management plan fall into two major categories: 1. Protecting current inventory 2. Acquiring new inventory Protect the Current Inventory The first step in protwing the current drill string inventory is designing a drill string based upon the requirements of the well. Sound design processes require the consideration of several drilling subsystems to approach an optimum cotilguration. This may include modeling of torque and dr~ casing wear, hydraulics, and hole cleaning performance, among others. The outcome of this work is the set of required string component specifications, both mechanical and dimensiomd. Next, an inspection prq must be provided to verify these specifications are met. Although API is the standard commonly reference~ API provides precious little drill string inspection guidance, leaving cotiion and much misconception. Recent joint-industry efforts have produced the driIl strin design and inspection guideline known as Standard DS-1h . DS-18 allows the user to efficiently address design questions and quickly establish an appropriate inspection program.

SUMMERS,

M. A. AND CRABTREE,

S. R.

IADCISPE -

Although

stress relief features are optional per APL they

and Tube Report for their assistance in mll-ing paper.

data for the

are recommended to rednm fatigue stresses in BHA connections. DS-lm 8 provi&s gui&lines for their use and inspection on most popular BHA connations. API mentions cold mrking of threads as a note to Connection Stress Relief Features, indimting that cold working will improve the conndon @ormance. Athis is a recommended process to inaease the life of the connection that tie purchaser must specify. Bending Strength Ratio (BSR) indicates the relative bending strength of the box versus the pin in a mated connection. Although, API defiies the BSR for the spectilc drill collars detailed in Table 6.1 of API SW. 73 it does not explain what the feature provides. API RP7G5 discusses BSR in more &tail referring to a baland connection as having a 2.501 B~ but de~nding on the anticipated drilling conditions and the size of the equipment, the BSR range may be m~ed. DS-lm 8 provides additi~ guidance on BSR ranges and how they should be a~lied Non-API Equipment As previously mention@ API only addresses the requirements for drill pipe, drill wllars, and chill stem subs. When purchasing equipment such as hea~ight drill pipe or renting one of the other thousands of components (e.g stabilizers, jars, etc.), the manufacturers &sign assumptions, the mwhanical and metallurgical properties of the materiaIs, and the rwommended load capacities must all be considered.

Conclusions 1. Maintaining low drill string failure risk can prove Mlcult

Re~rences 1. SWX R G.: Case History of DriUstem Failurea OfFkhore West tics; SPEDE (Mar& 1992)55 Reduction of North Sea Drillatring 2. HorbeeL J., et al, S~ Failq paper SPE 30348 presented at Offkhore Europe, A5-8 _ber, 1995 Institute Specification 7 Rotary Drill Stem 3. Amtican P-leum Elements, 38* Editiq April 1,1994 4. American Petroleum Institute Specification 5D M Pipe, 3d Editiq August, 1992 5. American Petroleum Institute Recommmded Practice 7G Drill Stem Design and Operating Limits, 15* Editi~ January 1, Pipe sod Tube Rep@ Tdaa, Oklahoma 7. Hill, T. H, et al Designing and QualifyingDrill Strings for E*ded Resch Drilling SPEDC, (Junq1996) 111 8. Standard DS-1, M k Design and Inspection, T H Hill Associates, Inc., Houston, Texas, December, 1992 9. Hill, T. H., et al: A wed Approach to Matem-Failw

~V=tiOU:

1995 6. Preston

SPEDE (Dec. 1992) 254

10.Amoco Drill String Failure Prevention for Rig Teams murse booh 1992 1l.SNq ~ E.: 1s your ~ piw Tough hOUgh? An htroddon to Leak-More-Bresk Conceptfl paper presenti at the 1987

Cdll. Aaan. of Drilling Enginecdn. contractors spring DrillingConferace, Aaan. of Drilling

April.

T. M., br, J. J.: A Major Source of at the SP~

12.Dykstra, M W., -, D.C-K, Warrq Mtig Componmt Maaa Imbalanw Downhole Vibrations, paper p=mted Drilling Confer.mce, 1995

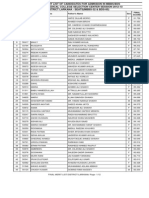

Table 1- Total Drill String Costs

Acquisition* Rental - Contractor /*d Purchase Inspection party Failwe Prevention* Bachp tools Replace / repair worn or rejected tools Corrosion control Engineering and Supetision Maintenance of handling

because of the fact that the controlling fimctions are performed by several Werent disciplines working for different companies and over along timeframe. 2. Win-win relationships are indispensable in su-ssful string management. drill

3.

The average cost of a drill string failure tends to increase in exploratory drilling projects. Improving drill string inspection practices and handling during rig operations can help protect the drill string components currently in inventory, Several cost-effective enhancements can be made to drill string purchase specifications to improve the performance of the tools as compared to API minimum requirements.

F*ing Losse& ~ Mobilizing replacement

4.

Ieq uipment

Hole Related unscheduled evente I I

5.

I Equipment replacement

I *Also include all coats related to rig delays, logistics, travel, material, and servica in each category.

Acknowledgements

The authors wish to thank Amoco Corporation BFTG Drilling for their support in the &velopment of this paper. Mso, thanks to OGCI Management, Inc. and The Preston Pipe

290

..

.. .

., . .. .

.-

... ..

lADC/SPE393=

DRILL STRING MANAGEMENT

TO REDUCE DRILLING RISKS

Figure 2- Loat Time Due to Drill String F~lurea Figure 1- 5-in Drill Pipe Sold per Year

So.rcmWmRPCw-T&, 18 u ~ @ g srl Ag % C4 ~z so s 14 42 10 OK 120

Exploration

vs. Development

~ls

-1+Expl.

-n

I

o o

60 100 160 Hours zoo Lost 2s0 300

Figure 3-

Conoco

- West

Mca

Psa l~dkn

Figure 4- Shell Expro - UK North

Sea

- Drill String Failure Reductions SPE W8 (HUH, d *

fss2 Failure Cost per Yesr Failures per 10,000 ft Mstoff per Failure ratio @umuHve

.Mstoffs

$10.4M 0.67 0.s6

4ss4 $1.6 m 0.26 0.36

3avings $13.6 W by 76a q Total failures reduced by 66*A

reduoed

Costtill

6*II

cost

FailuresMl

6*II

Failwee

Table 2-

Drill Pi~

Attributes

API Requiremetis I by Grads G-1 05 NR m 87% s-1 35 NR m 87% ~+ I Recommended All Gradea See N&e 2 (SSS N~e 1) See Note 3

Material Mribute Internal Ups Length Miu (min.-in.) (fi-lbs)

E-75 2 NR 87%

x-95 NR m 87 h

Charpy Impact T-

Tube Body Wall Thickness (min.-%)

291

SUMMERS,

M. A. AND CRABTREE,

S. R.

lADC/SPE 39325

Table 2 Notes: 1 Wile API does not require Charpy Impad Testing to be performed on grade E-75 drill pipe, it does have a protision for an agrmment b~een the purchaser and manufacturer for the material to be testd and meet the same requirements as the other grades covered in API SpW. 5D4. The recommendation of = ft-lbe or greater for all grades can typically be accompliWed very costeffectiwly and further efiends the life expectancy of the drill pipe. API does not address the minimum upm~ery). The purchaser should require recommendation for the best combination upset to internal surface intersection, for the length for any grade higher than E-75 (This is a minor that the manufacturer provide a technically suppotied of internal upset length and corresponding radii for the specific Aze and weight of drill pipe being purchased.

Minimum tube wall thickness can be reduced by as much as 12% % from nominal Men new. This allows for only an additional 7 A % of wall reduction before the pipe is downgraded to API Cla= 2 at The purchaser might consider tightening the minimum wall thicheee ~ wall remaining. specification to a value greater than 87 % % to extend the life of the pipe as API Premium Class.

Table 3Soiiy

BHA Attributes

API Requirement N& Addressed Not Addressed

Material Toughnm (Charpy impa~ Test) Bore Centralization

,

Conn*ion i Stress Relief Features Thread Cold Working Bending Strength Ratio O@onal Mentioned - No Reqt Mentioned - No Reqt I

292

You might also like

- How To Run and Cement Liners Part 1Document6 pagesHow To Run and Cement Liners Part 1bagus918No ratings yet

- Merit List Larkana Mbbs 20012Document0 pagesMerit List Larkana Mbbs 20012Rashid Ali SheikhNo ratings yet

- 3 - End of TubingDocument9 pages3 - End of TubingRashid Ali SheikhNo ratings yet

- Drilling Fluids SelectionDocument16 pagesDrilling Fluids SelectionRashid Ali SheikhNo ratings yet

- 00039325Document6 pages00039325Rashid Ali SheikhNo ratings yet

- 00039325Document6 pages00039325Rashid Ali SheikhNo ratings yet

- 00039325Document6 pages00039325Rashid Ali SheikhNo ratings yet

- Production Forecasts: Rashid Ali ShaikhDocument7 pagesProduction Forecasts: Rashid Ali ShaikhRashid Ali SheikhNo ratings yet

- Chapter 3: Reservoir DrivesDocument14 pagesChapter 3: Reservoir Drivesardie rayNo ratings yet

- 00039325Document6 pages00039325Rashid Ali SheikhNo ratings yet

- Oil & Gas DirectoryDocument35 pagesOil & Gas DirectoryRashid Ali SheikhNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)