Professional Documents

Culture Documents

2009 A-1 Class Notes

2009 A-1 Class Notes

Uploaded by

asadmir600Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2009 A-1 Class Notes

2009 A-1 Class Notes

Uploaded by

asadmir600Copyright:

Available Formats

Becker CPA Review Auditing 1 Class Notes AUDITING 1 CLASS NOTES Welcome to Auditing and Attestation.

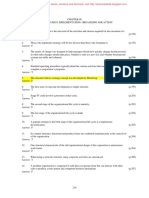

. The Auditing and Attestation section covers knowledge of procedures, standards, and skills related to auditing and other attestation engagements. This is the longest section of the CPA exam, comprising 4.5 hours, and it tends to require a bit of memorization. Many students find flashcards helpful in this regard. The exam is comprised of both multiple choice questions (70%) and simulations (condensed case studies, 30%). The simulations will include a written communication component that will account for 10% of the total exam score (or one third of the simulation score). There will be three multiple choice testlets (typically 30 questions each) and two simulations on each exam. The AICPA Content Specification Outline for Auditing breaks the exam down as follows: 1. Planning (22%-28%) 2. Consideration of internal control (12%-18%) 3. Obtaining and documenting audit evidence (32%-38%) 4. Reviewing the engagement (8%-12%) 5. Reporting (12%-18%) Auditing 1 includes the following information: I. AUDITING AND AUDITING STANDARDS A. You must know the definition of an audit and that it is the independent auditor's responsibility to perform the audit. The audit provides crucial credibility to management's financial statements. 1. An auditor must perform the audit under the umbrella of a Professional Code of Conduct, adhering to GAAS (TIP PIE ACDO) and applying professional skepticism. a. There are different standards that have to be followed depending on the type of engagement being performed. These standards are also referred to explicitly in the appropriate reports.

2. 3. 4. 5. 6. B.

GAAS: auditing standards GAGAS: government auditing standards Public Company Oversight Board (PCAOB) Standards: apply to "issuers" Statements on Standards for Attestation Engagements Statements on Standards for Accounting and Review Services

You must commit to memory the Generally Accepted Auditing Standards. These specifically deal with the performance of an audit. The mnemonic TIP PIE ACDO is the easiest way to remember them. You also must know if a particular standard is a general standard, a fieldwork standard, or a reporting standard. You must memorize word for word the standard auditor's report (an "unqualified" opinion). Note: Due to Sarbanes-Oxley, there is a slight modification to the exact language of the scope paragraph for reports on issuers. PCAOB standards are referenced instead of auditing standards generally accepted in the U.S.

C.

1

2009 DeVry/Becker Educational Development Corp. All rights reserved.

Becker CPA Review Auditing 1 Class Notes 1. The three paragraphs in the standard report are distinct and separate: Introductory Paragraph States what service is being performed and defines management's responsibilities versus the auditor's responsibilities. Scope Paragraph Explains what the service entails, and refers to the correct professional standards. Opinion Paragraph States the auditor's opinion regarding fair presentation of the financial statements. D. You must commit to memory the different types of opinions that can be rendered in the performance of an audit. 1. 2. Unqualified (clean) report, or standard opinion Modified unqualified report (adding explanatory language) a. b. c. d. e. 3. Division of responsibility Necessary and justified departure from GAAP Going concern Emphasis of a matter (auditor's sole decision) Justified lack of consistency

(The other three are less frequently tested.) Qualified report a. b. Qualified report due to a material GAAP departure: management failed to follow GAAP in the preparation of the FS or required footnotes. Qualified report due to a material GAAS issue: the auditor cannot determine an amount or a methodology, or sufficient evidence did not exist for the auditor to be able to form a conclusion.

4. E.

Disclaimer of opinion: no opinion is expressed.

You must understand which situations require the unqualified report to be modified--this is crucial to your passing the exam. The modification is solely dependent upon the circumstances posed by the examiners. You must understand which paragraphs are modified (i.e., wording is changed), or whether paragraphs are added or eliminated. Note: The bulk of the language in the standard report typically remains constant, so a good starting point is the complete memorization of that report.

F.

G.

You must have an understanding regarding how materiality may affect the type of report (i.e., qualified vs. adverse, or qualified vs. disclaimer). You must also understand the situations that give rise to a modified unqualified opinion. The next items appear on the exam with less frequency than the items covered above. 1. Unaudited Financial Statements Be aware of the responsibilities of the auditor if his/her name is associated with unaudited financial statements. 2. Reports on Comparative Financial Statements a. The report relates to two years, which must be clearly denoted within the report.

H.

2

2009 DeVry/Becker Educational Development Corp. All rights reserved.

Becker CPA Review Auditing 1 Class Notes b. c. 3. The examiners occasionally ask about issuing different opinions between the two years, or about updating an opinion from the previous year. Be aware of the issues occurring when a predecessor auditor is involved in the prior year report.

Other Items You should have a basic understanding of the auditor's responsibility with respect to each of the following items. a. b. c. d. e. f. g. Reporting on other information accompanying the FS in a client-prepared document. Required supplementary information. Segment information. Auditor-submitted documents. Condensed FS. Selected financial data. Reports on the application of accounting principles.

I.

You must know the definition of subsequent events and whether they would be considered Type I or Type II events. The auditor needs to differentiate between the two in order to determine whether management's treatment was appropriate (i.e., adjustment to the financial statements or footnote disclosure?). Be aware of the responsibilities of the auditor when facts are subsequently discovered that existed at the balance sheet date, or when an omitted audit procedure is discovered. 1. 2. If management fails to make the necessary disclosures and revisions, the auditor must advise the public. If the auditor has failed to properly perform the audit, then: a. b. The auditor should determine if another audit procedure took the place of the omitted procedure. If the missing procedure was necessary to support the opinion and no other procedures compensated for it, then the omitted audit procedure or an appropriate alternative should be performed. If the auditor can no longer support the opinion, appropriate disclosure must be made, starting with management.

J.

c. K. L.

Know what report modifications might be necessary when reporting on FS prepared for use in other countries. The appendix labeled "House of GAAP" provides a good understanding of the different levels of authority and guidance that exist and the hierarchy of those concepts, pronouncements, and literature. (A general review of this material should provide adequate preparation for the exam.)

3

2009 DeVry/Becker Educational Development Corp. All rights reserved.

You might also like

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5813)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Chapter 6 - Expenditure Cycle Part 2Document17 pagesChapter 6 - Expenditure Cycle Part 2Ryan Jay BanaoNo ratings yet

- Hall 5e TB Ch07Document19 pagesHall 5e TB Ch07Zerjo CantalejoNo ratings yet

- CH 11Document15 pagesCH 11Czarina CasallaNo ratings yet

- CH 10Document15 pagesCH 10Czarina CasallaNo ratings yet

- CH 06Document15 pagesCH 06Czarina CasallaNo ratings yet

- CH 09Document16 pagesCH 09Czarina CasallaNo ratings yet

- CH 07Document16 pagesCH 07Czarina CasallaNo ratings yet

- CH 04Document15 pagesCH 04Czarina CasallaNo ratings yet

- Chapt-14 Withholding TaxDocument3 pagesChapt-14 Withholding Taxhumnarvios100% (2)

- 2009 F-2 Class Notes PDFDocument3 pages2009 F-2 Class Notes PDFCzarina CasallaNo ratings yet

- At at 1st Preboard Oct08Document12 pagesAt at 1st Preboard Oct08Czarina CasallaNo ratings yet

- Doing Business in The Philippines 12 20 12Document22 pagesDoing Business in The Philippines 12 20 12jhienellNo ratings yet