Professional Documents

Culture Documents

Corporate Level Strategy

Corporate Level Strategy

Uploaded by

jamnaeemOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Corporate Level Strategy

Corporate Level Strategy

Uploaded by

jamnaeemCopyright:

Available Formats

CORPORATE-LEVEL STRATEGY THREE KEY ISSUES FACING THE CORPORATION THE FIRMS ORIENTATION TOWARD GROWTH, STABI LITY,

AND RETRENCHMENT (Directional Strategy) THE INDUSTRIES OR MARKETS IN WHICH THE FIRM COMPETES (Portfolio Strategy) THE MANNER IN WHICH MANAGEMENT COORDINAT ES ACTIVITIES AND TRANSFERS RESOURCES AND CULTIVATES CAPABILITIES AMONG PRODUCT LINES AND BUSINESS UNITS (Parenting Strategy) Corporate headquarters must play t he parent as it deals with its various lines of business (children).

CORPORATE GROWTH STRATEGIES CONCENTRATION 1. HORIZONTAL INTEGRATION GEOGRAPHIC EXPANSION Local, Regional, National, Global INCREASING THE RANGE OF PRODUCTS and/or SERVICES 2. VERTICAL INTEGRATION BACKWARD Long-Term Contracts Quasi-integration Tapered Integration Full Integration

FORWARD DIVERSIFICATION 1. CONCENTRIC Related 2. CONGLOMERATE Unrelated

GROWTH-ENTRY STRATEGIES DOMESTIC ENTRY INTERNAL DEVELOPMENT & EXPANSION EXTERNAL ACQUISITIONS & MERGERS STRATEGIC ALLIANCES & PARTNERSHIPS Licensing, Franchises, Joint Ventures INTERNA TIONAL ENTRY EXPORTING LICENSING FRANCHISING JOINT VENTURES ACQUISITIONS GREEN-FIELD DEVELOPM ENT PRODUCTION SHARING TURNKEY OPERATIONS MANAGEMENT CONTRACTS

WHEN ARE GROWTH STRATEGIES LOGICAL? COMPETITIVE POSITION WEAK RAPID REFORMULATE HORIZ & VERTICAL INTEGRATION DIVERSIFICATION SELL-OUT/DIV EST STRONG HORIZONTAL INTEGRATION VERTICAL INTEGRATION CONCENTRIC DIVERSIFICATIO N INTERNATIONAL EXPANSION DIVERSIFICATION ABANDONMENT SLOW JOINT VENTURE ---------------------------------------------------------------------------------MARKET GROWTH RATE --------------------------------------------DIVERSIFICATION CAPTIVE FIRM/MERGE

WHEN IS DIVERSIFICATION LOGICAL? DONT DIVERSIFY UNLESS SYNERGY IS ACHIEVED SHAREHOLDER VALUE IS BUILT CONCENTRIC DIVERSIFICATION FINDING A SYNERGISTIC FIT Marketing Operations Management MERGING THE FUNCTIONS CONGLOMERATE DIVERSIFICATION FIND FIRMS WHOSE ASSETS ARE U NDERVALUED FIND FIRMS THAT ARE FINANCIALLY DISTRESSED FIND FIRMS WITH BRIGHT PRO SPECTS BUT ARE SHORT ON $$$

CONGLOMERATE (UNRELATED) DIVERSIFICATION PROS 1--BUSINESS RISK IS SCATTERED OVER MANY INDUSTRIES 2--CAN INVEST CAPITAL IN WHAT EVER OFFERS THE BEST PROFIT PROSPECTS 3--PROFITABILITY IS MORE STABLE BECAUSE HA RD TIMES IN ONE INDUSTRY CAN BE PARTIALLY OFFSET BY GOOD TIMES IN ANOTHER 4--IF CORPORATE MANAGERS ARE GOOD AT SPOTTING BARGAIN-PRICED FIRMS WITH BIG UPSIDE PRO FIT POTENTIAL, SHAREHOLDER WEALTH WILL BE ENHANCED CONS 1--TOP MANAGEMENT COMPETENCE Can they tell a good acquisition from a bad one? Can they select good managers t o run each business? Do they know what to do if a business unit stumbles? 2--DIVERSIFICATION DOES NOTHING TO ENHANCE THE COMPETITIVE STRENGTH OF INDIVIDUA L BUSINESS UNITS Each business unit is on it own No corporate synergy can be ach ieved 3--ARE THE FIRMS PROFITS MORE STABLE? Do the up and down cycles cancel out? 4 --HOW MUCH DIVERSITY CAN THE FIRM MANAGE SUCCESSFULLY? How broad should our port folio be?

COMBINATION DIVERSIFICATION STRATEGIES ONE MAJOR CORE BUSINESS With a modest diversified portfolio (1/3 or less) NARROWL Y DIVERSIFIED With a few (2-5) related core business units With a few (2-5) unrela ted business units BROADLY DIVERSIFIED With many related business units With many business units in mostly unrelated industries A MULTI-BUSINESS FIRM With several unrelated groups of related businesses

POST-DIVERSIFICATION STRATEGIES MAKE NEW ACQUISITIONS Related or Unrelated? DIVEST SOME BUSINESS UNITS Poor Perf ormers? Poor Strategic Fit? RESTRUCTURE THE WHOLE PORTFOLIO NARROW THE DIVERSIFICA TION BASE BECOME A DIVERSIFIED MULTINATIONAL, MULTI-INDUSTRY COMPANY (DMNC)

CORPORATE STABILITY STRATEGIES PROFIT Keep milking the cow, but dont feed it Artificially supporting profits by cu tting costs Keeping up appearances that everything is still OK A temporary strat egy for a worsening environment PAUSE Consolidate after recent rapid growth A te mporary strategy to catch your breath PROCEED WITH CAUTION Environment looks scaryw ait to see what happens NO-CHANGE A very predictable environmentnothing uncertain ever happens Why tamper with success? What firms did before WalMart came

CORPORATE RETRENCHMENT STRATEGIES OFTEN TRIGGERED BY DISAPPOINTING PERFORMANCE ECONOMIC DOWNTURN EXCESSIVE DEBT ILL-CHOSEN ACQUISITIO NS TURNAROUND Help subsidiaries become profitable Belt-tightening and consolidation CAPTIVE COMPANY Give up independence for securitysell mostly to one large customer angel Can scale back on some functions, like marketing SELL-OUT/DIVEST Sell the entire operation to someone as an ongoing business Divest a healthy fir m that doesnt fit our portfolioor a low-producing business LIQUIDATION The last resortno one wants to buy the entire business The assets are worth more than the businessso theyre sold piece by piece

EVALUATING DIVERSIFIED PORTFOLIOS THE BCG GROWTH-SHARE MATRIX (Boston Consulting Group) DIMENSIONS Industry Growth Rate Compared to GDP Relative Market Share Uses ratio s instead of absolute market shares CLASSIFICATIONS Question Marks (or Problem C hildren or Wildcats) Stars Cows Dogs ADVANTAGES & IMPLICATIONS It is quantifiabl e and easy to use Easy to remember terms and their meaning when referring to bus iness units Assumes large market shares => economies of scale => cost leadership Each business unit moves across the matrix in predictable ways over time Focuse s attention on cash flows and needs

WEAKNESSES IN THE BCG GROWTH-SHARE MATRIX TOO SIMPLISTICIT ONLY HAS A FOUR-CELL MATRIX WHERE DO AVERAGE BUSINESSES BELONG? PR EJUDICIAL CLASSIFICATION SCHEME DOGS & PROBLEM CHILDREN v. STARS & COWSVERY BIASE D TERMS THE TRENDS & MOVEMENTS OF THESE UNITS SEEM MORE IMPORTANT IS HIGH INDUST RY GROWTH ALWAYS GOOD? DOES HIGH MARKET SHARE ALWAYS MEAN HIGH PROFITABILITY? FI RMS CAN LOSE MONEY WHILE HOLDING A LARGE MARKET SHARE LOW-SHARE BUSINESSES CAN A LSO BE PROFITABLE ONLY CONSIDERS RELATIONSHIP TO THE MARKET LEADERWHILE OTHERS AR E IGNORED WHAT ABOUT SMALL COMPETITORS WITH FAST-GROWING MARKET SHARES? GROWTH R ATE IS ONLY ONE ASPECT OF INDUSTRY ATTRACTIVENESS MARKET SHARE IS ONLY ONE ASPEC T OF OVERALL COMPETITIVE POSITION

THE BCG GROWTH-SHARE MATRIX RELATIVE MARKET SHARE HIGH 1.0 LOW --------------------------------------------HIGH STARS QUESTION MARKS INDUSTRY GROWTH RATE 1.0 --------------------------------------------COWS LOW DOGS --------------------------------------------RELATIVE MARKET SHARE Your market share divided by largest rivals share INDUSTRY GROWTH RATE Industry growth percentage compared to GDP SIZE OF CIRCLES The signi ficance (revenues) of each SBU to the firm

THE GE BUSINESS SCREEN THE INDUSTRY ATTRACTIVENESS / BUSINESS STRENGTH MATRIX TWO DIMENSIONS (McKinsey & Co) Industry Attractiveness MARKET SIZE & GROWTH RATE INDUSTRY PROFITABILITY INTENSITY OF COMPETITION BARRIE RS TO ENTRY / EXIT SEASONALITY / CYCLICALITY TECHNOLOGICAL & PRODUCT CONSIDERATI ONS CAPITAL REQUIREMENTS EMERGING OPPORTUNITIES & THREATS SOCIAL, ENVIRONMENTAL, & POLITICAL FACTORS STRATEGIC FIT WITH OTHER CURRENT LINES OF BUSINESS Business Strength / (Competitive Position) RELATIVE MARKET SHARE RELATIVE PRICE, QUALITY, & SERVICE v. RIVALS PROFIT MARGIN S and COST POSITION v. RIVALS KNOWLEDGE OF CUSTOMERS & MARKETS TECHNOLOGICAL CAP ABILITY & LEADERSHIP FINANCIAL & PHYSICAL RESOURCES CALIBER OF MANAGEMENT & STAF F COMPETENCIES MATCH KEY SUCCESS FACTORS

THE GE BUSINESS SCREEN BUSINESS STRENGTH / COMPETITIVE POSITION STRONG HIGH AVERAGE WEAK ---------------------------------------WINNER WINNER QUESTION MARK LOSER LONG-TERM INDUSTRY AVERAGE ---------------------------------------WINNER ATTRACTIVENESS AVERAGE BUSINESS LOSER ---------------------------------------LOW PROFIT PRODUCER LOSER ---------------------------------------INDIVIDUAL PRODUCT LINES Identified by le tter SIZE OF EACH CIRCLE Represents the total revenues in the industry PIE SLICE S Represents your share of that market

PROS & CONS OF THE GE BUSINESS SCREEN STRENGTHS USES MORE COMPREHENSIVE MEASURES / VARIABLES IN ASSESSING INDUSTRY ATT RACTIVENESS AND BUSINESS STRENGTH / COMPETITIVE POSITION DOESNT LEAD TO AS SIMPLI STIC CONCLUSIONS AS THE BCG GRID NINE CELL APPROACH ALLOWS FOR INTERMEDIATE RANK INGS BETWEEN HIGH/LOW AND STRONG/WEAK STRESSES CHANNELING OF RESOURCES TO AREAS WITH THE GREATEST PROBABILITY OF ACHIEVING COMPETITIVE ADVANTAGE AND SUPERIOR PE RFORMANCE WEAKNESSES PROVIDES NO REAL GUIDANCE ON THE SPECIFICS OF WHAT STRATEGY TO FOLLOW ITS TOO GENERAL CANT SPOT UNITS THAT ARE ABOUT TO BECOME WINNERS BECAUS E THEIR INDUSTRIES ARE ENTERING THE TAKEOFF STAGE USE OF NUMERIC ESTIMATES SEEMS OBJECTIVE, BUT IS REALLY VERY SUBJECTIVE SHOULD THE WEIGHTS & FACTORS USED TO A SSESS INDUSTRY ATTRACTIVENESS AND BUSINESS POSITION BE USED GENERICALLY, OR ADJU STED DEPENDING ON THE INDUSTRY UNDER INVESTIGATION?

THE HOFER LIFE-CYCLE MARKET EVOLUTION MATRIX TWO DIMENSIONS EARLY DEVELOPMENT RAPID GROWTH / TAKE-OFF SHAKE-OUT MATURITY / SA TURATION DECLINE / STAGNATION (Charles Hofer & A. D. Little, Co) Stage of Industry / Market Evolution Business Strength / (Competitive Position) SAME DIMENSIONS AS USED IN THE GE BUSINESS SCREEN ADVANTAGES Can be used to identify and track developing winners Illustrates how the firms bu sinesses are distributed across the stages of industry evolution

THE HOFER LIFE-CYCLE MARKET EVOLUTION MATRIX BUSINESS STRENGTH / COMPETITIVE POSITION STRONG EARLY DEVELOPMENT -----------------------------AVERAGE WEAK -----------------------------STAGE OF INDUSTRY / MARKET RAPID GROWTH / TAKE-OFF -----------------------------SHAKE-OUT EVOLUTION -----------------------------MATURITY / SATURATION ----------------------------DECLINE / STAGNATION -----------------------------ONLY ONE DIMENSION IS DIFFEREN T FROM THE GE BUSINESS SCREEN Except for the Stage of Market Evolution, this mod el is identical to the GE Business Screen

IN SUMMARY: USING PORTFOLIO ANALYSIS PROS AND CONS STRENGTHS ENCOURAGES TOP MANAGEMENT TO EVALUATE EACH LINE OF BUSIN ESS SEPARATELY, AND TO SET OBJECTIVES AND ALLOCATE RESOURCES TO EACH. IT STIMULA TES THE USE OF EXTERNALLY-ORIENTED DATA TO SUPPLEMENT MANAGEMENTS JUDGMENT RAISES THE ISSUE OF CASH FLOW AVAILABILITY FOR USE IN EXPANSION AND GROWTH GRAPHICALLY COMMUNICATES THE MIX OF BUSINESSES THE FIRM HAS INVESTED IN WEAKNESSES DEFINING PRODUCT / MARKET SEGMENTS IS DIFFICULT IT SUGGESTS STANDARD STRATEGIES THAT CAN MISS OPPORTUNITIES OR BE IMPRACTICAL PROVIDES AN ILLUSION OF SCIENTIFIC RIGOR, WHEN POSITIONS ARE REALLY BASED ON SUBJECTIVE JUDGMENTS VALUE-LADEN TERMS (cow, dog) LEAD TO SIMPLISTIC STRATEGIES AND SELF-FULFILLING PROPHESIES ITS NOT ALWAYS CLEAR WHAT MAKES AN INDUSTRY ATTRACTIVE OR WHERE A PRODUCT IS IN ITS LIFE CYCLE NAIVELY FOLLOWING PORTFOLIO PRESCRIPTIONS MAY REDUCE PROFITS DOGS CAN MAKE MONEY !

HOW TO APPLY PORTFOLIOS IN YOUR ANALYSIS THE NON-QUANTITATIVE APPROACH COMPARING INDUSTRY ATTRACTIVENESS ATTRACTIVENESS OF EACH INDUSTRY IN THE PORTFOLIO Is this a good industry for our organization to be in? EACH INDUSTRYS ATTRACTIVENESS RELATIVE TO THE OTHERS Whic h industries are the most / least attractive? ATTRACTIVENRSS OF ALL THE INDUSTRI ES AS A GROUP How appealing is the mix of industries? Is the portfolio a good one? TO DETERMINE INDUSTRY ATTRACTIVENESS 1--USE GE BUSINESS SCREEN METHODOLOGY 2--SUBJECTIVELY CLASSIFY EACH INDUSTRY FAC TOR INTO ONE OF THREE CATEGORIES HIGHLY ATTRACTIVE AVERAGE NOT ATTRACTIVE

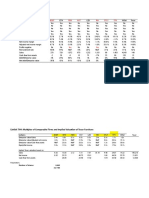

EVALUATING INDUSTRY ATTRACTIVENESS (UNWEIGHTED) INDUSTRY FACTOR MARKET SIZE & GROWTH RATE INDUSTRY PROFITABILITY IN TENSITY OF COMPETITION BARRIERS TO ENTRY/EXIT SEASONALITY/CYCLICALITY TECHNOLOGY & PRODUCT CONSIDERATIONS CAPITAL REQUIREMENTS EMERGING OPPORTUNITIES & THREATS SOCIAL, REGULATORY, & POLITICAL FACTORS STRATEGIC FIT WITH OTHER CURRENT LINES O F BUSINESS CLASSIFIED AS AVERAGE ATTRACTIVE UNATTRACTIVE UNATTRACTIVE AVERAGE AV ERAGE UNATTRACTIVE AVERAGE AVERAGE ATTRACTIVE OVERALL EVALUATION = AVERAGE

EVALUATING INDUSTRY ATTRACTIVENESS (NUMERIC, UNWEIGHTED) ASSIGN A NUMBER TO EACH INDUSTRY FACTOR USING THE FOLLOWING SCHEME UNATTRACTIVE = 0, 1, 2, 3 AVERAGE = 4, 5, 6 ATTRACTIVE = 7, 8, 9, 10 -------------------------------------------------------------INDUSTRY FACTOR ASSIGNED NUMB ER MARKET SIZE & GROWTH RATE INDUSTRY PROFITABILITY INTENSITY OF COMPETITION BAR RIERS TO ENTRY/EXIT SEASONALITY/CYCLICALITY TECHNOLOGY & PRODUCT CONSIDERATIONS CAPITAL REQUIREMENTS EMERGING OPPORTUNITIES & THREATS SOCIAL, REGULATORY, & POLI TICAL FACTORS STRATEGIC FIT WITH OTHER LINES OF BUSINESS 6 9 2 3 6 5 1 5 4 8 OVERALL EVALUATION = 49/10 = 4.9 = AVERAGE

EVALUATING INDUSTRY ATTRACTIVENESS (NUMERIC, WEIGHTED) 1--ASSIGN WEIGHTS TO EACH INDUSTRY FACTOR (Must add up to 100%) 2--THEN ASSIGN N UMBERS TO EACH FACTOR USING THE FOLLOWING SCHEME UNATTRACTIVE = 0 - 3 AVERAGE = 4 - 6 ATTRACTIVE = 7 - 10 3--MULTIPLY WEIGHTS BY NUMBERS TO DETERMINE THE WEIGHTE D SCORE -----------------------------------------------------------WEIGHT INDUSTRY FACTO R ASSIGNED NUMBER .10 .10 .15 .05 .05 .08 .12 .10 .10 .15 MARKET SIZE & GROWTH RATE INDUSTRY PROFITABILITY INTENSITY OF COMPETITION BARRIE RS TO ENTRY/EXIT SEASONALITY/CYCLICALITY TECHNOLOGY & PRODUCT CONSIDERATIONS CAP ITAL REQUIREMENTS EMERGING OPPORTUNITIES & THREATS SOCIAL, REGULATORY, & POLITIC AL FACTORS STRATEGIC FIT WITH OTHER LINES OF BUSINESS 6 9 2 3 6 5 1 5 4 8 OVERALL EVALUATION = 4.87 = AVERAGE

EVALUATING BUSINESS STRENGTH / COMPETITIVE POSITION (UNWEIGHTED) USE THE FOLLOWING SCHEME TO CLASSIFY EACH BUSINESS STRENGTH FACTOR STRONG AVERAGE WEAK -------------------------------------------------------------BUSINESS STRENGTH FACTOR CLASSIFIED AS OUR RELATIVE MARKET SHARE OUR RELATIVE PRICE v. RIVALS OUR QUALITY & SERVICE v. RIVALS OUR RELATIVE COST POSITION v. RIVALS OUR PROFIT MARGINS v. RIVALS KNOWLED GE OF CUSTOMERS & MARKETS TECHNOLOGICAL CAPABILITY / LEADERSHIP FINANCIAL & PHYS ICAL RESOURCES CALIBER OF MANAGEMENT & STAFF COMPETENCIES MATCH KEY SUCCESS FACT ORS STRONG AVERAGE AVERAGE STRONG STRONG AVERAGE WEAK AVERAGE STRONG AVERAGE OVERALL EVALUATION = AVERAGE to STRONG

EVALUATING COMPETITIVE BUSINESS STRENGTH (NUMERIC, UNWEIGHTED) ASSIGN NUMBERS TO EACH BUSINESS STRENGTH FACTOR USE THE FOLLOWING WEAK = 0, 1, 2, 3 AVERAGE = 4, 5, 6 STRONG = 7, 8, 9, 10 --------------------------------------------------------------ASSIGNED NUMBER IN DUSTRY FACTOR RELATIVE MARKET SHARE RELATIVE PRICE v. RIVALS QUALITY & SERVICE v . RIVALS RELATIVE COST POSITION v. RIVALS PROFIT MARGINS v. RIVALS KNOWLEDGE OF CUSTOMERS & MARKETS TECHNOLOGICAL CAPABILITY & LEADERSHIP FINANCIAL & PHYSICAL R ESOURCES CALIBER OF MANAGEMENT & STAFF COMPETENCIES MATCH KEY SUCCESS FACTORS 7 5 6 8 8 5 2 4 8 6 OVERALL EVALUATION = 59/10 = 5.9 = AVERAGE

EVALUATING COMPETITIVE BUSINESS STRENGTH (NUMERIC, WEIGHTED) 1--ASSIGN WEIGHTS TO EACH COMPETITIVE FACTOR (Must add up to 100%) 2--THEN ASSIG N NUMBERS TO EACH FACTOR USING THE FOLLOWING SCHEME WEAK = (0 3) AVERAGE = (4 6) STRONG = (7 10) 3--MULTIPLY WEIGHTS BY NUMBERS TO DETERMINE THE WEIGHTED SCORE -----------------------------------------------------------WEIGHT COMPETITIVE BU SINESS STRENGTH ASSIGNED NUMBER .08 .08 .15 .12 .06 .15 .05 .10 .06 .15 RELATIVE MARKET SHARE RELATIVE PRICE v. RIVALS QUALITY & SERVICE v. RIVALS RELAT IVE COST POSTION v. RIVALS PROFIT MARGINS v. RIVALS KNOWLEDGE OF CUSTOMERS & MAR KETS TECHNOLOGICAL CAPABILITY / LEADERSHIP FINANCIAL & PHYSICAL RESOURCES CALIBE R OF MANAGEMENT & STAFF COMPETENCIES MATCH KEY SUCCESS FACTORS 7 5 6 8 8 5 2 4 8 6 OVERALL EVALUATION = 5.93 = AVERAGE

COMPARING BUSINESS UNIT PERFORMANCE WHICH BUSINESS UNITS HAVE THE BEST/WORST PERFORMANCE? ASSESS THE TRENDS RE: Sale s Growth Profit Growth Contribution to Company Earnings Return on Capital Invest ed in the Business (ROA) Cash Flow Generated STRATEGIC FIT ANALYSIS STRATEGIC AT TRACTIVENESS Does this business have cost-sharing or skills-transfer opportuniti es? FINANCIAL ATTRACTIVENESS Does this business contribute to corporate performa nce objectives? RANK THE BUSINESS UNITS ON INVESTMENT PRIORITY Which units shoul d get the highest priority regarding financial support?

COMPARING BUSINESS UNIT PERFORMANCE A SIMPLE EXAMPLE UNIT A UNIT B UNIT C UNIT D SALES GROWTH GROWTH IN PROFITS CONTRIBUTION TO CORP EARNINGS (Omit 000s) RETURN ON ASSETS GENERATED CASH FLOWS (Omit 000s) .018 .032 $ 70 .072 $234 .068 .062 $554 .124 $611 .102 .103 $ 29 .088 $ 28 .071 .044 $237 .096 $342 STRATEGICALLY ATTRACTIVE FINANCIALLY ATTRACTIVE INVESTMENT PRIORITY No Yes 4 Yes Yes 1 Yes No 2 No Yes 3

CRAFTING A CORPORATE STRATEGY BY EVALUATING YOUR PORTFOLIO MATRIX 1. 2. 3. 4. 5. 6. 7. 8. DOES THE PORTFOLIO HAVE ENOUGH BUSINESSES IN ATTRACTIVE INDUSTRIES? DOES THE POR TFOLIO CONTAIN TOO MANY MARGINAL BUSINESSES OR QUESTION MARKS? DOES THE CORPORAT ION HAVE ENOUGH CASH COWS TO FINANCE THE STARS AND EMERGING WINNERS? DO THE CORE BUSINESSES GENERATE DEPENDABLE PROFITS OR CASH FLOWS? IS THE PORTFOLIO VULNERAB LE TO SEASONAL OR RECESSIONARY INFLUENCES? DOES THE PORTFOLIO CONTAIN BUSINESSES THAT THE CORPORATION DOESNT NEED TO BE IN? IS THE CORPORATION BURDENED WITH TOO MANY BUSINESSES IN AVERAGE-TO-WEAK COMPETITIVE POSITIONS? DOES THE MAKEUP OF THE PORTFOLIO PUT THE CORPORATION IN A GOOD POSITION FOR THE FUTURE?

STEPS IN THE STRATEGIC ANALYSIS OF DIVERSIFIED FIRMS A SUMMARY 1. 2. 3. 4. 5. 6. 7. 8. IDENTIFY THE PRESENT CORPORATE STRATEGY CONSTRUCT BUSINESS PORTFOLIO MATRICES PR OFILE THE INDUSTRY AND COMPETITIVE ENVIRONMENT OF EACH BUSINESS UNIT EVALUATE TH E COMPETITIVE STRENGTH OF EACH INDIVIDUAL BUSINESS COMPARE PERFORMANCE RECORDS O F EACH BUSINESS UNIT HOW WELL DOES EACH BUSINESS UNIT FIT WITH CURRENT CORPORATE S TRATEGY? RANK THE UNITS FROM HIGHEST TO LOWEST IN INVESTMENT PRIORITY CRAFT A SE RIES OF MOVES TO IMPROVE OVERALL CORPORATE PERFORMANCE

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5810)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (843)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (346)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Study of Consumer Awareness and Customer Response Towards Reliance LifeDocument46 pagesStudy of Consumer Awareness and Customer Response Towards Reliance Lifehimsimmc67% (3)

- Deed of Extrajudicial SettlementDocument5 pagesDeed of Extrajudicial SettlementConrad BrionesNo ratings yet

- Related Party TransactionDocument7 pagesRelated Party TransactionCasandra WilliamsNo ratings yet

- Corporate Governance and Foreign InvestmentDocument10 pagesCorporate Governance and Foreign InvestmentGagan KauraNo ratings yet

- TECHgium 2019 BrochureDocument8 pagesTECHgium 2019 BrochureSai Praveen Mygapula100% (1)

- Entrepreneur ReportDocument35 pagesEntrepreneur ReportMaryfhel LeyteNo ratings yet

- Teuer B DataDocument41 pagesTeuer B DataAishwary Gupta100% (1)

- Inter-Asia Investment Industries vs. CA, GR No. 125778Document4 pagesInter-Asia Investment Industries vs. CA, GR No. 125778Ronz RoganNo ratings yet

- Usman Nasir Butt: ObjectiveDocument2 pagesUsman Nasir Butt: ObjectiveAnonymous GmsJ7xuGpNo ratings yet

- Chart Income Tax RateDocument4 pagesChart Income Tax RateXela LaurenNo ratings yet

- LTC 013-2014 Reports and Informational Items For Jan 15 2013 CMDocument68 pagesLTC 013-2014 Reports and Informational Items For Jan 15 2013 CMDonPeeblesMIANo ratings yet

- Vadodara Convention Center - PROPOSALDocument125 pagesVadodara Convention Center - PROPOSALanon_87183652967% (3)

- The Story of William Wrigley Jr.-Soap Salesman Who Became The World's Best Gum ManufacturerDocument9 pagesThe Story of William Wrigley Jr.-Soap Salesman Who Became The World's Best Gum ManufacturerRiza VillariasNo ratings yet

- January 2019: Calendar Is Printable and Fully EditableDocument12 pagesJanuary 2019: Calendar Is Printable and Fully EditableDunas SvetlanaNo ratings yet

- Depreciation, ProvisionDocument37 pagesDepreciation, ProvisionSandhyaSharma100% (1)

- Models of Corporate GovernanceDocument25 pagesModels of Corporate Governancevasu aggarwalNo ratings yet

- Pfizer India - A Sales and Distribution AngleDocument10 pagesPfizer India - A Sales and Distribution AngleAroop SanyalNo ratings yet

- Global RPO DirectoryDocument70 pagesGlobal RPO DirectoryajlpodeNo ratings yet

- Clearing-Settlement and Risk Management of BATS at ISLAMABADDocument4 pagesClearing-Settlement and Risk Management of BATS at ISLAMABADhafsa1989No ratings yet

- Thin Capitalisation Rules and TreatiesDocument32 pagesThin Capitalisation Rules and TreatiesKharisma BaptiswanNo ratings yet

- Bakery Business Plan Template ExampleDocument8 pagesBakery Business Plan Template ExampleMuhammad HafizNo ratings yet

- Russ Baker - Bush and The JFK HitDocument93 pagesRuss Baker - Bush and The JFK HitrinaldofrancescaNo ratings yet

- (Visit 4) Maru 180Document42 pages(Visit 4) Maru 180Felipe SarmientoNo ratings yet

- SALN Form 2017 Downloadable Word and PDFDocument2 pagesSALN Form 2017 Downloadable Word and PDFJane Uranza Cadague100% (1)

- Billingstatement - Primo R. JulianesDocument2 pagesBillingstatement - Primo R. JulianesMaria Judith Peña Julianes100% (1)

- Winding Up of CompaniesDocument5 pagesWinding Up of CompaniesDickson Tk Chuma Jr.No ratings yet

- Cendant CorporationDocument7 pagesCendant CorporationMar100% (1)

- Myanmar Alumni Students List (June 15, 2015 Updated)Document8 pagesMyanmar Alumni Students List (June 15, 2015 Updated)nyaungzinNo ratings yet

- Senior Business Analyst Equities in NYC NY Resume Mark MelzlDocument4 pagesSenior Business Analyst Equities in NYC NY Resume Mark MelzlMarkMelzlNo ratings yet

- 1.1. Entrepreneur: 1.1.1. Meaning and Definition of EntrepreneurDocument10 pages1.1. Entrepreneur: 1.1.1. Meaning and Definition of Entrepreneurazam49No ratings yet