Professional Documents

Culture Documents

Portfolio Management

Uploaded by

Sumat Jain0 ratings0% found this document useful (0 votes)

20 views1 pageAutocorrelation

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentAutocorrelation

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

20 views1 pagePortfolio Management

Uploaded by

Sumat JainAutocorrelation

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

Autocorrelation

Definition of 'Autocorrelation'

A mathematical representation of the degree of similarity between a given time series and a lagged version of itself over successive time intervals. It is the same as calculating the correlation between two different time series, except that the same time series is used twice - once in its original form and once lagged one or more time periods. The term can also be referred to as "lagged correlation" or "serial correlation". Read more: http://www.investopedia.com/terms/a/autocorrelation.asp#ixzz2I2aoq8wx

Investopedia explains 'Autocorrelation'

When computed, the resulting number can range from +1 to -1. An autocorrelation of +1 represents perfect positive correlation (i.e. an increase seen in one time series will lead to a proportionate increase in the other time series), while a value of -1 represents perfect negative correlation (i.e. an increase seen in one time series results in a proportionate decrease in the other time series). This value can be useful for computing for security analysis. For example, if you know a stock historically has a high positive autocorrelation value and you witnessed the stock making solid gains over the past several days, you might reasonably expect the movements over the upcoming several days (the leading time series) to match those of the lagging time series and to move upwards. Read more: http://www.investopedia.com/terms/a/autocorrelation.asp#ixzz2I2asXgJK

You might also like

- Econometrics 3Document32 pagesEconometrics 3Anunay ChoudharyNo ratings yet

- BPFT AssignmentDocument12 pagesBPFT AssignmentDUSHYANT MUDGALNo ratings yet

- Forecasting Techniques - Reg AnalysisDocument44 pagesForecasting Techniques - Reg Analysiskamasuke hegdeNo ratings yet

- Notes On Econometrics EstmiationDocument2 pagesNotes On Econometrics EstmiationSolomon AbrahaNo ratings yet

- Financial EconometricsDocument16 pagesFinancial EconometricsVivekNo ratings yet

- Cross Section: Combination Pooled Data HeteroscedasticityDocument17 pagesCross Section: Combination Pooled Data HeteroscedasticityNavyashree B MNo ratings yet

- How The Mathematics of Fractals Can Help Predict Stock Markets Shifts - by Marco TavoraDocument21 pagesHow The Mathematics of Fractals Can Help Predict Stock Markets Shifts - by Marco TavorakecandirNo ratings yet

- AssigmentDocument13 pagesAssigmentSamea Saleh Dar100% (2)

- 2.10 Stationary Time Series-1607080624480Document35 pages2.10 Stationary Time Series-1607080624480ashutosh malhotraNo ratings yet

- Fuzzy Logic: Applying Truth ValuesDocument6 pagesFuzzy Logic: Applying Truth ValuesAditya DeshpandeNo ratings yet

- RSP Assignment: Kush Bansal Bba (Fia) 2A 18344Document22 pagesRSP Assignment: Kush Bansal Bba (Fia) 2A 18344anand negiNo ratings yet

- SSRN Id2759734Document24 pagesSSRN Id2759734teppeiNo ratings yet

- 14.1 - Autoregressive Models: Autocorrelation and Partial AutocorrelationDocument34 pages14.1 - Autoregressive Models: Autocorrelation and Partial Autocorrelationjhoms8No ratings yet

- PTRP Theory by Sahil SirDocument35 pagesPTRP Theory by Sahil SirSadique SheikhNo ratings yet

- Autocorrelation and Validation-UNIT 1-CSDocument16 pagesAutocorrelation and Validation-UNIT 1-CSDhanushreeNo ratings yet

- Binder 1Document33 pagesBinder 1anirban hatiNo ratings yet

- Module - Iv: Advanced Statistical Techniques: Q1. Characteristics of CorrelationDocument9 pagesModule - Iv: Advanced Statistical Techniques: Q1. Characteristics of CorrelationAfreenNo ratings yet

- Regression Diagnostics: Testing The Assumptions of Linear RegressionDocument7 pagesRegression Diagnostics: Testing The Assumptions of Linear RegressionsenarathnaNo ratings yet

- Two Stage Fama MacbethDocument5 pagesTwo Stage Fama Macbethkty21joy100% (1)

- SV AssertionsDocument8 pagesSV AssertionsSam HoneyNo ratings yet

- Systemverilog Assertions Tutorial: Pass StatementDocument11 pagesSystemverilog Assertions Tutorial: Pass StatementMansor HelaleNo ratings yet

- Name: Adewole Oreoluwa Adesina Matric. No.: RUN/ACC/19/8261 Course Code: Eco 307Document13 pagesName: Adewole Oreoluwa Adesina Matric. No.: RUN/ACC/19/8261 Course Code: Eco 307oreoluwa adewoleNo ratings yet

- Chapter 11 Solutions Solution Manual Introductory Econometrics For FinanceDocument4 pagesChapter 11 Solutions Solution Manual Introductory Econometrics For FinanceNazim Uddin MahmudNo ratings yet

- Econometrics Year 3 EcoDocument185 pagesEconometrics Year 3 Ecoantoinette MWANAKASALANo ratings yet

- Relative Frequency of A Class : MeanDocument5 pagesRelative Frequency of A Class : MeanMinahil KhanNo ratings yet

- 003-Forecasting Techniques DetailedDocument20 pages003-Forecasting Techniques DetailedJahanzaib ButtNo ratings yet

- Using CorrelationDocument5 pagesUsing CorrelationTradingSystemNo ratings yet

- Dow Jones Industrial Average Is A Time SeriesDocument4 pagesDow Jones Industrial Average Is A Time SeriesHoàng AnnhNo ratings yet

- Panel DataDocument5 pagesPanel Datasaeed meo100% (2)

- Assertion NotesDocument9 pagesAssertion NotesDebabrato BanikNo ratings yet

- Kirill IlinskiDocument19 pagesKirill IlinskiLeyti DiengNo ratings yet

- RegressionDocument14 pagesRegressionreduanullah nawshadNo ratings yet

- Time Series Analysis in Python With StatsmodelsDocument8 pagesTime Series Analysis in Python With StatsmodelsChong Hoo ChuahNo ratings yet

- Multiple Regression AnalysisDocument6 pagesMultiple Regression AnalysisSKH100% (7)

- A Review of L and Extensions: InvitedpaperDocument34 pagesA Review of L and Extensions: InvitedpaperallinacNo ratings yet

- Ecotrix Ecotrix: B.A. Economics (Hons.) (University of Delhi) B.A. Economics (Hons.) (University of Delhi)Document18 pagesEcotrix Ecotrix: B.A. Economics (Hons.) (University of Delhi) B.A. Economics (Hons.) (University of Delhi)Taruna BajajNo ratings yet

- 7.1 Regression Building RelationshipsDocument44 pages7.1 Regression Building RelationshipsQuỳnh Anh NguyễnNo ratings yet

- Unit3 3.1 Regression:: Causal Effect RelationshipDocument39 pagesUnit3 3.1 Regression:: Causal Effect RelationshipT ShrinnityaNo ratings yet

- Confidence Intervals On The Reliability of Repairable SystemsDocument9 pagesConfidence Intervals On The Reliability of Repairable SystemsMariut Elena LarisaNo ratings yet

- Dissertation Cox RegressionDocument5 pagesDissertation Cox RegressionWhitePaperWritingServicesCanada100% (1)

- RegressionDocument3 pagesRegressionaraceliNo ratings yet

- ECON3206 - Tutorial 4 - FelipeDocument19 pagesECON3206 - Tutorial 4 - FelipeAntonio DwNo ratings yet

- Time Series AnalysisDocument10 pagesTime Series AnalysisJayson VillezaNo ratings yet

- Estimation and Testing For Arch and GarchDocument9 pagesEstimation and Testing For Arch and GarchKhalid LatifNo ratings yet

- Cross CorrelationDocument10 pagesCross Correlationisabella343No ratings yet

- A Century of Generalized Momentum From Flexible Asset Allocations (FAA) To Elastic Asset Allocation (EAA)Document32 pagesA Century of Generalized Momentum From Flexible Asset Allocations (FAA) To Elastic Asset Allocation (EAA)doncalpeNo ratings yet

- NPTEL Course: Course Title: Security Analysis and Portfolio Management Course Coordinator: Dr. Jitendra MahakudDocument8 pagesNPTEL Course: Course Title: Security Analysis and Portfolio Management Course Coordinator: Dr. Jitendra MahakudAnkit ChawlaNo ratings yet

- Chapter 5Document25 pagesChapter 5Yohaannis BaayisaaNo ratings yet

- Time Series PennDocument67 pagesTime Series PennVishnu Prakash SinghNo ratings yet

- Latent Variable: JUNE 7, 2018Document5 pagesLatent Variable: JUNE 7, 2018Bhudev Kumar SahuNo ratings yet

- Automatic Stance Detection: By: Abhinav Kumar JhaDocument24 pagesAutomatic Stance Detection: By: Abhinav Kumar Jhaaggunna sai tejaNo ratings yet

- spss10 LOGITDocument17 pagesspss10 LOGITDebarati Das GuptaNo ratings yet

- W6 - L6 - Multiple Linear RegressionDocument3 pagesW6 - L6 - Multiple Linear RegressionRubasree JaishankarNo ratings yet

- StatisticsDocument743 pagesStatisticsmunish_tiwari2007100% (1)

- FsadfaDocument10 pagesFsadfaLethal11No ratings yet

- Systems Dependability Assessment: Modeling with Graphs and Finite State AutomataFrom EverandSystems Dependability Assessment: Modeling with Graphs and Finite State AutomataNo ratings yet

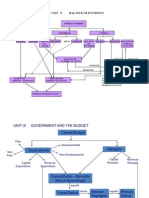

- Decision Support System in ManagementDocument64 pagesDecision Support System in ManagementSumat JainNo ratings yet

- Nehru Yuva Kendra Sangathan (NYKS) An IntroductionDocument24 pagesNehru Yuva Kendra Sangathan (NYKS) An IntroductionSumat JainNo ratings yet

- Investment Planning For Young InvestorsDocument143 pagesInvestment Planning For Young InvestorsSumat JainNo ratings yet

- Financial Education For School ChildrenDocument140 pagesFinancial Education For School ChildrenSumat Jain100% (1)

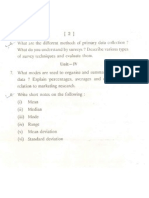

- Marketing Research & Consumer Behaviour 2Document1 pageMarketing Research & Consumer Behaviour 2Sumat JainNo ratings yet

- Accounting & Financial Management 2013 JuneDocument3 pagesAccounting & Financial Management 2013 JuneSumat JainNo ratings yet

- 2003 Accouting& Financial ManagmentDocument2 pages2003 Accouting& Financial ManagmentSumat JainNo ratings yet

- 2003 Accouting& Financial ManagmentDocument2 pages2003 Accouting& Financial ManagmentSumat JainNo ratings yet

- J 17 12 (Management)Document16 pagesJ 17 12 (Management)Sumat JainNo ratings yet

- Utd QP Accounting & Financial ManagementDocument17 pagesUtd QP Accounting & Financial ManagementSumat JainNo ratings yet

- New Microsoft Office Power Point PresentationFDocument3 pagesNew Microsoft Office Power Point PresentationFSumat JainNo ratings yet

- Fca - Paper 2002Document3 pagesFca - Paper 2002Sumat JainNo ratings yet

- Bank Service ChargeDocument35 pagesBank Service ChargeSumat JainNo ratings yet

- BPS11Document47 pagesBPS11Sumat JainNo ratings yet