Professional Documents

Culture Documents

Grayslake D46 Tonwhall Meeting Presentation 1/16/2013

Uploaded by

Lennie JarrattOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Grayslake D46 Tonwhall Meeting Presentation 1/16/2013

Uploaded by

Lennie JarrattCopyright:

Available Formats

For Our Childrens Future Grayslake District 46 Teacher Strike Townhall

Distressed Sales in D46

D46 Top 10 Highest Paid

Fiscal Year 2011

Name TRS Compensation Years Service Position

Geier Mathis Patrick Holm Williams Jeschke Roberts Kocher Schweizer Welter

$ 87,578 $ 87,578 $ 88,659 $ 89,041 $ 89,041 $ 89,041 $ 91,637 $ 94,514 $ 94,514 $ 101,528

6 22 25 27 33 28 21 30 38 31

English as a Second Language Language Arts Social Worker Elementary Self Contained Elementary Self Contained Social Worker Title I Remedial Reading Art General Social Studies Physical Education

D46 Top 10 Adminstrators

Fiscal Year 2011

Name TRS Compensation Years Service

Correll Morgan Detweiler Schoenberg Barkley Keer Knapp Smith Santelle Danielewicz

$ 170,844 $ 104,404 $ 102,561 $ 100,612 $ 97,380 $ 96,098 $ 95,108 $ 95,108 $ 86,647 $ 81,810

21 19 22 15 15 11 13 14 21 11

D46 Top 10 Retirees

Fiscal Year 2012

Name Pension Years Service Agency

Anderson, Kurtis G Davis, Charles A Miller, James J Koski, Mary H Smyth, Edna M Pivonka, Joe J Anderson, Ellen Eliza Welter, John W VanEs, Lorna J Mastejulia, Joann I

$180,966 $105,757 $100,482 $99,164 $79,822 $74,883 $73,198 $72,039 $71,346 $70,470

38 34 35 35 43 33 36 33 34 35

TRS TRS TRS TRS TRS TRS TRS TRS TRS TRS

D46 Teacher Scattergram

Step 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 off Total BA 0 10 4 9 7 3 BA 16 1 1 1 2 4 1 2 BA 24 BA 32 2 3 BA 8 1 2 1 1 3 MA 0 MA 16 MA 24 MA 32 MA 8 2 2 1 3 1 4 1 1 1 9 1 1 2 12 1 3 9 5 2 5 13 2 3 1 6 4 1 8 1 5 4 3 5 4 4 1 3 10 1 8 4 9 4 1 5 3 2 1 1 2 2 1 3 2 1 1 11 1 3 3 1 off Grand total 16 17 18 23 30 22 21 22 22 8 23 23 10 8 12 8 43 326 4.9% 5.2% 5.5% 7.1% 9.2% 6.7% 6.4% 6.7% 6.7% 2.5% 7.1% 7.1% 3.1% 2.5% 3.7% 2.5% 13.2 %

2 1

1 2 1

33 10.1%

14 4.3%

5 1.5%

9 2.8%

8 90 2.5% 27.6%

31 9.5%

10 55 3.1% 16.9%

43 28 43 8.6% 13.2%

Proposed Teacher Contract Framework

Year 1

Salary Range* 0 47,500 47,501 - 65,000 65,001 80,000 > 80,000 Salary Increase 0.5% 0.0% 0.0% 0.0%

Year 2

Salary Increase 1.0% 0.5% 0.0% 0.0%

Year 3

Salary Increase 2.0% 1.0% 0.5% 0.0%

Year 4

Salary Increase 3.0% 2.0% 1.0% 0.5%

Year 5

Salary Increase 3.0% 2.0% 1.0% 1.0%

Degree Masters Ph. D.

Bonus ** 2% 2%

No end of career salary increases above the normal raises everyone gets No salary schedule ** Bonus - Ont time payment that does not become part of the ongoing salary

How do we pay for these raises?

1. Increased State Aid due to Tax Levy Freeze 2. End the End of Career Salary Bumps 3. Healthcare Insurance Bids

Levy Freeze Helps District

Estimated actual tax revenues from an increase would be $750K District will hit* their O&M (Operations and Maintenance) cap this year District will hit* the Education fund cap next year With the tax levy increase, there will be a $1.4 million deficit next year Without a levy increase: 2014 $1,024,000 deficit, 2015 $189,000 surplus, 2016 $1,400,000 surplus** *Hitting the cap means the district cannot levy any monies above this rate cap limit. **The surpluses are due to the affect of a frozen levy and the continued dropping in EAV (Equallized Assessed Value) being placed into the General State Aid formula.

End of Career Salary Bump Affect

Year Retirement Announced Year 1 End of Career Bump Year 2 End of Career Bump Year 3 End of Career Bump Final Salary (Year 4) $ $ $ $ $ 75,000.00 79,500.00 84,270.00 89,326.20 94,685.77 71,014.33

Retirement (75%) $

10 Things You Probably Dont Know About IL State Pensions

1. 2. 3. 4. 5. 6. 7. 8. 9. 10. Taxpayers have contributed more, not less, than the 1995 Fifty year pension funding law required Since 2001 taxpayers have contributed 230% more than teachers to the Teachers Retirement System Less than 1% of state retirees worked 40 years The supposedly modest average state pensions are worth 4 times Social Security State retirees have used more than 132,000 years of sick-leave credit to receive extra pension without actually having to work for it Over 44,000 retirees have annual pensions greater than their total contributions over their entire career The reason TRS pension liability is so high is because teachers are paid more compared to adjoining states If IL teachers had the same salary and pension schedule as Wisconsin we would save more than $4 billion/yr. enough to make the annual pension payment If the pension rules in effect in 1970 when the Pension Guarantee was added to the state constitution were still in effect there would be no unfunded pension liability Teachers unions have given IL politicians of both parties more than $50 million in contributions since 1995

Healthcare Insurance Options

(District has been advised of potential savings here for at least 5 years)

Competitive Bid Estimates already presented to the board shows savings of $300,000 year 1 and up to $5,000,000 over 3 5 years Self Insure Savings estimates of $100,000+ year 1 and over $1,000,000 per year in 2 3 years

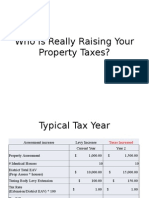

Who is Really Raising Your Property Taxes?

Who is Raising Your Taxes?

Assessment Levy Taxes

Typical Tax Year

Assessment increase Levy Increase Current Year Property Assessment # Identical Houses District Total EAV (Prop Assess * houses) Taxing Body Levy Extension Tax Rate (Extension/District EAV) * 100 Tax Bill (Prop Assess * Tax Rate)/100 $ $ $ $ $ 1,000.00 10 10,000.00 100.00 1.00 10.00 $ $ $ $ $ Taxes Increased Year 2 1,500.00 10 15,000.00 150.00 1.00 15.00

Assessment Increase Does NOT Increase Taxes

Assessment Increase Levy Unchanged Current Year Property Assessment # Identical Houses District Total EAV (Prop Assess * houses) Taxing Body Levy Extension Tax Rate (Extension/District EAV) * 100 Tax Bill (Prop Assess * Tax Rate)/100 $ $ $ $ $ 1,000.00 10 10,000.00 100.00 1.00 10.00 $ $ $ $ $ Taxes Unchanged Year 2 1,500.00 10 15,000.00 100.00 0.67 10.00

Lower Assessment Does NOT Lower Taxes

Assessment Decrease Levy Unchanged Current Year Property Assessment # Identical Houses District Total EAV (Prop Assess * houses) Taxing Body Levy Extension Tax Rate (Extension/District EAV) * 100 Tax Bill (Prop Assess * Tax Rate)/100 $ $ $ $ 1,000.00 10 10,000.00 100.00 1.00 $ $ $ $ Taxes Unchanged Year 2 500.00 10 5,000.00 100.00 2.00

10.00

10.00

Levy Increase Raises Taxes

Assessment Unchanged Levy Increased Current Year Property Assessment # Identical Houses District Total EAV (Prop Assess * houses) Taxing Body Levy Extension Tax Rate (Extension/District EAV) * 100 Tax Bill (Prop Assess * Tax Rate)/100 $ $ $ $ 1,000.00 10 10,000.00 100.00 1.00 $ $ $ $ Taxes Increased Year 2 1,000.00 10 10,000.00 150.00 1.50

10.00

15.00

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Michelle Obama's ThesisDocument98 pagesMichelle Obama's ThesissechNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Due Process Lawsuit Against UC-Irvine by Student Accused of RapeDocument42 pagesDue Process Lawsuit Against UC-Irvine by Student Accused of RapeThe College FixNo ratings yet

- Who Is Really Raising Your Property TaxesDocument6 pagesWho Is Really Raising Your Property TaxesLennie JarrattNo ratings yet

- Illinois Revenue Nov 2014Document6 pagesIllinois Revenue Nov 2014Lennie JarrattNo ratings yet

- 2012 ILGOP PlatformDocument14 pages2012 ILGOP PlatformLennie JarrattNo ratings yet

- Credible Vs No NcredibleDocument2 pagesCredible Vs No NcredibleBorela MoniqueNo ratings yet

- SS LawDocument10 pagesSS LawJoshua LanzonNo ratings yet

- FOP Letters Regarding IPRADocument30 pagesFOP Letters Regarding IPRAThe Daily LineNo ratings yet

- Office of The Sangguniang BarangayDocument3 pagesOffice of The Sangguniang BarangayelyssNo ratings yet

- Integrated Marketing CommunicationDocument133 pagesIntegrated Marketing CommunicationMariaAngelicaMargenApeNo ratings yet

- Erwin Tulfo Vs PeopleDocument3 pagesErwin Tulfo Vs PeopleanonNo ratings yet

- In Re Petition Martin NGDocument2 pagesIn Re Petition Martin NGshirlyn cuyongNo ratings yet

- Doj Circular 98Document1 pageDoj Circular 98Arbie Reyes100% (1)

- CCP Subject GuideDocument300 pagesCCP Subject GuideLessons In LawNo ratings yet

- Civil Service Reform in VietnamDocument4 pagesCivil Service Reform in VietnamphanvanquyetNo ratings yet

- Aggravating Circumstances ReportDocument19 pagesAggravating Circumstances ReportApril Yang100% (3)

- Fraser - Rethinking The Public SphereDocument26 pagesFraser - Rethinking The Public SpherePat PowerNo ratings yet

- Anarfi V Arthur: Division: Date: BeforeDocument3 pagesAnarfi V Arthur: Division: Date: BeforeSelwyn Spencer SackeyNo ratings yet

- Uganda Law Society V Attorney General of The Republic of Uganda (Constitutional Petition No 18 of 2005) 2006 UGSC 10 (30 January 2006)Document133 pagesUganda Law Society V Attorney General of The Republic of Uganda (Constitutional Petition No 18 of 2005) 2006 UGSC 10 (30 January 2006)khallatinum100% (1)

- Administrative Law CasesDocument186 pagesAdministrative Law CasesRL RecoNo ratings yet

- Law Course For CBP Officers (13th Edition, 2004) (Excerpts)Document8 pagesLaw Course For CBP Officers (13th Edition, 2004) (Excerpts)J CoxNo ratings yet

- Barrioquinto vs. FernandezDocument2 pagesBarrioquinto vs. FernandezIrene RamiloNo ratings yet

- Nolose Albert RaleshomeDocument14 pagesNolose Albert RaleshomeainasafiaNo ratings yet

- Bajaj TheoryDocument5 pagesBajaj TheoryNikhil IngaleNo ratings yet

- (U) Daily Activity Report: Marshall DistrictDocument5 pages(U) Daily Activity Report: Marshall DistrictFauquier NowNo ratings yet

- Go Vs PeopleDocument10 pagesGo Vs PeopleMaricel Caranto FriasNo ratings yet

- Mil Position PaperDocument3 pagesMil Position PaperBenedict riveraNo ratings yet

- Criminal Law NotesDocument7 pagesCriminal Law NotesAlvin PateresNo ratings yet

- Unit 4: Disast Er Risk Reduction An D ManagementDocument13 pagesUnit 4: Disast Er Risk Reduction An D ManagementMelanie GirayNo ratings yet

- Country Director South Sudan 1.7.2016Document3 pagesCountry Director South Sudan 1.7.2016iihaoutreachNo ratings yet

- Rosales Balm105 1Document4 pagesRosales Balm105 1Allyssa Melan RosalesNo ratings yet

- Jurisdiction in Criminal CasesDocument2 pagesJurisdiction in Criminal CaseschiNo ratings yet

- Group Assignment 01Document6 pagesGroup Assignment 01Yathu MathuNo ratings yet

- Batas Pil 1902Document3 pagesBatas Pil 1902RonnieEnggingNo ratings yet