Professional Documents

Culture Documents

Analysis of Annual Report 2009 of TTK Prestige Limited

Uploaded by

Kamil KhanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Analysis of Annual Report 2009 of TTK Prestige Limited

Uploaded by

Kamil KhanCopyright:

Available Formats

TTK PRESTIGE LIMITED

ANALYSIS OF ANNUAL REPORT 2009 OF TTK PRESTIGE LIMITED

Introduction

The TTK Group is an Indian business conglomerate with a presence across several segments of the industry including consumer durables, pharmaceuticals and supplements, bio-medical devices, maps and atlases, consular visa services, virtual assistant services and health care services. The TTK Group was started in 1928 by T. T. Krishnamachari, and is largely owned by the family. The group has revenues of over Rs. 10 billion with a presence across India and several international markets. The group has joint ventures with global corporations such as SSL International, who are the makers of Durex condoms and Dr. Scholl's foot care products. The group is also associated with several charitable and social organizations, such as the TTK Voluntary Blood Bank, the T.T. Ranganathan Clinical Research Foundation (a hospital for alcohol and drug addiction) and TTK Schools for the underprivileged. The TTK Group has been associated with several brands, which are now household names in India, such as: * Brylcreem * Kiwi (shoe polish) * Kohinoor condoms * Prestige pressure cookers * Woodward's gripe water

TTK PRESTIGE LIMITED

It was in the year 1928 that Mr. T.T.Krishnamachari the first finance minister of India founded TTK Prestige Limited one of oldest business houses in the country today. It made its humble beginning as a pressure cooker manufacturing and marketing company and soon rose to attain the status of being the market leader of pressure cookers in India. Through its constant research and product innovations, it offered the most comprehensive range of kitchen ware in the world.TTK attained its leadership status by providing, its customers quality products at an affordable price. It innovated and explored new business categories, all the while retaining its Indianess. Prestige has emerged as a household name and market leader with its unmatchable quality and customer appeal. It has successfully taken a big leap as a one- stop kitchen solutions provider bringing a smile of ease and satisfaction on every Prestige customers face. Prestige have introduced a wide range of Gas stoves, mixer grinders, non-stick cookware, life- style products, hobs, electric

Rohidas Patil Institute Of Management Studies

TTK PRESTIGE LIMITED

chimneys and the latest addition being modular kitchens to become a complete kitchen solution provider. Its products are here to stay with a promise of quality and comfort.

Rohidas Patil Institute Of Management Studies

TTK PRESTIGE LIMITED

BALANCE SHEET As At 31/03/2010 SOURCES OF FUNDS : Share Capital Reserves Total Equity Share Warrants Equity Application Money Total Shareholders Funds Secured Loans Unsecured Loans Total Debt Total Liabilities APPLICATION OF FUNDS : Gross Block Less : Accumulated Depreciation Less:Impairment of Assets Net Block Lease Adjustment Capital Work in Progress Producing Properties Investments Current Assets, Loans & Advances Inventories Sundry Debtors Cash and Bank Loans and Advances Total Current Assets Less : Current Liabilities and Provisions Current Liabilities Provisions Total Current Liabilities Net Current Assets Miscellaneous Expenses not written off Deferred Tax Assets Deferred Tax Liability Net Deferred Tax Total Assets Contingent Liabilities

(Rs in Cr.) 2010/03 2009/03 2008/03 2007/03 2006/03 11.33 112.84 0 0 124.17 0 2.8 2.8 126.97 11.33 73.31 0 0 84.64 17.86 2.84 20.7 105.34 11.33 57.55 0 0 68.88 20.48 26.39 46.87 115.75 11.33 43.77 0 0 55.1 46.92 26.61 73.53 128.63 11.33 35.99 0 0 47.32 46.15 11.1 57.25 104.57

83.49 43.02 0 40.47 0 23.53 0 0.39 61.29 60.26 43.97 42.58 208.1 90.25 52.16 142.41 65.69 0 1.1 4.21 -3.11 126.97 12.54

75.45 39.57 0 35.88 0 23.69 0 0.39 50.31 48.9 10.9 21.32 131.43 59.18 23.73 82.91 48.52 0 1.02 4.16 -3.14 105.34 16.94

67.42 36.09 0 31.33 0 25.28 0 0.39 60.68 47.28 10.64 16.99 135.59 59.18 14.58 73.76 61.83 0 0.82 3.9 -3.08 115.75 14.96

64.24 34.67 0 29.57 0 6.26 0 18.12 73.9 41.32 6.74 17.92 139.88 53.5 8.75 62.25 77.63 0.11 0 3.06 -3.06 128.63 20.99

56.8 32.48 0 24.32 0 0.93 0 18.12 57.29 27.7 9.26 11.55 105.8 39.53 4.77 44.3 61.5 0.23 2.33 2.86 -0.53 104.57 15.08

Rohidas Patil Institute Of Management Studies

TTK PRESTIGE LIMITED

Rohidas Patil Institute Of Management Studies

TTK PRESTIGE LIMITED

PROFIT AND LOSS AS ON 31/09/2010 2010/03 INCOME : Sales Turnover 516.8 Excise Duty 8.86 Net Sales 507.94 Other Income 5.38 Stock Adjustments 5.17 Total Income EXPENDITURE : Raw Materials Power & Fuel Cost Employee Cost Other Manufacturing Expenses Selling and Administration Expenses Miscellaneous Expenses Less: Pre-operative Expenses Capitalised Total Expenditure Operating Profit Interest Gross Profit Depreciation Profit Before Tax Tax Fringe Benefit tax Deferred Tax Reported Net Profit Extraordinary Items Adjusted Net Profit Adjst. below Net Profit P & L Balance brought forward Statutory Appropriations Appropriations P & L Balance carried down Dividend Preference Dividend Equity Dividend % 518.49

2009/03 416.21 14.93 401.28 0.5 -2.62 399.16

2008/03 339.85 14.25 325.6 25.81 -4.01 347.4

(Rs in Cr.) 2007/03 2006/03 293.25 11.85 281.4 0.66 8.65 290.71 231.83 9.93 221.9 0.75 0.22 222.87

269.8 4.91 33.83 6.83 113.02 7.64 0

218.84 4.39 28.98 5.78 96.02 5.39 0

174.9 2.53 25.47 5.51 75.74 25.72 0

161.64 2.92 17.83 4.24 73.28 3.95 0

118.86 2.9 16.54 2.93 57.28 3.85 0

436.03 82.46 3.47 78.99 3.59 75.4 22.99 0 -0.03 52.44 0 52.44 0 0 0 18.44 34 11.32 0 100

359.4 39.76 7.28 32.48 3.48 29 5.99 0.57 0.06 22.38 0 22.38 0 0 0 8.86 13.52 5.66 0 50

309.87 37.53 9.22 28.31 3.84 24.47 2.72 0.45 0.63 20.67 2.81 17.86 0 0 0 20.67 0 3.97 0 35

263.86 26.85 8.05 18.8 2.2 16.6 1.81 0.5 2.52 11.77 -0.07 11.84 0 0 0 11.77 0 3.41 0 30

202.36 20.51 6.62 13.89 1.89 12 0.98 0.36 3.55 7.11 -0.08 7.19 0 0 0 7.11 0 2.83 0 25

Rohidas Patil Institute Of Management Studies

TTK PRESTIGE LIMITED

Earnings Per Share-Unit Curr Earnings Per Share(Adj)-Unit Curr Book Value-Unit Curr

44.62 44.62 107.7

18.91 18.91 72.81

17.64 17.64 58.9

9.88 9.88 45.82

5.92 5.92 38.95

CASH FLOW - TTK Prestige Ltd AS ON 31/03/2010 2010/03 2009/03 Cash Flow Summary Cash and Cash Equivalents at 10.9 10.64 Beginning of the year Net Cash from Operating Activities 61.66 42.83 Net Cash Used in Investing Activities -2.93 -6.09 Net Cash Used in Financing -25.66 -36.48 Activities Net Inc/(Dec) in Cash and Cash 33.07 0.26 Equivalent Cash and Cash Equivalents at End of 43.97 10.9 the year

2008/03 6.74 46.34 -4.11 -38.33 3.9 10.64

( Rs in Cr.) 2007/03 2006/03 9.26 3.97 -12.66 6.17 -2.52 6.74 8.63 21.52 -5.14 -15.75 0.63 9.26

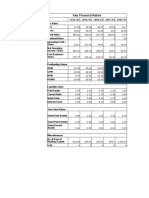

KEY FINANCIAL RATIOS - TTK Prestige Ltd Debt-Equity Ratio has come down to 0.11% from 0.45 %. This is due to company has repaid its entire secured load with cash surplus they had this year. Current ratio has increased to 1.36 in FY10 compare to FY 09 which was 1.27. Which is a good sign. This is due to company able to increase its flow of cash from operations. Bank balances of Company rise to Rs43 cr from 10cr. Interest cover ratio has drastically increased to 22.73 from 4.98 i.e. more than 350%. Again, this is because company has paid its entire secured loan.

2010/03 2009/03 Key Ratios Debt-Equity Ratio Long Term Debt-Equity Ratio Current Ratio Turnover Ratios Fixed Assets Inventory Debtors Interest Cover Ratio ROCE (%) RONW (%) 0.11 0.03 1.36 0.45 0.14 1.27

6.68 9.26 9.47 22.73 69.18 51.28

6.01 7.5 8.65 4.98 33.47 30

Rohidas Patil Institute Of Management Studies

TTK PRESTIGE LIMITED

Increase in Debtors turnover ratio shows the how the company is efficient in managing its debtors. It shows positive growth of 0.82 ROEC Return in equity capital has increased more than 106% compare to FY09. Which show good increase in profit for equity share holders. RONW also increased more than 70%. This is also the reason behind increase in share price in market. DUPONT Analysis - TTK Prestige Ltd 2010/03 2009/03 15.96 9.55 4.07 3.95 The increase in Sales and PBIDT is due to increase in sales volume. PBIDT / Sales has also gone up by 6.41% which indicate company is making good profit on sales. ROE has been increased to 51.28% more than 96% increase. Because company able to increase its sales by 24%, and at the same time there is increase in cash inflow etc.,

PBIDT/Sales(%) Assets Turnover ratio(sales / net assets) PAT/PBIDT(%) Net Assets/Net Worth ROE(%)

63.59 1.04 51.28

56.29 1.28 30

VALUATION RATIOS - TTK Prestige Ltd.

2010/03 2009/03 Price Earning (P/E) Price to Book Value ( P/BV) Price/Cash EPS (P/CEPS) EV/EBIDTA Market Cap/Sales 13.72 5.68 12.81 8.45 1.34 4.8 1.25 4.13 2.84 0.25 P/E ratio has increased to 13.72 when compare to FY09 (4.8). This indicates the investors are paying more for each unit of net income, so the stock is more expensive. A higher P/B ratio implies that investors expect management to create more value from the investment. It increased to 5.68.

Rohidas Patil Institute Of Management Studies

TTK PRESTIGE LIMITED

1. Directors report says that they have lunched new product in market like apple range inner lid pressure cooker, Induction Cook Tops, induction Compatible Pressure Cookers and Cookware etc., but it should be taken into consideration that whether this product will do good in market. Sometimes company makes minor improvements in existing products that make their way into their Annual Report but do not impact the top line as much as it appears at first glance. 2. Report also state that the company there has been threat to the domestic market from the unorganized markets and the regional brands because of their low unviable pricing strategy. But, I personally believe that, unviable pricing strategies are not long term events. In the long run companies that follow it, weather organized or un-organized, will go bankrupt so that is not something to worry about.

3. Sales grew by over 24%. But when we bifurcate sales into domestic and export, Domestic Sales grew 26.4% while exports declined by 20%. -Domestic sales may be increased due to the Government scheme for rural employment guarantee which is creating purchasing power in semi- urban and rural markets and in urban area also. -Export sales have been declined may be due to economic crisis in Middle East and Sri Lanka. 4. The company reports claim that free cash flow has been generated because of better inventory and debtor management which is INCORRECT. Debtors and inventory, it shows, have grown approx 23% & 22% respectively whereas on part of sales and Cost of Goods sold have increased by 24% and 16% respectively i.e. almost same percentage. It seems that increase in operating cash flow has come from increase in Sundry creditors. It seems that the company has outsourced its most of work to third party manufacturers and hence there is big increase in Creditors. But if we deduct the Creditors (29.58cr) the increase in Operating cash flow Rs18.83cr to Rs 61.66 cr from Rs 42.83 cr in Fy09 become miserable & the company has done worse off in terms of operating cash flow. 5. Reports says that company has came up with new outlets namely Prestige Smart Kitchen network but it did not indicate the value of increased stores because in the absence of

Rohidas Patil Institute Of Management Studies

TTK PRESTIGE LIMITED

that one cannot make out whether the numbers are significant or not. Apart from this they have also not mention whether the current outlets are doing well. 6. The Company has paid off its loans and become almost debt free. (good sign) 7. Company wants to go in rental income, but why? when it is generating free cash flow and having better business competitiveness. Investments in Property is always a grey area and instead of trying to secure their main business by entering into rental income business they should raise the cash & either expand their operations in their non cooker segment or Just return the money back to the shareholders. 8. CAPEX: Report Say Company incurred a capital expenditure of around Rs.10cr during the year including investments in the New Unit 2 of Uttarakhand. Main motive behind this may be, Uttarakhand enjoys Excise and Sales Tax benefits. Eventhough there is excess capacity at their current units in South India, it makes sense from the financial and logistics angle to have one unit in North to take care of the demand in North and West. It is great idea.

Rohidas Patil Institute Of Management Studies

You might also like

- Accounts Term PaperDocument86 pagesAccounts Term PaperVikramjit ਮਿਨਹਾਸNo ratings yet

- Balance Sheet (In Crores) - MSN LABORATARIESDocument3 pagesBalance Sheet (In Crores) - MSN LABORATARIESnawazNo ratings yet

- Balance Sheet (All Fig in Crores) : Sources of FundsDocument29 pagesBalance Sheet (All Fig in Crores) : Sources of Fundsaditya_behura4397No ratings yet

- Omaxe 1Document2 pagesOmaxe 1Shreemat PattajoshiNo ratings yet

- Indian Oil Corporation LTDDocument50 pagesIndian Oil Corporation LTDpriyankagrawal7No ratings yet

- United Breweries Holdings LimitedDocument7 pagesUnited Breweries Holdings Limitedsalini sasiNo ratings yet

- Key Financial RatiosDocument16 pagesKey Financial Ratioskriss2coolNo ratings yet

- 32 - Akshita - Sun Pharmaceuticals Industries.Document36 pages32 - Akshita - Sun Pharmaceuticals Industries.rajat_singlaNo ratings yet

- Du Pont AnalysisDocument5 pagesDu Pont Analysisbhavani67% (3)

- Ramco Cements StandaloneDocument13 pagesRamco Cements StandaloneTao LoheNo ratings yet

- Analysis of Working CapitalDocument7 pagesAnalysis of Working CapitalAzfar KawosaNo ratings yet

- 12 - Ishan Aggarwal - Shreyans Industries Ltd.Document11 pages12 - Ishan Aggarwal - Shreyans Industries Ltd.rajat_singlaNo ratings yet

- Arvind LTD: Balance Sheet Consolidated (Rs in CRS.)Document8 pagesArvind LTD: Balance Sheet Consolidated (Rs in CRS.)Sumit GuptaNo ratings yet

- Balance Sheet: Sources of FundsDocument7 pagesBalance Sheet: Sources of FundsAvanti GampaNo ratings yet

- Company Info - Print FinancialsDocument2 pagesCompany Info - Print Financialsmohan raj100% (1)

- Bav Projection and Valuation ReportDocument19 pagesBav Projection and Valuation ReportRishiNo ratings yet

- Term Paper Sandeep Anurag GautamDocument13 pagesTerm Paper Sandeep Anurag GautamRohit JainNo ratings yet

- 2 - Aditya - Balaji TelefilmsDocument12 pages2 - Aditya - Balaji Telefilmsrajat_singlaNo ratings yet

- AhujaDocument7 pagesAhujaShashikant Pandit RajnikantNo ratings yet

- Kalindee Rail Nirman: Balance SheetDocument9 pagesKalindee Rail Nirman: Balance Sheetrajat_singlaNo ratings yet

- Balance Sheet of Empee DistilleriesDocument4 pagesBalance Sheet of Empee DistilleriesArun PandiyanNo ratings yet

- Birla CableDocument4 pagesBirla Cablejanam shahNo ratings yet

- AMULDocument22 pagesAMULsurprise MFNo ratings yet

- Common Sized Balance Sheet As at 31st December, 2018: Acc LimitedDocument6 pagesCommon Sized Balance Sheet As at 31st December, 2018: Acc LimitedVandita KhudiaNo ratings yet

- Fsa Colgate - AssignmentDocument8 pagesFsa Colgate - AssignmentTeena ChandwaniNo ratings yet

- Year Latest 2017 2016 2015 2014 2013 2012 2011 2010 2009 Key RatiosDocument11 pagesYear Latest 2017 2016 2015 2014 2013 2012 2011 2010 2009 Key Ratiospriyanshu14No ratings yet

- FM Varsity Main-Model Chapter-4Document8 pagesFM Varsity Main-Model Chapter-4AnasNo ratings yet

- Britannia Industries LTDDocument4 pagesBritannia Industries LTDMEENU MARY MATHEWS RCBSNo ratings yet

- Trent LTD Ratio Analysis Excel Shivam JhaDocument6 pagesTrent LTD Ratio Analysis Excel Shivam JhaVandit BatlaNo ratings yet

- Surajit SahaDocument30 pagesSurajit SahaAgneesh DuttaNo ratings yet

- Name of The Company Balance Sheet: Mar '08 Mar '09 Sources of FundsDocument6 pagesName of The Company Balance Sheet: Mar '08 Mar '09 Sources of FundsNarendran KishoreNo ratings yet

- Analysis of Financial StatementsDocument7 pagesAnalysis of Financial StatementsGlen ValereenNo ratings yet

- This Is An Open Book Examination. 2. Attempt Any Four Out of Six Questions. 3. All Questions Carry Equal MarksDocument32 pagesThis Is An Open Book Examination. 2. Attempt Any Four Out of Six Questions. 3. All Questions Carry Equal MarksSukanya Shridhar 1 9 9 0 3 5No ratings yet

- Coca-Cola Co: FinancialsDocument6 pagesCoca-Cola Co: FinancialsSibghaNo ratings yet

- Balance Sheet - in Rs. Cr.Document3 pagesBalance Sheet - in Rs. Cr.jelsiya100% (1)

- Financial Analysis (HAL) FinalDocument22 pagesFinancial Analysis (HAL) FinalAbhishek SoniNo ratings yet

- FSA-Case Study QuestionDocument2 pagesFSA-Case Study QuestionaKSHAT sHARMANo ratings yet

- UltraTech Financial Statement - Ratio AnalysisDocument11 pagesUltraTech Financial Statement - Ratio AnalysisYen HoangNo ratings yet

- Relaxo Footwear - Updated BSDocument54 pagesRelaxo Footwear - Updated BSRonakk MoondraNo ratings yet

- P & L A/C Sanghicement Amt. %: IncomeDocument5 pagesP & L A/C Sanghicement Amt. %: IncomeMansi VyasNo ratings yet

- Walchandnagar Industries LTD: Industry:Engineering - Heavy - General - LargeDocument24 pagesWalchandnagar Industries LTD: Industry:Engineering - Heavy - General - LargearpanmajumderNo ratings yet

- Sourses of Funds: Balance Sheet 2010 2009Document4 pagesSourses of Funds: Balance Sheet 2010 2009Deven PipaliaNo ratings yet

- Binani Cement LTD Profit and Loss A/c: Mar '06 Mar '07 IncomeDocument8 pagesBinani Cement LTD Profit and Loss A/c: Mar '06 Mar '07 IncomemrupaniNo ratings yet

- Arch PharmalabsDocument6 pagesArch PharmalabsChandan VirmaniNo ratings yet

- 29 - Tej Inder - Bharti AirtelDocument14 pages29 - Tej Inder - Bharti Airtelrajat_singlaNo ratings yet

- Annual Accounts 2021Document11 pagesAnnual Accounts 2021Shehzad QureshiNo ratings yet

- Term Paper OF Accounting For Managers ON Ashoak Leyland: Lovely Professional UniversityDocument9 pagesTerm Paper OF Accounting For Managers ON Ashoak Leyland: Lovely Professional Universitymanpreet1415No ratings yet

- Assignment On Analysis of Annual Report ofDocument9 pagesAssignment On Analysis of Annual Report oflalagopgapangamdas100% (1)

- Eveready Industries India Balance Sheet - in Rs. Cr.Document5 pagesEveready Industries India Balance Sheet - in Rs. Cr.Jb SinghaNo ratings yet

- Caterpillar IndicadoresDocument24 pagesCaterpillar IndicadoresChris Fernandes De Matos BarbosaNo ratings yet

- Sagar CementsDocument33 pagesSagar Cementssarbjeetk21No ratings yet

- Financial Modelling AssignmentDocument24 pagesFinancial Modelling Assignmentaditiyab-pgdm-2022-24No ratings yet

- Profit and Loss Account of Akzo NobelDocument15 pagesProfit and Loss Account of Akzo NobelKaizad DadrewallaNo ratings yet

- Mehran Sugar Mills - Six Years Financial Review at A GlanceDocument3 pagesMehran Sugar Mills - Six Years Financial Review at A GlanceUmair ChandaNo ratings yet

- Sec A - Group 5 - GCPL - Final ProjectDocument36 pagesSec A - Group 5 - GCPL - Final ProjectDhruv GandhiNo ratings yet

- Statement of Profit and LossDocument10 pagesStatement of Profit and Losspallavi thakurNo ratings yet

- Company Info - Print FinancialsDocument2 pagesCompany Info - Print FinancialsregelNo ratings yet

- Asian PaintsDocument40 pagesAsian PaintsHemendra GuptaNo ratings yet