Professional Documents

Culture Documents

Fin 3060-Financial Statements

Uploaded by

api-204976604Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Fin 3060-Financial Statements

Uploaded by

api-204976604Copyright:

Available Formats

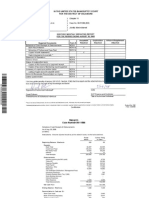

Balance Sheet for a College Student 1-Jan-13 ASSETS Monetary Assets Cash on hand Savings account Checking account

Tax refund due Total Monetary Assets Tangible Assets Personal Property Automobile Total Tangible Assets Investment Assets Bonds Mutual Fund Life insurance cash value Total Investment Assets Total Assets LIABILITIES Short-Term Liabilities Utilities bill due Electricity bill due Total Short-Term Liabilities Long-Term Liabilities Student Loans Total Long-Term Liabilities Total Liabilities Net Worth Total Liabilities and Net Worth 13153 $13,153 $13,278 $2,500 $15,778 83.36% 83.36% 84.16% 15.84% 100% 35 90 $125 0.22% 0.57% 0.79% 350 400 500 $1,250 $15,778 2.22% 2.54% 3.17% 7.92% 100% 600 12000 $12,600 3.80% 76.06% 79.86% 250 675 435 568 $1,928 1.58% 4.28% 2.76% 3.60% 12.22%

Cash Flow Statement for a College Student Jan 1, 2012-Dec 31, 2012 Income Salary Interest and Dividends Scholarships Gifts Tax refunds Total Income Expenditures Fixed Expenses Life Insurance Premiums Emergency fund savings Federal Income Taxes State Income Taxes City Income Taxes Social Security Taxes Total Fixed Expenses Variable Expenses Food Utilities Gasoline and Maintenance Medicines Clothing and Upkeep Church Gifts Personal Allowance Total Variable Expenses Total Expenses Surplus (Deficit) 1040 324 780 75 2300 1170 450 600 $6,739 $13,095 $1,730 7.02% 2.19% 5.26% 0.51% 15.51% 7.89% 3.04% 4.05% 45.46% 88.33% 11.67% 2400 540 1673 620 234 889 $6,356 16.19% 3.64% 11.28% 4.18% 1.58% 6% 42.87% 11700 65 2150 760 150 $14,825 78.92% 0.44% 14.50% 5.13% 1.01% 100%

Ratios Liquidity Ratio: $1928/$1235= 1.56 ratio Use this ratio to determine the number of months you could continue to meet your expenses using only monetary assets if income stops coming in. Asset-to-Debt Ratio: Compares total assets with total liabilities $15778/$13278=1.19 ratio

Debt Service-to-Income Ratio: $0/$14825= 0% View of total debt by comparing dollars spent on gross annual debt repayments with gross annual income. Debt Payments-to-Disposable Income Ratio: $0/$950.75= 0% Divides monthly disposable personal income into monthly debt repayments. Investment Assets-to-Total Assets Ratio: $1250/$15778= .079 or 7.9% Compares the value of investment assets to total assets.

You might also like

- East Coast Yachts KeyDocument8 pagesEast Coast Yachts Keyreddevil911100% (1)

- Personnel Budget CalculatorDocument4 pagesPersonnel Budget Calculatorapi-270519701No ratings yet

- Fy 15 FinalDocument2 pagesFy 15 Finalapi-308778314No ratings yet

- New Microsoft Office Excel WorksheetDocument3 pagesNew Microsoft Office Excel WorksheetMostakNo ratings yet

- Presupuesto FamiliarbDocument10 pagesPresupuesto FamiliarbmmauryfgNo ratings yet

- Financial StatementsDocument3 pagesFinancial Statementsapi-277627174No ratings yet

- Smoker Deterding Fin 3060 Balance SheetDocument2 pagesSmoker Deterding Fin 3060 Balance Sheetapi-295101123No ratings yet

- Financial Statement ProjectDocument4 pagesFinancial Statement Projectapi-280546867No ratings yet

- CAT ValuationDocument231 pagesCAT ValuationMichael CheungNo ratings yet

- 2012/2013 % of Budget Revenue FundraisingDocument1 page2012/2013 % of Budget Revenue FundraisingSandie BarrieNo ratings yet

- Financial Statements ActivityDocument3 pagesFinancial Statements Activityapi-293914084No ratings yet

- AT&T Vs MegafonDocument18 pagesAT&T Vs MegafonMikhay IstratiyNo ratings yet

- 2013 Tax RatesDocument4 pages2013 Tax Ratesapi-241405153No ratings yet

- Balance Sheet - in Rs. Cr.Document9 pagesBalance Sheet - in Rs. Cr.Ashwin KumarNo ratings yet

- Examining Financial StatementsDocument6 pagesExamining Financial StatementsSandy K. AtchisonNo ratings yet

- Financial RatiosDocument1 pageFinancial RatiosAbhishek RampalNo ratings yet

- Ratio AnalysisDocument13 pagesRatio AnalysisGaurav PoddarNo ratings yet

- Dunkin Brands 2015 CaseDocument24 pagesDunkin Brands 2015 CaseAna rose Arobo100% (2)

- Ratios PrblmsDocument13 pagesRatios PrblmsAbraz KhanNo ratings yet

- Fin3320 Proj Fa14 HersaltreDocument9 pagesFin3320 Proj Fa14 Hersaltreapi-290544848No ratings yet

- Pay SlipDocument50 pagesPay SlipSushil Shrestha100% (1)

- Fin 3060 IncomestatementDocument2 pagesFin 3060 Incomestatementapi-295008203No ratings yet

- Personal Finance 1st Edition Walker Solutions ManualDocument22 pagesPersonal Finance 1st Edition Walker Solutions Manualischiummargrave80ep100% (33)

- FMDocument233 pagesFMparika khannaNo ratings yet

- IB Merger ModelDocument12 pagesIB Merger Modelkirihara95100% (1)

- Metabolic AcidosisDocument16 pagesMetabolic Acidosisloglesb1No ratings yet

- General Fund Expenditures by Object and StaffingDocument15 pagesGeneral Fund Expenditures by Object and StaffingStatesman JournalNo ratings yet

- BudgetDocument5 pagesBudgetlep1191No ratings yet

- Financial Analysis K-ElectricDocument7 pagesFinancial Analysis K-ElectricFightclub ErNo ratings yet

- Financial Modeling-A Valuation Model of Boeing Co.Document49 pagesFinancial Modeling-A Valuation Model of Boeing Co.Shahid AliNo ratings yet

- FY 2014 Budget Status Final CorrectedDocument74 pagesFY 2014 Budget Status Final Correctedted_nesiNo ratings yet

- 2015 Brackets & Planning Limits (Janney)Document5 pages2015 Brackets & Planning Limits (Janney)John CortapassoNo ratings yet

- Financial RatioDocument12 pagesFinancial RatiomannavantNo ratings yet

- Boeing: I. Market InformationDocument20 pagesBoeing: I. Market InformationJames ParkNo ratings yet

- IIMB Term1 PGP Chapter1Document33 pagesIIMB Term1 PGP Chapter1vinitgNo ratings yet

- Financial PlanningDocument26 pagesFinancial PlanningKevinVdKNo ratings yet

- Lauri Petersen-Fin101-Brother and Sister Hopeful Starting Personal Monthly BudgetDocument6 pagesLauri Petersen-Fin101-Brother and Sister Hopeful Starting Personal Monthly Budgetapi-326207838No ratings yet

- Financial StatementsDocument4 pagesFinancial Statementsapi-277587862100% (1)

- Sample Individual Income Statement & Balance SheetDocument2 pagesSample Individual Income Statement & Balance Sheetsaorabh13No ratings yet

- Sales: Proforma Income StatementDocument2 pagesSales: Proforma Income StatementIshpal SinghNo ratings yet

- CF Roll No. 12046Document24 pagesCF Roll No. 12046Shilpa GiriNo ratings yet

- Financial Forecasting: SIFE Lakehead 2009Document7 pagesFinancial Forecasting: SIFE Lakehead 2009Marius AngaraNo ratings yet

- GPPSS 2012-13 Financial State of The District - FINALDocument18 pagesGPPSS 2012-13 Financial State of The District - FINALBrendan WalshNo ratings yet

- 10000006490Document17 pages10000006490Chapter 11 DocketsNo ratings yet

- Money Mangement Planner: 595 Market Street, 16th Floor San Francisco, CA 94105Document8 pagesMoney Mangement Planner: 595 Market Street, 16th Floor San Francisco, CA 94105ambuenaflorNo ratings yet

- Hindustan Unilever LTD.: Trend AnalysisDocument7 pagesHindustan Unilever LTD.: Trend AnalysisAnkitaBansalNo ratings yet

- Financial Statements ActivityDocument6 pagesFinancial Statements Activityapi-277584859No ratings yet

- Analysis of Financial StatementsDocument36 pagesAnalysis of Financial StatementsHery PrambudiNo ratings yet

- Budget Planner DemoDocument11 pagesBudget Planner DemoMartin GargiuloNo ratings yet

- Local Youth Group: ? HEJ HI? /?IJ HIE #H 7J H I7F 7A 2008-2012Document19 pagesLocal Youth Group: ? HEJ HI? /?IJ HIE #H 7J H I7F 7A 2008-2012Rushbh PatilNo ratings yet

- North Dakota Revenue News June 2014Document4 pagesNorth Dakota Revenue News June 2014Rob PortNo ratings yet

- Full Fin 3330 Revisions FinalDocument17 pagesFull Fin 3330 Revisions Finalapi-270660387No ratings yet

- Employee Health Clinic 2017 BOS Work Session 09.14.17Document25 pagesEmployee Health Clinic 2017 BOS Work Session 09.14.17Fauquier NowNo ratings yet

- X5a4 RLDocument1 pageX5a4 RLapi-288228380No ratings yet

- Excel - Financial AnalysisDocument13 pagesExcel - Financial AnalysisHuge EarnNo ratings yet

- Final Assignment BDocument21 pagesFinal Assignment Bapi-292053669No ratings yet

- Final Valuation Report GSDocument8 pagesFinal Valuation Report GSGennadiy SverzhinskiyNo ratings yet

- 2018 HW2 SolutionDocument5 pages2018 HW2 SolutionAhmad Bhatti100% (1)

- J.K. Lasser's 1001 Deductions and Tax Breaks 2024: Your Complete Guide to Everything DeductibleFrom EverandJ.K. Lasser's 1001 Deductions and Tax Breaks 2024: Your Complete Guide to Everything DeductibleNo ratings yet

- J.K. Lasser's 1001 Deductions and Tax Breaks 2023: Your Complete Guide to Everything DeductibleFrom EverandJ.K. Lasser's 1001 Deductions and Tax Breaks 2023: Your Complete Guide to Everything DeductibleNo ratings yet