Professional Documents

Culture Documents

Barclays - The Emerging Markets Quarterly - Vietnam - Sep 2012

Uploaded by

SIVVA2Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Barclays - The Emerging Markets Quarterly - Vietnam - Sep 2012

Uploaded by

SIVVA2Copyright:

Available Formats

Barclays | The Emerging Markets Quarterly

EMERGING ASIA: VIETNAM

Headline risks

Prakriti Sofat +65 6308 3201 prakriti.sofat@barclays.com Concerns about Vietnams banking sector heightened following a report that USD 12bn is needed for recapitalisation We believe policymakers are committed to clean up the banking system clarity on funding the capital needs will be key for investor sentiment

Banking sector concerns have come to the fore recently. We believe the government remains committed to cleaning up the banking sector; however, in the near term, headline risk is high. We expect the balance of payments to remain in surplus allowing FX reserves to rise. Concerns about Vietnams banking sector have come to the fore following the recent report from the Macro-economic Group, a group of independent specialists under the National Assemblys economic committee. The report estimated that the financial system needs a USD12bn capital injection. The report is a recommendation from the independent specialists and is not the view of the National Assemblys economic committee. We have been pointing to the banking sector as a key vulnerability of the sovereign and its credit ratings (see The Emerging Markets Quarterly, December 2011). Although the market regarded the news as a negative, we believe it is important to highlight that, by providing an initial estimate of potential recapitalisation needs, policymakers are showing a commitment to clean up the banking system. We believe clarity on funding these capital needs will be key for investor sentiment. We also think the news should be evaluated in the context of the countrys improving FX reserves and restructuring plans for state-owned enterprises (SOEs). In June, SBV Governor Binh told the National Assembly bad debts were 10% based on Vietnam accounting standards, up from 6% at the end of 2011 (WSJ). As per Governor Binh, 84% of the bad debts are secured by assets worth up to 130% of the value of the debts. In order to gauge the potential loan losses for the banking system, we undertake a scenario analysis (Figure 1). As an example, if NPLs were 20% and the recovery value 50%, the loan write-off would likely amount to USD14bn, or 10% of GDP. Vietnamese banks had provisions of VND70trn (USD3bn) at March 2012. Assuming that provisions remain the same, in our scenario above, additional funding needs to cover realised loan losses would be USD11bn. Note, all NPLs will not come due at the same time, but will be spread out over time however, most of loans will likely come due over one to two years. Given slow growth in H1 12 and a still-challenging external environment, we believe NPLs in the banking sector are likely to rise further.

Bad debts were10% or USD 13.5bn as of June We undertake a scenario analysis to gauge possible loan write offs Banks have USD 3bn worth of provisions

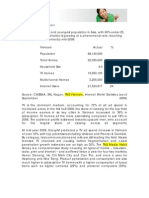

Figure 1: Scenarios for loan write-offs

Bad loans SBV (Vietnam accounting standards) Possible scenario (international accounting standards) 10% 20% 10% NPLs 70% recovery Loan recovery scenarios write off (USD bn) write off (% of GDP) further funding needs to cover realised loan losses (USD bn) (% of GDP)

Source: Barclays Research

VND trn 280 560

USD bn 13.5 27

% of GDP 10 20 20% NPLs

50% recovery

30% recovery

70% recovery

50% recovery

30% recovery

4 3

7 5

9 7

8 6

14 10

19 14

Assuming bank provisions remain at March 2012 level of VND70trn or USD3bn 1 1 4 3 6 4 5 4 11 8 16 12

25 September 2012

94

Barclays | The Emerging Markets Quarterly

We believe policymaker bias is to expedite banking sector consolidation by seeking investment from foreign banks

In terms of financing the loan losses, we believe the bias will be to expedite consolidation in the banking sector by seeking investments from foreign banks. Governor Binh said that increasing foreign ownership of commercial banks was a solution proposed in the scheme to restructure the credit institution system (see Viet Nam News, 8 Aug 2012). We also believe the government will likely draw funds from multilateral/bilateral organisations and from countries with close relations with Vietnam. The government will likely raise money onshore and cut back on spending. In July, PM Dung approved the (SOE) restructuring project and groups for 2012-2015. The objective of the project is to make SOEs more rationally structured and centred on core businesses. The SOEs will be classified into three categories, required to stop making investments in non-core business by 2015. According to Finance Ministry data, as quoted by state media, SOEs cannot repay as much as 20-30% of the VND415trn they owe banks (see Banks Bad Debts Weigh on Vietnam, The Wall Street Journal, 14 June 2012). Vietnams balance of payment position continues to improve, in line with our expectations. The January-August trade deficit was only USD583mn, compared with USD6.7bn in the same period last year. On the capital account side, we raise our FDI forecast by USD1bn to USD8.5bn (H1 12: USD5.4bn) and maintain our remittances projection of USD9bn for 2012. However, FX appreciation/stability has meant that resident outflows have been smaller. Overall, we raise our BoP surplus forecast by USD2bn to USD7bn for 2012, allowing FX reserves to end the year at USD23bn. We also expect the BoP to remain in surplus in 2013. The dong has appreciated by 0.9% year-to-date a first since 2007 and before that in 1995 consistent with the turn around in BoP. While we expect the BoP to remain in surplus in 2013, our sense is that the banking sector issues could potentially increase demand for gold/dollars and weigh on the dong. We expect a marginal 2% depreciation through 2013 and maintain our view that any depreciation will be gradual rather than a one-off. The government revised down its 2012 growth forecast to 5.2% from 6% we maintain our forecast at 4.8%. For 2013 we are cutting our expectation by 30bps to 5.5% given weaker regional growth, though more rate cuts and fiscal support will provide some offset (government target: 6%). Inflation was 5% in August 2012, down from a peak of 23% last August. We believe the bottom in inflation is probably behind us given the pick-up in commodity prices and base effects; however, lacklustre domestic demand should keep a tab on core inflation. Overall we expect inflation to average 9% in 2012 and come in slightly higher at 9.4% next year. We believe the pick-up in inflation will weigh on government bonds together with concerns over supply given rising contingent liabilities from the banking sector. Following 500bps of cumulative cuts on moderating inflation and weak growth performance, the policy rate has been on hold at 8% since late July. Given the challenging growth environment, and fairly tight credit conditions onshore (1.8% YTD early September, SBV annual target 8-10%), we believe the policy easing will not derail macro stability, though the risks have increased. In the near term we expect rates to be unchanged, but believe that by mid-2013 the SBV will start reversing the easing. We expect no change in Vietnams credit ratings over the coming three to six months. Key drivers for the ratings will be: 1) progress on bank consolidation/recapitalisation; 2) continued focus on macro stability; 3) restructuring of state-owned enterprises; and 4) increased transparency. The sovereign is currently rated BB- Stable by S&P, B1 Negative by Moodys and B+ Stable by Fitch.

Government initiates plan for SOE restructuring

BoP to remain in surplus in 2013 allowing FX reserves to rise further

VND to remain broadly stable; marginal 2% depreciation in 2013

We maintain our 2012 GDP forecast of 4.8% but are revising down our 2013 forecast by 30bps to 5.5%

Inflation to average 9% in 2012 and 9.4% in 2013

Policy rates to be unchanged; rate hikes to start in mid-2013

Vietnams rating to remain unchanged

25 September 2012

95

Barclays | The Emerging Markets Quarterly

Figure 2: FX reserves have been rising given BoP surplus

FX reserves (USD bn, LHS) Short-term external debt cover Import cover (mths) 9 8 7 6 5 4 3 2 1 0 00 01 02 03 04 05 06 07 08 09 10 11 12

Source: CEIC, Barclays Research

Figure 3: USD/VND has appreciated ytd

14 12 10

30 25 20 15 10 5 0

% year-on-year

2009E 5.3 4.5 3.1 8.7 1.7 -8.9 -13.4 93 -6.1 -6.6 -8.3 7.6 4.6 38.8 16.8 -9.0 -5.5 51.5 6.5 18,500 Last 4.7 6.9 20,905 10.00

8 6 4 2 0 -2 94 95 96 97 98 99 00 01 02 03 04 05 06 07 08 09 10 11 12

Source: CEIC, Barclays Research

Figure 4: Vietnam macroeconomic forecasts

2008 Activity Real GDP (% y/y) Domestic demand contribution (pp) Private consumption (% y/y) Fixed capital investment (% y/y) Net exports contribution (pp) Exports (% y/y)* Imports (% y/y)* GDP (USD bn) External sector Current account (USD bn) C/A (% GDP) Trade balance (USD bn)# Net FDI (USD bn) Other net inflows (USD bn) Gross external debt (USD bn) International reserves (USD bn) Public sector Public sector balance (% GDP) Primary balance (% GDP) Gross public debt (% GDP) Prices CPI (% Dec/Dec) FX, eop 19.9 17,483 1yr ago Real GDP (% y/y) CPI (% y/y, eop) FX (domestic currency/USD, eop) Overnight policy rate (%, eop) 6.1 22.5 20,830 14.00 11.8 19,500 Q3 12F 5.0 5.3 20,900 8.00 18.1 21,034 Q4 12F 5.5 6.3 21,000 8.00 6.3 21,000 Q1 13F 5.0 7.6 21,100 8.00 9.6 21,400 Q2 13F 5.5 10.3 21,200 9.00 -5.0 -3.4 42.9 -7.0 -5.6 53.0 -4.6 -3.2 49.9 -4.8 -3.6 47.4 -4.8 -3.7 46.2 -10.8 -12.0 -12.3 9.6 1.8 30.2 24.2 -3.5 -3.4 -5.1 8.0 4.8 43.8 12.9 0.3 0.2 -1.4 6.5 3.6 49.3 14.3 -0.9 -0.6 -0.5 8.5 2.8 52.8 23.0 -2.0 -1.3 -1.8 8.0 2.8 56.0 27.0 6.2 9.4 9.3 3.8 -3.2 29.5 27.6 90 6.8 12.1 10.0 10.9 -2.2 26.4 18.2 103 5.8 -0.6 4.4 -10.4 6.2 30.9 24.1 122 4.8 7.0 6.5 7.0 -1.3 15.1 14.0 138 5.5 8.3 8.0 8.0 -2.1 18.9 20.0 157 2010E 2011E 2012F 2013F

Note: *Nominal as real data not available. #Balance of payments basis, not customs basis. Source: Barclays Research

25 September 2012

96

You might also like

- Policy Easing To Accelerate in H1: China Outlook 2012Document21 pagesPolicy Easing To Accelerate in H1: China Outlook 2012valentinaivNo ratings yet

- Monetary Policy Statement: State Bank of PakistanDocument32 pagesMonetary Policy Statement: State Bank of Pakistanbenicepk1329No ratings yet

- Asset Quality: That Sinking Feeling!Document33 pagesAsset Quality: That Sinking Feeling!Ronitsinghthakur SinghNo ratings yet

- EuroCham Vietnam Newsletter Q2 2012Document28 pagesEuroCham Vietnam Newsletter Q2 2012European Chamber of Commerce in Vietnam100% (2)

- Viet Nam Bond Yields Fall as Inflation EasesDocument3 pagesViet Nam Bond Yields Fall as Inflation EasesGiang Khả LinhNo ratings yet

- MPS Apr 2012 EngDocument3 pagesMPS Apr 2012 Engbeyond_ecstasyNo ratings yet

- Sarasin EM Bond OutlookDocument20 pagesSarasin EM Bond OutlookabbdealsNo ratings yet

- F F y Y: Ear Uls MmetrDocument4 pagesF F y Y: Ear Uls MmetrChrisBeckerNo ratings yet

- Executive Summary of Bangladesh's Macro Financial Environment and Banking Sector DevelopmentsDocument5 pagesExecutive Summary of Bangladesh's Macro Financial Environment and Banking Sector DevelopmentsSajib DasNo ratings yet

- Monetary Policy Statement September 2013 HighlightsDocument42 pagesMonetary Policy Statement September 2013 HighlightsScorpian MouniehNo ratings yet

- Vietnam 2012 Outlook: Growth Story Intact On The Back of Financial Sector StressesDocument27 pagesVietnam 2012 Outlook: Growth Story Intact On The Back of Financial Sector Stresseslanpham19842003No ratings yet

- Brazil Commercial & Sovereign RisksDocument1 pageBrazil Commercial & Sovereign RisksjearodriguesNo ratings yet

- February 24, 2014 Fixed Income Market Review: Pham Luu Hung (MR.) Associate DirectorDocument6 pagesFebruary 24, 2014 Fixed Income Market Review: Pham Luu Hung (MR.) Associate DirectorChrispy DuckNo ratings yet

- Monetary Policy of Pakistan: Submitted To: Mirza Aqeel BaigDocument9 pagesMonetary Policy of Pakistan: Submitted To: Mirza Aqeel BaigAli AmjadNo ratings yet

- VCB - Jul 8 2014 by HSC PDFDocument6 pagesVCB - Jul 8 2014 by HSC PDFlehoangthuchienNo ratings yet

- FM Report July 2010Document11 pagesFM Report July 2010smashinguzairNo ratings yet

- Fund Managers Report: July 2011Document13 pagesFund Managers Report: July 2011Huzaifa MarviNo ratings yet

- Viet Nam-Update: Yield MovementsDocument3 pagesViet Nam-Update: Yield Movementscrazyfrog1991No ratings yet

- ECON6000 Macroeconomic Performance and Implications of ZIRPDocument13 pagesECON6000 Macroeconomic Performance and Implications of ZIRPShubham AgarwalNo ratings yet

- International Monetary Fund: Hina Conomic UtlookDocument10 pagesInternational Monetary Fund: Hina Conomic UtlooktoobaziNo ratings yet

- Niveshak Niveshak: AuditorsDocument26 pagesNiveshak Niveshak: AuditorsNiveshak - The InvestorNo ratings yet

- RBI Cautiously Holds RatesDocument4 pagesRBI Cautiously Holds RatesMeenakshi MittalNo ratings yet

- International Economics: Topic 7Document16 pagesInternational Economics: Topic 7Ngọc Minh NguyễnNo ratings yet

- Mar 282012 GseDocument4 pagesMar 282012 GseAhmed NirobNo ratings yet

- Major Developments: December 2011Document9 pagesMajor Developments: December 2011Kajal SarkarNo ratings yet

- Red Jun 2014Document38 pagesRed Jun 2014hrnanaNo ratings yet

- Annual Markets Roundup 09Document8 pagesAnnual Markets Roundup 09Ali ImamNo ratings yet

- BIMBSec - Economics - OPR at 4th MPC Meeting 2012 - 20120706Document3 pagesBIMBSec - Economics - OPR at 4th MPC Meeting 2012 - 20120706Bimb SecNo ratings yet

- Task 5 - Abin Som - 21FMCGB5Document6 pagesTask 5 - Abin Som - 21FMCGB5Abin Som 2028121No ratings yet

- SEB Asia Corporate Bulletin: MayDocument7 pagesSEB Asia Corporate Bulletin: MaySEB GroupNo ratings yet

- Crisil Sme Connect Dec09Document32 pagesCrisil Sme Connect Dec09Rahul JainNo ratings yet

- Bangladesh Bank Monetary Policy For FY 2012Document13 pagesBangladesh Bank Monetary Policy For FY 2012Nurul Mostofa100% (1)

- Outlook 2012 - Raymond JamesDocument2 pagesOutlook 2012 - Raymond JamesbubbleuppNo ratings yet

- Pub Blic D Debt: CH Apter 9Document21 pagesPub Blic D Debt: CH Apter 9Umair UddinNo ratings yet

- Financial Highlights of Pakistan Economy 08-09Document5 pagesFinancial Highlights of Pakistan Economy 08-09Waqar AliNo ratings yet

- Pakistan's Debt Situation from 2000-2017Document22 pagesPakistan's Debt Situation from 2000-2017Ayaz Ahmed KhanNo ratings yet

- SBP - Analyst Briefing NoteDocument3 pagesSBP - Analyst Briefing Notemuddasir1980No ratings yet

- Er 20130415 Bull Phat DragonDocument3 pagesEr 20130415 Bull Phat DragonBelinda WinkelmanNo ratings yet

- Factors Affecting Investments in Pakistan's EconomyDocument7 pagesFactors Affecting Investments in Pakistan's EconomyHome PhoneNo ratings yet

- JP Morgan - Global ReportDocument88 pagesJP Morgan - Global Reporttrinidad01No ratings yet

- Market Outlook Market Outlook: Dealer's DiaryDocument14 pagesMarket Outlook Market Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Quick Start Report - 2011-12 - Final 11.5.10Document50 pagesQuick Start Report - 2011-12 - Final 11.5.10New York SenateNo ratings yet

- Group 2 Presentation SlidesDocument27 pagesGroup 2 Presentation SlidesJasonNo ratings yet

- Monetary Policy of PakistanDocument8 pagesMonetary Policy of PakistanWajeeha HasnainNo ratings yet

- Six Hot Questions For Emerging Markets: Key InsightsDocument10 pagesSix Hot Questions For Emerging Markets: Key Insightsapi-167354334No ratings yet

- U BL Financial Statements Ann DecDocument122 pagesU BL Financial Statements Ann DecRehan NasirNo ratings yet

- Weekly Economic Commentary 7-19-2012Document7 pagesWeekly Economic Commentary 7-19-2012monarchadvisorygroupNo ratings yet

- Ratings On Thailand Affirmed at 'BBB+/A-2' and 'A-/A-2' Outlook StableDocument7 pagesRatings On Thailand Affirmed at 'BBB+/A-2' and 'A-/A-2' Outlook Stableapi-239405494No ratings yet

- SEB Report: Asian Recovery - Please Hold The LineDocument9 pagesSEB Report: Asian Recovery - Please Hold The LineSEB GroupNo ratings yet

- Financials Result ReviewDocument21 pagesFinancials Result ReviewAngel BrokingNo ratings yet

- HSBC 12072010 Vietnam MonitorDocument16 pagesHSBC 12072010 Vietnam MonitorNguyen Xuan QuangNo ratings yet

- The Prospect of Indonesian Banking Industry in 2010Document8 pagesThe Prospect of Indonesian Banking Industry in 2010DoxCak3No ratings yet

- Inflation drops to 22-month low on new formula in PakistanDocument7 pagesInflation drops to 22-month low on new formula in Pakistank.shaikhNo ratings yet

- 2007-8 Financial CrisesDocument4 pages2007-8 Financial CrisesHajira alamNo ratings yet

- 201503 - Hsbc-中国债券市场手册Document55 pages201503 - Hsbc-中国债券市场手册Jaa Nat CheungNo ratings yet

- Us Economic Outlook Bowed But Not BrokenDocument27 pagesUs Economic Outlook Bowed But Not BrokenVarun Prasad ANo ratings yet

- BIMBSec - Economics - OPR at 2nd MPC Meeting 2012 - 20120312Document3 pagesBIMBSec - Economics - OPR at 2nd MPC Meeting 2012 - 20120312Bimb SecNo ratings yet

- Barclays On Debt CeilingDocument13 pagesBarclays On Debt CeilingafonteveNo ratings yet

- Bank Industry Report-2012Document2 pagesBank Industry Report-2012Ehsanul KabirNo ratings yet

- Chandrasekaran Multi Modal Architectures AAAI06Document5 pagesChandrasekaran Multi Modal Architectures AAAI06SIVVA2No ratings yet

- I Hs Global Insight 20130502051956Document4 pagesI Hs Global Insight 20130502051956SIVVA2No ratings yet

- 67129812Document31 pages67129812SIVVA2No ratings yet

- Company Information 2012Document4 pagesCompany Information 2012SIVVA2No ratings yet

- Wine and Spirit 69 PDFDocument5 pagesWine and Spirit 69 PDFTuấn Thế NguyễnNo ratings yet

- Social Media Trends and Opportunities Googles Tips For BrandsDocument8 pagesSocial Media Trends and Opportunities Googles Tips For BrandsSIVVA2No ratings yet

- Asian Trends Creative MR and The Myth of Global Brands Insights From The ESOMDocument5 pagesAsian Trends Creative MR and The Myth of Global Brands Insights From The ESOMSIVVA2No ratings yet

- Stephens Markus Townsend 2007Document17 pagesStephens Markus Townsend 2007SIVVA2No ratings yet

- Application Form - Kantar Worldpanel Business Contest 2013Document2 pagesApplication Form - Kantar Worldpanel Business Contest 2013SIVVA2No ratings yet

- Hldkjalrq5yl132s10l1qljz 98871277Document2 pagesHldkjalrq5yl132s10l1qljz 98871277SIVVA2No ratings yet

- Brand ExtentionDocument14 pagesBrand ExtentionBiggy A AdegokeNo ratings yet

- Published Western Fims and The Personality Development of Teenagers in NigeriaDocument15 pagesPublished Western Fims and The Personality Development of Teenagers in NigeriaSIVVA2No ratings yet

- Bouckaert HalliganDocument31 pagesBouckaert HalliganSIVVA2No ratings yet

- Collaborative and Social Learning Using Virtual Worlds: Preparing Students For Virtually AnythingDocument7 pagesCollaborative and Social Learning Using Virtual Worlds: Preparing Students For Virtually AnythingSIVVA2No ratings yet

- Branding in Asia: The Creation, Development and Management of Asian Brands For The Global Market'Document3 pagesBranding in Asia: The Creation, Development and Management of Asian Brands For The Global Market'SIVVA2No ratings yet

- 07 Dec 2010-Asia Television Ad CoalitionDocument2 pages07 Dec 2010-Asia Television Ad CoalitionSIVVA2No ratings yet

- WORDLISTDocument20 pagesWORDLISTJavaid Ali ShahNo ratings yet

- PdfexportDocument2 pagesPdfexportSIVVA2No ratings yet

- Presidential Trivia: Did You Know???Document3 pagesPresidential Trivia: Did You Know???SIVVA2No ratings yet

- 661923029Document3 pages661923029SIVVA20% (6)

- EI Feature Article Feb06Document4 pagesEI Feature Article Feb06SIVVA2No ratings yet

- Session 4 Tran HungDocument11 pagesSession 4 Tran HungSIVVA2No ratings yet

- Strategic Management Nokia Case AnalysisDocument10 pagesStrategic Management Nokia Case Analysisbtamilarasan88100% (1)

- Out 48Document5 pagesOut 48SIVVA2No ratings yet

- Investment Climate ReformsDocument3 pagesInvestment Climate ReformsSIVVA2No ratings yet

- Global Shopping Centre Development - FinalDocument5 pagesGlobal Shopping Centre Development - FinalSIVVA2No ratings yet

- Dove vs. Dior-Extending The Brand Extension Decision-Making ProcessDocument16 pagesDove vs. Dior-Extending The Brand Extension Decision-Making ProcessVinod JoshiNo ratings yet

- Management Questionnaire USDocument5 pagesManagement Questionnaire USSIVVA2No ratings yet

- Methods in Case Study Analysis by Linda T KohnDocument9 pagesMethods in Case Study Analysis by Linda T KohnSIVVA2No ratings yet

- FTPDocument17 pagesFTPSIVVA2No ratings yet