Professional Documents

Culture Documents

MF0015 Fall Drive Assignment 2012

Uploaded by

Sneha Wid UCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

MF0015 Fall Drive Assignment 2012

Uploaded by

Sneha Wid UCopyright:

Available Formats

August/Fall 2012

Master of Business Administration - MBA Semester 4 Subject Code MF0015 Subject Name International Financial Management 4 Credits

(Book ID: B1316)

Assignment Set- 1 (60 Marks)

Note: Each question carries 10 Marks. Answer all the questions.

Q.1 What is meant by BOP? How are capital account convertibility and current account

convertibility different? What is the current scenario in India? Q.2 What is arbitrage? Explain with the help of suitable example a two-way and a three

way arbitrage. Q3. You are given the following information: Spot EUR/USD : 0.7940/0.8007 Three months swap: 25/35 Calculate three month EUR/USD rate.

Spot USD/GBP: 1.8215/1.8240

Q.4 Q.5

Explain various methods of Capital budgeting of MNCs. a. What are depository receipts? b. Boeing commercial Airplane Co. manufactures all its planes in United States and

prices them in dollars, even the 50% of its sales destined for overseas markets. Assess Boeings currency risk. How can it cope with this risk? Q.6 Distinguish between Eurobond and foreign bonds? What are the unique

characteristics of Eurobond markets?

August/Fall 2012

Master of Business Administration - MBA Semester 4 Subject Code MF0015 Subject Name International Financial Management 4 Credits

(Book ID: B1316)

Assignment Set- 2 (60 Marks)

Note: Each question carries 10 Marks. Answer all the questions.

Q.1 What do you mean by optimum capital structure? What factors affect cost of capital

across nations? Q.2 What is sub-prime lending? Explain the drivers of sub-prime lending? Explain briefly

the different exchange rate regime that is prevalent today. Q.3 What is covered interest rate arbitrage?

Assume spot rate of = $ 1.60 180 day forward rate = $ 1.56 180 day interest rate in U.K. = 4% 180 day U.S interest rate = 3% Is covered interest arbitrage by U.S investor feasible? Q.4 Q.5 Explain double taxation avoidance agreement in detail Explain American depository receipt sponsored programme and unsponsored

programme. Q.6 Explain (a) Parallel Loans (b) Back to- Back loans

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Form (12) Payslip For JNR ExDocument1 pageForm (12) Payslip For JNR Exnikhil kumarNo ratings yet

- 10 Economic ProblemsDocument3 pages10 Economic ProblemsMacorex10080% (5)

- Industril MKTG 910ADocument1 pageIndustril MKTG 910APinky MattaNo ratings yet

- MF0015 Fall Drive Assignment 2012Document2 pagesMF0015 Fall Drive Assignment 2012Sneha Wid UNo ratings yet

- Project Guidelines HR IMTDocument14 pagesProject Guidelines HR IMTmedeepikaNo ratings yet

- PHD Synopsis - AnilDocument14 pagesPHD Synopsis - AnilSurinder HansNo ratings yet

- Synopsis - Preeti BhaskarDocument16 pagesSynopsis - Preeti BhaskarPreeti BhaskarNo ratings yet

- Project Synopsis 5 1Document5 pagesProject Synopsis 5 1Sneha Wid UNo ratings yet

- Project TopicsDocument3 pagesProject Topicsshivjitiwari100% (1)

- Project Report Template SMUDocument11 pagesProject Report Template SMUshabs_raj99900% (1)

- Quest-0174-12 Critical Questions You Need To AskDocument20 pagesQuest-0174-12 Critical Questions You Need To AskSneha Wid UNo ratings yet

- PumaprojectDocument30 pagesPumaprojectSuhail N R PuraNo ratings yet

- Project TopicsDocument3 pagesProject Topicsshivjitiwari100% (1)

- PERT Exercise1 Q&ADocument14 pagesPERT Exercise1 Q&ADeepak Daya MattaNo ratings yet

- The Five Key Attributes Backup Software Needs To Possess To Automate and Simplify VM Data ProtectionDocument2 pagesThe Five Key Attributes Backup Software Needs To Possess To Automate and Simplify VM Data ProtectionDeepak Daya MattaNo ratings yet

- Computer Aided Management: Subject Code: CAMDocument4 pagesComputer Aided Management: Subject Code: CAMPomil LuthraNo ratings yet

- MISDocument8 pagesMISKaran NagarNo ratings yet

- IIIT Allahabad Application Form 2013Document7 pagesIIIT Allahabad Application Form 2013pratiksha1091No ratings yet

- Imt 12 PDFDocument5 pagesImt 12 PDFSneha Wid UNo ratings yet

- Britannia Milk Marketing Strategies of Britannia Milk ProducDocument66 pagesBritannia Milk Marketing Strategies of Britannia Milk ProducLijo PhilipsNo ratings yet

- Last 6 Months Current AffairsDocument74 pagesLast 6 Months Current Affairsratheesh1981No ratings yet

- Imt 19Document4 pagesImt 19Pinky MattaNo ratings yet

- MISDocument8 pagesMISKaran NagarNo ratings yet

- Computer Aided Management: Subject Code: CAMDocument4 pagesComputer Aided Management: Subject Code: CAMPomil LuthraNo ratings yet

- Imt 03Document4 pagesImt 03Sneha Wid UNo ratings yet

- Quest-0174-12 Critical Questions You Need To AskDocument20 pagesQuest-0174-12 Critical Questions You Need To AskSneha Wid UNo ratings yet

- MJ0009 Summer Drive Assignment 2012Document2 pagesMJ0009 Summer Drive Assignment 2012Deepak Daya MattaNo ratings yet

- IMT 31 Web TechnologyDocument4 pagesIMT 31 Web TechnologyDeepak Daya MattaNo ratings yet

- EC2024 Foundations of Macroeconomic Theory: University of Leicester Department of EconomicsDocument18 pagesEC2024 Foundations of Macroeconomic Theory: University of Leicester Department of EconomicsAngelo WongNo ratings yet

- Econ 151 SyllabusDocument2 pagesEcon 151 SyllabusImmah SantosNo ratings yet

- StrengthsDocument2 pagesStrengthsAyesha RaJaNo ratings yet

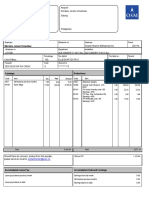

- Tax Invoice: Gstin Drug Licence NoDocument1 pageTax Invoice: Gstin Drug Licence Nopranay dasNo ratings yet

- SL. No. Districts Name of The Govt. ITI Bank Name Bank Address/ Branch A/C No. IFSC CodeDocument3 pagesSL. No. Districts Name of The Govt. ITI Bank Name Bank Address/ Branch A/C No. IFSC CodeRajendra Kumar MahalikNo ratings yet

- Noorani Sales: Billed To: Shipped ToDocument1 pageNoorani Sales: Billed To: Shipped Tomakbulhusen lalaNo ratings yet

- Summer Internship Presentation On Steel Authority of India Limited (SAIL)Document15 pagesSummer Internship Presentation On Steel Authority of India Limited (SAIL)Pankaj MahantaNo ratings yet

- Foreign Direct InvestmentDocument9 pagesForeign Direct Investmenttimothy454No ratings yet

- Pt. Diamitra Agung Perkasa: Tax InvoiceDocument1 pagePt. Diamitra Agung Perkasa: Tax InvoiceJoe AndarestaNo ratings yet

- GST Aug-19Document9 pagesGST Aug-19Harpreet Singh MongaNo ratings yet

- Trade and Investment Policies: True/False QuestionsDocument24 pagesTrade and Investment Policies: True/False QuestionsAshok SubramaniamNo ratings yet

- WEEK-1-3-ULO-B-Contempo TwinkoolDocument5 pagesWEEK-1-3-ULO-B-Contempo TwinkoolNorienne Teodoro50% (2)

- Economics SQP Term2Document4 pagesEconomics SQP Term2Shivam ShuklaNo ratings yet

- Fexam: Bl-Actg-6482-Lec-1933T Accounting For Special TransacDocument17 pagesFexam: Bl-Actg-6482-Lec-1933T Accounting For Special TransacAriam SorepsinNo ratings yet

- Fundamental Analysis of TCSDocument17 pagesFundamental Analysis of TCSarupritNo ratings yet

- Regional Integration Functions and FormsDocument26 pagesRegional Integration Functions and FormsTafwaza JereNo ratings yet

- Alrajhi-0 Compressed.5133686765536793Document1 pageAlrajhi-0 Compressed.5133686765536793Abdul-rheeim Q OwiNo ratings yet

- Maharashtra State Electricity Distribution Co. LTD: Bill Revision ReportDocument3 pagesMaharashtra State Electricity Distribution Co. LTD: Bill Revision ReportSachin KhandareNo ratings yet

- Mid Sem Notes FINA2222Document1 pageMid Sem Notes FINA2222zdoug1No ratings yet

- Awanda Ray ZumaraDocument4 pagesAwanda Ray ZumaraTaz ManiaNo ratings yet

- 1929 - The Crash ExplainedDocument3 pages1929 - The Crash Explainedfrederic9866No ratings yet

- Economy of MauritiusDocument6 pagesEconomy of MauritiusKristen NallanNo ratings yet

- Drivers of Globalization - The Contemporary World - PDFDocument24 pagesDrivers of Globalization - The Contemporary World - PDFAngel Blaze CandinatoNo ratings yet

- Morales, Jerson Umambac: Contactcenter@osm - NoDocument1 pageMorales, Jerson Umambac: Contactcenter@osm - NoJerson MoralesNo ratings yet

- Swot and Pestle Analysis of Kirloskar Group: Submitted By: Badal Solapurwala Charu Jagwani Mirva VaghasiaDocument14 pagesSwot and Pestle Analysis of Kirloskar Group: Submitted By: Badal Solapurwala Charu Jagwani Mirva VaghasiaMinhans SrivastavaNo ratings yet

- TOWS - Analysis CaterpillarDocument1 pageTOWS - Analysis CaterpillarJames WarnickNo ratings yet

- Great RecessionDocument4 pagesGreat RecessionRokaya Musrat RahmanNo ratings yet

- Essential Foundations of Economics 7th Edition Bade Test Bank Full Chapter PDFDocument68 pagesEssential Foundations of Economics 7th Edition Bade Test Bank Full Chapter PDFTerryGonzalezkqwy100% (15)