Professional Documents

Culture Documents

How To Upload Online

How To Upload Online

Uploaded by

Anonymous zpezMz2dOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

How To Upload Online

How To Upload Online

Uploaded by

Anonymous zpezMz2dCopyright:

Available Formats

PROCESS FLOW OF ECR PRECONDITIONS: 1. The Employer has registered his/her establsihment on the Employer e-Sewa Portal.

(For details click on How To Register). 2. The employer has downloaded the ECR file format and prepared the ECR text file. (For details Click on Download ECR File Format) NOTE: It is suggested that before going through the process, the employer goes through the FAQs. (Click FAQs)

1 of 12

PROCESS Step 1: Login to the Employer e-Sewa Portal. Click here for Login.

After login you will find the following screen.

2 of 12

Step 2: Upload ECR Click on ECR at the top Menu Bar. You will find the various options. Click ECR UPLOAD.

The following screen will open.

3 of 12

Select the text file you have to upload from the location where you have saved it. Check the Wage Month and year for which you are going to upload the ECR. Select the correct Wage Month/Year and click SUBMIT button.

If your text file has been prepared correctly, the Summary sheet as follows will appear.

4 of 12

Enter the additional details regarding EDLI and EPF/EDLI Administrative and Inspection charges. Check the Contribution rate also. By default it is 12%. If applicable for your establishment, you can change it to 10%. Click SUBMIT ECR button.

An alert will appear to confirm the Contribution rate. Click OK and again click SUBMIT ECR button.

5 of 12

Step 3: Approve ECR: A digitally signed PDF file with date and time of upload will appear on the screen. Note: In case the number of members in the ECR file is more than 200, please wait till you get an SMS alert to view/download the digitally signed PDF file. Click on the PDF file icon to download the file and verify the data with the data of the ECR text file uploaded by you.

Note: The PDF file that is displayed is digitally signed by EPFO for security purpose and no signature is required.

6 of 12

This step is also available at the following link (ECR PENDING FOR APPROVAL)

7 of 12

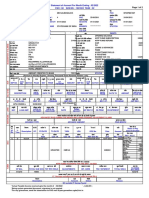

The digitally signed PDF will look like the following screens.

8 of 12

After you have satisfied yourself with the correctness of the data, click APPROVE button. An alert will come on Approval. Click OK.

9 of 12

Step 4: Download and Print Challan: On approval of the ECR file, a Temporary Return Reference Number (TRRN) for the uploaded ECR file will be generated and the next screen that will appear will display the Challan and Acknowledgement slip for uploaded file.

Click Challan Receipt File for downloading and printing the Challan. This step is also available at the following link (REQUEST ECR REJECTION)

10 of 12

The challan will look as follows: After Printing, manually fill in the details under For establishment use only.

The ECR Acknowledge slip will be as follows:

The challan generated on approval of ECR will lapse after 15 days if remittance is not made.

11 of 12

Till this stage the employer can request for rejection of the approved ECR. However if remittance is made against the ECR, it cannot be rejected. Step 5: Make Remittance: (Off line activity) There are two options. a. If the employer is a CINB (Corporate Internet Banking) customer of SBI, then he/she can make online payment through the onlinesbi portal of SBI. Click here for SBI Portal. ## b. Otherwise the remittance can be made through Demand draft/local cheque in any designated branch of SBI. For SBI designated branch list, click SBI BRANCHES FOR EPF REMITTANCE Once the cheque against the challan is realized, you will get SMS alert. With this the ECR filing process for the month will be complete.

## Note: The online payment option will be available after a few days. Please make remittance through Demand Draft/local cheque till the facility starts.

12 of 12

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5819)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Card Statement: Statement Date Last Payment DateDocument2 pagesCard Statement: Statement Date Last Payment DateS.M. Shamsuzzaman Salim0% (1)

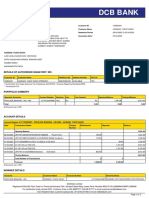

- DCB Bank: Statement of AccountDocument2 pagesDCB Bank: Statement of AccounthasnainNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Affidavit of Gemma Fe C. EndrigaDocument3 pagesAffidavit of Gemma Fe C. EndrigaAdine DyNo ratings yet

- The Palm Beach Hedge Fund Association Partners With NADEXDocument3 pagesThe Palm Beach Hedge Fund Association Partners With NADEXPR.comNo ratings yet

- Comsavings Bank Vs Sps. Danilo and Estrella Capistrano, GR No. 170942Document14 pagesComsavings Bank Vs Sps. Danilo and Estrella Capistrano, GR No. 170942Aldin Lucena AparecioNo ratings yet

- Procedure of Letter of Credit (LC), ImportDocument84 pagesProcedure of Letter of Credit (LC), ImportRayhan AhmedNo ratings yet

- Pre-Israel Guide 2012Document68 pagesPre-Israel Guide 2012PreIsraelGuide67% (3)

- Memorandum of UnderstandingDocument2 pagesMemorandum of UnderstandingAnmolNo ratings yet

- Income SourcesDocument35 pagesIncome Sourcesirina_nircaNo ratings yet

- Citibank Client Services 000 PO Box 769013 San Antonio, TX 78245-9013Document4 pagesCitibank Client Services 000 PO Box 769013 San Antonio, TX 78245-9013Steven Lee0% (1)

- ss1CRM SYNOPSISDocument51 pagesss1CRM SYNOPSISSatya SudhaNo ratings yet

- 5farmer Producer Operational FPO GuidelinesDocument9 pages5farmer Producer Operational FPO GuidelinesArun KurtakotiNo ratings yet

- Accounting Paper 1Document24 pagesAccounting Paper 1snowFlakes ANo ratings yet

- Offer Terms and Conditions: Oneplus - in Oneplus - in Oneplus - inDocument2 pagesOffer Terms and Conditions: Oneplus - in Oneplus - in Oneplus - inRahul KakunuruNo ratings yet

- FINS1612 Chapter 1 Textbook SummaryDocument13 pagesFINS1612 Chapter 1 Textbook SummaryVjzhNo ratings yet

- Invoice DP PT. Sinergi Prima EnjineeringDocument1 pageInvoice DP PT. Sinergi Prima EnjineeringDewy Cinta NovaenyNo ratings yet

- Bpi Family Bank vs. FrancoDocument2 pagesBpi Family Bank vs. Francofranzadon100% (3)

- CIR v. MarubeniDocument9 pagesCIR v. MarubeniMariano RentomesNo ratings yet

- Statement of Account For Month Ending: 02/2022 PAO: 60 SUS NO.: 1941024 TASK: 32Document3 pagesStatement of Account For Month Ending: 02/2022 PAO: 60 SUS NO.: 1941024 TASK: 32SalimNo ratings yet

- Udit SharmaDocument2 pagesUdit Sharmauditsharma2011No ratings yet

- 3 Facts About Teachers in The Philippines AABDocument2 pages3 Facts About Teachers in The Philippines AABAndrewNo ratings yet

- Unbilled Transactions PDFDocument2 pagesUnbilled Transactions PDFArjun NkNo ratings yet

- Econ ExamDocument2 pagesEcon ExamJonas ParreñoNo ratings yet

- Manacop VsDocument1 pageManacop VsJana marieNo ratings yet

- PF Withdrawal Claim FormDocument5 pagesPF Withdrawal Claim Formfaizan4033No ratings yet

- Chapter II - Organizational ProfileDocument16 pagesChapter II - Organizational ProfileSudarsun sunNo ratings yet

- ESL Banking Reading ComprehensionDocument3 pagesESL Banking Reading Comprehensionkardostundevvgmail.comNo ratings yet

- KM Pranshi MishraDocument58 pagesKM Pranshi MishraHarshit KashyapNo ratings yet

- Taxation Law Review Notes Corporation)Document9 pagesTaxation Law Review Notes Corporation)joycellemalabNo ratings yet

- TableView Changes R12Document95 pagesTableView Changes R12santosh7ckNo ratings yet