Professional Documents

Culture Documents

Report To Bondholders PDF

Uploaded by

Anonymous ZRsuuxNcCOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Report To Bondholders PDF

Uploaded by

Anonymous ZRsuuxNcCCopyright:

Available Formats

FY 2010 Report to Bondholders CASH MANAGEMENT Available cash from all funds is pooled and currently deposited in collateralized

money market accounts. A nominal amount is invested in the State Board of Administration investment pool. Interest earned is allocated to the different funds based on their equity share. In fiscal year 2010 combined unrestricted interest income for all Governmental, Expendable Trust, and Proprietary funds was $968,458, a 63 percent decrease from the previous year. The City has adopted a formal Investment Policy (Appendix B) which is currently under review. FY 2011 Report to Bondholders CASH MANAGEMENT Available cash from all funds is pooled and currently deposited in collateralized money market accounts. A nominal amount is invested in the State Board of Administration investment pool. Interest earned is allocated to the different funds based on their equity share. In fiscal year 2011 combined unrestricted interest income for all Governmental, Expendable Trust, and Proprietary funds was $1,960,264, a 102 percent increase from the previous year primarily from the loan to the Maritime Park related transactions, which interest is used to pay debt service on related bonds. The City has adopted a formal Investment Policy (Appendix B) which is currently under review. FY 2012 Report to Bondholders

CASH MANAGEMENT Available cash from all funds is pooled and currently deposited in collateralized money market accounts. A nominal amount is invested in the State Board of Administration investment pool. interest earned is allocated to the different funds based on their equity share. In fiscal year 2012 combined unrestricted interest income for all Governmental, Expendable Trust, and Proprietary funds as $1,960,621 which interest is used to pay debt service on related bonds. The City has adopted a formal Investment Policy (Appendix B) which is currently under review.

You might also like

- Strengthening Fiscal Decentralization in Nepal’s Transition to FederalismFrom EverandStrengthening Fiscal Decentralization in Nepal’s Transition to FederalismNo ratings yet

- Analysis of Balance Sheet-As Per 31 March 2010,2011 - (Vertical Format)Document2 pagesAnalysis of Balance Sheet-As Per 31 March 2010,2011 - (Vertical Format)Megha ShahNo ratings yet

- New York State Dedicated Highway and Bridge Trust Fund CrossroadsDocument18 pagesNew York State Dedicated Highway and Bridge Trust Fund CrossroadsNews10NBCNo ratings yet

- 06 General FundDocument64 pages06 General FundSamirahSwalehNo ratings yet

- Accounting Policies for Government Funds and Utility FundsDocument10 pagesAccounting Policies for Government Funds and Utility FundsThuy Ngo LeNo ratings yet

- Best Goverment FundDocument12 pagesBest Goverment FundMinaw BelayNo ratings yet

- Advanced Accounting 13th Edition Beams Solutions Manual DownloadDocument44 pagesAdvanced Accounting 13th Edition Beams Solutions Manual DownloadMay Madrigal100% (21)

- North Whitehall 2024 Final BudgetDocument61 pagesNorth Whitehall 2024 Final BudgetOlivia MarbleNo ratings yet

- Department of Accountancy & Finance Faculty of Management StudiesDocument16 pagesDepartment of Accountancy & Finance Faculty of Management Studieslakshanherath123No ratings yet

- CHP 21Document15 pagesCHP 21WellyMulyadiNo ratings yet

- Analysis of Pag-IBIG Fund 2020-19 Financial StatementsDocument7 pagesAnalysis of Pag-IBIG Fund 2020-19 Financial StatementsAldwinNo ratings yet

- Acc423 in 2015 Better City Received 5000000 of BondDocument8 pagesAcc423 in 2015 Better City Received 5000000 of BondDoreenNo ratings yet

- 2021-2022 Duluth Public Schools BudgetDocument22 pages2021-2022 Duluth Public Schools BudgetDuluth News TribuneNo ratings yet

- An Overview of National Budget in BangladeshDocument4 pagesAn Overview of National Budget in BangladeshAnikaNo ratings yet

- Acct 260 Cafr 2-15Document6 pagesAcct 260 Cafr 2-15StephanieNo ratings yet

- FS NBP December2010Document185 pagesFS NBP December2010Abdul Wahab ShaikhNo ratings yet

- Bellevue College CAFR Chapter 7 Project: 7-16Document5 pagesBellevue College CAFR Chapter 7 Project: 7-16StephanieNo ratings yet

- Moody's Report - Cincinnati OH - November 2012Document9 pagesMoody's Report - Cincinnati OH - November 2012COASTNo ratings yet

- Bellevue College CAFR Project Analyzes Tampa's Fiscal Year 2021 ReportDocument4 pagesBellevue College CAFR Project Analyzes Tampa's Fiscal Year 2021 ReportStephanieNo ratings yet

- Practice QuestionsDocument2 pagesPractice QuestionsnoumantamilNo ratings yet

- HB 1267 New Hampshire House BillDocument2 pagesHB 1267 New Hampshire House BillSustenomicsNo ratings yet

- Hyde and Analysis: Town Park Management'S DECEMBER 31.2006 Town) Town of For of Municipality Mid FireDocument10 pagesHyde and Analysis: Town Park Management'S DECEMBER 31.2006 Town) Town of For of Municipality Mid Fireapi-107641637No ratings yet

- Presented By: Nisha Vineeta SapnaDocument19 pagesPresented By: Nisha Vineeta SapnaNisha MalikNo ratings yet

- DPS 2019 2020Document46 pagesDPS 2019 2020mohsin.usafzai932No ratings yet

- Royal Group (Hemal, Vivek, Mitul)Document33 pagesRoyal Group (Hemal, Vivek, Mitul)Hemal PatelNo ratings yet

- Debt Management in Pakistan: Presented by Hira Wahla Saeed Ansari Atika Imtiaz Umair SiddiquiDocument38 pagesDebt Management in Pakistan: Presented by Hira Wahla Saeed Ansari Atika Imtiaz Umair Siddiquiumair_siddiqui89No ratings yet

- CH3 SolutionDocument10 pagesCH3 SolutionGabriel Aaron DionneNo ratings yet

- Ch. 02 Types of FinancingDocument85 pagesCh. 02 Types of FinancingUmesh Raj Pandeya100% (1)

- Fiduciary Funds and Permanent Funds: True/False (Chapter 10)Document25 pagesFiduciary Funds and Permanent Funds: True/False (Chapter 10)Holban AndreiNo ratings yet

- 2020 Cook County Preliminary ForecastDocument36 pages2020 Cook County Preliminary ForecastAnonymous 6f8RIS6No ratings yet

- 7 Consolidation Package - TemplateDocument369 pages7 Consolidation Package - TemplateOUSMAN SEIDNo ratings yet

- Chapter 20 Beams10e SMDocument14 pagesChapter 20 Beams10e SMStendy DharmawanNo ratings yet

- Segment ReportingDocument8 pagesSegment ReportingAnjanette SantosNo ratings yet

- 1h Bingham CH 8 Prof Chauvins Instructions Student VersionDocument9 pages1h Bingham CH 8 Prof Chauvins Instructions Student VersionAstha GoplaniNo ratings yet

- Chapter 4Document20 pagesChapter 4kratikabirleNo ratings yet

- Special Coverage: Most Important For Full MarksDocument21 pagesSpecial Coverage: Most Important For Full MarksLekshmi UNo ratings yet

- Governmental and Not-For-profit Accounting 5th Chapter 2 SolutionDocument28 pagesGovernmental and Not-For-profit Accounting 5th Chapter 2 SolutionCathy Gu75% (8)

- Government Budget and The EconomyDocument10 pagesGovernment Budget and The EconomyFathimaNo ratings yet

- Solutiondone 2-219Document1 pageSolutiondone 2-219trilocksp SinghNo ratings yet

- AFAR SimulationDocument111 pagesAFAR SimulationLloyd Sonica100% (1)

- 3b - 2016 - Advanced Final Govt Text Chapters Outline and AnswersDocument12 pages3b - 2016 - Advanced Final Govt Text Chapters Outline and AnswersLâm HàNo ratings yet

- Public ch8Document8 pagesPublic ch8Firdows SuleymanNo ratings yet

- 2022 Annual Financial Report For The National Government Volume IDocument500 pages2022 Annual Financial Report For The National Government Volume IAlbert Magno CaoileNo ratings yet

- Group 1 Budget ProcessDocument26 pagesGroup 1 Budget ProcessCassie ParkNo ratings yet

- Group 2 - FS EVALUATIONDocument20 pagesGroup 2 - FS EVALUATIONmarriette joy abadNo ratings yet

- Nineteen: Governmental Entities: Proprietary Funds, Fiduciary Funds, and Comprehensive Annual FinancialDocument34 pagesNineteen: Governmental Entities: Proprietary Funds, Fiduciary Funds, and Comprehensive Annual FinancialridaNo ratings yet

- Public Sector AccountingDocument10 pagesPublic Sector AccountingbillNo ratings yet

- Union Budget 2022 HighlightsDocument19 pagesUnion Budget 2022 HighlightsRudra PandaNo ratings yet

- Assignment 2: Measuring and Reporting Assets and LiabilitiesDocument9 pagesAssignment 2: Measuring and Reporting Assets and LiabilitiesDerek DalgadoNo ratings yet

- Not-for-Profit Fund AccountingDocument2 pagesNot-for-Profit Fund AccountingTehone TeketelewNo ratings yet

- Chapter 14 Eng 21Document19 pagesChapter 14 Eng 21Mohammad Mizanur RahmanNo ratings yet

- Week 3 Answers To Questions Final DFTDocument10 pagesWeek 3 Answers To Questions Final DFTGabriel Aaron Dionne0% (1)

- Accounting ProjectDocument3 pagesAccounting ProjectAbeer PervaizNo ratings yet

- Illustration: Debt Service Accounting For Regular Serial Bonds (2011 Transaction)Document3 pagesIllustration: Debt Service Accounting For Regular Serial Bonds (2011 Transaction)Jichang HikNo ratings yet

- ACCO 420 Case 1 - FINALDocument5 pagesACCO 420 Case 1 - FINALJane YangNo ratings yet

- Private Sector Operations in 2019: Report on Development EffectivenessFrom EverandPrivate Sector Operations in 2019: Report on Development EffectivenessNo ratings yet

- Scan Doc0035Document1 pageScan Doc0035Anonymous ZRsuuxNcCNo ratings yet

- Airport Part TIme OfficersDocument1 pageAirport Part TIme OfficersAnonymous ZRsuuxNcCNo ratings yet

- PR-Sisson Personnel FileDocument51 pagesPR-Sisson Personnel FileAnonymous ZRsuuxNcCNo ratings yet

- Streeter LawsuitDocument7 pagesStreeter LawsuitAnonymous ZRsuuxNcCNo ratings yet

- Potential SuspectDocument6 pagesPotential SuspectAnonymous ZRsuuxNcCNo ratings yet

- FY17 Budget Prep ManualDocument66 pagesFY17 Budget Prep ManualAnonymous ZRsuuxNcCNo ratings yet

- Illuminated Signage FINAL SUBMITTAL 4.19.2017Document5 pagesIlluminated Signage FINAL SUBMITTAL 4.19.2017Anonymous ZRsuuxNcCNo ratings yet

- Schmitt SchedulingDocument7 pagesSchmitt SchedulingAnonymous ZRsuuxNcCNo ratings yet

- Financial Report - Nine Months Ending June 30 2017Document48 pagesFinancial Report - Nine Months Ending June 30 2017Anonymous ZRsuuxNcCNo ratings yet

- CollusionDocument1 pageCollusionAnonymous ZRsuuxNcCNo ratings yet

- Escambia County Commissioners Jan 23 2017Document3 pagesEscambia County Commissioners Jan 23 2017Anonymous ZRsuuxNcCNo ratings yet

- MEMO Port Staff Re-OrganizationDocument1 pageMEMO Port Staff Re-OrganizationAnonymous ZRsuuxNcCNo ratings yet

- Re Entry 2014Document8 pagesRe Entry 2014Anonymous ZRsuuxNcCNo ratings yet

- MEMO - Mayor Veto Statement - Budget AnalystDocument1 pageMEMO - Mayor Veto Statement - Budget AnalystAnonymous ZRsuuxNcCNo ratings yet

- Glover ComplaintDocument13 pagesGlover ComplaintAnonymous ZRsuuxNcCNo ratings yet

- IndictmentDocument2 pagesIndictmentAnonymous ZRsuuxNcCNo ratings yet

- DocumentsDocument6 pagesDocumentsAnonymous ZRsuuxNcCNo ratings yet

- M. Casey Rodgers: United States District Court Northern District of Florida Pensacola DivisionDocument1 pageM. Casey Rodgers: United States District Court Northern District of Florida Pensacola DivisionAnonymous ZRsuuxNcCNo ratings yet

- MDeWeese LetterDocument2 pagesMDeWeese LetterAnonymous ZRsuuxNcCNo ratings yet

- Aerose Amendment2Document3 pagesAerose Amendment2Anonymous ZRsuuxNcCNo ratings yet

- Re Entry 2013Document11 pagesRe Entry 2013Anonymous ZRsuuxNcCNo ratings yet

- RE - Fire ChiefDocument2 pagesRE - Fire ChiefAnonymous ZRsuuxNcCNo ratings yet

- Handwritten NotesDocument1 pageHandwritten NotesAnonymous ZRsuuxNcCNo ratings yet

- Allen DepoDocument58 pagesAllen DepoAnonymous ZRsuuxNcCNo ratings yet

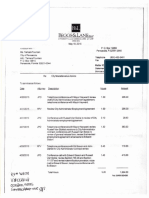

- B&L InvoicesDocument6 pagesB&L InvoicesAnonymous ZRsuuxNcCNo ratings yet

- MX-2615N 20160608 155412Document4 pagesMX-2615N 20160608 155412Anonymous ZRsuuxNcCNo ratings yet

- Promotions Press ReleaseDocument1 pagePromotions Press ReleaseAnonymous ZRsuuxNcCNo ratings yet

- Snowflake ArrestDocument3 pagesSnowflake ArrestAnonymous ZRsuuxNcCNo ratings yet

- Special Council Meeting - May 26 2016Document1 pageSpecial Council Meeting - May 26 2016Anonymous ZRsuuxNcCNo ratings yet

- ECUA Public Records JudgmentDocument4 pagesECUA Public Records JudgmentAnonymous ZRsuuxNcCNo ratings yet