Professional Documents

Culture Documents

Investment Examples

Investment Examples

Uploaded by

Vishwanath VerenkarCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Investment Examples

Investment Examples

Uploaded by

Vishwanath VerenkarCopyright:

Available Formats

Investment Examples On each example worksheet, read the comments at the bottom of the sheet, then click Tools

Solver... to examine the decision variables, constraints, and objective. To find the optimal solution, click the Solve button. The models in this workbook deal with decisions to invest in stocks and bonds. To help you understand the models in this workbook, we briefly explain the ideas behind the stock and bond models in the Theory worksheet. The Markowitz model uses the Solver to determine the percent of our available funds to invest in each of five stocks, so as to incur the least risk for a target rate of return. The resulting portfolio of stocks is called an efficient portfolio. In this model, we assume that the variances and covariances of stocks are known. In the Full Markowitz model, we calculate the variances and covariances of stocks from a history of stock prices. The Efficient Frontier worksheet contains a Markowitz model and an embedded chart. A short VBA program, also included in the workbook, uses the Solver to optimize the Markowitz model for several different target rates of return. The VBA code is run and the resulting portfolio returns and variances are plotted on the chart when you press the button on the worksheet. The Sharpe model computes an efficient portfolio using alphas and betas which relate the return on each stock to the return on the market and the risk-free rate. The alphas, betas and residual variances are computed via linear regression from a history of stock prices. The four Bond worksheets illustrate how a portfolio of bonds may be 'immunized' against changes in interest rates. The model Bond1 assumes that bond durations are known. In model Bond2, the durations are calculated using Excels DURATION function. Models Bond3 and Bond4 illustrate 'exact matching' in fixed-income portfolios. Here we assume that the investor has a series of liabilities (for example, pension payments) to be met in future periods, and the principal and interest on the bonds must cover the liabilities in each period.

o help you stock and bond

unds to invest e resulting the variances the variances

s the button on

has, betas and

nown. In model

nts) to be met in ties in each

Stock Examples - Background Every stock in the market has a certain return. We assume that this return has a normal distribution. This means that we can completely describe this distribution by two terms. The first term is the mean (expected return) and the second is the variance of returns. We can also compute a covariance of returns between any pair of stocks -- those that move together will have positive covariances, those that move in opposite directions will have negative covariances. If we know the expected return and variance of several stocks, we can put together a portfolio of these stocks that has a desired variance (risk) with a certain expected return. The Solver is used to pick the portfolio with the smallest variance for a certain expected return. (Or it could be used to find the highest expected return for a certain variance.) How do we calculate the expected return and variance of a portfolio? Harry Markowitz developed a method that computes the portfolio variance as the sum of the individual stock variances and covariances between pairs of stocks in the portfolio, weighted by the relative proportion of each stock in the portfolio. From a mathematical point of view this is the right thing to do. However, since all covariance terms between all stocks must be known, this requires many calculations. A portfolio with 100 different stocks would require more than 5000 covariance terms, for instance. William Sharpe devised another method of determining the expected return and variance of a portfolio. This method assumes that the return of each stock is composed of two parts: One part (denoted by beta) is dependent on the overall market's performance, and the other (denoted by alpha) is independent of the market. So we can write the expected return as Return = Beta * Market + Alpha + Residual In this equation, alpha and beta are constants that are different for each stock; the residual term is a random variable with an expected value of zero. When this formula is used, a portfolio with 100 stocks would only require 302 terms to fully describe its distribution (100 alphas, 100 betas, 100 residual variances, plus the market return and the market variance). Compared to the more than 5000 terms of the Markowitz method, this is a big improvement. However, although the Sharpe method requires less work, it is not as accurate as the Markowitz method. Bond Examples - Background Bonds are generally considered less risky than stocks. If a bond is of high credit quality, its price changes will depend almost entirely on interest rate changes. If interest rates go up, the price of a bond goes down, while if interest rates go down, the price of a bond goes up. However, most bonds pay interest in an annual (or semi-annual) coupon, and the interest can be reinvested. If interest rates go up, the price of the bond does go down, but the coupon could be reinvested at the higher interest rate. These two effects cancel each other out at the end of the duration of a bond. The duration of a bond is the average time in which a bond is repaid. For example, if a bond has a maturity of 3 years with face value $1,000 and an annual coupon payment of $100 and a yield of 10%, the duration is 2.735 years. Thus, one way of protecting against fluctuation of interest rates is to have a portfolio whose duration is equal to ones own

investment time horizon. A portfolio of bonds has a duration that is the weighted average of the duration of the individual bonds. In model Bond1 we assume we know the duration of the bonds available and want to maximize the yield of the portfolio while keeping the duration equal to a given investment time horizon. This technique is known as bond portfolio 'immunization.' Bond2 is another immunization model, but this time the duration for each bond is calculated from the face value, maturity, annual coupon and yield to maturity of each bond. In model Bond3 we look at another common way to protect against interest rate fluctuations. When we acquire a portfolio of bonds, we can exactly calculate the cash flow that arrives from this portfolio. This consists of the coupons plus the face values of the bonds that mature. This also works the other way around. If we know we need to have certain amounts of cash available at certain periods, we can put together a portfolio that does exactly this. The Solver chooses that portfolio that covers the required amounts in each year and costs the least. Bond4 is another example of this technique called 'Exact Matching.' This time we allow excess funds in a certain period to be reinvested to meet requirements in a future period.

o terms. The ns. We can also ogether will

ain expected

vidual stock the relative is the right

variance of

and the other

he residual

bution (100 et variance). mprovement.

quality, its tes go up, the

e interest can e coupon could ut at the end of nd is repaid. annual coupon of protecting al to ones own

d average of

nt to maximize time horizon.

e, maturity,

fluctuations. at arrives from

nts of cash is. The Solver

139347145.xls

Portfolio Optimization - Markowitz Method

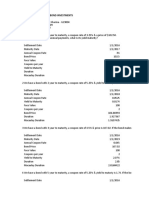

This Solver model uses the QUADPRODUCT function at cell I14 to compute the portfolio variance. It can be solved for the minimum variance using either the GRG nonlinear solver or the Quadratic Solver. Stock 1 Portfolio % Expected Return Linear QP Terms Stock 2 Stock 3 Stock 4 Stock 5 Total

20.00% 7.00% 0

20.00% 8.00% 0

20.00% 9.50% 0

20.00% 6.50% 0

20.00% 14.00% 0

100.00%

Variance/Covariance Matrix Stock 1 Stock 1 Stock 2 Stock 3 Stock 4 Stock 5 Stock 2 Stock 3 Stock 4 Stock 5

2.50% 0.10% 1.00% -0.50% 1.60%

0.10% 1.10% -0.10% 1.20% -0.85%

1.00% -0.10% 1.20% 0.65% 0.75%

-0.50% 1.20% 0.65% 0.40% 1.00%

1.60% -0.85% 0.75% 1.00% 2.00%

Variance Std. Dev. Return

Problem An investor wants to put together a portfolio consisting of up to 5 stocks. Using the Markowitz method, what is the best combination of stocks to minimize risk for a given return? The variances are known for each stock, as are the covariances between all stocks. The returns for all stocks are also known. Solution 1) The variables are the percentage allocations of our funds to invest in each stock. In this worksheet, the variables are given the name Allocations. The sum of the allocations (which must be 100%) is computed in the cell named Total_Portfolio. 2) The constraints are very simple. First there are the logical constraints: Allocations >= 0 via the Assume Non-Negative option Total_Portfolio = 1 Then there is a constraint that the portfolio return should be at least a certain target value (9% in this example). This return is calculated in the cell named Portfolio_return: Portfolio_Return >= 0.09 3) The objective is to minimize portfolio variance, which is calculated according to the Markowitz method in the cell named Portfolio_Variance. Remarks In this worksheet, we use the QUADPRODUCT function to compute the portfolio variance. If you see #NAME? on this worksheet, you need to open the add-in (DOTPRD32.XLL or DOTPROD.XLL) that provides QUADPRODUCT. In the Full Markowitz worksheet, we calculate the portfolio variance 'manually' without using QUADPRODUCT. The Markowitz method can only be used if all the variances of individual stocks, and the covariances between each pair of stocks are known. In this model we assumed that all the terms are given. In the Full Markowitz worksheet we actually calculate the variances and covariances from a history of stock prices.

Page 7

139347145.xls

#NAME? #NAME? 9.00%

thod, what is the

stock, as are the

heet, the variables the cell named

n this example). This

method in the cell

ee #NAME? on

ces between each

witz worksheet we

Page 8

139347145.xls

Portfolio Optimization - Markowitz Method

An investor wants to put together a portfolio, drawing from a set of 5 candidate stocks. What is the best combination of stocks to achieve a given rate of return with the least risk? Stock 1 Portfolio % Expected Return Stock 2 Stock 3 Stock 4 Stock 5 Total

20.00% 8.70%

20.00% 7.10%

20.00% 9.40%

20.00% 10.70%

20.00% 6.90%

100.00%

Variance/Covariance Matrix Stock 1 Stock 1 Stock 2 Stock 3 Stock 4 Stock 5 Variance Terms Return Terms Stock 2 Stock 3 Stock 4 Stock 5

0.03% 0.12% 0.03% 0.06% 0.01% 0.01% 1.74%

Stock 1

0.12% 1.23% 0.20% 0.16% -0.05% 0.07% 1.42%

Stock 2

0.03% 0.20% 0.04% 0.04% -0.01% 0.01% 1.88%

Stock 3

0.06% 0.16% 0.04% 0.51% 0.02% 0.03% 2.14%

Stock 4

0.01% -0.05% -0.01% 0.02% 0.05% 0.00% 1.38%

Stock 5 Variance Std. Dev. Return

Historical data (Returns) on stocks

Period 1 Period 2 Period 3 Period 4 Period 5 Period 6 Period 7 Period 8 Period 9 Period 10

10.00% 12.00% 8.00% 7.00% 9.00% 7.00% 8.00% 6.00% 9.00% 11.00%

15.00% 17.00% 4.00% -8.00% 15.00% 22.00% 3.00% -14.00% 2.00% 15.00%

12.00% 13.00% 9.00% 7.00% 9.00% 11.00% 9.00% 6.00% 8.00% 10.00%

18.00% 16.00% 3.00% 4.00% 8.00% 10.00% -3.00% 15.00% 20.00% 16.00%

5.00% 8.00% 10.00% 9.00% 5.00% 4.00% 4.00% 6.00% 8.00% 10.00%

Problem An investor wants to put together a portfolio consisting of up to 5 stocks. Using the Markowitz method, what is the best combination of stocks to minimize risk for a given return? In this model, we calculate stock returns, the variance of each stock, and the covariances between stocks, using the Excel functions AVERAGE, VARP and COVAR. Solution 1) The variables are the percentage allocations of our funds to invest in each stock. In this worksheet, the variables are cells B6 to F6 (they are not given a name). The sum of the percentage allocations (which must be 100%) is computed in cell H6. 2) The constraints are very simple. First there are the logical constraints: B6:F6 >= 0 via the Assume Non-Negative option H6 = 1

Page 9

139347145.xls

Then there is a constraint that the portfolio return should be at least a certain target value (9% in this example). This return is calculated in cell I19, as the sum of the weighted stock returns: I19 >= 0.09 3) The objective is to minimize portfolio variance, which is calculated from the weighted individual stock variances and covariances according to the Markowitz method in cell I17. Remarks The stock variances and covariances are calculated in cells B11:F15 from the historical price data in cells B23:F32. Using historical price data to compute estimates of stock returns, variances and covariances is only a first step in investment planning. Stock returns, as well as variances and covariances, vary over time. Investors often rely on security analysts to provide better estimates of these quantities for the future.

Page 10

139347145.xls

0.12% 3.49% 8.56%

hod, what is the

turns, the variance

eet, the variables

t be 100%) is

Page 11

139347145.xls

this example). This

stock variances

in cells B23:F32.

y a first step in

ors often rely on

Page 12

139347145.xls

Portfolio Optimization - Markowitz Method

An investor wants to put together a portfolio, drawing from a set of 5 candidate stocks. 'What is the best combination of stocks to achieve a given rate of return with the least risk? Stock 1 Portfolio % Expected Return Stock 2 Stock 3 Stock 4 Stock 5 Total

0.00% 7.00%

3.57% 8.00%

0.00% 9.50%

0.00% 6.50%

96.43% 15.00%

100.00%

Variance/Covariance Matrix Stock 1 Stock 1 Stock 2 Stock 3 Stock 4 Stock 5 Variance Terms Return Terms Stock 2 Stock 3 Stock 4 Stock 5

2.50% 0.10% 1.00% -0.50% 1.60% 0.00% 0.00%

0.10% 1.10% -0.10% 1.20% -0.85% -0.03% 0.29%

1.00% -0.10% 1.20% 0.65% 0.75% 0.00% 0.00%

-0.50% 1.20% 0.65% 0.40% 1.00% 0.00% 0.00%

1.60% -0.85% 0.75% 1.00% 2.00%

Variance

1.83% 14.46%

Std. Dev. Des. Ret Return

This worksheet includes a Markowitz portfolio model that can be optimized by the Solver to find the minimum variance portfolio for a given target rate of return. We then use VBA (Visual Basic Application Edition) code to set the target rate of return to different values (from 10% to almost 15%) and run the Solver to optimize the model for each target return. The VBA code stores the target returns and resulting portfolio variances in cells J21 through K40, which are linked to the X-Y plot shown to the right. When you press the button labeled 'Create Frontier', the VBA code is run and the resulting efficient frontier is drawn on the embedded chart. To see the VBA code controlling the Solver, select Tools Macro... Visual Basic Editor, or press Alt+F11. In the VBA window, in the left-hand Project list window double-click on Modules, then double-click on Module1. To successully run the code and create the chart, you may need to choose Tools References... in the VBA Editor and click to set a check mark next to 'Solver'.

Page 13

139347145.xls

Efficient Frontier

12.06

10.06

8.06 Return

6.06

4.06

2.06

0.0180255 13.43% 14.75% 14.75%

0.06 0 2 4 6 Variance 8 10 12

the minimum variance

de to set the target which are linked to

odel for each target return.

de is run and the

+F11. In the VBA and click to set a

e1. To successully

Page 14

139347145.xls

12

Page 15

139347145.xls

Portfolio Optimization - Single-Index Method

An investor wants to put together a portfolio, drawing from a set of 5 candidate stocks. What is the best combination of stocks to get the maximum return with a given variance (risk) ? Stock 1 Portfolio % Beta-Coefficient Alpha-Coefficient Residual Variance Weighted Variance Stock 2 Stock 3 Stock 4 Stock 5 Total

20.00% 20.00% 20.00% 20.00% 20.00% 0.577381 1.672619 0.64881 0.934524 0.767857 0.047738 -0.04274 0.049881 0.043452 0.016786 0.000261 0.014236 0.000353 0.006059 0.000389 0.00001 0.00057 0.00001 0.00024 0.00002

Portfolio Variance Portfolio Return

100.00%

0.12% 8.56%

Market

Historical data (Returns) on stocks

Stock 1 Period 1 Period 2 Period 3 Period 4 Period 5 Period 6 Period 7 Period 8 Period 9 Period 10 Stock 2 Stock 3 Stock 4 Stock 5

10.00% 12.00% 8.00% 7.00% 9.00% 7.00% 8.00% 6.00% 9.00% 11.00%

15.00% 17.00% 4.00% -8.00% 15.00% 22.00% 3.00% -14.00% 2.00% 15.00%

12.00% 13.00% 9.00% 7.00% 9.00% 11.00% 9.00% 6.00% 8.00% 10.00%

18.00% 16.00% 3.00% 4.00% 8.00% 10.00% -3.00% 15.00% 20.00% 16.00%

5.00% 8.00% 10.00% 9.00% 5.00% 4.00% 4.00% 6.00% 8.00% 10.00%

8.00% 10.00% 9.00% 7.00% 4.00% 6.00% 5.00% 5.00% 6.00% 8.00%

Problem An investor wants to put together a portfolio consisting of up to 5 stocks. Using the Sharpe Single-Index method, what is the best combination of stocks to maximize return for a given level of risk (variance)? Solution 1) The variables are the percentage or fractional allocations of our funds to invest in each stock. In this worksheet, the variables are given the name Portfolio_fractions. The sum of the allocations (which must be 100%) is computed in the cell named Portfolio_Total. 2) The constraints are very simple. First there are the logical constraints: Portfolio_Fractions >= 0 via the Assume Non-Negative option Portfolio_Total = 1 Then there is a constraint that the portfolio variance should be no more than 0.0003 (in this example). The portfolio variance is calculated in the cell named Variance: Variance <= 0.0003 3) The objective is to maximize portfolio return which is calculated according to the Sharpe method in the cell named Return. Remarks

Page 16

139347145.xls

This model uses historical data on the stocks and market to calculate the returns and variance of the stocks and the portfolio. It also uses Excel's regression tools to estimate the alphas and betas, as well as the residual error, necessary to use the Sharpe Single Index method. A different approach to this problem would be to minimize risk for a certain return. It is easy to adjust the Solver to do this. Simply change the set cell to be the variance and adjust the constraint to hold the return at a given level.

Page 17

139347145.xls

Bond Immunization Model

An investor wants to put together a portfolio, drawing from a set of 5 candidate bonds. What is the best combination of bonds to get the optimum yield with a given investment time horizon ? Bond 1 Portfolio % Duration (Years) Yield to Maturity Bond 2 Bond 3 Bond 4 Bond 5 Bond 6 Total

20.00% 2.8 8.00%

20.00% 3.1 6.00%

20.00% 3.7 10.00%

20.00% 3.5 9.00%

10.00% 3.8 8.00%

10.00% 4 5.00% 3.8 3.4 7.90%

100.00%

Investment Time Horizon Portfolio Duration Portfolio Yield

Problem An investor wants to put together a portfolio consisting of up to 6 different bonds. To minimize risk of loss of principal value due to interest rate fluctuations and to assure enough cash-flow at a certain point in the future, he wants to make sure that the average duration of the bonds equals his investment time horizon. How should the investor choose his portfolio to optimize the combined yield of the bonds, while making sure that the duration of the portfolio equals the investment time horizon? The duration and the yield to maturity are known for each bond. Solution 1) The variables are the percentages or fractions of our available funds to invest in each bond. In worksheet BOND1 these are given the name Portfolio_fractions. 2) The constraints are very simple. First we have the logical constraints: Portfolio_fractions >= 0 via the Assume Non-Negative option Portfolio_total = 1 Then there is the constraint to make sure that the portfolio duration equals the investment time horizon: Portfolio_duration = Time_horizon 3) The objective is to maximize the portfolio yield. This is given the name Portfolio_yield Remarks In this model we assume that the duration of the bond is known. In worksheet BOND2 we will see how to use EXCEL's build-in functions to calculate the duration of each bond.

Page 18

139347145.xls

Bond Immunization Model

An investor wants to put together a portfolio, consisting out of a maximum of 6 bonds. What is the best combination of bonds to get the optimum yield with a given investment time horizon ? The period from settlement to maturity is 4 years for each bond. Bond 1 Portfolio % Yield to Maturity Coupon Payment Face Value Duration (Years) Bond 2 Bond 3 Bond 4 Bond 5 Bond 6 Total

20.00% 8.00% $150 $1,000

20.00% 6.00% $100 $1,000

20.00% 9.00% $120 $1,000

20.00% 10.00% $175 $1,000

20.00% 7.00% $0 $1,000

20.00% 9.00% $125 $1,000

120.00%

#NAME? #NAME? #NAME? #NAME? #NAME? #NAME?

Investment Time Horizon Portfolio Duration Portfolio Yield

3.5 #NAME? 9.80%

Problem An investor wants to put together a portfolio consisting of up to 6 different bonds. To minimize risk of loss of principal value due to interest rate fluctuations and to assure enough cash-flow at a certain point in the future, he wants to make sure that the average duration of the bonds equals his investment time horizon. How should the investor choose his portfolio to optimize the combined yield of the bonds, while making sure that the duration of the portfolio equals the investment time horizon? All bonds mature in 4 years and have one annual interest payment. The annual payments, the yield and the face values of the bonds are all known Solution 1) The variables are the percentages or fractions of our available funds to invest in each bond. In worksheet BOND1 these are given the name Portfolio_fractions. 2) The constraints are very simple. First we have the logical constraints: Portfolio_fractions >= 0 via the Assume Non-Negative option Portfolio_total = 1 Then there is the constraint to make sure that the portfolio duration equals the investment time horizon: Portfolio_duration = Time_horizon 3) The objective is to maximize the portfolio yield. This is given the name Portfolio_yield Remarks The solution is the same as in worksheet BOND1. The difference is that instead of the duration of each bond being given, it is now calculated from the yield, annual coupon and face value. The Excel function DURATION is only available if you have installed the Analysis ToolPak add-in. If you see #NAME? on the worksheet, choose Tools Add-Ins..., click to put a check mark next to Analysis ToolPak, then click OK. If Analysis ToolPak is missing from the list of available add-ins, you may need to install it from the Excel or Office CD.

Page 19

139347145.xls

Bond Model - Exact Matching

What is the minimum cost portfolio, consisting of up to 6 bonds, that provides enough cash flow to cover liabilities in each period? Interest Rate Characteristics of bonds Bond 1 Face Value Coupon Payment Years to Maturity Price Bond 2 Bond 3 Bond 4 Bond 5

7%

$1,000 $100 3 #NAME?

Bond 1

$1,000 $125 5 #NAME?

Bond 2

$1,000 $150 6 #NAME?

Bond 3

$1,000 $200 4 #NAME?

Bond 4

$1,000 $75 6 #NAME?

Bond 5

Number Purchased

10

Bond 1

10

Bond 2

10

Bond 3

10

Bond 4

10

Bond 5

Cost #NAME?

Total

Cash Flow

Year 1 Year 2 Year 3 Year 4 Year 5 Year 6

$1,000 $1,000 $1,000

$1,250 $1,250 $1,250 $1,250 $1,250

$1,500 $1,500 $1,500 $1,500 $1,500 $1,500

$2,000 $2,000 $2,000 $2,000

$750 $750 $750 $750 $750 $750

$6,500 $6,500 $6,500 $5,500 $3,500 $2,250

Problem In models BOND1 and BOND2 we saw a way for an investor to protect against interest rate fluctuations. Here, we'll look at another method. An investor wants to put together a portfolio consisting of up to 6 different bonds. He has certain cashflow requirements in the future that the coupons of the bonds should cover. (For example, a pension fund must meet requirements for future pension payments.) These payments are independent of interest rate changes. How should the investor choose his portfolio to minimize the cost of the bonds, while making sure that the payments cover his future cashflow requirements? Solution 1) The variables are the number of each bond to include in the portfolio. In worksheet BOND3 these are given the name Purchased_bonds. 2) The constraints are very simple. First we have the logical constraints: Purchased_bonds >= 0 via the Assume Non-Negative option Purchased_bonds = integer (We can not buy fractions of a bond) Then there is the constraint to make sure that the cash-flow requirements are met: Cash_flow >= Liabilities 3) The objective is to minimize the portfolio cost. This is given the name Total_cost. Remarks In this model we assume that money coming in from maturing bonds can not be used to cover the cash-flow requirements. Also, we do not account for excess money in one period that may be transferred to the next period. In model BOND4 we will account for this.

Page 20

139347145.xls

Liability

$32,000 $25,000 $22,000 $28,000 $25,000 $20,000

s. Here, we'll look He has certain cash-

und must meet

s. How should the

over his future cash-

e given the name

h-flow requirements. model BOND4 we

Page 21

139347145.xls

Bond Model - Exact Matching with Cash Carryforward

What is the minimum cost portfolio, consisting of up to 6 bonds, that provides enough cash flow to cover liabilities in each period? Interest Rate Characteristics of bonds Bond 1 Face Value Coupon Payment Years to Maturity Price Bond 2 Bond 3 Bond 4 Bond 5

7%

$1,000 $100 3 #NAME?

Bond 1

$1,000 $125 5 #NAME?

Bond 2

$1,000 $150 6 #NAME?

Bond 3

$1,000 $175 4 #NAME?

Bond 4

$1,000 $75 6 #NAME?

Bond 5

Number Purchased

50

Bond 1 Bond 2

50

Bond 3

50

Bond 4

50

Bond 5

50 $3,750 $3,750 $3,750 $3,750 $3,750 $3,750

Cash Flow

Year 1 Year 2 Year 3 Year 4 Year 5 Year 6

$5,000 $5,000 $5,000

$6,250 $6,250 $6,250 $6,250 $6,250

$7,500 $7,500 $7,500 $7,500 $7,500 $7,500

$8,750 $8,750 $8,750 $8,750

Problem An investor wants to put together a portfolio consisting of up to 6 different bonds. He has certain cash-flow requirements in the future that the coupons of the bonds should cover. (For example, a pension fund must meet requirements for future pension payments.) These payments are independent of interest rate changes. Excess payments in a period can be reinvested, to be available in the next period, at a certain interest rate. How should the investor choose his portfolio to minimize the cost of the bonds, while making sure that the payments cover his future cash-flow requirements? Solution 1) The variables are the number of each bond to include in the portfolio. In worksheet BOND3 these are given the name Purchased_bonds. 2) The constraints are very simple. First we have the logical constraints: Purchased_bonds >= 0 via the Assume Non-Negative option Purchased_bonds = integer (We can not buy fractions of a bond) Then there is the constraint to make sure that the cash-flow requirements are met: Cash_flow >= Liabilities 3) The objective is to minimize the portfolio cost. This is given the name Total_cost. Remarks The solution is similar to the one in BOND3. The difference is that the cash-flow takes into account the reinvestment of excess funds in one period for the next period. Remember that the original idea behind exact matching was to minimize the influence of interest rate changes. In this model, however, we are again more dependent on the interest rate, since a shift in the future rate would affect the solution to the model. Thus, the market value of the portfolio may fluctuate to a greater extent than if we ignored reinvestment opportunities.

Page 22

139347145.xls

Cost #NAME?

Total w/Int Liability

$31,250 $30,448 $37,079 $42,384 $32,891 $19,694

$32,000 $25,000 $22,000 $28,000 $25,000 $20,000

cash-flow requirements in the future

nts for future pension payments.)

einvested, to be available in the

he cost of the bonds, while making

se are given the name

t the reinvestment of excess

was to minimize the influence to a greater extent than if we

ate, since a shift in the future

Page 23

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5819)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- CFI - FMVA Certification ProgramDocument42 pagesCFI - FMVA Certification ProgramAnesu ChibweNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- 2019 Mock Exam A - Morning SessionDocument23 pages2019 Mock Exam A - Morning SessionDan ChanNo ratings yet

- CFA PM, AA, Econ, FI, Trading, Perf EvalDocument42 pagesCFA PM, AA, Econ, FI, Trading, Perf EvalKnightspageNo ratings yet

- DoubleLine Just Markets 2022 PresentationDocument69 pagesDoubleLine Just Markets 2022 PresentationZerohedge100% (1)

- Calculus For MFDocument4 pagesCalculus For MFSujeethraj KoppoluNo ratings yet

- UK Gilts CalculationsDocument10 pagesUK Gilts CalculationsAditee100% (1)

- SIP Dynamic CalcyDocument18 pagesSIP Dynamic CalcyjaickyrenNo ratings yet

- Excel Built in Financial Functions Cheat Sheet: by ViaDocument2 pagesExcel Built in Financial Functions Cheat Sheet: by ViaJagdish Prasad SharmaNo ratings yet

- Financial Markets and Institutions Solved MCQs (Set-7)Document6 pagesFinancial Markets and Institutions Solved MCQs (Set-7)Tonie NascentNo ratings yet

- DurationDocument5 pagesDurationNiño Rey LopezNo ratings yet

- CFA - 15 & 16. Fixed IncomeDocument11 pagesCFA - 15 & 16. Fixed IncomeChan Kwok WanNo ratings yet

- Financial Markets and InstitutionsDocument5 pagesFinancial Markets and InstitutionsEng Abdikarim WalhadNo ratings yet

- Bond Valuation and Risk Ch-8Document37 pagesBond Valuation and Risk Ch-8রোকন উদ্দিন সিকদারNo ratings yet

- Ôn Tập Cuối Kỳ - Trắc NghiệmDocument35 pagesÔn Tập Cuối Kỳ - Trắc Nghiệmthaoluhan456No ratings yet

- Money Market Question BookDocument10 pagesMoney Market Question Bookchris0% (1)

- Practice QuestionsDocument2 pagesPractice QuestionsferrakimNo ratings yet

- ING Group 2Document4 pagesING Group 2Puneet JainNo ratings yet

- AAG Constant Maturity SwapsDocument3 pagesAAG Constant Maturity SwapsIshanGuptaNo ratings yet

- TPA Check ListDocument2 pagesTPA Check Listehtsham007No ratings yet

- Money Market Products & Opportunities: R. A. Kamath Chief Dealer, Abhyudaya BankDocument69 pagesMoney Market Products & Opportunities: R. A. Kamath Chief Dealer, Abhyudaya BankNikhil KediaNo ratings yet

- RSM 332 Problem Set #1Document4 pagesRSM 332 Problem Set #1Paul Huang0% (1)

- 2023 L3 Section3Document122 pages2023 L3 Section3PrarthanaRavikumarNo ratings yet

- MMS III Finance SyllabusDocument30 pagesMMS III Finance SyllabusHardik ThakkarNo ratings yet

- Tugas CH 9Document7 pagesTugas CH 9Adham NurjatiNo ratings yet

- Chapter 8Document78 pagesChapter 8Faisal SiddiquiNo ratings yet

- PDF Investments An Introduction 11Th Edition Herbert B Mayo Ebook Full ChapterDocument53 pagesPDF Investments An Introduction 11Th Edition Herbert B Mayo Ebook Full Chapterjennifer.mccrae899100% (3)

- Fabozzi Bmas7 Ch23 ImDocument37 pagesFabozzi Bmas7 Ch23 ImSandeep SidanaNo ratings yet

- 1.duration Question 2Document9 pages1.duration Question 2ShobhitNo ratings yet

- Lehmansn 1Document17 pagesLehmansn 1sajivshriv100% (1)

- CH 06 Hull Fundamentals 9 TH EdDocument30 pagesCH 06 Hull Fundamentals 9 TH EdIbrahim KhatatbehNo ratings yet