Professional Documents

Culture Documents

Post-Graduate Diploma in Financial Markets & Insurance: Semester-I - Retest Indian Financial System

Post-Graduate Diploma in Financial Markets & Insurance: Semester-I - Retest Indian Financial System

Uploaded by

pratik053880 ratings0% found this document useful (0 votes)

6 views1 pagefsdf

Original Title

0202

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentfsdf

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

6 views1 pagePost-Graduate Diploma in Financial Markets & Insurance: Semester-I - Retest Indian Financial System

Post-Graduate Diploma in Financial Markets & Insurance: Semester-I - Retest Indian Financial System

Uploaded by

pratik05388fsdf

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

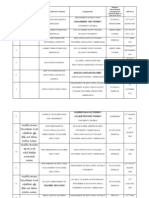

Post-Graduate Diploma in Financial Markets & Insurance

Semester-I Retest INDIAN FINANCIAL SYSTEM

Date: 2/1/2013 Time: 6-30p.m. to 8-00p.m. ATTEMPT ANY FIVE FROM THE FOLLOWING: Q. 1 Q.2 Q. 3 Q. 4 Q.5 Q.6 Q.7 (A) What is FDI and FII? How useful these investment for India in Current Scenario? (B) Narrate importance of Capital Market in developing of Economy. (A) What is Debt Market? Explain concept of Commercial Paper and Certificate of Deposit. (B) Explain Disinvestment giving two examples. (A) Explain Repo Rate and Interest Rate Swap. (B) Explain IPO Market & Book Building concept. (A) Explain Credit Rating? Highlight methodology & indicate rating of BBB symbol. (B) Explain Factoring and any five types of Factoring Services. (A) What is Capital Adequacy? And highlight briefly various Banking Sector reforms introduced in phase-I and Phase-II. (B) What is monetary policy? Narrate CRR & SLR. (A) Explain various types of Mutual Funds Schemes? (B) Narrate off share funds. Income fund and opened scheme. Short Notes (ANY THREE): (i) Net Asset Value (NAV) (ii) Future Contracts (iii) Non-Convertible Debenture (NCD) (iv) Depository Receipt (v) Insider Trading (A) Explain function of banking institutions. (B) Categories Objectives of reforms by Govt. and narrate any three reforms currently introduced by SEBI. Marks: 50

Q.8

You might also like

- Sample Letter To Transfer Bank Account From One Branch To AnotherDocument1 pageSample Letter To Transfer Bank Account From One Branch To Anotherpratik05388No ratings yet

- Financial Soundness Indicators for Financial Sector Stability in Viet NamFrom EverandFinancial Soundness Indicators for Financial Sector Stability in Viet NamNo ratings yet

- (Question Papers) RBrtI Grade "B" Officers - Finance and Management Papers of Last 8 Exams (Phase 2) MrunalDocument10 pages(Question Papers) RBrtI Grade "B" Officers - Finance and Management Papers of Last 8 Exams (Phase 2) Mrunalguru1241987babuNo ratings yet

- 3 - RBI Mains Finance Last 9 Years PapersDocument8 pages3 - RBI Mains Finance Last 9 Years PapersGeo SunnyNo ratings yet

- Guess Papers BY Sir Khalid Aziz: Iqra Commerce NetworkDocument14 pagesGuess Papers BY Sir Khalid Aziz: Iqra Commerce NetworkAnonymous NKjJIpNo ratings yet

- Banking and InsuranceDocument13 pagesBanking and InsuranceKiran Kumar50% (2)

- Security Analysis and Port Folio Management: Question Bank (5years) 2 MarksDocument7 pagesSecurity Analysis and Port Folio Management: Question Bank (5years) 2 MarksVignesh Narayanan100% (1)

- Gujarat Technological UniversityDocument1 pageGujarat Technological UniversityFaisal MalekNo ratings yet

- Gujarat Technological University: InstructionsDocument1 pageGujarat Technological University: InstructionsFaisal Malek0% (1)

- Sapm QBDocument8 pagesSapm QBSiva KumarNo ratings yet

- FRA Test Papers: Archive - Sem VDocument32 pagesFRA Test Papers: Archive - Sem VBharatSirveeNo ratings yet

- MCom AssignmentsDocument4 pagesMCom AssignmentsrakikiraNo ratings yet

- EDM - Practice QuetionsDocument4 pagesEDM - Practice Quetionsomshirdhankar30No ratings yet

- Economics of Pakistan Important QuestionsDocument7 pagesEconomics of Pakistan Important QuestionsKhalid MahmoodNo ratings yet

- Investment BankingDocument1 pageInvestment BankingmbabbhumikaNo ratings yet

- IFS Suggestion GKJDocument6 pagesIFS Suggestion GKJAN-DROID GAMER RATULNo ratings yet

- Question BankDocument4 pagesQuestion BankRajkishor SinghNo ratings yet

- Question Paper PDFDocument7 pagesQuestion Paper PDFSanjay AgnihotriNo ratings yet

- Question BankDocument2 pagesQuestion BankNirmiti MalavadeNo ratings yet

- (Question Papers) RBI Grade "B" Officers - Finance and Management Papers of Last 8 Exams (Phase 2) MrunalDocument4 pages(Question Papers) RBI Grade "B" Officers - Finance and Management Papers of Last 8 Exams (Phase 2) MrunalakurilNo ratings yet

- FM Question BankDocument20 pagesFM Question BankrajeeevaNo ratings yet

- Financial ManagementDocument1 pageFinancial ManagementlogicballiaNo ratings yet

- MBA-2 Sem-III: Management of Financial ServicesDocument17 pagesMBA-2 Sem-III: Management of Financial ServicesDivyang VyasNo ratings yet

- Global Commerce Academy: MBF BCDocument1 pageGlobal Commerce Academy: MBF BCAhmad Nawaz JanjuaNo ratings yet

- Question Paper Review - Financial Services - Cpc6aDocument7 pagesQuestion Paper Review - Financial Services - Cpc6ajeganrajrajNo ratings yet

- Assigment Mba-4 SEM Financial Derivatives (Kmbfm05) UNIT-1Document19 pagesAssigment Mba-4 SEM Financial Derivatives (Kmbfm05) UNIT-1Shalini ShekharNo ratings yet

- IBP Banking Regulations Past PaperDocument2 pagesIBP Banking Regulations Past PaperSeth Valdez0% (1)

- International Business PaperDocument1 pageInternational Business PaperspandanNo ratings yet

- MEFA Important Questions JWFILESDocument14 pagesMEFA Important Questions JWFILESEshwar TejaNo ratings yet

- Security Analysis and Portfolio Management QBDocument13 pagesSecurity Analysis and Portfolio Management QBAnonymous y3E7iaNo ratings yet

- BA7024 CorporateFinancequestionbankDocument5 pagesBA7024 CorporateFinancequestionbankNorman MberiNo ratings yet

- MEFA Unit Wise Imp QuestionsDocument6 pagesMEFA Unit Wise Imp QuestionsSatya KumarNo ratings yet

- 405 FinanceDocument5 pages405 FinanceAyush KumarNo ratings yet

- Important Questions in Banking Insurance.Document3 pagesImportant Questions in Banking Insurance.Chandra sekhar VallepuNo ratings yet

- Assignment - SAIMDocument1 pageAssignment - SAIMAshutosh SharmaNo ratings yet

- Financial Management Important QuestionsDocument3 pagesFinancial Management Important QuestionsSaba TaherNo ratings yet

- AssignmentDocument1 pageAssignmentshubhamyadav7462No ratings yet

- APRIL 2012 M. Com. (Semester - IV) (Compulsory) Examination - 2012Document3 pagesAPRIL 2012 M. Com. (Semester - IV) (Compulsory) Examination - 2012kavitachordiya86No ratings yet

- Gujarat Technological University: InstructionsDocument1 pageGujarat Technological University: InstructionsShyamsunder SinghNo ratings yet

- University of Engineering & Management, Jaipur: University Examination MBA, 1 Year, 2 SemesterDocument4 pagesUniversity of Engineering & Management, Jaipur: University Examination MBA, 1 Year, 2 SemesterSupriyo BiswasNo ratings yet

- (Accredited by NAAC With "A" Grade) (MBA - Approved by AICTE, New Delhi) (Affiliated To Bharathidasan University, Tiruchirappalli - 24)Document5 pages(Accredited by NAAC With "A" Grade) (MBA - Approved by AICTE, New Delhi) (Affiliated To Bharathidasan University, Tiruchirappalli - 24)Maria Monisha DNo ratings yet

- Previous Year Question Papers (Theory) PDFDocument4 pagesPrevious Year Question Papers (Theory) PDFSiva KumarNo ratings yet

- Security Analysis and Portfolio Management: Question BankDocument12 pagesSecurity Analysis and Portfolio Management: Question BankgiteshNo ratings yet

- K 2830202mfsDocument2 pagesK 2830202mfsFaisal MalekNo ratings yet

- MFP 004Document2 pagesMFP 004shekhawatsp101No ratings yet

- Security Analysis and Portfolio Management FaqDocument5 pagesSecurity Analysis and Portfolio Management Faqshanthini_srmNo ratings yet

- IFS Suggested Questions by GKJDocument5 pagesIFS Suggested Questions by GKJNayanNo ratings yet

- Assignments PTU BBA 703Document5 pagesAssignments PTU BBA 703so_icidNo ratings yet

- Mba (Banking & Insurance)Document128 pagesMba (Banking & Insurance)Rama LingamNo ratings yet

- BA7021-Security Analysis and Portfolio PDFDocument6 pagesBA7021-Security Analysis and Portfolio PDFLavanya GunalanNo ratings yet

- Investment Management - MBA 4th SemDocument6 pagesInvestment Management - MBA 4th SemManasu Shiva Mysuru0% (1)

- 2010 - May - June-06AL61 PDFDocument1 page2010 - May - June-06AL61 PDFRevati MotagiNo ratings yet

- Ba 5012 Security Analysis and Portfolio Management Unit 1 Part ADocument7 pagesBa 5012 Security Analysis and Portfolio Management Unit 1 Part AHarihara PuthiranNo ratings yet

- (Question Papers) RBI Grade "B" Officers - Finance and Management Papers of Last 8 Exams (Phase 2) MrunalDocument8 pages(Question Papers) RBI Grade "B" Officers - Finance and Management Papers of Last 8 Exams (Phase 2) MrunalsaymtrNo ratings yet

- Question Bank Sem IIIDocument3 pagesQuestion Bank Sem IIIRahul NishadNo ratings yet

- Important Questions For Khu802 (2023-24)Document5 pagesImportant Questions For Khu802 (2023-24)Omkar SinghNo ratings yet

- Question Bank MFSDocument2 pagesQuestion Bank MFSSandip ThakkarNo ratings yet

- PGDFMDocument6 pagesPGDFMAvinashNo ratings yet

- Islamic Capital Markets and Products: Managing Capital and Liquidity Requirements Under Basel IIIFrom EverandIslamic Capital Markets and Products: Managing Capital and Liquidity Requirements Under Basel IIINo ratings yet

- ASEAN+3 Bond Market Guide 2017 Lao People's Democratic RepublicFrom EverandASEAN+3 Bond Market Guide 2017 Lao People's Democratic RepublicNo ratings yet

- Vakalatnama: in The High Court of Gujart at Ahmedabad DistrictDocument1 pageVakalatnama: in The High Court of Gujart at Ahmedabad Districtpratik05388No ratings yet

- Octa-Core Processors - Real Advantage or Marketing Myth - NDTV GadgetsDocument9 pagesOcta-Core Processors - Real Advantage or Marketing Myth - NDTV Gadgetspratik05388No ratings yet

- Semester-I Semester-Iii Semester-V: Subject Code Subject Name Subject Code Subject Name Subject Code Subject NameDocument2 pagesSemester-I Semester-Iii Semester-V: Subject Code Subject Name Subject Code Subject Name Subject Code Subject Namepratik05388No ratings yet

- Tala AshDocument26 pagesTala Ashpratik05388No ratings yet

- Day/ Time Monday Tuesday Wednesday Thursday Friday Saturday 8 Am 9 Am 10-30 AM 11 - 30 AM 12 - 30 PMDocument1 pageDay/ Time Monday Tuesday Wednesday Thursday Friday Saturday 8 Am 9 Am 10-30 AM 11 - 30 AM 12 - 30 PMpratik05388No ratings yet

- Computer PracticalDocument2 pagesComputer Practicalpratik05388No ratings yet

- Whether International/ National/state/ Regional/college or University Level API ScoreDocument3 pagesWhether International/ National/state/ Regional/college or University Level API Scorepratik05388No ratings yet